Strategic Management Analysis of Godiva in the United Kingdom

VerifiedAdded on 2020/03/16

|18

|4376

|60

Report

AI Summary

This report provides a comprehensive strategic management analysis of Godiva's operations in the United Kingdom. It begins with an executive summary and an introduction outlining the importance of strategic management. The report then delves into Godiva's company and industry background, followed by an external analysis using PESTLE and Porter's Five Forces frameworks to assess the political, economic, social, technological, legal, and environmental factors, as well as industry rivalry, buyer power, supplier power, and threats of new entrants and substitutes. An internal analysis, including VRIO analysis, evaluates Godiva's resources and capabilities. The report also explores strategic directions using Bowman's Strategy Clock, identifying potential strategies like hybrid, differentiation, and focused differentiation. Finally, the report offers strategic recommendations for Godiva to maintain its competitive advantage in the UK market, concluding with a summary of key findings and suggestions for future success.

Running Head: STRATEGIC MANAGEMENT 1

Strategic Management: Godiva in UK

Strategic Management: Godiva in UK

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

STRATEGIC MANAGEMENT 2

Executive Summary

Strategic Management is an important process for an organization to effectively manage its

business operations. An organization needs to adopt various effective strategies to deal with the

challenges and stay competitive in the industry. The major objective of this report is to analyze

the internal and external environment of the Godiva that is offering premium and luxury

chocolates and other food products at higher prices. This report includes the external analysis of

the company in context of United Kingdom. The environment in this country is favorable for the

business of Godiva. It includes different strategic aspects of the company. Godiva is facing two

major challenges, i.e. intense competition and health concerns of people. Furthermore, it includes

internal analysis of company by considering its resources and capabilities. At the end, it consists

of different strategies in strategy clock of Godiva. The company can go ahead with the given

recommendations to stay competitive in the market.

Executive Summary

Strategic Management is an important process for an organization to effectively manage its

business operations. An organization needs to adopt various effective strategies to deal with the

challenges and stay competitive in the industry. The major objective of this report is to analyze

the internal and external environment of the Godiva that is offering premium and luxury

chocolates and other food products at higher prices. This report includes the external analysis of

the company in context of United Kingdom. The environment in this country is favorable for the

business of Godiva. It includes different strategic aspects of the company. Godiva is facing two

major challenges, i.e. intense competition and health concerns of people. Furthermore, it includes

internal analysis of company by considering its resources and capabilities. At the end, it consists

of different strategies in strategy clock of Godiva. The company can go ahead with the given

recommendations to stay competitive in the market.

STRATEGIC MANAGEMENT 3

Table of Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Company and Industry Background............................................................................................4

External Analysis.............................................................................................................................5

Macro Environmental Analysis (PESTLE Analysis)...................................................................5

Political:....................................................................................................................................5

Economical:..............................................................................................................................5

Social Factors:..........................................................................................................................6

Technological Factors..............................................................................................................6

Legal Factors............................................................................................................................6

Environmental Factors.............................................................................................................7

Micro-Environmental Analysis (Porter’s Five Forces Analysis).................................................7

Industry Rivalry........................................................................................................................7

Bargaining Power of buyers.....................................................................................................7

Bargaining Power of Suppliers.................................................................................................7

Threats of New Entrants...........................................................................................................8

Threats of Substitutes...............................................................................................................8

Internal Analysis (VRIO Analysis).................................................................................................8

Valuable.......................................................................................................................................9

Rare..............................................................................................................................................9

Inimitability................................................................................................................................10

Organization...............................................................................................................................10

Strategic Directions (Bowman’s Strategy Clock)..........................................................................10

Low price and low value added.................................................................................................11

Low Price...................................................................................................................................11

Hybrid........................................................................................................................................11

Differentiation............................................................................................................................12

Focused Differentiation..............................................................................................................12

Risk High Margins.....................................................................................................................12

Monopoly Pricing......................................................................................................................12

Table of Contents

Executive Summary.........................................................................................................................2

Introduction......................................................................................................................................4

Company and Industry Background............................................................................................4

External Analysis.............................................................................................................................5

Macro Environmental Analysis (PESTLE Analysis)...................................................................5

Political:....................................................................................................................................5

Economical:..............................................................................................................................5

Social Factors:..........................................................................................................................6

Technological Factors..............................................................................................................6

Legal Factors............................................................................................................................6

Environmental Factors.............................................................................................................7

Micro-Environmental Analysis (Porter’s Five Forces Analysis).................................................7

Industry Rivalry........................................................................................................................7

Bargaining Power of buyers.....................................................................................................7

Bargaining Power of Suppliers.................................................................................................7

Threats of New Entrants...........................................................................................................8

Threats of Substitutes...............................................................................................................8

Internal Analysis (VRIO Analysis).................................................................................................8

Valuable.......................................................................................................................................9

Rare..............................................................................................................................................9

Inimitability................................................................................................................................10

Organization...............................................................................................................................10

Strategic Directions (Bowman’s Strategy Clock)..........................................................................10

Low price and low value added.................................................................................................11

Low Price...................................................................................................................................11

Hybrid........................................................................................................................................11

Differentiation............................................................................................................................12

Focused Differentiation..............................................................................................................12

Risk High Margins.....................................................................................................................12

Monopoly Pricing......................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

STRATEGIC MANAGEMENT 4

Loss of Market Share.................................................................................................................12

Strategic Recommendations.......................................................................................................13

Conclusion.................................................................................................................................13

References......................................................................................................................................14

Loss of Market Share.................................................................................................................12

Strategic Recommendations.......................................................................................................13

Conclusion.................................................................................................................................13

References......................................................................................................................................14

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

STRATEGIC MANAGEMENT 5

STRATEGIC MANAGEMENT 6

Introduction

Strategic management is the approach that is used to develop and implement new and effective

strategies and marketing tactics, so that it can successfully stay in the competitive business

environment and gain competitive advantage over its competitors. It is an important process for

an organization to enhance its performance and status in perspective market. This report includes

different analyses for strategic management of Godiva in United Kingdom, i.e. a well-established

manufacturer of premium chocolates and other related products, like; cocoa, coffee, truffles,

biscuits, sweets, shakes, chocolate liqueur and party and wedding favors and some other food

items in gift baskets. The organization is well-known and well-established in United Kingdom

and in some other countries due to its premium and luxury chocolates. The report consists of

various strategic aspects about Godiva by conducting different analyses, like; internal analysis,

external analysis and strategy clock etc. At the end, it includes strategic recommendations to

overcome the challenges, which are faced by the organization in this industry.

Company and Industry Background

Godiva Chocolatier is famous producer of premium chocolates and other related food products.

In the year 1926, the organization was found in Belgium. In 2007, it was acquired by Turkish

Yildiz holdings. Currently, the company is operating over 600 shops and boutiques in Canada,

Europe, United States, and United Kingdom, Asia and products and services of Godiva are

available through more than 10000 retailers also. Along with the chocolates, the company also

offers some other food products, like; biscuits, cocoa, truffles, coffee, dipped fruits, sweets,

shakes, chocolate liqueur and other food products, which are prepared in gift baskets. In addition,

Godiva manufactures some occasional and seasonal chocolates with special gift packing for

special occasions (Godiva, 2017). The signature package of this company is Gold Ballotin. In

addition to chocolates and food products, the company has taken license for manufacturing the

ice-cream, coffee pods, cheesecake, which comes in different flavors of chocolate. It offers the

products in Kosher and sugar free varieties.

Godiva is offering its products and services in different countries. The company has covered the

food and chocolate industry in United Kingdom by its premium chocolates. The chocolate

industry in United Kingdom is one of the largest in European Union with British people having

Introduction

Strategic management is the approach that is used to develop and implement new and effective

strategies and marketing tactics, so that it can successfully stay in the competitive business

environment and gain competitive advantage over its competitors. It is an important process for

an organization to enhance its performance and status in perspective market. This report includes

different analyses for strategic management of Godiva in United Kingdom, i.e. a well-established

manufacturer of premium chocolates and other related products, like; cocoa, coffee, truffles,

biscuits, sweets, shakes, chocolate liqueur and party and wedding favors and some other food

items in gift baskets. The organization is well-known and well-established in United Kingdom

and in some other countries due to its premium and luxury chocolates. The report consists of

various strategic aspects about Godiva by conducting different analyses, like; internal analysis,

external analysis and strategy clock etc. At the end, it includes strategic recommendations to

overcome the challenges, which are faced by the organization in this industry.

Company and Industry Background

Godiva Chocolatier is famous producer of premium chocolates and other related food products.

In the year 1926, the organization was found in Belgium. In 2007, it was acquired by Turkish

Yildiz holdings. Currently, the company is operating over 600 shops and boutiques in Canada,

Europe, United States, and United Kingdom, Asia and products and services of Godiva are

available through more than 10000 retailers also. Along with the chocolates, the company also

offers some other food products, like; biscuits, cocoa, truffles, coffee, dipped fruits, sweets,

shakes, chocolate liqueur and other food products, which are prepared in gift baskets. In addition,

Godiva manufactures some occasional and seasonal chocolates with special gift packing for

special occasions (Godiva, 2017). The signature package of this company is Gold Ballotin. In

addition to chocolates and food products, the company has taken license for manufacturing the

ice-cream, coffee pods, cheesecake, which comes in different flavors of chocolate. It offers the

products in Kosher and sugar free varieties.

Godiva is offering its products and services in different countries. The company has covered the

food and chocolate industry in United Kingdom by its premium chocolates. The chocolate

industry in United Kingdom is one of the largest in European Union with British people having

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

STRATEGIC MANAGEMENT 7

more chocolates than other country in European Union (Burns, 2016). So, it is beneficial for the

organization to offer its products in United Kingdom. It will enhance the sales of its chocolates

and other food products. According to a survey, it was analyzed that approximately 20% of the

chocolates sold in the country is consumed by people above 55 years. There are various players

in the industry, which are posing competition for Godiva in UK, like; Cadbury, Ferrero, Galaxy,

Mars, Maltesers etc. Godiva can take various benefits and competitive advantage as it offers the

occasional and seasonal chocolates with attractive and special packaging (Godiva, 2017).

There are some challenges, which are faced by Godiva in UK industry. The major challenges are

like; intense competition and health concerns, as people are becoming more conscious for their

health. It is affecting the sales of chocolate products and decreasing the revenues of the company

in UK chocolate industry.

External Analysis

Macro Environmental Analysis (PESTLE Analysis)

Pestle analysis is an approach which has been executed by the business organization so as to

execute the external environment and also the factor which are prevailing in the business

environment and are also held responsible for stimulating the operations within the

organizational structure. The below executed analysis has been made focused on the external

components of Godiva Gems:

Political:

The political elements comprises of the political stability of the economy, the trends emerged

due to the political operations and activities etc. These are some of the components which are

very much liable in stimulating the business environment of Godiva Gems (Agarwal, Grassl &

Pahl, 2012). For instance, the business entity has a need to comply legally with other industries

for the government regulations which include health, sanitation, and safety rules for the

operations and activities etc. In case of products labeling the rules and regulations should be

strictly followed by the entity. The imposition of taxes has been considered as another liable

political factor which determines how Godiva has been managing the products and services. For

example, if there is a rise in the value-added tax, then this may lead to an increase in the

more chocolates than other country in European Union (Burns, 2016). So, it is beneficial for the

organization to offer its products in United Kingdom. It will enhance the sales of its chocolates

and other food products. According to a survey, it was analyzed that approximately 20% of the

chocolates sold in the country is consumed by people above 55 years. There are various players

in the industry, which are posing competition for Godiva in UK, like; Cadbury, Ferrero, Galaxy,

Mars, Maltesers etc. Godiva can take various benefits and competitive advantage as it offers the

occasional and seasonal chocolates with attractive and special packaging (Godiva, 2017).

There are some challenges, which are faced by Godiva in UK industry. The major challenges are

like; intense competition and health concerns, as people are becoming more conscious for their

health. It is affecting the sales of chocolate products and decreasing the revenues of the company

in UK chocolate industry.

External Analysis

Macro Environmental Analysis (PESTLE Analysis)

Pestle analysis is an approach which has been executed by the business organization so as to

execute the external environment and also the factor which are prevailing in the business

environment and are also held responsible for stimulating the operations within the

organizational structure. The below executed analysis has been made focused on the external

components of Godiva Gems:

Political:

The political elements comprises of the political stability of the economy, the trends emerged

due to the political operations and activities etc. These are some of the components which are

very much liable in stimulating the business environment of Godiva Gems (Agarwal, Grassl &

Pahl, 2012). For instance, the business entity has a need to comply legally with other industries

for the government regulations which include health, sanitation, and safety rules for the

operations and activities etc. In case of products labeling the rules and regulations should be

strictly followed by the entity. The imposition of taxes has been considered as another liable

political factor which determines how Godiva has been managing the products and services. For

example, if there is a rise in the value-added tax, then this may lead to an increase in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

STRATEGIC MANAGEMENT 8

chocolate price and reduced sales. And however there will be a decrease in the taxes and this will

increase the demand for the products.

Economical:

The economical factor comprises of the economic stability of the economy which is linked with

the stability of the business corporation and also gets affected from the same. For instance the

interest rates or the tax rates increased by the governing authorities of UK will surely have

impacts on the prices of the products and which will directly have an impact on the demand of

the products. Moreover, due to global economic downturn there was a pause or softness in the

sales of Godiva Gems (Bock, Opsahl & George, 2010). On the basis of the research it was also

observed that the consumers reduced visiting the malls where the stores and boutiques of the

business entity are located and which also affected the sales graphs.

Social Factors:

The business corporation is found very much concerned about the society and has been involved

into the operations and activities which are social friendly and are manufactured after

considering the needs of the society. Moreover, there are various concerns in United Kingdom

owing to increasing cases and situations of obesity and other health issues. Many doctors and

nutritionists advise the people to reduce the consumption of chocolates and other sugar products

that will impact the sales of Godiva in the future. As it is offering chocolates and gift wrapped

chocolates, so it must go ahead with the youth segment (Kluyver, 2010). The youth generally

prefer to gift the luxury chocolates on special occasions to the people whom they care and they

want to make an impression. In addition, the company is offering sugar free chocolates, which

can be consumed by the people with diabetes and sugar diseases.

Technological Factors

In today’s business environment, technological factors play an important role in the growth and

success of an organization. The organizations are using new and advanced technology to update

and upgrade its operations and services. Godiva has adopted various technological aspects,

which are related to trends in this industry. It has an attractive website, which is depends upon to

develop brand awareness and image. Furthermore, it uses this website for ordering facility for its

chocolates and other food products and discussing about the reputational concerns among

strategic consumer relations (Garrone, Pieters and Swinnen, 2016). In addition, Godiva is

chocolate price and reduced sales. And however there will be a decrease in the taxes and this will

increase the demand for the products.

Economical:

The economical factor comprises of the economic stability of the economy which is linked with

the stability of the business corporation and also gets affected from the same. For instance the

interest rates or the tax rates increased by the governing authorities of UK will surely have

impacts on the prices of the products and which will directly have an impact on the demand of

the products. Moreover, due to global economic downturn there was a pause or softness in the

sales of Godiva Gems (Bock, Opsahl & George, 2010). On the basis of the research it was also

observed that the consumers reduced visiting the malls where the stores and boutiques of the

business entity are located and which also affected the sales graphs.

Social Factors:

The business corporation is found very much concerned about the society and has been involved

into the operations and activities which are social friendly and are manufactured after

considering the needs of the society. Moreover, there are various concerns in United Kingdom

owing to increasing cases and situations of obesity and other health issues. Many doctors and

nutritionists advise the people to reduce the consumption of chocolates and other sugar products

that will impact the sales of Godiva in the future. As it is offering chocolates and gift wrapped

chocolates, so it must go ahead with the youth segment (Kluyver, 2010). The youth generally

prefer to gift the luxury chocolates on special occasions to the people whom they care and they

want to make an impression. In addition, the company is offering sugar free chocolates, which

can be consumed by the people with diabetes and sugar diseases.

Technological Factors

In today’s business environment, technological factors play an important role in the growth and

success of an organization. The organizations are using new and advanced technology to update

and upgrade its operations and services. Godiva has adopted various technological aspects,

which are related to trends in this industry. It has an attractive website, which is depends upon to

develop brand awareness and image. Furthermore, it uses this website for ordering facility for its

chocolates and other food products and discussing about the reputational concerns among

strategic consumer relations (Garrone, Pieters and Swinnen, 2016). In addition, Godiva is

STRATEGIC MANAGEMENT 9

adopting different tools and techniques for its internal and external operations, like; ERP, CRM

etc.

Legal Factors

Godiva is operating within a systematic legal framework and following all the rules and

regulations of the country. It is complying with all the taxes and regulations, which are imposed

in the companies in chocolate industry. Godiva has faced some issues related to regulations and

policies. In the UK industry, it was forced to decrease its marketing efforts for ice-cream

segment to eliminate the legal disputes in the future. The firm did not want to come in any

business concern, which seems violate the trade regulations and policies. The company is needed

to pay different taxes to government at different tax rates (Ho, 2014).

Environmental Factors

For the growth of each and every company, environmental factors play a significant role, as the

people are becoming very much concerned about environment and related things. After

considering these factors, Godiva has increased its attention towards corporate social

responsibility (Hill, Jones and Schilling, 2014). It is focusing on the environmental concerns,

which are received from customers related to recycling and packaging of chocolates and other

food products.

Micro-Environmental Analysis (Porter’s Five Forces Analysis)

Micro-environmental analysis is a tool of strategic management that is used by an organization to

analyze different factors in the industry, which may impact the growth and success of company

in respective industry. In this, the analysis for Godiva has been conducted by evaluating Porter’s

five forces, which are given below;

Industry Rivalry

For Godiva, industry rivalry is high in UK chocolate industry. There are various companies,

which are competing against Godiva and planning to make control over this company (Hitt,

Ireland and Hoskisson, 2012). The major competitors in the industry are, like; Ferrero, Cadbury,

Galaxy, Mars etc. These players have covered a significant market share in the UK chocolate

industry. Industry rivalry will be powerful among these firms as they offer similar products and

services in their stores. Godiva is offering premium chocolates, so prices of products are higher

than its competitors. It is affecting the growth of its business in the country.

adopting different tools and techniques for its internal and external operations, like; ERP, CRM

etc.

Legal Factors

Godiva is operating within a systematic legal framework and following all the rules and

regulations of the country. It is complying with all the taxes and regulations, which are imposed

in the companies in chocolate industry. Godiva has faced some issues related to regulations and

policies. In the UK industry, it was forced to decrease its marketing efforts for ice-cream

segment to eliminate the legal disputes in the future. The firm did not want to come in any

business concern, which seems violate the trade regulations and policies. The company is needed

to pay different taxes to government at different tax rates (Ho, 2014).

Environmental Factors

For the growth of each and every company, environmental factors play a significant role, as the

people are becoming very much concerned about environment and related things. After

considering these factors, Godiva has increased its attention towards corporate social

responsibility (Hill, Jones and Schilling, 2014). It is focusing on the environmental concerns,

which are received from customers related to recycling and packaging of chocolates and other

food products.

Micro-Environmental Analysis (Porter’s Five Forces Analysis)

Micro-environmental analysis is a tool of strategic management that is used by an organization to

analyze different factors in the industry, which may impact the growth and success of company

in respective industry. In this, the analysis for Godiva has been conducted by evaluating Porter’s

five forces, which are given below;

Industry Rivalry

For Godiva, industry rivalry is high in UK chocolate industry. There are various companies,

which are competing against Godiva and planning to make control over this company (Hitt,

Ireland and Hoskisson, 2012). The major competitors in the industry are, like; Ferrero, Cadbury,

Galaxy, Mars etc. These players have covered a significant market share in the UK chocolate

industry. Industry rivalry will be powerful among these firms as they offer similar products and

services in their stores. Godiva is offering premium chocolates, so prices of products are higher

than its competitors. It is affecting the growth of its business in the country.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

STRATEGIC MANAGEMENT 10

Bargaining Power of buyers

Bargaining power of buyers is moderate for the organization in this sector. The buyers of Godiva

are dispersed all over the world and they are billions in the number. In the industry, the number

of competitors is increasing with the premium and luxury chocolates and with attractive

packaging. They are offering their chocolates and other food products at lower prices, which can

alter the customer loyalty. The customers may switch to any other brands with similar products.

There is no switching cost for buyers (Kipley & Jewe, 2014).

Bargaining Power of Suppliers

Bargaining power of suppliers is very low in the UK chocolate industry, as there are so many

suppliers in the industry. Godiva has greater bargaining power in comparison to its suppliers. As

there are number of suppliers in the industry, so that organization can purchase raw materials at

lower costs and in the bulk.

Threats of New Entrants

For Godiva, the threat of new entrants is low as there are so many organizations, which are

already well-known and well-established for their products and services. These firms consist of,

like; Mars, Ferrero, Cadbury, Nestle and some other international brands (Meissner, 2012). It

creates a barrier for entry to start a new brand or company. Moreover, another barrier is

requirement of high capital investment in the initial phase of start-up.

Threats of Substitutes

Threat of substitutes is moderate for Godiva in United Kingdom. In the country, supermarkets

are trying to imitate the famous chocolates and offering their own brands in the stores at

comparatively lower prices. Moreover, confectionaries have been brought various gift packs and

snacks. Thus, there is a number of substitutes, which exist in the market, like; beverages, chips

etc. But, still Chocolate products cover higher share than its substitutes as people can preserve

them easily.

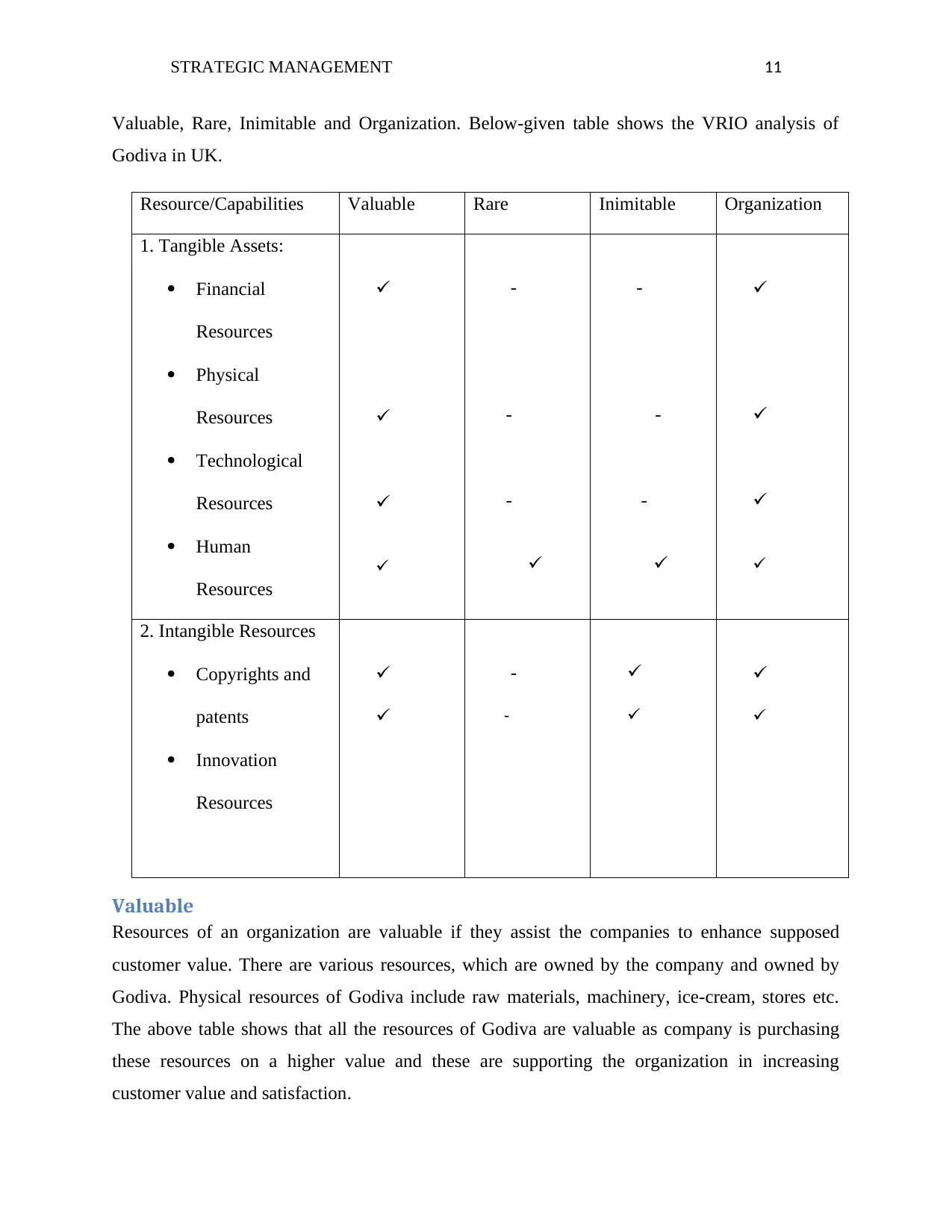

Internal Analysis (VRIO Analysis)

Internal analysis of an organization can be conducted by using VRIO analysis. VRIO analysis is

a strategic tool that is practiced to determine that which capabilities and resources of the

company are more useful for its competitive advantage and power (Managementmania, 2016).

This consists of the resources and capabilities that have different characteristics of VRIO, like;

Bargaining Power of buyers

Bargaining power of buyers is moderate for the organization in this sector. The buyers of Godiva

are dispersed all over the world and they are billions in the number. In the industry, the number

of competitors is increasing with the premium and luxury chocolates and with attractive

packaging. They are offering their chocolates and other food products at lower prices, which can

alter the customer loyalty. The customers may switch to any other brands with similar products.

There is no switching cost for buyers (Kipley & Jewe, 2014).

Bargaining Power of Suppliers

Bargaining power of suppliers is very low in the UK chocolate industry, as there are so many

suppliers in the industry. Godiva has greater bargaining power in comparison to its suppliers. As

there are number of suppliers in the industry, so that organization can purchase raw materials at

lower costs and in the bulk.

Threats of New Entrants

For Godiva, the threat of new entrants is low as there are so many organizations, which are

already well-known and well-established for their products and services. These firms consist of,

like; Mars, Ferrero, Cadbury, Nestle and some other international brands (Meissner, 2012). It

creates a barrier for entry to start a new brand or company. Moreover, another barrier is

requirement of high capital investment in the initial phase of start-up.

Threats of Substitutes

Threat of substitutes is moderate for Godiva in United Kingdom. In the country, supermarkets

are trying to imitate the famous chocolates and offering their own brands in the stores at

comparatively lower prices. Moreover, confectionaries have been brought various gift packs and

snacks. Thus, there is a number of substitutes, which exist in the market, like; beverages, chips

etc. But, still Chocolate products cover higher share than its substitutes as people can preserve

them easily.

Internal Analysis (VRIO Analysis)

Internal analysis of an organization can be conducted by using VRIO analysis. VRIO analysis is

a strategic tool that is practiced to determine that which capabilities and resources of the

company are more useful for its competitive advantage and power (Managementmania, 2016).

This consists of the resources and capabilities that have different characteristics of VRIO, like;

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

STRATEGIC MANAGEMENT 11

Valuable, Rare, Inimitable and Organization. Below-given table shows the VRIO analysis of

Godiva in UK.

Resource/Capabilities Valuable Rare Inimitable Organization

1. Tangible Assets:

Financial

Resources

Physical

Resources

Technological

Resources

Human

Resources

-

-

-

-

-

-

2. Intangible Resources

Copyrights and

patents

Innovation

Resources

-

-

Valuable

Resources of an organization are valuable if they assist the companies to enhance supposed

customer value. There are various resources, which are owned by the company and owned by

Godiva. Physical resources of Godiva include raw materials, machinery, ice-cream, stores etc.

The above table shows that all the resources of Godiva are valuable as company is purchasing

these resources on a higher value and these are supporting the organization in increasing

customer value and satisfaction.

Valuable, Rare, Inimitable and Organization. Below-given table shows the VRIO analysis of

Godiva in UK.

Resource/Capabilities Valuable Rare Inimitable Organization

1. Tangible Assets:

Financial

Resources

Physical

Resources

Technological

Resources

Human

Resources

-

-

-

-

-

-

2. Intangible Resources

Copyrights and

patents

Innovation

Resources

-

-

Valuable

Resources of an organization are valuable if they assist the companies to enhance supposed

customer value. There are various resources, which are owned by the company and owned by

Godiva. Physical resources of Godiva include raw materials, machinery, ice-cream, stores etc.

The above table shows that all the resources of Godiva are valuable as company is purchasing

these resources on a higher value and these are supporting the organization in increasing

customer value and satisfaction.

STRATEGIC MANAGEMENT 12

Rare

This component of VRIO analysis indicates that how limited and rare are the resources. At

Godiva, there is only resource, which can be considered as rare, like; human resources. The

company has several people in its team, who have patented a lot of their products and services,

hence making sure significant competitive advantage for Godiva (Nagle, Hogan and Zale, 2016).

Inimitability

Organizations, which have rare, valuable and expensive to copy resources can attain significant

competitive advantage. Godiva is offering the premium and luxury chocolates, so imitation of

resources is significantly low. The company is trying to sustain its market share with the efforts

in marketing and research and development process. The organizations cannot copy its resources,

like; copyrights, patents and innovations of organization.

Organization

A company must organize its processes, systems, policies, management, culture and

organizational structure to become able to realize the capacity of its rare, valuable and inimitable

resources and capabilities. By this only, an organization can attain a significant competitive

advantage (Peteraf, Gamble and Thompson, 2014). At Godiva, all of the resources are assisted

by existing systems and management and organization can use the resources properly. Godiva’s

priority has always been to carry the best and most innovative chocolates to the people that make

difference from its competitors.

Strategic Directions (Bowman’s Strategy Clock)

Strategic clock of Bowman is a model, which discovers different options for strategic direction,

i.e. how the products and services of an organization should be positioned and directed in the

market to provide it competitive position in the industry (Thompson & Martin, 2010). This

strategy clock assists in understanding different alternatives of how a company can position its

products on the basis of two dimensions, i.e. perceived value and price. Strategic clock for

Godiva is explained below;

Rare

This component of VRIO analysis indicates that how limited and rare are the resources. At

Godiva, there is only resource, which can be considered as rare, like; human resources. The

company has several people in its team, who have patented a lot of their products and services,

hence making sure significant competitive advantage for Godiva (Nagle, Hogan and Zale, 2016).

Inimitability

Organizations, which have rare, valuable and expensive to copy resources can attain significant

competitive advantage. Godiva is offering the premium and luxury chocolates, so imitation of

resources is significantly low. The company is trying to sustain its market share with the efforts

in marketing and research and development process. The organizations cannot copy its resources,

like; copyrights, patents and innovations of organization.

Organization

A company must organize its processes, systems, policies, management, culture and

organizational structure to become able to realize the capacity of its rare, valuable and inimitable

resources and capabilities. By this only, an organization can attain a significant competitive

advantage (Peteraf, Gamble and Thompson, 2014). At Godiva, all of the resources are assisted

by existing systems and management and organization can use the resources properly. Godiva’s

priority has always been to carry the best and most innovative chocolates to the people that make

difference from its competitors.

Strategic Directions (Bowman’s Strategy Clock)

Strategic clock of Bowman is a model, which discovers different options for strategic direction,

i.e. how the products and services of an organization should be positioned and directed in the

market to provide it competitive position in the industry (Thompson & Martin, 2010). This

strategy clock assists in understanding different alternatives of how a company can position its

products on the basis of two dimensions, i.e. perceived value and price. Strategic clock for

Godiva is explained below;

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.