MOD001147: Dynamics of Strategy - Netflix Strategic Audit

VerifiedAdded on 2022/08/15

|74

|12134

|17

Report

AI Summary

This report presents a comprehensive strategic audit of Netflix, a leading company in the global video streaming market. The analysis begins with an introduction to the competitive media services landscape, highlighting the increasing market growth driven by factors like internet penetration and technological advancements. The report then delves into Netflix's internal analysis, including historical developments from its inception, strategic choices, VMOST framework (Vision, Mission, Objectives, Strategy, Tactics), product portfolio, BCG matrix, and market definition. Financial and value chain analyses, along with core competencies and the McKinsey 7-S framework, are also included. The external analysis covers customer and competitor analysis, industry life cycle, and a PESTEL analysis. A strategic fit analysis, incorporating SWOT, EVR congruence, ESP, and a balanced scorecard, assesses Netflix's position. The report further explores strategic direction, trend and sensitivity analyses, and risk management. It proposes strategic options, including incorporating educational shows and obtaining secondary listings in emerging markets. The report evaluates the suitability, acceptability, and feasibility of these options. The implementation and control sections discuss alignment of company structure, project management, and green strategy. The report concludes with a business plan and execution plan, offering insights into Netflix's strategic choices and market position.

Running head: MANAGEMENT

Strategic Fit of Netflix

Name of the student

Name of the university

Author Note:

Strategic Fit of Netflix

Name of the student

Name of the university

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGEMENT

Abstract:

The global video streaming market is one of the most competitive segments in the entertainment

industry. The competition has become so intense that it has necessitated even the leader in the

market namely, Netflix restructure its market strategies. The analysis clearly points out several

aspects of Netflix which contribute to its strong market position. First of all, the company is

listed on NASDAQ which enables it raise capital from the American stock market. Secondly, the

company markets immense varieties of shows like films, documentaries and TV shows which

enables it to generate immense revenue. However, the report has also brought into the light

several weaknesses in terms of marketing of products in case of Netflix. First, its operations are

still very much centred on the US, its home country whereas its competitors like Hulu and

Amazon, also based in the US enjoy strong international presence. Secondly, Netflix charges far

higher rates compared to its competitors like Hulu. Thirdly, Amazon provides a more vast range

of products. These two factors limits the product differentiation of Netflix, thus rendering its

competitively weak. The company should form a business plan to strengthen its market position.

The emergent business plan would consist of two strategies namely, marketing more purposeful

shows to spread consumer education and obtaining secondary listing in emerging markets. These

emergent strategies would be supported by an approval of an amount of $5 billion

Abstract:

The global video streaming market is one of the most competitive segments in the entertainment

industry. The competition has become so intense that it has necessitated even the leader in the

market namely, Netflix restructure its market strategies. The analysis clearly points out several

aspects of Netflix which contribute to its strong market position. First of all, the company is

listed on NASDAQ which enables it raise capital from the American stock market. Secondly, the

company markets immense varieties of shows like films, documentaries and TV shows which

enables it to generate immense revenue. However, the report has also brought into the light

several weaknesses in terms of marketing of products in case of Netflix. First, its operations are

still very much centred on the US, its home country whereas its competitors like Hulu and

Amazon, also based in the US enjoy strong international presence. Secondly, Netflix charges far

higher rates compared to its competitors like Hulu. Thirdly, Amazon provides a more vast range

of products. These two factors limits the product differentiation of Netflix, thus rendering its

competitively weak. The company should form a business plan to strengthen its market position.

The emergent business plan would consist of two strategies namely, marketing more purposeful

shows to spread consumer education and obtaining secondary listing in emerging markets. These

emergent strategies would be supported by an approval of an amount of $5 billion

2MANAGEMENT

Table of Contents

Abstract:...........................................................................................................................................1

SECTION 1 – Analysis and Discussion..........................................................................................9

Part 1. Introduction..........................................................................................................................9

Part 2. Internal Analysis:...............................................................................................................10

Part 2.1. Historical Analysis:.....................................................................................................10

Timeline:................................................................................................................................10

Strategic choices:...................................................................................................................12

VMOST.........................................................................................................................................15

Vision and Mission....................................................................................................................15

Strategy......................................................................................................................................16

Tactics........................................................................................................................................16

Product Portfolio:...........................................................................................................................17

Show Product Portfolio:............................................................................................................18

BCG Matrix...............................................................................................................................19

(Cash Cow, Star, Problem Child, Dog).....................................................................................19

Star:............................................................................................................................................19

Cash cows:.................................................................................................................................20

Question mark:...........................................................................................................................21

Dog:...........................................................................................................................................21

Table of Contents

Abstract:...........................................................................................................................................1

SECTION 1 – Analysis and Discussion..........................................................................................9

Part 1. Introduction..........................................................................................................................9

Part 2. Internal Analysis:...............................................................................................................10

Part 2.1. Historical Analysis:.....................................................................................................10

Timeline:................................................................................................................................10

Strategic choices:...................................................................................................................12

VMOST.........................................................................................................................................15

Vision and Mission....................................................................................................................15

Strategy......................................................................................................................................16

Tactics........................................................................................................................................16

Product Portfolio:...........................................................................................................................17

Show Product Portfolio:............................................................................................................18

BCG Matrix...............................................................................................................................19

(Cash Cow, Star, Problem Child, Dog).....................................................................................19

Star:............................................................................................................................................19

Cash cows:.................................................................................................................................20

Question mark:...........................................................................................................................21

Dog:...........................................................................................................................................21

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGEMENT

Product Position:........................................................................................................................22

Introduce new products:........................................................................................................22

Education:..............................................................................................................................22

Market Definition and Location....................................................................................................23

Competitors (Rank)...................................................................................................................23

Current Competitive Position........................................................................................................24

Product Positioning....................................................................................................................24

Company's Aggressiveness Strategy.............................................................................................24

Current Competitive Strategy........................................................................................................25

Ansoff Matrix for Company [New Product Development; New Market Development;

Prescriptive Strategy etc.]..............................................................................................................26

Green Strategy [Ask yourself, is my company eco-friendly?]:.....................................................27

Summary of Historical Analysis:...................................................................................................27

FINANCIAL ANALYSIS.............................................................................................................28

Extract of Financial Data...............................................................................................................28

Accounting Ratios.........................................................................................................................28

Summary of Ratio Analysis:......................................................................................................30

Evaluation of COMPANY Financial Position using the CAMELS Framework......................30

Summary of Financial Analysis:...................................................................................................32

Value Chain Analysis....................................................................................................................32

Product Position:........................................................................................................................22

Introduce new products:........................................................................................................22

Education:..............................................................................................................................22

Market Definition and Location....................................................................................................23

Competitors (Rank)...................................................................................................................23

Current Competitive Position........................................................................................................24

Product Positioning....................................................................................................................24

Company's Aggressiveness Strategy.............................................................................................24

Current Competitive Strategy........................................................................................................25

Ansoff Matrix for Company [New Product Development; New Market Development;

Prescriptive Strategy etc.]..............................................................................................................26

Green Strategy [Ask yourself, is my company eco-friendly?]:.....................................................27

Summary of Historical Analysis:...................................................................................................27

FINANCIAL ANALYSIS.............................................................................................................28

Extract of Financial Data...............................................................................................................28

Accounting Ratios.........................................................................................................................28

Summary of Ratio Analysis:......................................................................................................30

Evaluation of COMPANY Financial Position using the CAMELS Framework......................30

Summary of Financial Analysis:...................................................................................................32

Value Chain Analysis....................................................................................................................32

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGEMENT

Porter’s Value Chain..................................................................................................................32

Summary of the value chain:.....................................................................................................33

Core Competencies........................................................................................................................34

McKinsey’s 7-S Framework:.........................................................................................................35

Customer Analysis and Market Segmentation –...........................................................................35

Distinguishable:.........................................................................................................................35

Relevant to purchasing:.............................................................................................................37

Sufficiently large:......................................................................................................................37

Reachable...................................................................................................................................37

Competitor Analysis:.................................................................................................................37

Cooperative Environment..............................................................................................................38

Competitive Industry Environment...........................................................................................38

Key Factors for Success – Lynch (2015, p83- 84)....................................................................39

Industry Life Cycle:.......................................................................................................................39

PESTEL Analysis:.........................................................................................................................39

Degree of Turbulence in the Environment:...................................................................................41

Summary of Opportunities and Threats:........................................................................................41

Strategic Fit Analysis.....................................................................................................................41

SWOT Analysis of Netflix:...........................................................................................................42

EVR Congruence [See table below. Goggle Model for further details]........................................43

Porter’s Value Chain..................................................................................................................32

Summary of the value chain:.....................................................................................................33

Core Competencies........................................................................................................................34

McKinsey’s 7-S Framework:.........................................................................................................35

Customer Analysis and Market Segmentation –...........................................................................35

Distinguishable:.........................................................................................................................35

Relevant to purchasing:.............................................................................................................37

Sufficiently large:......................................................................................................................37

Reachable...................................................................................................................................37

Competitor Analysis:.................................................................................................................37

Cooperative Environment..............................................................................................................38

Competitive Industry Environment...........................................................................................38

Key Factors for Success – Lynch (2015, p83- 84)....................................................................39

Industry Life Cycle:.......................................................................................................................39

PESTEL Analysis:.........................................................................................................................39

Degree of Turbulence in the Environment:...................................................................................41

Summary of Opportunities and Threats:........................................................................................41

Strategic Fit Analysis.....................................................................................................................41

SWOT Analysis of Netflix:...........................................................................................................42

EVR Congruence [See table below. Goggle Model for further details]........................................43

5MANAGEMENT

ESP:...............................................................................................................................................44

Balanced Scorecard:......................................................................................................................44

Summary of Strategic Fit:..........................................................................................................44

SECTION 2 – Strategic Direction.................................................................................................46

Trend and Sensitivity Analysis:.....................................................................................................46

Risk Management..........................................................................................................................48

Growth Strategic Options..............................................................................................................53

Strategic Direction:........................................................................................................................53

Incorporating more educational shows:.....................................................................................53

Obtain secondary listing in emerging markets:.........................................................................54

Suitability – Suitable to whom and what.......................................................................................57

Suitability to Resource Base (Lynch 2015, p132) Fig 4.8 – 7 elements.......................................57

Suitability to Culture......................................................................................................................57

Suitability to Purpose of the Company......................................................................................58

Suitability to Stakeholders.........................................................................................................58

Summary of Suitability..............................................................................................................59

Acceptability..................................................................................................................................59

Acceptability of Business Model...................................................................................................59

Acceptability to Ethics and Social Responsibility.........................................................................59

Acceptability to Knowledge Management....................................................................................59

ESP:...............................................................................................................................................44

Balanced Scorecard:......................................................................................................................44

Summary of Strategic Fit:..........................................................................................................44

SECTION 2 – Strategic Direction.................................................................................................46

Trend and Sensitivity Analysis:.....................................................................................................46

Risk Management..........................................................................................................................48

Growth Strategic Options..............................................................................................................53

Strategic Direction:........................................................................................................................53

Incorporating more educational shows:.....................................................................................53

Obtain secondary listing in emerging markets:.........................................................................54

Suitability – Suitable to whom and what.......................................................................................57

Suitability to Resource Base (Lynch 2015, p132) Fig 4.8 – 7 elements.......................................57

Suitability to Culture......................................................................................................................57

Suitability to Purpose of the Company......................................................................................58

Suitability to Stakeholders.........................................................................................................58

Summary of Suitability..............................................................................................................59

Acceptability..................................................................................................................................59

Acceptability of Business Model...................................................................................................59

Acceptability to Ethics and Social Responsibility.........................................................................59

Acceptability to Knowledge Management....................................................................................59

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGEMENT

Acceptability to Technology..........................................................................................................59

Acceptability using Blue Ocean Strategy......................................................................................59

Summary of Acceptability Analysis..............................................................................................60

Feasibility......................................................................................................................................60

Internal Feasibility Checklist.....................................................................................................61

1. Capital Investment Required.....................................................................................................61

2. Projection of cumulative profits (based on strategic choices)...................................................61

3. Working Capital Requirements.................................................................................................61

4. Tax Liabilities and Dividend Payments.....................................................................................62

5. Number of current employees? Redundancy? Is the company over-staffed? –........................62

6. New technical skills; new plants, etc.........................................................................................63

7. New products and how they are to be developed......................................................................63

8. Amount and timing of market investment.................................................................................63

9. Possibility of acquisition, merger, joint venture, etc.................................................................63

10. Communication of ideas to all those involved........................................................................64

External Feasibility Checklist........................................................................................................64

Financial Feasibility Checklist:.....................................................................................................64

Financial Evaluation..................................................................................................................64

Summary of Feasibility:............................................................................................................66

Summary of Suitability, Acceptability and Feasibility:............................................................66

Acceptability to Technology..........................................................................................................59

Acceptability using Blue Ocean Strategy......................................................................................59

Summary of Acceptability Analysis..............................................................................................60

Feasibility......................................................................................................................................60

Internal Feasibility Checklist.....................................................................................................61

1. Capital Investment Required.....................................................................................................61

2. Projection of cumulative profits (based on strategic choices)...................................................61

3. Working Capital Requirements.................................................................................................61

4. Tax Liabilities and Dividend Payments.....................................................................................62

5. Number of current employees? Redundancy? Is the company over-staffed? –........................62

6. New technical skills; new plants, etc.........................................................................................63

7. New products and how they are to be developed......................................................................63

8. Amount and timing of market investment.................................................................................63

9. Possibility of acquisition, merger, joint venture, etc.................................................................63

10. Communication of ideas to all those involved........................................................................64

External Feasibility Checklist........................................................................................................64

Financial Feasibility Checklist:.....................................................................................................64

Financial Evaluation..................................................................................................................64

Summary of Feasibility:............................................................................................................66

Summary of Suitability, Acceptability and Feasibility:............................................................66

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGEMENT

Internal Development....................................................................................................................66

E-Commerce:.................................................................................................................................66

Implementation and Control..........................................................................................................66

Alignment of Company Structure..................................................................................................67

Elements of the Implementation Process.......................................................................................67

Project Management Approach.....................................................................................................67

Project Monitoring and Control.....................................................................................................67

Green Strategy...............................................................................................................................67

Managing Change..........................................................................................................................67

Managing Strategic Leadership.....................................................................................................68

Business Plan.................................................................................................................................68

Execution Plan for Chosen Strategic Option.................................................................................68

Conclusion:....................................................................................................................................68

References:....................................................................................................................................70

Internal Development....................................................................................................................66

E-Commerce:.................................................................................................................................66

Implementation and Control..........................................................................................................66

Alignment of Company Structure..................................................................................................67

Elements of the Implementation Process.......................................................................................67

Project Management Approach.....................................................................................................67

Project Monitoring and Control.....................................................................................................67

Green Strategy...............................................................................................................................67

Managing Change..........................................................................................................................67

Managing Strategic Leadership.....................................................................................................68

Business Plan.................................................................................................................................68

Execution Plan for Chosen Strategic Option.................................................................................68

Conclusion:....................................................................................................................................68

References:....................................................................................................................................70

8MANAGEMENT

Tables of charts and figures:

Figure 1. Timeline of Netflix 12

Figure 2. Product portfolio of Netflix............................................................................................18

Figure 3, BCG matrix of Netflix....................................................................................................19

Figure 4. Comparison between Netflix, Amazon and Hulu..........................................................24

Figure 5. VRIO of Netflix.............................................................................................................26

Figure 6. Ansoff matrix.................................................................................................................26

Figure 7. Garph showing share price on LSE................................................................................55

Figure 8. Graph showing share prices of Amazon, Netflix and Walt Disney...............................56

Tables of charts and figures:

Figure 1. Timeline of Netflix 12

Figure 2. Product portfolio of Netflix............................................................................................18

Figure 3, BCG matrix of Netflix....................................................................................................19

Figure 4. Comparison between Netflix, Amazon and Hulu..........................................................24

Figure 5. VRIO of Netflix.............................................................................................................26

Figure 6. Ansoff matrix.................................................................................................................26

Figure 7. Garph showing share price on LSE................................................................................55

Figure 8. Graph showing share prices of Amazon, Netflix and Walt Disney...............................56

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MANAGEMENT

SECTION 1 – Analysis and Discussion

Part 1. Introduction

The media services market is one of the most competitive segments of the global

entertainment market. The global video streaming market is estimated to achieve a growth of

18.8% (CGAR) to reach a value of $687.2 billion within 2024 (Globenewswire.com. 2019). The

growth in the market is driven by factors like increase in internet penetration in both developed

and emerging market and technological advancements taking in the ICT industry. The video

streaming market attracts consumers both from the developed and emerging, making it one of

most profitable segments in the entertainment industry. The market as a result experiences

presence of global giants like Amazon and Vodafone (Primevideo.com. 2020). This level of

competition is further intensifying in video streaming companies embracing innovations to offer

more innovative market mixes which are aligned with the changing expectations of the

customers to maintain their respective competitive advantages. Davcik and Sharma (2016)

mention that marketing strategies enable companies to gain competitive advantage in the market

and surpass their competitors’ positions. Lynch (2015) defines the term strategy from diverse

angles. Analysis of these definitions would bring into the light the essence of forming strategies

in business organisations like Netflix. The first definition of strategies defines the term as the

match between the internal competencies and external market factors. Strategies are the plans

which firms take according to their internal factors like financial strengths in response to the

market environment. Strategies can also be defined that the plans which companies adopt to

achieve their organisational goals like increase in revenue generation. The fact applies strongly

to the video streaming and media services industry with the increasing numbers of players. The

aim of the assignment of would be exploring the market strategies adopted by a company.

SECTION 1 – Analysis and Discussion

Part 1. Introduction

The media services market is one of the most competitive segments of the global

entertainment market. The global video streaming market is estimated to achieve a growth of

18.8% (CGAR) to reach a value of $687.2 billion within 2024 (Globenewswire.com. 2019). The

growth in the market is driven by factors like increase in internet penetration in both developed

and emerging market and technological advancements taking in the ICT industry. The video

streaming market attracts consumers both from the developed and emerging, making it one of

most profitable segments in the entertainment industry. The market as a result experiences

presence of global giants like Amazon and Vodafone (Primevideo.com. 2020). This level of

competition is further intensifying in video streaming companies embracing innovations to offer

more innovative market mixes which are aligned with the changing expectations of the

customers to maintain their respective competitive advantages. Davcik and Sharma (2016)

mention that marketing strategies enable companies to gain competitive advantage in the market

and surpass their competitors’ positions. Lynch (2015) defines the term strategy from diverse

angles. Analysis of these definitions would bring into the light the essence of forming strategies

in business organisations like Netflix. The first definition of strategies defines the term as the

match between the internal competencies and external market factors. Strategies are the plans

which firms take according to their internal factors like financial strengths in response to the

market environment. Strategies can also be defined that the plans which companies adopt to

achieve their organisational goals like increase in revenue generation. The fact applies strongly

to the video streaming and media services industry with the increasing numbers of players. The

aim of the assignment of would be exploring the market strategies adopted by a company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGEMENT

Sergeev, Akhmetshina and Grabovyy (2019) mention that market strategies which business

organisations adopt are dependent on the macroeconomic conditions and market competition

levels. That is why it is extremely important for firms to conduct market analyses prior to

forming marketing strategies. The assignment, keeping the matter in light would take into

account different tools like PESTEL and Porter;s Five Forces models. Zhou, Mavondo and

Saunders (2019) point out that firms today view their different functions as systems which are

interrelated and interdependent, using the systems approach. For example, the outcome of

marketing activities is generation of revenue which in turn directly impacts the financial

operations of the company. That is why in the pursuit of exploring the marketing strategies, the

research would incorporate the financial aspects of the company chosen. The entire research

would commence under the stewardship of Netflix, the leading global media services and video

streaming company based in the United States of America (Netflix.com. 2020).

Part 2. Internal Analysis:

Estrin, Nielsen and Nielsen (2017) mention that the capability of multinational companies

to form and implement market strategies is directly impacted by their internal capabilities. The

multinational companies have certain capabilities which enable them to surpass their competitors

and emerge as market leaders. These capabilities include financial strengths, manpower,

technological strengths and innovative strengths. The following section would analyse the

analysis of the internal environmental conditions which apply to Netflix:

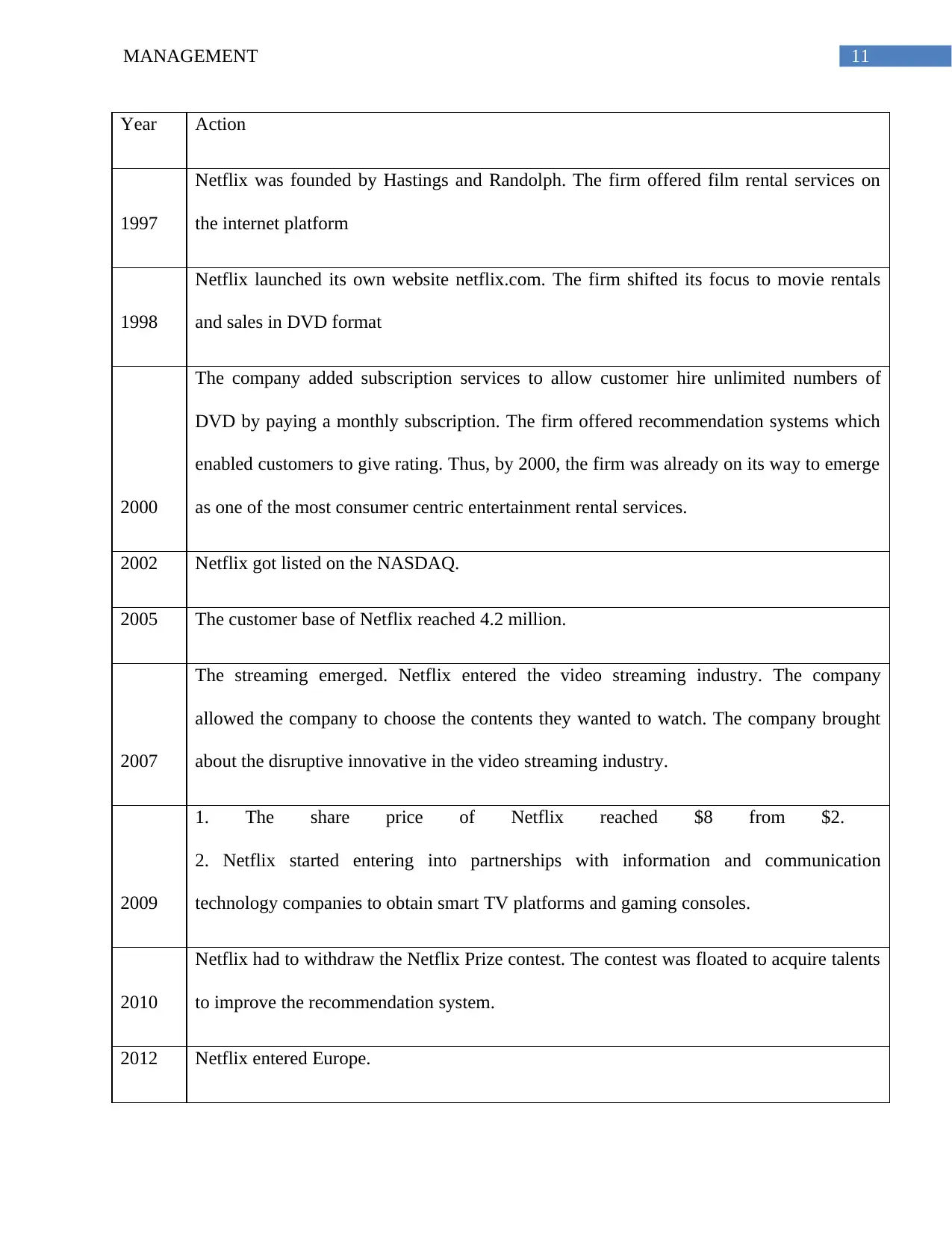

Part 2.1. Historical Analysis:

Timeline:

The following section would explore the timeline of Netflix right from inception as a

video renting company to a global media services giant it is today:

Sergeev, Akhmetshina and Grabovyy (2019) mention that market strategies which business

organisations adopt are dependent on the macroeconomic conditions and market competition

levels. That is why it is extremely important for firms to conduct market analyses prior to

forming marketing strategies. The assignment, keeping the matter in light would take into

account different tools like PESTEL and Porter;s Five Forces models. Zhou, Mavondo and

Saunders (2019) point out that firms today view their different functions as systems which are

interrelated and interdependent, using the systems approach. For example, the outcome of

marketing activities is generation of revenue which in turn directly impacts the financial

operations of the company. That is why in the pursuit of exploring the marketing strategies, the

research would incorporate the financial aspects of the company chosen. The entire research

would commence under the stewardship of Netflix, the leading global media services and video

streaming company based in the United States of America (Netflix.com. 2020).

Part 2. Internal Analysis:

Estrin, Nielsen and Nielsen (2017) mention that the capability of multinational companies

to form and implement market strategies is directly impacted by their internal capabilities. The

multinational companies have certain capabilities which enable them to surpass their competitors

and emerge as market leaders. These capabilities include financial strengths, manpower,

technological strengths and innovative strengths. The following section would analyse the

analysis of the internal environmental conditions which apply to Netflix:

Part 2.1. Historical Analysis:

Timeline:

The following section would explore the timeline of Netflix right from inception as a

video renting company to a global media services giant it is today:

11MANAGEMENT

Year Action

1997

Netflix was founded by Hastings and Randolph. The firm offered film rental services on

the internet platform

1998

Netflix launched its own website netflix.com. The firm shifted its focus to movie rentals

and sales in DVD format

2000

The company added subscription services to allow customer hire unlimited numbers of

DVD by paying a monthly subscription. The firm offered recommendation systems which

enabled customers to give rating. Thus, by 2000, the firm was already on its way to emerge

as one of the most consumer centric entertainment rental services.

2002 Netflix got listed on the NASDAQ.

2005 The customer base of Netflix reached 4.2 million.

2007

The streaming emerged. Netflix entered the video streaming industry. The company

allowed the company to choose the contents they wanted to watch. The company brought

about the disruptive innovative in the video streaming industry.

2009

1. The share price of Netflix reached $8 from $2.

2. Netflix started entering into partnerships with information and communication

technology companies to obtain smart TV platforms and gaming consoles.

2010

Netflix had to withdraw the Netflix Prize contest. The contest was floated to acquire talents

to improve the recommendation system.

2012 Netflix entered Europe.

Year Action

1997

Netflix was founded by Hastings and Randolph. The firm offered film rental services on

the internet platform

1998

Netflix launched its own website netflix.com. The firm shifted its focus to movie rentals

and sales in DVD format

2000

The company added subscription services to allow customer hire unlimited numbers of

DVD by paying a monthly subscription. The firm offered recommendation systems which

enabled customers to give rating. Thus, by 2000, the firm was already on its way to emerge

as one of the most consumer centric entertainment rental services.

2002 Netflix got listed on the NASDAQ.

2005 The customer base of Netflix reached 4.2 million.

2007

The streaming emerged. Netflix entered the video streaming industry. The company

allowed the company to choose the contents they wanted to watch. The company brought

about the disruptive innovative in the video streaming industry.

2009

1. The share price of Netflix reached $8 from $2.

2. Netflix started entering into partnerships with information and communication

technology companies to obtain smart TV platforms and gaming consoles.

2010

Netflix had to withdraw the Netflix Prize contest. The contest was floated to acquire talents

to improve the recommendation system.

2012 Netflix entered Europe.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 74

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.