Auditing Report: Business Risk Assessment of Stockland Stapled Company

VerifiedAdded on 2019/11/08

|17

|4107

|342

Report

AI Summary

This report provides a comprehensive auditing analysis of Stockland Stapled, a major real estate company. It begins with an executive summary and table of contents, followed by an introduction outlining the report's focus on business risk assessment. The report then delves into the nature of Stockland Stapled, including its history, business segments, and financial performance. It examines the real estate industry in Australia, including its contribution to GDP, growth rate, key players, and growth opportunities. The legal environment section covers intellectual property, business and environmental laws, import/export regulations, and financial reporting standards. External environmental factors are analyzed using PEST, SWOT, and Porter's Five Forces models. The report assesses the company's objectives, strategies, and business risks. It includes sections on analytical procedures and management/governance, concluding with a summary of findings and a list of references. The analysis covers various aspects such as market competition, supplier bargaining power, buyer dynamics, and the impact of interest rates, providing a detailed overview of the company's operational and strategic environment.

Auditing 1

Running Head: Auditing

Auditing

Running Head: Auditing

Auditing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Auditing 2

Executive Summary

There is an increase competition in the market and for the purpose of overcoming the

competition, there is a need to analyse the external business environment for the purpose of

making effective strategies. For this purpose, different techniques are used by the company such

as PEST analysis, SWOT analysis and Porter’s five forces model.

Executive Summary

There is an increase competition in the market and for the purpose of overcoming the

competition, there is a need to analyse the external business environment for the purpose of

making effective strategies. For this purpose, different techniques are used by the company such

as PEST analysis, SWOT analysis and Porter’s five forces model.

Auditing 3

Table of Contents

Executive Summary.......................................................................................................................................2

Introduction....................................................................................................................................................3

Part 1: Understanding Nature of the Entity....................................................................................................4

Part 2: Understanding the Industry................................................................................................................4

Part 3: Understanding the legal environment:...............................................................................................5

Part 4: Understanding External Environmental Factors................................................................................7

Part 5: Understand objectives, strategies and Assessing Business Risks:...................................................11

Part 6 Performing Analytical Procedures to understand Entity’s Performance...........................................12

Part 7: Understand management and Governance:......................................................................................14

Conclusion...................................................................................................................................................15

References....................................................................................................................................................16

Table of Contents

Executive Summary.......................................................................................................................................2

Introduction....................................................................................................................................................3

Part 1: Understanding Nature of the Entity....................................................................................................4

Part 2: Understanding the Industry................................................................................................................4

Part 3: Understanding the legal environment:...............................................................................................5

Part 4: Understanding External Environmental Factors................................................................................7

Part 5: Understand objectives, strategies and Assessing Business Risks:...................................................11

Part 6 Performing Analytical Procedures to understand Entity’s Performance...........................................12

Part 7: Understand management and Governance:......................................................................................14

Conclusion...................................................................................................................................................15

References....................................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Auditing 4

Introduction

This report emphasizes on the assessment of the business risk for Stockland Stapled which is

considered as one of the largest diversified real estate company. The report includes the

information related to the industry, nature of the business, external environment, legal

environment, governance and business risk management that have an impact on the profitability

and performance of the business.

Part 1: Understanding Nature of the Entity

Stockland Staple is founded in the year 1952 which is considered as one of the largest company

in the real estate industry. The company has more than $16.6 billion of real estate assets. The

business operations of the company include construction and management of different business

parks, logistics centre, residential communities, shopping centers, office assets and retirement

living villages. This company has adopted diversified business model for the purpose of

developing dynamic town centers to help different communities of the country. The company has

three segments commercial property, retirement and residential living which has increased

earnings (Stockland Stapled, 2017).

There is an increase in the profits by 9.4% in the year 2015 to $608 million. Besides this, there is

also an increase in the funds from operations to 14.7% with statutory profits of $903 million

which is more than 70% as compared to the year 2014. The company has also made acquisitions

across its different business segments of nearly $600 million. In addition to this, the company

has made investments seven medium density residential projects in four states. The company has

adopted the Australian Accounting Standards for the purpose of reporting the financial

information in an effective manner (Stockland Stapled, 2017).

Introduction

This report emphasizes on the assessment of the business risk for Stockland Stapled which is

considered as one of the largest diversified real estate company. The report includes the

information related to the industry, nature of the business, external environment, legal

environment, governance and business risk management that have an impact on the profitability

and performance of the business.

Part 1: Understanding Nature of the Entity

Stockland Staple is founded in the year 1952 which is considered as one of the largest company

in the real estate industry. The company has more than $16.6 billion of real estate assets. The

business operations of the company include construction and management of different business

parks, logistics centre, residential communities, shopping centers, office assets and retirement

living villages. This company has adopted diversified business model for the purpose of

developing dynamic town centers to help different communities of the country. The company has

three segments commercial property, retirement and residential living which has increased

earnings (Stockland Stapled, 2017).

There is an increase in the profits by 9.4% in the year 2015 to $608 million. Besides this, there is

also an increase in the funds from operations to 14.7% with statutory profits of $903 million

which is more than 70% as compared to the year 2014. The company has also made acquisitions

across its different business segments of nearly $600 million. In addition to this, the company

has made investments seven medium density residential projects in four states. The company has

adopted the Australian Accounting Standards for the purpose of reporting the financial

information in an effective manner (Stockland Stapled, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Auditing 5

Part 2: Understanding the Industry

The real estate industry contributes 18% of the total GDP of the Australia. The growth rate of the

real estate industry is 4.2% annually. The real estate companies focuses on procurement an

element of the supply chain in order to create effective portfolio strategy by the analysis of

delivery, monitoring of the procurement activities in a timely manner. The stakeholder

management is done by engaging with suppliers and customers by the way of consultation,

communication, negotiation and reporting. The procurement function can be improved by the

implementation of the effective administration policies. The real estate industry provides

employment to approximately 110132 employees. The size of the real estate investment market

has grown to $ 7.4 trillion in 2016 from $7.1 trillion in 2015 (Forlee, 2015).

The major players in the real estate industry in Australia include Richardson &Wrench, LJ

Hooker, Barry Plant, Harcourts Group, Mirvac Ltd and Elders Real Estate. These players has

different growth opportunities and provide luxurious services to the customers due to presence of

various factors such as lifestyle, demographics, job creation, population growth, infrastructure

and amenity. There is an increase in the population of the Australia which has resulted in

increasing the demand for residential properties and different businesses which provide different

growth opportunities to the real estate companies. In addition to this, it also helps in attracting

large number of investors which results in increasing the number of competitors in the market

(Jones & Rogers, 2016).

Part 3: Understanding the legal environment:

Understanding the Australian legal obligations is very important for every business. These legal

obligations designed by the Australian government to establish fair competition between

Part 2: Understanding the Industry

The real estate industry contributes 18% of the total GDP of the Australia. The growth rate of the

real estate industry is 4.2% annually. The real estate companies focuses on procurement an

element of the supply chain in order to create effective portfolio strategy by the analysis of

delivery, monitoring of the procurement activities in a timely manner. The stakeholder

management is done by engaging with suppliers and customers by the way of consultation,

communication, negotiation and reporting. The procurement function can be improved by the

implementation of the effective administration policies. The real estate industry provides

employment to approximately 110132 employees. The size of the real estate investment market

has grown to $ 7.4 trillion in 2016 from $7.1 trillion in 2015 (Forlee, 2015).

The major players in the real estate industry in Australia include Richardson &Wrench, LJ

Hooker, Barry Plant, Harcourts Group, Mirvac Ltd and Elders Real Estate. These players has

different growth opportunities and provide luxurious services to the customers due to presence of

various factors such as lifestyle, demographics, job creation, population growth, infrastructure

and amenity. There is an increase in the population of the Australia which has resulted in

increasing the demand for residential properties and different businesses which provide different

growth opportunities to the real estate companies. In addition to this, it also helps in attracting

large number of investors which results in increasing the number of competitors in the market

(Jones & Rogers, 2016).

Part 3: Understanding the legal environment:

Understanding the Australian legal obligations is very important for every business. These legal

obligations designed by the Australian government to establish fair competition between

Auditing 6

competitors, to provide protection to parties and integrity in the market. The regulations that

should be following by the businesses in Australia are discussed below:

Intellectual property laws:

Intellectual property includes patent, trademarks, design and secret processes and formulas of

business. Australian intellectual property law has legal obligations about the patent of a

company. Patent is an exclusive right provided by government to an inventor and according to

these rights no third party can make and use that invention (Hart, et al., 2013). Along with this,

businesses can register a trademark and in some circumstances it works as a marketing tool.

When a company registers its trademark than other companies cannot use the brand of registered

company.

Australian business and environment laws:

Australian government has made some regulations to protect the consumers, the environment of

Australia and the community of the country, as well as these regulations made to promote fair

trading and fair competition. To ensure fair trading with businesses and consumers Australia has

a national statutory framework. For unfair contract terms, consumer right guarantee, product

safety laws and other areas, Australian government made Australian Consumer law (ACL). This

law should be follow by the businesses for a fair trading (Latimer, 2012). According to this law

if any business does not follow this law than that business will be punishable.

Australian Import and Export Law:

Australia has strong business contracts with most of the other countries. The Australian

government has number of policies that assist Australian businesses to involve in international

trade. Australia has six Free Trade Agreements (FTAs) with other countries. Businesses in

Australia can import goods from other countries but that import functions should be done under

competitors, to provide protection to parties and integrity in the market. The regulations that

should be following by the businesses in Australia are discussed below:

Intellectual property laws:

Intellectual property includes patent, trademarks, design and secret processes and formulas of

business. Australian intellectual property law has legal obligations about the patent of a

company. Patent is an exclusive right provided by government to an inventor and according to

these rights no third party can make and use that invention (Hart, et al., 2013). Along with this,

businesses can register a trademark and in some circumstances it works as a marketing tool.

When a company registers its trademark than other companies cannot use the brand of registered

company.

Australian business and environment laws:

Australian government has made some regulations to protect the consumers, the environment of

Australia and the community of the country, as well as these regulations made to promote fair

trading and fair competition. To ensure fair trading with businesses and consumers Australia has

a national statutory framework. For unfair contract terms, consumer right guarantee, product

safety laws and other areas, Australian government made Australian Consumer law (ACL). This

law should be follow by the businesses for a fair trading (Latimer, 2012). According to this law

if any business does not follow this law than that business will be punishable.

Australian Import and Export Law:

Australia has strong business contracts with most of the other countries. The Australian

government has number of policies that assist Australian businesses to involve in international

trade. Australia has six Free Trade Agreements (FTAs) with other countries. Businesses in

Australia can import goods from other countries but that import functions should be done under

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Auditing 7

the consideration of government and businesses should follow the rules and regulations made by

government, businesses should pay duty taxes and businesses should have permits and

quarantine to import goods from other countries. If any business imports goods without

following these government requirements than the Australian Department of Immigration and

Border Protection can seize the imported goods.

Australian law related to financial reporting:

Australian government has clear some standards for the financial reports and a business has to

follow the standards to make a valid financial report. The same reporting standards apply in the

all Australian states and territories. Businesses in Australia required to report to the various

departments like; Australian Taxation Office (ATO), the Australian Securities and Investment

Commission (ASIC) and the Australian Security Exchange (ASE). If someone operating

business in Australia than a Business Activity Statement (BAS) has to submitted by businessman

to the Australian Taxation Office (ATO). Some accounting standards are fixed by Australian

Accounting Standards Board (AASB) that should be applied in all general purpose financial

reports of public and private sectors (Chairns, et al., 2011).

Part 4: Understanding External Environmental Factors

In order to make effective strategies to gain competitive advantage, there is a need to carry out

external environment analysis by the use of different techniques such as SWOT analysis, PEST

analysis and Porter’s five forces model which are as follows:

a) PEST Analysis

Political Factors

The political environment of Australia is stable which means that there is no occurrence of wars

and conflicts in the country which facilitates in attracting foreign investors to make investments

the consideration of government and businesses should follow the rules and regulations made by

government, businesses should pay duty taxes and businesses should have permits and

quarantine to import goods from other countries. If any business imports goods without

following these government requirements than the Australian Department of Immigration and

Border Protection can seize the imported goods.

Australian law related to financial reporting:

Australian government has clear some standards for the financial reports and a business has to

follow the standards to make a valid financial report. The same reporting standards apply in the

all Australian states and territories. Businesses in Australia required to report to the various

departments like; Australian Taxation Office (ATO), the Australian Securities and Investment

Commission (ASIC) and the Australian Security Exchange (ASE). If someone operating

business in Australia than a Business Activity Statement (BAS) has to submitted by businessman

to the Australian Taxation Office (ATO). Some accounting standards are fixed by Australian

Accounting Standards Board (AASB) that should be applied in all general purpose financial

reports of public and private sectors (Chairns, et al., 2011).

Part 4: Understanding External Environmental Factors

In order to make effective strategies to gain competitive advantage, there is a need to carry out

external environment analysis by the use of different techniques such as SWOT analysis, PEST

analysis and Porter’s five forces model which are as follows:

a) PEST Analysis

Political Factors

The political environment of Australia is stable which means that there is no occurrence of wars

and conflicts in the country which facilitates in attracting foreign investors to make investments

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Auditing 8

in different companies of different industries. In addition to this, the country has liberalized

trading policies which results in promotion of the businesses in the real estate industry as the

investors are attracted to make investment in the industry. Besides this, it also facilitates in

expansion of the real estate businesses with lower risks (Frynas & Mellahi, 2015).

Economic Factors

The GDP and employment growth rate of Australia is declined which has a significant impact on

the lifestyle of the people in the country. In addition to this, declined economic growth of the

company is considered unfavorable for the businesses. The presence of competitive interest rate

and tax rate is considered favorable for the Stockland Stapled company as it facilitates in gaining

finance at low cost for carrying out their activities and expansion of the business operations

(Pimentel & Peshin, 2014).

Social Factors

There is an increase in the population of the country due to increase in the number of immigrants

from different countries for the purpose of gaining education and labor for different businesses.

This has resulted in increased demand for different types of properties in the country such as

residential properties, business outlets and so on. This is considered favorable for the Stockland

Stapled company and results in accelerating the growth of the company in the country (Posner,

2014).

Technological factors:

Rapid changes have been taking place in the technologies, therefore, it is required by the

companies to adopt new technologies to construct properties in the country to develop

infrastructure which helps in attracting investors and businesses to make investment in the

country which results in increasing the standard of living of the people in the country. Stockland

in different companies of different industries. In addition to this, the country has liberalized

trading policies which results in promotion of the businesses in the real estate industry as the

investors are attracted to make investment in the industry. Besides this, it also facilitates in

expansion of the real estate businesses with lower risks (Frynas & Mellahi, 2015).

Economic Factors

The GDP and employment growth rate of Australia is declined which has a significant impact on

the lifestyle of the people in the country. In addition to this, declined economic growth of the

company is considered unfavorable for the businesses. The presence of competitive interest rate

and tax rate is considered favorable for the Stockland Stapled company as it facilitates in gaining

finance at low cost for carrying out their activities and expansion of the business operations

(Pimentel & Peshin, 2014).

Social Factors

There is an increase in the population of the country due to increase in the number of immigrants

from different countries for the purpose of gaining education and labor for different businesses.

This has resulted in increased demand for different types of properties in the country such as

residential properties, business outlets and so on. This is considered favorable for the Stockland

Stapled company and results in accelerating the growth of the company in the country (Posner,

2014).

Technological factors:

Rapid changes have been taking place in the technologies, therefore, it is required by the

companies to adopt new technologies to construct properties in the country to develop

infrastructure which helps in attracting investors and businesses to make investment in the

country which results in increasing the standard of living of the people in the country. Stockland

Auditing 9

Stapled has made investments in research and development activities in order to bring innovation

in their processes to provide different types of real estate properties with advanced technologies

in a cost effective manner to its customers (Grant & Jordan, 2015).

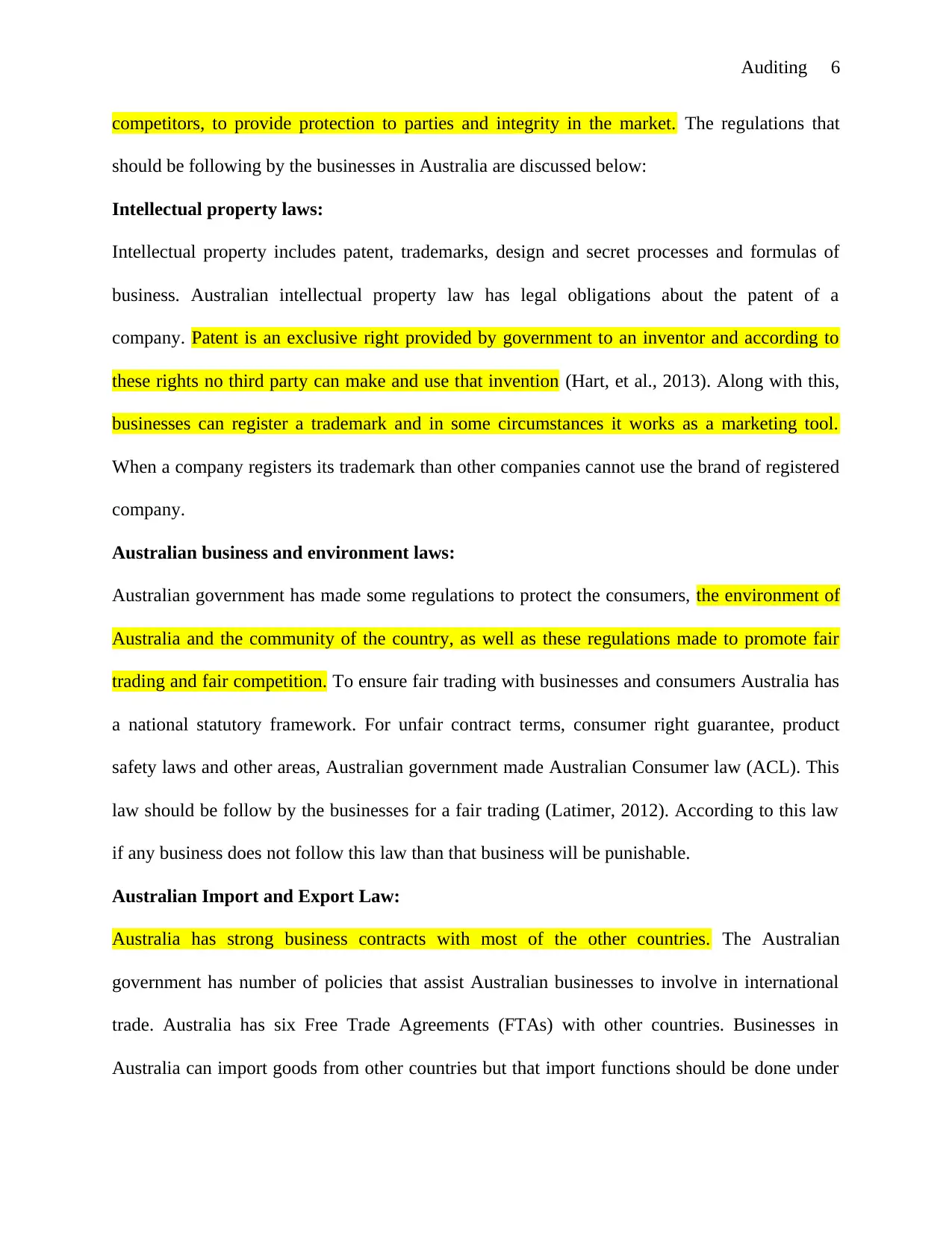

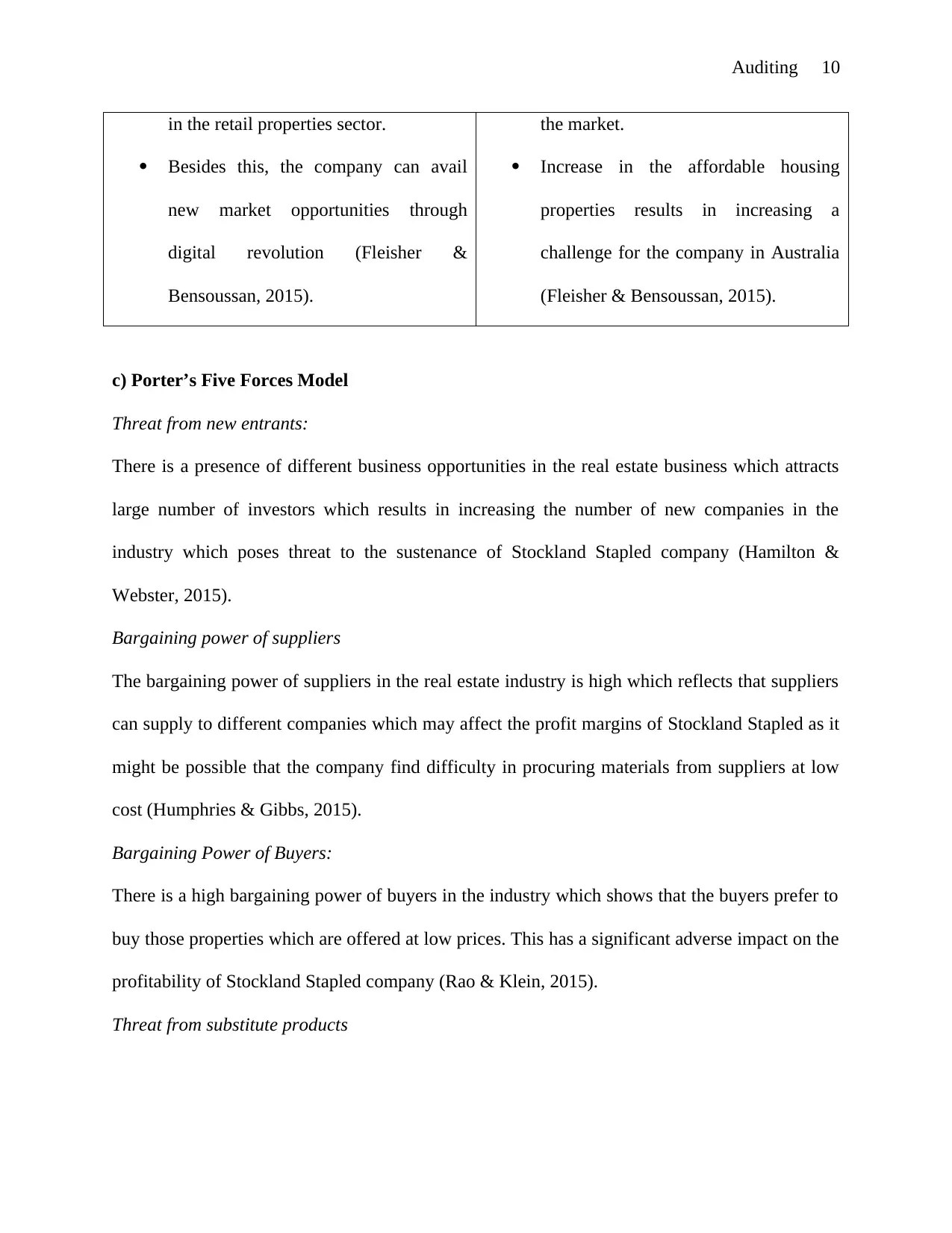

b) SWOT Analysis

Strengths Weaknesses

It is one of the largest diversified real

estate company of Australia.

Besides this, the company has strong

control across the supply chain and

established strong relationship with

different stakeholders.

The business has adopted different

sustainable and environmental friendly

practices for the purpose of

contributing towards the protection of

the environment and stakeholders.

In addition to this, the company

provides flexible working environment

to its employees which results in

improving the operational efficiency of

the company (Braun & Latham, 2014).

There is a reduction in the retail

portfolio of the company (Braun &

Latham, 2014).

Opportunities Threats

There is an existence of opportunities

for the company to expand its business

There is an increased competition from

international and domestic players in

Stapled has made investments in research and development activities in order to bring innovation

in their processes to provide different types of real estate properties with advanced technologies

in a cost effective manner to its customers (Grant & Jordan, 2015).

b) SWOT Analysis

Strengths Weaknesses

It is one of the largest diversified real

estate company of Australia.

Besides this, the company has strong

control across the supply chain and

established strong relationship with

different stakeholders.

The business has adopted different

sustainable and environmental friendly

practices for the purpose of

contributing towards the protection of

the environment and stakeholders.

In addition to this, the company

provides flexible working environment

to its employees which results in

improving the operational efficiency of

the company (Braun & Latham, 2014).

There is a reduction in the retail

portfolio of the company (Braun &

Latham, 2014).

Opportunities Threats

There is an existence of opportunities

for the company to expand its business

There is an increased competition from

international and domestic players in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Auditing 10

in the retail properties sector.

Besides this, the company can avail

new market opportunities through

digital revolution (Fleisher &

Bensoussan, 2015).

the market.

Increase in the affordable housing

properties results in increasing a

challenge for the company in Australia

(Fleisher & Bensoussan, 2015).

c) Porter’s Five Forces Model

Threat from new entrants:

There is a presence of different business opportunities in the real estate business which attracts

large number of investors which results in increasing the number of new companies in the

industry which poses threat to the sustenance of Stockland Stapled company (Hamilton &

Webster, 2015).

Bargaining power of suppliers

The bargaining power of suppliers in the real estate industry is high which reflects that suppliers

can supply to different companies which may affect the profit margins of Stockland Stapled as it

might be possible that the company find difficulty in procuring materials from suppliers at low

cost (Humphries & Gibbs, 2015).

Bargaining Power of Buyers:

There is a high bargaining power of buyers in the industry which shows that the buyers prefer to

buy those properties which are offered at low prices. This has a significant adverse impact on the

profitability of Stockland Stapled company (Rao & Klein, 2015).

Threat from substitute products

in the retail properties sector.

Besides this, the company can avail

new market opportunities through

digital revolution (Fleisher &

Bensoussan, 2015).

the market.

Increase in the affordable housing

properties results in increasing a

challenge for the company in Australia

(Fleisher & Bensoussan, 2015).

c) Porter’s Five Forces Model

Threat from new entrants:

There is a presence of different business opportunities in the real estate business which attracts

large number of investors which results in increasing the number of new companies in the

industry which poses threat to the sustenance of Stockland Stapled company (Hamilton &

Webster, 2015).

Bargaining power of suppliers

The bargaining power of suppliers in the real estate industry is high which reflects that suppliers

can supply to different companies which may affect the profit margins of Stockland Stapled as it

might be possible that the company find difficulty in procuring materials from suppliers at low

cost (Humphries & Gibbs, 2015).

Bargaining Power of Buyers:

There is a high bargaining power of buyers in the industry which shows that the buyers prefer to

buy those properties which are offered at low prices. This has a significant adverse impact on the

profitability of Stockland Stapled company (Rao & Klein, 2015).

Threat from substitute products

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Auditing 11

There is a presence of increased number of similar products by other companies in the industry at

low prices due to which it is necessary for Stockland Stapled to differentiate it products in the

form of features and implementation of new technologies in order to charge high prices for the

products that the customers are ready to pay (Fleisher & Bensoussan, 2015).

Rivalry among the existing players

There is a presence of high competition in the industry due to the presence of increase number of

existing players. This forces the company to provide the products and services at low cost and

with innovative features in order to overcome the competition (Chick & Handfield, 2014).

d) Other External Factors

There is a presence of low interest rates has a direct effect on the retail and residential property

segments and is beneficial for the office and industrial segments. The decline in the currency

helps in boosting the investment and consumption and improving the overall economy of the

country (Fleisher & Bensoussan, 2015).

Part 5: Understand objectives, strategies and Assessing Business Risks:

Objective and Stratgy:

Stockland is Australia’s one of the largest diversified property group. It has more than $15.8

billion of real estate assets. The goal of this company is to be a great Australian real estate

company that makes a valuable contribution to Australian communities and the country

(Stockland, 2017). Stockland believe that “there is a better way to live.” The primary objective of

Stockland is to deliver the earning and return to the security holders above the Australian Real

Estate investment Trust index average, and Stockland can achieve this objective by creating

quality communities and property assets and by delivering great customer experiences. To

achieve the objective, Stockland business strategy has three strategic priorities:

There is a presence of increased number of similar products by other companies in the industry at

low prices due to which it is necessary for Stockland Stapled to differentiate it products in the

form of features and implementation of new technologies in order to charge high prices for the

products that the customers are ready to pay (Fleisher & Bensoussan, 2015).

Rivalry among the existing players

There is a presence of high competition in the industry due to the presence of increase number of

existing players. This forces the company to provide the products and services at low cost and

with innovative features in order to overcome the competition (Chick & Handfield, 2014).

d) Other External Factors

There is a presence of low interest rates has a direct effect on the retail and residential property

segments and is beneficial for the office and industrial segments. The decline in the currency

helps in boosting the investment and consumption and improving the overall economy of the

country (Fleisher & Bensoussan, 2015).

Part 5: Understand objectives, strategies and Assessing Business Risks:

Objective and Stratgy:

Stockland is Australia’s one of the largest diversified property group. It has more than $15.8

billion of real estate assets. The goal of this company is to be a great Australian real estate

company that makes a valuable contribution to Australian communities and the country

(Stockland, 2017). Stockland believe that “there is a better way to live.” The primary objective of

Stockland is to deliver the earning and return to the security holders above the Australian Real

Estate investment Trust index average, and Stockland can achieve this objective by creating

quality communities and property assets and by delivering great customer experiences. To

achieve the objective, Stockland business strategy has three strategic priorities:

Auditing 12

Grow assets return and customer base: This strategy is based on driving returns in their core

businesses.

Capital Strength: According to this strategy Stockland actively maintaining its balance

sheet’s diverse funding sources and efficient cost of capital (Stockland, 2017).

Operational Excellence: This strategy includes improvement in the ways the company

operate across the group to enhance the efficiencies and effectiveness of the employees and

the overall performance.

Business Risks:

There are many business risks that can be experience by any company like Stockland. If

Stockland develops its business than there is a risk that existing employees can work with new

technology or not. If Stockland develops its business it means the infrastructure and the standard

of the technology will increase so this can be a problem for the existing employees. Another risk

for Stockland is introduction of new products and services; this is also a risk for business because

suddenly increased in production and the procedure of new product production can be a problem

for business because the employees will not able to understand the procedure and the description

of the product (Berkowitz, et al., 2011). Use of IT in businesses can be a risk because to operate

the technology business needs expertise. Using IT in business is beneficial but it can be happen

that the system and processes can be incompatible. Along with this, regulatory requirements are

also a part of risk for businesses. Regulatory risk is the risk that a change in law and regulation

will affect the business and market. These changes in law and regulation made by government

and these changes can increase the cost of operating a business and can change the competitive

landscape.

Grow assets return and customer base: This strategy is based on driving returns in their core

businesses.

Capital Strength: According to this strategy Stockland actively maintaining its balance

sheet’s diverse funding sources and efficient cost of capital (Stockland, 2017).

Operational Excellence: This strategy includes improvement in the ways the company

operate across the group to enhance the efficiencies and effectiveness of the employees and

the overall performance.

Business Risks:

There are many business risks that can be experience by any company like Stockland. If

Stockland develops its business than there is a risk that existing employees can work with new

technology or not. If Stockland develops its business it means the infrastructure and the standard

of the technology will increase so this can be a problem for the existing employees. Another risk

for Stockland is introduction of new products and services; this is also a risk for business because

suddenly increased in production and the procedure of new product production can be a problem

for business because the employees will not able to understand the procedure and the description

of the product (Berkowitz, et al., 2011). Use of IT in businesses can be a risk because to operate

the technology business needs expertise. Using IT in business is beneficial but it can be happen

that the system and processes can be incompatible. Along with this, regulatory requirements are

also a part of risk for businesses. Regulatory risk is the risk that a change in law and regulation

will affect the business and market. These changes in law and regulation made by government

and these changes can increase the cost of operating a business and can change the competitive

landscape.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.