Stock Performance Analysis: Assessing Risk-Return for Investment

VerifiedAdded on 2023/06/03

|10

|1152

|422

Report

AI Summary

This report provides a comprehensive analysis of two stocks, General Dynamics (GD) and Boeing, to determine which offers a better risk-return profile for investment. The analysis includes calculations of stock returns, Jarque-Bera tests for normality, hypothesis testing to compare mean returns and risk levels, and CAPM model implementation to estimate beta and assess the relationship between excess market returns and stock excess returns. The findings indicate that GD stock may be superior due to offering similar returns at a significantly lower risk compared to Boeing. The report also interprets the statistical results, including beta values, R-squared, and confidence intervals, to provide a well-rounded recommendation for the client.

Statistics of Business & Finance

STUDENT NAME:

[Pick the date]

STUDENT NAME:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PART A: Calculations

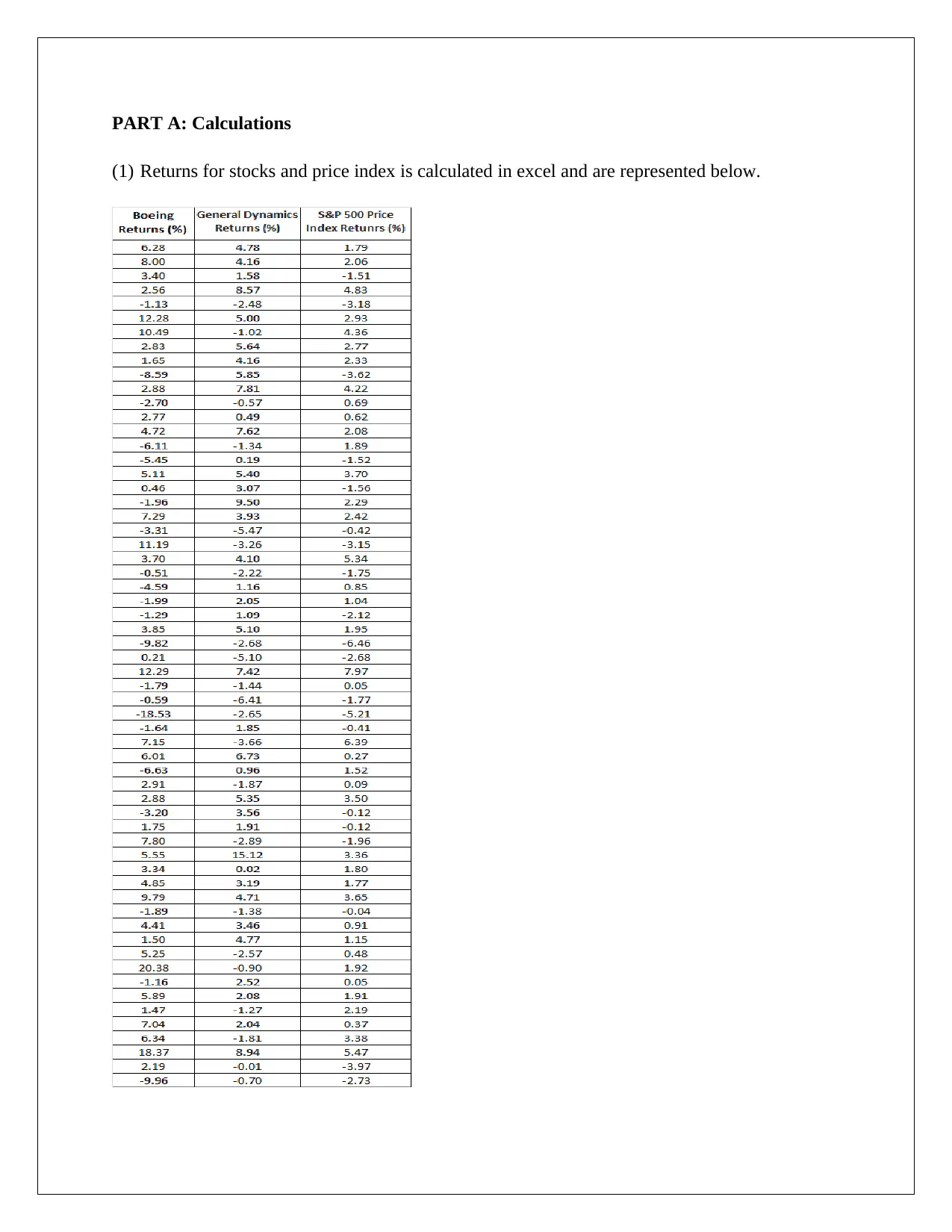

(1) Returns for stocks and price index is calculated in excel and are represented below.

(1) Returns for stocks and price index is calculated in excel and are represented below.

Jarque Berra (JB) test

Hypotheses

Test statistics

Relevant formula

Observation

It is apparent from the above JB statistic computed values that JB stat for GD is higher than

applicable critical value and hence, alternative hypothesis will be accepted and null hypothesis

will be rejected.

Further, that JB stat for Boeing is lower than applicable critical value and hence, alternative

hypothesis will not be accepted and null hypothesis will not be rejected.

Result

It can be concluded based on the above observation that stock returns of GD represents normal

distribution but the same is not true for Boeing stock returns.

Hypotheses

Test statistics

Relevant formula

Observation

It is apparent from the above JB statistic computed values that JB stat for GD is higher than

applicable critical value and hence, alternative hypothesis will be accepted and null hypothesis

will be rejected.

Further, that JB stat for Boeing is lower than applicable critical value and hence, alternative

hypothesis will not be accepted and null hypothesis will not be rejected.

Result

It can be concluded based on the above observation that stock returns of GD represents normal

distribution but the same is not true for Boeing stock returns.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

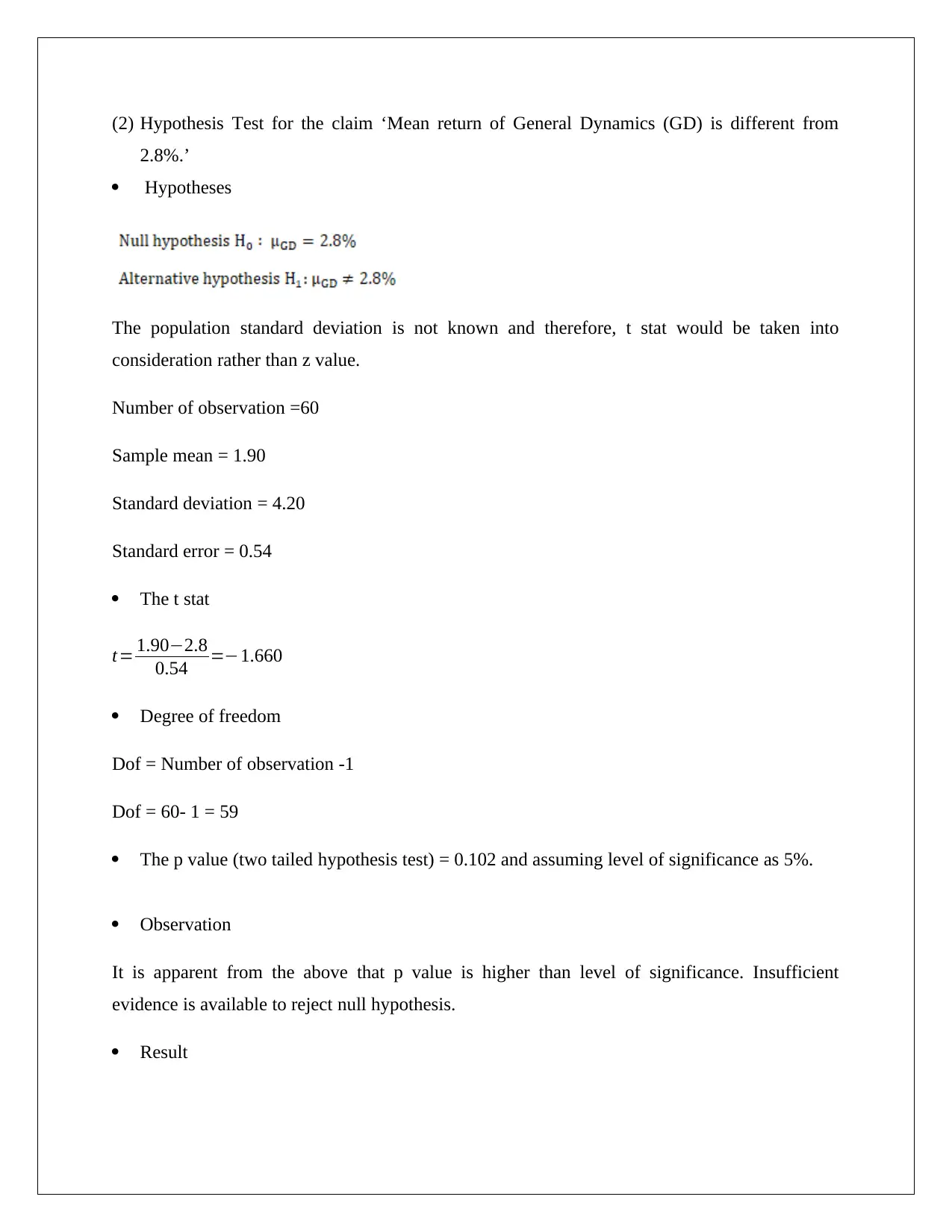

(2) Hypothesis Test for the claim ‘Mean return of General Dynamics (GD) is different from

2.8%.’

Hypotheses

The population standard deviation is not known and therefore, t stat would be taken into

consideration rather than z value.

Number of observation =60

Sample mean = 1.90

Standard deviation = 4.20

Standard error = 0.54

The t stat

t= 1.90−2.8

0.54 =−1.660

Degree of freedom

Dof = Number of observation -1

Dof = 60- 1 = 59

The p value (two tailed hypothesis test) = 0.102 and assuming level of significance as 5%.

Observation

It is apparent from the above that p value is higher than level of significance. Insufficient

evidence is available to reject null hypothesis.

Result

2.8%.’

Hypotheses

The population standard deviation is not known and therefore, t stat would be taken into

consideration rather than z value.

Number of observation =60

Sample mean = 1.90

Standard deviation = 4.20

Standard error = 0.54

The t stat

t= 1.90−2.8

0.54 =−1.660

Degree of freedom

Dof = Number of observation -1

Dof = 60- 1 = 59

The p value (two tailed hypothesis test) = 0.102 and assuming level of significance as 5%.

Observation

It is apparent from the above that p value is higher than level of significance. Insufficient

evidence is available to reject null hypothesis.

Result

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It can be concluded based on the above observation that mean return of General Returns (GD) is

not different from 2.8%.

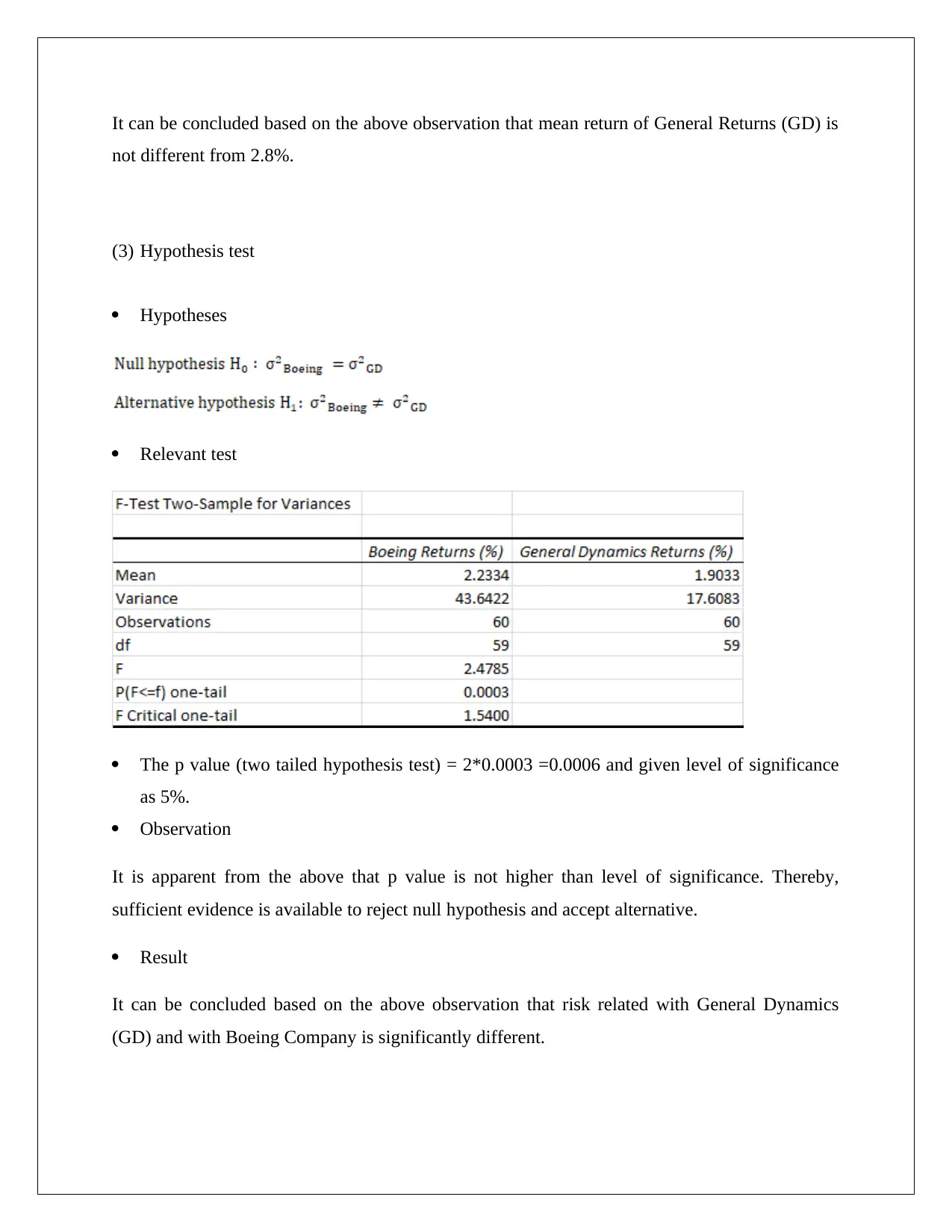

(3) Hypothesis test

Hypotheses

Relevant test

The p value (two tailed hypothesis test) = 2*0.0003 =0.0006 and given level of significance

as 5%.

Observation

It is apparent from the above that p value is not higher than level of significance. Thereby,

sufficient evidence is available to reject null hypothesis and accept alternative.

Result

It can be concluded based on the above observation that risk related with General Dynamics

(GD) and with Boeing Company is significantly different.

not different from 2.8%.

(3) Hypothesis test

Hypotheses

Relevant test

The p value (two tailed hypothesis test) = 2*0.0003 =0.0006 and given level of significance

as 5%.

Observation

It is apparent from the above that p value is not higher than level of significance. Thereby,

sufficient evidence is available to reject null hypothesis and accept alternative.

Result

It can be concluded based on the above observation that risk related with General Dynamics

(GD) and with Boeing Company is significantly different.

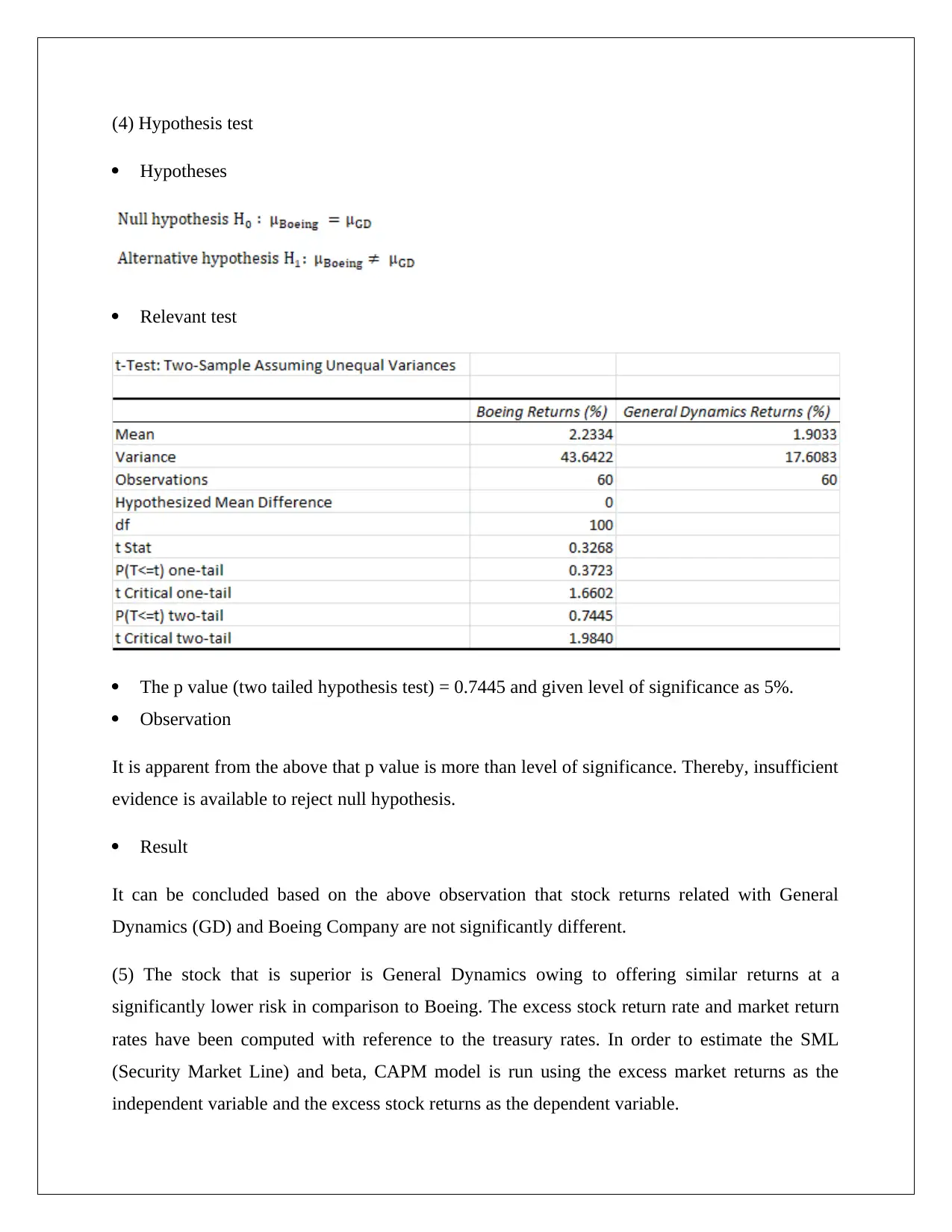

(4) Hypothesis test

Hypotheses

Relevant test

The p value (two tailed hypothesis test) = 0.7445 and given level of significance as 5%.

Observation

It is apparent from the above that p value is more than level of significance. Thereby, insufficient

evidence is available to reject null hypothesis.

Result

It can be concluded based on the above observation that stock returns related with General

Dynamics (GD) and Boeing Company are not significantly different.

(5) The stock that is superior is General Dynamics owing to offering similar returns at a

significantly lower risk in comparison to Boeing. The excess stock return rate and market return

rates have been computed with reference to the treasury rates. In order to estimate the SML

(Security Market Line) and beta, CAPM model is run using the excess market returns as the

independent variable and the excess stock returns as the dependent variable.

Hypotheses

Relevant test

The p value (two tailed hypothesis test) = 0.7445 and given level of significance as 5%.

Observation

It is apparent from the above that p value is more than level of significance. Thereby, insufficient

evidence is available to reject null hypothesis.

Result

It can be concluded based on the above observation that stock returns related with General

Dynamics (GD) and Boeing Company are not significantly different.

(5) The stock that is superior is General Dynamics owing to offering similar returns at a

significantly lower risk in comparison to Boeing. The excess stock return rate and market return

rates have been computed with reference to the treasury rates. In order to estimate the SML

(Security Market Line) and beta, CAPM model is run using the excess market returns as the

independent variable and the excess stock returns as the dependent variable.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

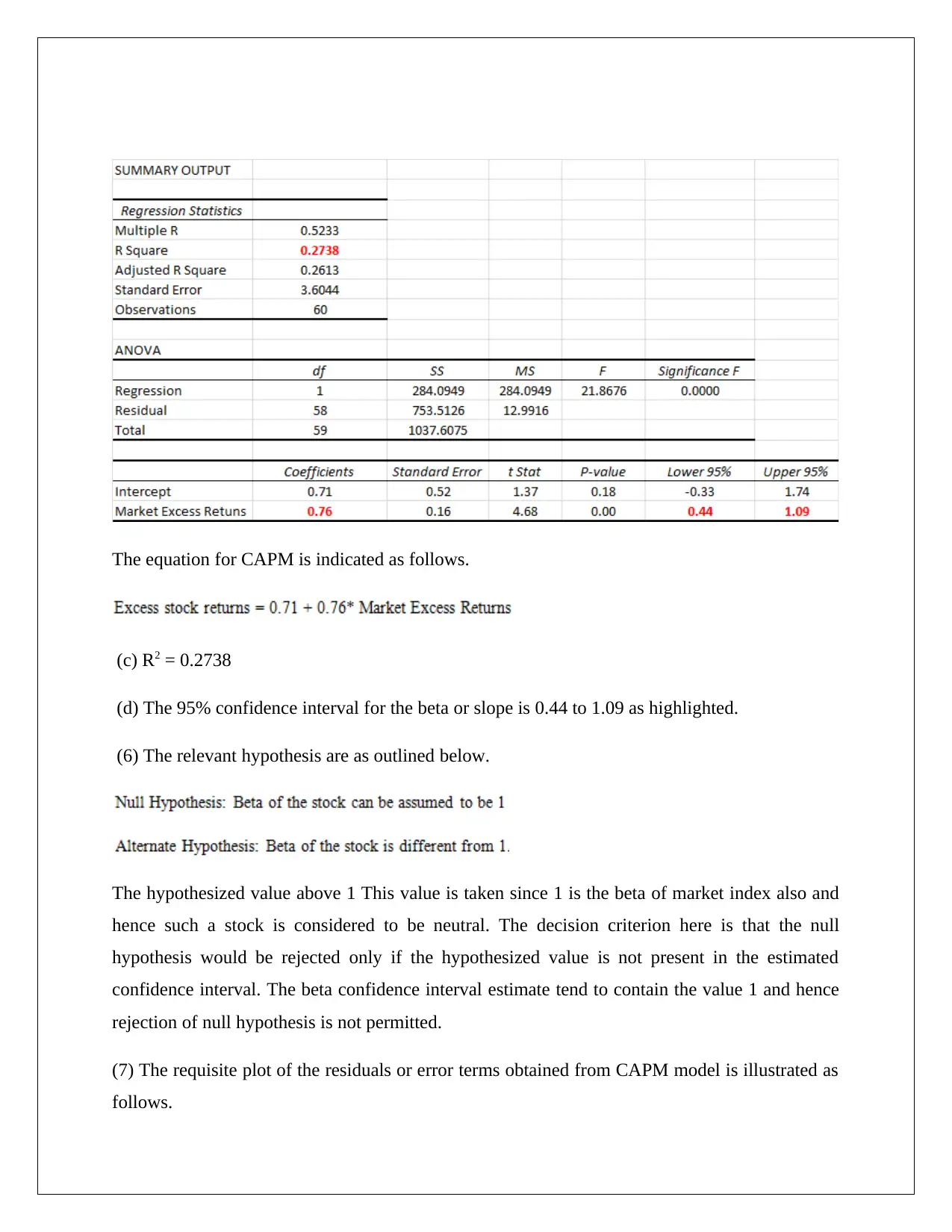

The equation for CAPM is indicated as follows.

(c) R2 = 0.2738

(d) The 95% confidence interval for the beta or slope is 0.44 to 1.09 as highlighted.

(6) The relevant hypothesis are as outlined below.

The hypothesized value above 1 This value is taken since 1 is the beta of market index also and

hence such a stock is considered to be neutral. The decision criterion here is that the null

hypothesis would be rejected only if the hypothesized value is not present in the estimated

confidence interval. The beta confidence interval estimate tend to contain the value 1 and hence

rejection of null hypothesis is not permitted.

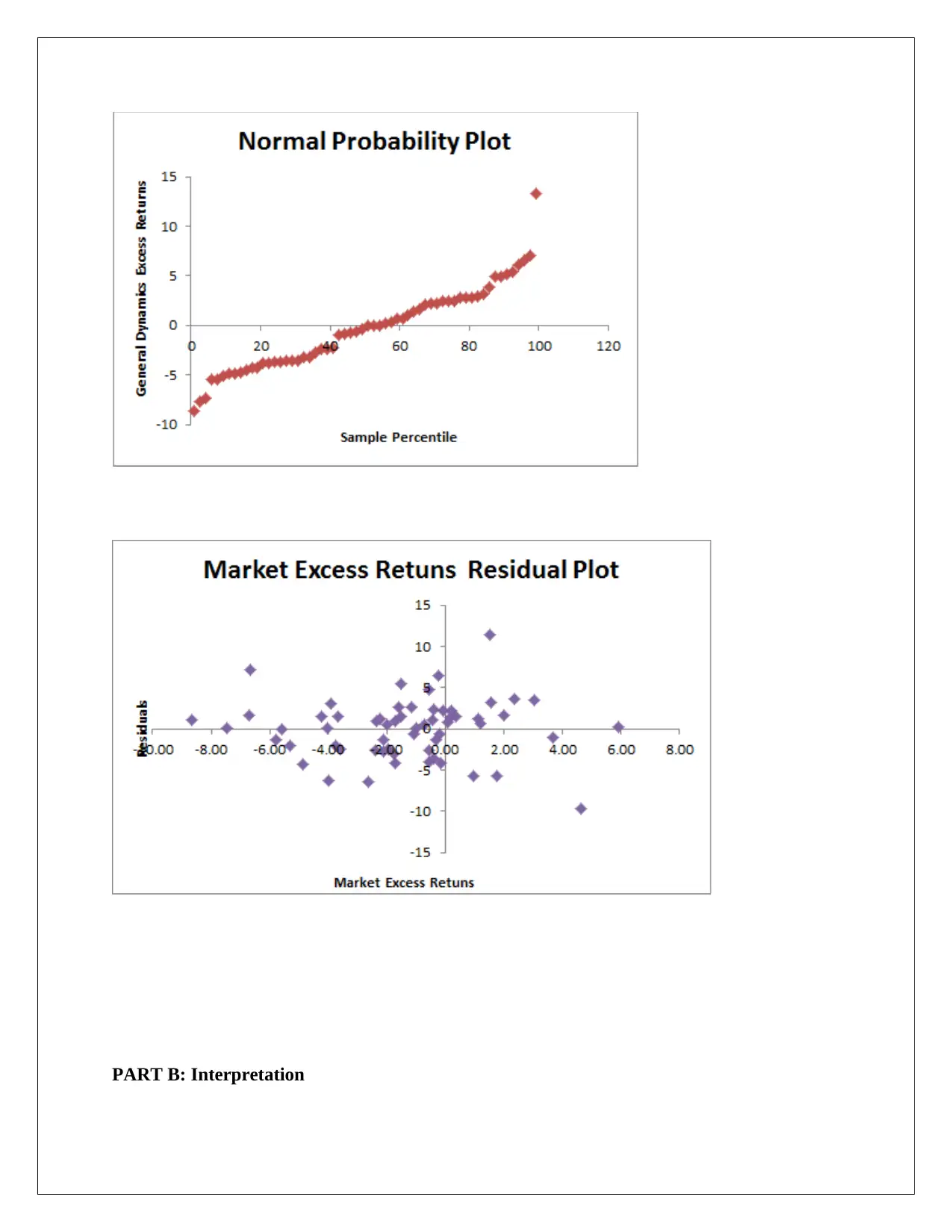

(7) The requisite plot of the residuals or error terms obtained from CAPM model is illustrated as

follows.

(c) R2 = 0.2738

(d) The 95% confidence interval for the beta or slope is 0.44 to 1.09 as highlighted.

(6) The relevant hypothesis are as outlined below.

The hypothesized value above 1 This value is taken since 1 is the beta of market index also and

hence such a stock is considered to be neutral. The decision criterion here is that the null

hypothesis would be rejected only if the hypothesized value is not present in the estimated

confidence interval. The beta confidence interval estimate tend to contain the value 1 and hence

rejection of null hypothesis is not permitted.

(7) The requisite plot of the residuals or error terms obtained from CAPM model is illustrated as

follows.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PART B: Interpretation

(1) The stock returns of GD stock can be assumed to be normally distributed but this is not true

for Boeing stock returns.

In relation to investment, it is known that risk and returns are associated The average monthly

returns are higher for Boeing stock for the interval under consideration when compared to GD

stock. However, Boeing is achieving these returns at the cost of higher risk which is represented

by higher standard deviation in comparison to GD stock

(2) The distribution of the test statistics under null hypothesis is student t. Further, it is apparent

that the stock return on GD stock does not differ from 2.8%.

(3) The associated stock return risk is not the same for both the stocks. Taking the sample data

into consideration, it would be evident that lower risk is associated with GD stock in comparison

with Boeing.

(4) There is no significant difference in the average returns of the two stocks. To select the

superior stock, it is imperative to consider that risk is lower for GD stock while the population

returns for the two stock is similar. Hence, GD stock would be superior since it offers higher

returns per unit risk when compared with Boeing.

(5) (b) GD stock beta derived from CAPM model is 0.76. This indicates that as there is a change

in market excess return by 1%, the corresponding change in the GD stock excess return would be

0.76%. Further, the two variables exhibit same direction change.

(c) The R2 value indicates that the excess market returns can only offer explanation to 27.38% of

the changes observed in the stock excess returns and hence represent a poor fit.

(d) We can conclude with 95% probability that GD stock beta would belong to the interval

(0.44,1.09)

(6) On the basis of the confidence interval based hypothesis test, it may be concluded that the

GD stock is neutral since confidence interval for beta comprises of the value one.

(7) Considering the residual plot, it would be appropriate to conclude that the error terms do not

form any fixed pattern since the distribution is random which is indicative of the assumption of

for Boeing stock returns.

In relation to investment, it is known that risk and returns are associated The average monthly

returns are higher for Boeing stock for the interval under consideration when compared to GD

stock. However, Boeing is achieving these returns at the cost of higher risk which is represented

by higher standard deviation in comparison to GD stock

(2) The distribution of the test statistics under null hypothesis is student t. Further, it is apparent

that the stock return on GD stock does not differ from 2.8%.

(3) The associated stock return risk is not the same for both the stocks. Taking the sample data

into consideration, it would be evident that lower risk is associated with GD stock in comparison

with Boeing.

(4) There is no significant difference in the average returns of the two stocks. To select the

superior stock, it is imperative to consider that risk is lower for GD stock while the population

returns for the two stock is similar. Hence, GD stock would be superior since it offers higher

returns per unit risk when compared with Boeing.

(5) (b) GD stock beta derived from CAPM model is 0.76. This indicates that as there is a change

in market excess return by 1%, the corresponding change in the GD stock excess return would be

0.76%. Further, the two variables exhibit same direction change.

(c) The R2 value indicates that the excess market returns can only offer explanation to 27.38% of

the changes observed in the stock excess returns and hence represent a poor fit.

(d) We can conclude with 95% probability that GD stock beta would belong to the interval

(0.44,1.09)

(6) On the basis of the confidence interval based hypothesis test, it may be concluded that the

GD stock is neutral since confidence interval for beta comprises of the value one.

(7) Considering the residual plot, it would be appropriate to conclude that the error terms do not

form any fixed pattern since the distribution is random which is indicative of the assumption of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

error term being normally distribution being satisfied,. This can also be confirmed from the

normal probability plot.

normal probability plot.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Statistical Analysis of Business and Finance Data - [Semester]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fbusiness-finance-statistics-hypothesis-interpretation_page_2.jpg&w=256&q=75)