Statistics Assignment: Analyzing Housing, Mutual Funds, and Returns

VerifiedAdded on 2022/08/29

|11

|829

|28

Homework Assignment

AI Summary

This statistics assignment analyzes financial data, focusing on descriptive and inferential statistics. Part A examines fixed interest rates, comparing periods before and after 2000, using box plots, descriptive statistics, and the empirical rule to assess distributions, symmetry, and variation. Part B delves into mutual funds, employing hypothesis testing to investigate the relationship between risk and sales charges, the proportion of sales charges in average risk funds, and the impact of higher risk on returns, with a regression analysis to predict returns based on various factors. The assignment includes tables, graphs, and interpretations to support the statistical findings and conclusions.

Running head: STATISTICS

Statistics

Name of the Student:

Name of the University:

Author note:

Statistics

Name of the Student:

Name of the University:

Author note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STATISTICS

Table of Contents

PART A......................................................................................................................................2

PART B......................................................................................................................................4

Answer to the question 1........................................................................................................4

Answer to the question 2........................................................................................................6

Answer to the question 3........................................................................................................6

Answer to the question 4........................................................................................................7

Bibliography...............................................................................................................................9

PART A

Table of Contents

PART A......................................................................................................................................2

PART B......................................................................................................................................4

Answer to the question 1........................................................................................................4

Answer to the question 2........................................................................................................6

Answer to the question 3........................................................................................................6

Answer to the question 4........................................................................................................7

Bibliography...............................................................................................................................9

PART A

2STATISTICS

(i)

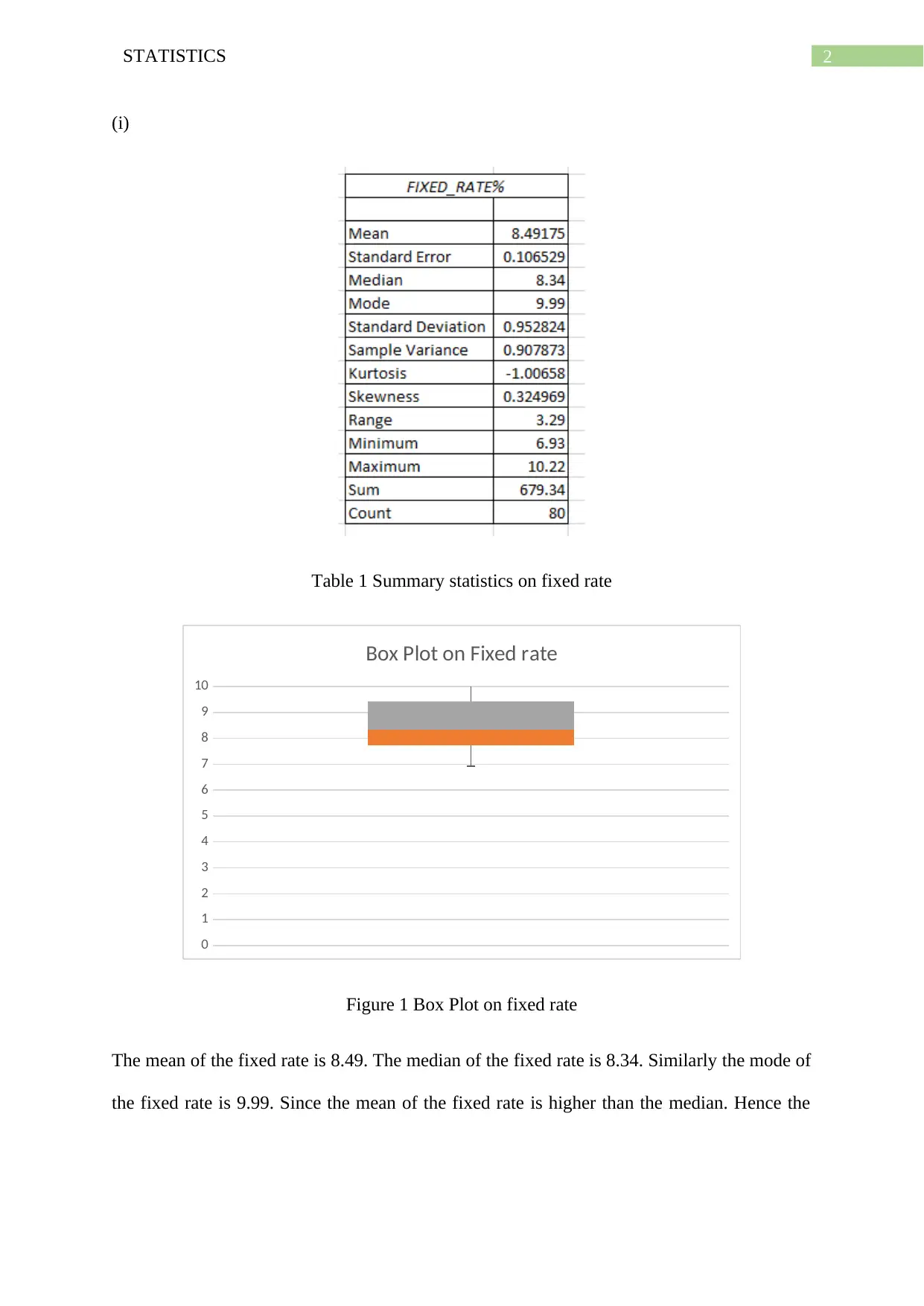

Table 1 Summary statistics on fixed rate

0

1

2

3

4

5

6

7

8

9

10

Box Plot on Fixed rate

Figure 1 Box Plot on fixed rate

The mean of the fixed rate is 8.49. The median of the fixed rate is 8.34. Similarly the mode of

the fixed rate is 9.99. Since the mean of the fixed rate is higher than the median. Hence the

(i)

Table 1 Summary statistics on fixed rate

0

1

2

3

4

5

6

7

8

9

10

Box Plot on Fixed rate

Figure 1 Box Plot on fixed rate

The mean of the fixed rate is 8.49. The median of the fixed rate is 8.34. Similarly the mode of

the fixed rate is 9.99. Since the mean of the fixed rate is higher than the median. Hence the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STATISTICS

skewness is positive. The value of the skewness is 0.32. The variance, standard deviation and

range of the fixed rate is 0.90, 0.95 and 3.29.

In the 5th month 1990 the higher variation has been seen.

(ii)

1 10 19 28 37 46 55 64 73 82 91 100 109 118 127 136 145 154 163 172 181

0

2

4

6

8

10

12

Fixed rate

Observations

Frequency

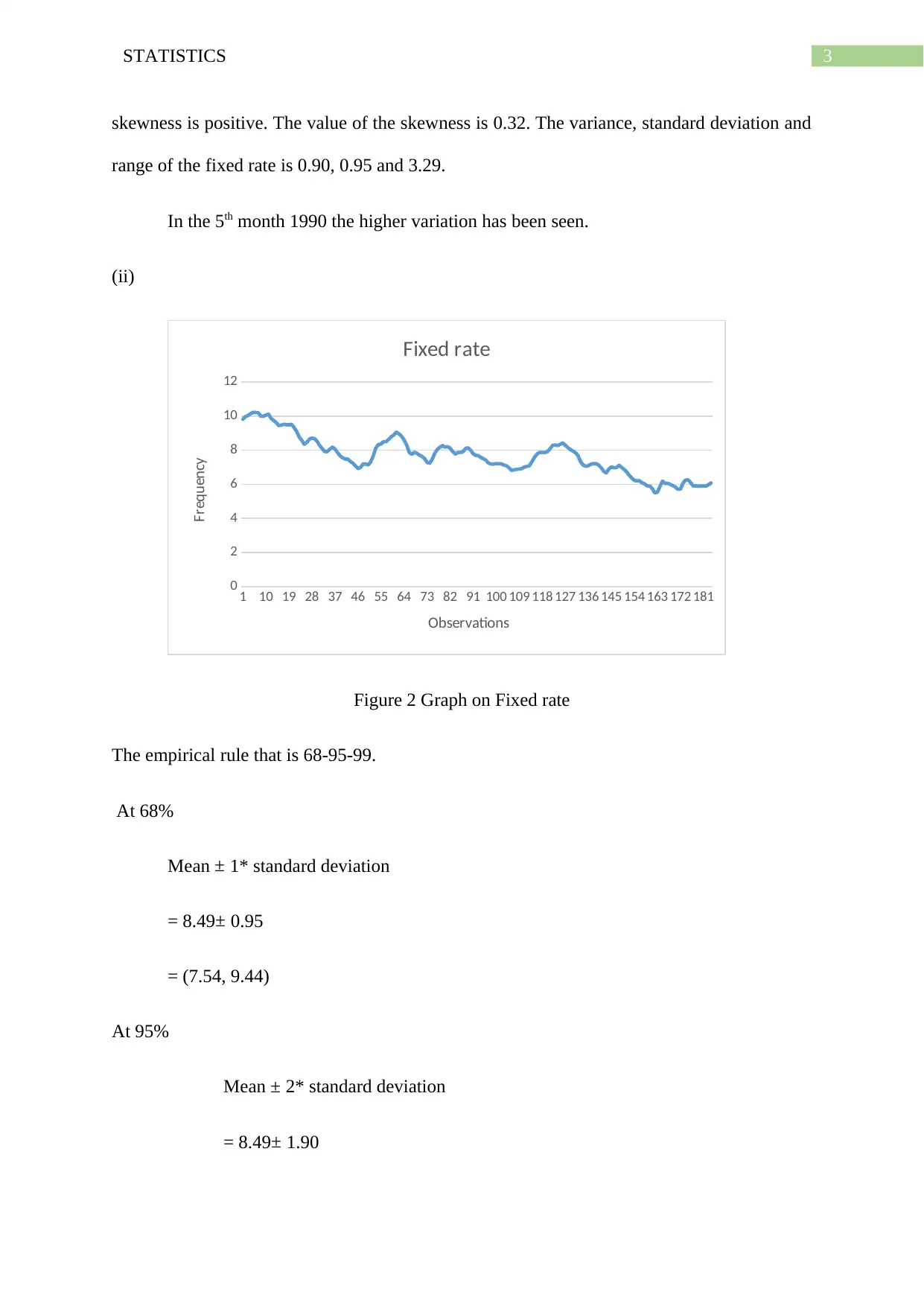

Figure 2 Graph on Fixed rate

The empirical rule that is 68-95-99.

At 68%

Mean ± 1* standard deviation

= 8.49± 0.95

= (7.54, 9.44)

At 95%

Mean ± 2* standard deviation

= 8.49± 1.90

skewness is positive. The value of the skewness is 0.32. The variance, standard deviation and

range of the fixed rate is 0.90, 0.95 and 3.29.

In the 5th month 1990 the higher variation has been seen.

(ii)

1 10 19 28 37 46 55 64 73 82 91 100 109 118 127 136 145 154 163 172 181

0

2

4

6

8

10

12

Fixed rate

Observations

Frequency

Figure 2 Graph on Fixed rate

The empirical rule that is 68-95-99.

At 68%

Mean ± 1* standard deviation

= 8.49± 0.95

= (7.54, 9.44)

At 95%

Mean ± 2* standard deviation

= 8.49± 1.90

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4STATISTICS

= (6.58, 10.39)

At 99%

Mean ± 3* standard deviation

= 8.49± 2.86

= (5.63, 11.35)

Sampling error = 1.65

PART B

Answer to the question 1

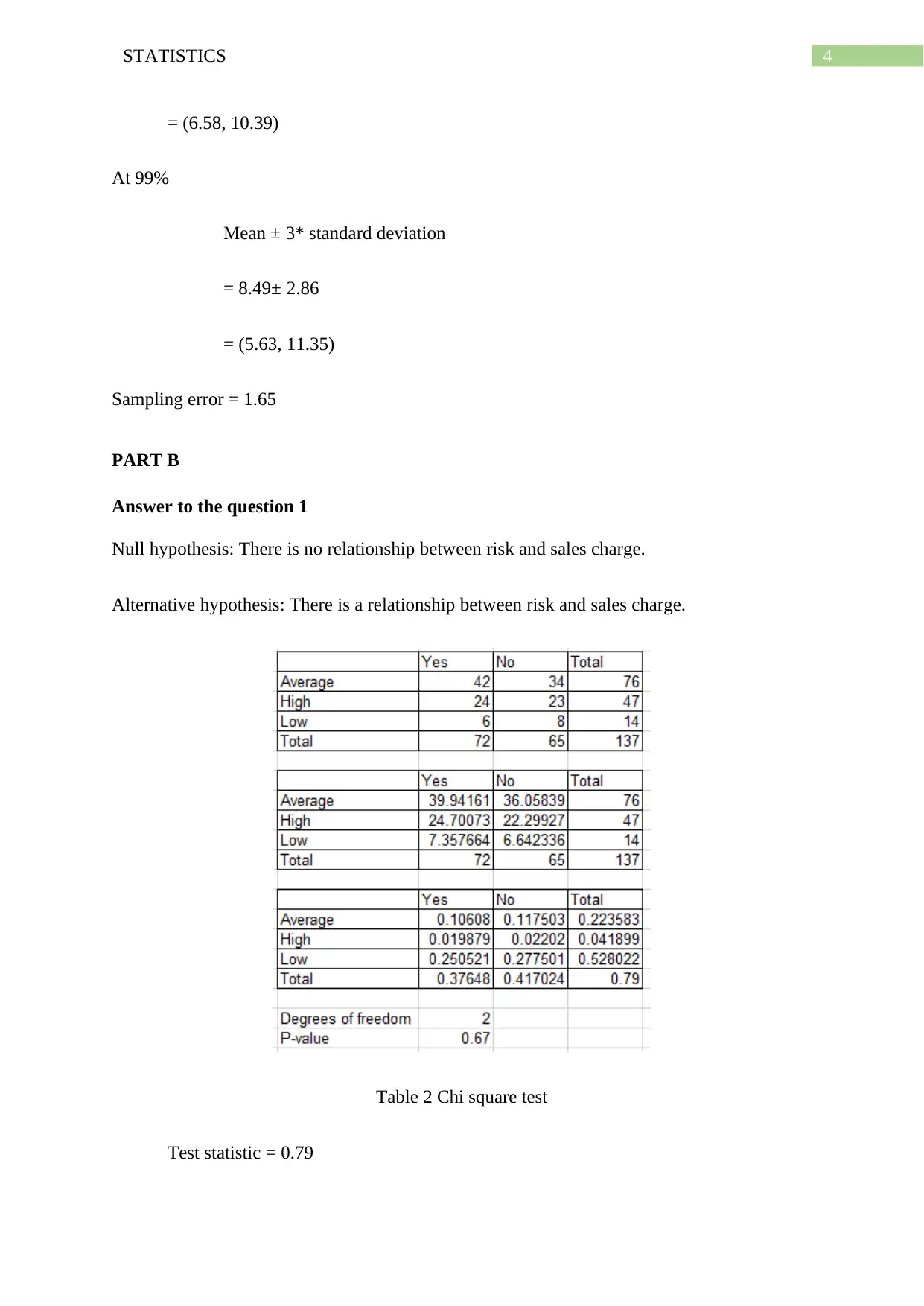

Null hypothesis: There is no relationship between risk and sales charge.

Alternative hypothesis: There is a relationship between risk and sales charge.

Table 2 Chi square test

Test statistic = 0.79

= (6.58, 10.39)

At 99%

Mean ± 3* standard deviation

= 8.49± 2.86

= (5.63, 11.35)

Sampling error = 1.65

PART B

Answer to the question 1

Null hypothesis: There is no relationship between risk and sales charge.

Alternative hypothesis: There is a relationship between risk and sales charge.

Table 2 Chi square test

Test statistic = 0.79

5STATISTICS

P-value 0.67

Alpha =0.05

It has been seen that the P-value > alpha. Hence the null hypothesis is not significant.

Thus it may be summarized that is no relationship between risk and sales charge.

Again

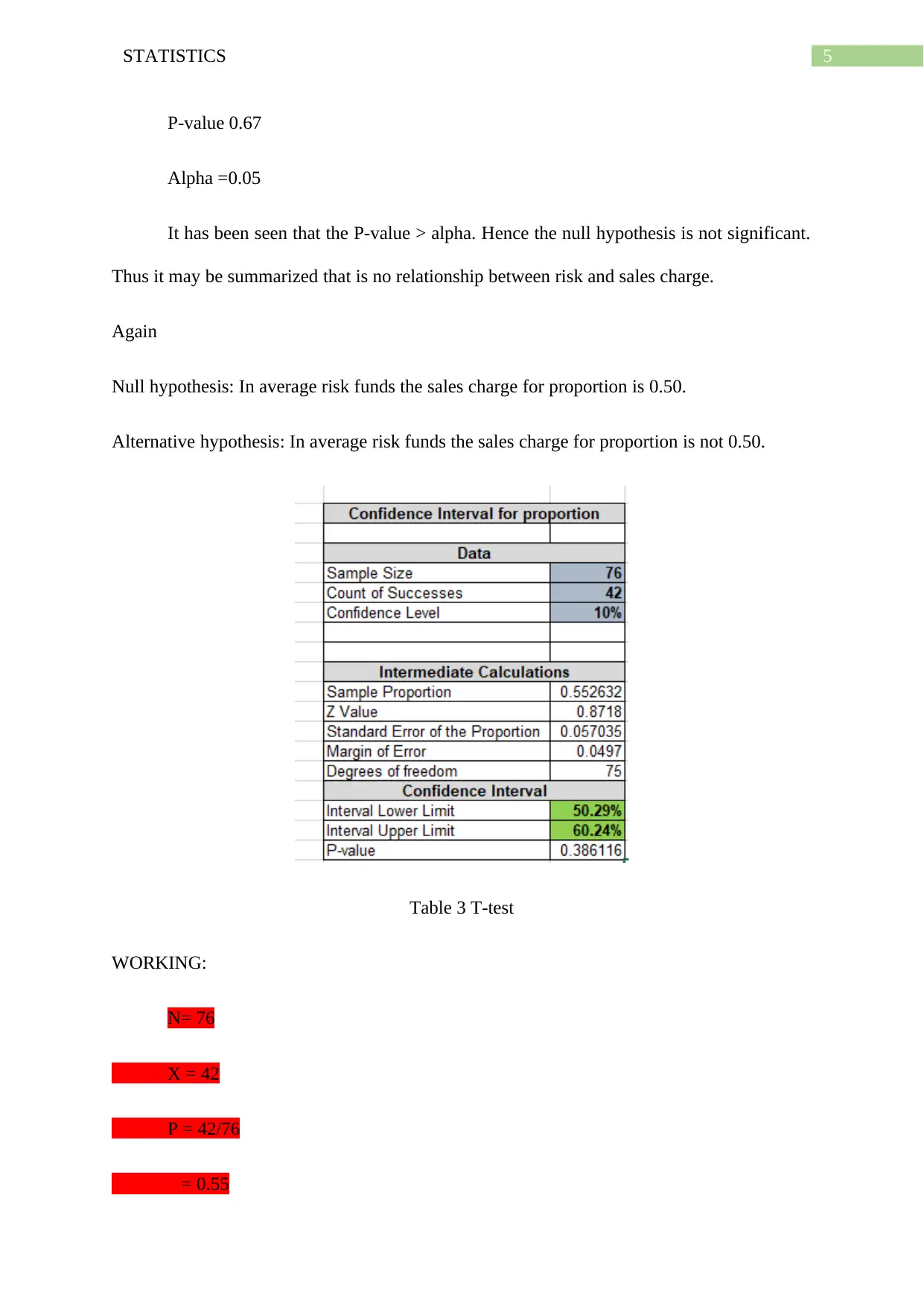

Null hypothesis: In average risk funds the sales charge for proportion is 0.50.

Alternative hypothesis: In average risk funds the sales charge for proportion is not 0.50.

Table 3 T-test

WORKING:

N= 76

X = 42

P = 42/76

= 0.55

P-value 0.67

Alpha =0.05

It has been seen that the P-value > alpha. Hence the null hypothesis is not significant.

Thus it may be summarized that is no relationship between risk and sales charge.

Again

Null hypothesis: In average risk funds the sales charge for proportion is 0.50.

Alternative hypothesis: In average risk funds the sales charge for proportion is not 0.50.

Table 3 T-test

WORKING:

N= 76

X = 42

P = 42/76

= 0.55

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STATISTICS

P1= 0.50

Z=

p− p 1

√ p 1∗(1− p 1)

n¿

¿

=

0.55−0.50

√ 0.50∗(1−0.50)

76 ¿

¿

= 0.87

SHOW EXCEL: P-value= t.dist.2t(test statistic, df)

It is clear that P-value > alpha (alpha =0.10). Hence the null hypothesis is not

significant. Thus it may be summarized that in average risk funds the sales charge for

proportion is 0.50.

Therefore the percentage of average risk and high risk of sales charge is 50%.

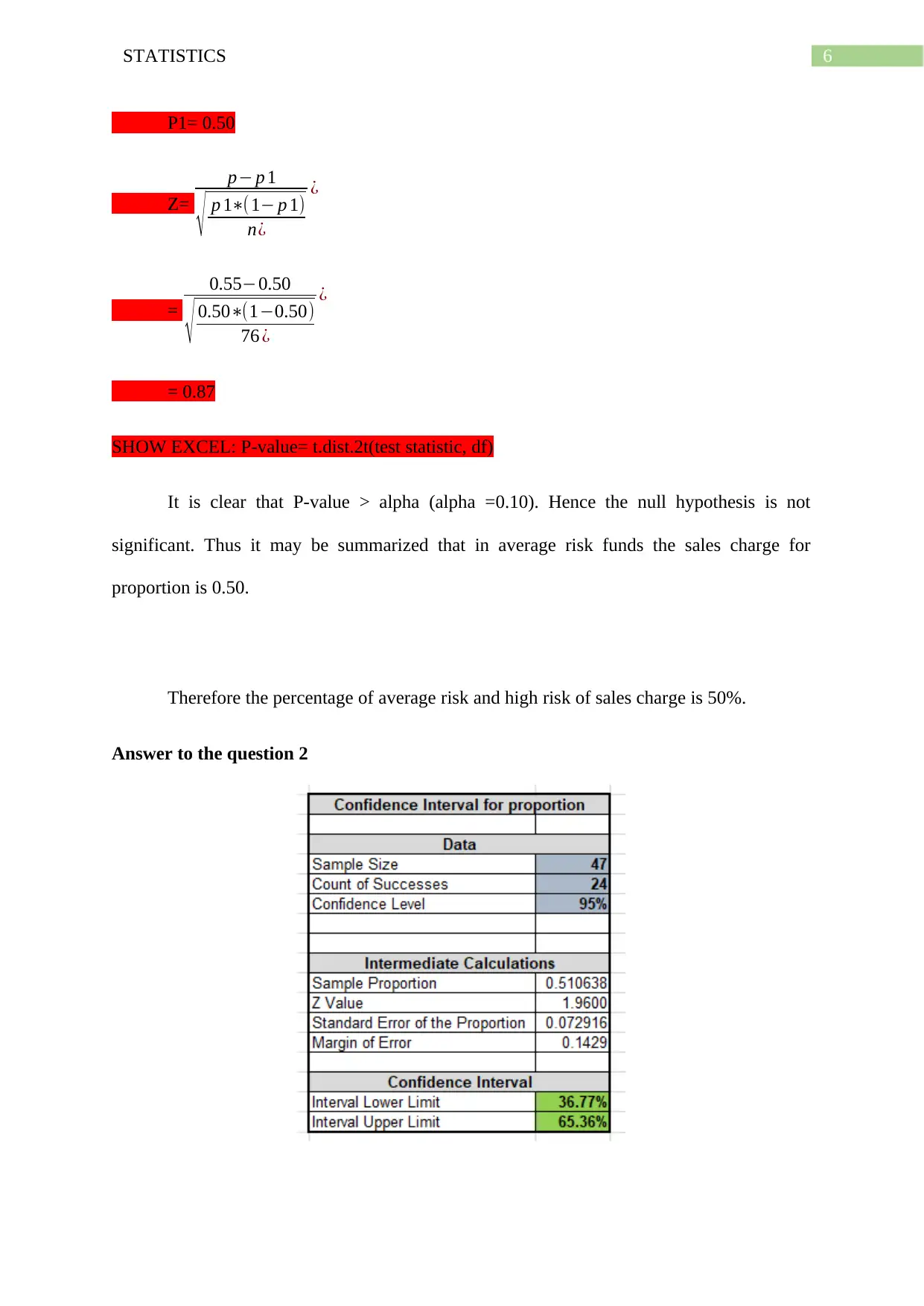

Answer to the question 2

P1= 0.50

Z=

p− p 1

√ p 1∗(1− p 1)

n¿

¿

=

0.55−0.50

√ 0.50∗(1−0.50)

76 ¿

¿

= 0.87

SHOW EXCEL: P-value= t.dist.2t(test statistic, df)

It is clear that P-value > alpha (alpha =0.10). Hence the null hypothesis is not

significant. Thus it may be summarized that in average risk funds the sales charge for

proportion is 0.50.

Therefore the percentage of average risk and high risk of sales charge is 50%.

Answer to the question 2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STATISTICS

Table 5 Confidence interval

Null hypothesis: The mutual fund with higher risk is 50%

Alternative hypothesis: The mutual fund with higher risk is not 50%

The confidence interval is (36.77%, 65.36%). The higher risk of mutual fund lies

within the confidence interval. Hence the null hypothesis is accepted.

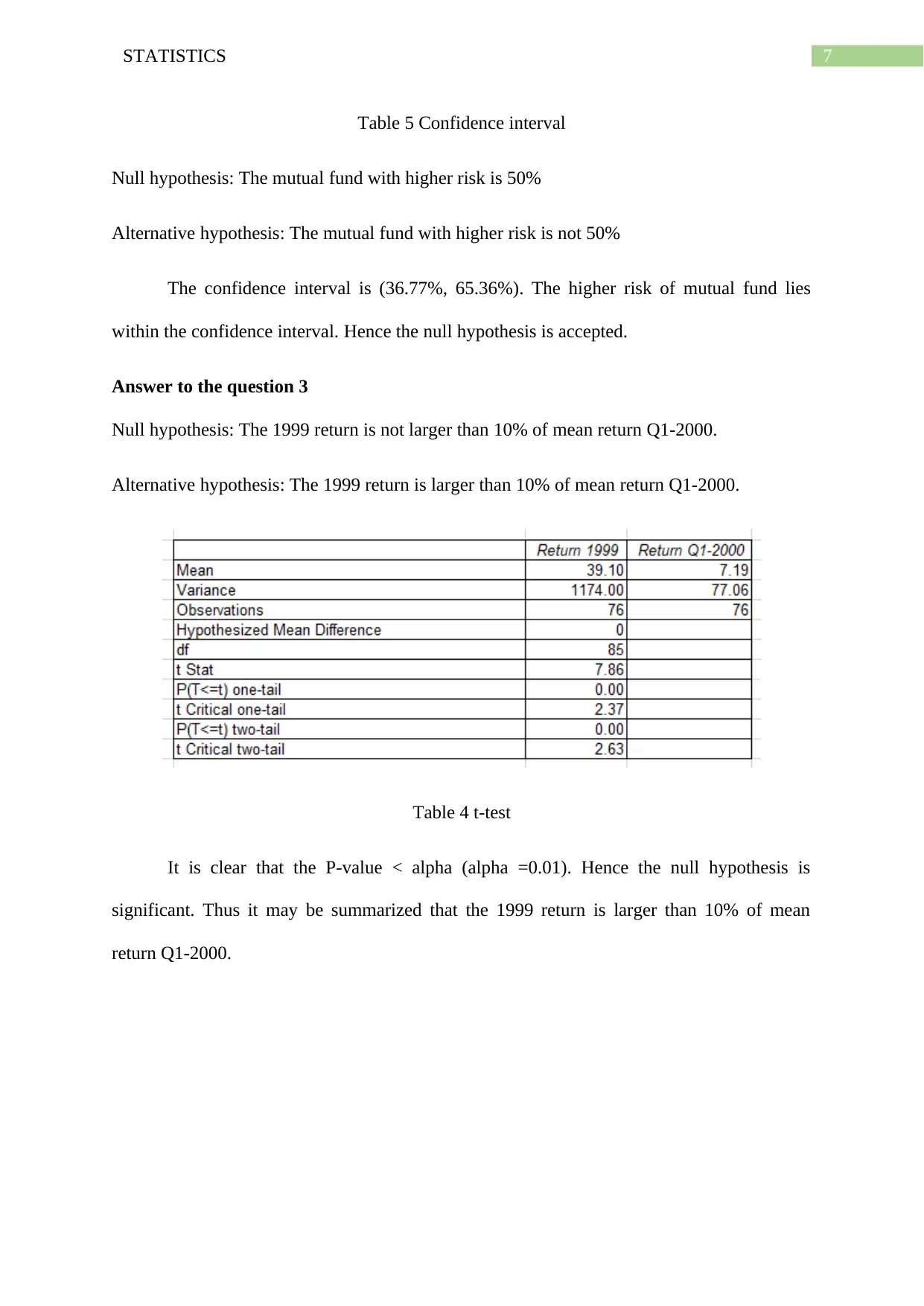

Answer to the question 3

Null hypothesis: The 1999 return is not larger than 10% of mean return Q1-2000.

Alternative hypothesis: The 1999 return is larger than 10% of mean return Q1-2000.

Table 4 t-test

It is clear that the P-value < alpha (alpha =0.01). Hence the null hypothesis is

significant. Thus it may be summarized that the 1999 return is larger than 10% of mean

return Q1-2000.

Table 5 Confidence interval

Null hypothesis: The mutual fund with higher risk is 50%

Alternative hypothesis: The mutual fund with higher risk is not 50%

The confidence interval is (36.77%, 65.36%). The higher risk of mutual fund lies

within the confidence interval. Hence the null hypothesis is accepted.

Answer to the question 3

Null hypothesis: The 1999 return is not larger than 10% of mean return Q1-2000.

Alternative hypothesis: The 1999 return is larger than 10% of mean return Q1-2000.

Table 4 t-test

It is clear that the P-value < alpha (alpha =0.01). Hence the null hypothesis is

significant. Thus it may be summarized that the 1999 return is larger than 10% of mean

return Q1-2000.

8STATISTICS

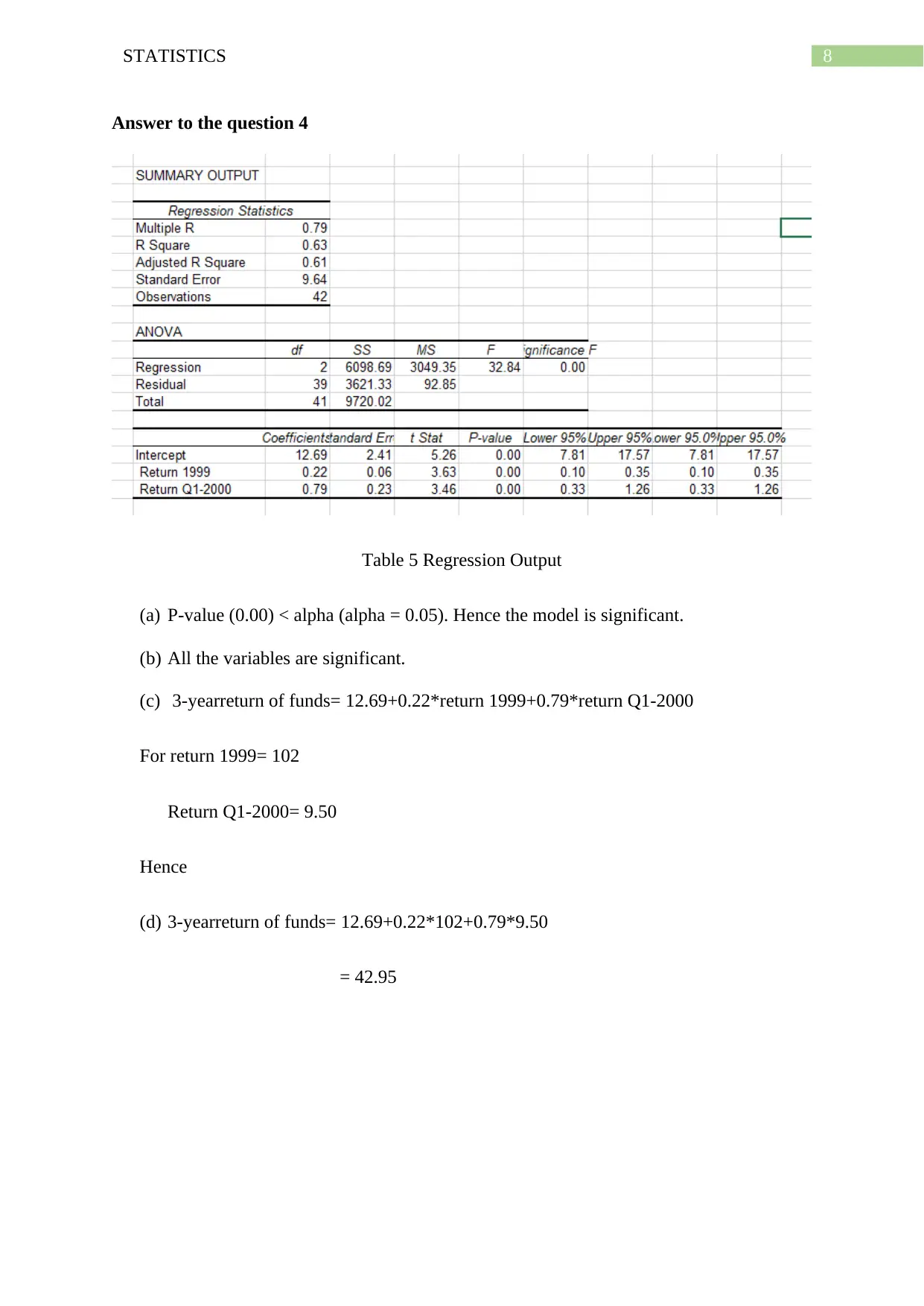

Answer to the question 4

Table 5 Regression Output

(a) P-value (0.00) < alpha (alpha = 0.05). Hence the model is significant.

(b) All the variables are significant.

(c) 3-yearreturn of funds= 12.69+0.22*return 1999+0.79*return Q1-2000

For return 1999= 102

Return Q1-2000= 9.50

Hence

(d) 3-yearreturn of funds= 12.69+0.22*102+0.79*9.50

= 42.95

Answer to the question 4

Table 5 Regression Output

(a) P-value (0.00) < alpha (alpha = 0.05). Hence the model is significant.

(b) All the variables are significant.

(c) 3-yearreturn of funds= 12.69+0.22*return 1999+0.79*return Q1-2000

For return 1999= 102

Return Q1-2000= 9.50

Hence

(d) 3-yearreturn of funds= 12.69+0.22*102+0.79*9.50

= 42.95

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9STATISTICS

Bibliography

Amrhein, Valentin, David Trafimow, and Sander Greenland. "Inferential statistics as

descriptive statistics: There is no replication crisis if we don’t expect replication." The

American Statistician 73, no. sup1 (2019): 262-270.

De Winter, Joost CF. "Using the Student's t-test with extremely small sample sizes."

Practical Assessment, Research, and Evaluation 18, no. 1 (2013): 10.

George, Darren, and Paul Mallery. "Descriptive statistics." In IBM SPSS Statistics 23 Step by

Step, pp. 126-134. Routledge, 2016.

Bibliography

Amrhein, Valentin, David Trafimow, and Sander Greenland. "Inferential statistics as

descriptive statistics: There is no replication crisis if we don’t expect replication." The

American Statistician 73, no. sup1 (2019): 262-270.

De Winter, Joost CF. "Using the Student's t-test with extremely small sample sizes."

Practical Assessment, Research, and Evaluation 18, no. 1 (2013): 10.

George, Darren, and Paul Mallery. "Descriptive statistics." In IBM SPSS Statistics 23 Step by

Step, pp. 126-134. Routledge, 2016.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10STATISTICS

Keith, Timothy Z. Multiple regression and beyond: An introduction to multiple regression

and structural equation modeling. Routledge, 2014.

McHugh, Mary L. "The chi-square test of independence." Biochemia medica: Biochemia

medica 23, no. 2 (2013): 143-149.

Pandis, Nikolaos. "The chi-square test." American journal of orthodontics and dentofacial

orthopedics 150, no. 5 (2016): 898-899.

Keith, Timothy Z. Multiple regression and beyond: An introduction to multiple regression

and structural equation modeling. Routledge, 2014.

McHugh, Mary L. "The chi-square test of independence." Biochemia medica: Biochemia

medica 23, no. 2 (2013): 143-149.

Pandis, Nikolaos. "The chi-square test." American journal of orthodontics and dentofacial

orthopedics 150, no. 5 (2016): 898-899.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.