ACCT1001 Presentation: South32 Limited Financial Performance Analysis

VerifiedAdded on 2022/09/09

|12

|615

|15

Presentation

AI Summary

This presentation analyzes the financial performance of South32 Limited, an Australian mining and metals company. It begins with an overview of the company's history, products, size, and locations. The analysis examines key assets, liabilities, equity, income, and expenses, highlighting the impact of accounting conventions and managerial judgments on asset measurement. The presentation assesses the company's financial position through profitability, liquidity, and efficiency ratios, comparing performance over time. The analysis concludes with an assessment of the company's financial health and provides references to support the findings. The report covers the period up to 2019 and provides insights for prospective investors.

ACCOUNTING AND

FINANCE

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

In the following parts, history of 32 South limited, overview of

products or brands, size as well as location of the operation of

company is discussed.

These parts also discuss the key assets, liabilities, earning, equity

class, expenditure performance, measurement of key assets as

well as management decisions.

In these parts, the profitability ratios, liquidity ratios along with

efficiency ratios of 32 South limited are assessed.

In the following parts, history of 32 South limited, overview of

products or brands, size as well as location of the operation of

company is discussed.

These parts also discuss the key assets, liabilities, earning, equity

class, expenditure performance, measurement of key assets as

well as management decisions.

In these parts, the profitability ratios, liquidity ratios along with

efficiency ratios of 32 South limited are assessed.

Background of company

South32 Limited is the mining as well as metals

organisation headquartered in Perth (Western Australia).

This organisation is listed on Australian Securities Exchange.

It has secondary listing on the London marketplace along with

Johannesburg bourse (Reuters, 2019).

The organisation manufactures silver, alumina, zinc, aluminium,

manganese, lead, nickel, thermal coal along with coking coal.

South32 Limited is the mining as well as metals

organisation headquartered in Perth (Western Australia).

This organisation is listed on Australian Securities Exchange.

It has secondary listing on the London marketplace along with

Johannesburg bourse (Reuters, 2019).

The organisation manufactures silver, alumina, zinc, aluminium,

manganese, lead, nickel, thermal coal along with coking coal.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Liabilities, assets, equity classes,

expenses and incomes

From the annual report of company, it is found that the key

liabilities of organization is $4547 in 2019. It is analyzed that the

key liabilities were $ 4424 in 2018.

It is analyzed that the equity of the organization is $ 10168 in

2019. In addition, it was $ 10709 in 2019.

In 2019, the key assets of organization is $14715. It was $ 15133

in 2018 (Bloomberg, 2018).

expenses and incomes

From the annual report of company, it is found that the key

liabilities of organization is $4547 in 2019. It is analyzed that the

key liabilities were $ 4424 in 2018.

It is analyzed that the equity of the organization is $ 10168 in

2019. In addition, it was $ 10709 in 2019.

In 2019, the key assets of organization is $14715. It was $ 15133

in 2018 (Bloomberg, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The expenses of South32 Limited are $ 7092 in 2019. They were $

6577 in year 2018.

It means that the expenses of organisation have been enhanced from

year 2018 (Annual report, 2019).

The income of South32 Limited is reduced in 2019. It was $ 1332 in

2018 and it was $ 389 in 2019 (Investing.com, 2018).

Increasing expenses and reducing income reflecting the negative

position of the company.

6577 in year 2018.

It means that the expenses of organisation have been enhanced from

year 2018 (Annual report, 2019).

The income of South32 Limited is reduced in 2019. It was $ 1332 in

2018 and it was $ 389 in 2019 (Investing.com, 2018).

Increasing expenses and reducing income reflecting the negative

position of the company.

Accounting conventions to affect

measurement of key assets

The accounting conventions are helpful in assessing the financial

condition of the company.

South32 Limited utilises the consistent accounting conventions.

The corporation’s assets have been displayed from US dollars to

Australian dollars on the basis of accounting conventions.

The € has displayed as the American dollars (Alexander, 2011).

The significant information is recorded in the accounting convention.

measurement of key assets

The accounting conventions are helpful in assessing the financial

condition of the company.

South32 Limited utilises the consistent accounting conventions.

The corporation’s assets have been displayed from US dollars to

Australian dollars on the basis of accounting conventions.

The € has displayed as the American dollars (Alexander, 2011).

The significant information is recorded in the accounting convention.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Measurements of corporation by the managerial

judgments

The expression “managerial judgment” is broader in its scope.

The managerial judgment is considered as the procedure of

taking managerial decisions.

It is capability of manager to utilize the judgment for resolving the

issues.

As the leader of workstation, the manager is expected to create

judgment call ranging in the scope as well as effect from

negligible to game-changing.

judgments

The expression “managerial judgment” is broader in its scope.

The managerial judgment is considered as the procedure of

taking managerial decisions.

It is capability of manager to utilize the judgment for resolving the

issues.

As the leader of workstation, the manager is expected to create

judgment call ranging in the scope as well as effect from

negligible to game-changing.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

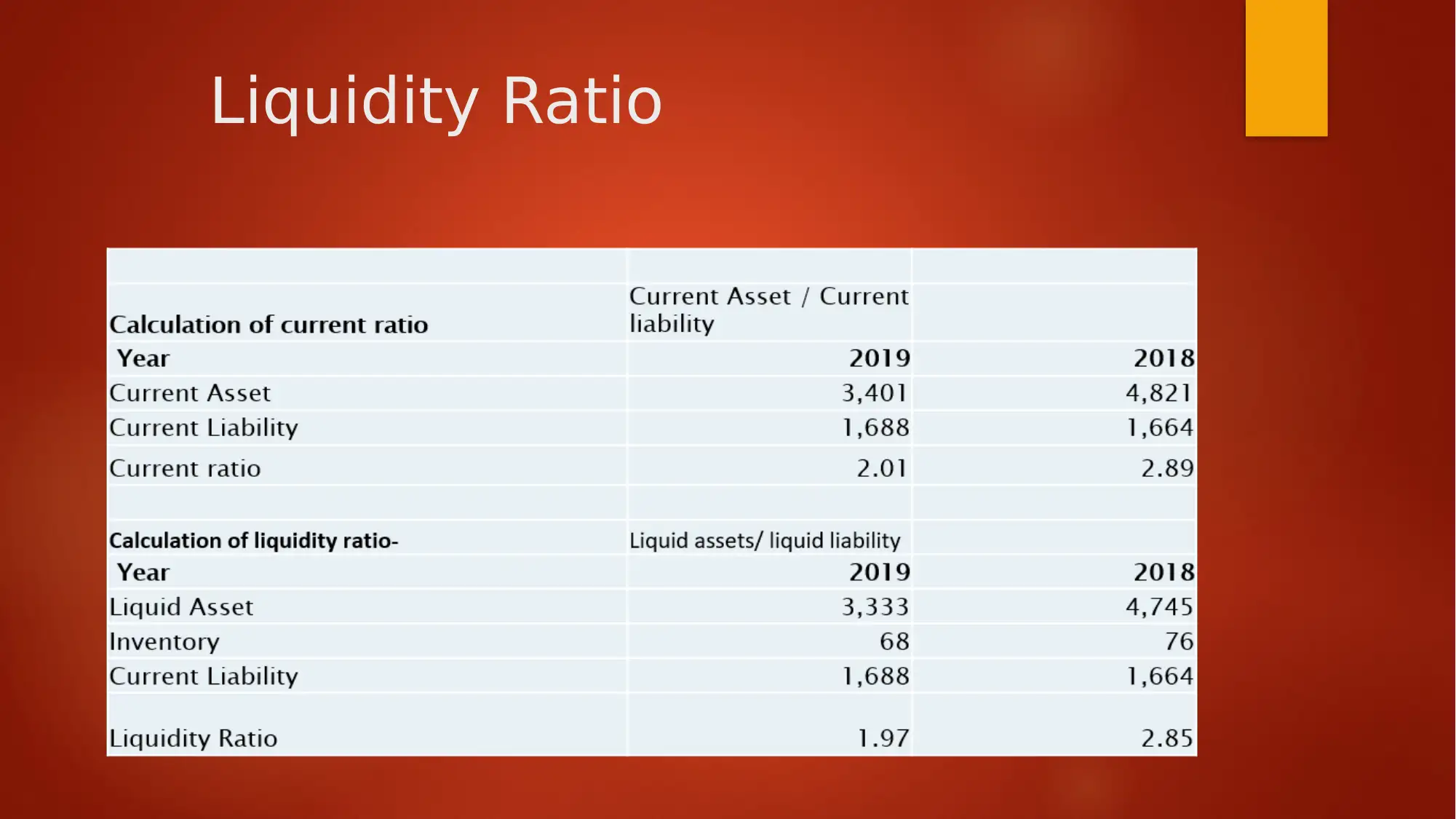

Liquidity Ratio

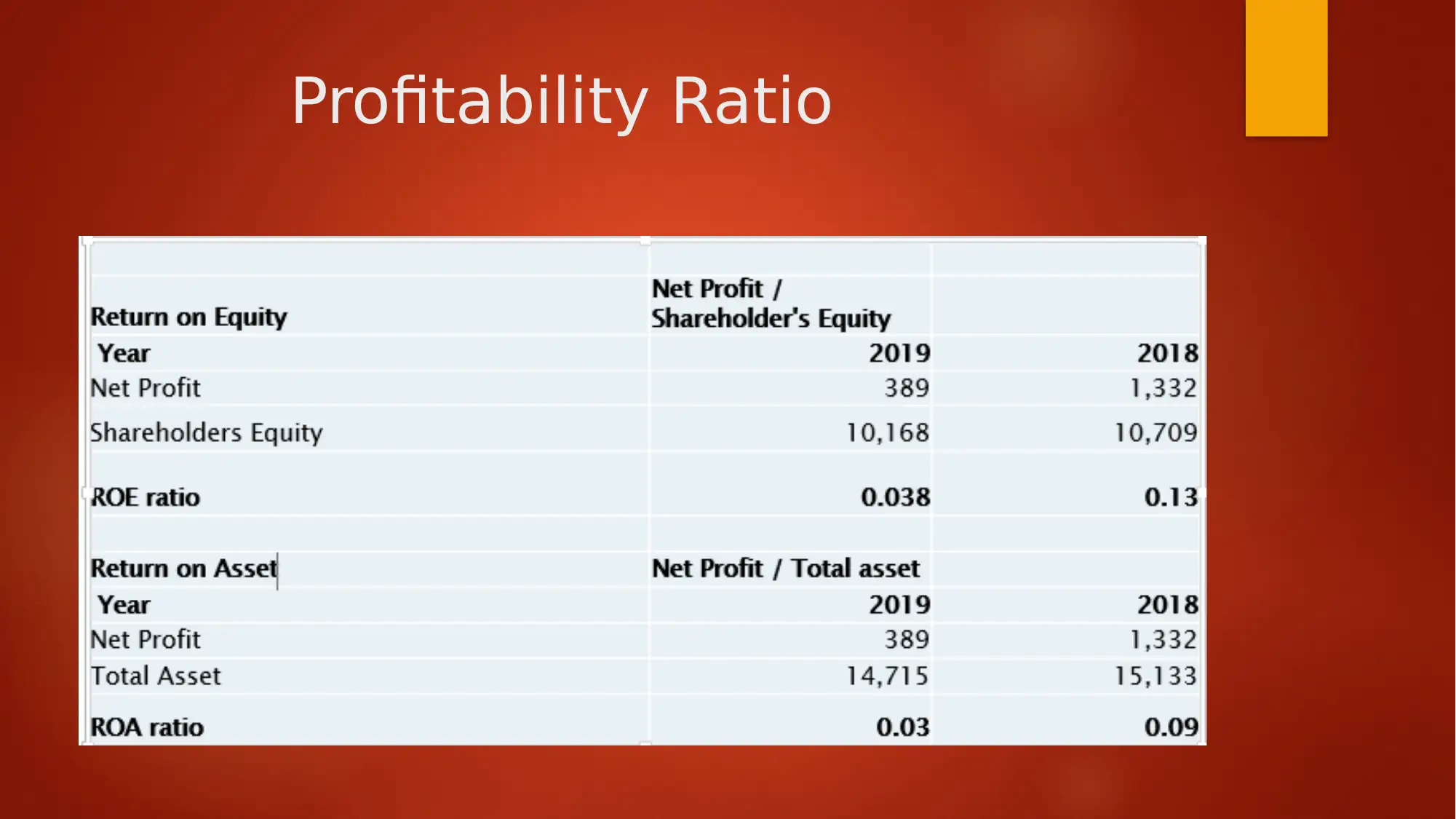

Profitability Ratio

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

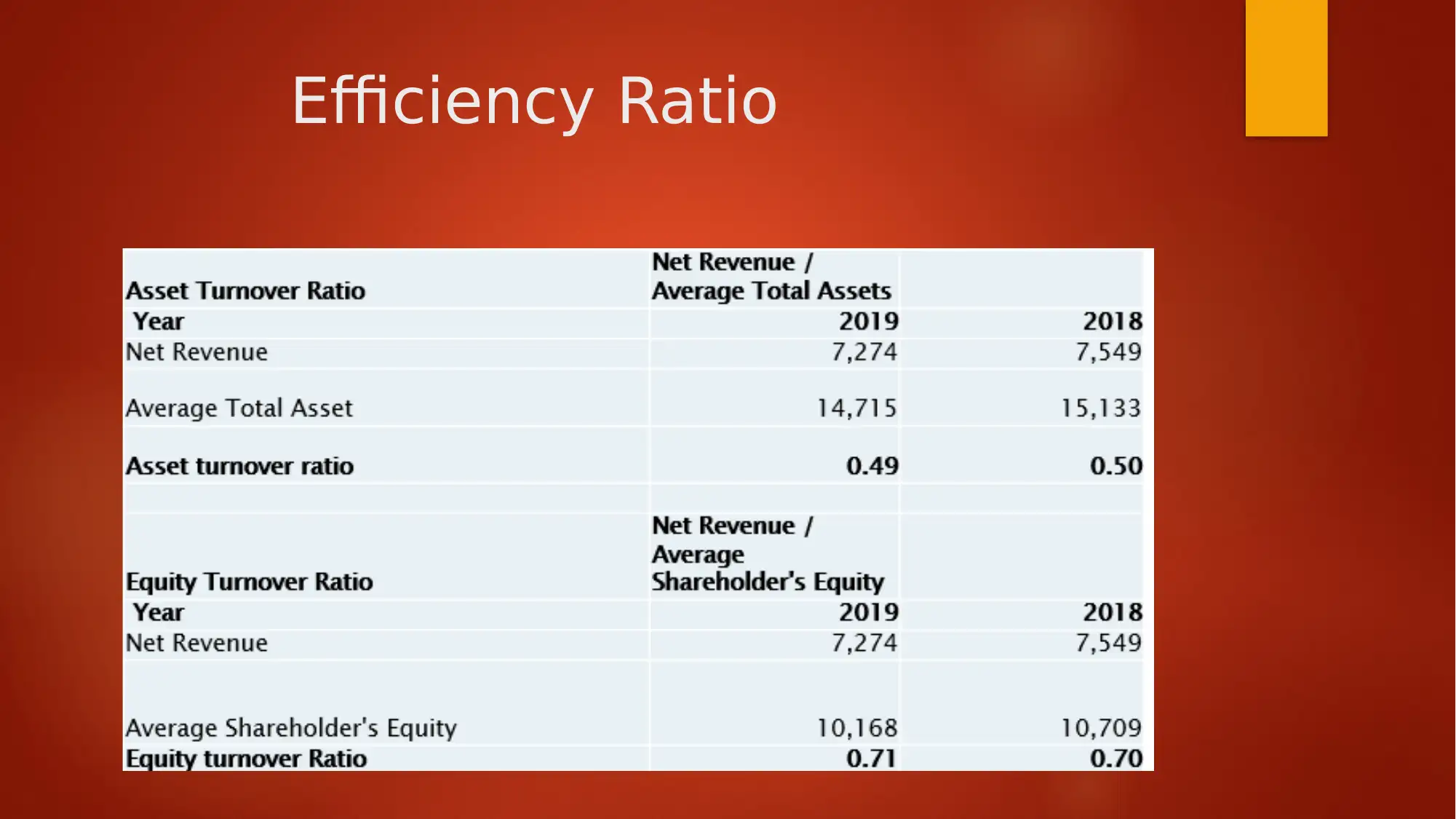

Efficiency Ratio

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion

From this presentation, it is assessed the financial condition of entity is

not good in marketplace

It can also see that the company good revenues which was reducing

the profits.

The organization does not have good assets.

The company is not in good liquidity position.

The debt of company is also not higher so they do not have burden.

From this presentation, it is assessed the financial condition of entity is

not good in marketplace

It can also see that the company good revenues which was reducing

the profits.

The organization does not have good assets.

The company is not in good liquidity position.

The debt of company is also not higher so they do not have burden.

References

Annual report (2019). 32South Limited. Retrieved from:

https://www.south32.net/docs/default-source/exchange-releases/annual-report-

2019.pdf?sfvrsn=8bb8d211_2

Bloomberg (2018). 32South Limited. Retrieved from :

https://www.bloomberg.com/profile/company/S32:SJ

Investing.com (2018). 32South Limited. Retrieved from:

https://au.investing.com/equities/south32-ltd-historical-data

Reuters (2019). 32South Limited. Retrieved from: https://www.reuters.com/companies/S32.AX

Annual report (2019). 32South Limited. Retrieved from:

https://www.south32.net/docs/default-source/exchange-releases/annual-report-

2019.pdf?sfvrsn=8bb8d211_2

Bloomberg (2018). 32South Limited. Retrieved from :

https://www.bloomberg.com/profile/company/S32:SJ

Investing.com (2018). 32South Limited. Retrieved from:

https://au.investing.com/equities/south32-ltd-historical-data

Reuters (2019). 32South Limited. Retrieved from: https://www.reuters.com/companies/S32.AX

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.