Strategic and Change Management at Santander Bank - A Report

VerifiedAdded on 2023/06/15

|12

|3586

|107

Report

AI Summary

This report provides a detailed analysis of Santander Bank's strategic and change management approaches. It begins with a company background, highlighting Santander's operations and market presence. The report explores the strategy planning process using William’s strategy management model and examines how the McKinsey 7S model is applied to manage strategic change, particularly in response to challenges like the COVID-19 crisis. Furthermore, it includes a PESTLE analysis, evaluating the political, economic, social, technological, environmental, and legal factors impacting the bank, and applies Porter's Five Forces model to assess the competitive landscape. The report also discusses Porter's generic strategies employed by Santander to maintain its competitive edge. The analysis covers various aspects of Santander's operations, including its digital banking initiatives, responses to the pandemic, and customer experience strategies.

Strategic and Change

management- Santander

Bank

management- Santander

Bank

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

EXECUTIVE SUMMARY.................................................................................................................................3

COMPANY BACKGROUND............................................................................................................................3

SECTION ONE...............................................................................................................................................4

1.1 About company activities..................................................................................................................4

Critically explore the strategy planning process using William’s strategy management model..............5

SECTION 2....................................................................................................................................................5

McKinsey strategy change model is being applied by your bank when dealing with strategic change.. .5

SECTION 3....................................................................................................................................................7

PESTLE analysis and Porters five forces model........................................................................................7

SECTION 4..................................................................................................................................................10

Porters generic strategy........................................................................................................................10

REFERENCES..............................................................................................................................................12

EXECUTIVE SUMMARY.................................................................................................................................3

COMPANY BACKGROUND............................................................................................................................3

SECTION ONE...............................................................................................................................................4

1.1 About company activities..................................................................................................................4

Critically explore the strategy planning process using William’s strategy management model..............5

SECTION 2....................................................................................................................................................5

McKinsey strategy change model is being applied by your bank when dealing with strategic change.. .5

SECTION 3....................................................................................................................................................7

PESTLE analysis and Porters five forces model........................................................................................7

SECTION 4..................................................................................................................................................10

Porters generic strategy........................................................................................................................10

REFERENCES..............................................................................................................................................12

EXECUTIVE SUMMARY

A change management plan in business defines how an organisation will deal with topics

like distribution network modifications, stock levels, planning, and scope statement. The purpose

of developing a formal approach is to ensure that any adverse effects of transition are minimized.

To execute a change management plan successfully, participants must devise a strategy for

recognizing whenever an action is made, approving modifications, implementing changes, and

monitoring changes to verify they have had the intended effect. This report based on The Spanish

Santander Group's Santander Bank, originally Sovereign Bank, is a completely subsidiary

company. It is situated in Boston and serves the Northeastern United States as its primary

market. In this report consist of Mckinsey strategy, Porters five forces model, PESTLE analysis

and Porters generic strategy.

COMPANY BACKGROUND

Santander Bank, N.A. began as "Sovereign Bank," a commercial bank in Wyomissing,

Pennsylvania, on October 8, 1902. Textile employees were among the firm's first consumers.

Banking system, housing, business finance, treasury services, lines of credit, financial industry,

trust and financial advisory, and insurers are among the goods and services it provides. It has

$57.5 billion in savings, 650 consumer banking locations, and more than 2,000 ATMs, and

employees roughly 9,800 employees. Our aim at Santander Bank is to assist individuals and

businesses succeed. This holds true for our customers, neighborhoods, staff members, and

prospective teammates. With $89.5 billion in assets, Santander Bank, N.A., based in Boston, is

one of the country's major retail and commercial lenders. Massachusetts, New Jersey,

Connecticut, Rhode Island, New York, New Jersey, Pennsylvania, and Delaware are home to the

Bank's nearly 9,200 workers and more over 3 million consumers. The Bank is a completely

affiliate of Banco Santander, S.A., a Madrid-based banking conglomerate with over 148 million

customers in the United States, Europe, and Latin America. Santander Holdings USA, Inc.,

Banco Santander's intermediary controlling corporation in the World, is in charge of it. Check

www.santanderbank.com for further details on Santander Bank.

A change management plan in business defines how an organisation will deal with topics

like distribution network modifications, stock levels, planning, and scope statement. The purpose

of developing a formal approach is to ensure that any adverse effects of transition are minimized.

To execute a change management plan successfully, participants must devise a strategy for

recognizing whenever an action is made, approving modifications, implementing changes, and

monitoring changes to verify they have had the intended effect. This report based on The Spanish

Santander Group's Santander Bank, originally Sovereign Bank, is a completely subsidiary

company. It is situated in Boston and serves the Northeastern United States as its primary

market. In this report consist of Mckinsey strategy, Porters five forces model, PESTLE analysis

and Porters generic strategy.

COMPANY BACKGROUND

Santander Bank, N.A. began as "Sovereign Bank," a commercial bank in Wyomissing,

Pennsylvania, on October 8, 1902. Textile employees were among the firm's first consumers.

Banking system, housing, business finance, treasury services, lines of credit, financial industry,

trust and financial advisory, and insurers are among the goods and services it provides. It has

$57.5 billion in savings, 650 consumer banking locations, and more than 2,000 ATMs, and

employees roughly 9,800 employees. Our aim at Santander Bank is to assist individuals and

businesses succeed. This holds true for our customers, neighborhoods, staff members, and

prospective teammates. With $89.5 billion in assets, Santander Bank, N.A., based in Boston, is

one of the country's major retail and commercial lenders. Massachusetts, New Jersey,

Connecticut, Rhode Island, New York, New Jersey, Pennsylvania, and Delaware are home to the

Bank's nearly 9,200 workers and more over 3 million consumers. The Bank is a completely

affiliate of Banco Santander, S.A., a Madrid-based banking conglomerate with over 148 million

customers in the United States, Europe, and Latin America. Santander Holdings USA, Inc.,

Banco Santander's intermediary controlling corporation in the World, is in charge of it. Check

www.santanderbank.com for further details on Santander Bank.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

SECTION ONE

1.1 About company activities

Santander is Europe's fourth largest bank, with around US$1.4 trillion in total assets under

administration as of 2017. (AUM). The bank has a total market capitalization of $69.9 billion

and is quoted on the Euro Stoxx 50 market index. For its Corporate and Commercial Banking

customers, Santander UK has began rolling out an inventive smart phone application created on

open digital banking. The app gives Santander UK customers a'single view' of their various

balance sheets and activity from several banks. The Cash Flow Manager software, created by

tomato pay1, an open banking fintech for small and medium-sized businesses, is also aimed to

expedite transactions with QR codes and streamline accounting. Cash Flow Management

consolidates all amounts and activities for a company's multiple bank accounts into one

convenient spot. Customers of Santander UK who are using the app can link and check their

bank information for up to 98 percent of their accounts. The programme analyses each

company's data to provide segmented insights about its expenditures, such as how employment

expenditure in a specific month compared to the average over a set period of time. Cash Flow

Manager analyses a company's future financial status by analyzing its transactions and providing

precise estimates.

As the quickly growing corona virus scenario has an extraordinary influence on both our

professional and personal life, Santander is making steps to make sure that we can continue to

deliver critical services to all of our clients while also improving the protection of our clients and

staff. Shorter branch hours were enforced at the start of the pandemic to limit the chance of

COVID-19 spreading. Banking is a necessary industry that serves a fundamental purpose for our

customers. They will extend our present branch hours on May 1st, after careful assessment of the

customer service experience and company requirement. Our clients will benefit from the

extended hours since they will have more freedom. To help minimise the transmission of the

coronavirus and lower the risk to both our patients and employees, we will continue following

social separation recommendations.

1.1 About company activities

Santander is Europe's fourth largest bank, with around US$1.4 trillion in total assets under

administration as of 2017. (AUM). The bank has a total market capitalization of $69.9 billion

and is quoted on the Euro Stoxx 50 market index. For its Corporate and Commercial Banking

customers, Santander UK has began rolling out an inventive smart phone application created on

open digital banking. The app gives Santander UK customers a'single view' of their various

balance sheets and activity from several banks. The Cash Flow Manager software, created by

tomato pay1, an open banking fintech for small and medium-sized businesses, is also aimed to

expedite transactions with QR codes and streamline accounting. Cash Flow Management

consolidates all amounts and activities for a company's multiple bank accounts into one

convenient spot. Customers of Santander UK who are using the app can link and check their

bank information for up to 98 percent of their accounts. The programme analyses each

company's data to provide segmented insights about its expenditures, such as how employment

expenditure in a specific month compared to the average over a set period of time. Cash Flow

Manager analyses a company's future financial status by analyzing its transactions and providing

precise estimates.

As the quickly growing corona virus scenario has an extraordinary influence on both our

professional and personal life, Santander is making steps to make sure that we can continue to

deliver critical services to all of our clients while also improving the protection of our clients and

staff. Shorter branch hours were enforced at the start of the pandemic to limit the chance of

COVID-19 spreading. Banking is a necessary industry that serves a fundamental purpose for our

customers. They will extend our present branch hours on May 1st, after careful assessment of the

customer service experience and company requirement. Our clients will benefit from the

extended hours since they will have more freedom. To help minimise the transmission of the

coronavirus and lower the risk to both our patients and employees, we will continue following

social separation recommendations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Critically explore the strategy planning process using William’s strategy management model

Manage and oversee the strategic creation, execution, and supervision of strategies, policy,

and procedures throughout Santander US and Santander Holdings Limited to execute the

Operational Risk Programme (risk evaluation, appetite for risk, and major risk signals, managing

change, and training). In furthermore, he is in charge of the Operational Risk Council and

Working Group's management, as well as the authoring of individual risk revisions and

administrative.

During the first year, they established a customer experience strategy for Santander's Credit

Card Portfolio (4.5 million+ cards), which resulted in a 12 percent reduction in grievances

(complaints v active accounts) and a considerable increase in public happiness during a period of

unparalleled expansion. Times to get new Santander credit cards were decreased by a median of

5 days throughout all registration methods, with notable success in the telephonic registration

route, which saw a 65 percent reduction in time to card.

SECTION 2

McKinsey strategy change model is being applied by your bank when dealing with strategic

change

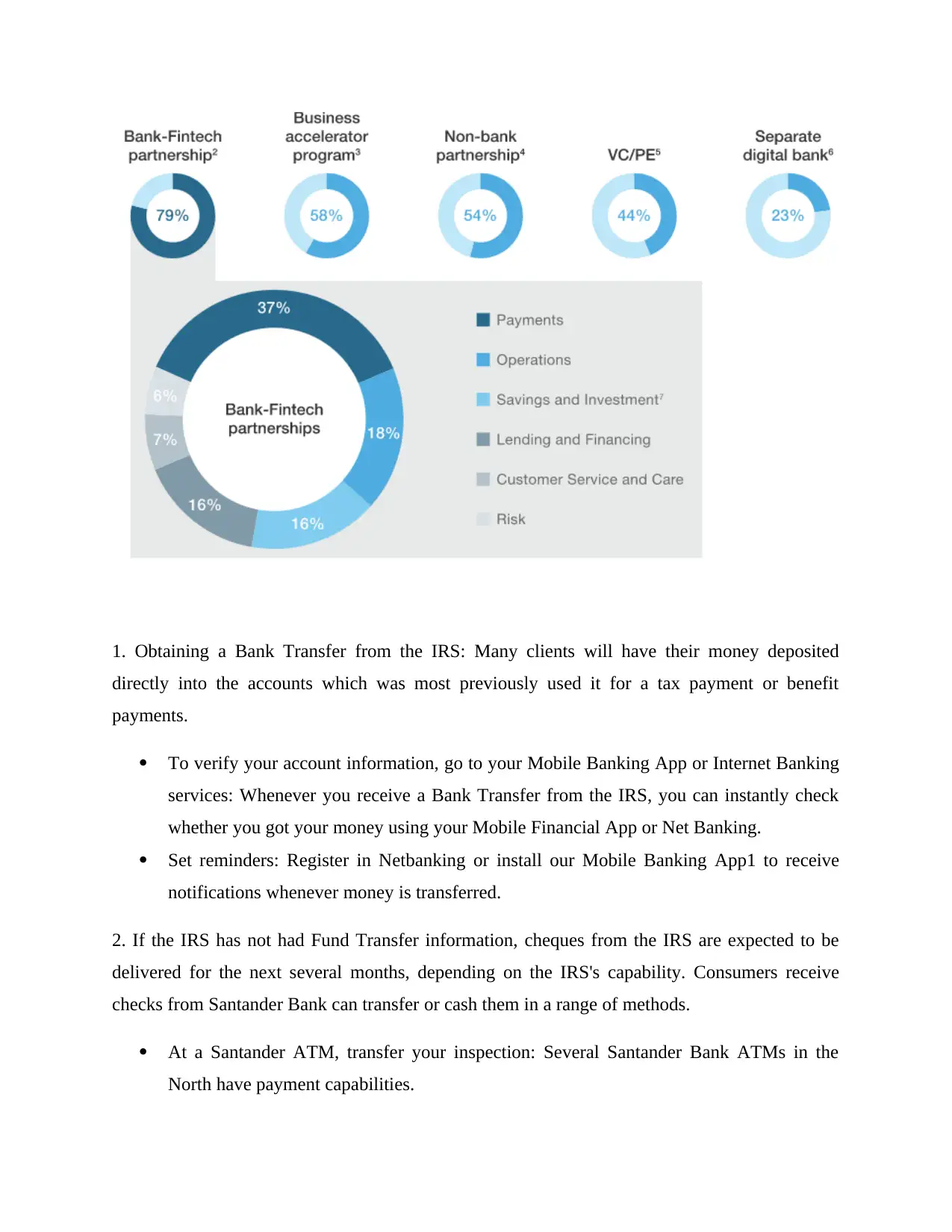

The model provides a framework for examining and evaluating variations in an

organization's internal condition. It is built on seven fundamental aspects that define the

performance of an organisation and should be interconnected and coordinated to produce

complementary results. The covid-19 crisis will add to the banking service business model's pre-

crisis challenges, such as earnings stress and low revenue growth (cheap money and higher

investment), stricter restrictions (following the original economic meltdown), and competitive

pressures from financial institutions and modern electronic applicants. The third batch of

stimulus funds has begun to be distributed by the Inland Revenue Department (IRS). Whether

you've applied for a payout and the IRS has your Fund Transfer data, the first installments are

likely to be issued by the end of the day on Wednesday, March 17, 2021, depending on the info

we now have.

Manage and oversee the strategic creation, execution, and supervision of strategies, policy,

and procedures throughout Santander US and Santander Holdings Limited to execute the

Operational Risk Programme (risk evaluation, appetite for risk, and major risk signals, managing

change, and training). In furthermore, he is in charge of the Operational Risk Council and

Working Group's management, as well as the authoring of individual risk revisions and

administrative.

During the first year, they established a customer experience strategy for Santander's Credit

Card Portfolio (4.5 million+ cards), which resulted in a 12 percent reduction in grievances

(complaints v active accounts) and a considerable increase in public happiness during a period of

unparalleled expansion. Times to get new Santander credit cards were decreased by a median of

5 days throughout all registration methods, with notable success in the telephonic registration

route, which saw a 65 percent reduction in time to card.

SECTION 2

McKinsey strategy change model is being applied by your bank when dealing with strategic

change

The model provides a framework for examining and evaluating variations in an

organization's internal condition. It is built on seven fundamental aspects that define the

performance of an organisation and should be interconnected and coordinated to produce

complementary results. The covid-19 crisis will add to the banking service business model's pre-

crisis challenges, such as earnings stress and low revenue growth (cheap money and higher

investment), stricter restrictions (following the original economic meltdown), and competitive

pressures from financial institutions and modern electronic applicants. The third batch of

stimulus funds has begun to be distributed by the Inland Revenue Department (IRS). Whether

you've applied for a payout and the IRS has your Fund Transfer data, the first installments are

likely to be issued by the end of the day on Wednesday, March 17, 2021, depending on the info

we now have.

1. Obtaining a Bank Transfer from the IRS: Many clients will have their money deposited

directly into the accounts which was most previously used it for a tax payment or benefit

payments.

To verify your account information, go to your Mobile Banking App or Internet Banking

services: Whenever you receive a Bank Transfer from the IRS, you can instantly check

whether you got your money using your Mobile Financial App or Net Banking.

Set reminders: Register in Netbanking or install our Mobile Banking App1 to receive

notifications whenever money is transferred.

2. If the IRS has not had Fund Transfer information, cheques from the IRS are expected to be

delivered for the next several months, depending on the IRS's capability. Consumers receive

checks from Santander Bank can transfer or cash them in a range of methods.

At a Santander ATM, transfer your inspection: Several Santander Bank ATMs in the

North have payment capabilities.

directly into the accounts which was most previously used it for a tax payment or benefit

payments.

To verify your account information, go to your Mobile Banking App or Internet Banking

services: Whenever you receive a Bank Transfer from the IRS, you can instantly check

whether you got your money using your Mobile Financial App or Net Banking.

Set reminders: Register in Netbanking or install our Mobile Banking App1 to receive

notifications whenever money is transferred.

2. If the IRS has not had Fund Transfer information, cheques from the IRS are expected to be

delivered for the next several months, depending on the IRS's capability. Consumers receive

checks from Santander Bank can transfer or cash them in a range of methods.

At a Santander ATM, transfer your inspection: Several Santander Bank ATMs in the

North have payment capabilities.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Visit one of our locations and speak with a bank manager: In-branch servicing is still

accessible at Santander Banking institutions on a short term basis. Kindly locate their

location to track the quality of services offered, as well as operating hours. Although we

can help at their locations, we recommend that you use an ATM right now.

3. The IRS may send before bank card when they don't have their bank transfer information.

When a client receives a pre-paid debit card, they should do the following:

By phoning 800-240-8100, you can register the pre-paid card, create a four-digit PIN, and

compare the number (TTY: 800-241-9100).

The reverse of the card should be signed.

eipcard.com is where you can register your card.

Users using these credentials to retrieve and move money electronically to their personal

checking account while paying any money, purchase at retail places anywhere Visa is

recognized, and get cash from ATMs and cash back offers facilities at merchant outlets

once they've been activated.

Santander does not offer cash advances at the teller line if they wish to withdraw cash

from their card.

Be wary of phishing: Hackers are reaping the benefits of the COVID-19 climate by ramping up

emails and online frauds, so be cautious. No one from Santander Bank or the Internal Revenue

Service will phone you to ask for private details.

SECTION 3

PESTLE analysis and Porters five forces model

PESTEL analysis is a strategic coordination and execution methodology that is broadly

employed. It is an abbreviation for the macro business ecosystem's political, economic, social,

technological, environmental, and legal concerns. Legislative measures, increased environmental

conservation, shared social tendencies, advances in technology, and a developing judicial

framework all contribute to Santander Bank's complex world.

Political: If a group does not handle the legal and political aspects of their approach, they will

struggle to attain success, high standing, and belief. For Santander, political and legal parts

accessible at Santander Banking institutions on a short term basis. Kindly locate their

location to track the quality of services offered, as well as operating hours. Although we

can help at their locations, we recommend that you use an ATM right now.

3. The IRS may send before bank card when they don't have their bank transfer information.

When a client receives a pre-paid debit card, they should do the following:

By phoning 800-240-8100, you can register the pre-paid card, create a four-digit PIN, and

compare the number (TTY: 800-241-9100).

The reverse of the card should be signed.

eipcard.com is where you can register your card.

Users using these credentials to retrieve and move money electronically to their personal

checking account while paying any money, purchase at retail places anywhere Visa is

recognized, and get cash from ATMs and cash back offers facilities at merchant outlets

once they've been activated.

Santander does not offer cash advances at the teller line if they wish to withdraw cash

from their card.

Be wary of phishing: Hackers are reaping the benefits of the COVID-19 climate by ramping up

emails and online frauds, so be cautious. No one from Santander Bank or the Internal Revenue

Service will phone you to ask for private details.

SECTION 3

PESTLE analysis and Porters five forces model

PESTEL analysis is a strategic coordination and execution methodology that is broadly

employed. It is an abbreviation for the macro business ecosystem's political, economic, social,

technological, environmental, and legal concerns. Legislative measures, increased environmental

conservation, shared social tendencies, advances in technology, and a developing judicial

framework all contribute to Santander Bank's complex world.

Political: If a group does not handle the legal and political aspects of their approach, they will

struggle to attain success, high standing, and belief. For Santander, political and legal parts

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

involve the intention of the sector to follow the govt's established principles and regulation in

order to be classified as a legal and permitted business sector. In this case, the UK Banking

Sector, for example, should be capable of addressing political and legal issues in order to

demonstrate that they value the government's ideals and regulations in all of their business

activities.

Economical: It is critical that a certain component of the company pay close attention to its

financial health while dealing with Santander. The impact on macroeconomic of some trade acts

as an axis around which other targets rotate. The position to benefit considers the environment in

which business takes place, such as the structure of the breach of the peace where a part operates,

the overall financial condition of the area or district, the situation in relation to other businesses,

and the situation of the financial market. The global financial structure in the industry in issue,

whether that is a monopoly, an oligopoly, or anything close to a perfectly competitive market

structure.

Social: Society and tradition are also important components that should be prioritised by every

company, particularly those operating on a global scale like Santander. It is critical that the

section operates in accordance with community plans in order to achieve good standing and a

positive public persona. Heritage aspects, on the other side, are equally vital in aligning to

actualize the unique wishes of different people who belong to different cultures.

Technological: The complexity of achieving organisation success through improved performance

and profitability, combined with new contributions of speed knowledge, has strengthened the

perspective of both experts and business executives in the orientation of methodologies.

Legal: Corporations are expected by national rules to arrange valid employment contracts. These

agreements are approved by reputable government entities and cover all areas of employment.

Future employment agreements make sure that the people concerned have a good relationship

and that there are no misunderstandings or collusions. Santander Bank follows labour rules and

informs its employees about them during the hiring process. Santander Bank's Human resources

also holds courses and workshops sessions for workers on a regular basis to engage them and

educate them on worker protections and other legal requirements. Reputed organisations and

institutions conduct frequent audits of enterprises to ensure that safety nets, drills, and

order to be classified as a legal and permitted business sector. In this case, the UK Banking

Sector, for example, should be capable of addressing political and legal issues in order to

demonstrate that they value the government's ideals and regulations in all of their business

activities.

Economical: It is critical that a certain component of the company pay close attention to its

financial health while dealing with Santander. The impact on macroeconomic of some trade acts

as an axis around which other targets rotate. The position to benefit considers the environment in

which business takes place, such as the structure of the breach of the peace where a part operates,

the overall financial condition of the area or district, the situation in relation to other businesses,

and the situation of the financial market. The global financial structure in the industry in issue,

whether that is a monopoly, an oligopoly, or anything close to a perfectly competitive market

structure.

Social: Society and tradition are also important components that should be prioritised by every

company, particularly those operating on a global scale like Santander. It is critical that the

section operates in accordance with community plans in order to achieve good standing and a

positive public persona. Heritage aspects, on the other side, are equally vital in aligning to

actualize the unique wishes of different people who belong to different cultures.

Technological: The complexity of achieving organisation success through improved performance

and profitability, combined with new contributions of speed knowledge, has strengthened the

perspective of both experts and business executives in the orientation of methodologies.

Legal: Corporations are expected by national rules to arrange valid employment contracts. These

agreements are approved by reputable government entities and cover all areas of employment.

Future employment agreements make sure that the people concerned have a good relationship

and that there are no misunderstandings or collusions. Santander Bank follows labour rules and

informs its employees about them during the hiring process. Santander Bank's Human resources

also holds courses and workshops sessions for workers on a regular basis to engage them and

educate them on worker protections and other legal requirements. Reputed organisations and

institutions conduct frequent audits of enterprises to ensure that safety nets, drills, and

preventative procedures are in place. Worker safety and health encompasses not just their

physical well-being, but also their mental and emotional health.

Environmental: A greater emphasis is being placed on environmental protection and recycling.

Increasing awareness of the need of composting and demand that things be thrown off in

environmentally friendly ways. Usage of recycled products is also becoming more popular

among consumers. Santander Bank, like many other businesses, has developed dedicated sites

for dumping of products to be recovered. It is also creating a new product portfolio of recyclable

materials for customers to advantage from the nation's stringent waste reporting and monitoring

legislation. Companies should affiliate with, and identify with, waste disposal organizations and

organizations in order to comply with legislation, maintain controls, and avoid potential

headaches. In order to ensure sustainable development, the company currently has a well-defined

and regulated wastewater treatment procedure in place, as well as a waste disposal system that is

ecologically sound.

Porter’s five forces model

Porter Five Forces can be used as a strategic management technique by Santander Bank (United

Kingdom) planners to conduct market research. It will aid Santander Bank planners in

visualizing the numerous competitive factors that exist in the financial sector, both in domestic

and overseas markets.

1. Buyers' negotiating power at Santander Bank and in the banking industry - When buyers have

a lot of negotiating power, their try to push prices down, restricting Santander Bank's ability to

produce economic profit.

2. Threat of new entrants in the Money Center Banks sector - Whether there's a significant new

entrants in the Financial Institution Banks market, present companies will be happy to accept

profitability in order to mitigate the threat of new entry.

3. Threat of replacement goods & services in the Money Center Banking sector - If the threat of

substitution and offerings is strong, Santander Bank must either invest consistently in R&D or

reduce the financial performance to competitors.

physical well-being, but also their mental and emotional health.

Environmental: A greater emphasis is being placed on environmental protection and recycling.

Increasing awareness of the need of composting and demand that things be thrown off in

environmentally friendly ways. Usage of recycled products is also becoming more popular

among consumers. Santander Bank, like many other businesses, has developed dedicated sites

for dumping of products to be recovered. It is also creating a new product portfolio of recyclable

materials for customers to advantage from the nation's stringent waste reporting and monitoring

legislation. Companies should affiliate with, and identify with, waste disposal organizations and

organizations in order to comply with legislation, maintain controls, and avoid potential

headaches. In order to ensure sustainable development, the company currently has a well-defined

and regulated wastewater treatment procedure in place, as well as a waste disposal system that is

ecologically sound.

Porter’s five forces model

Porter Five Forces can be used as a strategic management technique by Santander Bank (United

Kingdom) planners to conduct market research. It will aid Santander Bank planners in

visualizing the numerous competitive factors that exist in the financial sector, both in domestic

and overseas markets.

1. Buyers' negotiating power at Santander Bank and in the banking industry - When buyers have

a lot of negotiating power, their try to push prices down, restricting Santander Bank's ability to

produce economic profit.

2. Threat of new entrants in the Money Center Banks sector - Whether there's a significant new

entrants in the Financial Institution Banks market, present companies will be happy to accept

profitability in order to mitigate the threat of new entry.

3. Threat of replacement goods & services in the Money Center Banking sector - If the threat of

substitution and offerings is strong, Santander Bank must either invest consistently in R&D or

reduce the financial performance to competitors.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4. Competition among current players in the Money Center Banks market — When competition

is fierce, incumbent companies like Santander Bank find it difficult to make long-term profits.

5. Supplier bargaining power in Money Center Banks - Whenever customers have a lot of

bargaining power, they can get a better deal from Santander Bank. It will affect Santander Bank's

tendency to preserve above-average profitability in the Money Center Financial sector.

The Porter Five Forces model can be used by managers to assess Santander Bank's performance

in the Financial Institution Banks market. Santander Bank's Porter five forces assessment will aid

in comprehending and addressing the kind and intensity of play, as well as how Santander Bank

can deal with it. Even though many businesses appear to be very various externally, whenever

these five forces are examined closely, they identify the determinants of success in each sector.

(Strategists can use Porter Five Forces to figure out what drives Santander Bank's profitability in

the Money Center Banks market.) The primary goal of Santander Bank's analysts and managers

is to assist the company in gaining a long - term competitive advantages and fending off

competitive pressures from other Money Center Banks.

SECTION 4

Porters generic strategy

Porter's Generic Strategies Model explains how a corporation can position itself depending on its

competitive edge and service breadth. It provides firms with three generic alternatives for

identifying and distinguishing their core competencies:

1. Means of cost effectiveness to be capable of offering the lowest pricing, which are often

accompanied by "no frills" service. New technology, efficient operations, and a low cost base

can all contribute to cost efficiency, which can be aided by economies of scale. This method

necessitates that businesses continually enhance their efficiency and cut costs. Santander is one

of the world's largest retail banks, with one of the lowest cost-to-income ratios. A strong cost-

cutting culture, a constant focus on innovation and digitization, a high degree of standardization,

simple goods and procedures, and a goal of top-3 rankings in its home markets with close

customer ties all contributed to their success.

is fierce, incumbent companies like Santander Bank find it difficult to make long-term profits.

5. Supplier bargaining power in Money Center Banks - Whenever customers have a lot of

bargaining power, they can get a better deal from Santander Bank. It will affect Santander Bank's

tendency to preserve above-average profitability in the Money Center Financial sector.

The Porter Five Forces model can be used by managers to assess Santander Bank's performance

in the Financial Institution Banks market. Santander Bank's Porter five forces assessment will aid

in comprehending and addressing the kind and intensity of play, as well as how Santander Bank

can deal with it. Even though many businesses appear to be very various externally, whenever

these five forces are examined closely, they identify the determinants of success in each sector.

(Strategists can use Porter Five Forces to figure out what drives Santander Bank's profitability in

the Money Center Banks market.) The primary goal of Santander Bank's analysts and managers

is to assist the company in gaining a long - term competitive advantages and fending off

competitive pressures from other Money Center Banks.

SECTION 4

Porters generic strategy

Porter's Generic Strategies Model explains how a corporation can position itself depending on its

competitive edge and service breadth. It provides firms with three generic alternatives for

identifying and distinguishing their core competencies:

1. Means of cost effectiveness to be capable of offering the lowest pricing, which are often

accompanied by "no frills" service. New technology, efficient operations, and a low cost base

can all contribute to cost efficiency, which can be aided by economies of scale. This method

necessitates that businesses continually enhance their efficiency and cut costs. Santander is one

of the world's largest retail banks, with one of the lowest cost-to-income ratios. A strong cost-

cutting culture, a constant focus on innovation and digitization, a high degree of standardization,

simple goods and procedures, and a goal of top-3 rankings in its home markets with close

customer ties all contributed to their success.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Despite the severe economic circumstances in which banks have recently found themselves,

Santander's effectiveness of risk following points are a different strategy adopted by this

corporation to distinguish itself from its competition. Also, Santander's image is distinct in terms

of what they have accomplished over the years. Whenever Santander bought Abbey's bank in

2004, for example, the investments and reversal or transformation given in the company was

extremely effective and highly effective. With a massive expense ratio, Santander may be one of

the most effective banks around the world. Nonetheless, the retail and commercial bank sector's

attitude and business model are distinct in that all branches adhere to the same regulatory

framework.

Organizations can best exploit their competitive advantage and so remain competitive if they

have a clear position in one of these areas.

The issue is that most banks are stuck in the middle, unable to take a firm stance. Most banks

aim to serve a wide range of consumers by offering a diverse range of products and services. At

the same time, they want to stand out by providing better service and innovative ideas, but they

struggle to improve their offering on a regular basis and lack customer-centric processes. As a

result, they lose position to cost-leaders who offer lower pricing, cede ground to true

differentiators who provide superior service, and are beaten by specialists who are experts in

their field.

Banks must examine their distinctive attributes that fuel their competitive advantage, as well as

determine where they are now positioned, in order to turn the ship around.

Santander's effectiveness of risk following points are a different strategy adopted by this

corporation to distinguish itself from its competition. Also, Santander's image is distinct in terms

of what they have accomplished over the years. Whenever Santander bought Abbey's bank in

2004, for example, the investments and reversal or transformation given in the company was

extremely effective and highly effective. With a massive expense ratio, Santander may be one of

the most effective banks around the world. Nonetheless, the retail and commercial bank sector's

attitude and business model are distinct in that all branches adhere to the same regulatory

framework.

Organizations can best exploit their competitive advantage and so remain competitive if they

have a clear position in one of these areas.

The issue is that most banks are stuck in the middle, unable to take a firm stance. Most banks

aim to serve a wide range of consumers by offering a diverse range of products and services. At

the same time, they want to stand out by providing better service and innovative ideas, but they

struggle to improve their offering on a regular basis and lack customer-centric processes. As a

result, they lose position to cost-leaders who offer lower pricing, cede ground to true

differentiators who provide superior service, and are beaten by specialists who are experts in

their field.

Banks must examine their distinctive attributes that fuel their competitive advantage, as well as

determine where they are now positioned, in order to turn the ship around.

REFERENCES

Books and Journal

Donald, M., 2019. Leading and Managing Change in the Age of Disruption and Artificial

Intelligence. Emerald Group Publishing.

Martinelli, R.J., Waddell, J.M. and Rahschulte, T.J., 2017. Projects without boundaries:

Successfully leading teams and managing projects in a virtual world. John Wiley &

Sons.

Tirmizi, S.A. and Vogelsang, J.D. eds., 2016. Leading and managing in the social sector:

strategies for advancing human dignity and social justice. Springer.

Dick, T.B. and et. al., 2018. Fundamentals of leading, tools for managing, and strategies for

sustaining change. American Journal of Health-System Pharmacy, 75(19), pp.1450-

1455.

Yoder-Wise, P.S., 2018. Clinical Safety: The Core of Leading, Managing, and

Following. Leading and Managing in Nursing-E-Book, p.20.

Jones, M.E., 2020. Leading Leaders in Managing Civilians. Army Law., p.47.

Baltyn, P., 2016. Baltic Dry Index as economic leading indicator in the United States.

In Managing innovation and diversity in knowledge society through turbulent time:

Proceedings of the MakeLearn and TIIM Joint International Conference 2016 (pp.

205-211). ToKnowPress.

Kroll, M.W. and Kroll, K., Prostacare Pty Ltd, 2020. System for managing high impedance

changes in a non-thermal ablation system for bph. U.S. Patent Application

16/287,551.

Bramandita, B., 2020. Managing Digital Organization in Restaurant Company while Corona

Outbreak. Available at SSRN 3616495.

Yoder-Wise, P.S., 2018. Clinical Safety: The Core of Leading, Managing, and

Following. Leading and Managing in Nursing-E-Book, p.20.

Jalagat Jr, R.C., 2017. Leading and Managing People and Organizational Change: Individual and

Organizational Benefits and Its Value on Staff Development. Business, Management

and Economics Research, 3(8), pp.146-150.

Books and Journal

Donald, M., 2019. Leading and Managing Change in the Age of Disruption and Artificial

Intelligence. Emerald Group Publishing.

Martinelli, R.J., Waddell, J.M. and Rahschulte, T.J., 2017. Projects without boundaries:

Successfully leading teams and managing projects in a virtual world. John Wiley &

Sons.

Tirmizi, S.A. and Vogelsang, J.D. eds., 2016. Leading and managing in the social sector:

strategies for advancing human dignity and social justice. Springer.

Dick, T.B. and et. al., 2018. Fundamentals of leading, tools for managing, and strategies for

sustaining change. American Journal of Health-System Pharmacy, 75(19), pp.1450-

1455.

Yoder-Wise, P.S., 2018. Clinical Safety: The Core of Leading, Managing, and

Following. Leading and Managing in Nursing-E-Book, p.20.

Jones, M.E., 2020. Leading Leaders in Managing Civilians. Army Law., p.47.

Baltyn, P., 2016. Baltic Dry Index as economic leading indicator in the United States.

In Managing innovation and diversity in knowledge society through turbulent time:

Proceedings of the MakeLearn and TIIM Joint International Conference 2016 (pp.

205-211). ToKnowPress.

Kroll, M.W. and Kroll, K., Prostacare Pty Ltd, 2020. System for managing high impedance

changes in a non-thermal ablation system for bph. U.S. Patent Application

16/287,551.

Bramandita, B., 2020. Managing Digital Organization in Restaurant Company while Corona

Outbreak. Available at SSRN 3616495.

Yoder-Wise, P.S., 2018. Clinical Safety: The Core of Leading, Managing, and

Following. Leading and Managing in Nursing-E-Book, p.20.

Jalagat Jr, R.C., 2017. Leading and Managing People and Organizational Change: Individual and

Organizational Benefits and Its Value on Staff Development. Business, Management

and Economics Research, 3(8), pp.146-150.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.