Financial Markets: Portfolio Construction, Risk, and Return Analysis

VerifiedAdded on 2023/05/30

|9

|1777

|51

Homework Assignment

AI Summary

This assignment focuses on analyzing investment risk and return within financial markets, specifically using stocks from the S&P 500 index. It involves calculating expected returns, standard deviations, and correlations for selected stocks like Amazon, Berkshire Hathaway, and Johnson & Johnson. The analysis extends to constructing and evaluating different portfolio strategies, including equally weighted, market value-weighted, and momentum-based portfolios. The assignment also covers calculating monthly and annualized excess returns, and Sharpe ratios. Ultimately, the goal is to understand the trade-offs between risk and return in portfolio management and to visually represent investment alternatives through risk-return graphs. This document is available on Desklib, a platform offering study tools and resources for students.

Running head: FINANCIAL MARKET AND INSTITUTES

Financial Market and Institutes

Name of the Student:

Name of the University:

Author’s Note:

Financial Market and Institutes

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL MARKETS AND INSTITUTES

Table of Contents

In Response to Question 1...............................................................................................................2

In Response to Question 2...............................................................................................................2

In Response to Question 3...............................................................................................................4

In Response to Question 4...............................................................................................................4

In Response to Question 5...............................................................................................................4

In Response to Question 6...............................................................................................................5

In Response to Question 7...............................................................................................................5

In Response to Question 8...............................................................................................................5

Bibliography....................................................................................................................................8

Table of Contents

In Response to Question 1...............................................................................................................2

In Response to Question 2...............................................................................................................2

In Response to Question 3...............................................................................................................4

In Response to Question 4...............................................................................................................4

In Response to Question 5...............................................................................................................4

In Response to Question 6...............................................................................................................5

In Response to Question 7...............................................................................................................5

In Response to Question 8...............................................................................................................5

Bibliography....................................................................................................................................8

2FINANCIAL MARKETS AND INSTITUTES

In Response to Question 1

The five stocks selected from the current constituent of S&P 500 Index was Amazon

Incorporation, Berkshire Hathaway, Broadridge Financial Solutions, Johnson & Johnson, and

McDonalds. The five stocks are the constituent of S&P 500 Index.

In Response to Question 2

The analyst expectation price and the consensus was calculated based on Index value at the

starting period of investment and the ending value of the investment as per the return. The

expected return generated from each of the stock is calculated based on return generated from

each of the stock or asset class respectively.

In Response to Question 1

The five stocks selected from the current constituent of S&P 500 Index was Amazon

Incorporation, Berkshire Hathaway, Broadridge Financial Solutions, Johnson & Johnson, and

McDonalds. The five stocks are the constituent of S&P 500 Index.

In Response to Question 2

The analyst expectation price and the consensus was calculated based on Index value at the

starting period of investment and the ending value of the investment as per the return. The

expected return generated from each of the stock is calculated based on return generated from

each of the stock or asset class respectively.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL MARKETS AND INSTITUTES

Date Berkshire Hathaway Index Amazon. Inc Index Johnson &Johnson Index Broadridge Financial Solutions Index Mc Donalds Corporation Index

1 1 1 1 1

1/1/2016 -1.72% 0.98 -13.15% 0.87 1.67% 1.02 0.26% 1.00 4.77% 1.05

2/1/2016 3.39% 1.02 -5.87% 0.82 0.74% 1.02 4.80% 1.05 -5.32% 0.99

3/1/2016 5.75% 1.07 7.44% 0.88 3.59% 1.06 5.67% 1.11 8.06% 1.07

4/1/2016 2.54% 1.10 11.11% 0.98 3.59% 1.10 1.43% 1.13 0.64% 1.08

5/1/2016 -3.40% 1.06 9.58% 1.07 0.54% 1.11 7.27% 1.21 -3.50% 1.04

6/1/2016 3.02% 1.10 -0.99% 1.06 8.41% 1.20 1.57% 1.23 -1.41% 1.03

7/1/2016 -0.36% 1.09 6.04% 1.12 3.24% 1.24 4.29% 1.28 -1.52% 1.01

8/1/2016 4.31% 1.14 1.36% 1.14 -4.70% 1.18 2.39% 1.31 -1.69% 0.99

9/1/2016 -4.00% 1.09 8.86% 1.24 -0.35% 1.17 -2.18% 1.28 0.52% 1.00

10/1/2016 -0.12% 1.09 -5.67% 1.17 -1.81% 1.15 -4.17% 1.23 -2.42% 0.97

11/1/2016 9.11% 1.19 -4.97% 1.11 -4.04% 1.11 0.12% 1.23 5.95% 1.03

12/1/2016 3.52% 1.23 2.41% 1.14 4.23% 1.15 2.41% 1.26 2.85% 1.06

1/1/2017 0.71% 1.24 7.13% 1.22 -1.70% 1.13 0.85% 1.27 0.70% 1.07

2/1/2017 4.44% 1.30 2.62% 1.25 7.91% 1.22 4.21% 1.32 4.14% 1.11

3/1/2017 -2.77% 1.26 4.91% 1.31 2.59% 1.26 -1.99% 1.30 2.28% 1.14

4/1/2017 -0.88% 1.25 4.34% 1.37 -0.87% 1.24 3.43% 1.34 7.96% 1.23

5/1/2017 0.04% 1.25 7.53% 1.47 3.87% 1.29 8.51% 1.46 7.83% 1.33

6/1/2017 2.47% 1.28 -2.68% 1.43 3.83% 1.34 -0.43% 1.45 1.50% 1.35

7/1/2017 3.31% 1.33 2.04% 1.46 0.33% 1.35 0.84% 1.46 1.93% 1.37

8/1/2017 3.54% 1.37 -0.73% 1.45 -0.26% 1.34 2.99% 1.51 3.11% 1.41

9/1/2017 1.19% 1.39 -1.96% 1.42 -1.16% 1.33 3.44% 1.56 -1.48% 1.39

10/1/2017 1.97% 1.42 14.97% 1.64 7.23% 1.42 6.80% 1.66 6.53% 1.49

11/1/2017 3.25% 1.46 6.47% 1.74 -0.06% 1.42 3.19% 1.72 3.03% 1.53

12/1/2017 2.70% 1.50 -0.62% 1.73 0.89% 1.43 2.17% 1.75 0.68% 1.54

1/1/2018 8.15% 1.62 24.06% 2.15 -1.10% 1.42 6.87% 1.87 -0.57% 1.53

2/1/2018 -3.35% 1.57 4.24% 2.24 -6.01% 1.33 4.12% 1.95 -7.83% 1.41

3/1/2018 -3.73% 1.51 -4.30% 2.14 -0.70% 1.32 9.27% 2.13 -0.24% 1.41

4/1/2018 -2.88% 1.47 8.21% 2.32 -1.30% 1.31 -1.93% 2.09 7.07% 1.51

5/1/2018 -1.14% 1.45 4.05% 2.41 -5.43% 1.24 7.69% 2.25 -4.44% 1.44

6/1/2018 -2.55% 1.41 4.31% 2.51 2.19% 1.26 -0.30% 2.24 -2.07% 1.41

7/1/2018 6.01% 1.50 4.57% 2.63 9.21% 1.38 -1.53% 2.21 1.18% 1.43

8/1/2018 5.48% 1.58 13.24% 2.98 1.64% 1.40 19.61% 2.64 2.98% 1.47

9/1/2018 2.58% 1.62 -0.48% 2.96 3.27% 1.45 -2.36% 2.58 3.76% 1.53

10/1/2018 -4.12% 1.55 -20.22% 2.36 1.32% 1.47 -11.06% 2.30 5.74% 1.61

11/1/2018 2.72% 1.60 -5.09% 2.24 1.43% 1.49 -14.32% 1.97 3.29% 1.67

Date Berkshire Hathaway Index Amazon. Inc Index Johnson &Johnson Index Broadridge Financial Solutions Index Mc Donalds Corporation Index

1 1 1 1 1

1/1/2016 -1.72% 0.98 -13.15% 0.87 1.67% 1.02 0.26% 1.00 4.77% 1.05

2/1/2016 3.39% 1.02 -5.87% 0.82 0.74% 1.02 4.80% 1.05 -5.32% 0.99

3/1/2016 5.75% 1.07 7.44% 0.88 3.59% 1.06 5.67% 1.11 8.06% 1.07

4/1/2016 2.54% 1.10 11.11% 0.98 3.59% 1.10 1.43% 1.13 0.64% 1.08

5/1/2016 -3.40% 1.06 9.58% 1.07 0.54% 1.11 7.27% 1.21 -3.50% 1.04

6/1/2016 3.02% 1.10 -0.99% 1.06 8.41% 1.20 1.57% 1.23 -1.41% 1.03

7/1/2016 -0.36% 1.09 6.04% 1.12 3.24% 1.24 4.29% 1.28 -1.52% 1.01

8/1/2016 4.31% 1.14 1.36% 1.14 -4.70% 1.18 2.39% 1.31 -1.69% 0.99

9/1/2016 -4.00% 1.09 8.86% 1.24 -0.35% 1.17 -2.18% 1.28 0.52% 1.00

10/1/2016 -0.12% 1.09 -5.67% 1.17 -1.81% 1.15 -4.17% 1.23 -2.42% 0.97

11/1/2016 9.11% 1.19 -4.97% 1.11 -4.04% 1.11 0.12% 1.23 5.95% 1.03

12/1/2016 3.52% 1.23 2.41% 1.14 4.23% 1.15 2.41% 1.26 2.85% 1.06

1/1/2017 0.71% 1.24 7.13% 1.22 -1.70% 1.13 0.85% 1.27 0.70% 1.07

2/1/2017 4.44% 1.30 2.62% 1.25 7.91% 1.22 4.21% 1.32 4.14% 1.11

3/1/2017 -2.77% 1.26 4.91% 1.31 2.59% 1.26 -1.99% 1.30 2.28% 1.14

4/1/2017 -0.88% 1.25 4.34% 1.37 -0.87% 1.24 3.43% 1.34 7.96% 1.23

5/1/2017 0.04% 1.25 7.53% 1.47 3.87% 1.29 8.51% 1.46 7.83% 1.33

6/1/2017 2.47% 1.28 -2.68% 1.43 3.83% 1.34 -0.43% 1.45 1.50% 1.35

7/1/2017 3.31% 1.33 2.04% 1.46 0.33% 1.35 0.84% 1.46 1.93% 1.37

8/1/2017 3.54% 1.37 -0.73% 1.45 -0.26% 1.34 2.99% 1.51 3.11% 1.41

9/1/2017 1.19% 1.39 -1.96% 1.42 -1.16% 1.33 3.44% 1.56 -1.48% 1.39

10/1/2017 1.97% 1.42 14.97% 1.64 7.23% 1.42 6.80% 1.66 6.53% 1.49

11/1/2017 3.25% 1.46 6.47% 1.74 -0.06% 1.42 3.19% 1.72 3.03% 1.53

12/1/2017 2.70% 1.50 -0.62% 1.73 0.89% 1.43 2.17% 1.75 0.68% 1.54

1/1/2018 8.15% 1.62 24.06% 2.15 -1.10% 1.42 6.87% 1.87 -0.57% 1.53

2/1/2018 -3.35% 1.57 4.24% 2.24 -6.01% 1.33 4.12% 1.95 -7.83% 1.41

3/1/2018 -3.73% 1.51 -4.30% 2.14 -0.70% 1.32 9.27% 2.13 -0.24% 1.41

4/1/2018 -2.88% 1.47 8.21% 2.32 -1.30% 1.31 -1.93% 2.09 7.07% 1.51

5/1/2018 -1.14% 1.45 4.05% 2.41 -5.43% 1.24 7.69% 2.25 -4.44% 1.44

6/1/2018 -2.55% 1.41 4.31% 2.51 2.19% 1.26 -0.30% 2.24 -2.07% 1.41

7/1/2018 6.01% 1.50 4.57% 2.63 9.21% 1.38 -1.53% 2.21 1.18% 1.43

8/1/2018 5.48% 1.58 13.24% 2.98 1.64% 1.40 19.61% 2.64 2.98% 1.47

9/1/2018 2.58% 1.62 -0.48% 2.96 3.27% 1.45 -2.36% 2.58 3.76% 1.53

10/1/2018 -4.12% 1.55 -20.22% 2.36 1.32% 1.47 -11.06% 2.30 5.74% 1.61

11/1/2018 2.72% 1.60 -5.09% 2.24 1.43% 1.49 -14.32% 1.97 3.29% 1.67

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL MARKETS AND INSTITUTES

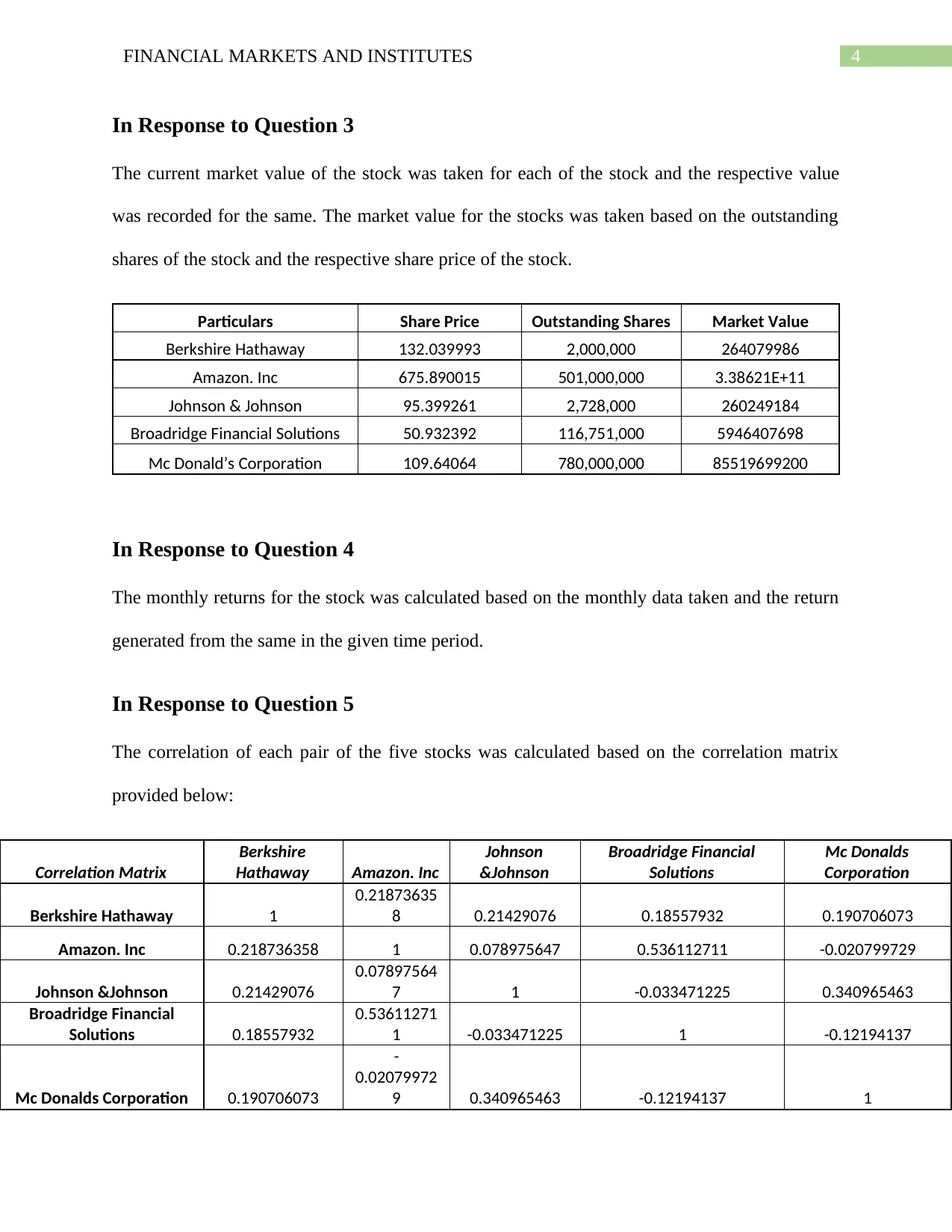

In Response to Question 3

The current market value of the stock was taken for each of the stock and the respective value

was recorded for the same. The market value for the stocks was taken based on the outstanding

shares of the stock and the respective share price of the stock.

Particulars Share Price Outstanding Shares Market Value

Berkshire Hathaway 132.039993 2,000,000 264079986

Amazon. Inc 675.890015 501,000,000 3.38621E+11

Johnson & Johnson 95.399261 2,728,000 260249184

Broadridge Financial Solutions 50.932392 116,751,000 5946407698

Mc Donald’s Corporation 109.64064 780,000,000 85519699200

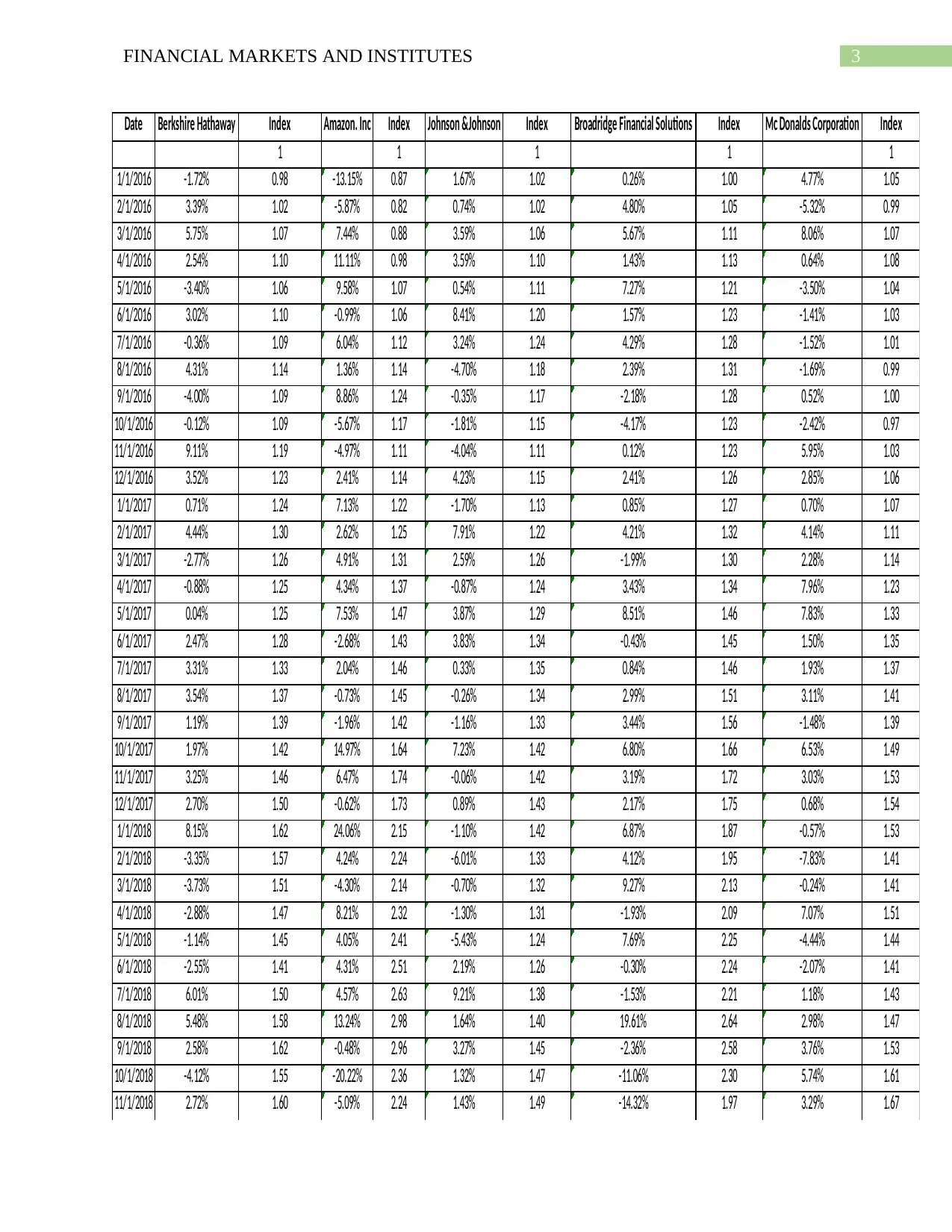

In Response to Question 4

The monthly returns for the stock was calculated based on the monthly data taken and the return

generated from the same in the given time period.

In Response to Question 5

The correlation of each pair of the five stocks was calculated based on the correlation matrix

provided below:

Correlation Matrix

Berkshire

Hathaway Amazon. Inc

Johnson

&Johnson

Broadridge Financial

Solutions

Mc Donalds

Corporation

Berkshire Hathaway 1

0.21873635

8 0.21429076 0.18557932 0.190706073

Amazon. Inc 0.218736358 1 0.078975647 0.536112711 -0.020799729

Johnson &Johnson 0.21429076

0.07897564

7 1 -0.033471225 0.340965463

Broadridge Financial

Solutions 0.18557932

0.53611271

1 -0.033471225 1 -0.12194137

Mc Donalds Corporation 0.190706073

-

0.02079972

9 0.340965463 -0.12194137 1

In Response to Question 3

The current market value of the stock was taken for each of the stock and the respective value

was recorded for the same. The market value for the stocks was taken based on the outstanding

shares of the stock and the respective share price of the stock.

Particulars Share Price Outstanding Shares Market Value

Berkshire Hathaway 132.039993 2,000,000 264079986

Amazon. Inc 675.890015 501,000,000 3.38621E+11

Johnson & Johnson 95.399261 2,728,000 260249184

Broadridge Financial Solutions 50.932392 116,751,000 5946407698

Mc Donald’s Corporation 109.64064 780,000,000 85519699200

In Response to Question 4

The monthly returns for the stock was calculated based on the monthly data taken and the return

generated from the same in the given time period.

In Response to Question 5

The correlation of each pair of the five stocks was calculated based on the correlation matrix

provided below:

Correlation Matrix

Berkshire

Hathaway Amazon. Inc

Johnson

&Johnson

Broadridge Financial

Solutions

Mc Donalds

Corporation

Berkshire Hathaway 1

0.21873635

8 0.21429076 0.18557932 0.190706073

Amazon. Inc 0.218736358 1 0.078975647 0.536112711 -0.020799729

Johnson &Johnson 0.21429076

0.07897564

7 1 -0.033471225 0.340965463

Broadridge Financial

Solutions 0.18557932

0.53611271

1 -0.033471225 1 -0.12194137

Mc Donalds Corporation 0.190706073

-

0.02079972

9 0.340965463 -0.12194137 1

5FINANCIAL MARKETS AND INSTITUTES

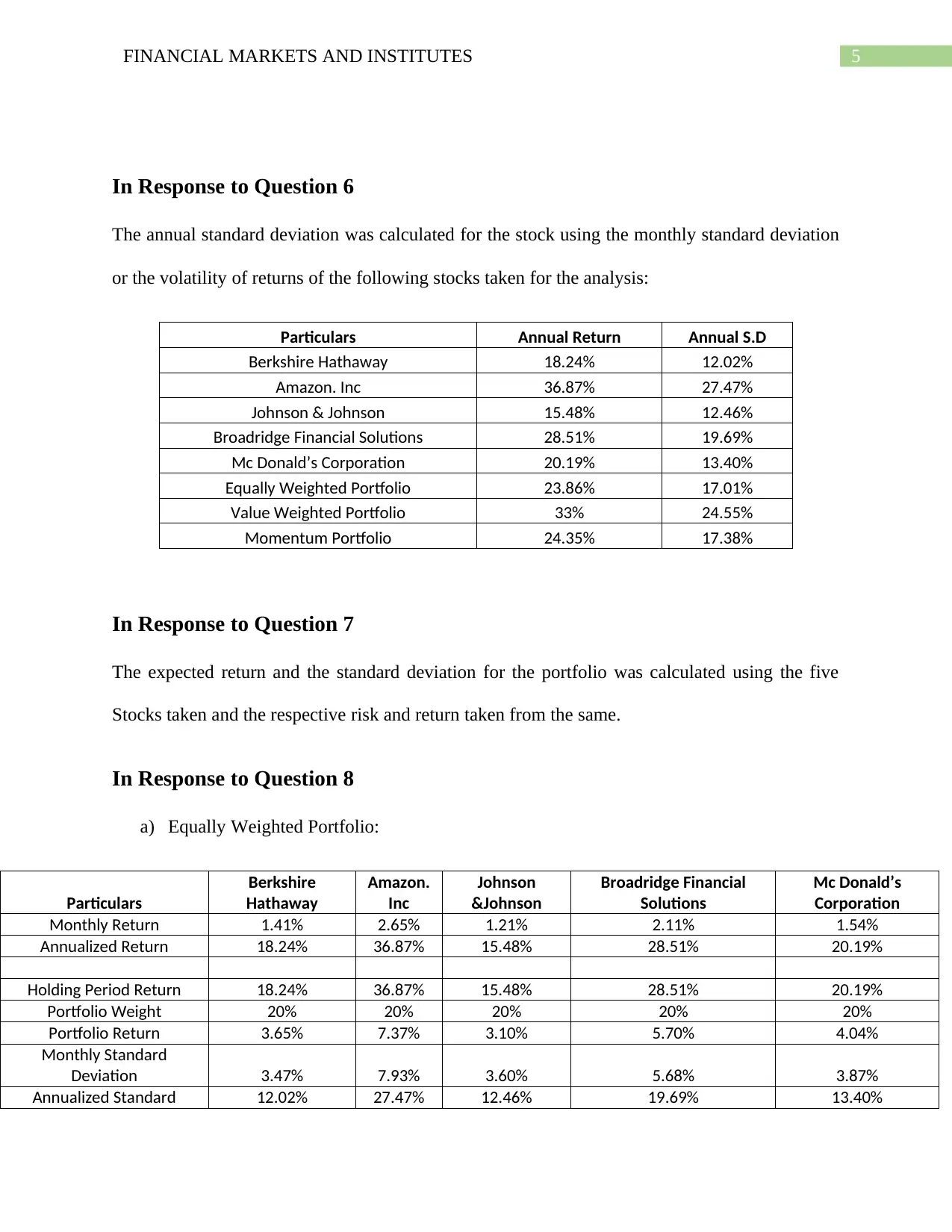

In Response to Question 6

The annual standard deviation was calculated for the stock using the monthly standard deviation

or the volatility of returns of the following stocks taken for the analysis:

Particulars Annual Return Annual S.D

Berkshire Hathaway 18.24% 12.02%

Amazon. Inc 36.87% 27.47%

Johnson & Johnson 15.48% 12.46%

Broadridge Financial Solutions 28.51% 19.69%

Mc Donald’s Corporation 20.19% 13.40%

Equally Weighted Portfolio 23.86% 17.01%

Value Weighted Portfolio 33% 24.55%

Momentum Portfolio 24.35% 17.38%

In Response to Question 7

The expected return and the standard deviation for the portfolio was calculated using the five

Stocks taken and the respective risk and return taken from the same.

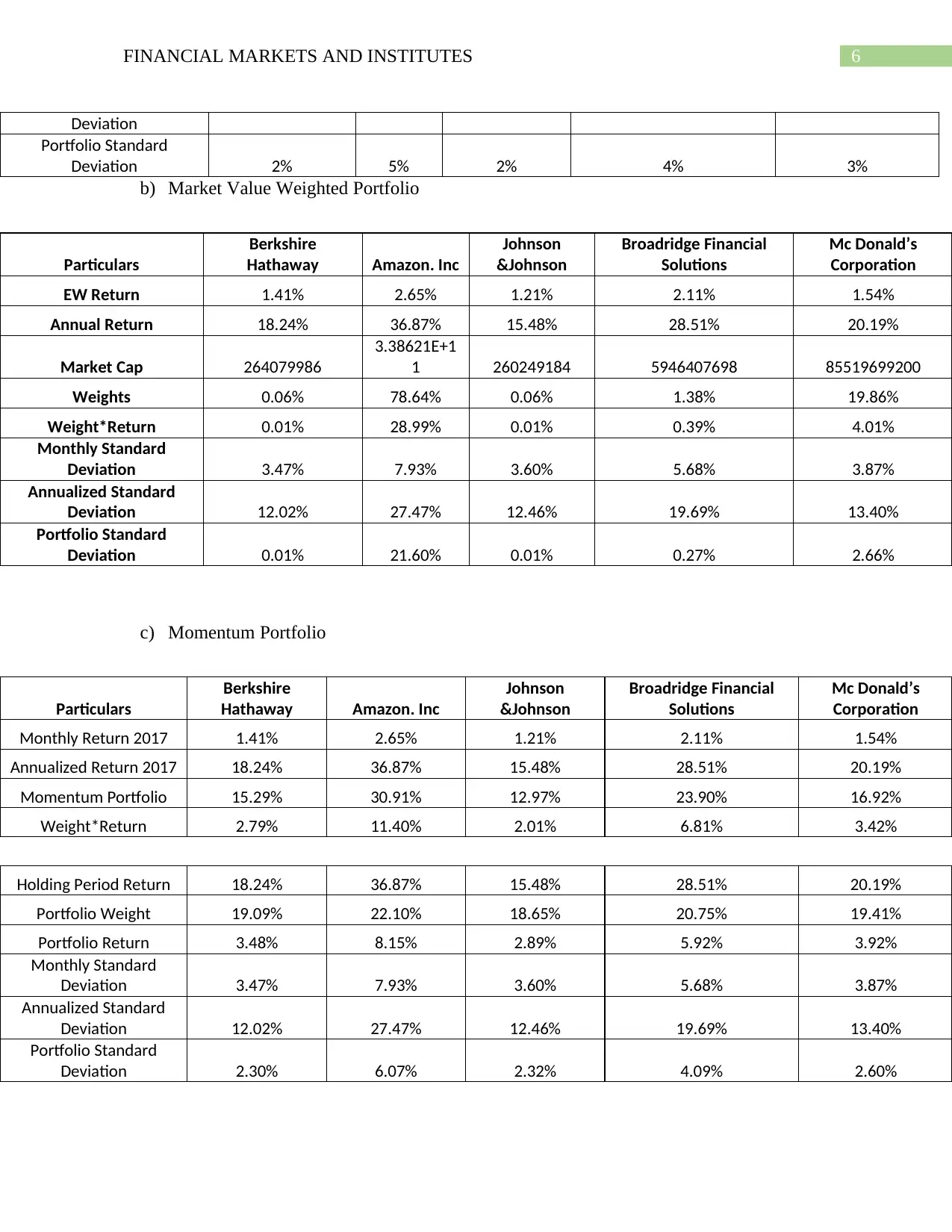

In Response to Question 8

a) Equally Weighted Portfolio:

Particulars

Berkshire

Hathaway

Amazon.

Inc

Johnson

&Johnson

Broadridge Financial

Solutions

Mc Donald’s

Corporation

Monthly Return 1.41% 2.65% 1.21% 2.11% 1.54%

Annualized Return 18.24% 36.87% 15.48% 28.51% 20.19%

Holding Period Return 18.24% 36.87% 15.48% 28.51% 20.19%

Portfolio Weight 20% 20% 20% 20% 20%

Portfolio Return 3.65% 7.37% 3.10% 5.70% 4.04%

Monthly Standard

Deviation 3.47% 7.93% 3.60% 5.68% 3.87%

Annualized Standard 12.02% 27.47% 12.46% 19.69% 13.40%

In Response to Question 6

The annual standard deviation was calculated for the stock using the monthly standard deviation

or the volatility of returns of the following stocks taken for the analysis:

Particulars Annual Return Annual S.D

Berkshire Hathaway 18.24% 12.02%

Amazon. Inc 36.87% 27.47%

Johnson & Johnson 15.48% 12.46%

Broadridge Financial Solutions 28.51% 19.69%

Mc Donald’s Corporation 20.19% 13.40%

Equally Weighted Portfolio 23.86% 17.01%

Value Weighted Portfolio 33% 24.55%

Momentum Portfolio 24.35% 17.38%

In Response to Question 7

The expected return and the standard deviation for the portfolio was calculated using the five

Stocks taken and the respective risk and return taken from the same.

In Response to Question 8

a) Equally Weighted Portfolio:

Particulars

Berkshire

Hathaway

Amazon.

Inc

Johnson

&Johnson

Broadridge Financial

Solutions

Mc Donald’s

Corporation

Monthly Return 1.41% 2.65% 1.21% 2.11% 1.54%

Annualized Return 18.24% 36.87% 15.48% 28.51% 20.19%

Holding Period Return 18.24% 36.87% 15.48% 28.51% 20.19%

Portfolio Weight 20% 20% 20% 20% 20%

Portfolio Return 3.65% 7.37% 3.10% 5.70% 4.04%

Monthly Standard

Deviation 3.47% 7.93% 3.60% 5.68% 3.87%

Annualized Standard 12.02% 27.47% 12.46% 19.69% 13.40%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL MARKETS AND INSTITUTES

Deviation

Portfolio Standard

Deviation 2% 5% 2% 4% 3%

b) Market Value Weighted Portfolio

Particulars

Berkshire

Hathaway Amazon. Inc

Johnson

&Johnson

Broadridge Financial

Solutions

Mc Donald’s

Corporation

EW Return 1.41% 2.65% 1.21% 2.11% 1.54%

Annual Return 18.24% 36.87% 15.48% 28.51% 20.19%

Market Cap 264079986

3.38621E+1

1 260249184 5946407698 85519699200

Weights 0.06% 78.64% 0.06% 1.38% 19.86%

Weight*Return 0.01% 28.99% 0.01% 0.39% 4.01%

Monthly Standard

Deviation 3.47% 7.93% 3.60% 5.68% 3.87%

Annualized Standard

Deviation 12.02% 27.47% 12.46% 19.69% 13.40%

Portfolio Standard

Deviation 0.01% 21.60% 0.01% 0.27% 2.66%

c) Momentum Portfolio

Particulars

Berkshire

Hathaway Amazon. Inc

Johnson

&Johnson

Broadridge Financial

Solutions

Mc Donald’s

Corporation

Monthly Return 2017 1.41% 2.65% 1.21% 2.11% 1.54%

Annualized Return 2017 18.24% 36.87% 15.48% 28.51% 20.19%

Momentum Portfolio 15.29% 30.91% 12.97% 23.90% 16.92%

Weight*Return 2.79% 11.40% 2.01% 6.81% 3.42%

Holding Period Return 18.24% 36.87% 15.48% 28.51% 20.19%

Portfolio Weight 19.09% 22.10% 18.65% 20.75% 19.41%

Portfolio Return 3.48% 8.15% 2.89% 5.92% 3.92%

Monthly Standard

Deviation 3.47% 7.93% 3.60% 5.68% 3.87%

Annualized Standard

Deviation 12.02% 27.47% 12.46% 19.69% 13.40%

Portfolio Standard

Deviation 2.30% 6.07% 2.32% 4.09% 2.60%

Deviation

Portfolio Standard

Deviation 2% 5% 2% 4% 3%

b) Market Value Weighted Portfolio

Particulars

Berkshire

Hathaway Amazon. Inc

Johnson

&Johnson

Broadridge Financial

Solutions

Mc Donald’s

Corporation

EW Return 1.41% 2.65% 1.21% 2.11% 1.54%

Annual Return 18.24% 36.87% 15.48% 28.51% 20.19%

Market Cap 264079986

3.38621E+1

1 260249184 5946407698 85519699200

Weights 0.06% 78.64% 0.06% 1.38% 19.86%

Weight*Return 0.01% 28.99% 0.01% 0.39% 4.01%

Monthly Standard

Deviation 3.47% 7.93% 3.60% 5.68% 3.87%

Annualized Standard

Deviation 12.02% 27.47% 12.46% 19.69% 13.40%

Portfolio Standard

Deviation 0.01% 21.60% 0.01% 0.27% 2.66%

c) Momentum Portfolio

Particulars

Berkshire

Hathaway Amazon. Inc

Johnson

&Johnson

Broadridge Financial

Solutions

Mc Donald’s

Corporation

Monthly Return 2017 1.41% 2.65% 1.21% 2.11% 1.54%

Annualized Return 2017 18.24% 36.87% 15.48% 28.51% 20.19%

Momentum Portfolio 15.29% 30.91% 12.97% 23.90% 16.92%

Weight*Return 2.79% 11.40% 2.01% 6.81% 3.42%

Holding Period Return 18.24% 36.87% 15.48% 28.51% 20.19%

Portfolio Weight 19.09% 22.10% 18.65% 20.75% 19.41%

Portfolio Return 3.48% 8.15% 2.89% 5.92% 3.92%

Monthly Standard

Deviation 3.47% 7.93% 3.60% 5.68% 3.87%

Annualized Standard

Deviation 12.02% 27.47% 12.46% 19.69% 13.40%

Portfolio Standard

Deviation 2.30% 6.07% 2.32% 4.09% 2.60%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL MARKETS AND INSTITUTES

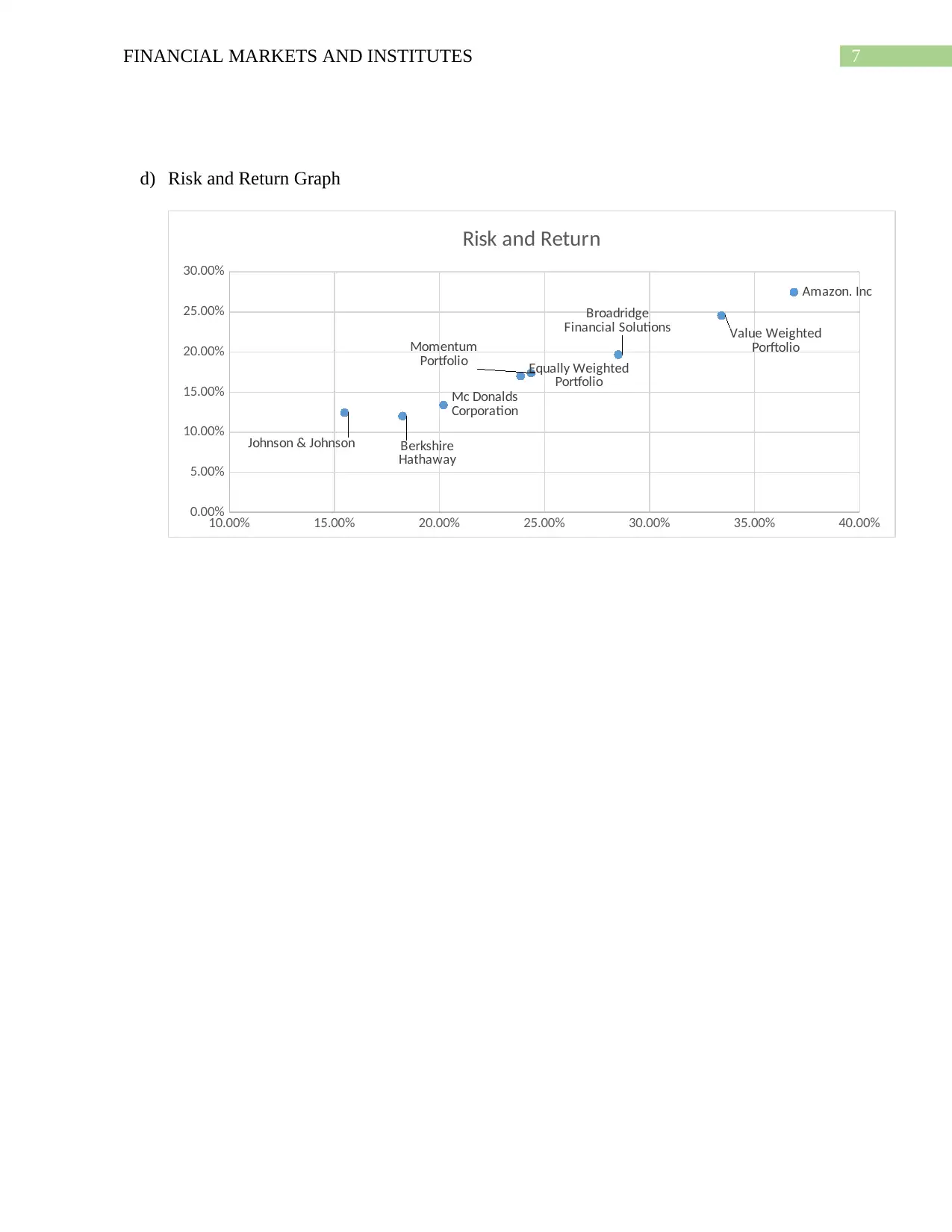

d) Risk and Return Graph

10.00% 15.00% 20.00% 25.00% 30.00% 35.00% 40.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

Berkshire

Hathaway

Amazon. Inc

Johnson & Johnson

Broadridge

Financial Solutions

Mc Donalds

Corporation

Equally Weighted

Portfolio

Value Weighted

PorftolioMomentum

Portfolio

Risk and Return

d) Risk and Return Graph

10.00% 15.00% 20.00% 25.00% 30.00% 35.00% 40.00%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

Berkshire

Hathaway

Amazon. Inc

Johnson & Johnson

Broadridge

Financial Solutions

Mc Donalds

Corporation

Equally Weighted

Portfolio

Value Weighted

PorftolioMomentum

Portfolio

Risk and Return

8FINANCIAL MARKETS AND INSTITUTES

Bibliography

Baker, M. and Wurgler, J., 2015. Do strict capital requirements raise the cost of capital? Bank

regulation, capital structure, and the low-risk anomaly. American Economic Review, 105(5),

pp.315-20.

Gray, P., 2014. Stock weighting and nontrading bias in estimated portfolio returns. Accounting

& Finance, 54(2), pp.467-503.

Khan, M.T.I., Tan, S.H. and Chong, L.L., 2017. Perception of past portfolio returns, optimism

and financial decisions. Review of Behavioral Finance, 9(1), pp.79-98.

Rokade, A., Malhotra, A. and Wanchoo, A., 2016, May. Enhancing portfolio returns by

identifying high growth companies in Indian stock market using artificial intelligence. In Recent

Trends in Electronics, Information & Communication Technology (RTEICT), IEEE

International Conference on (pp. 262-266). IEEE.

Bibliography

Baker, M. and Wurgler, J., 2015. Do strict capital requirements raise the cost of capital? Bank

regulation, capital structure, and the low-risk anomaly. American Economic Review, 105(5),

pp.315-20.

Gray, P., 2014. Stock weighting and nontrading bias in estimated portfolio returns. Accounting

& Finance, 54(2), pp.467-503.

Khan, M.T.I., Tan, S.H. and Chong, L.L., 2017. Perception of past portfolio returns, optimism

and financial decisions. Review of Behavioral Finance, 9(1), pp.79-98.

Rokade, A., Malhotra, A. and Wanchoo, A., 2016, May. Enhancing portfolio returns by

identifying high growth companies in Indian stock market using artificial intelligence. In Recent

Trends in Electronics, Information & Communication Technology (RTEICT), IEEE

International Conference on (pp. 262-266). IEEE.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.