Strategic Analysis of ARB Corporation Using Porter's Five Forces

VerifiedAdded on 2022/11/10

|7

|1426

|409

Report

AI Summary

This report provides a comprehensive analysis of ARB Corporation using Porter's Five Forces framework. It examines the competitive forces within the automotive accessories manufacturing industry, including the threat of substitute products, the intensity of competition among existing players, the power of buyers and suppliers, and the threat of new entrants. The analysis reveals insights into ARB Corporation's strengths and weaknesses relative to its competitors, such as TJM Products Pty Ltd and Cequent. The report highlights the low threat of substitutes and new entrants due to high switching costs and entry barriers, while also acknowledging the power of suppliers. Furthermore, a competitor analysis is presented, comparing ARB Corporation with key players based on their services, products, strengths, and weaknesses, offering a strategic context for understanding the competitive dynamics within the industry.

Porter Five Force Framework

Porter five forces is a framework that is used to analyse the five competitive forces

that outline all the industries and support in defining the strength as well as weakness of an

industry. This model is mostly utilized to recognize the structure of an industry for defining

the corporate strategy. Porter five force frameworks can be used for the analysis of any of the

economy’s segment in the hunt for attractiveness and profitability (Dobbs, 2014).

Threat of substitute product – Substitute services or products that could be utilized in

place of the product of the company increases the level of threat. Businesses that create

services or products with no close substitute holds higher power to augment the price range

and lock in favourable terms. Considering the case of automobile industry’s accessories

manufacturing market, the ARB Corporation does not deal with much of the substitute threat

which reduces the intensity of this force. Besides this, the switching cost from one product to

another for the customer in the industry is high and there are possibility that customer may

not get the same value from the substitutes they are using.

Competition among existing players – The force of competitive rivalry in the industry

talks about the number of competitors and their capability to weaken a strength or existence

of a company. It has been said that the more the competitors in an industry with offering

equal number of services and products results in lessening the power of a business (Magretta

& Porter, 2012). Buyers and suppliers move towards the competitor if it is offering better

services at lower prices. Considering the industry of ARB Corporation, there are limited

numbers of players who offer similar services and products but are powerful and has higher

share in the market. The limited number of players allows equal chance to other players to

play accordingly and gain the position in the market. Therefore, the competitive rivalry in this

Porter five forces is a framework that is used to analyse the five competitive forces

that outline all the industries and support in defining the strength as well as weakness of an

industry. This model is mostly utilized to recognize the structure of an industry for defining

the corporate strategy. Porter five force frameworks can be used for the analysis of any of the

economy’s segment in the hunt for attractiveness and profitability (Dobbs, 2014).

Threat of substitute product – Substitute services or products that could be utilized in

place of the product of the company increases the level of threat. Businesses that create

services or products with no close substitute holds higher power to augment the price range

and lock in favourable terms. Considering the case of automobile industry’s accessories

manufacturing market, the ARB Corporation does not deal with much of the substitute threat

which reduces the intensity of this force. Besides this, the switching cost from one product to

another for the customer in the industry is high and there are possibility that customer may

not get the same value from the substitutes they are using.

Competition among existing players – The force of competitive rivalry in the industry

talks about the number of competitors and their capability to weaken a strength or existence

of a company. It has been said that the more the competitors in an industry with offering

equal number of services and products results in lessening the power of a business (Magretta

& Porter, 2012). Buyers and suppliers move towards the competitor if it is offering better

services at lower prices. Considering the industry of ARB Corporation, there are limited

numbers of players who offer similar services and products but are powerful and has higher

share in the market. The limited number of players allows equal chance to other players to

play accordingly and gain the position in the market. Therefore, the competitive rivalry in this

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

industry is low to survive in the industry there is need of offering higher quality products and

maintaining strong bonds with the suppliers as well as dealers. Some of the competitors of

ARB Corporation in the industry are TJM Products Pty Ltd, Cequent, WARN Industries, etc.

(Zoom Info, 2019).

Power of Buyer – This force of the framework deals with the capability that is hold by

the customer to drive the prices of the services and products down. It is influenced by the

number of customer or buyer a company has, how important every customer is and how

much it cost to a business to search new market segment or customer for its output. In case of

ARB Corporation’s industry, the power of the buyer is low as there is very limited number of

players who provide high quality services that is needed to manufacture the final Motor

vehicle and four wheeler vehicles, hence considered to holding high switching cost for the

buyer (Financial Times, 2019).

Threat of New Players – The power of a business in the industry is also influenced by

the entry of the new player. The less money as well as time it requires by the competitor to

take entry in the market of the company and be an influential player, which impacts the

position of the existing players (Magretta & Porter, 2012). In the case of ARB Corporation’s

industry, deals with lesser threat of the new entrant due to higher entry barriers (Bloomberg,

2019b). This is due to the requirement of high capital investment as well as resources for

operating in the industry.

Power of Supplier - This force talks about how easy it is for the supplier to increase

the input’s cost. It is influenced by the supplier’s number of the service or product. For ARB

Corporation and its industry players the power of supplier is higher due to higher switching

cost. Besides this, the demand of the product supplied by the supplier is higher which

reinforces their position against the business.

maintaining strong bonds with the suppliers as well as dealers. Some of the competitors of

ARB Corporation in the industry are TJM Products Pty Ltd, Cequent, WARN Industries, etc.

(Zoom Info, 2019).

Power of Buyer – This force of the framework deals with the capability that is hold by

the customer to drive the prices of the services and products down. It is influenced by the

number of customer or buyer a company has, how important every customer is and how

much it cost to a business to search new market segment or customer for its output. In case of

ARB Corporation’s industry, the power of the buyer is low as there is very limited number of

players who provide high quality services that is needed to manufacture the final Motor

vehicle and four wheeler vehicles, hence considered to holding high switching cost for the

buyer (Financial Times, 2019).

Threat of New Players – The power of a business in the industry is also influenced by

the entry of the new player. The less money as well as time it requires by the competitor to

take entry in the market of the company and be an influential player, which impacts the

position of the existing players (Magretta & Porter, 2012). In the case of ARB Corporation’s

industry, deals with lesser threat of the new entrant due to higher entry barriers (Bloomberg,

2019b). This is due to the requirement of high capital investment as well as resources for

operating in the industry.

Power of Supplier - This force talks about how easy it is for the supplier to increase

the input’s cost. It is influenced by the supplier’s number of the service or product. For ARB

Corporation and its industry players the power of supplier is higher due to higher switching

cost. Besides this, the demand of the product supplied by the supplier is higher which

reinforces their position against the business.

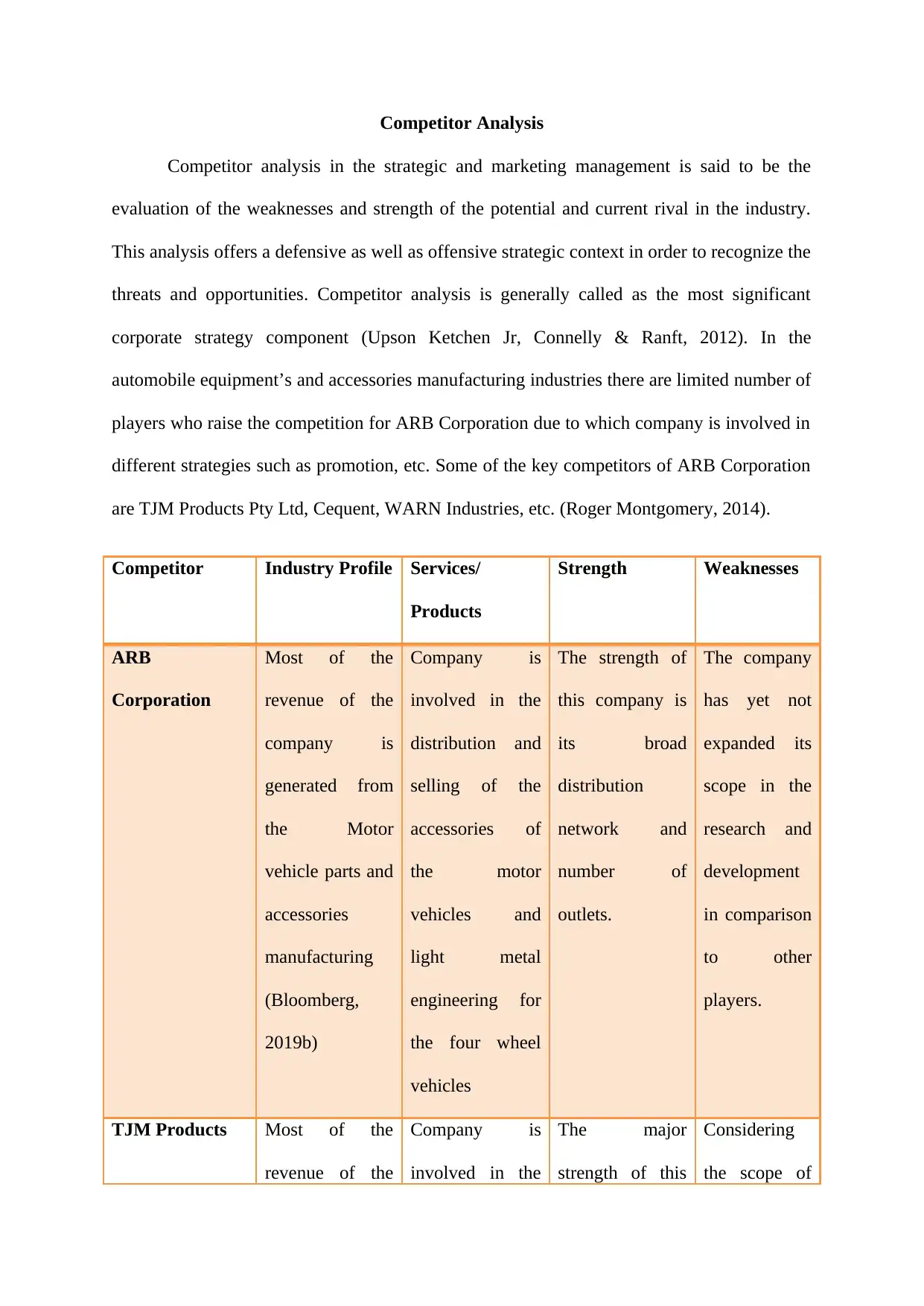

Competitor Analysis

Competitor analysis in the strategic and marketing management is said to be the

evaluation of the weaknesses and strength of the potential and current rival in the industry.

This analysis offers a defensive as well as offensive strategic context in order to recognize the

threats and opportunities. Competitor analysis is generally called as the most significant

corporate strategy component (Upson Ketchen Jr, Connelly & Ranft, 2012). In the

automobile equipment’s and accessories manufacturing industries there are limited number of

players who raise the competition for ARB Corporation due to which company is involved in

different strategies such as promotion, etc. Some of the key competitors of ARB Corporation

are TJM Products Pty Ltd, Cequent, WARN Industries, etc. (Roger Montgomery, 2014).

Competitor Industry Profile Services/

Products

Strength Weaknesses

ARB

Corporation

Most of the

revenue of the

company is

generated from

the Motor

vehicle parts and

accessories

manufacturing

(Bloomberg,

2019b)

Company is

involved in the

distribution and

selling of the

accessories of

the motor

vehicles and

light metal

engineering for

the four wheel

vehicles

The strength of

this company is

its broad

distribution

network and

number of

outlets.

The company

has yet not

expanded its

scope in the

research and

development

in comparison

to other

players.

TJM Products Most of the

revenue of the

Company is

involved in the

The major

strength of this

Considering

the scope of

Competitor analysis in the strategic and marketing management is said to be the

evaluation of the weaknesses and strength of the potential and current rival in the industry.

This analysis offers a defensive as well as offensive strategic context in order to recognize the

threats and opportunities. Competitor analysis is generally called as the most significant

corporate strategy component (Upson Ketchen Jr, Connelly & Ranft, 2012). In the

automobile equipment’s and accessories manufacturing industries there are limited number of

players who raise the competition for ARB Corporation due to which company is involved in

different strategies such as promotion, etc. Some of the key competitors of ARB Corporation

are TJM Products Pty Ltd, Cequent, WARN Industries, etc. (Roger Montgomery, 2014).

Competitor Industry Profile Services/

Products

Strength Weaknesses

ARB

Corporation

Most of the

revenue of the

company is

generated from

the Motor

vehicle parts and

accessories

manufacturing

(Bloomberg,

2019b)

Company is

involved in the

distribution and

selling of the

accessories of

the motor

vehicles and

light metal

engineering for

the four wheel

vehicles

The strength of

this company is

its broad

distribution

network and

number of

outlets.

The company

has yet not

expanded its

scope in the

research and

development

in comparison

to other

players.

TJM Products Most of the

revenue of the

Company is

involved in the

The major

strength of this

Considering

the scope of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

company is

generated from

the Motor

vehicle parts and

accessories

manufacturing

manufacturing of

motor vehicle

accessories and

parts

(Bloomberg,

2019a).

company is that

it offers high

quality of

accessories.

other players

the company

has not

expanded its

operations in

other segment

like

accessories of

four wheel

vehicles.

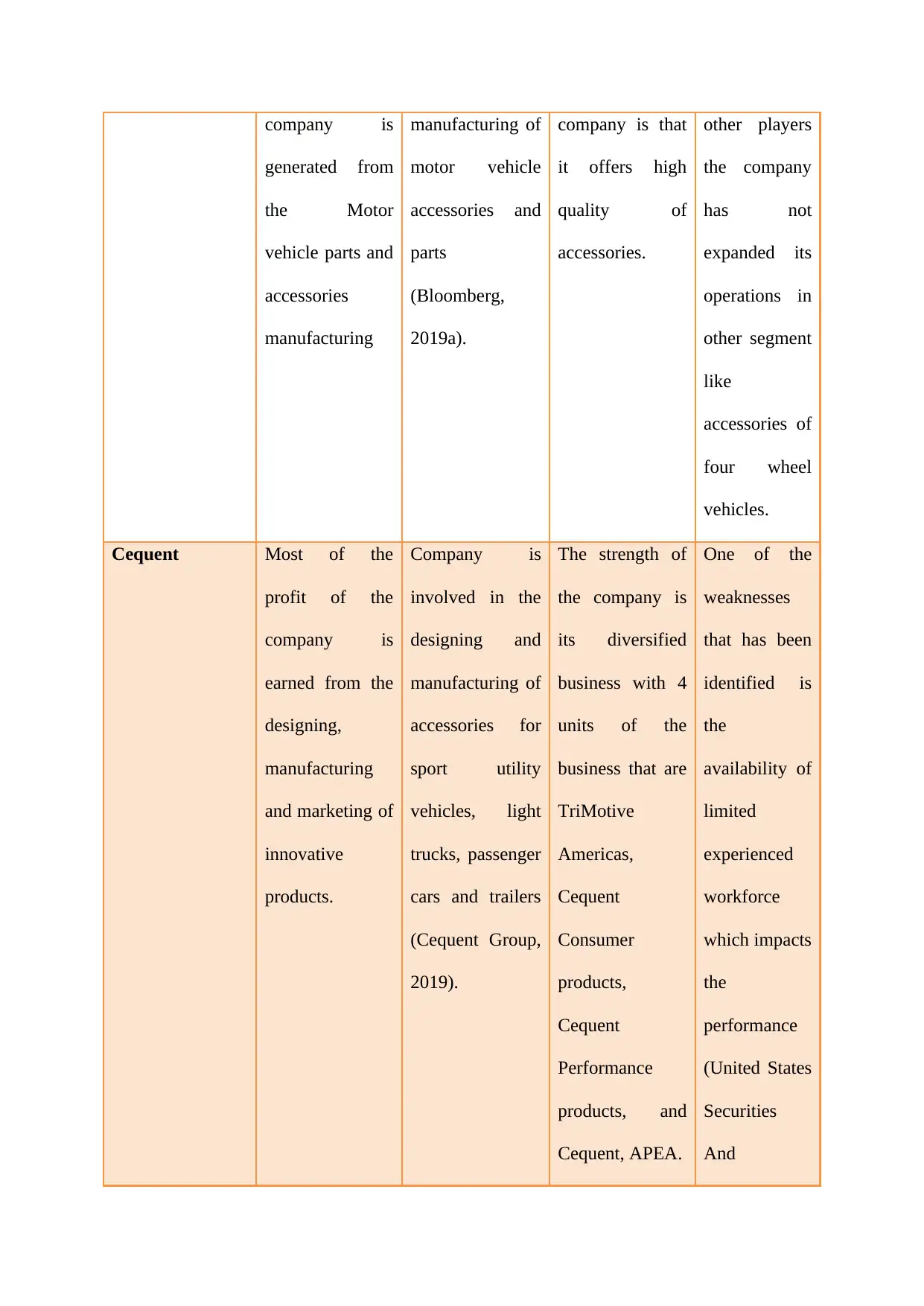

Cequent Most of the

profit of the

company is

earned from the

designing,

manufacturing

and marketing of

innovative

products.

Company is

involved in the

designing and

manufacturing of

accessories for

sport utility

vehicles, light

trucks, passenger

cars and trailers

(Cequent Group,

2019).

The strength of

the company is

its diversified

business with 4

units of the

business that are

TriMotive

Americas,

Cequent

Consumer

products,

Cequent

Performance

products, and

Cequent, APEA.

One of the

weaknesses

that has been

identified is

the

availability of

limited

experienced

workforce

which impacts

the

performance

(United States

Securities

And

generated from

the Motor

vehicle parts and

accessories

manufacturing

manufacturing of

motor vehicle

accessories and

parts

(Bloomberg,

2019a).

company is that

it offers high

quality of

accessories.

other players

the company

has not

expanded its

operations in

other segment

like

accessories of

four wheel

vehicles.

Cequent Most of the

profit of the

company is

earned from the

designing,

manufacturing

and marketing of

innovative

products.

Company is

involved in the

designing and

manufacturing of

accessories for

sport utility

vehicles, light

trucks, passenger

cars and trailers

(Cequent Group,

2019).

The strength of

the company is

its diversified

business with 4

units of the

business that are

TriMotive

Americas,

Cequent

Consumer

products,

Cequent

Performance

products, and

Cequent, APEA.

One of the

weaknesses

that has been

identified is

the

availability of

limited

experienced

workforce

which impacts

the

performance

(United States

Securities

And

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Exchange

Commission,

2005).

From the above competitive analysis, it has been identified that ARB Corporation has

gained a significant position in the industry because the other players has little diverse

business which does not majorly impact the performance of this company.

Commission,

2005).

From the above competitive analysis, it has been identified that ARB Corporation has

gained a significant position in the industry because the other players has little diverse

business which does not majorly impact the performance of this company.

References

Bloomberg. (2019a). Tjm Products Pty Ltd. Retrieved from

https://www.bloomberg.com/profile/company/7551340Z:AU

Bloomberg. (2019b). About ARB Corp Ltd. Retrieved from

https://www.bloomberg.com/quote/ARB:AU

Cequent Group. (2019). Welcome to Cequent. Retrieved from http://www.cequentgroup.com/

Dobbs, M. (2014). Guidelines for applying Porter's five forces framework: a set of industry

analysis templates. Competitiveness Review, 24(1), 32-45.

Financial Times. (2019). About the company. Retrieved from

https://markets.ft.com/data/equities/tearsheet/profile?s=ARB:ASX

Magretta, J., & Porter, M.E. (2012). Understanding Michael Porter: The Essential Guide to

Competition and Strategy 2nd ed. U.S: Harvard Business Press.

Roger Montgomery. (2014). ARB Corporation: An Analysis. Retrieved from

https://rogermontgomery.com/arb-corporation-an-analysis-30092014/

United States Securities And Exchange Commission. (2005). Annual report of Cequent.

Retrieved from

https://www.sec.gov/Archives/edgar/data/842633/000095013606002701/file001.htm

Upson, J. W., Ketchen Jr, D. J., Connelly, B. L., & Ranft, A. L. (2012). Competitor analysis

and foothold moves. Academy of Management Journal, 55(1), 93-110.

Zoom Info. (2019). ARB Corporation Limited. Retrieved from

https://www.zoominfo.com/c/arb-corporation-limited/2556271

Bloomberg. (2019a). Tjm Products Pty Ltd. Retrieved from

https://www.bloomberg.com/profile/company/7551340Z:AU

Bloomberg. (2019b). About ARB Corp Ltd. Retrieved from

https://www.bloomberg.com/quote/ARB:AU

Cequent Group. (2019). Welcome to Cequent. Retrieved from http://www.cequentgroup.com/

Dobbs, M. (2014). Guidelines for applying Porter's five forces framework: a set of industry

analysis templates. Competitiveness Review, 24(1), 32-45.

Financial Times. (2019). About the company. Retrieved from

https://markets.ft.com/data/equities/tearsheet/profile?s=ARB:ASX

Magretta, J., & Porter, M.E. (2012). Understanding Michael Porter: The Essential Guide to

Competition and Strategy 2nd ed. U.S: Harvard Business Press.

Roger Montgomery. (2014). ARB Corporation: An Analysis. Retrieved from

https://rogermontgomery.com/arb-corporation-an-analysis-30092014/

United States Securities And Exchange Commission. (2005). Annual report of Cequent.

Retrieved from

https://www.sec.gov/Archives/edgar/data/842633/000095013606002701/file001.htm

Upson, J. W., Ketchen Jr, D. J., Connelly, B. L., & Ranft, A. L. (2012). Competitor analysis

and foothold moves. Academy of Management Journal, 55(1), 93-110.

Zoom Info. (2019). ARB Corporation Limited. Retrieved from

https://www.zoominfo.com/c/arb-corporation-limited/2556271

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.