Financial Analysis of Samsung Plc: A Strategic Management Report

VerifiedAdded on 2023/01/19

|19

|4931

|50

Report

AI Summary

This report provides a detailed financial analysis of Samsung Plc, focusing on strategic financial management. It begins by evaluating the sources of financial data used to understand Samsung's business strategy, including net cash available, revenue growth, and profitability ratios, and discusses the need for such data in formulating business strategies, such as vision and mission statements, assessing financial requirements, setting targets, managing risk, and reporting to owners. The report then explores risks associated with financial decisions, like market risk, credit risk, and liquidity risk, and reviews techniques for assessing investment proposals, including net present value, payback period, accounting rate of return, and internal rate of return. Finally, the report interprets Samsung Plc's financial statements, including the income statement, through ratio analysis, providing insights into its financial position and profitability, and comparing data from 2017 and 2018.

Finance for Strategic

Managers

Managers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION

Strategic financial management is a process by which company manages its finances to

by doing business operations in efficient and effective manner to succeed in enhancing its

profitability. Strategic managers of an business organisation shall required to have full

knowledge related to financial management which is essential for long term survivability of the

company. For better understanding of this topic, a company named Samsung Plc is given for

better understanding which is engaged in providing various electronic innovative products such

as smart phones, television and so on. Evaluation of financial statements of Samsung Plc is also

given in such report to asses the current viability of the company and making recommendations

based on such interpretation.

TASK 1

Evaluation of the sources of financial data that are utilised for knowing the business strategy:

Financial information of an company like Samsung Plc are very useful for it key

stakeholders to measuring the its business strategy which a company has made for its future

business operations. Such information is also help the company in evaluating its business

processes in finding that whether it perform well in achieve its goals and objectives (Gliedt and

Hoicka, 2015). some of the financial data that are helpful in identify its business strategy which

is as follows:

Net cash available: Any company's net cash may gives information about its

financial fitness. More cash in hand in an organisation indicates that company has

utilising its financial resources in efficient and effective manner to generate more

cash for new investments (Ward, 2012).

Revenue Growth: A good growth in company's revenue shall indicate that it has

performed its business operations in good manner and it indicates that company has

good scope in future and company has capability to succeed in the long run.

Profitability ratios: It ratios provides the information about operational efficiency of

an company and provides the areas where company is required to take some

corrective actions. It may be helpful for various key stakeholders in knowing the

various information about the company's business strategy because it takes various

aspects of its operations such sales, profits in the given accounting period.

1

Strategic financial management is a process by which company manages its finances to

by doing business operations in efficient and effective manner to succeed in enhancing its

profitability. Strategic managers of an business organisation shall required to have full

knowledge related to financial management which is essential for long term survivability of the

company. For better understanding of this topic, a company named Samsung Plc is given for

better understanding which is engaged in providing various electronic innovative products such

as smart phones, television and so on. Evaluation of financial statements of Samsung Plc is also

given in such report to asses the current viability of the company and making recommendations

based on such interpretation.

TASK 1

Evaluation of the sources of financial data that are utilised for knowing the business strategy:

Financial information of an company like Samsung Plc are very useful for it key

stakeholders to measuring the its business strategy which a company has made for its future

business operations. Such information is also help the company in evaluating its business

processes in finding that whether it perform well in achieve its goals and objectives (Gliedt and

Hoicka, 2015). some of the financial data that are helpful in identify its business strategy which

is as follows:

Net cash available: Any company's net cash may gives information about its

financial fitness. More cash in hand in an organisation indicates that company has

utilising its financial resources in efficient and effective manner to generate more

cash for new investments (Ward, 2012).

Revenue Growth: A good growth in company's revenue shall indicate that it has

performed its business operations in good manner and it indicates that company has

good scope in future and company has capability to succeed in the long run.

Profitability ratios: It ratios provides the information about operational efficiency of

an company and provides the areas where company is required to take some

corrective actions. It may be helpful for various key stakeholders in knowing the

various information about the company's business strategy because it takes various

aspects of its operations such sales, profits in the given accounting period.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Apart from it, there are some other source of finance such as:

Internal source-

Internal accounting system - Internal control, as established in accounting and auditing, is

a process to ensure the achievement of the goals of an entity in terms of organizational

effectiveness and performance, accurate financial reporting, and adherence with laws,

regulations. By use of it information regards to financial transactions can be gathered.

Payroll system - A payroll system covers anything related to worker salary and work tax

filing. It involves recording hours, estimating salaries, paying taxes and other

exemptions, copying and checking, and paying government jobs taxes This can be helpful

in order to assessing key financial information about outflow of funds.

External source-

Suppliers- This can be defined as a group supplying goods or services. A manufacturer

can be differentiated from a contractor or subcontractor which typically provides

technical feedback to deliverables. In the context of providing financial information, the

suppliers play a key role. It is so because they have detailed information regards to

companies' paying efficiency and their revenues.

Budget- It is also a key source of providing financial information. This is so because

under it estimated amount of income and expenditures is included and users can gather

needed monetary informations.

Assessment for need of financial data and information for formulation of business strategy:

In any business organisation, financial data is very beneficial as they provide the valuable

information about the such company to the management and helps the management staff in in

formulation of its key business strategy. Herein, below some financial information is mentioned

that is as follows:

Profitability - Profitability is an ability to use its assets to generate income that covers its

costs In certain words, it is the capacity of an organization to make profits from its

activities. It can be beneficial in order to formulate the business strategies because

managers can assess key information about proportion of total income and costs.

Cash flow- Cash flow is the net spending of cash equivalents to and from a company. The

ability of a corporation to build shareholder value at the most fundamental level is

defined by its ability to produce positive cash flows or, more precisely, optimize lengthy-

2

Internal source-

Internal accounting system - Internal control, as established in accounting and auditing, is

a process to ensure the achievement of the goals of an entity in terms of organizational

effectiveness and performance, accurate financial reporting, and adherence with laws,

regulations. By use of it information regards to financial transactions can be gathered.

Payroll system - A payroll system covers anything related to worker salary and work tax

filing. It involves recording hours, estimating salaries, paying taxes and other

exemptions, copying and checking, and paying government jobs taxes This can be helpful

in order to assessing key financial information about outflow of funds.

External source-

Suppliers- This can be defined as a group supplying goods or services. A manufacturer

can be differentiated from a contractor or subcontractor which typically provides

technical feedback to deliverables. In the context of providing financial information, the

suppliers play a key role. It is so because they have detailed information regards to

companies' paying efficiency and their revenues.

Budget- It is also a key source of providing financial information. This is so because

under it estimated amount of income and expenditures is included and users can gather

needed monetary informations.

Assessment for need of financial data and information for formulation of business strategy:

In any business organisation, financial data is very beneficial as they provide the valuable

information about the such company to the management and helps the management staff in in

formulation of its key business strategy. Herein, below some financial information is mentioned

that is as follows:

Profitability - Profitability is an ability to use its assets to generate income that covers its

costs In certain words, it is the capacity of an organization to make profits from its

activities. It can be beneficial in order to formulate the business strategies because

managers can assess key information about proportion of total income and costs.

Cash flow- Cash flow is the net spending of cash equivalents to and from a company. The

ability of a corporation to build shareholder value at the most fundamental level is

defined by its ability to produce positive cash flows or, more precisely, optimize lengthy-

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

term free cash flow. It can also be useful for assessing information about cash position

which may contribute in preparation of business strategies.

Cost projection- Cost Projection is a large investment statement for development projects,

implementation and maintenance to set up the venture strategy and render the project

operational. Financial investment includes all acquisition expenses, rentals, all applicable

taxes and equipment acquisitions, technology, learning and tutoring programs, internal /

existing project tools, deployment. It can be useful for preparation of business strategies

because by use of this, managers can analyse future need of funds.

Some of need of financial data in formulation process are as follows:

Vision statement: Creation of this statement of a company requires the information and

data related to its financial data because by assessing the current financial position of an

organisation, it may be able to make its vision statement (Stead and Stead, 2014).

Therefore, it is said that such statement acts as a road map that help the company in

guiding the management staff related to its internal works. But on the other hands,

preparation of such is not so much easy because company has to take a balanced view

that includes both forward looking view along with providing ideal state while creating

vision statement.

Mission statement: This statement may be defined as company's long term plans which it

wants to fulfil in log run. For establishing the mission statements of an company, various

financial information such net cash available in present, its profitability position etc.

(Hill, Jones and Schilling, 2014). In other words, it may be said that it is a statement

which defines about organisation's philosophy, identify and their future plans. This will

assist it in formulating its goals and objectives to provide direction for its day to day

business activities.

Assessing financial requirements- The financial information is useful in order to analyse

need of financial resources. It may become possible because by help of available

informations, managers can make accurate projection of financial resources.

Setting and meeting targets- In addition, financial informations are needed in order to

setting and meeting financial targets. This is so because users can analyse about

efficiency of business and in accordance of that set financial targets.

3

which may contribute in preparation of business strategies.

Cost projection- Cost Projection is a large investment statement for development projects,

implementation and maintenance to set up the venture strategy and render the project

operational. Financial investment includes all acquisition expenses, rentals, all applicable

taxes and equipment acquisitions, technology, learning and tutoring programs, internal /

existing project tools, deployment. It can be useful for preparation of business strategies

because by use of this, managers can analyse future need of funds.

Some of need of financial data in formulation process are as follows:

Vision statement: Creation of this statement of a company requires the information and

data related to its financial data because by assessing the current financial position of an

organisation, it may be able to make its vision statement (Stead and Stead, 2014).

Therefore, it is said that such statement acts as a road map that help the company in

guiding the management staff related to its internal works. But on the other hands,

preparation of such is not so much easy because company has to take a balanced view

that includes both forward looking view along with providing ideal state while creating

vision statement.

Mission statement: This statement may be defined as company's long term plans which it

wants to fulfil in log run. For establishing the mission statements of an company, various

financial information such net cash available in present, its profitability position etc.

(Hill, Jones and Schilling, 2014). In other words, it may be said that it is a statement

which defines about organisation's philosophy, identify and their future plans. This will

assist it in formulating its goals and objectives to provide direction for its day to day

business activities.

Assessing financial requirements- The financial information is useful in order to analyse

need of financial resources. It may become possible because by help of available

informations, managers can make accurate projection of financial resources.

Setting and meeting targets- In addition, financial informations are needed in order to

setting and meeting financial targets. This is so because users can analyse about

efficiency of business and in accordance of that set financial targets.

3

Managing risk- Along with the above mentioned role, the financial informations are

useful for managing overall risks in an effective manner. This is so because, the managers

can prepare effective strategies and operations in order to beat their competitors which

leads to lower volume of risk.

Reporting to owners- As well as the financial information is required for making aware to

business owners regards to actual position. For this purpose there are different kinds of

financial statements such as income statement, balance sheet etc.

Internal and external needs- The financial information is needed for internal and external

purpose. Such as in the internal perspective, this is needed for managers, employees in

order to make effective plans and policies. As well as for external users like suppliers,

customers the financial information is needed.

Analysis of risks related to financial business decision:

These include various type of risks when an organisation its finance related decisions,

some of are as follows:

Market risk: It relates with risk when a company wants to change the conditions related

to market place from where it compete for its business. In other words, market from

where an organisation sells its products plays a significant role, if market is neutral for

its new product then it is said that company has no power to influence such market.

Credit risk: It is risk which is related to its customer when a company decide to change

its credit period. Company shall required to assess all the possible effects of such change

and according take decision. If by decreasing the credit period given to customer,

consumers of such company has starts decreases, then it is said that company has not do

it and this is called credit risk

Liquidity risk: This is related to company's liquidity position, this mean that company

shall required to manage its working capital requirements in such a manner that it does

not effect in adverse manner (Balogun, Bartunek and Do, 2015).

Strategic risk - Strategic risk is the danger that a corporation may be at risk of failing or

intervening in business decisions. Strategic risk is a significant determinant the value of

a company, especially if the company suffers a steep decline in a short time.

4

useful for managing overall risks in an effective manner. This is so because, the managers

can prepare effective strategies and operations in order to beat their competitors which

leads to lower volume of risk.

Reporting to owners- As well as the financial information is required for making aware to

business owners regards to actual position. For this purpose there are different kinds of

financial statements such as income statement, balance sheet etc.

Internal and external needs- The financial information is needed for internal and external

purpose. Such as in the internal perspective, this is needed for managers, employees in

order to make effective plans and policies. As well as for external users like suppliers,

customers the financial information is needed.

Analysis of risks related to financial business decision:

These include various type of risks when an organisation its finance related decisions,

some of are as follows:

Market risk: It relates with risk when a company wants to change the conditions related

to market place from where it compete for its business. In other words, market from

where an organisation sells its products plays a significant role, if market is neutral for

its new product then it is said that company has no power to influence such market.

Credit risk: It is risk which is related to its customer when a company decide to change

its credit period. Company shall required to assess all the possible effects of such change

and according take decision. If by decreasing the credit period given to customer,

consumers of such company has starts decreases, then it is said that company has not do

it and this is called credit risk

Liquidity risk: This is related to company's liquidity position, this mean that company

shall required to manage its working capital requirements in such a manner that it does

not effect in adverse manner (Balogun, Bartunek and Do, 2015).

Strategic risk - Strategic risk is the danger that a corporation may be at risk of failing or

intervening in business decisions. Strategic risk is a significant determinant the value of

a company, especially if the company suffers a steep decline in a short time.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Compliance risk- Compliance risk is the vulnerability of a company to legal fines,

monetary penalties, and material failure if it fails to comply with business rules and

regulations, policies, or recommended best practices.

Operational risk- Operational risk is "the risk of a value change due to the fact which

potential losses, sustained due to inadequate or ineffective internal systems, people and

structures or external events, vary from the potential losses"

Risk modelling - Modelling financial risk is use of structured econometric methods to

assess a financial portfolio's cumulative risk. Risk analysis is one of many sub-goals in

the wider field of financial analysis.

Review of techniques that may be used in assessing investment proposals:

There are various methods available for evaluating the company's several capital

expenditure projects, these are as follows:

Net present value: NPV technique is utilised by the company for measuring

various investment projects of the company by calculating the present cash

inflows and present cash outflows. Thereafter, PV of cash outflows are deducted

from P.V of net cash inflow (Andreu, Ortiz and Sarto, 2014).

Payback period: in simple words, payback period is the period which an

investment projects shall take to recover the cost of its initial investment. If

payback period is less than investment proposal total period, then it is said that the

proposed project is viable.

Accounting rate of return: Another name of such technique is average rate which

is utilised for taking various long term investing decisions. Main unique feature of

this method is that such method uses the expected net operating income but all

other methods gives more more emphasis on the cash flows.

Internal rate of return: Such technique assists the companies in evaluating the

profitability level of potential investments. If such return is more than cost of

capital of proposed investment then it is said that investment proposal is viable

and company shall require to accept such proposal (Davis and Tama‐Sweet,

2012).

5

monetary penalties, and material failure if it fails to comply with business rules and

regulations, policies, or recommended best practices.

Operational risk- Operational risk is "the risk of a value change due to the fact which

potential losses, sustained due to inadequate or ineffective internal systems, people and

structures or external events, vary from the potential losses"

Risk modelling - Modelling financial risk is use of structured econometric methods to

assess a financial portfolio's cumulative risk. Risk analysis is one of many sub-goals in

the wider field of financial analysis.

Review of techniques that may be used in assessing investment proposals:

There are various methods available for evaluating the company's several capital

expenditure projects, these are as follows:

Net present value: NPV technique is utilised by the company for measuring

various investment projects of the company by calculating the present cash

inflows and present cash outflows. Thereafter, PV of cash outflows are deducted

from P.V of net cash inflow (Andreu, Ortiz and Sarto, 2014).

Payback period: in simple words, payback period is the period which an

investment projects shall take to recover the cost of its initial investment. If

payback period is less than investment proposal total period, then it is said that the

proposed project is viable.

Accounting rate of return: Another name of such technique is average rate which

is utilised for taking various long term investing decisions. Main unique feature of

this method is that such method uses the expected net operating income but all

other methods gives more more emphasis on the cash flows.

Internal rate of return: Such technique assists the companies in evaluating the

profitability level of potential investments. If such return is more than cost of

capital of proposed investment then it is said that investment proposal is viable

and company shall require to accept such proposal (Davis and Tama‐Sweet,

2012).

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

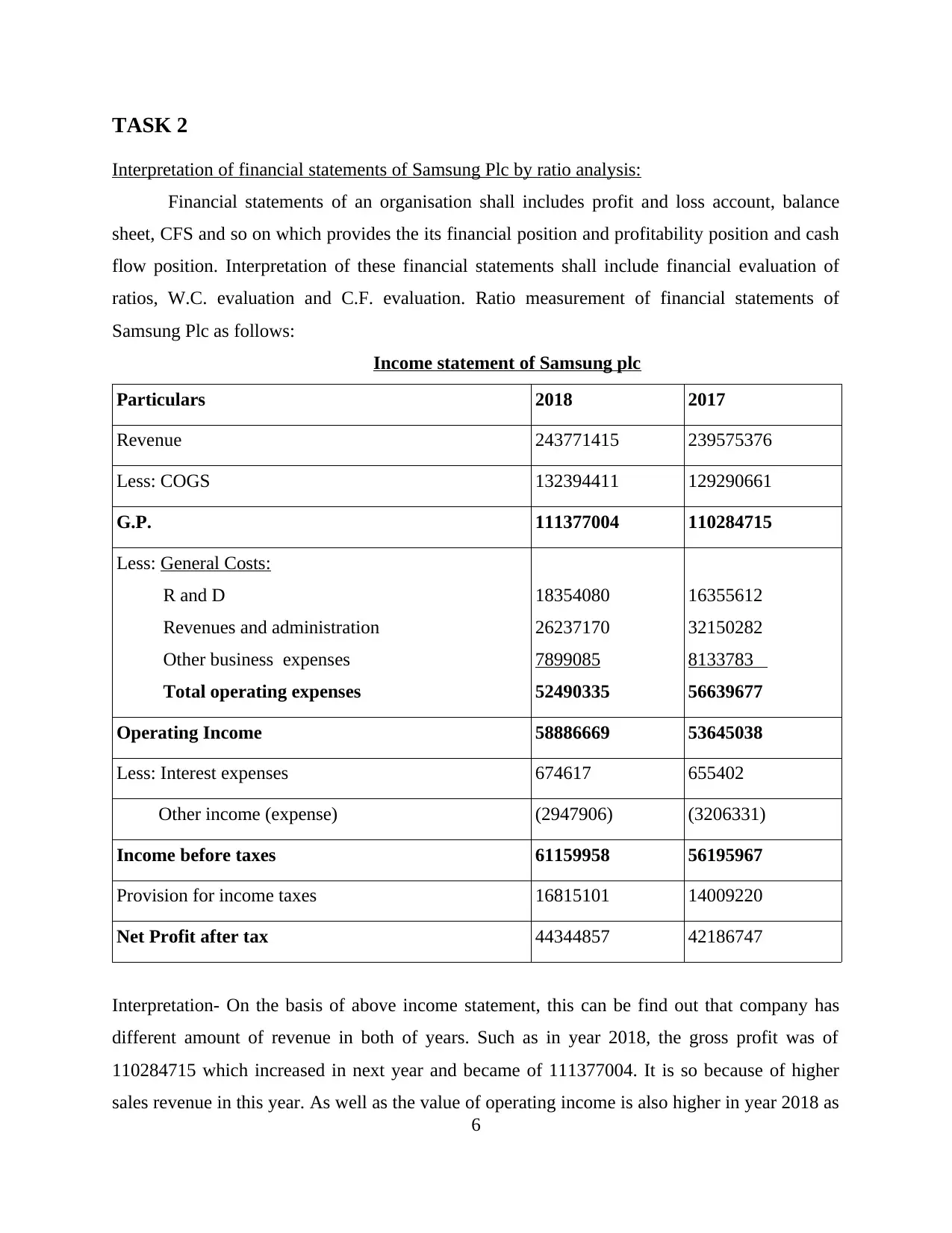

TASK 2

Interpretation of financial statements of Samsung Plc by ratio analysis:

Financial statements of an organisation shall includes profit and loss account, balance

sheet, CFS and so on which provides the its financial position and profitability position and cash

flow position. Interpretation of these financial statements shall include financial evaluation of

ratios, W.C. evaluation and C.F. evaluation. Ratio measurement of financial statements of

Samsung Plc as follows:

Income statement of Samsung plc

Particulars 2018 2017

Revenue 243771415 239575376

Less: COGS 132394411 129290661

G.P. 111377004 110284715

Less: General Costs:

R and D

Revenues and administration

Other business expenses

Total operating expenses

18354080

26237170

7899085

52490335

16355612

32150282

8133783

56639677

Operating Income 58886669 53645038

Less: Interest expenses 674617 655402

Other income (expense) (2947906) (3206331)

Income before taxes 61159958 56195967

Provision for income taxes 16815101 14009220

Net Profit after tax 44344857 42186747

Interpretation- On the basis of above income statement, this can be find out that company has

different amount of revenue in both of years. Such as in year 2018, the gross profit was of

110284715 which increased in next year and became of 111377004. It is so because of higher

sales revenue in this year. As well as the value of operating income is also higher in year 2018 as

6

Interpretation of financial statements of Samsung Plc by ratio analysis:

Financial statements of an organisation shall includes profit and loss account, balance

sheet, CFS and so on which provides the its financial position and profitability position and cash

flow position. Interpretation of these financial statements shall include financial evaluation of

ratios, W.C. evaluation and C.F. evaluation. Ratio measurement of financial statements of

Samsung Plc as follows:

Income statement of Samsung plc

Particulars 2018 2017

Revenue 243771415 239575376

Less: COGS 132394411 129290661

G.P. 111377004 110284715

Less: General Costs:

R and D

Revenues and administration

Other business expenses

Total operating expenses

18354080

26237170

7899085

52490335

16355612

32150282

8133783

56639677

Operating Income 58886669 53645038

Less: Interest expenses 674617 655402

Other income (expense) (2947906) (3206331)

Income before taxes 61159958 56195967

Provision for income taxes 16815101 14009220

Net Profit after tax 44344857 42186747

Interpretation- On the basis of above income statement, this can be find out that company has

different amount of revenue in both of years. Such as in year 2018, the gross profit was of

110284715 which increased in next year and became of 111377004. It is so because of higher

sales revenue in this year. As well as the value of operating income is also higher in year 2018 as

6

compare to year 2017. So overall, it can be interpreted that above company's performance is

better in year 2018.

Ratio analysis:

It may defined as a mathematical technique by which several financial ratios are

calculated to by the company to analysis and measure the performances of company by the help

of its financial statements. The ratio analysis is more beneficial and useful if one year ratios are

compared with years or with other company (Fonseka, Ramos and Tian, 2012).

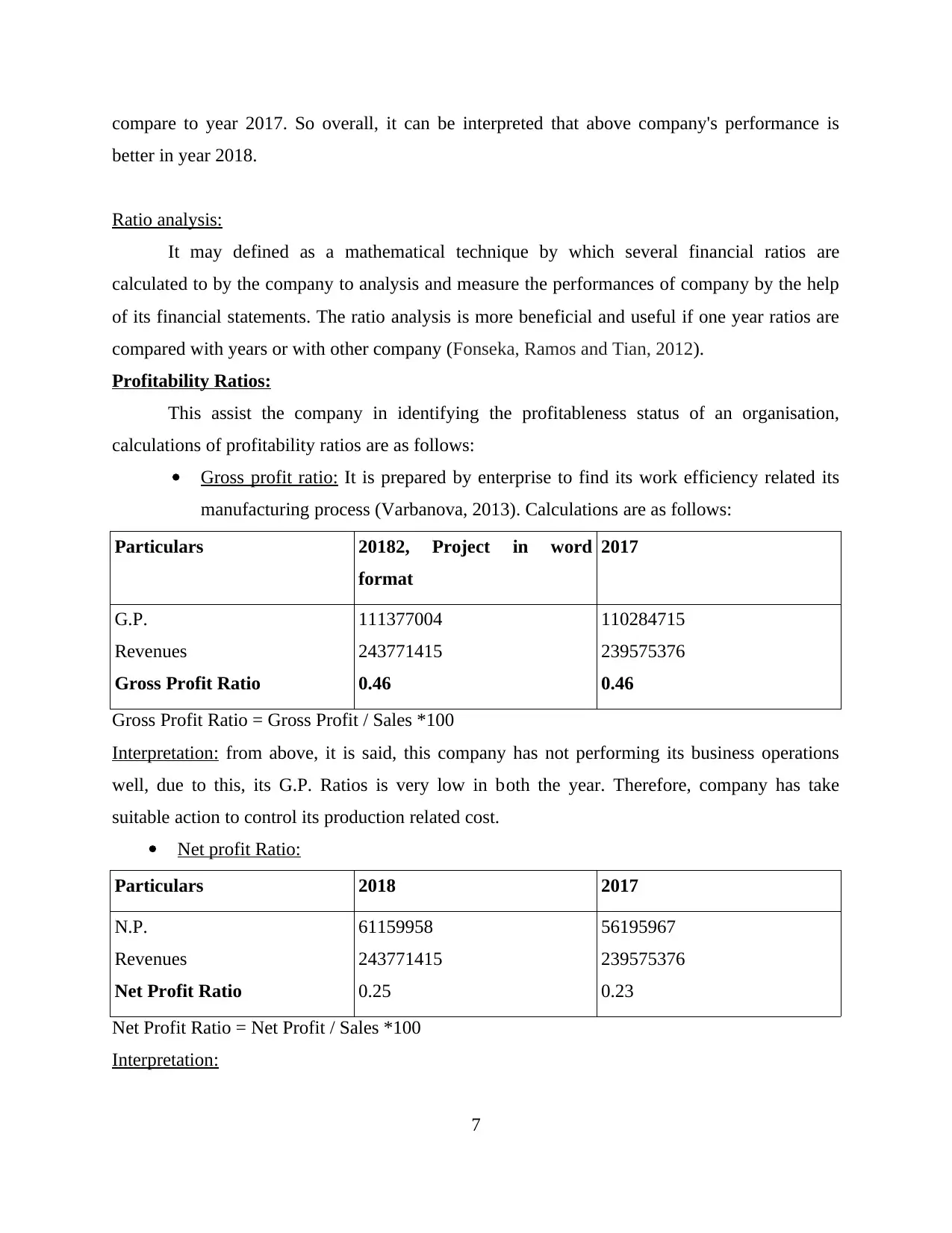

Profitability Ratios:

This assist the company in identifying the profitableness status of an organisation,

calculations of profitability ratios are as follows:

Gross profit ratio: It is prepared by enterprise to find its work efficiency related its

manufacturing process (Varbanova, 2013). Calculations are as follows:

Particulars 20182, Project in word

format

2017

G.P.

Revenues

Gross Profit Ratio

111377004

243771415

0.46

110284715

239575376

0.46

Gross Profit Ratio = Gross Profit / Sales *100

Interpretation: from above, it is said, this company has not performing its business operations

well, due to this, its G.P. Ratios is very low in both the year. Therefore, company has take

suitable action to control its production related cost.

Net profit Ratio:

Particulars 2018 2017

N.P.

Revenues

Net Profit Ratio

61159958

243771415

0.25

56195967

239575376

0.23

Net Profit Ratio = Net Profit / Sales *100

Interpretation:

7

better in year 2018.

Ratio analysis:

It may defined as a mathematical technique by which several financial ratios are

calculated to by the company to analysis and measure the performances of company by the help

of its financial statements. The ratio analysis is more beneficial and useful if one year ratios are

compared with years or with other company (Fonseka, Ramos and Tian, 2012).

Profitability Ratios:

This assist the company in identifying the profitableness status of an organisation,

calculations of profitability ratios are as follows:

Gross profit ratio: It is prepared by enterprise to find its work efficiency related its

manufacturing process (Varbanova, 2013). Calculations are as follows:

Particulars 20182, Project in word

format

2017

G.P.

Revenues

Gross Profit Ratio

111377004

243771415

0.46

110284715

239575376

0.46

Gross Profit Ratio = Gross Profit / Sales *100

Interpretation: from above, it is said, this company has not performing its business operations

well, due to this, its G.P. Ratios is very low in both the year. Therefore, company has take

suitable action to control its production related cost.

Net profit Ratio:

Particulars 2018 2017

N.P.

Revenues

Net Profit Ratio

61159958

243771415

0.25

56195967

239575376

0.23

Net Profit Ratio = Net Profit / Sales *100

Interpretation:

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It has to be evident after seen above calculations that its year 2018 ratios is 0.25% as

compared to year 2017 0.23%. This mean that its net profit ratio has increased but not so much

as in both years it has less than 1% N.P. Ratio. Company shall require to take suitable steps to

control its operating cost to enhance the its profitability.

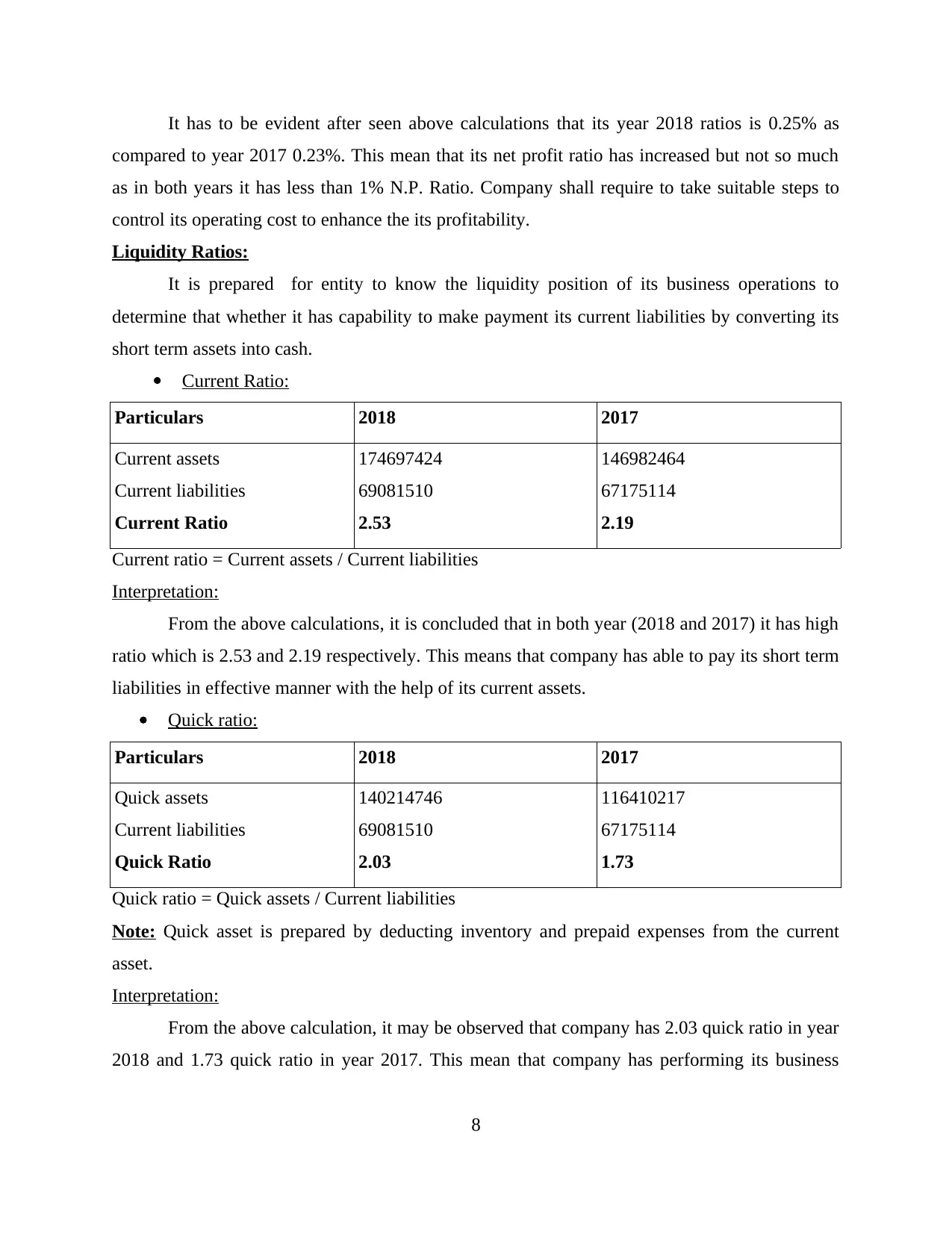

Liquidity Ratios:

It is prepared for entity to know the liquidity position of its business operations to

determine that whether it has capability to make payment its current liabilities by converting its

short term assets into cash.

Current Ratio:

Particulars 2018 2017

Current assets

Current liabilities

Current Ratio

174697424

69081510

2.53

146982464

67175114

2.19

Current ratio = Current assets / Current liabilities

Interpretation:

From the above calculations, it is concluded that in both year (2018 and 2017) it has high

ratio which is 2.53 and 2.19 respectively. This means that company has able to pay its short term

liabilities in effective manner with the help of its current assets.

Quick ratio:

Particulars 2018 2017

Quick assets

Current liabilities

Quick Ratio

140214746

69081510

2.03

116410217

67175114

1.73

Quick ratio = Quick assets / Current liabilities

Note: Quick asset is prepared by deducting inventory and prepaid expenses from the current

asset.

Interpretation:

From the above calculation, it may be observed that company has 2.03 quick ratio in year

2018 and 1.73 quick ratio in year 2017. This mean that company has performing its business

8

compared to year 2017 0.23%. This mean that its net profit ratio has increased but not so much

as in both years it has less than 1% N.P. Ratio. Company shall require to take suitable steps to

control its operating cost to enhance the its profitability.

Liquidity Ratios:

It is prepared for entity to know the liquidity position of its business operations to

determine that whether it has capability to make payment its current liabilities by converting its

short term assets into cash.

Current Ratio:

Particulars 2018 2017

Current assets

Current liabilities

Current Ratio

174697424

69081510

2.53

146982464

67175114

2.19

Current ratio = Current assets / Current liabilities

Interpretation:

From the above calculations, it is concluded that in both year (2018 and 2017) it has high

ratio which is 2.53 and 2.19 respectively. This means that company has able to pay its short term

liabilities in effective manner with the help of its current assets.

Quick ratio:

Particulars 2018 2017

Quick assets

Current liabilities

Quick Ratio

140214746

69081510

2.03

116410217

67175114

1.73

Quick ratio = Quick assets / Current liabilities

Note: Quick asset is prepared by deducting inventory and prepaid expenses from the current

asset.

Interpretation:

From the above calculation, it may be observed that company has 2.03 quick ratio in year

2018 and 1.73 quick ratio in year 2017. This mean that company has performing its business

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

operations very well so that it capacity to pay its current liabilities with the help of its quick

assets by converting them in cash has enhanced.

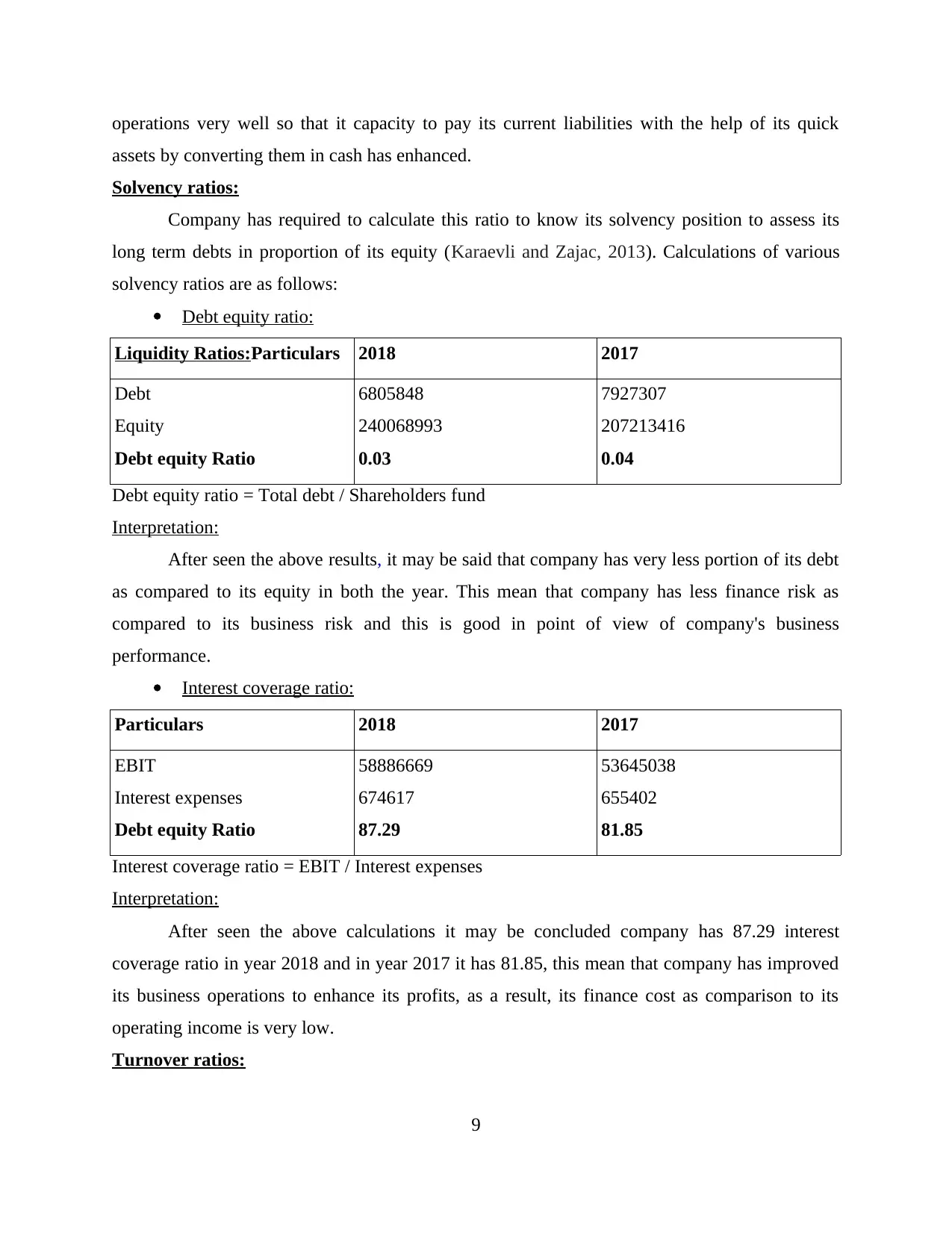

Solvency ratios:

Company has required to calculate this ratio to know its solvency position to assess its

long term debts in proportion of its equity (Karaevli and Zajac, 2013). Calculations of various

solvency ratios are as follows:

Debt equity ratio:

Liquidity Ratios:Particulars 2018 2017

Debt

Equity

Debt equity Ratio

6805848

240068993

0.03

7927307

207213416

0.04

Debt equity ratio = Total debt / Shareholders fund

Interpretation:

After seen the above results, it may be said that company has very less portion of its debt

as compared to its equity in both the year. This mean that company has less finance risk as

compared to its business risk and this is good in point of view of company's business

performance.

Interest coverage ratio:

Particulars 2018 2017

EBIT

Interest expenses

Debt equity Ratio

58886669

674617

87.29

53645038

655402

81.85

Interest coverage ratio = EBIT / Interest expenses

Interpretation:

After seen the above calculations it may be concluded company has 87.29 interest

coverage ratio in year 2018 and in year 2017 it has 81.85, this mean that company has improved

its business operations to enhance its profits, as a result, its finance cost as comparison to its

operating income is very low.

Turnover ratios:

9

assets by converting them in cash has enhanced.

Solvency ratios:

Company has required to calculate this ratio to know its solvency position to assess its

long term debts in proportion of its equity (Karaevli and Zajac, 2013). Calculations of various

solvency ratios are as follows:

Debt equity ratio:

Liquidity Ratios:Particulars 2018 2017

Debt

Equity

Debt equity Ratio

6805848

240068993

0.03

7927307

207213416

0.04

Debt equity ratio = Total debt / Shareholders fund

Interpretation:

After seen the above results, it may be said that company has very less portion of its debt

as compared to its equity in both the year. This mean that company has less finance risk as

compared to its business risk and this is good in point of view of company's business

performance.

Interest coverage ratio:

Particulars 2018 2017

EBIT

Interest expenses

Debt equity Ratio

58886669

674617

87.29

53645038

655402

81.85

Interest coverage ratio = EBIT / Interest expenses

Interpretation:

After seen the above calculations it may be concluded company has 87.29 interest

coverage ratio in year 2018 and in year 2017 it has 81.85, this mean that company has improved

its business operations to enhance its profits, as a result, its finance cost as comparison to its

operating income is very low.

Turnover ratios:

9

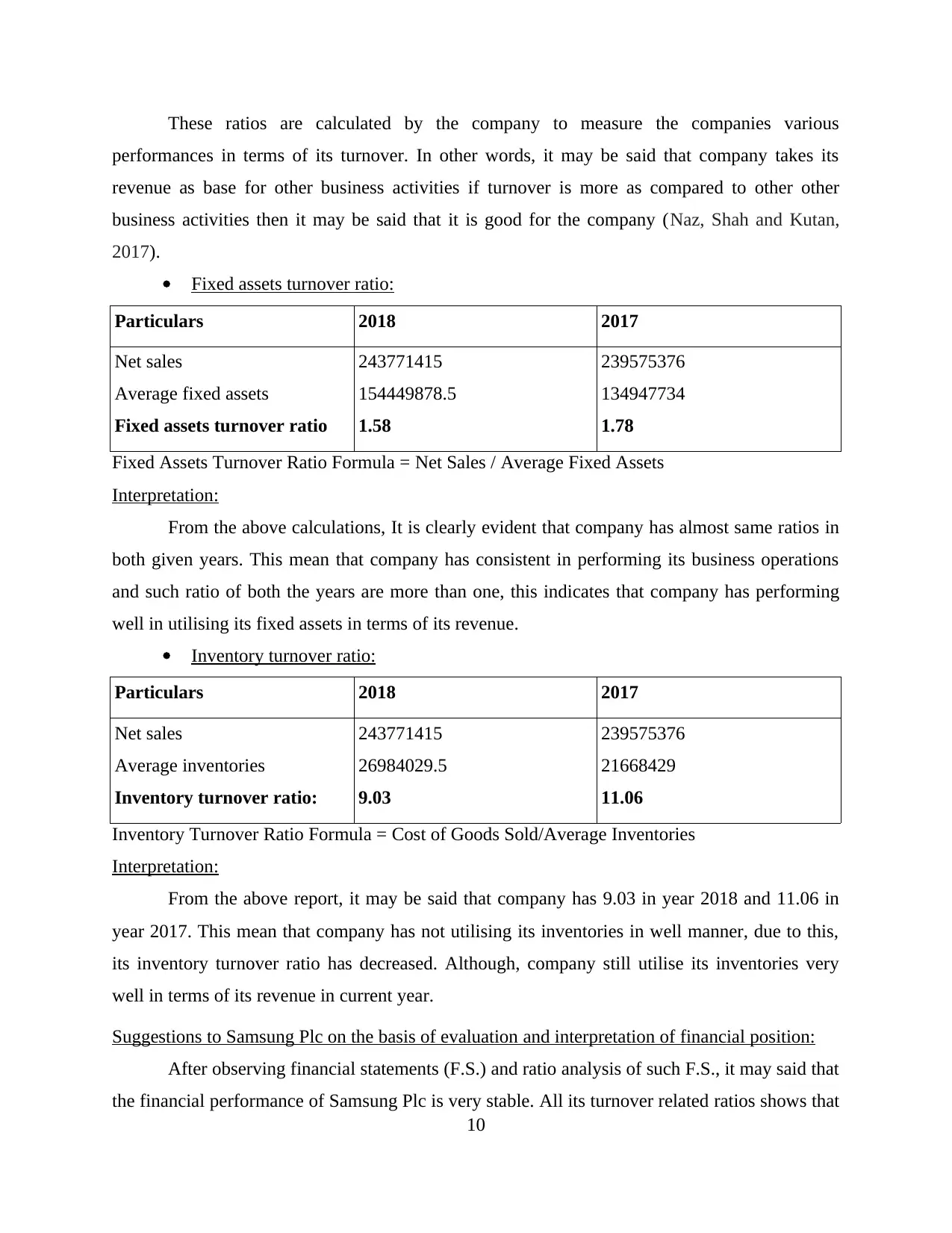

These ratios are calculated by the company to measure the companies various

performances in terms of its turnover. In other words, it may be said that company takes its

revenue as base for other business activities if turnover is more as compared to other other

business activities then it may be said that it is good for the company (Naz, Shah and Kutan,

2017).

Fixed assets turnover ratio:

Particulars 2018 2017

Net sales

Average fixed assets

Fixed assets turnover ratio

243771415

154449878.5

1.58

239575376

134947734

1.78

Fixed Assets Turnover Ratio Formula = Net Sales / Average Fixed Assets

Interpretation:

From the above calculations, It is clearly evident that company has almost same ratios in

both given years. This mean that company has consistent in performing its business operations

and such ratio of both the years are more than one, this indicates that company has performing

well in utilising its fixed assets in terms of its revenue.

Inventory turnover ratio:

Particulars 2018 2017

Net sales

Average inventories

Inventory turnover ratio:

243771415

26984029.5

9.03

239575376

21668429

11.06

Inventory Turnover Ratio Formula = Cost of Goods Sold/Average Inventories

Interpretation:

From the above report, it may be said that company has 9.03 in year 2018 and 11.06 in

year 2017. This mean that company has not utilising its inventories in well manner, due to this,

its inventory turnover ratio has decreased. Although, company still utilise its inventories very

well in terms of its revenue in current year.

Suggestions to Samsung Plc on the basis of evaluation and interpretation of financial position:

After observing financial statements (F.S.) and ratio analysis of such F.S., it may said that

the financial performance of Samsung Plc is very stable. All its turnover related ratios shows that

10

performances in terms of its turnover. In other words, it may be said that company takes its

revenue as base for other business activities if turnover is more as compared to other other

business activities then it may be said that it is good for the company (Naz, Shah and Kutan,

2017).

Fixed assets turnover ratio:

Particulars 2018 2017

Net sales

Average fixed assets

Fixed assets turnover ratio

243771415

154449878.5

1.58

239575376

134947734

1.78

Fixed Assets Turnover Ratio Formula = Net Sales / Average Fixed Assets

Interpretation:

From the above calculations, It is clearly evident that company has almost same ratios in

both given years. This mean that company has consistent in performing its business operations

and such ratio of both the years are more than one, this indicates that company has performing

well in utilising its fixed assets in terms of its revenue.

Inventory turnover ratio:

Particulars 2018 2017

Net sales

Average inventories

Inventory turnover ratio:

243771415

26984029.5

9.03

239575376

21668429

11.06

Inventory Turnover Ratio Formula = Cost of Goods Sold/Average Inventories

Interpretation:

From the above report, it may be said that company has 9.03 in year 2018 and 11.06 in

year 2017. This mean that company has not utilising its inventories in well manner, due to this,

its inventory turnover ratio has decreased. Although, company still utilise its inventories very

well in terms of its revenue in current year.

Suggestions to Samsung Plc on the basis of evaluation and interpretation of financial position:

After observing financial statements (F.S.) and ratio analysis of such F.S., it may said that

the financial performance of Samsung Plc is very stable. All its turnover related ratios shows that

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.