University Finance Assignment: Stock Valuation and Analysis Report

VerifiedAdded on 2022/08/12

|6

|726

|16

Report

AI Summary

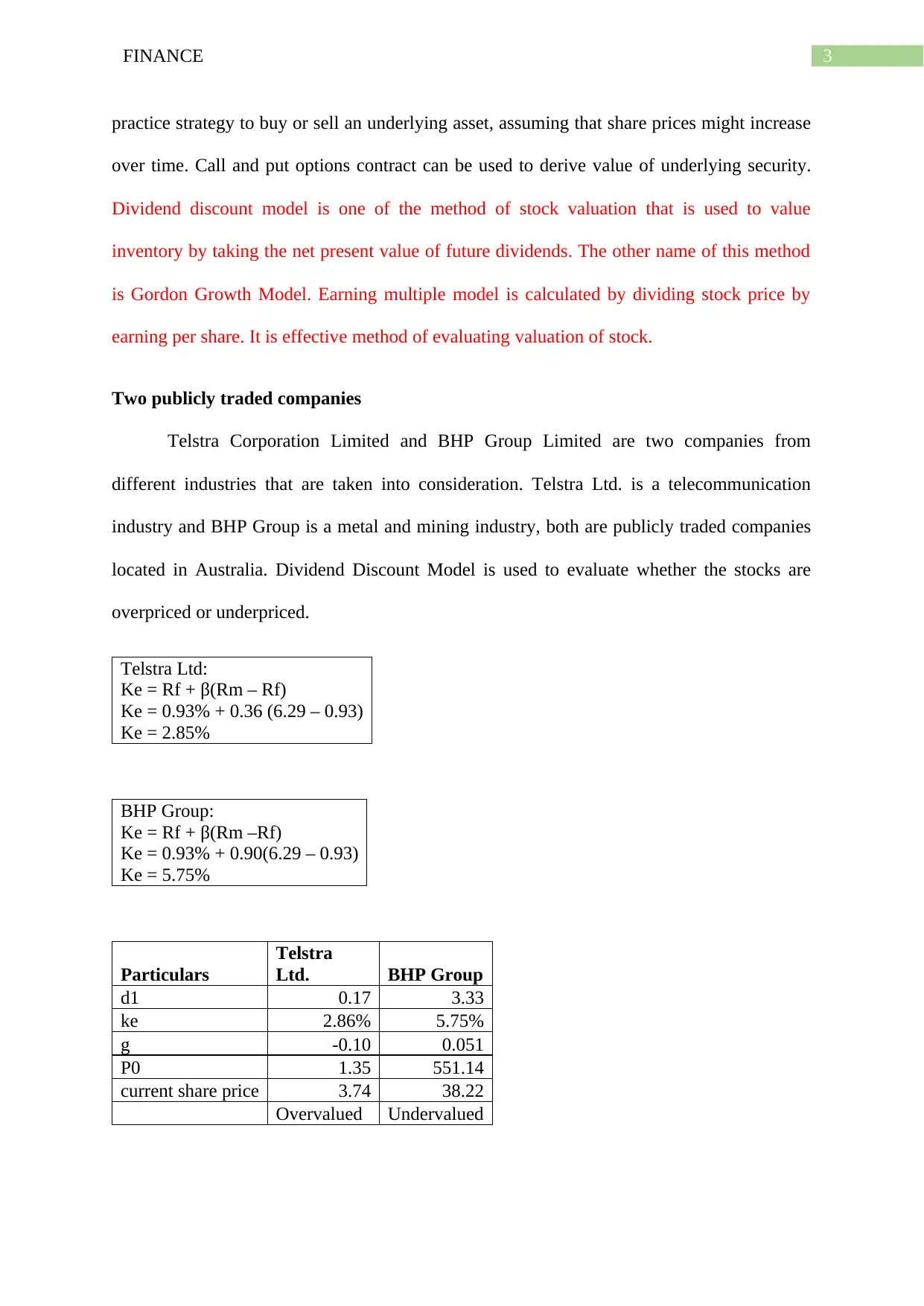

This finance report delves into the topic of stock valuation, particularly focusing on companies that do not pay dividends. It begins by identifying industries where dividend payments are less common, explaining the rationale behind companies reinvesting earnings for growth rather than distributing dividends. The report then outlines specific factors investors consider when valuing such stocks, including earnings, future projects, and potential for capital appreciation. Several valuation techniques are discussed, such as shorting strategies, options contracts, and the dividend discount model. The report further illustrates these concepts by analyzing two publicly traded companies, Telstra Corporation Limited and BHP Group Limited, from different industries, and assessing their stock valuations using the dividend discount model. The analysis includes calculations and a comparison of the companies' current share prices to determine if they are overvalued or undervalued by the market.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)