Strategic Analysis of GSK and Pfizer Joint Venture (Business Strategy)

VerifiedAdded on 2022/09/27

|24

|5408

|34

Report

AI Summary

This report offers a comprehensive strategic analysis of the GlaxoSmithKline (GSK) and Pfizer joint venture. It begins with an introduction to the purpose and background of the companies, followed by an external analysis using PESTLE and Porter's Five Forces frameworks to identify opportunities and threats. The internal analysis delves into GSK's resources and capabilities, including a VRIO analysis to determine competitive advantages. The report then evaluates the joint venture strategy through a SWOT analysis, assessing its suitability, acceptability, and feasibility, culminating in a conclusion that summarizes the key findings. Appendices provide additional data, including success factors, cash flow, revenues, and a stakeholder power matrix. The analysis focuses on the pharmaceutical industry's dynamics and the strategic implications of the GSK-Pfizer partnership.

Running head: STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

Name of the Student

Name of the University

Author Note

STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

Table of Contents

1. Introduction................................................................................................................2

1.1 The purpose of the report.....................................................................................2

1.2 Company background..........................................................................................2

2. External analysis of GlaxoSmithKline.......................................................................3

2.1 Discussion related to the business environment (PESTLE analysis)...................3

2.2 Porter’s five forces analysis of GlaxoSmithKline................................................6

2.3 Identification of the Opportunities and Threats...................................................8

3. Internal analysis of GlaxoSmithKline........................................................................9

3.1 Resources and capabilities GlaxoSmithKline......................................................9

3.2 Ways by which unique capabilities are linked to competitive advantage..........12

VRIO analysis of GlaxoSmithKline.........................................................................13

4. Strategy evaluation...................................................................................................14

4.1 SWOT analysis of Joint venture........................................................................14

4.2 Suitability...........................................................................................................15

4.3 Acceptability......................................................................................................16

4.4 Feasibility...........................................................................................................16

5. Conclusion................................................................................................................16

6. References................................................................................................................18

7. Appendices...............................................................................................................22

Appendix 1 – Success factors..................................................................................22

Appendix 2 – Cash flow and revenues.....................................................................22

Appendix 3 – Stakeholder power matrix based on joint venture.............................23

Table of Contents

1. Introduction................................................................................................................2

1.1 The purpose of the report.....................................................................................2

1.2 Company background..........................................................................................2

2. External analysis of GlaxoSmithKline.......................................................................3

2.1 Discussion related to the business environment (PESTLE analysis)...................3

2.2 Porter’s five forces analysis of GlaxoSmithKline................................................6

2.3 Identification of the Opportunities and Threats...................................................8

3. Internal analysis of GlaxoSmithKline........................................................................9

3.1 Resources and capabilities GlaxoSmithKline......................................................9

3.2 Ways by which unique capabilities are linked to competitive advantage..........12

VRIO analysis of GlaxoSmithKline.........................................................................13

4. Strategy evaluation...................................................................................................14

4.1 SWOT analysis of Joint venture........................................................................14

4.2 Suitability...........................................................................................................15

4.3 Acceptability......................................................................................................16

4.4 Feasibility...........................................................................................................16

5. Conclusion................................................................................................................16

6. References................................................................................................................18

7. Appendices...............................................................................................................22

Appendix 1 – Success factors..................................................................................22

Appendix 2 – Cash flow and revenues.....................................................................22

Appendix 3 – Stakeholder power matrix based on joint venture.............................23

2STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

1. Introduction

1.1 The purpose of the report

The analysis in the report will be related to joint venture that had been developed by

GlaxoSmithKline and Pfizer in the year 2018. The joint venture was able to provide major

opportunities to GSK for improving its strategies and developing value for the shareholders

as well. The report will provide an analysis of the internal and external environment of

GlaxoSmithKline based on the joint venture that has been formed with Pfizer Inc.

1.2 Company background

GlaxoSmithKline plc or GSK is a multinational pharmaceutical organization that has

its headquarters in Brentford, London. The organization had been established in the year

2000 with the help of the merger of two firms namely Glaxo Wellcome and SmithKline

Beecham. GSK has also gained the place of world’s seventh largest pharmaceutical

organization within the year 2015 after companies like Johnson & Johnson, Novartis,

Hoffman-La Roche, Merck and Sanofi. Emma Walmsley had become the CEO of GSK in the

year 2017 and she was also the first female CEO of the firm. The company had earned

revenues of around 21.3 Billion Euros with the sales of its vaccines and drugs (Gsk.com.,

2019).

The external environment will be analysed with the help of PESTLE and Porter’s

framework. Internal environment of the organization will be examined with respect to the

resources and capabilities that have been earned by GlaxoSmithKline in the pharmaceutical

industry. The approach that has been applied by the firm in order to develop the Joint venture

processes with Pfizer Inc. will also be a vital part of the study that will be made in the report.

1. Introduction

1.1 The purpose of the report

The analysis in the report will be related to joint venture that had been developed by

GlaxoSmithKline and Pfizer in the year 2018. The joint venture was able to provide major

opportunities to GSK for improving its strategies and developing value for the shareholders

as well. The report will provide an analysis of the internal and external environment of

GlaxoSmithKline based on the joint venture that has been formed with Pfizer Inc.

1.2 Company background

GlaxoSmithKline plc or GSK is a multinational pharmaceutical organization that has

its headquarters in Brentford, London. The organization had been established in the year

2000 with the help of the merger of two firms namely Glaxo Wellcome and SmithKline

Beecham. GSK has also gained the place of world’s seventh largest pharmaceutical

organization within the year 2015 after companies like Johnson & Johnson, Novartis,

Hoffman-La Roche, Merck and Sanofi. Emma Walmsley had become the CEO of GSK in the

year 2017 and she was also the first female CEO of the firm. The company had earned

revenues of around 21.3 Billion Euros with the sales of its vaccines and drugs (Gsk.com.,

2019).

The external environment will be analysed with the help of PESTLE and Porter’s

framework. Internal environment of the organization will be examined with respect to the

resources and capabilities that have been earned by GlaxoSmithKline in the pharmaceutical

industry. The approach that has been applied by the firm in order to develop the Joint venture

processes with Pfizer Inc. will also be a vital part of the study that will be made in the report.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

2. External analysis of GlaxoSmithKline

2.1 Discussion related to the business environment (PESTLE analysis)

Political factors – The rise in global expenditures in healthcare has a major influence

in the UK healthcare industry. Financial performance of healthcare ecosystem of the UK

affects GSK and its revenues even after the joint venture with Pfizer Inc. The Brexit based

proposal that was placed in the year 2017 has a major negative impact on the business

environment in the United Kingdom. The organizations like GSK that are a part of the

healthcare sector of UK can be influenced negatively due to low economic growth after

Brexit decision. The exit of the UK from European Union has affected the trade policies that

can influence the prices of GSK. Healthcare is also a major component related to social

welfare in the country and an organization like GSK is considered to be a major contributor

based to the proper improvement of economic growth of the UK and it is an opportunity for

its growth. (Aguinis, Edwards & Bradley, 2017).

Economic factors – The pharmaceutical industry witnessed many high value based

Joint ventures in the last few years. The growth rates of pharmaceutical industry have been

able to surpass many different industries that are a part of the United Kingdom. However, the

economic policies of the country have been influenced by the global financial crisis and

reduction in production volume has affected the manufacturing process of GSK. Government

interventions and labour costs are able to influence the productivity of GSK in the UK due to

the changes that can take place in the tax policies. The effective quality of infrastructure can

have an impact on the skills of the workforce of the organization that is able to provide

growth opportunity to GSK. The business operations of GSK in the United Kingdom have

been based on the effective prioritisation of proper investment of resources in the operations.

The major economic factors that have an impact on GlaxoSmithKline include exchange rates,

2. External analysis of GlaxoSmithKline

2.1 Discussion related to the business environment (PESTLE analysis)

Political factors – The rise in global expenditures in healthcare has a major influence

in the UK healthcare industry. Financial performance of healthcare ecosystem of the UK

affects GSK and its revenues even after the joint venture with Pfizer Inc. The Brexit based

proposal that was placed in the year 2017 has a major negative impact on the business

environment in the United Kingdom. The organizations like GSK that are a part of the

healthcare sector of UK can be influenced negatively due to low economic growth after

Brexit decision. The exit of the UK from European Union has affected the trade policies that

can influence the prices of GSK. Healthcare is also a major component related to social

welfare in the country and an organization like GSK is considered to be a major contributor

based to the proper improvement of economic growth of the UK and it is an opportunity for

its growth. (Aguinis, Edwards & Bradley, 2017).

Economic factors – The pharmaceutical industry witnessed many high value based

Joint ventures in the last few years. The growth rates of pharmaceutical industry have been

able to surpass many different industries that are a part of the United Kingdom. However, the

economic policies of the country have been influenced by the global financial crisis and

reduction in production volume has affected the manufacturing process of GSK. Government

interventions and labour costs are able to influence the productivity of GSK in the UK due to

the changes that can take place in the tax policies. The effective quality of infrastructure can

have an impact on the skills of the workforce of the organization that is able to provide

growth opportunity to GSK. The business operations of GSK in the United Kingdom have

been based on the effective prioritisation of proper investment of resources in the operations.

The major economic factors that have an impact on GlaxoSmithKline include exchange rates,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

interest rates, economic policies and the price fluctuations (DiMasi, Grabowski & Hansen,

2016).

Social factors – The changes that have taken place in demands and needs of

consumers have an impact on the products that are offered by pharmaceutical organizations

like GSK. Aging population has also enhanced the sales of GSK in the industry and research

and development based investments have increased due to increase in levels of demands for

the products. The class structure, power structure and hierarchy in the UK society can affect

the attitudes of customers in the UK. The needs of the UK society based on health and

wellbeing will be fulfilled effectively by the products that are offered by GSK. The political

and media attention is also able to play a key part in enhancing the sales of the firm and

provided opportunity of development to GSK (Barrick et al., 2015).

Technological factors – The advancements in technological and scientific

environment have provided support to the industry players so that they are able to adjust to

the changing environments. The pharmaceutical industry has depicted huge levels of

transformation in the last five years and provided chance of growth to the major

organizations. Value chain structure in the healthcare sector can influence the operations of a

firm like GSK. Digital technologies have been able to support the transformation of

healthcare sector of the UK. The “smart health” based approaches have improved the quality

of the products and offered opportunity of profitability improvement. The innovation

processes are encouraged with the assistance of proper research and development made by

GSK (Baumgartner & Rauter, 2017).

Environmental factors – The change in climate and weather can have an impact on

the laws that are developed for controlling pollution. Waste management and reduction of

carbon footprint by production process of GSK can influence its operations. The research and

interest rates, economic policies and the price fluctuations (DiMasi, Grabowski & Hansen,

2016).

Social factors – The changes that have taken place in demands and needs of

consumers have an impact on the products that are offered by pharmaceutical organizations

like GSK. Aging population has also enhanced the sales of GSK in the industry and research

and development based investments have increased due to increase in levels of demands for

the products. The class structure, power structure and hierarchy in the UK society can affect

the attitudes of customers in the UK. The needs of the UK society based on health and

wellbeing will be fulfilled effectively by the products that are offered by GSK. The political

and media attention is also able to play a key part in enhancing the sales of the firm and

provided opportunity of development to GSK (Barrick et al., 2015).

Technological factors – The advancements in technological and scientific

environment have provided support to the industry players so that they are able to adjust to

the changing environments. The pharmaceutical industry has depicted huge levels of

transformation in the last five years and provided chance of growth to the major

organizations. Value chain structure in the healthcare sector can influence the operations of a

firm like GSK. Digital technologies have been able to support the transformation of

healthcare sector of the UK. The “smart health” based approaches have improved the quality

of the products and offered opportunity of profitability improvement. The innovation

processes are encouraged with the assistance of proper research and development made by

GSK (Baumgartner & Rauter, 2017).

Environmental factors – The change in climate and weather can have an impact on

the laws that are developed for controlling pollution. Waste management and reduction of

carbon footprint by production process of GSK can influence its operations. The research and

5STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

development activities that are accomplished by the GlaxoSmithKline in the medicine field

have to be based on the laws related to environmental protection. The company is thereby

able to save the image of the brand so that the sales levels can be increased in an effective

manner. The investments that are made in CSR activities are also based on the ways by which

the environment can be saved and offer an opportunity to GSK to improve its image

(Cartwright & Matthews, 2016).

Legal factors – The Discrimination law and anti-trust law are able to affect the

policies that are formed by GSK as the work environment in the organization will be

developed accordingly. Consumer protection is a major aspect related to legal aspects of

GSK. The healthcare based industry is considered to be highly critical in nature and the local

rules have to be taken into consideration in order to save the organization from facing any

lawsuit that provide threats to its operations. The selling and copyright based laws have also

been able to play a key part in the methods by which a major firm like GSK can sustain its

profitable operations (Chatterji et al., 2016).

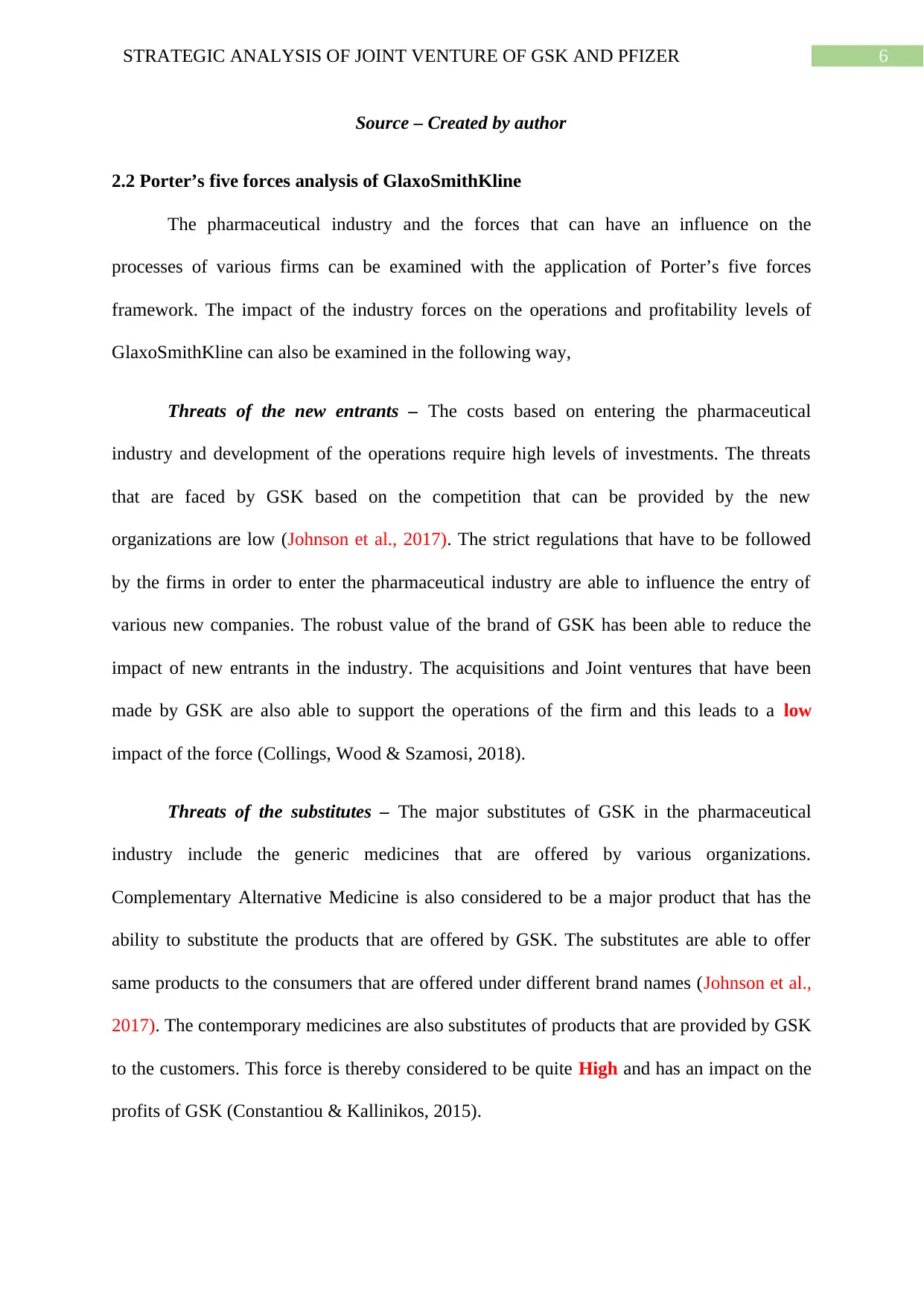

Figure 1 – PESTLE analysis

PESTLE

Political factors - UK

economic growth, social

welfare of health sector.

Legal factors - Compliance with the

legal requirements, healthcare

industry facing lawsuits.

Environmental factors - Research

and developmemt related to

environmental protection laws,

investments in CSR.

Technological factors -

Advancements in

technology, scientific

advancements.

Social factors - Health conscious

customers, Media and political

attention.

Economic factors - High value

mergers by GSK, growth rates

of pharmaceutical industry.

development activities that are accomplished by the GlaxoSmithKline in the medicine field

have to be based on the laws related to environmental protection. The company is thereby

able to save the image of the brand so that the sales levels can be increased in an effective

manner. The investments that are made in CSR activities are also based on the ways by which

the environment can be saved and offer an opportunity to GSK to improve its image

(Cartwright & Matthews, 2016).

Legal factors – The Discrimination law and anti-trust law are able to affect the

policies that are formed by GSK as the work environment in the organization will be

developed accordingly. Consumer protection is a major aspect related to legal aspects of

GSK. The healthcare based industry is considered to be highly critical in nature and the local

rules have to be taken into consideration in order to save the organization from facing any

lawsuit that provide threats to its operations. The selling and copyright based laws have also

been able to play a key part in the methods by which a major firm like GSK can sustain its

profitable operations (Chatterji et al., 2016).

Figure 1 – PESTLE analysis

PESTLE

Political factors - UK

economic growth, social

welfare of health sector.

Legal factors - Compliance with the

legal requirements, healthcare

industry facing lawsuits.

Environmental factors - Research

and developmemt related to

environmental protection laws,

investments in CSR.

Technological factors -

Advancements in

technology, scientific

advancements.

Social factors - Health conscious

customers, Media and political

attention.

Economic factors - High value

mergers by GSK, growth rates

of pharmaceutical industry.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

Source – Created by author

2.2 Porter’s five forces analysis of GlaxoSmithKline

The pharmaceutical industry and the forces that can have an influence on the

processes of various firms can be examined with the application of Porter’s five forces

framework. The impact of the industry forces on the operations and profitability levels of

GlaxoSmithKline can also be examined in the following way,

Threats of the new entrants – The costs based on entering the pharmaceutical

industry and development of the operations require high levels of investments. The threats

that are faced by GSK based on the competition that can be provided by the new

organizations are low (Johnson et al., 2017). The strict regulations that have to be followed

by the firms in order to enter the pharmaceutical industry are able to influence the entry of

various new companies. The robust value of the brand of GSK has been able to reduce the

impact of new entrants in the industry. The acquisitions and Joint ventures that have been

made by GSK are also able to support the operations of the firm and this leads to a low

impact of the force (Collings, Wood & Szamosi, 2018).

Threats of the substitutes – The major substitutes of GSK in the pharmaceutical

industry include the generic medicines that are offered by various organizations.

Complementary Alternative Medicine is also considered to be a major product that has the

ability to substitute the products that are offered by GSK. The substitutes are able to offer

same products to the consumers that are offered under different brand names (Johnson et al.,

2017). The contemporary medicines are also substitutes of products that are provided by GSK

to the customers. This force is thereby considered to be quite High and has an impact on the

profits of GSK (Constantiou & Kallinikos, 2015).

Source – Created by author

2.2 Porter’s five forces analysis of GlaxoSmithKline

The pharmaceutical industry and the forces that can have an influence on the

processes of various firms can be examined with the application of Porter’s five forces

framework. The impact of the industry forces on the operations and profitability levels of

GlaxoSmithKline can also be examined in the following way,

Threats of the new entrants – The costs based on entering the pharmaceutical

industry and development of the operations require high levels of investments. The threats

that are faced by GSK based on the competition that can be provided by the new

organizations are low (Johnson et al., 2017). The strict regulations that have to be followed

by the firms in order to enter the pharmaceutical industry are able to influence the entry of

various new companies. The robust value of the brand of GSK has been able to reduce the

impact of new entrants in the industry. The acquisitions and Joint ventures that have been

made by GSK are also able to support the operations of the firm and this leads to a low

impact of the force (Collings, Wood & Szamosi, 2018).

Threats of the substitutes – The major substitutes of GSK in the pharmaceutical

industry include the generic medicines that are offered by various organizations.

Complementary Alternative Medicine is also considered to be a major product that has the

ability to substitute the products that are offered by GSK. The substitutes are able to offer

same products to the consumers that are offered under different brand names (Johnson et al.,

2017). The contemporary medicines are also substitutes of products that are provided by GSK

to the customers. This force is thereby considered to be quite High and has an impact on the

profits of GSK (Constantiou & Kallinikos, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

Bargaining power of the buyers – Most of the research and development based

techniques of GlaxoSmithKline are aimed the production of transparent and high quality

products. The consumers of GSK mainly include doctors, patients, pharmacists and the

hospitals as well. The power that the buyers in pharmaceutical industry have is able to

influence the revenues in the industry. However, the buyers do not have the ability to affect

the prices of products in a huge manner and have a medium impact on the firm. The

application of modern technologies is able to play a major part in appropriate enhancement of

the product base of GSK (Dodgson, 2018).

Bargaining power of the suppliers – The suppliers of GSK are able to provide the

labour and various raw materials that are mainly required for the production of diverse

products that are offered to the customers. The suppliers can provide high levels of threats to

GSK based on the proper continuation of manufacturing process and enhancing the revenue

levels as well. The generation of revenues and reduction of competition is also based on the

prices that are decided by the suppliers (Donelan, Walker & Salek, 2015).

Competitive rivalry – The regulations and government policies in the pharmaceutical

industry is considered to be quite strict that is able to restrict the number of competitors. The

size of pharmaceutical industry is quite large and is able to support the prosperity of GSK.

The growth of pharmaceutical industry and quick generation of the revenues has also been

able to reduce the levels of competition faced by GSK. Extensive research and development

based techniques also have the ability to lower the number of competitors (Frow et al., 2015).

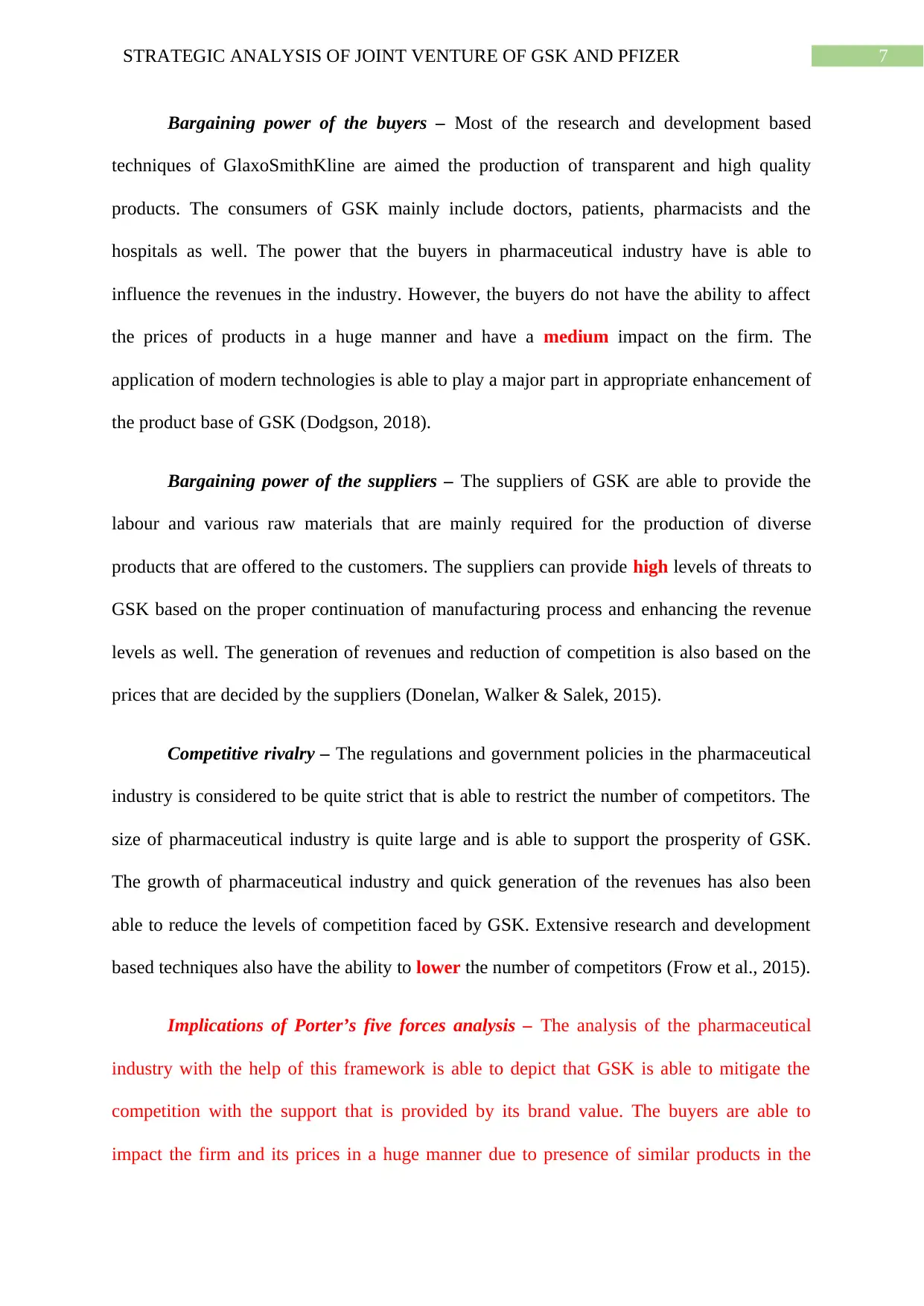

Implications of Porter’s five forces analysis – The analysis of the pharmaceutical

industry with the help of this framework is able to depict that GSK is able to mitigate the

competition with the support that is provided by its brand value. The buyers are able to

impact the firm and its prices in a huge manner due to presence of similar products in the

Bargaining power of the buyers – Most of the research and development based

techniques of GlaxoSmithKline are aimed the production of transparent and high quality

products. The consumers of GSK mainly include doctors, patients, pharmacists and the

hospitals as well. The power that the buyers in pharmaceutical industry have is able to

influence the revenues in the industry. However, the buyers do not have the ability to affect

the prices of products in a huge manner and have a medium impact on the firm. The

application of modern technologies is able to play a major part in appropriate enhancement of

the product base of GSK (Dodgson, 2018).

Bargaining power of the suppliers – The suppliers of GSK are able to provide the

labour and various raw materials that are mainly required for the production of diverse

products that are offered to the customers. The suppliers can provide high levels of threats to

GSK based on the proper continuation of manufacturing process and enhancing the revenue

levels as well. The generation of revenues and reduction of competition is also based on the

prices that are decided by the suppliers (Donelan, Walker & Salek, 2015).

Competitive rivalry – The regulations and government policies in the pharmaceutical

industry is considered to be quite strict that is able to restrict the number of competitors. The

size of pharmaceutical industry is quite large and is able to support the prosperity of GSK.

The growth of pharmaceutical industry and quick generation of the revenues has also been

able to reduce the levels of competition faced by GSK. Extensive research and development

based techniques also have the ability to lower the number of competitors (Frow et al., 2015).

Implications of Porter’s five forces analysis – The analysis of the pharmaceutical

industry with the help of this framework is able to depict that GSK is able to mitigate the

competition with the support that is provided by its brand value. The buyers are able to

impact the firm and its prices in a huge manner due to presence of similar products in the

8STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

industry. The highly effective supply chain is considered to be an important aspect that

supports the operations of GSK in the industry (Donelan, Walker & Salek, 2015).

Figure 2 – Porter’s five forces analysis

Source – Created by author

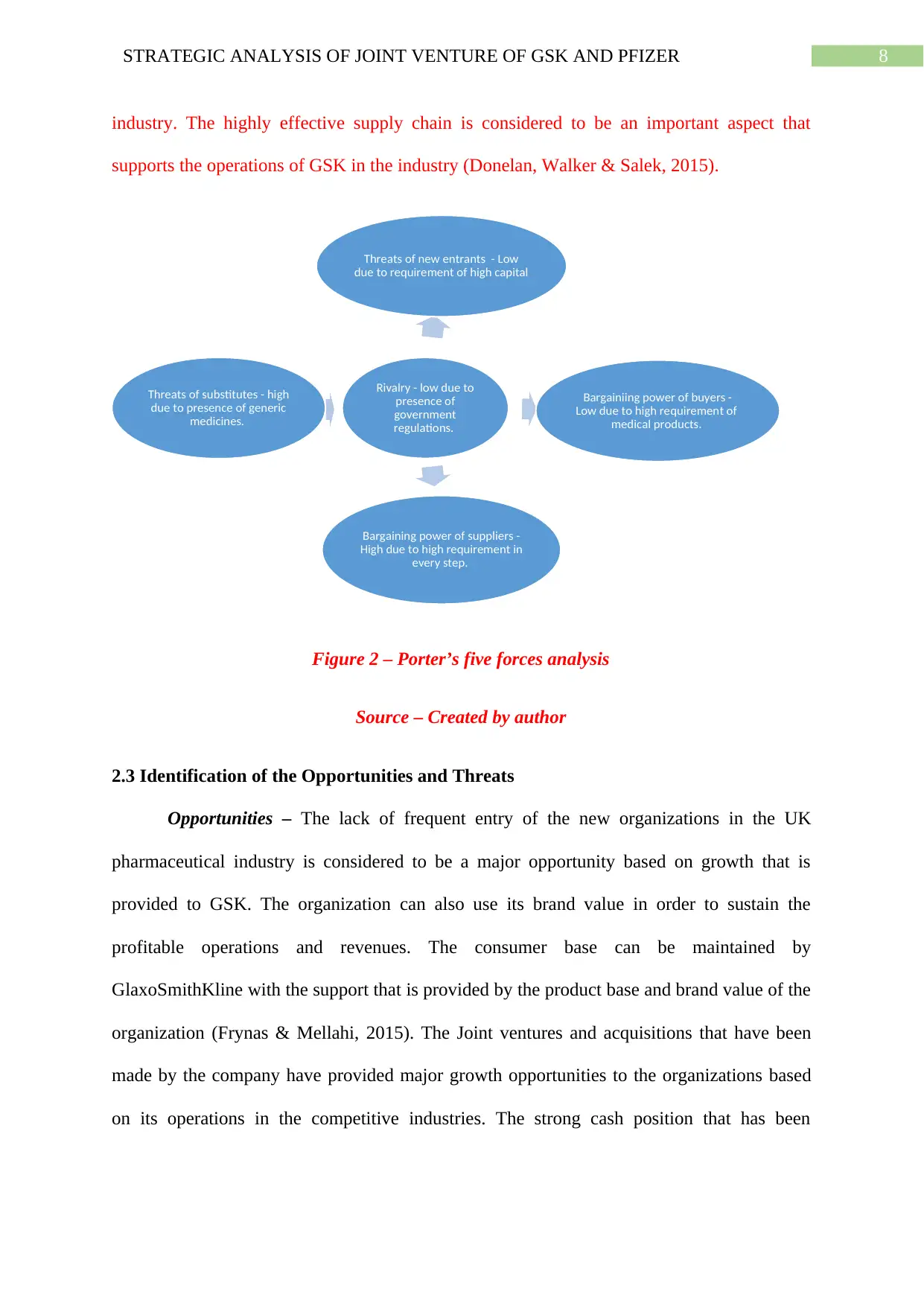

2.3 Identification of the Opportunities and Threats

Opportunities – The lack of frequent entry of the new organizations in the UK

pharmaceutical industry is considered to be a major opportunity based on growth that is

provided to GSK. The organization can also use its brand value in order to sustain the

profitable operations and revenues. The consumer base can be maintained by

GlaxoSmithKline with the support that is provided by the product base and brand value of the

organization (Frynas & Mellahi, 2015). The Joint ventures and acquisitions that have been

made by the company have provided major growth opportunities to the organizations based

on its operations in the competitive industries. The strong cash position that has been

Rivalry - low due to

presence of

government

regulations.

Threats of new entrants - Low

due to requirement of high capital

Bargainiing power of buyers -

Low due to high requirement of

medical products.

Bargaining power of suppliers -

High due to high requirement in

every step.

Threats of substitutes - high

due to presence of generic

medicines.

industry. The highly effective supply chain is considered to be an important aspect that

supports the operations of GSK in the industry (Donelan, Walker & Salek, 2015).

Figure 2 – Porter’s five forces analysis

Source – Created by author

2.3 Identification of the Opportunities and Threats

Opportunities – The lack of frequent entry of the new organizations in the UK

pharmaceutical industry is considered to be a major opportunity based on growth that is

provided to GSK. The organization can also use its brand value in order to sustain the

profitable operations and revenues. The consumer base can be maintained by

GlaxoSmithKline with the support that is provided by the product base and brand value of the

organization (Frynas & Mellahi, 2015). The Joint ventures and acquisitions that have been

made by the company have provided major growth opportunities to the organizations based

on its operations in the competitive industries. The strong cash position that has been

Rivalry - low due to

presence of

government

regulations.

Threats of new entrants - Low

due to requirement of high capital

Bargainiing power of buyers -

Low due to high requirement of

medical products.

Bargaining power of suppliers -

High due to high requirement in

every step.

Threats of substitutes - high

due to presence of generic

medicines.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

developed by GSK can support the future operations of the firm based on the development of

the product base and enhancing the revenue levels as well (Hannon, 2016).

Threats – GlaxoSmithKline is facing threats from the organizations that provide

generic medicines for the purpose of fulfilling the demands of the consumers. The

organizations that operate in the pharmaceutical industry other than GSK can provide same

products to the customers. The customers in the industry are provided with different options

that are mainly related to proper fulfilment of their medical needs. This is considered to be a

major threat that is provided to an organization like GlaxoSmithKline (Helfat & Martin,

2015).

Figure 3 – SWOT analysis framework

Source - (Helfat & Martin, 2015)

developed by GSK can support the future operations of the firm based on the development of

the product base and enhancing the revenue levels as well (Hannon, 2016).

Threats – GlaxoSmithKline is facing threats from the organizations that provide

generic medicines for the purpose of fulfilling the demands of the consumers. The

organizations that operate in the pharmaceutical industry other than GSK can provide same

products to the customers. The customers in the industry are provided with different options

that are mainly related to proper fulfilment of their medical needs. This is considered to be a

major threat that is provided to an organization like GlaxoSmithKline (Helfat & Martin,

2015).

Figure 3 – SWOT analysis framework

Source - (Helfat & Martin, 2015)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

3. Internal analysis of GlaxoSmithKline

3.1 Resources and capabilities GlaxoSmithKline

Unique Capabilities of GSK - The business strategy that has been developed by GSK

is mainly based on the three innovative preferences of strategy. The company aims at

boosting the growth and reducing risk levels that are faced in the industry. The importance

that is provided by GSK to partnership and outsourcing is based three aspects that include

growing the diversification of global business, delivering the products of greater value and

simplification of the operating model of GSK (Hitt, Ireland & Hoskisson, 2016). The

company aimed at diversifying the business operations to the development of consumer

products in order to gain a major global position. GSK has emerged as the leader in Nutrition

healthcare industry of the United Kingdom with the assistance of its diverse product

portfolio. The industry of consumer healthcare is also considered to be challenging in nature

due to the increase in demands of the customers (Lidstone & MacLennan, 2017).

The proper development of business strategy of GSK has proven to be a major

capability of the firm. The outsourcing based capabilities that have been developed by GSK

have been able to play a major role in the improvement of its operations and production based

facilities as well. The research and development based capabilities of GSK have been able to

support the manufacture of various products that are provided by the firm (Mulinari &

Ozieranski, 2018). The research based capabilities of GSK have supported the development

of different pharmaceutical products of the firm. The global manufacturing and the supply

chain based facilities of GSK have provided support to the growth levels of the firm. The

patents of different important medicines for the treatment of diseases like cancer that are

gained by GSK have an impact on the contribution that is provided by the firm. The supply

chain of GSK has increased the capability of the firm to reach the customers faster in

comparison to the other organizations (Musacchio, Lazzarini & Aguilera, 2015).

3. Internal analysis of GlaxoSmithKline

3.1 Resources and capabilities GlaxoSmithKline

Unique Capabilities of GSK - The business strategy that has been developed by GSK

is mainly based on the three innovative preferences of strategy. The company aims at

boosting the growth and reducing risk levels that are faced in the industry. The importance

that is provided by GSK to partnership and outsourcing is based three aspects that include

growing the diversification of global business, delivering the products of greater value and

simplification of the operating model of GSK (Hitt, Ireland & Hoskisson, 2016). The

company aimed at diversifying the business operations to the development of consumer

products in order to gain a major global position. GSK has emerged as the leader in Nutrition

healthcare industry of the United Kingdom with the assistance of its diverse product

portfolio. The industry of consumer healthcare is also considered to be challenging in nature

due to the increase in demands of the customers (Lidstone & MacLennan, 2017).

The proper development of business strategy of GSK has proven to be a major

capability of the firm. The outsourcing based capabilities that have been developed by GSK

have been able to play a major role in the improvement of its operations and production based

facilities as well. The research and development based capabilities of GSK have been able to

support the manufacture of various products that are provided by the firm (Mulinari &

Ozieranski, 2018). The research based capabilities of GSK have supported the development

of different pharmaceutical products of the firm. The global manufacturing and the supply

chain based facilities of GSK have provided support to the growth levels of the firm. The

patents of different important medicines for the treatment of diseases like cancer that are

gained by GSK have an impact on the contribution that is provided by the firm. The supply

chain of GSK has increased the capability of the firm to reach the customers faster in

comparison to the other organizations (Musacchio, Lazzarini & Aguilera, 2015).

11STRATEGIC ANALYSIS OF JOINT VENTURE OF GSK AND PFIZER

Resources – The resources that are gained by GSK have provided major levels of

support to the manufacturing activities of the firm. The company has been successful in the

development of an effective resource base for the purpose of proper formation of the product

portfolio that is able to attract the consumers from different parts of the United Kingdom

(Prajogo, 2016).

Financial resources – The financial resources of GSK are considered to be highly

supportive for the company so that it is able to maintain high levels of growth. The

organization has been able to continue with the Joint ventures and the acquisitions with the

proper usage of the financial resources and strong cash position of the firm as well. GSK has

also formed a well-organized supply chain with the help of financial resources and cash flows

that have been gained by the organization (Schuhmacher, Gassmann & Hinder, 2016). The

efficient supplier base of GSK has been able to play a key part in proper development of its

operations in the pharmaceutical industry.

Human resources – The employees and customers are also considered to be major

human resources of the organization. The employees of GSK have provided a major level of

their contribution to the research and development based activities (Teece, Peteraf & Leih,

2016). Research and development has been able to play a key part in the ways by which GSK

can improve the product portfolio of the organization. The diversity in product portfolio of

GSK has helped the organization to attract huge number of customers towards the

organization (Vilhelmsson, Davis & Mulinari, 2016).

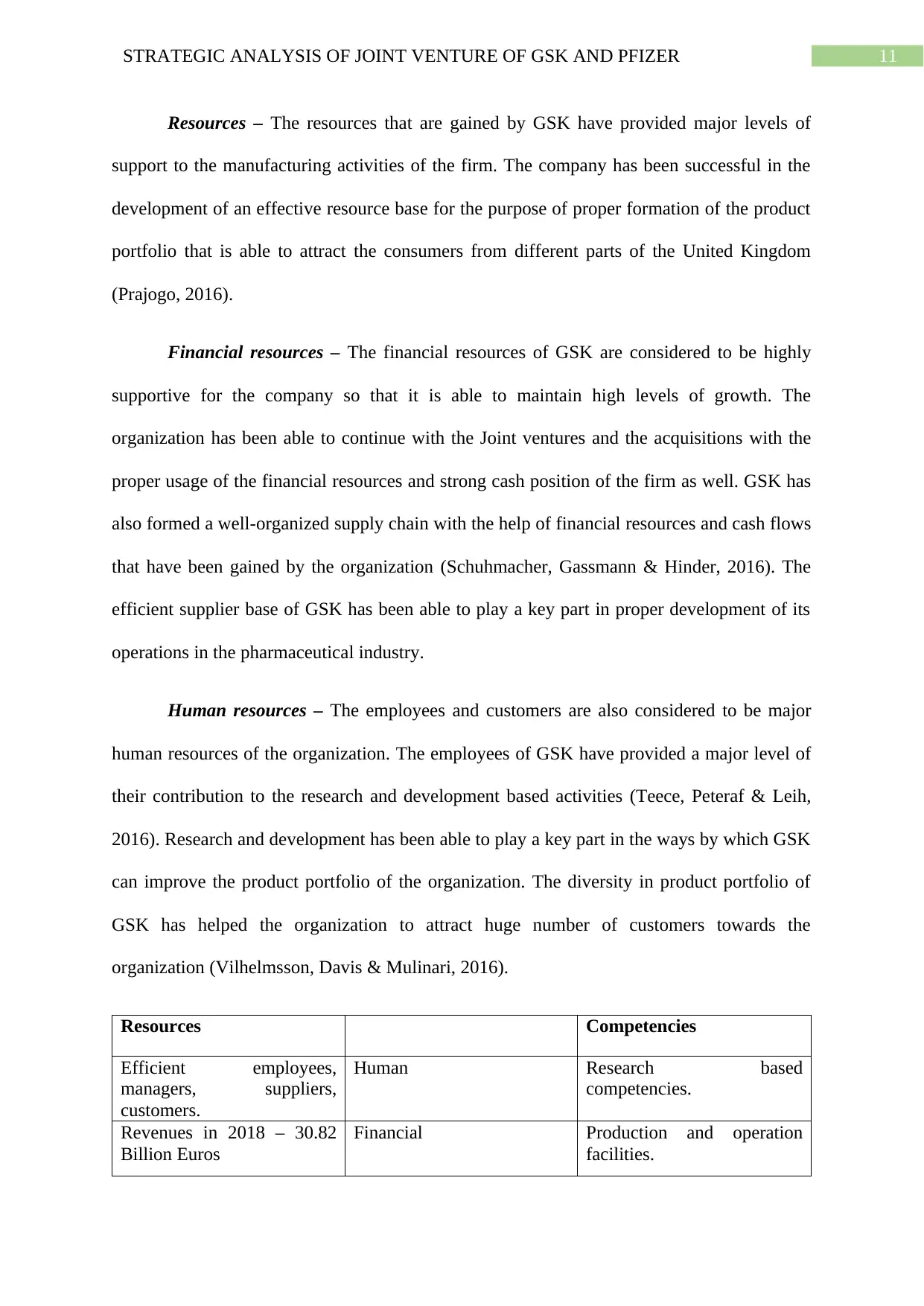

Resources Competencies

Efficient employees,

managers, suppliers,

customers.

Human Research based

competencies.

Revenues in 2018 – 30.82

Billion Euros

Financial Production and operation

facilities.

Resources – The resources that are gained by GSK have provided major levels of

support to the manufacturing activities of the firm. The company has been successful in the

development of an effective resource base for the purpose of proper formation of the product

portfolio that is able to attract the consumers from different parts of the United Kingdom

(Prajogo, 2016).

Financial resources – The financial resources of GSK are considered to be highly

supportive for the company so that it is able to maintain high levels of growth. The

organization has been able to continue with the Joint ventures and the acquisitions with the

proper usage of the financial resources and strong cash position of the firm as well. GSK has

also formed a well-organized supply chain with the help of financial resources and cash flows

that have been gained by the organization (Schuhmacher, Gassmann & Hinder, 2016). The

efficient supplier base of GSK has been able to play a key part in proper development of its

operations in the pharmaceutical industry.

Human resources – The employees and customers are also considered to be major

human resources of the organization. The employees of GSK have provided a major level of

their contribution to the research and development based activities (Teece, Peteraf & Leih,

2016). Research and development has been able to play a key part in the ways by which GSK

can improve the product portfolio of the organization. The diversity in product portfolio of

GSK has helped the organization to attract huge number of customers towards the

organization (Vilhelmsson, Davis & Mulinari, 2016).

Resources Competencies

Efficient employees,

managers, suppliers,

customers.

Human Research based

competencies.

Revenues in 2018 – 30.82

Billion Euros

Financial Production and operation

facilities.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.