Strategic Analysis of CBA: HI5019 Strategic Information Systems

VerifiedAdded on 2023/04/22

|18

|4165

|279

Report

AI Summary

This report presents a strategic analysis of the Commonwealth Bank of Australia (CBA), a leading multinational bank. Part 1 covers the business background, industry, and general environment analysis (political, social, economic, legal, environmental, and technological factors). It examines the industry environment using Porter's Five Forces (threat of new entrants, bargaining power of customers), competitive environment, and identifies key opportunities and threats. Part 2 focuses on tangible and intangible resources, capability identification, and proposes an information system solution, including its evaluation. The analysis uses examples from scholarly sources to support its arguments, providing a comprehensive overview of CBA's strategic position.

Running head: STRATEGIC INFORMATION SYSTEM

Strategic Information System

[Name of the Student]

[Name of the University]

[Author note]

Strategic Information System

[Name of the Student]

[Name of the University]

[Author note]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STRATEGIC INFORMATION SYSTEM

Table of Contents

Introduction:...................................................................................................................3

Part 1:.............................................................................................................................3

The Current organization structure:...........................................................................3

General Environmental Analysis:..............................................................................4

Political:.................................................................................................................4

Social factors:.........................................................................................................4

Economic factors:...................................................................................................5

Legal Factors..........................................................................................................6

Environmental Factors:..........................................................................................6

Technology:............................................................................................................7

The industry environment..........................................................................................8

Threat of New Entrants:.........................................................................................8

Bargaining power of the customers:......................................................................8

Competitive Environment:.........................................................................................8

Threats and Opportunities:.......................................................................................11

Opportunities:.......................................................................................................11

Threats:.................................................................................................................12

PART 2.........................................................................................................................12

Tangible and Intangible Resources:.........................................................................12

Capabilities identification........................................................................................13

Information System Solution...................................................................................14

Table of Contents

Introduction:...................................................................................................................3

Part 1:.............................................................................................................................3

The Current organization structure:...........................................................................3

General Environmental Analysis:..............................................................................4

Political:.................................................................................................................4

Social factors:.........................................................................................................4

Economic factors:...................................................................................................5

Legal Factors..........................................................................................................6

Environmental Factors:..........................................................................................6

Technology:............................................................................................................7

The industry environment..........................................................................................8

Threat of New Entrants:.........................................................................................8

Bargaining power of the customers:......................................................................8

Competitive Environment:.........................................................................................8

Threats and Opportunities:.......................................................................................11

Opportunities:.......................................................................................................11

Threats:.................................................................................................................12

PART 2.........................................................................................................................12

Tangible and Intangible Resources:.........................................................................12

Capabilities identification........................................................................................13

Information System Solution...................................................................................14

2STRATEGIC INFORMATION SYSTEM

Evaluation of the proposed system..........................................................................14

References:...................................................................................................................15

Evaluation of the proposed system..........................................................................14

References:...................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STRATEGIC INFORMATION SYSTEM

Introduction:

Commonwealth Bank of Australia is the organization which has been selected in

order to complete the report. The primary objective of the paper includes the presenting of an

in-depth analysis of the accounting packages which mainly includes the challenges that are

faced while using the accounting software. Accounting information system can be considered

to be a financial software which is customizable and is used by the business mainly for the

purpose recording, interpreting, processing and keeping a track of the financial data that are

listed along with the financial statements and the accounts (Commbank.com.au. 2019). Some

of the most commonly used financial statement includes the balance sheet, the cash flow

statement and the statement of income. Besides this another important factor is that the

businesses are capable of either purchasing the accounting software from the vendors or

might be associated with developing these internally. The accounting software which is

appropriate must be efficient, valuable and resources saving tool which would be responsible

for suiting the business needs and would also be easy to manage.

Part 1:

The Current organization structure:

The organization which has been selected for the analysis is the Commonwealth Bank

of Australia. This Bank is listed amongst the top four banks of Australia and is a public

limited company as per listed in the Australian Securities Exchange. Besides this

Commonwealth Bank of Australia is the largest multinational bank located in Australia and is

consisting of subsidiaries in many countries like U.K, USA, New Zealand, Fiji and Asia

(Hatton et al. 2017). The bank is responsible for offering financial services to the small

business owners as well as to personal clients. The organizational structure of the

Introduction:

Commonwealth Bank of Australia is the organization which has been selected in

order to complete the report. The primary objective of the paper includes the presenting of an

in-depth analysis of the accounting packages which mainly includes the challenges that are

faced while using the accounting software. Accounting information system can be considered

to be a financial software which is customizable and is used by the business mainly for the

purpose recording, interpreting, processing and keeping a track of the financial data that are

listed along with the financial statements and the accounts (Commbank.com.au. 2019). Some

of the most commonly used financial statement includes the balance sheet, the cash flow

statement and the statement of income. Besides this another important factor is that the

businesses are capable of either purchasing the accounting software from the vendors or

might be associated with developing these internally. The accounting software which is

appropriate must be efficient, valuable and resources saving tool which would be responsible

for suiting the business needs and would also be easy to manage.

Part 1:

The Current organization structure:

The organization which has been selected for the analysis is the Commonwealth Bank

of Australia. This Bank is listed amongst the top four banks of Australia and is a public

limited company as per listed in the Australian Securities Exchange. Besides this

Commonwealth Bank of Australia is the largest multinational bank located in Australia and is

consisting of subsidiaries in many countries like U.K, USA, New Zealand, Fiji and Asia

(Hatton et al. 2017). The bank is responsible for offering financial services to the small

business owners as well as to personal clients. The organizational structure of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4STRATEGIC INFORMATION SYSTEM

Commonwealth Bank of Australia can be considered to be vertically integrated and is

associated with working in the form of a network structure and the main leader of the entire

team is the CEO of the Bank.

General Environmental Analysis:

Political:

The political analysis mainly considers the deregulation along with the privatization

and this is one of the major reason which transformed the CBA into a peoples bank into a

private organization. This in turn is responsible for increasing the returns to its stakeholders

and managers who are free from any responsibility regarding the community. There exists

one major cleft in between the privatization and the traditional policies of the government.

Along with remarking this with immense ill will the Commonwealth bank, in conventional

area of the electorate, it also leads to discontinuity of the promises which are mostly explicit

(Hallikainen et al. 2017). The financial deregulations and the privatization of the

Commonwealth bank of Australia has been disastrous for the public of Australia. Same thing

has happened because of the financial deregulation. Banks have been associated with

embossing fees and charges at the time of entry of the financial deregulation and besides this

it also cut the services and have bee associated with the utilization of the collective power of

monopoly whenever it is needed. The latest correction did not know weather or not the

government of Australia guaranteed the deposits made in the bank. Other Major impact upon

the commonwealth bank is that they have started operating as saving banks by spinning off

their insurance along with the other activities.

Social factors:

The culture and the ways of doing anything in a society might be associated with

having a huge impact upon the culture of the organization existing in a particular

Commonwealth Bank of Australia can be considered to be vertically integrated and is

associated with working in the form of a network structure and the main leader of the entire

team is the CEO of the Bank.

General Environmental Analysis:

Political:

The political analysis mainly considers the deregulation along with the privatization

and this is one of the major reason which transformed the CBA into a peoples bank into a

private organization. This in turn is responsible for increasing the returns to its stakeholders

and managers who are free from any responsibility regarding the community. There exists

one major cleft in between the privatization and the traditional policies of the government.

Along with remarking this with immense ill will the Commonwealth bank, in conventional

area of the electorate, it also leads to discontinuity of the promises which are mostly explicit

(Hallikainen et al. 2017). The financial deregulations and the privatization of the

Commonwealth bank of Australia has been disastrous for the public of Australia. Same thing

has happened because of the financial deregulation. Banks have been associated with

embossing fees and charges at the time of entry of the financial deregulation and besides this

it also cut the services and have bee associated with the utilization of the collective power of

monopoly whenever it is needed. The latest correction did not know weather or not the

government of Australia guaranteed the deposits made in the bank. Other Major impact upon

the commonwealth bank is that they have started operating as saving banks by spinning off

their insurance along with the other activities.

Social factors:

The culture and the ways of doing anything in a society might be associated with

having a huge impact upon the culture of the organization existing in a particular

5STRATEGIC INFORMATION SYSTEM

environment. The beliefs that are shared along with the attitudes of the population are

associated with playing a very vital role in the way by which the marketers of the

Commonwealth Bank of Australia would be understanding the customers present in a

particular market. Besides this it also helps in the designing of the marketing messages for the

consumers of the banking industry. Banks are responsible for playing a very vital role in

assisting the societies and this is generally done by providing the societies with a financial

literacy program or by adding or collaborating the different organizations in a community

(Galliers and Leidner 2014). Employees are provided with an additional opportunity by

helping them in getting engaged with the different local communities which is initially

responsible for the promotion of the cultures all across the border communities. Besides this,

the providing of faster access to the various educational facilities for the indigenous youths as

well as for adults to get financial literacy is another important social factor. For all these

reasons there is a positive impact upon the commonwealth bank of Australia.

Economic factors:

The Capital Position of the Commonwealth Bank of Australia is seen to be neutral as

per the measurements conducted by the RAC and the standard ratio For this reason the Bank

has been associated with increasing the strength of its capital level under the Basel III

regulatory capital framework which would be having a much stronger impact upon the

neutral capital setting of the bank or would be responsible for bringing a better outcome on

the philosophies related to management of individual bank capitals.

There exist various kind of innovations which are responsible for the improvements of

the frontline customer interface of the commonwealth bank of Australia (Coviello and Tanev

2017). For this reason, they are associated with investing upon the technology which are

responsible for the simplification of the process and is responsible for driving the

productivity which is initially responsible for leading towards the operational efficiencies

environment. The beliefs that are shared along with the attitudes of the population are

associated with playing a very vital role in the way by which the marketers of the

Commonwealth Bank of Australia would be understanding the customers present in a

particular market. Besides this it also helps in the designing of the marketing messages for the

consumers of the banking industry. Banks are responsible for playing a very vital role in

assisting the societies and this is generally done by providing the societies with a financial

literacy program or by adding or collaborating the different organizations in a community

(Galliers and Leidner 2014). Employees are provided with an additional opportunity by

helping them in getting engaged with the different local communities which is initially

responsible for the promotion of the cultures all across the border communities. Besides this,

the providing of faster access to the various educational facilities for the indigenous youths as

well as for adults to get financial literacy is another important social factor. For all these

reasons there is a positive impact upon the commonwealth bank of Australia.

Economic factors:

The Capital Position of the Commonwealth Bank of Australia is seen to be neutral as

per the measurements conducted by the RAC and the standard ratio For this reason the Bank

has been associated with increasing the strength of its capital level under the Basel III

regulatory capital framework which would be having a much stronger impact upon the

neutral capital setting of the bank or would be responsible for bringing a better outcome on

the philosophies related to management of individual bank capitals.

There exist various kind of innovations which are responsible for the improvements of

the frontline customer interface of the commonwealth bank of Australia (Coviello and Tanev

2017). For this reason, they are associated with investing upon the technology which are

responsible for the simplification of the process and is responsible for driving the

productivity which is initially responsible for leading towards the operational efficiencies

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STRATEGIC INFORMATION SYSTEM

from the initiatives related to productivity which are responsible for bringing benefits and for

having a positive impact upon the expense base.

Legal Factors

Commonwealth bank of Australia has started an Open advice review program (OAR),

that was to be used by the customer of Commonwealth financial planning limited and

financial wisdom limited for the purpose of compensating regarding any kind of poor

financial advice. Some of the important Legal responsibility that the OAR of the CBA is

having includes the following:

Negotiation with the independent parties as well as with the ICAs.

Preparation and focusing upon the documentation of the customers.

For all these reasons the CBA has specialized team who are associated with the

assessment of the OAR and for this reason there exists the availability of checks as well as

balances for the purpose of enriching the rightfulness of the outcomes for the customers who

have been affected. This includes the Independent Customer Advocate or the ICA which is

group compromising of the three largest customary advocacy firms and they are mainly

selected by the customers for the purpose assessing them by making use of the scrutiny of

their assessment outcomes. Existence of the Independent review panel helps in surveying the

offers of the customers along with the estimations regarding the things where the customers

are unable to reach the agreement that has been signed with the CBA (Cassidy 2016). The

OAR program has been associated with putting forward a lot of challenges such as the

establishment of the services which are actually needed by the customers, providing of proper

definition of the scope and many more. These in turn has been associated with impacting the

time that is required for the preparation of assessment of individual customer cases in

program.

from the initiatives related to productivity which are responsible for bringing benefits and for

having a positive impact upon the expense base.

Legal Factors

Commonwealth bank of Australia has started an Open advice review program (OAR),

that was to be used by the customer of Commonwealth financial planning limited and

financial wisdom limited for the purpose of compensating regarding any kind of poor

financial advice. Some of the important Legal responsibility that the OAR of the CBA is

having includes the following:

Negotiation with the independent parties as well as with the ICAs.

Preparation and focusing upon the documentation of the customers.

For all these reasons the CBA has specialized team who are associated with the

assessment of the OAR and for this reason there exists the availability of checks as well as

balances for the purpose of enriching the rightfulness of the outcomes for the customers who

have been affected. This includes the Independent Customer Advocate or the ICA which is

group compromising of the three largest customary advocacy firms and they are mainly

selected by the customers for the purpose assessing them by making use of the scrutiny of

their assessment outcomes. Existence of the Independent review panel helps in surveying the

offers of the customers along with the estimations regarding the things where the customers

are unable to reach the agreement that has been signed with the CBA (Cassidy 2016). The

OAR program has been associated with putting forward a lot of challenges such as the

establishment of the services which are actually needed by the customers, providing of proper

definition of the scope and many more. These in turn has been associated with impacting the

time that is required for the preparation of assessment of individual customer cases in

program.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STRATEGIC INFORMATION SYSTEM

Environmental Factors:

CBA is one of the largest organizations located in Australia consisting of direct as

well as indirect impacts upon the environment. So, it needs to be prevented and one of the

most important way by which this can be prevented is by attaining of the Carbon Reduction

Target. Another way of doing this is by supporting the group clients in their transition

towards the low carbon economy. These particular targets have been carried out by

replacement of the lighting which is efficient and by upgrading the hardware, air conditioning

and the ventilation or the HVAC system present in the retail as well as in the commercial

buildings (Appelbaum et al. 2017). For this reason, CBA has also been associated with

moving their offices from the inefficient buildings to the premises which are environmentally

efficient. This is having a huge impact upon the CBA and for this reason in the year of 2012

CBA won the sustainability award for built environment.

Technology:

CBA was the first bank of Australia that was responsible for providing settlements

and baking on a real-time basis and besides this the bank was also associated with providing

24-hour access to various banking services by making use of the EFTOS and the ATM or by

means of mobile banking (Ogiela 2015). This is one of the most famous online brokers which

is responsible for providing of facilities such as the Net bank and Comm Sec. Some of the

recent innovations of the recent innovation includes the caching for the Facebook and this

are:

CBA is the first bank associated with providing social media banking so as to help the

customers experience a speedy and secure banking.

Allowing the smart sign for the customers so as to manage the loan documents

electronically from anywhere and anytime.

Environmental Factors:

CBA is one of the largest organizations located in Australia consisting of direct as

well as indirect impacts upon the environment. So, it needs to be prevented and one of the

most important way by which this can be prevented is by attaining of the Carbon Reduction

Target. Another way of doing this is by supporting the group clients in their transition

towards the low carbon economy. These particular targets have been carried out by

replacement of the lighting which is efficient and by upgrading the hardware, air conditioning

and the ventilation or the HVAC system present in the retail as well as in the commercial

buildings (Appelbaum et al. 2017). For this reason, CBA has also been associated with

moving their offices from the inefficient buildings to the premises which are environmentally

efficient. This is having a huge impact upon the CBA and for this reason in the year of 2012

CBA won the sustainability award for built environment.

Technology:

CBA was the first bank of Australia that was responsible for providing settlements

and baking on a real-time basis and besides this the bank was also associated with providing

24-hour access to various banking services by making use of the EFTOS and the ATM or by

means of mobile banking (Ogiela 2015). This is one of the most famous online brokers which

is responsible for providing of facilities such as the Net bank and Comm Sec. Some of the

recent innovations of the recent innovation includes the caching for the Facebook and this

are:

CBA is the first bank associated with providing social media banking so as to help the

customers experience a speedy and secure banking.

Allowing the smart sign for the customers so as to manage the loan documents

electronically from anywhere and anytime.

8STRATEGIC INFORMATION SYSTEM

The My Wealth is associated with allowing the investors in analyze and invest upon the

financial products once they login.

The industry environment

Threat of New Entrants:

The digitalized financial systems of CBA have been capable of reaching a certain

level of maturity and besides this the other existing bank of Australia are generally associated

with the utilization of different channels of entrants in order to capture the market shares.

Similarly, there are also other threats from the competitors that are located in other regions or

are domestic (Dwivedi et al. 2015). The usage of the technology by other competitors is

generally done in order to offer virtual or physical financials services to the Australian

financial market. This would generally be responsible for putting forward the various type of

challenges related to the growth of the organization however the CBA is a major incumbent

to the financial industry and is responsible for capturing most of the market shares.

Bargaining power of the customers:

The bargaining power that the Australian customers are having is considered to be

very high and is also responsible for bringing financial packages of similar kind along with

the competitive rates for the purpose of expanding the shares in the market that is entirely

concentrated (Laudon and Laudon 2015). The Australian market favours the bargaining by

the customers regarding the rate which is best and due to this reason, the bank also influences

the bargaining power of the customers in a dynamic way. This is done by making offers

which includes the providing of aggressive rate for the customers by means of dropping the

five-year fixed home loan rate and many more.

The My Wealth is associated with allowing the investors in analyze and invest upon the

financial products once they login.

The industry environment

Threat of New Entrants:

The digitalized financial systems of CBA have been capable of reaching a certain

level of maturity and besides this the other existing bank of Australia are generally associated

with the utilization of different channels of entrants in order to capture the market shares.

Similarly, there are also other threats from the competitors that are located in other regions or

are domestic (Dwivedi et al. 2015). The usage of the technology by other competitors is

generally done in order to offer virtual or physical financials services to the Australian

financial market. This would generally be responsible for putting forward the various type of

challenges related to the growth of the organization however the CBA is a major incumbent

to the financial industry and is responsible for capturing most of the market shares.

Bargaining power of the customers:

The bargaining power that the Australian customers are having is considered to be

very high and is also responsible for bringing financial packages of similar kind along with

the competitive rates for the purpose of expanding the shares in the market that is entirely

concentrated (Laudon and Laudon 2015). The Australian market favours the bargaining by

the customers regarding the rate which is best and due to this reason, the bank also influences

the bargaining power of the customers in a dynamic way. This is done by making offers

which includes the providing of aggressive rate for the customers by means of dropping the

five-year fixed home loan rate and many more.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9STRATEGIC INFORMATION SYSTEM

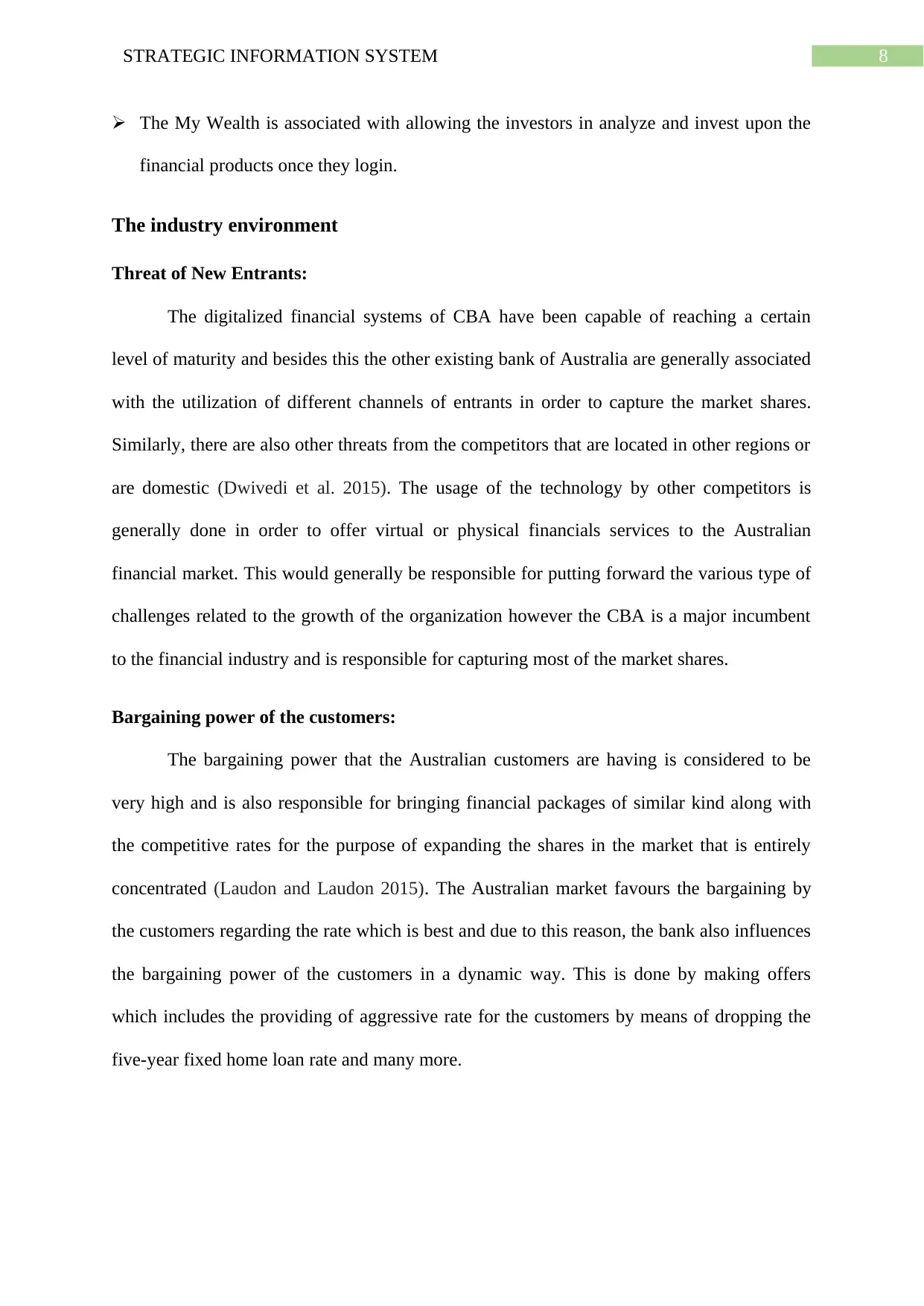

Competitive Environment:

The major competitors of the Commonwealth Bank of Australia mainly include the

other major banks existing in Australia and this are namely the NAB Australia, ANZ

Australia, ASB Bank, Westpac Bank, Bank West, St. George Bank Australia and lastly the

Kiwi Bank New Zealand. Below is the figure which depicts the core competitors of the CBA.

Fig 1: Core competitors of Commonwealth Bank of Australia

Source: (Galliers and Leidner 2014)

The figure provided above has been associated with depicting the core as well as the

main competitors of CBA. From the figure it can be ensured that the Commonwealth bank of

Australia is the one which is associated with gaining the maximum number of shares. the

figure depicts the fact that almost 20% of the shares along with the clients are taken by the

Commonwealth Bank of Australia whereas the NAP is having only 16% and the ANZ is

having 13%.

Competitive Environment:

The major competitors of the Commonwealth Bank of Australia mainly include the

other major banks existing in Australia and this are namely the NAB Australia, ANZ

Australia, ASB Bank, Westpac Bank, Bank West, St. George Bank Australia and lastly the

Kiwi Bank New Zealand. Below is the figure which depicts the core competitors of the CBA.

Fig 1: Core competitors of Commonwealth Bank of Australia

Source: (Galliers and Leidner 2014)

The figure provided above has been associated with depicting the core as well as the

main competitors of CBA. From the figure it can be ensured that the Commonwealth bank of

Australia is the one which is associated with gaining the maximum number of shares. the

figure depicts the fact that almost 20% of the shares along with the clients are taken by the

Commonwealth Bank of Australia whereas the NAP is having only 16% and the ANZ is

having 13%.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10STRATEGIC INFORMATION SYSTEM

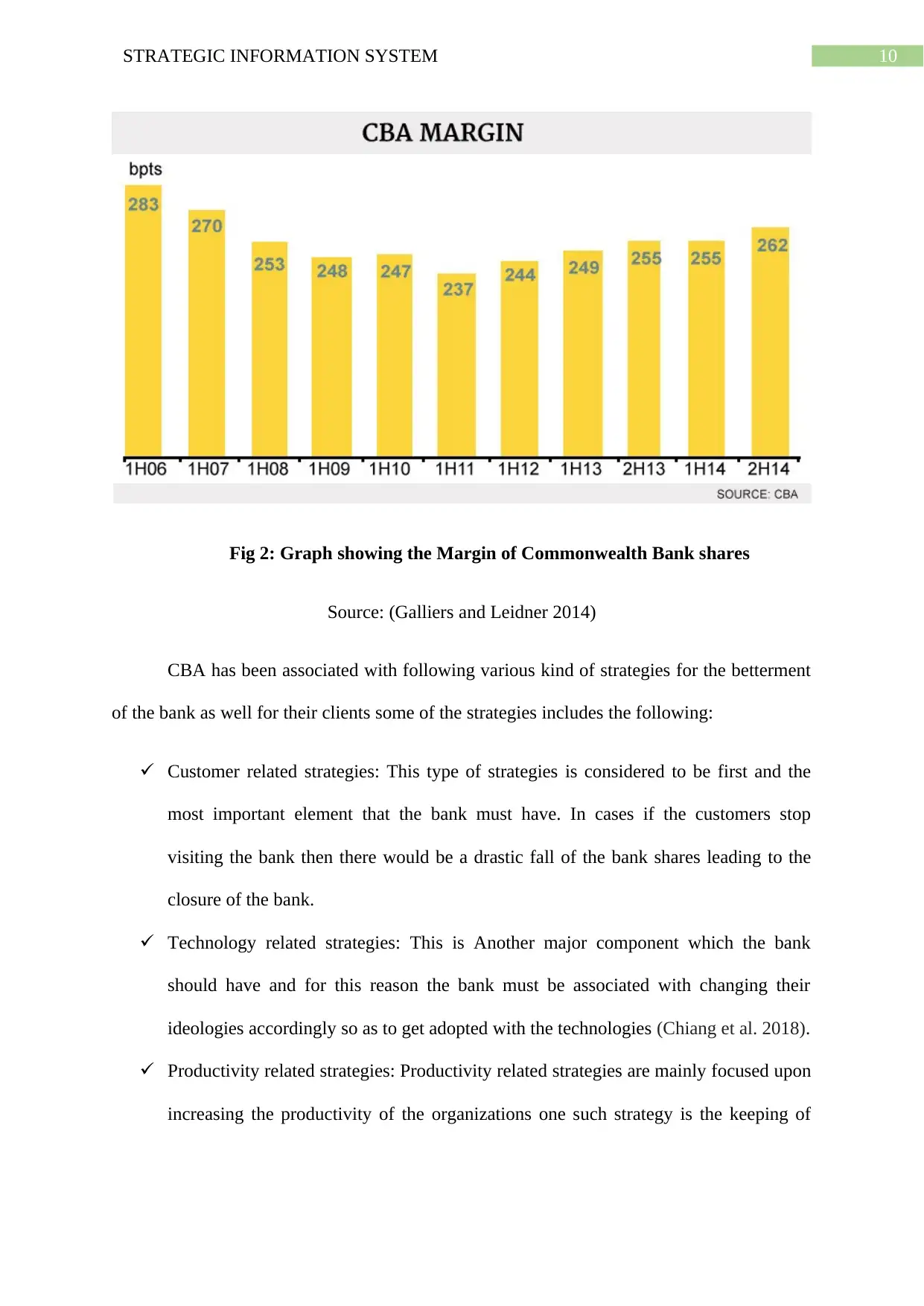

Fig 2: Graph showing the Margin of Commonwealth Bank shares

Source: (Galliers and Leidner 2014)

CBA has been associated with following various kind of strategies for the betterment

of the bank as well for their clients some of the strategies includes the following:

Customer related strategies: This type of strategies is considered to be first and the

most important element that the bank must have. In cases if the customers stop

visiting the bank then there would be a drastic fall of the bank shares leading to the

closure of the bank.

Technology related strategies: This is Another major component which the bank

should have and for this reason the bank must be associated with changing their

ideologies accordingly so as to get adopted with the technologies (Chiang et al. 2018).

Productivity related strategies: Productivity related strategies are mainly focused upon

increasing the productivity of the organizations one such strategy is the keeping of

Fig 2: Graph showing the Margin of Commonwealth Bank shares

Source: (Galliers and Leidner 2014)

CBA has been associated with following various kind of strategies for the betterment

of the bank as well for their clients some of the strategies includes the following:

Customer related strategies: This type of strategies is considered to be first and the

most important element that the bank must have. In cases if the customers stop

visiting the bank then there would be a drastic fall of the bank shares leading to the

closure of the bank.

Technology related strategies: This is Another major component which the bank

should have and for this reason the bank must be associated with changing their

ideologies accordingly so as to get adopted with the technologies (Chiang et al. 2018).

Productivity related strategies: Productivity related strategies are mainly focused upon

increasing the productivity of the organizations one such strategy is the keeping of

11STRATEGIC INFORMATION SYSTEM

records on a regular and annual basis regarding the productivity as well as the records

of the employees.

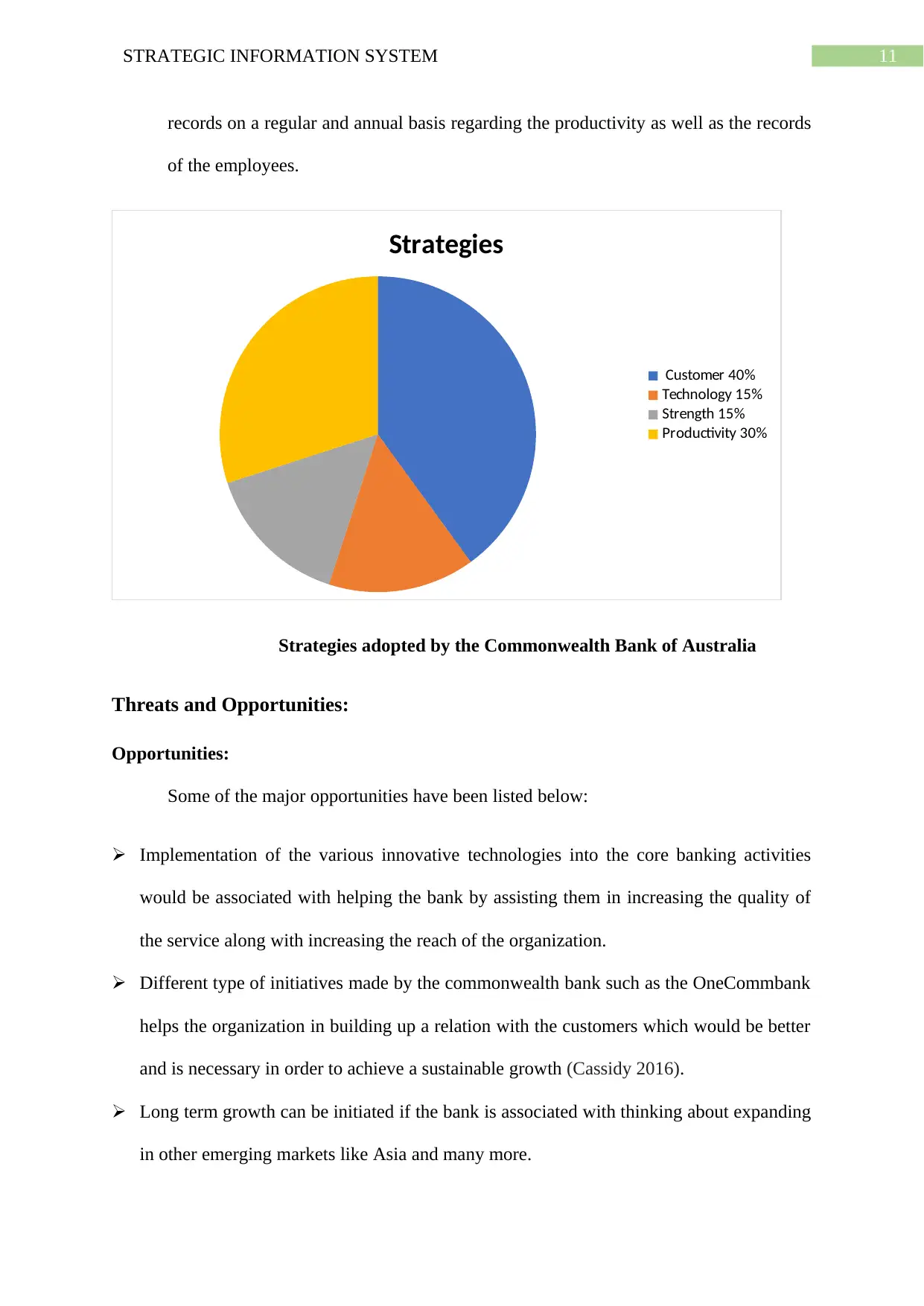

Strategies

Customer 40%

Technology 15%

Strength 15%

Productivity 30%

Strategies adopted by the Commonwealth Bank of Australia

Threats and Opportunities:

Opportunities:

Some of the major opportunities have been listed below:

Implementation of the various innovative technologies into the core banking activities

would be associated with helping the bank by assisting them in increasing the quality of

the service along with increasing the reach of the organization.

Different type of initiatives made by the commonwealth bank such as the OneCommbank

helps the organization in building up a relation with the customers which would be better

and is necessary in order to achieve a sustainable growth (Cassidy 2016).

Long term growth can be initiated if the bank is associated with thinking about expanding

in other emerging markets like Asia and many more.

records on a regular and annual basis regarding the productivity as well as the records

of the employees.

Strategies

Customer 40%

Technology 15%

Strength 15%

Productivity 30%

Strategies adopted by the Commonwealth Bank of Australia

Threats and Opportunities:

Opportunities:

Some of the major opportunities have been listed below:

Implementation of the various innovative technologies into the core banking activities

would be associated with helping the bank by assisting them in increasing the quality of

the service along with increasing the reach of the organization.

Different type of initiatives made by the commonwealth bank such as the OneCommbank

helps the organization in building up a relation with the customers which would be better

and is necessary in order to achieve a sustainable growth (Cassidy 2016).

Long term growth can be initiated if the bank is associated with thinking about expanding

in other emerging markets like Asia and many more.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.