Strategic Report: Merger and Acquisition Management Analysis

VerifiedAdded on 2021/12/20

|9

|1987

|62

Report

AI Summary

This report provides a comprehensive analysis of strategic issues in Merger and Acquisition Management. It addresses the challenges a company faces when considering mergers and acquisitions, including maintaining stable financial prospects amidst increasing capital expenditures. The report explores various strategies, such as merging with rival companies or restructuring product lines, and evaluates their potential impact on market dominance, cash flow, and competitiveness. It emphasizes the importance of thorough cost-benefit analysis and risk assessment to ensure that strategic decisions align with the company's goals and stakeholder interests. The analysis also considers non-monetary benefits like enhanced brand strength and customer confidence. Furthermore, the report touches upon the validation of results in the context of stakeholder concerns and the application of analytical models like Porter's Five Forces and SWOT analysis to identify strengths, weaknesses, opportunities, and threats. Desklib provides access to this report along with a wide range of study resources.

Running head: MERGER AND ACQUISITION MANAGEMENT 1

Merger and Acquisition Management

Student’s Name

Institutional Affiliation

Merger and Acquisition Management

Student’s Name

Institutional Affiliation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MERGER AND ACQUISITION MANAGEMENT 2

Merger and Acquisition Management

Executive Summary

The company is faced with various strategic issues at hand that would change its

operations. In this case, the company is confronted with maintenance of stable financial

prospects due to the increasing capital expenditures after the proposed acquisition and merger by

the rival companies. Essentially, mergers and acquisition are strategies that are applied by many

companies with the intention of enhancing market dominance and increasing the cash flow.

However, the capital expenditure associated with such acquisitions is huge, which depends on

the competitiveness of the rival company, its asset base, and the customer base. It should be

noted that the company has expressed the intention of being acquired by major competitors and

another smaller firm that has a significant market share in the wearable business. Upon the

approval by the CIO, the company will be bought or will merge with one sister companies

depending on the benefits acquired. Nonetheless, such a strategic issue needs careful planning

and proper forecasting due to the severity of the resource allocation and benefits. Despite the

prospects that the firm is set to improve the cash flow significantly, there is a threat that the firm

may suffer financially due to the long time taken to breakeven its operations in the acquired

entities. Further, the need to scrutinize the decision is attributed to the fact that the firm’s capital

expenditure against the revenue may rise significantly.

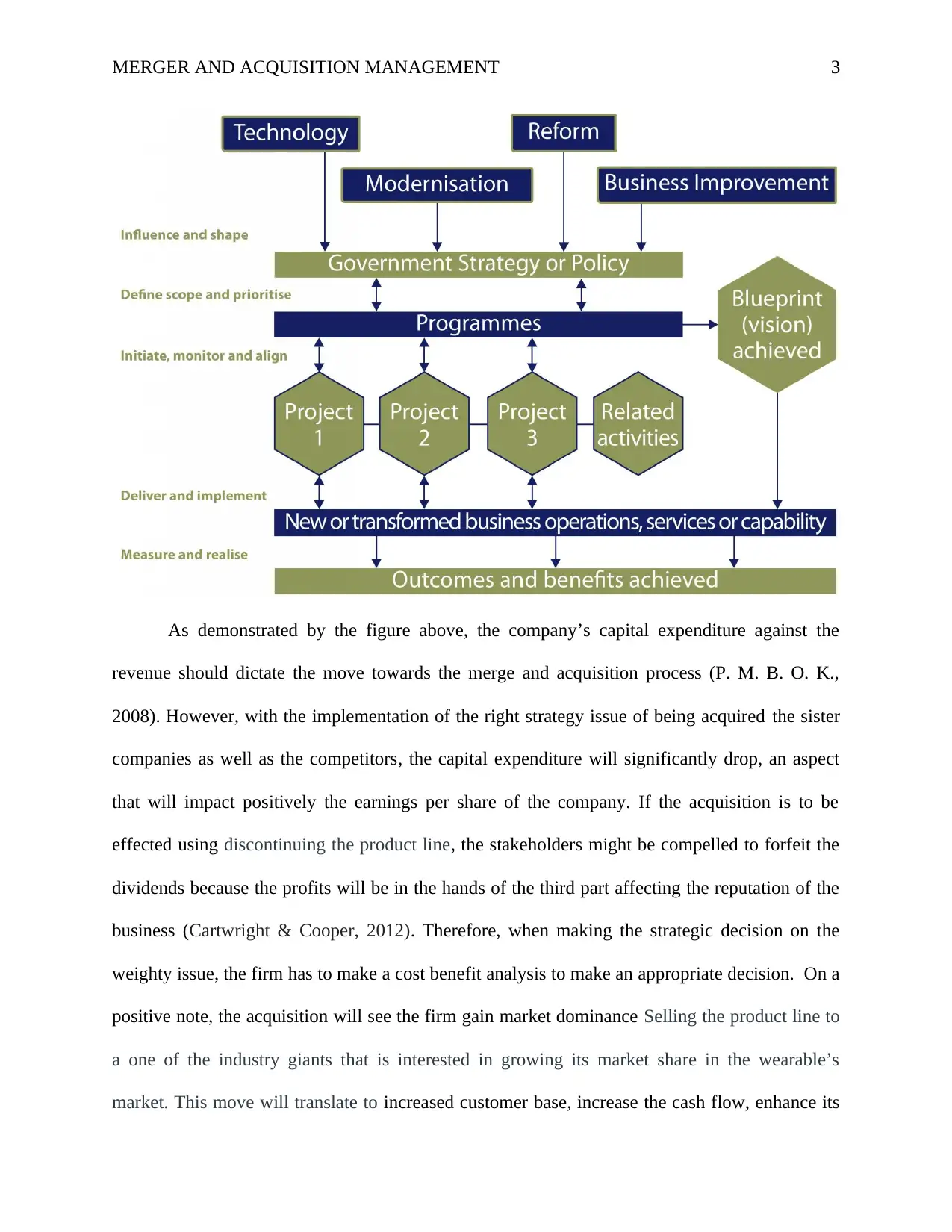

Achievability Chart

Merger and Acquisition Management

Executive Summary

The company is faced with various strategic issues at hand that would change its

operations. In this case, the company is confronted with maintenance of stable financial

prospects due to the increasing capital expenditures after the proposed acquisition and merger by

the rival companies. Essentially, mergers and acquisition are strategies that are applied by many

companies with the intention of enhancing market dominance and increasing the cash flow.

However, the capital expenditure associated with such acquisitions is huge, which depends on

the competitiveness of the rival company, its asset base, and the customer base. It should be

noted that the company has expressed the intention of being acquired by major competitors and

another smaller firm that has a significant market share in the wearable business. Upon the

approval by the CIO, the company will be bought or will merge with one sister companies

depending on the benefits acquired. Nonetheless, such a strategic issue needs careful planning

and proper forecasting due to the severity of the resource allocation and benefits. Despite the

prospects that the firm is set to improve the cash flow significantly, there is a threat that the firm

may suffer financially due to the long time taken to breakeven its operations in the acquired

entities. Further, the need to scrutinize the decision is attributed to the fact that the firm’s capital

expenditure against the revenue may rise significantly.

Achievability Chart

MERGER AND ACQUISITION MANAGEMENT 3

As demonstrated by the figure above, the company’s capital expenditure against the

revenue should dictate the move towards the merge and acquisition process (P. M. B. O. K.,

2008). However, with the implementation of the right strategy issue of being acquired the sister

companies as well as the competitors, the capital expenditure will significantly drop, an aspect

that will impact positively the earnings per share of the company. If the acquisition is to be

effected using discontinuing the product line, the stakeholders might be compelled to forfeit the

dividends because the profits will be in the hands of the third part affecting the reputation of the

business (Cartwright & Cooper, 2012). Therefore, when making the strategic decision on the

weighty issue, the firm has to make a cost benefit analysis to make an appropriate decision. On a

positive note, the acquisition will see the firm gain market dominance Selling the product line to

a one of the industry giants that is interested in growing its market share in the wearable’s

market. This move will translate to increased customer base, increase the cash flow, enhance its

As demonstrated by the figure above, the company’s capital expenditure against the

revenue should dictate the move towards the merge and acquisition process (P. M. B. O. K.,

2008). However, with the implementation of the right strategy issue of being acquired the sister

companies as well as the competitors, the capital expenditure will significantly drop, an aspect

that will impact positively the earnings per share of the company. If the acquisition is to be

effected using discontinuing the product line, the stakeholders might be compelled to forfeit the

dividends because the profits will be in the hands of the third part affecting the reputation of the

business (Cartwright & Cooper, 2012). Therefore, when making the strategic decision on the

weighty issue, the firm has to make a cost benefit analysis to make an appropriate decision. On a

positive note, the acquisition will see the firm gain market dominance Selling the product line to

a one of the industry giants that is interested in growing its market share in the wearable’s

market. This move will translate to increased customer base, increase the cash flow, enhance its

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MERGER AND ACQUISITION MANAGEMENT 4

competitiveness, and improve on product diversification among other benefits. Importantly, the

consideration of vast expansion by the company is necessitated by the fact that the organization

could plunge into a bankruptcy situation. Therefore, it remains to be seen whether the firm will

take appropriate action and prevent the undesired effects if the CIO approves the acquisition.

Projects Outcome

On a different note, one of the strategic issues and an outcome that is faced by the

company entails the product restructuring that will see the firm use a different interface for its

products in a bid to cut on the capital cost as well as maintain its market potential. It should be

noted that the primary outcome of the arguments is they form the grounds for the approach that

the firm will apply to expand without experiencing vast effects on the company’s propensity. For

instance, the expansion issue through acquisition is worthy of analysis since it is from such

analysis that the firms projections are evaluated, the weaknesses, and the ability of the firm to

effectively implement such without strategies. Importantly, failure to analyses the issues would

make the company weaknesses be concealed, while the opportunities fail to be utilized hence

placing the entity at a disadvantaged point

Non-Monetary benefits

The main aim of analyzing the company’s strategic management strategy is to

comprehend the company better based on the business plan with the intention of understanding

the external and internal environment. Analyzing the strategic management processes would

enable the company to profile itself properly, achieve strategic competitiveness, increase its

market share, and earn high customer confidence (Shi, Sun & Prescott, 2012). The analysis is

particularly aimed at determining whether the firm is applying the best strategic plans that will

enable progression and market dominance. Besides this, acquisitions are intended to enhance

competitiveness, and improve on product diversification among other benefits. Importantly, the

consideration of vast expansion by the company is necessitated by the fact that the organization

could plunge into a bankruptcy situation. Therefore, it remains to be seen whether the firm will

take appropriate action and prevent the undesired effects if the CIO approves the acquisition.

Projects Outcome

On a different note, one of the strategic issues and an outcome that is faced by the

company entails the product restructuring that will see the firm use a different interface for its

products in a bid to cut on the capital cost as well as maintain its market potential. It should be

noted that the primary outcome of the arguments is they form the grounds for the approach that

the firm will apply to expand without experiencing vast effects on the company’s propensity. For

instance, the expansion issue through acquisition is worthy of analysis since it is from such

analysis that the firms projections are evaluated, the weaknesses, and the ability of the firm to

effectively implement such without strategies. Importantly, failure to analyses the issues would

make the company weaknesses be concealed, while the opportunities fail to be utilized hence

placing the entity at a disadvantaged point

Non-Monetary benefits

The main aim of analyzing the company’s strategic management strategy is to

comprehend the company better based on the business plan with the intention of understanding

the external and internal environment. Analyzing the strategic management processes would

enable the company to profile itself properly, achieve strategic competitiveness, increase its

market share, and earn high customer confidence (Shi, Sun & Prescott, 2012). The analysis is

particularly aimed at determining whether the firm is applying the best strategic plans that will

enable progression and market dominance. Besides this, acquisitions are intended to enhance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MERGER AND ACQUISITION MANAGEMENT 5

market dominance, promote brand strength, increase sales and ultimately improve on the position

in the market. The company is seeking to acquire two renowned entities that hold significant

market share in the US market. However, this should be conducted after thorough analysis on the

strategy’s advantages against the cost implications. Through this analysis, it will be possible for

the firm to determine whether it is worthwhile to implement the acquisition strategy bearing in

mind the company reputation and customer satisfaction associated with such ventures and

management moves (Ferreira, Santos, de Almeida & Reis, 2014).

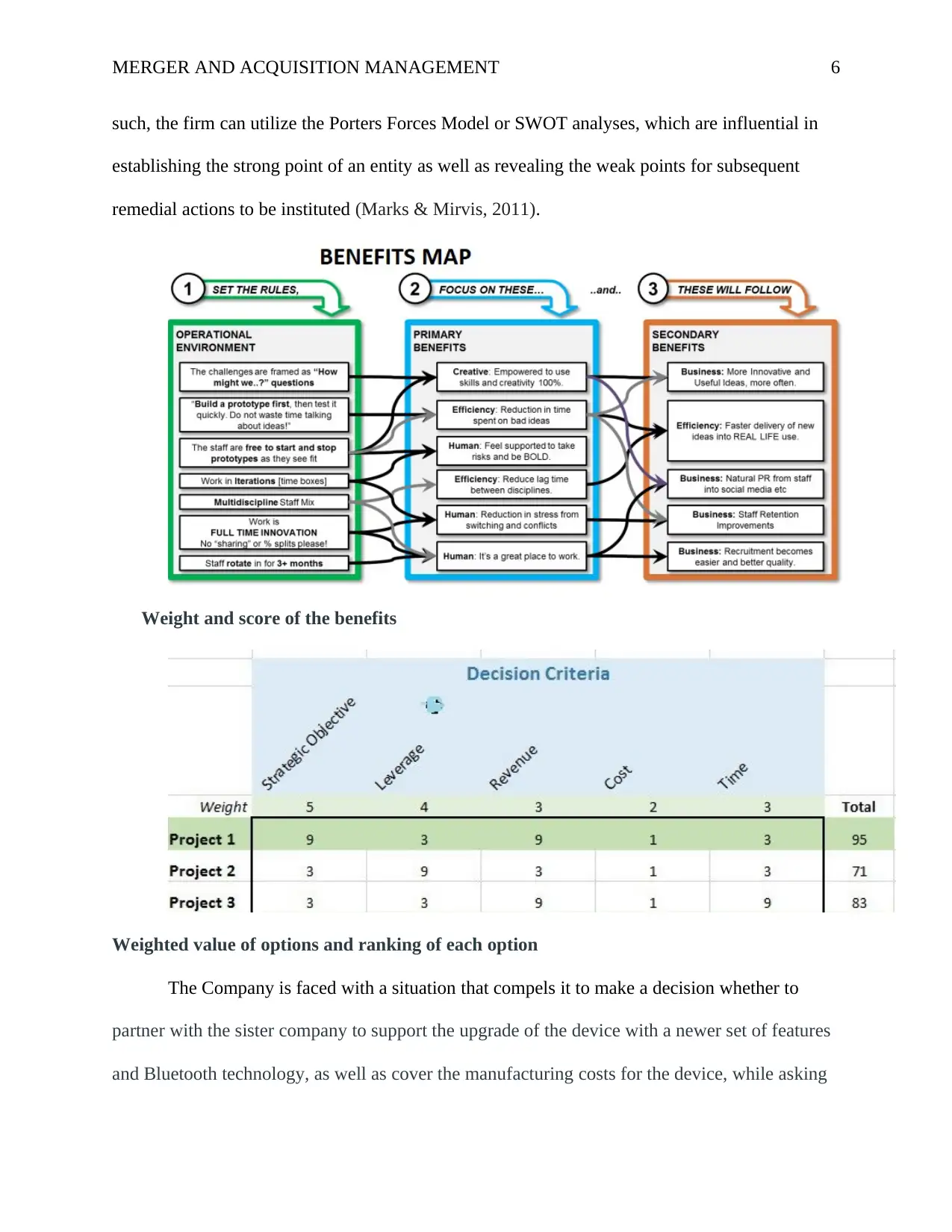

Benefit Map

On a different perspective, another analysis objective is to evaluate the company’s

product redefinition and restructuring as the key benefits that both the customer and the company

will get. Through this analysis, the firm will be able to determine whether making the

restructuring is the best approach to take to reduce the capital expenditure intensity. These

analyses are aimed at identifying available opportunities in the market place, threats to the

business, and hence delineate the best approach to utilize the presented opportunities while

avoiding the undesired effects. The firm is expected to utilize resources, capabilities, and human

competencies in the various approaches and strategies (Phillips & Zhdanov, 2013). Therefore,

the analysis herewith will demonstrate the resources available for each strategy, the capability of

the firm to utilize the resources, and the human resource to implement such strategies. In case

there are deficiencies in either of the stated aspects, the firm will seek alternative strategy for the

expansion or even lobby for more resources. Thus, the analysis will form the ground for

corrective action to ensure that the company remains competitive in its products and services.

Moreover, the analysis will gather data through various models to determine the suitability of the

company in the market while delineating on the appropriate way to resolve the weaknesses. As

market dominance, promote brand strength, increase sales and ultimately improve on the position

in the market. The company is seeking to acquire two renowned entities that hold significant

market share in the US market. However, this should be conducted after thorough analysis on the

strategy’s advantages against the cost implications. Through this analysis, it will be possible for

the firm to determine whether it is worthwhile to implement the acquisition strategy bearing in

mind the company reputation and customer satisfaction associated with such ventures and

management moves (Ferreira, Santos, de Almeida & Reis, 2014).

Benefit Map

On a different perspective, another analysis objective is to evaluate the company’s

product redefinition and restructuring as the key benefits that both the customer and the company

will get. Through this analysis, the firm will be able to determine whether making the

restructuring is the best approach to take to reduce the capital expenditure intensity. These

analyses are aimed at identifying available opportunities in the market place, threats to the

business, and hence delineate the best approach to utilize the presented opportunities while

avoiding the undesired effects. The firm is expected to utilize resources, capabilities, and human

competencies in the various approaches and strategies (Phillips & Zhdanov, 2013). Therefore,

the analysis herewith will demonstrate the resources available for each strategy, the capability of

the firm to utilize the resources, and the human resource to implement such strategies. In case

there are deficiencies in either of the stated aspects, the firm will seek alternative strategy for the

expansion or even lobby for more resources. Thus, the analysis will form the ground for

corrective action to ensure that the company remains competitive in its products and services.

Moreover, the analysis will gather data through various models to determine the suitability of the

company in the market while delineating on the appropriate way to resolve the weaknesses. As

MERGER AND ACQUISITION MANAGEMENT 6

such, the firm can utilize the Porters Forces Model or SWOT analyses, which are influential in

establishing the strong point of an entity as well as revealing the weak points for subsequent

remedial actions to be instituted (Marks & Mirvis, 2011).

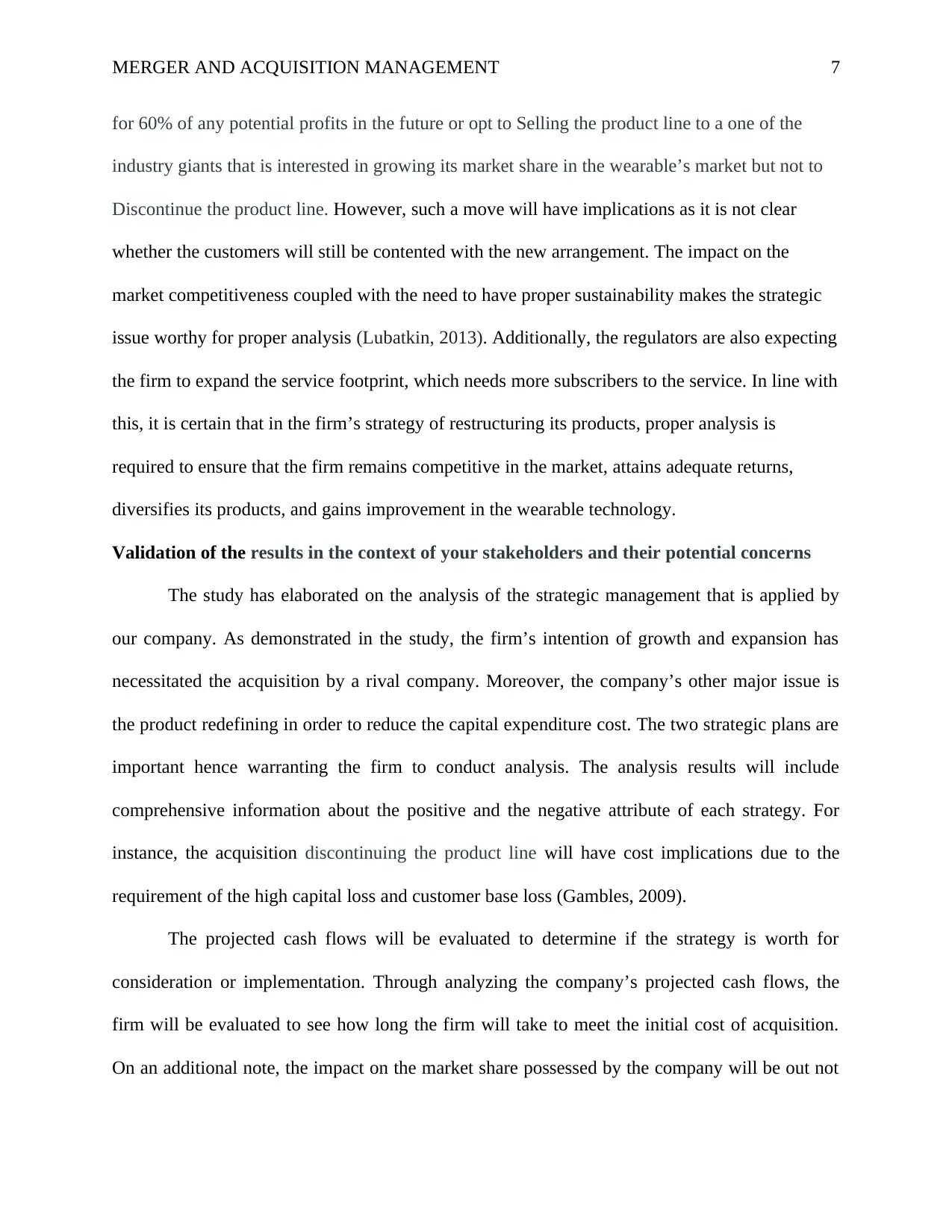

Weight and score of the benefits

Weighted value of options and ranking of each option

The Company is faced with a situation that compels it to make a decision whether to

partner with the sister company to support the upgrade of the device with a newer set of features

and Bluetooth technology, as well as cover the manufacturing costs for the device, while asking

such, the firm can utilize the Porters Forces Model or SWOT analyses, which are influential in

establishing the strong point of an entity as well as revealing the weak points for subsequent

remedial actions to be instituted (Marks & Mirvis, 2011).

Weight and score of the benefits

Weighted value of options and ranking of each option

The Company is faced with a situation that compels it to make a decision whether to

partner with the sister company to support the upgrade of the device with a newer set of features

and Bluetooth technology, as well as cover the manufacturing costs for the device, while asking

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MERGER AND ACQUISITION MANAGEMENT 7

for 60% of any potential profits in the future or opt to Selling the product line to a one of the

industry giants that is interested in growing its market share in the wearable’s market but not to

Discontinue the product line. However, such a move will have implications as it is not clear

whether the customers will still be contented with the new arrangement. The impact on the

market competitiveness coupled with the need to have proper sustainability makes the strategic

issue worthy for proper analysis (Lubatkin, 2013). Additionally, the regulators are also expecting

the firm to expand the service footprint, which needs more subscribers to the service. In line with

this, it is certain that in the firm’s strategy of restructuring its products, proper analysis is

required to ensure that the firm remains competitive in the market, attains adequate returns,

diversifies its products, and gains improvement in the wearable technology.

Validation of the results in the context of your stakeholders and their potential concerns

The study has elaborated on the analysis of the strategic management that is applied by

our company. As demonstrated in the study, the firm’s intention of growth and expansion has

necessitated the acquisition by a rival company. Moreover, the company’s other major issue is

the product redefining in order to reduce the capital expenditure cost. The two strategic plans are

important hence warranting the firm to conduct analysis. The analysis results will include

comprehensive information about the positive and the negative attribute of each strategy. For

instance, the acquisition discontinuing the product line will have cost implications due to the

requirement of the high capital loss and customer base loss (Gambles, 2009).

The projected cash flows will be evaluated to determine if the strategy is worth for

consideration or implementation. Through analyzing the company’s projected cash flows, the

firm will be evaluated to see how long the firm will take to meet the initial cost of acquisition.

On an additional note, the impact on the market share possessed by the company will be out not

for 60% of any potential profits in the future or opt to Selling the product line to a one of the

industry giants that is interested in growing its market share in the wearable’s market but not to

Discontinue the product line. However, such a move will have implications as it is not clear

whether the customers will still be contented with the new arrangement. The impact on the

market competitiveness coupled with the need to have proper sustainability makes the strategic

issue worthy for proper analysis (Lubatkin, 2013). Additionally, the regulators are also expecting

the firm to expand the service footprint, which needs more subscribers to the service. In line with

this, it is certain that in the firm’s strategy of restructuring its products, proper analysis is

required to ensure that the firm remains competitive in the market, attains adequate returns,

diversifies its products, and gains improvement in the wearable technology.

Validation of the results in the context of your stakeholders and their potential concerns

The study has elaborated on the analysis of the strategic management that is applied by

our company. As demonstrated in the study, the firm’s intention of growth and expansion has

necessitated the acquisition by a rival company. Moreover, the company’s other major issue is

the product redefining in order to reduce the capital expenditure cost. The two strategic plans are

important hence warranting the firm to conduct analysis. The analysis results will include

comprehensive information about the positive and the negative attribute of each strategy. For

instance, the acquisition discontinuing the product line will have cost implications due to the

requirement of the high capital loss and customer base loss (Gambles, 2009).

The projected cash flows will be evaluated to determine if the strategy is worth for

consideration or implementation. Through analyzing the company’s projected cash flows, the

firm will be evaluated to see how long the firm will take to meet the initial cost of acquisition.

On an additional note, the impact on the market share possessed by the company will be out not

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MERGER AND ACQUISITION MANAGEMENT 8

perspective to determine whether the firm will gain market dominance after the acquisition by

the three entities.

perspective to determine whether the firm will gain market dominance after the acquisition by

the three entities.

MERGER AND ACQUISITION MANAGEMENT 9

References

Cartwright, S., & Cooper, C. L. (2012). Managing mergers acquisitions and strategic alliances.

Routledge.

Ferreira, M. P., Santos, J. C., de Almeida, M. I. R., & Reis, N. R. (2014). Mergers & acquisitions

research: A bibliometric study of top strategy and international business journals, 1980–

2010. Journal of Business Research, 67(12), 2550-2558.

Gambles, I. (2009). Making the business case: Proposals that succeed for projects that work.

Gower Publishing, Ltd..

Gaughan, P. A. (2010). Mergers, acquisitions, and corporate restructurings. John Wiley & Sons.

Lubatkin, M. (2013). Merger strategies and stockholder value. In Mergers & Acquisitions (pp.

43-57). Routledge.

Marks, M. L., & Mirvis, P. H. (2011). Merge ahead: A research agenda to increase merger and

acquisition success. Journal of business and psychology, 26(2), 161-168.

P. M. B. O. K. (2008). A guide to the project management body of knowledge. In Project

Management Institute.

Phillips, G. M., & Zhdanov, A. (2013). R&D and the Incentives from Merger and Acquisition

Activity. The Review of Financial Studies, 26(1), 34-78.

Shi, W., Sun, J., & Prescott, J. E. (2012). A temporal perspective of merger and acquisition and

strategic alliance initiatives: Review and future direction. Journal of Management, 38(1),

164-209.

References

Cartwright, S., & Cooper, C. L. (2012). Managing mergers acquisitions and strategic alliances.

Routledge.

Ferreira, M. P., Santos, J. C., de Almeida, M. I. R., & Reis, N. R. (2014). Mergers & acquisitions

research: A bibliometric study of top strategy and international business journals, 1980–

2010. Journal of Business Research, 67(12), 2550-2558.

Gambles, I. (2009). Making the business case: Proposals that succeed for projects that work.

Gower Publishing, Ltd..

Gaughan, P. A. (2010). Mergers, acquisitions, and corporate restructurings. John Wiley & Sons.

Lubatkin, M. (2013). Merger strategies and stockholder value. In Mergers & Acquisitions (pp.

43-57). Routledge.

Marks, M. L., & Mirvis, P. H. (2011). Merge ahead: A research agenda to increase merger and

acquisition success. Journal of business and psychology, 26(2), 161-168.

P. M. B. O. K. (2008). A guide to the project management body of knowledge. In Project

Management Institute.

Phillips, G. M., & Zhdanov, A. (2013). R&D and the Incentives from Merger and Acquisition

Activity. The Review of Financial Studies, 26(1), 34-78.

Shi, W., Sun, J., & Prescott, J. E. (2012). A temporal perspective of merger and acquisition and

strategic alliance initiatives: Review and future direction. Journal of Management, 38(1),

164-209.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.