BSBI MBA: Strategic Analysis of Virgin Airlines in the European Market

VerifiedAdded on 2022/10/14

|19

|5022

|242

Report

AI Summary

This report provides a strategic analysis of Virgin Airlines within the European airline industry, utilizing tools such as PESTLE, SWOT, and Porter’s Five Forces to evaluate the company's position and challenges. The analysis reveals the impact of political and economic factors, high competition, and supplier bargaining power on Virgin Airlines. The SWOT analysis highlights the company's strengths, including the support of Virgin Atlantic, and weaknesses related to pricing strategies. The report recommends implementing Porter’s generic strategies to achieve a competitive advantage and anticipates the airline's route expansion. It covers the organization's overview, industry context, and detailed analysis of external and internal factors affecting Virgin Airlines' performance in the European market. Desklib provides access to this report along with a wide range of past papers and solved assignments for students.

Strategic Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic Management 1

Executive Summary

The main aim of this report is to analyses the challenges that are faced by Virgin Airlines to

evaluate the strategies to overcome the issues. In this report, strategic management tools have

been used to evaluate the position and challenges that are faced by the airline's such PESTLE,

SWOT and Porter’s Five Forces Analysis. The fluctuation in political and economic factor

affects the operation of the company. As per the porter’s five forces analysis, it is observed that

the company has high competition and also the suppliers have high bargaining power due to

which the chance of facing the loss is high. The internal analysis of the company has been done

with the use of SWOT Analysis. It has been found that the airline has the strong support of its

holding company which is popular with the name of Virgin Atlantic. There are also other

weaknesses that the airline needs to improve such as price sets and offers to beat the competitors.

It is recommending that the airline attain a competitive advantage by implementing the porter’s

generic strategies. It is predicted that airlines will expand its routes shortly.

Executive Summary

The main aim of this report is to analyses the challenges that are faced by Virgin Airlines to

evaluate the strategies to overcome the issues. In this report, strategic management tools have

been used to evaluate the position and challenges that are faced by the airline's such PESTLE,

SWOT and Porter’s Five Forces Analysis. The fluctuation in political and economic factor

affects the operation of the company. As per the porter’s five forces analysis, it is observed that

the company has high competition and also the suppliers have high bargaining power due to

which the chance of facing the loss is high. The internal analysis of the company has been done

with the use of SWOT Analysis. It has been found that the airline has the strong support of its

holding company which is popular with the name of Virgin Atlantic. There are also other

weaknesses that the airline needs to improve such as price sets and offers to beat the competitors.

It is recommending that the airline attain a competitive advantage by implementing the porter’s

generic strategies. It is predicted that airlines will expand its routes shortly.

Strategic Management 2

Contents

Introduction......................................................................................................................................4

Overview of the organization and Industry................................................................................4

Section 1: PESTLE Analysis...........................................................................................................5

Section 2: Porter’s Five Forces Analysis.........................................................................................8

Section 3: SWOT Analysis............................................................................................................10

3.1: Potential Scenarios..............................................................................................................13

3.2: Strategic Recommendations................................................................................................14

Conclusion.....................................................................................................................................15

References......................................................................................................................................16

Contents

Introduction......................................................................................................................................4

Overview of the organization and Industry................................................................................4

Section 1: PESTLE Analysis...........................................................................................................5

Section 2: Porter’s Five Forces Analysis.........................................................................................8

Section 3: SWOT Analysis............................................................................................................10

3.1: Potential Scenarios..............................................................................................................13

3.2: Strategic Recommendations................................................................................................14

Conclusion.....................................................................................................................................15

References......................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic Management 3

Introduction

Strategic management is the continuous planning, monitoring, analysis and assessment of all

information which is necessary for the organization to meet its goals and objectives. The

organization needs to implement this procedure at the workplace as it helps to evaluate the

environment (Morden, 2016). Gathering information about the environment is beneficial for the

company to expand the business in a new market or to operate smoothly in the existing market.

In this procedure the internal and external analysis has been done that affects the growth of the

company. The company needs to evaluate the factors that affect the operation of the business as

it becomes the challenges for the company while operating. Numerous strategic tools help to

evaluate the business environment of the company such as PESTLE Analysis, SWOT Analysis,

Porter’s Five Forces Framework, Value chain analysis and the others (Lasserre, 2017). The

report is based on strategic management to analyze the challenges factors that affect the

organization. In this report, Virgin Airline in the European Airline Industry has been taken into

consideration to analyze the internal and external environment of the company.

There are some strategic tools have been used to analyze the internal or external environment. At

the beginning of this report, the external factors will be analyzed that impact the business with

the help of PESTLE Analysis. After that, Porter’s Five Forces Framework Analysis is used to

evaluate the key drivers of the airline industry or SWOT Analysis tool is used to analyze the

internal factor of the company. At the end of the report, the suggestion has been given based on

the above analysis.

Overview of the organization and Industry

Virgin Airline is a trading name of Virgin Atlantic Airways Limited. It is a British Airline in the

country of United Kingdom. It was established in the year 1984 to operate the business in the

Introduction

Strategic management is the continuous planning, monitoring, analysis and assessment of all

information which is necessary for the organization to meet its goals and objectives. The

organization needs to implement this procedure at the workplace as it helps to evaluate the

environment (Morden, 2016). Gathering information about the environment is beneficial for the

company to expand the business in a new market or to operate smoothly in the existing market.

In this procedure the internal and external analysis has been done that affects the growth of the

company. The company needs to evaluate the factors that affect the operation of the business as

it becomes the challenges for the company while operating. Numerous strategic tools help to

evaluate the business environment of the company such as PESTLE Analysis, SWOT Analysis,

Porter’s Five Forces Framework, Value chain analysis and the others (Lasserre, 2017). The

report is based on strategic management to analyze the challenges factors that affect the

organization. In this report, Virgin Airline in the European Airline Industry has been taken into

consideration to analyze the internal and external environment of the company.

There are some strategic tools have been used to analyze the internal or external environment. At

the beginning of this report, the external factors will be analyzed that impact the business with

the help of PESTLE Analysis. After that, Porter’s Five Forces Framework Analysis is used to

evaluate the key drivers of the airline industry or SWOT Analysis tool is used to analyze the

internal factor of the company. At the end of the report, the suggestion has been given based on

the above analysis.

Overview of the organization and Industry

Virgin Airline is a trading name of Virgin Atlantic Airways Limited. It is a British Airline in the

country of United Kingdom. It was established in the year 1984 to operate the business in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic Management 4

airline industry. The Company operates in different locations such as the UK, Australia, and

Europe. In this report, the analysis has been done on the European Airline Industry. There are 33

destinations in which the Airlines carried the passengers (Virgin Atlantic, 2019).

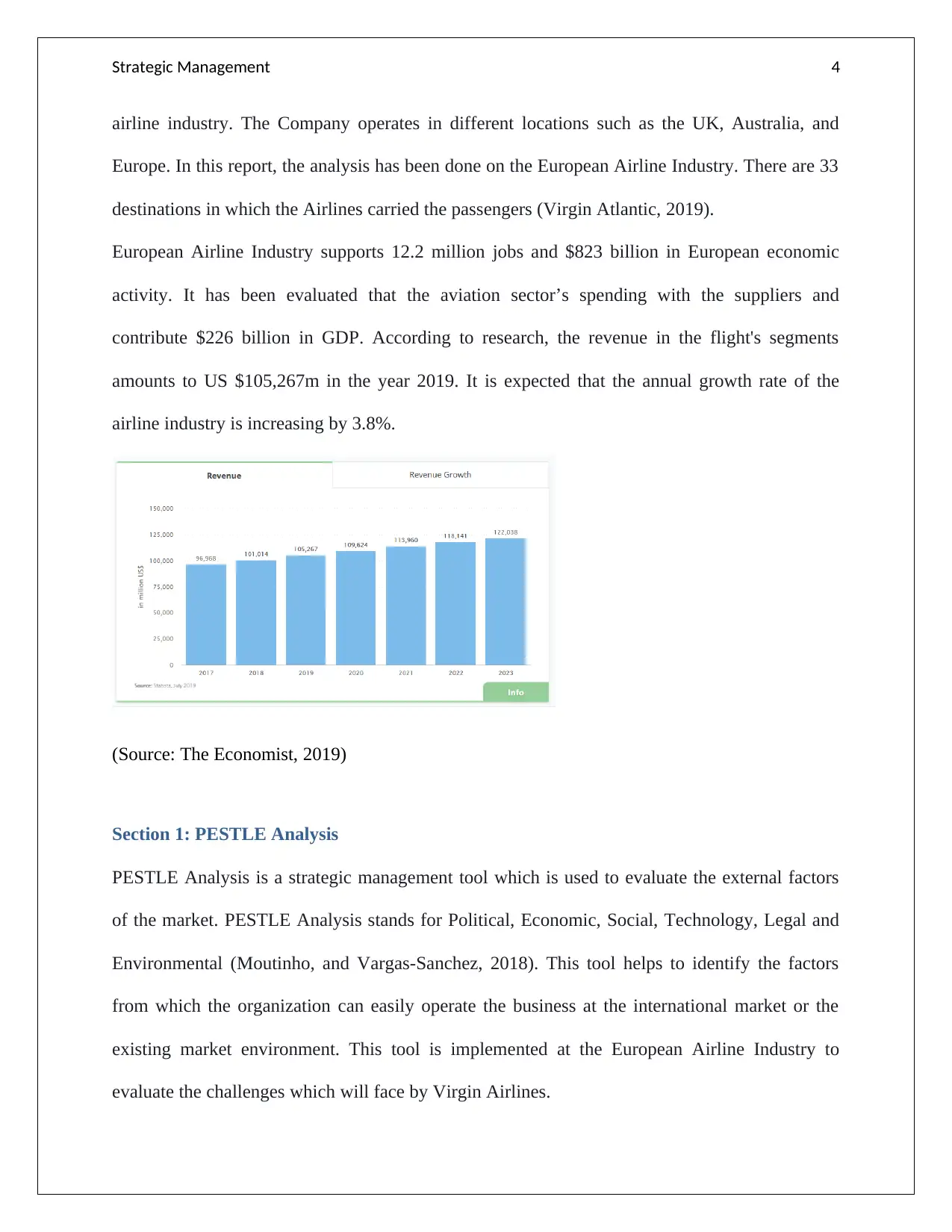

European Airline Industry supports 12.2 million jobs and $823 billion in European economic

activity. It has been evaluated that the aviation sector’s spending with the suppliers and

contribute $226 billion in GDP. According to research, the revenue in the flight's segments

amounts to US $105,267m in the year 2019. It is expected that the annual growth rate of the

airline industry is increasing by 3.8%.

(Source: The Economist, 2019)

Section 1: PESTLE Analysis

PESTLE Analysis is a strategic management tool which is used to evaluate the external factors

of the market. PESTLE Analysis stands for Political, Economic, Social, Technology, Legal and

Environmental (Moutinho, and Vargas-Sanchez, 2018). This tool helps to identify the factors

from which the organization can easily operate the business at the international market or the

existing market environment. This tool is implemented at the European Airline Industry to

evaluate the challenges which will face by Virgin Airlines.

airline industry. The Company operates in different locations such as the UK, Australia, and

Europe. In this report, the analysis has been done on the European Airline Industry. There are 33

destinations in which the Airlines carried the passengers (Virgin Atlantic, 2019).

European Airline Industry supports 12.2 million jobs and $823 billion in European economic

activity. It has been evaluated that the aviation sector’s spending with the suppliers and

contribute $226 billion in GDP. According to research, the revenue in the flight's segments

amounts to US $105,267m in the year 2019. It is expected that the annual growth rate of the

airline industry is increasing by 3.8%.

(Source: The Economist, 2019)

Section 1: PESTLE Analysis

PESTLE Analysis is a strategic management tool which is used to evaluate the external factors

of the market. PESTLE Analysis stands for Political, Economic, Social, Technology, Legal and

Environmental (Moutinho, and Vargas-Sanchez, 2018). This tool helps to identify the factors

from which the organization can easily operate the business at the international market or the

existing market environment. This tool is implemented at the European Airline Industry to

evaluate the challenges which will face by Virgin Airlines.

Strategic Management 5

Political

The political factor defines the decisions of government which helps to operate the business.

Airlines registered in the EU are also controlled by EU nationals and they have all rights or

freedom to fly in all member states. For example- Ryanair is the biggest airline company in the

EU which flies all over the European countries. It has been seen that the decision or favor of the

government is the major factor for the airline industry as it operates at the international level.

There are some countries give preferential treatments to companies from their own country such

as France government develop the policy to support their national carriers that affect the

expansion of airline companies (Politico, 2018).

Economical

Economic defines the current status of the country or the government decision towards the

industry. Europe is the second-largest economy in the world in nominal terms. It has been

evaluated that the GDP of the country is to be $18.8 trillion in the year 2018 (CNBC, 2018). The

fluctuation in GDP rate affects the prices of fuel due to which the operation of the airline is also

affected. the upward trend of the European airline industry, price elasticity of demand differ from

countries or region, types of passengers, stage length and even over time. The upward trend

encourages the more airlines companies to purchase more airlines and also open the more routes

of the airport to all over the regions of Europe. It has been seen that the unstable fuel prices

affecting the business of the airline industry as fuel is the major resource in the airline industry. It

is expected that the company will face the challenge in the coming future due to fluctuation of

prices of fuel.

Social

Political

The political factor defines the decisions of government which helps to operate the business.

Airlines registered in the EU are also controlled by EU nationals and they have all rights or

freedom to fly in all member states. For example- Ryanair is the biggest airline company in the

EU which flies all over the European countries. It has been seen that the decision or favor of the

government is the major factor for the airline industry as it operates at the international level.

There are some countries give preferential treatments to companies from their own country such

as France government develop the policy to support their national carriers that affect the

expansion of airline companies (Politico, 2018).

Economical

Economic defines the current status of the country or the government decision towards the

industry. Europe is the second-largest economy in the world in nominal terms. It has been

evaluated that the GDP of the country is to be $18.8 trillion in the year 2018 (CNBC, 2018). The

fluctuation in GDP rate affects the prices of fuel due to which the operation of the airline is also

affected. the upward trend of the European airline industry, price elasticity of demand differ from

countries or region, types of passengers, stage length and even over time. The upward trend

encourages the more airlines companies to purchase more airlines and also open the more routes

of the airport to all over the regions of Europe. It has been seen that the unstable fuel prices

affecting the business of the airline industry as fuel is the major resource in the airline industry. It

is expected that the company will face the challenge in the coming future due to fluctuation of

prices of fuel.

Social

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic Management 6

Social states the behavior of society towards the industry. It has been seen that the consumer

lifestyle is enhancing in traveling due to which the demand has fluctuated. In Europe, people are

always going for the best deal. Moreover, the consumer does not stick to a single brand as they

can easily switch with the other brand to get the best offers and facilities. As the consumers go

for the best deals then it will become a challenge for the company in future growth. It is observed

that the organization has to offers the best deals to consumers otherwise they face the challenges

in the coming future. Passengers are the main drivers for the airline industry as they are the main

source of revenue that is why; the industry must satisfy them. Enhancing the lifestyle of the

passenger is also beneficial for the company as more or more people travel with airplanes

(Aviation Benefit, 2018).

Technological

The technological factor defines the technology that an organization or country used to develop

the economy. It has been seen that Europe is the home of most prominent researchers as the

government invest in the technological areas. The government of Europe believes in technology

and innovation. As per the European new structure and investment funds, the government invests

nearly €10 billion to innovation activities that help the airline industry to grow in the market

(European Commission, 2019). Advance technology helps airlines to implement the new trends

and tools to update or enhance transportation services. There are technological trends that an

airline company should implement on its aircraft to reduce the barriers and enhance their

services. Biometrics, BlockChain, Artificial Intelligence, Immersive experience, voice

technology, and others are the trends that are developed by using advanced technology. It is

observed that advance technology is beneficial for the airline that is why; it can be said that the

Social states the behavior of society towards the industry. It has been seen that the consumer

lifestyle is enhancing in traveling due to which the demand has fluctuated. In Europe, people are

always going for the best deal. Moreover, the consumer does not stick to a single brand as they

can easily switch with the other brand to get the best offers and facilities. As the consumers go

for the best deals then it will become a challenge for the company in future growth. It is observed

that the organization has to offers the best deals to consumers otherwise they face the challenges

in the coming future. Passengers are the main drivers for the airline industry as they are the main

source of revenue that is why; the industry must satisfy them. Enhancing the lifestyle of the

passenger is also beneficial for the company as more or more people travel with airplanes

(Aviation Benefit, 2018).

Technological

The technological factor defines the technology that an organization or country used to develop

the economy. It has been seen that Europe is the home of most prominent researchers as the

government invest in the technological areas. The government of Europe believes in technology

and innovation. As per the European new structure and investment funds, the government invests

nearly €10 billion to innovation activities that help the airline industry to grow in the market

(European Commission, 2019). Advance technology helps airlines to implement the new trends

and tools to update or enhance transportation services. There are technological trends that an

airline company should implement on its aircraft to reduce the barriers and enhance their

services. Biometrics, BlockChain, Artificial Intelligence, Immersive experience, voice

technology, and others are the trends that are developed by using advanced technology. It is

observed that advance technology is beneficial for the airline that is why; it can be said that the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic Management 7

technological factor is considered as the beneficial factor for the airline while operating in

Europe (Future travel experience, 2019).

Section 2: Porter’s Five Forces Analysis

The threat of new entrants

It has been seen that the degree of threat of new entrants is low as it is difficult to enter the

airline industry. The first reason is that the organization needs a high amount of capital while

entering the market. The company should enough funds so that it will repair or establish the

proper airlines with the permission of the government. Airline companies operate their airlines

from one country to another due to which the airlines need to take the permission or license from

the government to operate the business (Noe, Hollenbeck, Gerhart, and Wright, 2017).

The threat of competitors

The threat level of competitors is high in the airline industry because there are limited companies

in the industry as compared to the other industries. Ryanair, Easyjet, British Airways and Air

France are the main competitors of the airline. The company has to face high competition in this

industry as the competition in this industry is always beyond the geographical areas. Airlines

operated at the international level have high competition with the companies. As there are

limited airlines in the industry that is why; these airlines offer better prices with the high quality

to attracts the consumers towards their services. It is a fact that the consumers are more attracted

towards those organizations or airlines which offer the best deal as per their budget with the high

quality that is why; the airlines need to set the effective price to attract the consumers. The best

deals and services assist the organization to gain a competitive advantage in the market (The

Telegraph, 2018).

Bargaining power of buyers

technological factor is considered as the beneficial factor for the airline while operating in

Europe (Future travel experience, 2019).

Section 2: Porter’s Five Forces Analysis

The threat of new entrants

It has been seen that the degree of threat of new entrants is low as it is difficult to enter the

airline industry. The first reason is that the organization needs a high amount of capital while

entering the market. The company should enough funds so that it will repair or establish the

proper airlines with the permission of the government. Airline companies operate their airlines

from one country to another due to which the airlines need to take the permission or license from

the government to operate the business (Noe, Hollenbeck, Gerhart, and Wright, 2017).

The threat of competitors

The threat level of competitors is high in the airline industry because there are limited companies

in the industry as compared to the other industries. Ryanair, Easyjet, British Airways and Air

France are the main competitors of the airline. The company has to face high competition in this

industry as the competition in this industry is always beyond the geographical areas. Airlines

operated at the international level have high competition with the companies. As there are

limited airlines in the industry that is why; these airlines offer better prices with the high quality

to attracts the consumers towards their services. It is a fact that the consumers are more attracted

towards those organizations or airlines which offer the best deal as per their budget with the high

quality that is why; the airlines need to set the effective price to attract the consumers. The best

deals and services assist the organization to gain a competitive advantage in the market (The

Telegraph, 2018).

Bargaining power of buyers

Strategic Management 8

It has been seen that the bargaining power of consumers is high just because of many choices or

options. As discussed above, there are limited airlines in the industry those offers the best deals

to consumers for the higher level of satisfaction or the attraction of more or more customers. As

the companies offer the best prices just to attract more consumers due to which the buyers have

many options to borrow the services from the best place for them. The buyer selects the best deal

among the companies as per their requirements and conditions. It states that the consumers have

large numbers of options from which they bought the services (Sriram, and Shapiro, 2015).

Bargaining power of supplier

It is observed that the bargaining power of suppliers is high as there is a limited number of

suppliers in the industry that provides the resources of aircraft. The suppliers are rare but they

operate at international level due to which a large number of airlines operates their business

effectively and efficiently. It has been seen that Airbus and Rolls Royce have a partnership with

the Virgin Atlantic as they play the roles as the suppliers. The organization operates its business

with the help of its suppliers. It is not that possible for the airline to switch with the suppliers as

it requires the high cost while shifting with the company as it is difficult to switch with the quick

shift to other suppliers. As the airlines do not switch with the other suppliers that are why; the

negotiating power of suppliers is high in the airline industry. This factor affects the airline’s

operations in terms of profit as well as quality. The quality or low of high services rely on

resources provided by the suppliers. The airlines need to develop a strong relationship with the

suppliers that is why; the airlines have to work as per the agreement of suppliers (Airline

Suppliers, 2018).

The threat of substitute

It has been seen that the bargaining power of consumers is high just because of many choices or

options. As discussed above, there are limited airlines in the industry those offers the best deals

to consumers for the higher level of satisfaction or the attraction of more or more customers. As

the companies offer the best prices just to attract more consumers due to which the buyers have

many options to borrow the services from the best place for them. The buyer selects the best deal

among the companies as per their requirements and conditions. It states that the consumers have

large numbers of options from which they bought the services (Sriram, and Shapiro, 2015).

Bargaining power of supplier

It is observed that the bargaining power of suppliers is high as there is a limited number of

suppliers in the industry that provides the resources of aircraft. The suppliers are rare but they

operate at international level due to which a large number of airlines operates their business

effectively and efficiently. It has been seen that Airbus and Rolls Royce have a partnership with

the Virgin Atlantic as they play the roles as the suppliers. The organization operates its business

with the help of its suppliers. It is not that possible for the airline to switch with the suppliers as

it requires the high cost while shifting with the company as it is difficult to switch with the quick

shift to other suppliers. As the airlines do not switch with the other suppliers that are why; the

negotiating power of suppliers is high in the airline industry. This factor affects the airline’s

operations in terms of profit as well as quality. The quality or low of high services rely on

resources provided by the suppliers. The airlines need to develop a strong relationship with the

suppliers that is why; the airlines have to work as per the agreement of suppliers (Airline

Suppliers, 2018).

The threat of substitute

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic Management 9

The threat level of substitute is high as compare to the other industries. It is observed that there

are many other transportation services provided by other companies and industries to move from

one place to another place. In an earlier life, people move from one place to another through

train, buses, ships, and others. In current days, these transportations give high competition to the

airline industries (Salavou, 2015). The Railway industry is the major substitute of the airline

industry as the passengers mainly focus on these industries for traveling. Railways are the major

priority of the passengers as everyone affords travelling from railways because the industry

provides the services at cheap prices. It has been seen that the Ships industry is also one of the

transportation industries that increases the threat of substitute for the airline industries. A large

number of people travels from the ship for international trips. A lot of people enjoy their

traveling in the ship as a holiday trip due to which the chances of the replacement are high. As

there is much other transportation industry that can replace the airline industry by providing the

similar services to passengers with the cheap prices or the different facilities that is why; the

Virgin Airline has a high degree of threat of substitute.

Section 3: SWOT Analysis

SWOT Analysis is a tool of strategic management that helps the organization to evaluate the

internal ability of the company (Ansoff, Kipley, Lewis, Helm-Stevens, and Ansoff, 2018). This

tool contains four factors such as strength, weaknesses, opportunity, and threat. The internal

evaluation also helps to develop the strategies or policies to operate smoothly in the market.

SWOT Analysis is implemented on Virgin Airlines and these are given below:

Strength

Strength defines the strong ability or factors of the company. It has been analyzed that the brand

image of its holding company is strong which is known as Virgin Atlantic. The company

The threat level of substitute is high as compare to the other industries. It is observed that there

are many other transportation services provided by other companies and industries to move from

one place to another place. In an earlier life, people move from one place to another through

train, buses, ships, and others. In current days, these transportations give high competition to the

airline industries (Salavou, 2015). The Railway industry is the major substitute of the airline

industry as the passengers mainly focus on these industries for traveling. Railways are the major

priority of the passengers as everyone affords travelling from railways because the industry

provides the services at cheap prices. It has been seen that the Ships industry is also one of the

transportation industries that increases the threat of substitute for the airline industries. A large

number of people travels from the ship for international trips. A lot of people enjoy their

traveling in the ship as a holiday trip due to which the chances of the replacement are high. As

there is much other transportation industry that can replace the airline industry by providing the

similar services to passengers with the cheap prices or the different facilities that is why; the

Virgin Airline has a high degree of threat of substitute.

Section 3: SWOT Analysis

SWOT Analysis is a tool of strategic management that helps the organization to evaluate the

internal ability of the company (Ansoff, Kipley, Lewis, Helm-Stevens, and Ansoff, 2018). This

tool contains four factors such as strength, weaknesses, opportunity, and threat. The internal

evaluation also helps to develop the strategies or policies to operate smoothly in the market.

SWOT Analysis is implemented on Virgin Airlines and these are given below:

Strength

Strength defines the strong ability or factors of the company. It has been analyzed that the brand

image of its holding company is strong which is known as Virgin Atlantic. The company

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic Management 10

operates in different countries. It is also observed that the company is growing with the

continuously as the percentage of growing the number of passengers is increased by 4.8% to 5.4

million (Virgin Atlantic, 2018). Strong growth in terms of the increasing number of passenger or

the increasing the revenue is also considered as strength for the company.

Weakness

Weaknesses refer to the areas in which the organization has to work to improve their

performance. In the case of Virgin Airlines, it has been found that the company comes at the last

second position in the European airline industry just because of less demand or low image of the

brand in the market. It is required for the organization to provide unique services or offers good

deals so that more or more passenger comes towards the services of the organization. But it has

been seen that the organization does not provide the extra facilities or else offers great deals as

compare to the other companies (World atlas, 2018).

The other weakness of the company is GBP versus USD, economic uncertainty as it affects the

operation of the company. The company is not too strong in term of revenue as compared to

others due to which the operation area affected the organization.

The continued shortage of Trent 1000 engines used on Boeing 787 aircraft. The shortage of Trent

affects the airlines in a major way as these are necessary for the company.

Opportunity

Opportunity states the areas in which the organization has to invest its amount just to grow in the

market. In the case of Virgin Airline, the company has the opportunity to operate in all over

states of Europe. As per the above analysis, it is observed the airlines of Europe are handling or

control by EU nations due to which they have the freedom to flies in all states of Europe. That is

operates in different countries. It is also observed that the company is growing with the

continuously as the percentage of growing the number of passengers is increased by 4.8% to 5.4

million (Virgin Atlantic, 2018). Strong growth in terms of the increasing number of passenger or

the increasing the revenue is also considered as strength for the company.

Weakness

Weaknesses refer to the areas in which the organization has to work to improve their

performance. In the case of Virgin Airlines, it has been found that the company comes at the last

second position in the European airline industry just because of less demand or low image of the

brand in the market. It is required for the organization to provide unique services or offers good

deals so that more or more passenger comes towards the services of the organization. But it has

been seen that the organization does not provide the extra facilities or else offers great deals as

compare to the other companies (World atlas, 2018).

The other weakness of the company is GBP versus USD, economic uncertainty as it affects the

operation of the company. The company is not too strong in term of revenue as compared to

others due to which the operation area affected the organization.

The continued shortage of Trent 1000 engines used on Boeing 787 aircraft. The shortage of Trent

affects the airlines in a major way as these are necessary for the company.

Opportunity

Opportunity states the areas in which the organization has to invest its amount just to grow in the

market. In the case of Virgin Airline, the company has the opportunity to operate in all over

states of Europe. As per the above analysis, it is observed the airlines of Europe are handling or

control by EU nations due to which they have the freedom to flies in all states of Europe. That is

Strategic Management 11

why; it can be said that the company has the opportunities to open the more lines of Europe

states to expand the business.

It has been evaluated that the cash position of the company is strong as it has £489m cash at the

year-end. Due to a strong cash position and the lower liability position in the market then the

company has the opportunity to merge with the other company. It is observed that there are many

companies in the airline industry of Europe that operates effectively in the market such as

Easyjet, Ryanair, Air France, British Airways and the others. Although, these companies operate

more effectively as compared to the company that is why; it is difficult to merge with them. But

it has to merge with the Easyjet as it has high brand value in the airline industry of Europe. This

helps the organization to earn a high profit or revenue and also increase the percentage of

passengers towards the airlines (Phadermrod, Crowder, and Wills, 2019).

Threat

Threat refers to the areas from which the company has a heavy risk (Gürel, and Tat, 2017). As

per the analysis, it has been seen that Virgin Airlines has a high threat of competitors in the

market as the other companies operate more smoothly and efficiently. Ryanair, Easyjet, British

Airlines are the top of the main competitor of Virgin Airline. Due to similar services provided by

the companies with excellent great deals increase the threat of grabbing the large market share

for Virgin Airlines. It has been evaluated that the airline has less share as compare to the other

competitors such as it has 30.08% market share in the market which is less as compared to the

others. Although, the airlines are ranked in the top airlines in the airline industry that is why; the

threat of competitors is high.

The other threat the airline face is the changing climate. It is a major threat for the airline as the

climate is the biggest factors that directly affect the flights. It has been seen that the changing

why; it can be said that the company has the opportunities to open the more lines of Europe

states to expand the business.

It has been evaluated that the cash position of the company is strong as it has £489m cash at the

year-end. Due to a strong cash position and the lower liability position in the market then the

company has the opportunity to merge with the other company. It is observed that there are many

companies in the airline industry of Europe that operates effectively in the market such as

Easyjet, Ryanair, Air France, British Airways and the others. Although, these companies operate

more effectively as compared to the company that is why; it is difficult to merge with them. But

it has to merge with the Easyjet as it has high brand value in the airline industry of Europe. This

helps the organization to earn a high profit or revenue and also increase the percentage of

passengers towards the airlines (Phadermrod, Crowder, and Wills, 2019).

Threat

Threat refers to the areas from which the company has a heavy risk (Gürel, and Tat, 2017). As

per the analysis, it has been seen that Virgin Airlines has a high threat of competitors in the

market as the other companies operate more smoothly and efficiently. Ryanair, Easyjet, British

Airlines are the top of the main competitor of Virgin Airline. Due to similar services provided by

the companies with excellent great deals increase the threat of grabbing the large market share

for Virgin Airlines. It has been evaluated that the airline has less share as compare to the other

competitors such as it has 30.08% market share in the market which is less as compared to the

others. Although, the airlines are ranked in the top airlines in the airline industry that is why; the

threat of competitors is high.

The other threat the airline face is the changing climate. It is a major threat for the airline as the

climate is the biggest factors that directly affect the flights. It has been seen that the changing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.