Statistical Analysis of Credit Card Spending and Family Size

VerifiedAdded on 2019/12/28

|30

|2296

|259

Report

AI Summary

This report presents a comprehensive statistical analysis of credit card spending, household size, and income levels. The study begins with descriptive statistics, providing an overview of the mean, median, mode, and standard deviation for each variable. Regression analysis is then employed to identify the relationships between these variables, with a focus on how income and family size impact credit card charges. The report includes regression equations, interpretations of the results, and the addition of variables to refine the model. Further analysis includes histograms, descriptive statistics, and correlation analysis of exam and assignment scores. Finally, ANOVA is used to assess depression levels across different cities, with a discussion on the appropriateness of treatment methods. The findings provide valuable insights into consumer behavior and statistical methodologies.

STATISTICS AND RESEARCH

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION.......................................................................................................................................................................................3

TASK1.........................................................................................................................................................................................................3

1.1 Descriptive statistics method.............................................................................................................................................................3

2 Regression analysis...............................................................................................................................................................................4

3 Regression equation............................................................................................................................................................................11

4 Family size and credit card change in expenses.................................................................................................................................11

5 Addition of variable to model.............................................................................................................................................................12

TASK 2......................................................................................................................................................................................................12

Activity 01.............................................................................................................................................................................................12

Activity 02.............................................................................................................................................................................................12

Activity 03.............................................................................................................................................................................................24

TASK 3......................................................................................................................................................................................................26

1 Descriptive statistics...........................................................................................................................................................................26

2 ANNOVA...........................................................................................................................................................................................27

3 Appropriateness of treatment..............................................................................................................................................................29

CONCLUSION..........................................................................................................................................................................................29

INTRODUCTION.......................................................................................................................................................................................3

TASK1.........................................................................................................................................................................................................3

1.1 Descriptive statistics method.............................................................................................................................................................3

2 Regression analysis...............................................................................................................................................................................4

3 Regression equation............................................................................................................................................................................11

4 Family size and credit card change in expenses.................................................................................................................................11

5 Addition of variable to model.............................................................................................................................................................12

TASK 2......................................................................................................................................................................................................12

Activity 01.............................................................................................................................................................................................12

Activity 02.............................................................................................................................................................................................12

Activity 03.............................................................................................................................................................................................24

TASK 3......................................................................................................................................................................................................26

1 Descriptive statistics...........................................................................................................................................................................26

2 ANNOVA...........................................................................................................................................................................................27

3 Appropriateness of treatment..............................................................................................................................................................29

CONCLUSION..........................................................................................................................................................................................29

INTRODUCTION

Statistics is the one of the main domain that is used to solve the business problems. In the current report, descriptive statistics

tools are applied on data set and results are interpreted in proper manner. Apart from this regression analysis tools are applied on data

set and cause as well as effect relationship is identified among the variables. At end of the report conclusion is prepared. In this way

entire research work is carried out in the present research study.

TASK1

1.1 Descriptive statistics method

Income ($1000s) Household Size Amount Charged ($)

Mean 43.48 Mean 3.42 Mean 3963.86

Standard Error 2.057786 Standard Error 0.245930138 Standard Error 132.023387

Median 42 Median 3 Median 4090

Mode 54 Mode 2 Mode 3890

Standard Deviation 14.55074

Standard

Deviation 1.738988681 Standard Deviation 933.5463219

Sample Variance 211.7241 Sample Variance 3.024081633 Sample Variance 871508.7351

Kurtosis -1.24772 Kurtosis -0.722808552 Kurtosis -0.742482171

Skewness 0.095856 Skewness 0.527895977 Skewness -0.128860064

Range 46 Range 6 Range 3814

Minimum 21 Minimum 1 Minimum 1864

Maximum 67 Maximum 7 Maximum 5678

Sum 2174 Sum 171 Sum 198193

Count 50 Count 50 Count 50

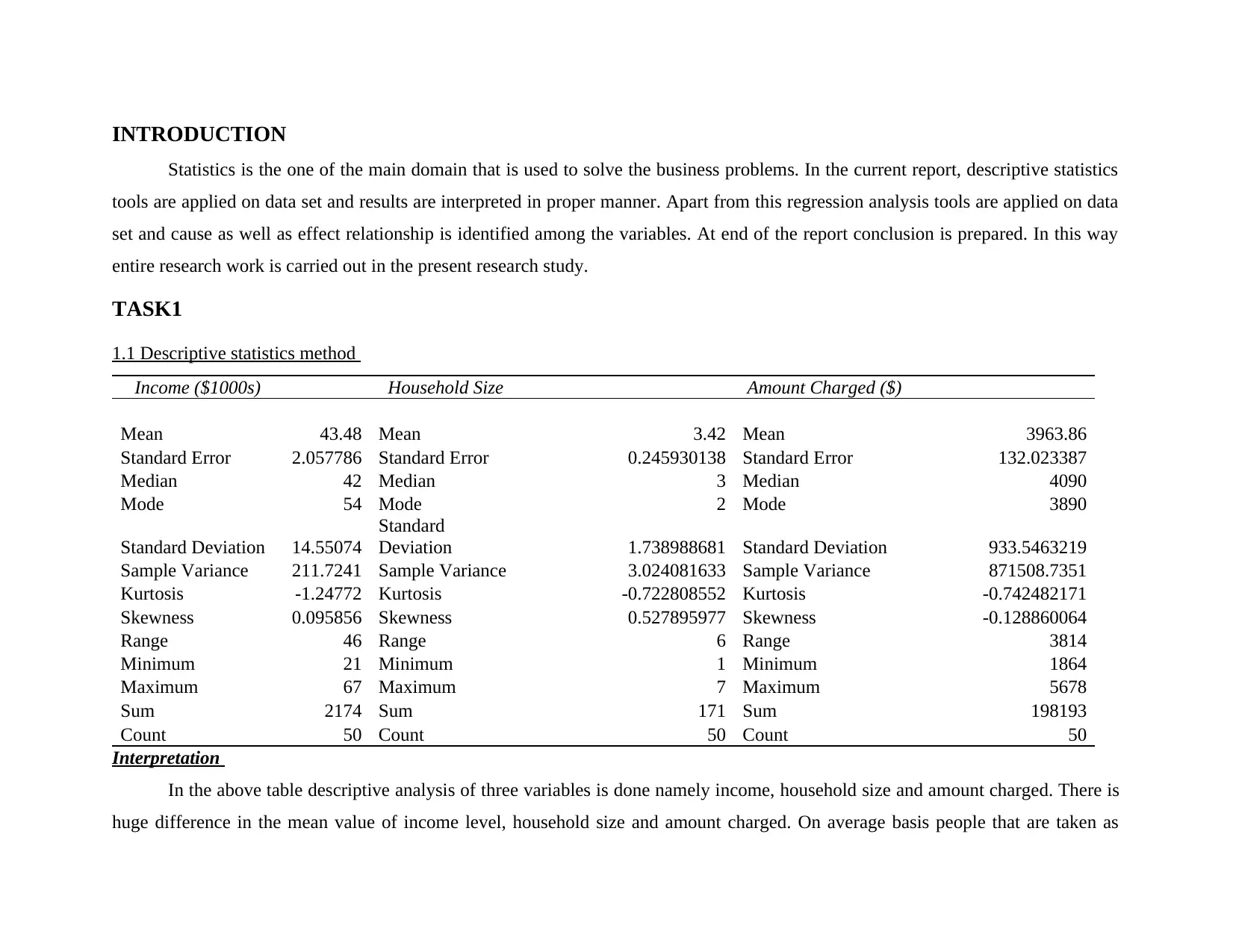

Interpretation

In the above table descriptive analysis of three variables is done namely income, household size and amount charged. There is

huge difference in the mean value of income level, household size and amount charged. On average basis people that are taken as

Statistics is the one of the main domain that is used to solve the business problems. In the current report, descriptive statistics

tools are applied on data set and results are interpreted in proper manner. Apart from this regression analysis tools are applied on data

set and cause as well as effect relationship is identified among the variables. At end of the report conclusion is prepared. In this way

entire research work is carried out in the present research study.

TASK1

1.1 Descriptive statistics method

Income ($1000s) Household Size Amount Charged ($)

Mean 43.48 Mean 3.42 Mean 3963.86

Standard Error 2.057786 Standard Error 0.245930138 Standard Error 132.023387

Median 42 Median 3 Median 4090

Mode 54 Mode 2 Mode 3890

Standard Deviation 14.55074

Standard

Deviation 1.738988681 Standard Deviation 933.5463219

Sample Variance 211.7241 Sample Variance 3.024081633 Sample Variance 871508.7351

Kurtosis -1.24772 Kurtosis -0.722808552 Kurtosis -0.742482171

Skewness 0.095856 Skewness 0.527895977 Skewness -0.128860064

Range 46 Range 6 Range 3814

Minimum 21 Minimum 1 Minimum 1864

Maximum 67 Maximum 7 Maximum 5678

Sum 2174 Sum 171 Sum 198193

Count 50 Count 50 Count 50

Interpretation

In the above table descriptive analysis of three variables is done namely income, household size and amount charged. There is

huge difference in the mean value of income level, household size and amount charged. On average basis people that are taken as

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

respondent in the present research earn $43000 with average size of family which is 3.42 which means that on average basis there are

three to four members in each family. Amount charged is $3963 for credit card for each family. In order to measure the frequency of

the occurrence of values in case of income variable mode value of 54 is observed followed by mode value of 2 in case of household

size. In case of customer amount charged mode value is $3890. It can be said that in case of income there are varied number of

respondents that are earning amount of $54000. Apart from this, mode value in case of household size is 2 which means that there are

several families in which there are 2 members. Results are clearly reflecting that mode value is $3890 which means that there are

number of respondents which charge amount of $3890. Results are clearly reflecting that with small percentage change in income big

variation comes in amount charged. It can be said that amount charged to some extent is dependent on the income level of individuals.

When income level of people increased then at same time amount charged changed to some extent.

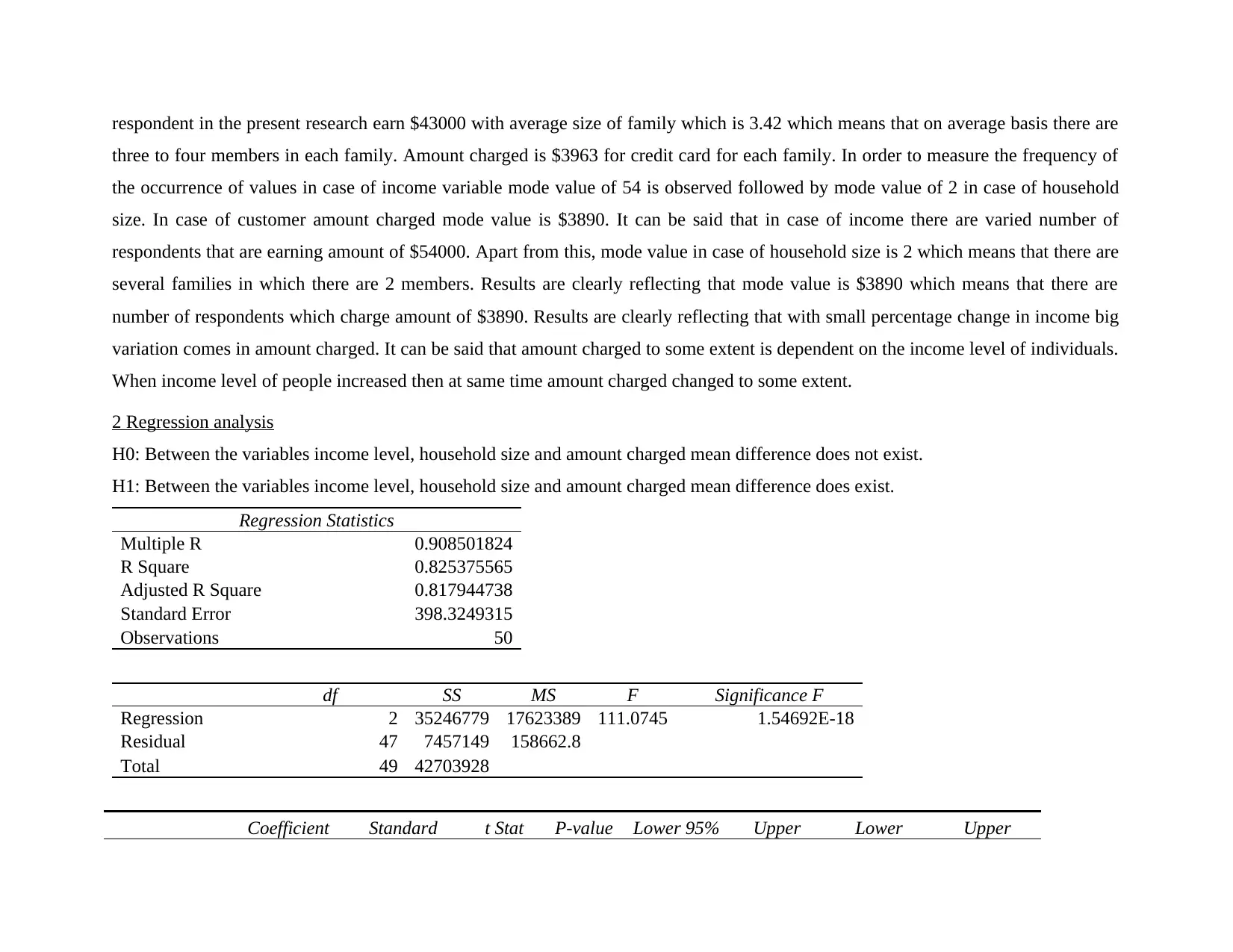

2 Regression analysis

H0: Between the variables income level, household size and amount charged mean difference does not exist.

H1: Between the variables income level, household size and amount charged mean difference does exist.

Regression Statistics

Multiple R 0.908501824

R Square 0.825375565

Adjusted R Square 0.817944738

Standard Error 398.3249315

Observations 50

df SS MS F Significance F

Regression 2 35246779 17623389 111.0745 1.54692E-18

Residual 47 7457149 158662.8

Total 49 42703928

Coefficient Standard t Stat P-value Lower 95% Upper Lower Upper

three to four members in each family. Amount charged is $3963 for credit card for each family. In order to measure the frequency of

the occurrence of values in case of income variable mode value of 54 is observed followed by mode value of 2 in case of household

size. In case of customer amount charged mode value is $3890. It can be said that in case of income there are varied number of

respondents that are earning amount of $54000. Apart from this, mode value in case of household size is 2 which means that there are

several families in which there are 2 members. Results are clearly reflecting that mode value is $3890 which means that there are

number of respondents which charge amount of $3890. Results are clearly reflecting that with small percentage change in income big

variation comes in amount charged. It can be said that amount charged to some extent is dependent on the income level of individuals.

When income level of people increased then at same time amount charged changed to some extent.

2 Regression analysis

H0: Between the variables income level, household size and amount charged mean difference does not exist.

H1: Between the variables income level, household size and amount charged mean difference does exist.

Regression Statistics

Multiple R 0.908501824

R Square 0.825375565

Adjusted R Square 0.817944738

Standard Error 398.3249315

Observations 50

df SS MS F Significance F

Regression 2 35246779 17623389 111.0745 1.54692E-18

Residual 47 7457149 158662.8

Total 49 42703928

Coefficient Standard t Stat P-value Lower 95% Upper Lower Upper

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

s Error 95% 95.0% 95.0%

Intercept

1305.03388

5 197.771

6.59871

2

3.32E-

08

907.169975

8 1702.898 907.17

1702.89779

4

Income

($1000s)

33.1219553

9 3.970237

8.34256

3

7.89E-

11

25.1348678

7 41.10904 25.13487 41.1090429

Household

Size

356.340203

2 33.2204

10.7265

5

3.17E-

14 289.509379 423.171 289.5094

423.171027

3

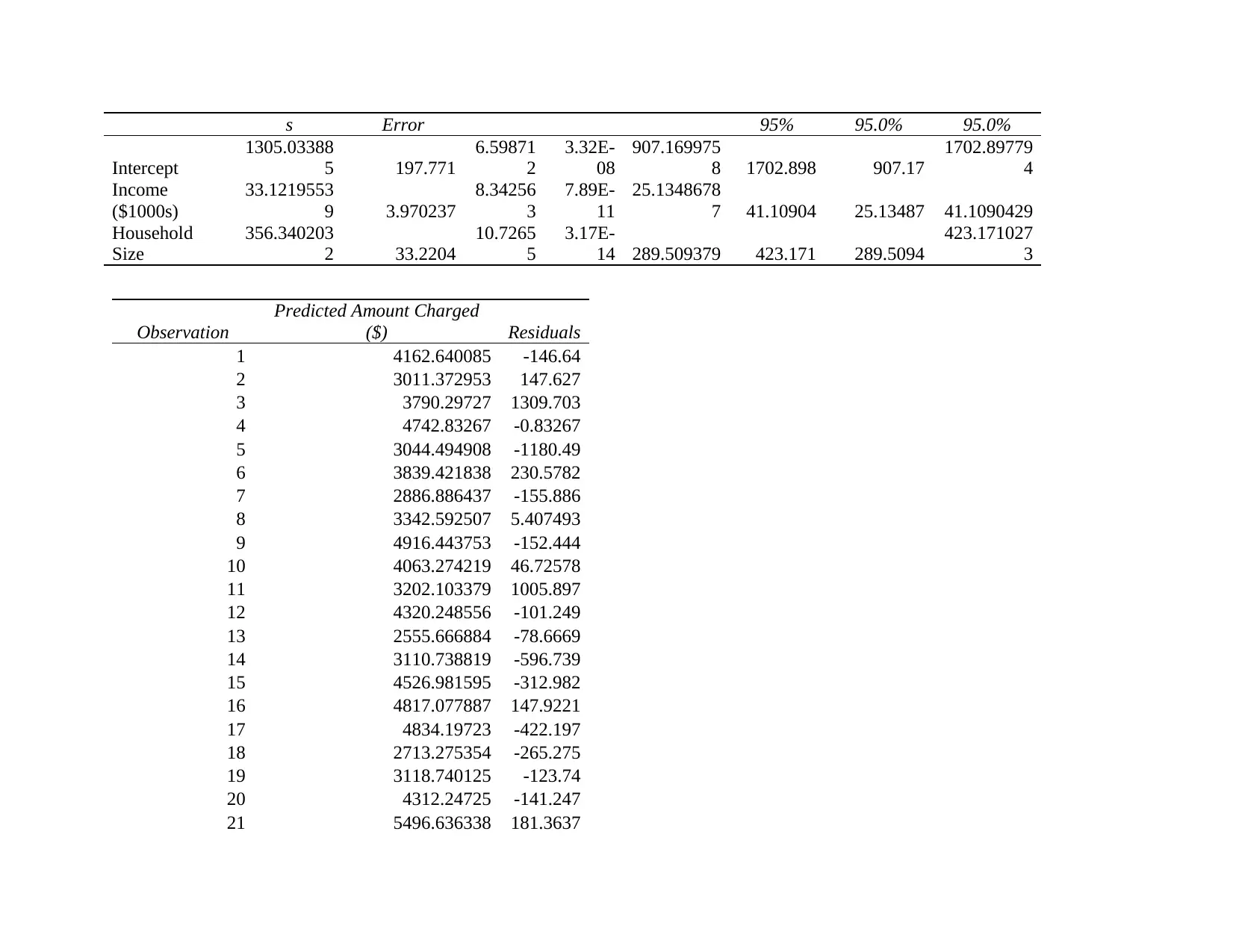

Observation

Predicted Amount Charged

($) Residuals

1 4162.640085 -146.64

2 3011.372953 147.627

3 3790.29727 1309.703

4 4742.83267 -0.83267

5 3044.494908 -1180.49

6 3839.421838 230.5782

7 2886.886437 -155.886

8 3342.592507 5.407493

9 4916.443753 -152.444

10 4063.274219 46.72578

11 3202.103379 1005.897

12 4320.248556 -101.249

13 2555.666884 -78.6669

14 3110.738819 -596.739

15 4526.981595 -312.982

16 4817.077887 147.9221

17 4834.19723 -422.197

18 2713.275354 -265.275

19 3118.740125 -123.74

20 4312.24725 -141.247

21 5496.636338 181.3637

Intercept

1305.03388

5 197.771

6.59871

2

3.32E-

08

907.169975

8 1702.898 907.17

1702.89779

4

Income

($1000s)

33.1219553

9 3.970237

8.34256

3

7.89E-

11

25.1348678

7 41.10904 25.13487 41.1090429

Household

Size

356.340203

2 33.2204

10.7265

5

3.17E-

14 289.509379 423.171 289.5094

423.171027

3

Observation

Predicted Amount Charged

($) Residuals

1 4162.640085 -146.64

2 3011.372953 147.627

3 3790.29727 1309.703

4 4742.83267 -0.83267

5 3044.494908 -1180.49

6 3839.421838 230.5782

7 2886.886437 -155.886

8 3342.592507 5.407493

9 4916.443753 -152.444

10 4063.274219 46.72578

11 3202.103379 1005.897

12 4320.248556 -101.249

13 2555.666884 -78.6669

14 3110.738819 -596.739

15 4526.981595 -312.982

16 4817.077887 147.9221

17 4834.19723 -422.197

18 2713.275354 -265.275

19 3118.740125 -123.74

20 4312.24725 -141.247

21 5496.636338 181.3637

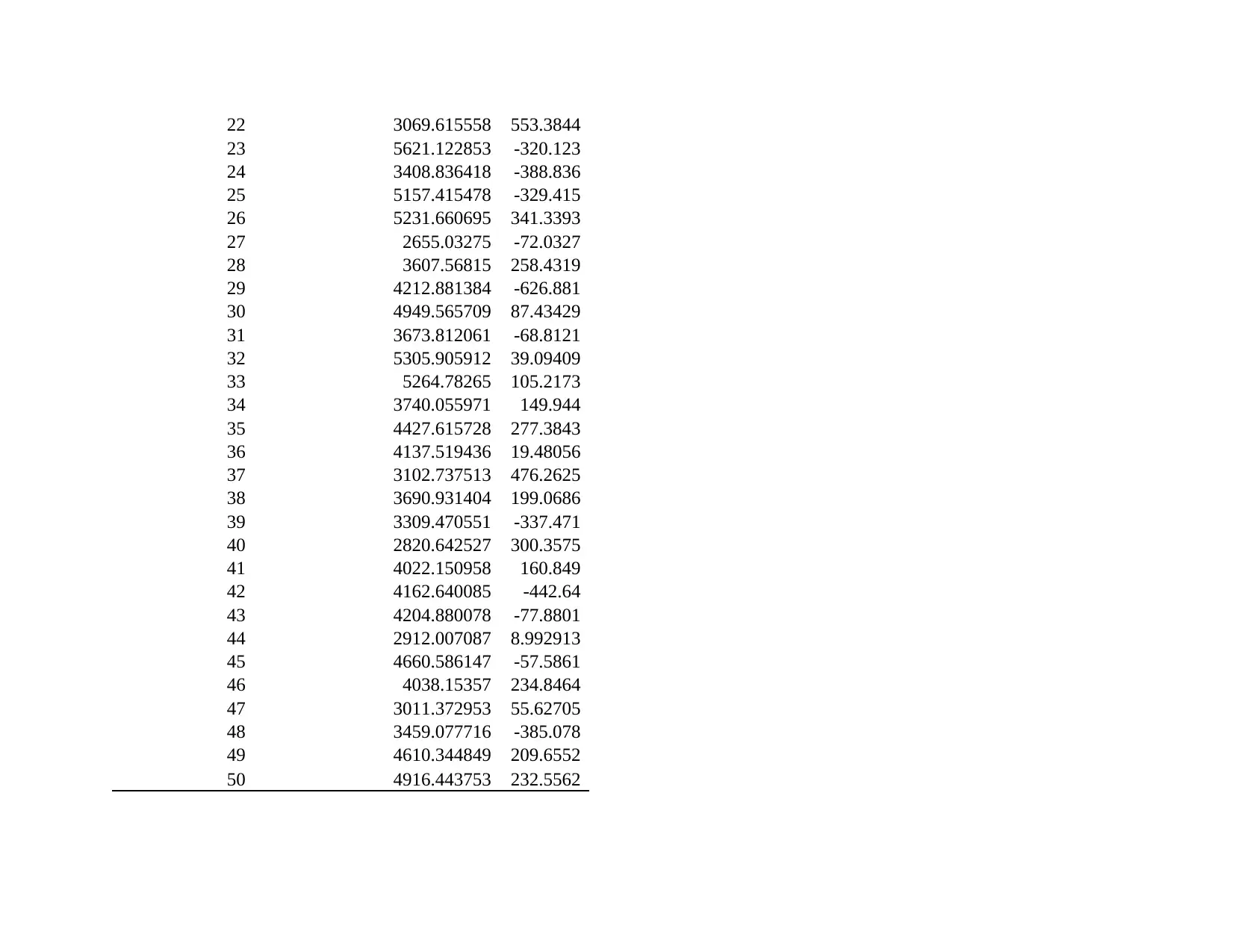

22 3069.615558 553.3844

23 5621.122853 -320.123

24 3408.836418 -388.836

25 5157.415478 -329.415

26 5231.660695 341.3393

27 2655.03275 -72.0327

28 3607.56815 258.4319

29 4212.881384 -626.881

30 4949.565709 87.43429

31 3673.812061 -68.8121

32 5305.905912 39.09409

33 5264.78265 105.2173

34 3740.055971 149.944

35 4427.615728 277.3843

36 4137.519436 19.48056

37 3102.737513 476.2625

38 3690.931404 199.0686

39 3309.470551 -337.471

40 2820.642527 300.3575

41 4022.150958 160.849

42 4162.640085 -442.64

43 4204.880078 -77.8801

44 2912.007087 8.992913

45 4660.586147 -57.5861

46 4038.15357 234.8464

47 3011.372953 55.62705

48 3459.077716 -385.078

49 4610.344849 209.6552

50 4916.443753 232.5562

23 5621.122853 -320.123

24 3408.836418 -388.836

25 5157.415478 -329.415

26 5231.660695 341.3393

27 2655.03275 -72.0327

28 3607.56815 258.4319

29 4212.881384 -626.881

30 4949.565709 87.43429

31 3673.812061 -68.8121

32 5305.905912 39.09409

33 5264.78265 105.2173

34 3740.055971 149.944

35 4427.615728 277.3843

36 4137.519436 19.48056

37 3102.737513 476.2625

38 3690.931404 199.0686

39 3309.470551 -337.471

40 2820.642527 300.3575

41 4022.150958 160.849

42 4162.640085 -442.64

43 4204.880078 -77.8801

44 2912.007087 8.992913

45 4660.586147 -57.5861

46 4038.15357 234.8464

47 3011.372953 55.62705

48 3459.077716 -385.078

49 4610.344849 209.6552

50 4916.443753 232.5562

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

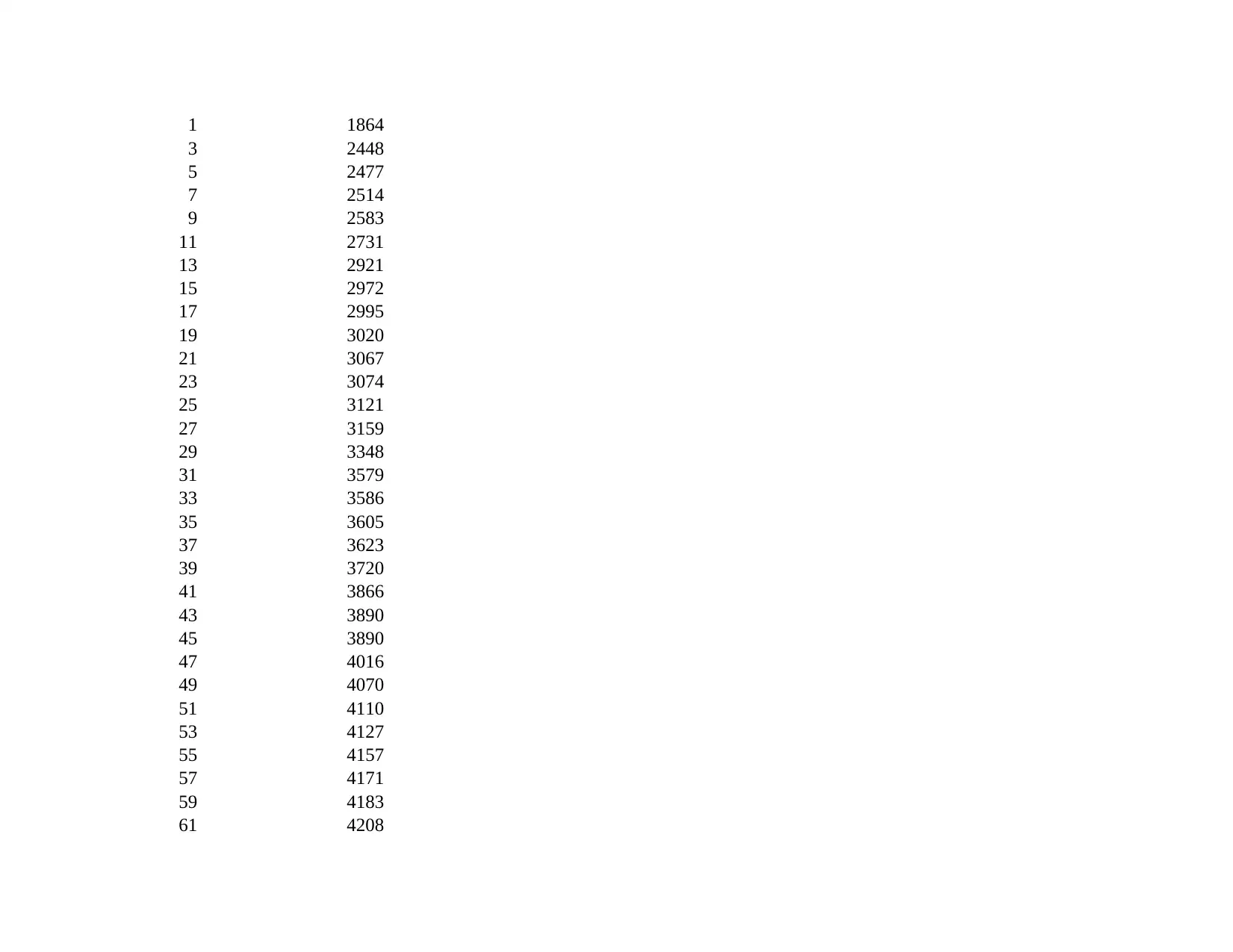

Percentile Amount Charged ($)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 1864

3 2448

5 2477

7 2514

9 2583

11 2731

13 2921

15 2972

17 2995

19 3020

21 3067

23 3074

25 3121

27 3159

29 3348

31 3579

33 3586

35 3605

37 3623

39 3720

41 3866

43 3890

45 3890

47 4016

49 4070

51 4110

53 4127

55 4157

57 4171

59 4183

61 4208

3 2448

5 2477

7 2514

9 2583

11 2731

13 2921

15 2972

17 2995

19 3020

21 3067

23 3074

25 3121

27 3159

29 3348

31 3579

33 3586

35 3605

37 3623

39 3720

41 3866

43 3890

45 3890

47 4016

49 4070

51 4110

53 4127

55 4157

57 4171

59 4183

61 4208

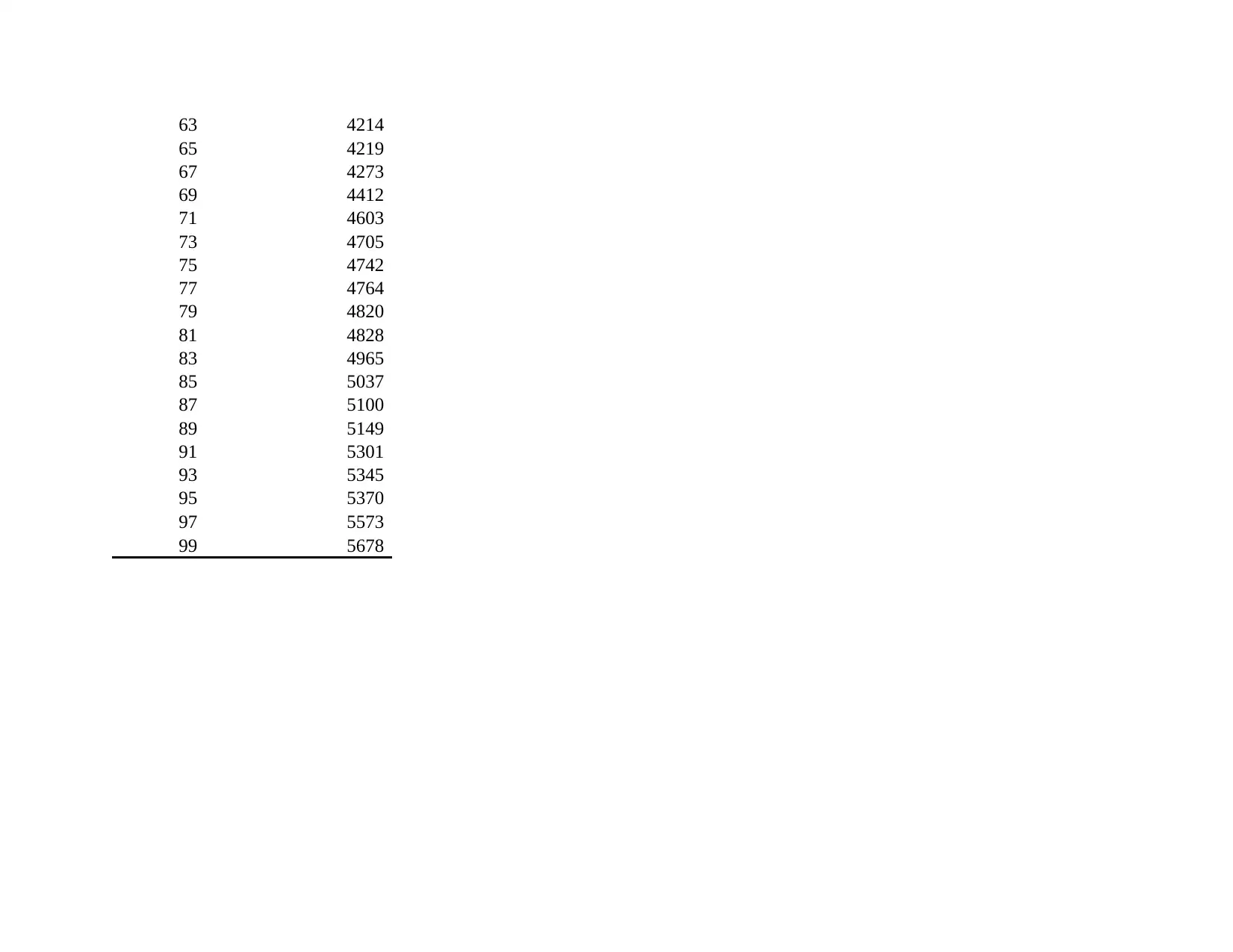

63 4214

65 4219

67 4273

69 4412

71 4603

73 4705

75 4742

77 4764

79 4820

81 4828

83 4965

85 5037

87 5100

89 5149

91 5301

93 5345

95 5370

97 5573

99 5678

65 4219

67 4273

69 4412

71 4603

73 4705

75 4742

77 4764

79 4820

81 4828

83 4965

85 5037

87 5100

89 5149

91 5301

93 5345

95 5370

97 5573

99 5678

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

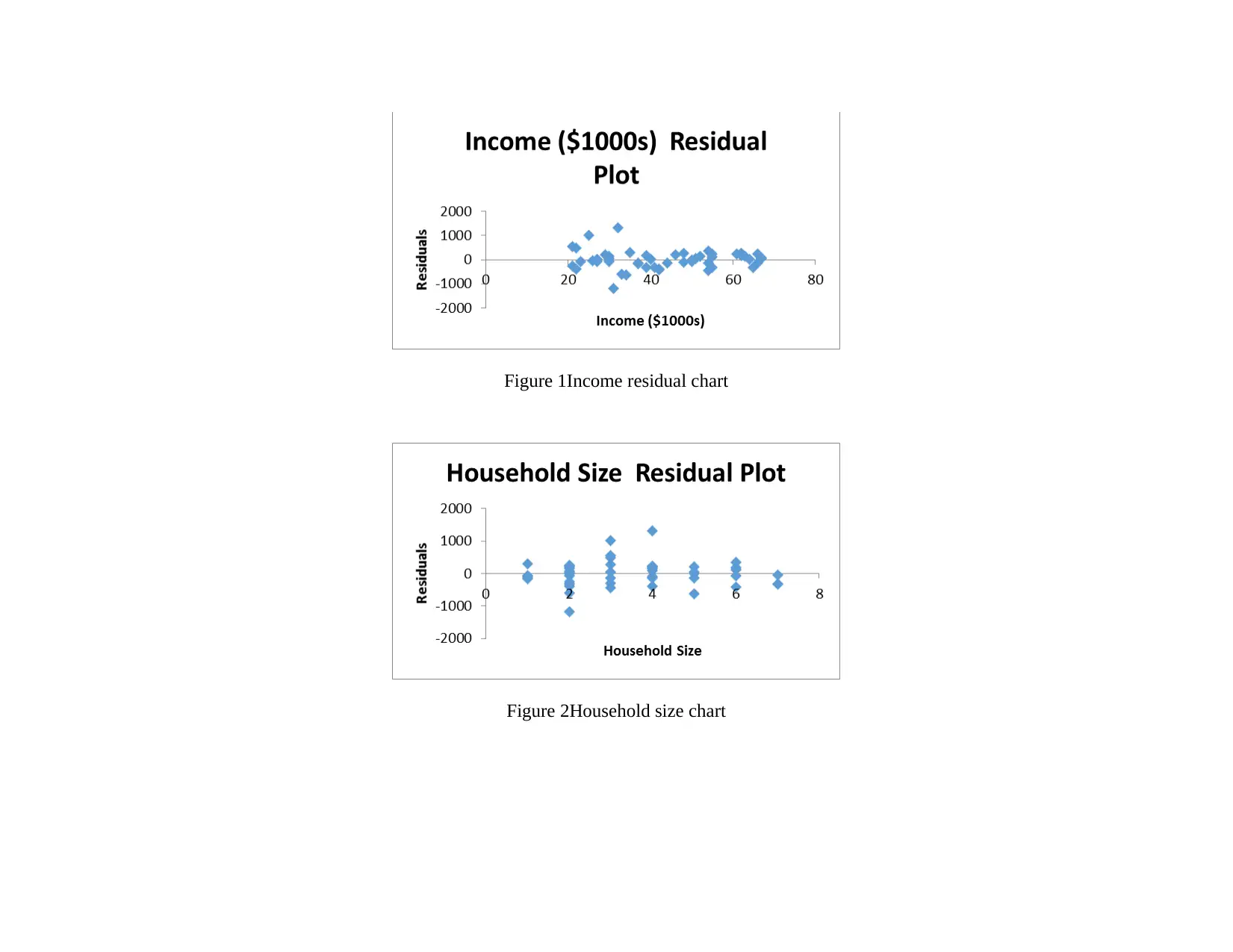

Figure 1Income residual chart

Figure 2Household size chart

Figure 2Household size chart

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

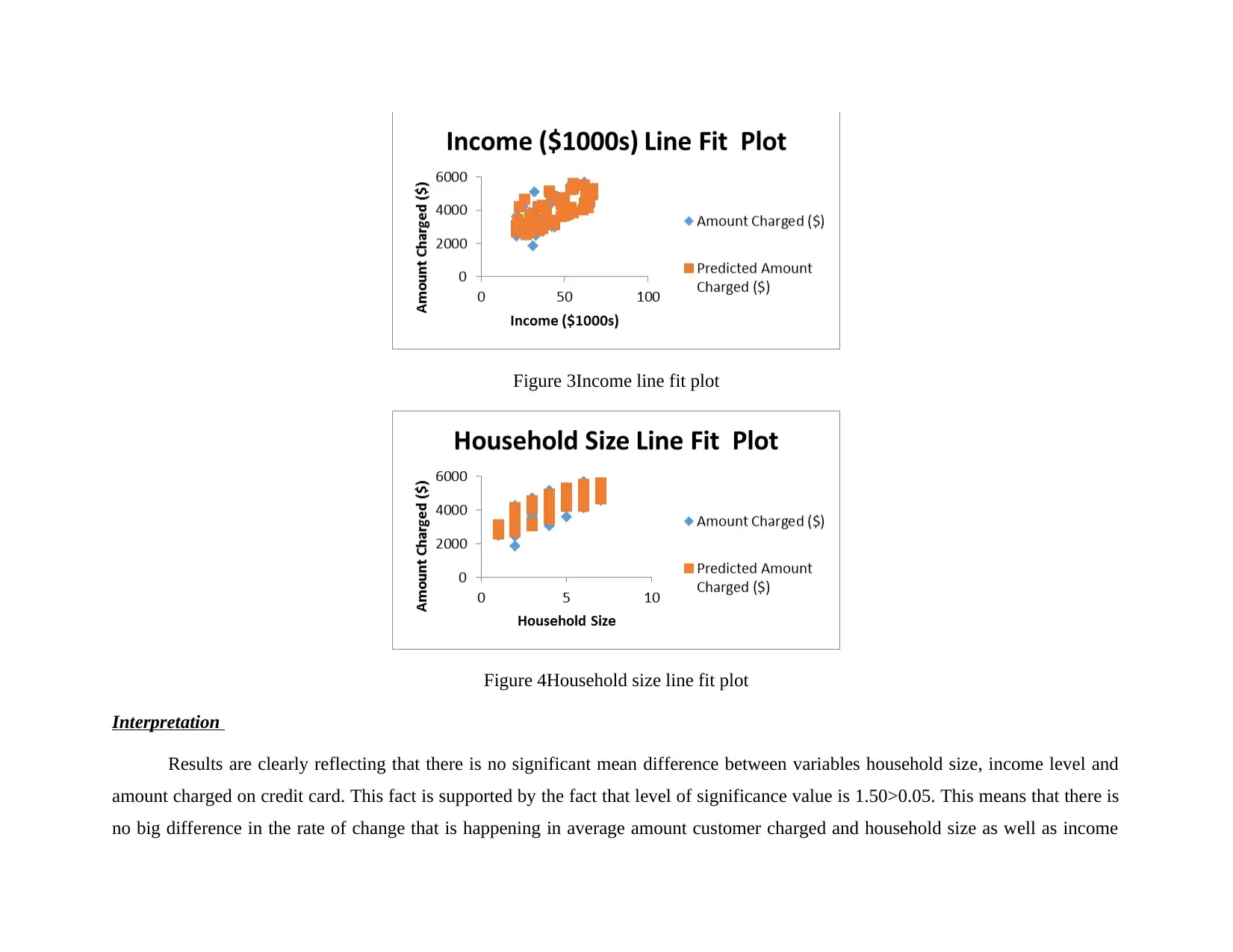

Figure 3Income line fit plot

Figure 4Household size line fit plot

Interpretation

Results are clearly reflecting that there is no significant mean difference between variables household size, income level and

amount charged on credit card. This fact is supported by the fact that level of significance value is 1.50>0.05. This means that there is

no big difference in the rate of change that is happening in average amount customer charged and household size as well as income

Figure 4Household size line fit plot

Interpretation

Results are clearly reflecting that there is no significant mean difference between variables household size, income level and

amount charged on credit card. This fact is supported by the fact that level of significance value is 1.50>0.05. This means that there is

no big difference in the rate of change that is happening in average amount customer charged and household size as well as income

level. From the model it can be observed that value of multiple R is 0.90 and same of R square is 0.82. These results are clearly

indicating that there is high value of correlation which is 0.90 which means that with change in relevant independent variable big

variation comes in the dependent variable. Results are clearly reflecting that with change in relevant variable 82% variation comes in

the credit card charge. Intercept value is $1305 which means that even independent variable value is zero average amount charged on

credit card is equal to the mentioned value. Beta value is 33.12 for income level and this reflects that in case slight variation comes in

income level credit card charge amount will change by 33.12 points. On other hand, if household size will change then in that case

average spend on credit card will change by 356 points.

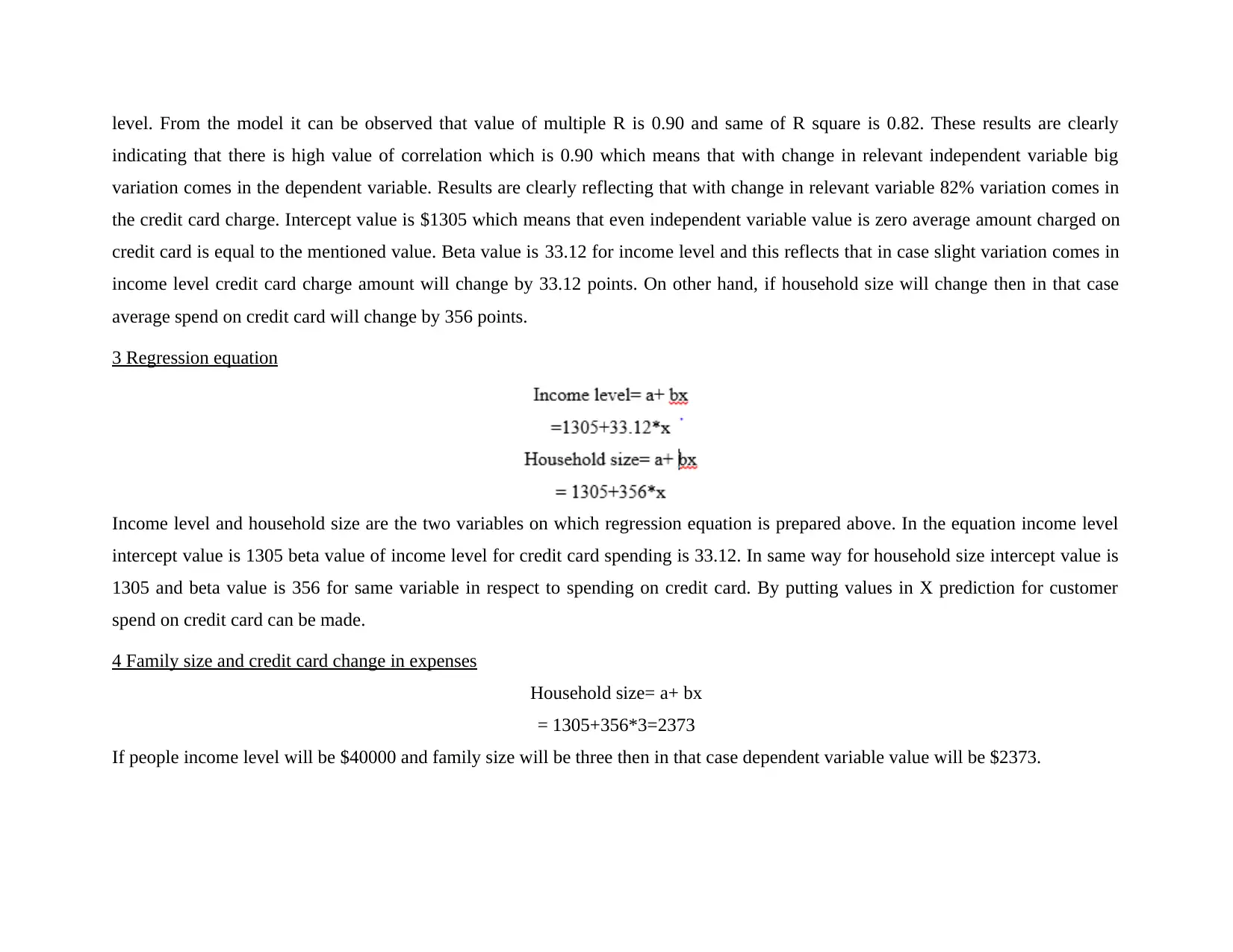

3 Regression equation

Income level and household size are the two variables on which regression equation is prepared above. In the equation income level

intercept value is 1305 beta value of income level for credit card spending is 33.12. In same way for household size intercept value is

1305 and beta value is 356 for same variable in respect to spending on credit card. By putting values in X prediction for customer

spend on credit card can be made.

4 Family size and credit card change in expenses

Household size= a+ bx

= 1305+356*3=2373

If people income level will be $40000 and family size will be three then in that case dependent variable value will be $2373.

indicating that there is high value of correlation which is 0.90 which means that with change in relevant independent variable big

variation comes in the dependent variable. Results are clearly reflecting that with change in relevant variable 82% variation comes in

the credit card charge. Intercept value is $1305 which means that even independent variable value is zero average amount charged on

credit card is equal to the mentioned value. Beta value is 33.12 for income level and this reflects that in case slight variation comes in

income level credit card charge amount will change by 33.12 points. On other hand, if household size will change then in that case

average spend on credit card will change by 356 points.

3 Regression equation

Income level and household size are the two variables on which regression equation is prepared above. In the equation income level

intercept value is 1305 beta value of income level for credit card spending is 33.12. In same way for household size intercept value is

1305 and beta value is 356 for same variable in respect to spending on credit card. By putting values in X prediction for customer

spend on credit card can be made.

4 Family size and credit card change in expenses

Household size= a+ bx

= 1305+356*3=2373

If people income level will be $40000 and family size will be three then in that case dependent variable value will be $2373.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 30

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.