Strategic Analysis of Westpac Bank Information System - HI5019 Report

VerifiedAdded on 2023/06/07

|15

|4010

|169

Report

AI Summary

This report provides a strategic analysis of Westpac Bank's information system, examining its business background, industry context, and competitive environment. The analysis includes PESTEL and Porter's Five Forces frameworks to assess political, economic, social, technological, legal, and environmental factors, along with supplier and buyer power, potential entrants, substitute products, and competitive rivalry. The report also identifies opportunities and threats faced by Westpac, focusing on its digital banking initiatives, competitor analysis (NAB and ANZ), and the impact of fintech. Furthermore, the analysis explores tangible and intangible assets, aiming to provide a comprehensive understanding of the bank's strategic positioning and information system effectiveness. This report is designed to offer valuable insights into the challenges and opportunities within the financial services sector, particularly for institutions like Westpac Bank.

Running head: STRATEGIC INFORMATION SYSTEM

STRATEGIC INFORMATION SYSTEM – WESTPAC BANK

Name of the Student

Name of the University

Author Note

STRATEGIC INFORMATION SYSTEM – WESTPAC BANK

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STRATEGIC INFORMATION SYSTEM

Introduction

In this report, the discussion is going to be done on the strategic information system of Westpac

bank. Westpac bank is among the four major banks of Australia, with the headquarters located in the

Sydney. The westpac bank has divided in two segments, bank associated with the institution and the bank

associated with consumer. Not only in Australia, Westpac bank holds a good rank in New Zealand. The

bank had formed alliance with several other foreign banks. The main objective of the bank is to increase

the wealth of the members associated with the society. The vision of the bank is to gain the leadership in

the sector of finance globally. The paper is going to discuss about the westpac bak in detail. In order to

determine the strategic information system of the westpac bank , SWOT analysis and PESTEL analysis

will be done, The competitive environment faced by the Westpac bank will be discussed in detailed. The

opportunities and the threats that are associated with the bank will also be discussed. Second part of the

paper will discss abput the resource required by the Westpac bank. The capabilities of the Westpac bank

will be analyzed in the report. In addition to this, an information system will be proposed in order to

improve the strategies of the westpac bank. The proposed system will be evaluated with a

recommendation for improving the information system of the Westpac bank.

Discussion

Task 1

Business background:

Westpac bank is among the largest bank of Australia and was founded in year 1817. Headquarter

of Westpac bank is located at Sydney. This offers a large portfolio of financial service and banking to

their customers. More than 35,000 employees are associated with Westpac bank. The bank is working for

achieveing the target of becoming the world’s greatest bank providing the best facility to their customers

Introduction

In this report, the discussion is going to be done on the strategic information system of Westpac

bank. Westpac bank is among the four major banks of Australia, with the headquarters located in the

Sydney. The westpac bank has divided in two segments, bank associated with the institution and the bank

associated with consumer. Not only in Australia, Westpac bank holds a good rank in New Zealand. The

bank had formed alliance with several other foreign banks. The main objective of the bank is to increase

the wealth of the members associated with the society. The vision of the bank is to gain the leadership in

the sector of finance globally. The paper is going to discuss about the westpac bak in detail. In order to

determine the strategic information system of the westpac bank , SWOT analysis and PESTEL analysis

will be done, The competitive environment faced by the Westpac bank will be discussed in detailed. The

opportunities and the threats that are associated with the bank will also be discussed. Second part of the

paper will discss abput the resource required by the Westpac bank. The capabilities of the Westpac bank

will be analyzed in the report. In addition to this, an information system will be proposed in order to

improve the strategies of the westpac bank. The proposed system will be evaluated with a

recommendation for improving the information system of the Westpac bank.

Discussion

Task 1

Business background:

Westpac bank is among the largest bank of Australia and was founded in year 1817. Headquarter

of Westpac bank is located at Sydney. This offers a large portfolio of financial service and banking to

their customers. More than 35,000 employees are associated with Westpac bank. The bank is working for

achieveing the target of becoming the world’s greatest bank providing the best facility to their customers

2STRATEGIC INFORMATION SYSTEM

so that they can achieve the best financial services. Westpac bank has developed several strategies in

order to overcome the challenges faced by them. For example the company has formed alliance with

customers , this includes business banks that handles customers and sales. The vision of the bank is to

evolve as the greatest financial provider, helping communities and people so that they can increase their

wealth. The system of the Westpac bank has embedded the core values in the company in order to support

the bank, this values includes encouraging teamwork so that they can work together in order to achieve a

goal . The main objective of the Westpac back is to direct their customers towards the correct path. The

objective of the company needs to be reviewed every year so that they can understand the position of the

bank and can determine new features in order to cope up with the evolving business

environment(westpac.com.au, 2018). The bank provides best facilities in the area of foreign exchange

among different banks of Australia. The aim of the bank is to give the customer full satisfaction. In

addition to this the organization has been optimistic towards the organization change and always comes

up with new ideas in order to cope up with the market need.

Type of Industry:

The industry of westpac bank is one of the largest bank specialized in financial services. Westpac

Institutional bank delivers a wide range of solutions for corporate, institutional, public sector and

commercial. This is associated with the markets Australia, Asia, New Zealand, US and

Europe(westpac.com.au, 2018). The relationship management teams of Westpac bank are focused on

giving strategic connections in order to provide financial solutions to the clients their industries.

Environmental analysis:

The environmental analysis of the westpac bank includes PESTEL analysis. The process of

environmental analysis has following stages: environmental scanning, scanning means analyzing the

process of the environment and identifying the features that will influence the business. For determining

so that they can achieve the best financial services. Westpac bank has developed several strategies in

order to overcome the challenges faced by them. For example the company has formed alliance with

customers , this includes business banks that handles customers and sales. The vision of the bank is to

evolve as the greatest financial provider, helping communities and people so that they can increase their

wealth. The system of the Westpac bank has embedded the core values in the company in order to support

the bank, this values includes encouraging teamwork so that they can work together in order to achieve a

goal . The main objective of the Westpac back is to direct their customers towards the correct path. The

objective of the company needs to be reviewed every year so that they can understand the position of the

bank and can determine new features in order to cope up with the evolving business

environment(westpac.com.au, 2018). The bank provides best facilities in the area of foreign exchange

among different banks of Australia. The aim of the bank is to give the customer full satisfaction. In

addition to this the organization has been optimistic towards the organization change and always comes

up with new ideas in order to cope up with the market need.

Type of Industry:

The industry of westpac bank is one of the largest bank specialized in financial services. Westpac

Institutional bank delivers a wide range of solutions for corporate, institutional, public sector and

commercial. This is associated with the markets Australia, Asia, New Zealand, US and

Europe(westpac.com.au, 2018). The relationship management teams of Westpac bank are focused on

giving strategic connections in order to provide financial solutions to the clients their industries.

Environmental analysis:

The environmental analysis of the westpac bank includes PESTEL analysis. The process of

environmental analysis has following stages: environmental scanning, scanning means analyzing the

process of the environment and identifying the features that will influence the business. For determining

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STRATEGIC INFORMATION SYSTEM

the environmental analysis, PESEL analysis is needed to be done. PESTEL analysis stands for political ,

economical , social , technological , legal and environmental.

Political: This includes the changes that are done within the policy such as introduction of bank levy. The

policy of the bank changes with time and the requirements of the market. This influences the industry

adversely. Major bank levy bill was passed in 2017 by the parliament of Australia, this mandates a

0.06(Altameem,Aldrees and Alsaeed 2014). Westpac bank falls under this mandate. The aim of the

government is to reduce the budget and strengthen the structural position of the bank. The impact of this

is directly on the shareholders and consumers that are associated with the bank.

Economic: Economic analysis of the westpac bank includes determining the economy associated with the

bank. This contains the factor that states in which direction the economy might move. This helps to build

strategies in order to cope up with the changes. The factors that will affect the business:

Interest rate

Inflation rate

Disposable income buyers

Credit accessibility

Unemployment rates

Foreign exchange rate

Social factors: The thinking of the people varies from country to country, as the mindset of people is

different. This attitude towards the business influences the growth of the business(Hoque, Hossin and

Khan 2016). The factors that will help to identify the social factors of the Westpac bank are a s follows:

The implications of the strategies on the basis of the culture followed by the particular country

The demographics associated

The lifestyle of the people

The domestic structure

the environmental analysis, PESEL analysis is needed to be done. PESTEL analysis stands for political ,

economical , social , technological , legal and environmental.

Political: This includes the changes that are done within the policy such as introduction of bank levy. The

policy of the bank changes with time and the requirements of the market. This influences the industry

adversely. Major bank levy bill was passed in 2017 by the parliament of Australia, this mandates a

0.06(Altameem,Aldrees and Alsaeed 2014). Westpac bank falls under this mandate. The aim of the

government is to reduce the budget and strengthen the structural position of the bank. The impact of this

is directly on the shareholders and consumers that are associated with the bank.

Economic: Economic analysis of the westpac bank includes determining the economy associated with the

bank. This contains the factor that states in which direction the economy might move. This helps to build

strategies in order to cope up with the changes. The factors that will affect the business:

Interest rate

Inflation rate

Disposable income buyers

Credit accessibility

Unemployment rates

Foreign exchange rate

Social factors: The thinking of the people varies from country to country, as the mindset of people is

different. This attitude towards the business influences the growth of the business(Hoque, Hossin and

Khan 2016). The factors that will help to identify the social factors of the Westpac bank are a s follows:

The implications of the strategies on the basis of the culture followed by the particular country

The demographics associated

The lifestyle of the people

The domestic structure

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4STRATEGIC INFORMATION SYSTEM

Educational level

The distribution of the wealth

Technological factors: The technological factors include the transformation of the service and digital

product. The digitization offers opportunity in order to increase the efficiency and provide service in a

innovative way all over the industry(Upadhyay et al. 2017). Westpac has introduced 160 new features and

enhanced the digital banking throughout their banking platform so that they can provide best service for

their customers; this includes online payment, loan application and many more. In order to achieve

success, it has also built partnership with fintech starts ups so that it can strengthen their characteristics in

the field of digital technologies.

Legal: Legal factors include analyzing the changing environment that will affect the business.

Implementation of strict rules and regulations set by the authorities can challenge the environment of the

business. The Australian commission has launched an investigation for westpac bank to determine the

practices involved in the bank. The bank has implemented new policies in order to increase the security

involved in maintaining the financial details(Alshubaily and Altameem 2017).

Environmental factors: The environmental factors involved in the Westpac bank are to change the

business practices. The business gets affected with the change in the climatic conditions. The reactions of

the customer regarding to a particular factor may varies and this may lead to issue(Koech, Gichunge and

Thuo 2016). The necessary environment factors that are needed to be analyzed for business are:

Geographical location

Waste disposal

Laws climate and weather

People’s attitude towards the changing environment

Educational level

The distribution of the wealth

Technological factors: The technological factors include the transformation of the service and digital

product. The digitization offers opportunity in order to increase the efficiency and provide service in a

innovative way all over the industry(Upadhyay et al. 2017). Westpac has introduced 160 new features and

enhanced the digital banking throughout their banking platform so that they can provide best service for

their customers; this includes online payment, loan application and many more. In order to achieve

success, it has also built partnership with fintech starts ups so that it can strengthen their characteristics in

the field of digital technologies.

Legal: Legal factors include analyzing the changing environment that will affect the business.

Implementation of strict rules and regulations set by the authorities can challenge the environment of the

business. The Australian commission has launched an investigation for westpac bank to determine the

practices involved in the bank. The bank has implemented new policies in order to increase the security

involved in maintaining the financial details(Alshubaily and Altameem 2017).

Environmental factors: The environmental factors involved in the Westpac bank are to change the

business practices. The business gets affected with the change in the climatic conditions. The reactions of

the customer regarding to a particular factor may varies and this may lead to issue(Koech, Gichunge and

Thuo 2016). The necessary environment factors that are needed to be analyzed for business are:

Geographical location

Waste disposal

Laws climate and weather

People’s attitude towards the changing environment

5STRATEGIC INFORMATION SYSTEM

Demographic factor: This is referred to as the study of statistical data that includes the details about

population, especially the human beings. This is basically used to determine the dynamic population , that

is the population that keeps on changing over time span. The demographic is divided are gender, race,

age, household income, home ownership and disabilities(Kavanagh and Johnson 2017).

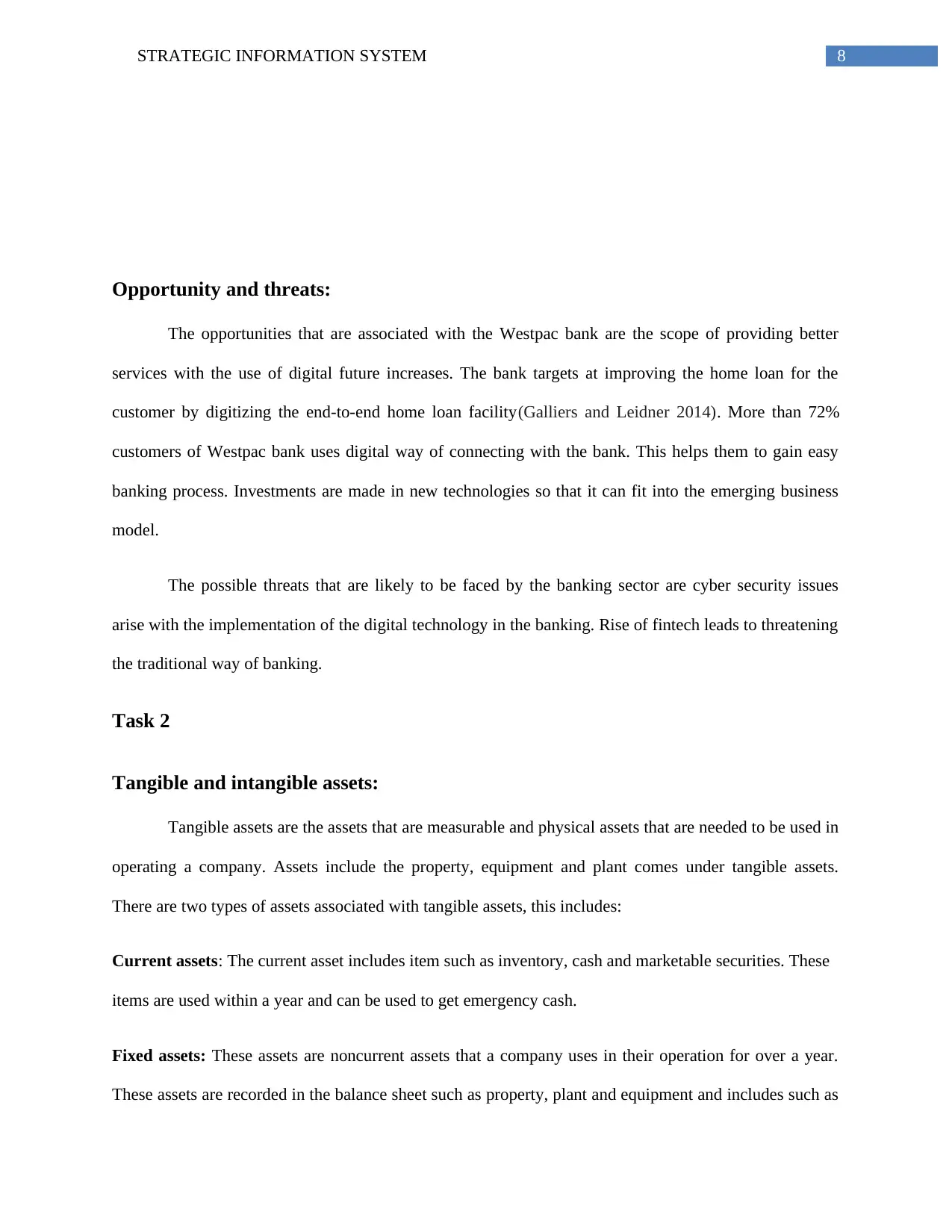

The industry environment:

The industry environment can be determined with the help of the porter’s five forces. The five

forces is used to analyze the competitive intensity that affects the business(Dwivedi et al. 2015).

Threat from new entrants:

There arises threat from the new coming banks. Each bank starts a business with the aim of

getting profit and can gain huge consumers among their rivals. But in the banking sector , it becomes very

much difficult to overcome the financial problems(Aversa,Cabantous and Haefliger 2018). This becomes

very much necessary to understand the consumer requirement and offer schemes accordingly. Thus, it

takes huge effort to understand the requirement of the customers and prepare a strategy accordingly.

Thus, the threat from the new entrant is less, as the consumer will look forward to get associated with the

bank that is having a good reputation in the market instead of going for a new bank.

Power of Suppliers:

The primary resource of every banking sector is capita. There are four main suppliers:

1. Customer deposits

2. mortgage- baked securities

3. Mortgage and loans

Demographic factor: This is referred to as the study of statistical data that includes the details about

population, especially the human beings. This is basically used to determine the dynamic population , that

is the population that keeps on changing over time span. The demographic is divided are gender, race,

age, household income, home ownership and disabilities(Kavanagh and Johnson 2017).

The industry environment:

The industry environment can be determined with the help of the porter’s five forces. The five

forces is used to analyze the competitive intensity that affects the business(Dwivedi et al. 2015).

Threat from new entrants:

There arises threat from the new coming banks. Each bank starts a business with the aim of

getting profit and can gain huge consumers among their rivals. But in the banking sector , it becomes very

much difficult to overcome the financial problems(Aversa,Cabantous and Haefliger 2018). This becomes

very much necessary to understand the consumer requirement and offer schemes accordingly. Thus, it

takes huge effort to understand the requirement of the customers and prepare a strategy accordingly.

Thus, the threat from the new entrant is less, as the consumer will look forward to get associated with the

bank that is having a good reputation in the market instead of going for a new bank.

Power of Suppliers:

The primary resource of every banking sector is capita. There are four main suppliers:

1. Customer deposits

2. mortgage- baked securities

3. Mortgage and loans

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STRATEGIC INFORMATION SYSTEM

4. Loans from other financial institutions

With the utilization of these four suppliers, the bank becomes sure of the resources they need in order to

serve their customer and this enables maintaining sufficient amount of capital so that they can meet the

withdrawal expectations(Tsang 2014). The power of supplier is dependent on the market, and this gets

fluctuated with the need of the market.

Power of Buyers:

The buyer does not affects the banking sector, but there is lies a major factor that affects the

power of the customer that is switching the cost. The internet has greatly influenced the banking sector.

This is very hard to convince the customer to switch their bank account, as they may not feel secure in

changing the bank. Thus it takes a lot effort to convince the customer to change into another banking

platform(Grover et al. 2018).

Availability of Substitutes:

Bank possesses a major threat from the non-financial sectors. There are huge chances of getting

substituted by a non financial competitor. There is no real threat for the industry but some of the non

financial sector offers banking services. This turns to be a great threat for the banking sector (Peppard and

Ward 2016).

Competitive rivalry:

This is referred to as the competition that is likely to be faced by the Westpac bank by other

rivalry banks. The other bank attracts the customer by offering a lower financing, higher rates, better

investment policies and good convincing power(Chorafas 2016). The competition is being determined by

analyzing that which bank can provide best and fastest service with better security. Some banks have the

4. Loans from other financial institutions

With the utilization of these four suppliers, the bank becomes sure of the resources they need in order to

serve their customer and this enables maintaining sufficient amount of capital so that they can meet the

withdrawal expectations(Tsang 2014). The power of supplier is dependent on the market, and this gets

fluctuated with the need of the market.

Power of Buyers:

The buyer does not affects the banking sector, but there is lies a major factor that affects the

power of the customer that is switching the cost. The internet has greatly influenced the banking sector.

This is very hard to convince the customer to switch their bank account, as they may not feel secure in

changing the bank. Thus it takes a lot effort to convince the customer to change into another banking

platform(Grover et al. 2018).

Availability of Substitutes:

Bank possesses a major threat from the non-financial sectors. There are huge chances of getting

substituted by a non financial competitor. There is no real threat for the industry but some of the non

financial sector offers banking services. This turns to be a great threat for the banking sector (Peppard and

Ward 2016).

Competitive rivalry:

This is referred to as the competition that is likely to be faced by the Westpac bank by other

rivalry banks. The other bank attracts the customer by offering a lower financing, higher rates, better

investment policies and good convincing power(Chorafas 2016). The competition is being determined by

analyzing that which bank can provide best and fastest service with better security. Some banks have the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STRATEGIC INFORMATION SYSTEM

habit to forming alliance with other banks instead of spending money on advertising and marketing so

that they can gain huge profit.

Fig1: Porter’s five forces

Source: (westpac.com.au, 2018)

Competitor environment

The westpac bank provides an innovative way of making the payment with the help of modern

platform. The assembly payment helps to create new solutions and enhances the services provided by the

bank. This helps in improving the experiences through use of high touch consulting involvement so that it

can identify the complex requirements and delivers the requirements with the use of API driven

technology. The competitors of the Westpac bank are nab and ANZ (Laudon and Laudon 2015).

habit to forming alliance with other banks instead of spending money on advertising and marketing so

that they can gain huge profit.

Fig1: Porter’s five forces

Source: (westpac.com.au, 2018)

Competitor environment

The westpac bank provides an innovative way of making the payment with the help of modern

platform. The assembly payment helps to create new solutions and enhances the services provided by the

bank. This helps in improving the experiences through use of high touch consulting involvement so that it

can identify the complex requirements and delivers the requirements with the use of API driven

technology. The competitors of the Westpac bank are nab and ANZ (Laudon and Laudon 2015).

8STRATEGIC INFORMATION SYSTEM

Opportunity and threats:

The opportunities that are associated with the Westpac bank are the scope of providing better

services with the use of digital future increases. The bank targets at improving the home loan for the

customer by digitizing the end-to-end home loan facility(Galliers and Leidner 2014). More than 72%

customers of Westpac bank uses digital way of connecting with the bank. This helps them to gain easy

banking process. Investments are made in new technologies so that it can fit into the emerging business

model.

The possible threats that are likely to be faced by the banking sector are cyber security issues

arise with the implementation of the digital technology in the banking. Rise of fintech leads to threatening

the traditional way of banking.

Task 2

Tangible and intangible assets:

Tangible assets are the assets that are measurable and physical assets that are needed to be used in

operating a company. Assets include the property, equipment and plant comes under tangible assets.

There are two types of assets associated with tangible assets, this includes:

Current assets: The current asset includes item such as inventory, cash and marketable securities. These

items are used within a year and can be used to get emergency cash.

Fixed assets: These assets are noncurrent assets that a company uses in their operation for over a year.

These assets are recorded in the balance sheet such as property, plant and equipment and includes such as

Opportunity and threats:

The opportunities that are associated with the Westpac bank are the scope of providing better

services with the use of digital future increases. The bank targets at improving the home loan for the

customer by digitizing the end-to-end home loan facility(Galliers and Leidner 2014). More than 72%

customers of Westpac bank uses digital way of connecting with the bank. This helps them to gain easy

banking process. Investments are made in new technologies so that it can fit into the emerging business

model.

The possible threats that are likely to be faced by the banking sector are cyber security issues

arise with the implementation of the digital technology in the banking. Rise of fintech leads to threatening

the traditional way of banking.

Task 2

Tangible and intangible assets:

Tangible assets are the assets that are measurable and physical assets that are needed to be used in

operating a company. Assets include the property, equipment and plant comes under tangible assets.

There are two types of assets associated with tangible assets, this includes:

Current assets: The current asset includes item such as inventory, cash and marketable securities. These

items are used within a year and can be used to get emergency cash.

Fixed assets: These assets are noncurrent assets that a company uses in their operation for over a year.

These assets are recorded in the balance sheet such as property, plant and equipment and includes such as

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9STRATEGIC INFORMATION SYSTEM

machinery, office furniture, trucks and many more. The money that is generated with the use of tangible

assets are recorded in the income statement in form of revenue (Cassidy 2016).

Intangible assets:

This are referred to as the nonphysical assets that are used for long-term period. This are often the

intellectual assets and it becomes difficult to assign a value to this asset as this are uncertain. The type of

intangible assets is:

Band equity: This is considered as the intangible asset because the brand value is not a physical asset

and is determined by the perception of the consumers. Brand equity is of two types negative rand equity

and positive brand equity (Arvidsson,Holmström and Lyytinen 2014).

Capabilities of the Westpac Bank:

The aim of the bank is to help their members and increase the wealth of their members. The bank

is capable of delivering online help for their members and services faster than other banks. This also

provides lower interest rate and a 24 hours help from an expert accountant. The bank provides several

financial services in Australia, New Zealand and all the nearby pacific areas, this aims at becoming the

global market leader and focuses on other region. The bank works at providing satisfaction to their

customers (Galliers and Leidner 2014). The organization has come up with positive approaches towards

ethical business and corporate social responsibility. The values applied by the Westpac bank in their

organization have helped to increase the efficiency and return on investment. This helps the bank to

maintain its position among the top banks of Australia.

Core competency:

The core competencies are the main blocks of every organization. With the help of this the

strategies the organization can maintain the competencies the criteria includes:

1. It determines the competence provided is significant or not.

machinery, office furniture, trucks and many more. The money that is generated with the use of tangible

assets are recorded in the income statement in form of revenue (Cassidy 2016).

Intangible assets:

This are referred to as the nonphysical assets that are used for long-term period. This are often the

intellectual assets and it becomes difficult to assign a value to this asset as this are uncertain. The type of

intangible assets is:

Band equity: This is considered as the intangible asset because the brand value is not a physical asset

and is determined by the perception of the consumers. Brand equity is of two types negative rand equity

and positive brand equity (Arvidsson,Holmström and Lyytinen 2014).

Capabilities of the Westpac Bank:

The aim of the bank is to help their members and increase the wealth of their members. The bank

is capable of delivering online help for their members and services faster than other banks. This also

provides lower interest rate and a 24 hours help from an expert accountant. The bank provides several

financial services in Australia, New Zealand and all the nearby pacific areas, this aims at becoming the

global market leader and focuses on other region. The bank works at providing satisfaction to their

customers (Galliers and Leidner 2014). The organization has come up with positive approaches towards

ethical business and corporate social responsibility. The values applied by the Westpac bank in their

organization have helped to increase the efficiency and return on investment. This helps the bank to

maintain its position among the top banks of Australia.

Core competency:

The core competencies are the main blocks of every organization. With the help of this the

strategies the organization can maintain the competencies the criteria includes:

1. It determines the competence provided is significant or not.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10STRATEGIC INFORMATION SYSTEM

2. This determines the strategy used dominates the share market or not.

3. The difficulty faced by the competitors to intimate the rivalry.

4. This determines the strategy provided will be advantageous for the competitive environment or not.

For improving the potential improvement:

It is necessary to develop a information system that will help to maintain the structure of the organization.

Their always lies a scope to improve the strategies that will help to develop the business. Westpac

provides several types of services for their customers this includes loan for the student, migrating

accounts and many more (Pearlson, Saunders and Galletta 2016). The main objective of the bank is to

serve the their customers with best facilities so that they can gain the trust of their customers. There are

areas where the bank needs to focus such as for home loans and for setting up business in the consumer

level. Their are some additional objectives that will help to increase the growth of the organization, this

includes:

Westpac bank needs rapid globalization so that it can expand the business. The bank has

developed their branches in foreign countries and focuses at level related to institution and

generates penetration strategies.

The organization needs proper mitigation techniques so that it can improve in the areas and help

in the growth of the organization.

Improving the digitization platform will help to connect the maximum users on the online

platform of the bank.

Information system helps the banking industry and maintains the growth of the organization. The

sectors are dependent on managing the information and data. The requirements are necessary to be

2. This determines the strategy used dominates the share market or not.

3. The difficulty faced by the competitors to intimate the rivalry.

4. This determines the strategy provided will be advantageous for the competitive environment or not.

For improving the potential improvement:

It is necessary to develop a information system that will help to maintain the structure of the organization.

Their always lies a scope to improve the strategies that will help to develop the business. Westpac

provides several types of services for their customers this includes loan for the student, migrating

accounts and many more (Pearlson, Saunders and Galletta 2016). The main objective of the bank is to

serve the their customers with best facilities so that they can gain the trust of their customers. There are

areas where the bank needs to focus such as for home loans and for setting up business in the consumer

level. Their are some additional objectives that will help to increase the growth of the organization, this

includes:

Westpac bank needs rapid globalization so that it can expand the business. The bank has

developed their branches in foreign countries and focuses at level related to institution and

generates penetration strategies.

The organization needs proper mitigation techniques so that it can improve in the areas and help

in the growth of the organization.

Improving the digitization platform will help to connect the maximum users on the online

platform of the bank.

Information system helps the banking industry and maintains the growth of the organization. The

sectors are dependent on managing the information and data. The requirements are necessary to be

11STRATEGIC INFORMATION SYSTEM

maintained in the information system at different leveled and checks the security involved in the

organization.

Recommendation:

In order to achieve the aim of getting globalised , I will suggest to implement some strategies ion

developing the Westpac bank. This are :

In order to rule over the finance sector , the bank should go for differentiating the products. This will help

to distinguishing the products in the market.

In order to attract more customers, I will suggest the bank should come up with extraordinary financial

services. This will also add up to competitive advantages.

Apart from these strategies, market penetration strategy is needed to be implemented within the business

plan. The bank should gain the license so that it can operate its branches in various developing countries.

The area of the home loan should be developed in the banking sector of Westpac bank.

These strategies will help to develop the features and services provided by the bank for their customers.

Conclusion

From the above discussion it can be stated that the aim of the Westpac bank is to have global

leadership in the field of finance. The above report discusses about Westpac bank and the features that are

provided by the bank for their customer. This is very much necessary to develop strategies that will help

to develop the bank. the opportunities and the threats associated with the bank are described in the report .

PESTLE analysis for the Westpac bank is also done in the report. All the factors are being described in

brief. Moreover, the vision of the bank is described. The report discusses the rival companies of the

Westpac bank and the competitive strategies associated with the bank. The aim of the strategic analysis is

to build up some strategies that will help in achieving the vision. The report suggest the need of

maintained in the information system at different leveled and checks the security involved in the

organization.

Recommendation:

In order to achieve the aim of getting globalised , I will suggest to implement some strategies ion

developing the Westpac bank. This are :

In order to rule over the finance sector , the bank should go for differentiating the products. This will help

to distinguishing the products in the market.

In order to attract more customers, I will suggest the bank should come up with extraordinary financial

services. This will also add up to competitive advantages.

Apart from these strategies, market penetration strategy is needed to be implemented within the business

plan. The bank should gain the license so that it can operate its branches in various developing countries.

The area of the home loan should be developed in the banking sector of Westpac bank.

These strategies will help to develop the features and services provided by the bank for their customers.

Conclusion

From the above discussion it can be stated that the aim of the Westpac bank is to have global

leadership in the field of finance. The above report discusses about Westpac bank and the features that are

provided by the bank for their customer. This is very much necessary to develop strategies that will help

to develop the bank. the opportunities and the threats associated with the bank are described in the report .

PESTLE analysis for the Westpac bank is also done in the report. All the factors are being described in

brief. Moreover, the vision of the bank is described. The report discusses the rival companies of the

Westpac bank and the competitive strategies associated with the bank. The aim of the strategic analysis is

to build up some strategies that will help in achieving the vision. The report suggest the need of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.