Strategic Information Systems for Business: CBA Case Study

VerifiedAdded on 2023/06/12

|20

|4527

|436

Report

AI Summary

This report provides a comprehensive analysis of the strategic information systems employed by the Commonwealth Bank of Australia (CBA). It begins by outlining the bank's organizational structure and the operational challenges it faces, including declining market share and customer dissatisfaction. The report then examines the strategies adopted by CBA to address these challenges, focusing on customer-centric approaches, technological advancements, and productivity improvements. The system acquisition methods used by the organization, including commercial software, custom software, and ERP systems, are discussed. Furthermore, the report includes a system flowchart illustrating the bank's procedures and identifies potential control problems and fraud risks. The second part of the report delves into the development and adaptation of accounting software packages by CBA, assessing the current market size, key players, and competitive advantages. Finally, the report highlights the gaps and challenges encountered by users of these accounting software packages and offers recommendations to mitigate these issues. This resource is helpful for students studying Strategic Information Systems for Business and Enterprise.

Running Head: STRATEGIC INFORMATION SYSTEM

Strategic Information System

[Name of the Student]

[Name of the University]

[Author note]

Strategic Information System

[Name of the Student]

[Name of the University]

[Author note]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction:

Accounting software is nothing but a software which is having the function of executing the

different type of transactions. The software also consists of another function that is to track and

operate the various kind of transactions along with the execution of the transactions. Different

types of business models are associated with the usage of the software due to the reason that this

type of software are very much efficient and are associated with favoring the various processes

that are included in the business(Grabinskia, Kedziora and Krasodomska 2014). This is a

literature review which is associated with discussing about the organization known as the

“Commonwealth Bank of Australia” which is one of the top four bank of Australia. The

Accounting software acts as the information system that is associated with performing various

processes related to accounting. The third party providers are associated with providing this

software to various companies that want to use the accounting software. Once an organization

wishes to use the software then the vendors are associated with distributing this software to the

organization (Aletkin 2014). Despite of this in some cases it has also been seen that the

accounting software often acting as an integration of both the two cases mentioned above but are

consisting of some type of alterations. There exists two type of accounting software and this

classification has been done depending upon the environment in which they work. The two main

categories mainly includes the online accounting software and computer based accounting

software. Besides this this kind of software are associated with providing the facility of giving

access of the accounts to the users any time and from anywhere (Malíková and Brabec 2012).

The literature review regarding the Commonwealth bank of Australia would be

associated with providing an overview of the structure that the organization is having along with

reviewing the various type of operational problems which the organization facing due to the

Accounting software is nothing but a software which is having the function of executing the

different type of transactions. The software also consists of another function that is to track and

operate the various kind of transactions along with the execution of the transactions. Different

types of business models are associated with the usage of the software due to the reason that this

type of software are very much efficient and are associated with favoring the various processes

that are included in the business(Grabinskia, Kedziora and Krasodomska 2014). This is a

literature review which is associated with discussing about the organization known as the

“Commonwealth Bank of Australia” which is one of the top four bank of Australia. The

Accounting software acts as the information system that is associated with performing various

processes related to accounting. The third party providers are associated with providing this

software to various companies that want to use the accounting software. Once an organization

wishes to use the software then the vendors are associated with distributing this software to the

organization (Aletkin 2014). Despite of this in some cases it has also been seen that the

accounting software often acting as an integration of both the two cases mentioned above but are

consisting of some type of alterations. There exists two type of accounting software and this

classification has been done depending upon the environment in which they work. The two main

categories mainly includes the online accounting software and computer based accounting

software. Besides this this kind of software are associated with providing the facility of giving

access of the accounts to the users any time and from anywhere (Malíková and Brabec 2012).

The literature review regarding the Commonwealth bank of Australia would be

associated with providing an overview of the structure that the organization is having along with

reviewing the various type of operational problems which the organization facing due to the

structure of the organization. Then the literature review has been associated with discussing the

system acquisition method adopted by the organization which includes the commercial software,

custom software along with the ERP. Followed by this a system flowchart has been provided

regarding the procedures in the bank. Lastly the control problems have been identified along

with identifying the various kind of frauds that might occur in the Commonwealth bank of

Australia.

The second part of the literature review discusses about the development and adaptation

of the accounting software packages by the Commonwealth bank of Australia. The second part

also provides an overview of the current market size along with identifying the leaders in the

market and what are the things that are associated with providing the bank with a competitive

advantage. Lastly the gaps ad challenges has been identified which are encountered by the users

or the customers of the accounting software packages and certain recommendations have been

also been provided in order to tackle the challenges.

Discussion:

Part 1:

About the Organization: Commonwealth Bank of Australia

Commonwealth bank of Australia is listed as one of the top four bank of Australia having

the highest number of market shares which has its branches operating in several other areas all

across the globe. The Commonwealth bank has been operating in various regions of the world to

provide various kind of services related to finance such as the “ services related to fund

management”, “ services like giving of loans and making of investments”, “retail banking”,

“education loans”, “other types of loan” and many more (Commbank.com.au. 2018). The

system acquisition method adopted by the organization which includes the commercial software,

custom software along with the ERP. Followed by this a system flowchart has been provided

regarding the procedures in the bank. Lastly the control problems have been identified along

with identifying the various kind of frauds that might occur in the Commonwealth bank of

Australia.

The second part of the literature review discusses about the development and adaptation

of the accounting software packages by the Commonwealth bank of Australia. The second part

also provides an overview of the current market size along with identifying the leaders in the

market and what are the things that are associated with providing the bank with a competitive

advantage. Lastly the gaps ad challenges has been identified which are encountered by the users

or the customers of the accounting software packages and certain recommendations have been

also been provided in order to tackle the challenges.

Discussion:

Part 1:

About the Organization: Commonwealth Bank of Australia

Commonwealth bank of Australia is listed as one of the top four bank of Australia having

the highest number of market shares which has its branches operating in several other areas all

across the globe. The Commonwealth bank has been operating in various regions of the world to

provide various kind of services related to finance such as the “ services related to fund

management”, “ services like giving of loans and making of investments”, “retail banking”,

“education loans”, “other types of loan” and many more (Commbank.com.au. 2018). The

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Australian Securities Exchange also known as the ASE has been associated with listing the

Commonwealth bank of Australia as the best bank in its report published in the year of 2015.

The major operations of the bank started in 1911 which was operated by the government of

Australia. The major competitors of this bank includes the Australia New Zealand bank, Westpac

and lastly the NAB or the National Australian Bank. Despite of being established by the

Australian government it become totally private in the 1996.

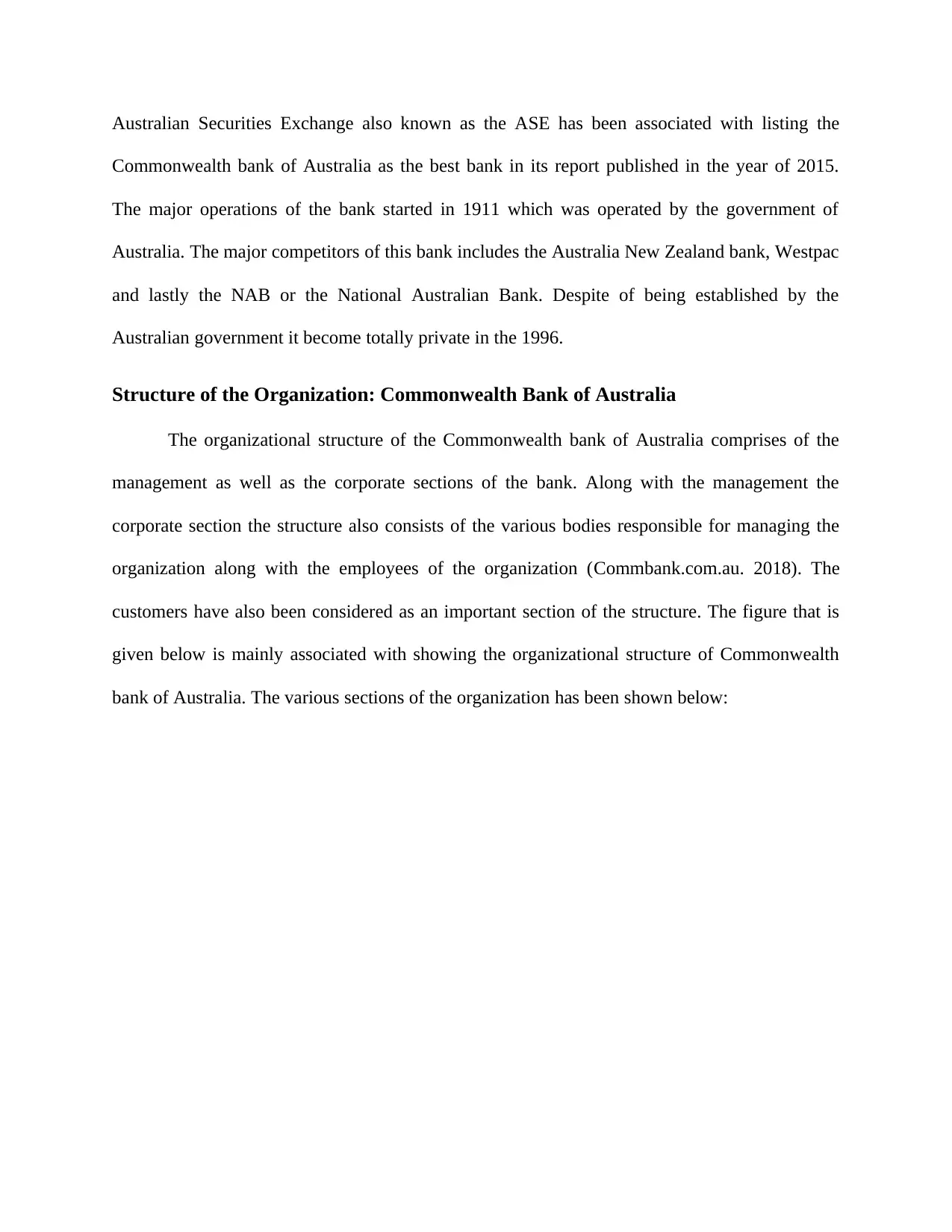

Structure of the Organization: Commonwealth Bank of Australia

The organizational structure of the Commonwealth bank of Australia comprises of the

management as well as the corporate sections of the bank. Along with the management the

corporate section the structure also consists of the various bodies responsible for managing the

organization along with the employees of the organization (Commbank.com.au. 2018). The

customers have also been considered as an important section of the structure. The figure that is

given below is mainly associated with showing the organizational structure of Commonwealth

bank of Australia. The various sections of the organization has been shown below:

Commonwealth bank of Australia as the best bank in its report published in the year of 2015.

The major operations of the bank started in 1911 which was operated by the government of

Australia. The major competitors of this bank includes the Australia New Zealand bank, Westpac

and lastly the NAB or the National Australian Bank. Despite of being established by the

Australian government it become totally private in the 1996.

Structure of the Organization: Commonwealth Bank of Australia

The organizational structure of the Commonwealth bank of Australia comprises of the

management as well as the corporate sections of the bank. Along with the management the

corporate section the structure also consists of the various bodies responsible for managing the

organization along with the employees of the organization (Commbank.com.au. 2018). The

customers have also been considered as an important section of the structure. The figure that is

given below is mainly associated with showing the organizational structure of Commonwealth

bank of Australia. The various sections of the organization has been shown below:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 1: Organizational structure of Commonwealth Bank of Australia

(Source: Commbank.com.au, 2018)

Problems Faced by the Organization: Commonwealth Bank of Australia

The Commonwealth bank of Australia is the largest bank of Australia but still it faces certain

problems and in this literature review we would be discussing about the major problems which

are faced by the bank, Commonwealth bank of Australia. From the latest market survey it was

found that there has been occurring a drastic fall of the market shares of this bank and due to this

fall in the value of the shares, the bank is facing certain problems while conducting its various

business processes mainly during the process of providing service to the customers (Sam et al.

(Source: Commbank.com.au, 2018)

Problems Faced by the Organization: Commonwealth Bank of Australia

The Commonwealth bank of Australia is the largest bank of Australia but still it faces certain

problems and in this literature review we would be discussing about the major problems which

are faced by the bank, Commonwealth bank of Australia. From the latest market survey it was

found that there has been occurring a drastic fall of the market shares of this bank and due to this

fall in the value of the shares, the bank is facing certain problems while conducting its various

business processes mainly during the process of providing service to the customers (Sam et al.

2012). From the records collected in last few years it has been seen the major reason for this

facing this type of problem is mainly because of the reason that the Commonwealth bank of

Australia is making of strategies which are not at all suitable for the organization and the services

that they provide. After identification of the reasons that lies behind the major problems faced by

them the Commonwealth bank of Australia, they have started to implement certain steps which

would be helping them a lot in tackling of the problems that has been identified by them

(Commbank.com.au. 2018). This steps would also be helping them in making improvements as

well. but still some problems exists even after taking certain steps and it was found that the way

in which they were operating in order to tackle the problems were totally wrong and the major

reason due to which the strategies were considered wrong was because of the fact that they did

not understood the constant changes which were taking place within the market. The major

reason lying behind the alterations of mainly due to the organizational structure that the

Commonwealth bank of Australia was having and also due to competitions that exists between

the chosen bank and the other banks present in Australia. The problems were not only restricted

to this and started to grow even more when the requirements of the customers were not being

satisfied (Hammad, Jusoh and Ghozali 2013). It has been found that the customers are not at all

satisfied with the services that are provide by the Commonwealth bank of Australia because the

necessities of the customers were at all being fulfilled. This problem could be better understand

by making use of one example that is the bank was not capable of providing loans to the

customers and along with the interests which were also charged by the bank on the loans were

also high as compared to the other banks of Australia. This incapability of providing loans

according the needs of the customers also acted as one of the reason lying behind the downfall of

the shares (Leon 2014). All this reasons like the higher rate of interest and getting unable to get

facing this type of problem is mainly because of the reason that the Commonwealth bank of

Australia is making of strategies which are not at all suitable for the organization and the services

that they provide. After identification of the reasons that lies behind the major problems faced by

them the Commonwealth bank of Australia, they have started to implement certain steps which

would be helping them a lot in tackling of the problems that has been identified by them

(Commbank.com.au. 2018). This steps would also be helping them in making improvements as

well. but still some problems exists even after taking certain steps and it was found that the way

in which they were operating in order to tackle the problems were totally wrong and the major

reason due to which the strategies were considered wrong was because of the fact that they did

not understood the constant changes which were taking place within the market. The major

reason lying behind the alterations of mainly due to the organizational structure that the

Commonwealth bank of Australia was having and also due to competitions that exists between

the chosen bank and the other banks present in Australia. The problems were not only restricted

to this and started to grow even more when the requirements of the customers were not being

satisfied (Hammad, Jusoh and Ghozali 2013). It has been found that the customers are not at all

satisfied with the services that are provide by the Commonwealth bank of Australia because the

necessities of the customers were at all being fulfilled. This problem could be better understand

by making use of one example that is the bank was not capable of providing loans to the

customers and along with the interests which were also charged by the bank on the loans were

also high as compared to the other banks of Australia. This incapability of providing loans

according the needs of the customers also acted as one of the reason lying behind the downfall of

the shares (Leon 2014). All this reasons like the higher rate of interest and getting unable to get

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

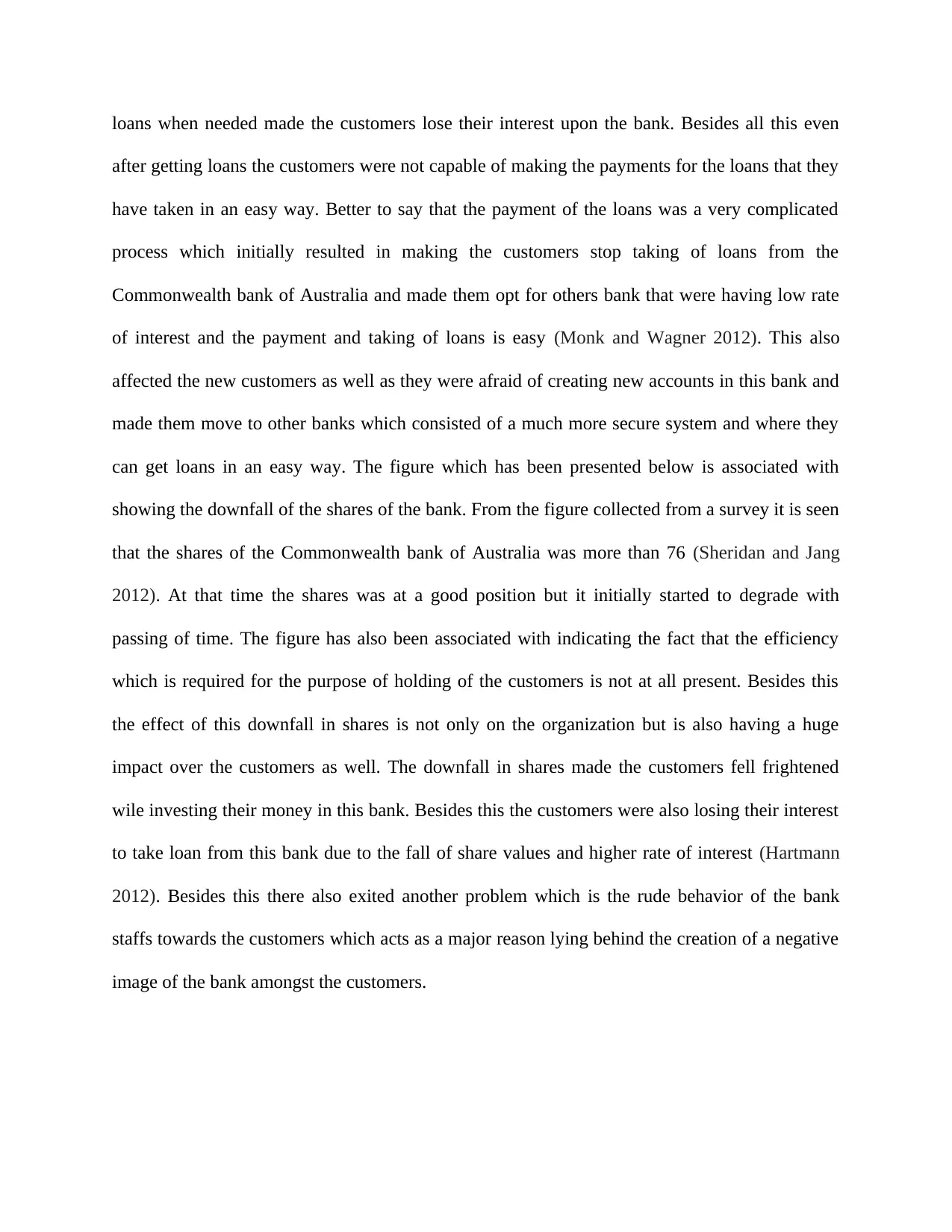

loans when needed made the customers lose their interest upon the bank. Besides all this even

after getting loans the customers were not capable of making the payments for the loans that they

have taken in an easy way. Better to say that the payment of the loans was a very complicated

process which initially resulted in making the customers stop taking of loans from the

Commonwealth bank of Australia and made them opt for others bank that were having low rate

of interest and the payment and taking of loans is easy (Monk and Wagner 2012). This also

affected the new customers as well as they were afraid of creating new accounts in this bank and

made them move to other banks which consisted of a much more secure system and where they

can get loans in an easy way. The figure which has been presented below is associated with

showing the downfall of the shares of the bank. From the figure collected from a survey it is seen

that the shares of the Commonwealth bank of Australia was more than 76 (Sheridan and Jang

2012). At that time the shares was at a good position but it initially started to degrade with

passing of time. The figure has also been associated with indicating the fact that the efficiency

which is required for the purpose of holding of the customers is not at all present. Besides this

the effect of this downfall in shares is not only on the organization but is also having a huge

impact over the customers as well. The downfall in shares made the customers fell frightened

wile investing their money in this bank. Besides this the customers were also losing their interest

to take loan from this bank due to the fall of share values and higher rate of interest (Hartmann

2012). Besides this there also exited another problem which is the rude behavior of the bank

staffs towards the customers which acts as a major reason lying behind the creation of a negative

image of the bank amongst the customers.

after getting loans the customers were not capable of making the payments for the loans that they

have taken in an easy way. Better to say that the payment of the loans was a very complicated

process which initially resulted in making the customers stop taking of loans from the

Commonwealth bank of Australia and made them opt for others bank that were having low rate

of interest and the payment and taking of loans is easy (Monk and Wagner 2012). This also

affected the new customers as well as they were afraid of creating new accounts in this bank and

made them move to other banks which consisted of a much more secure system and where they

can get loans in an easy way. The figure which has been presented below is associated with

showing the downfall of the shares of the bank. From the figure collected from a survey it is seen

that the shares of the Commonwealth bank of Australia was more than 76 (Sheridan and Jang

2012). At that time the shares was at a good position but it initially started to degrade with

passing of time. The figure has also been associated with indicating the fact that the efficiency

which is required for the purpose of holding of the customers is not at all present. Besides this

the effect of this downfall in shares is not only on the organization but is also having a huge

impact over the customers as well. The downfall in shares made the customers fell frightened

wile investing their money in this bank. Besides this the customers were also losing their interest

to take loan from this bank due to the fall of share values and higher rate of interest (Hartmann

2012). Besides this there also exited another problem which is the rude behavior of the bank

staffs towards the customers which acts as a major reason lying behind the creation of a negative

image of the bank amongst the customers.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 2: Downfall of shares in Commonwealth Bank

(Source: Commbank.com.au, 2018)

Strategies adopted by the Organization: Commonwealth Bank of Australia

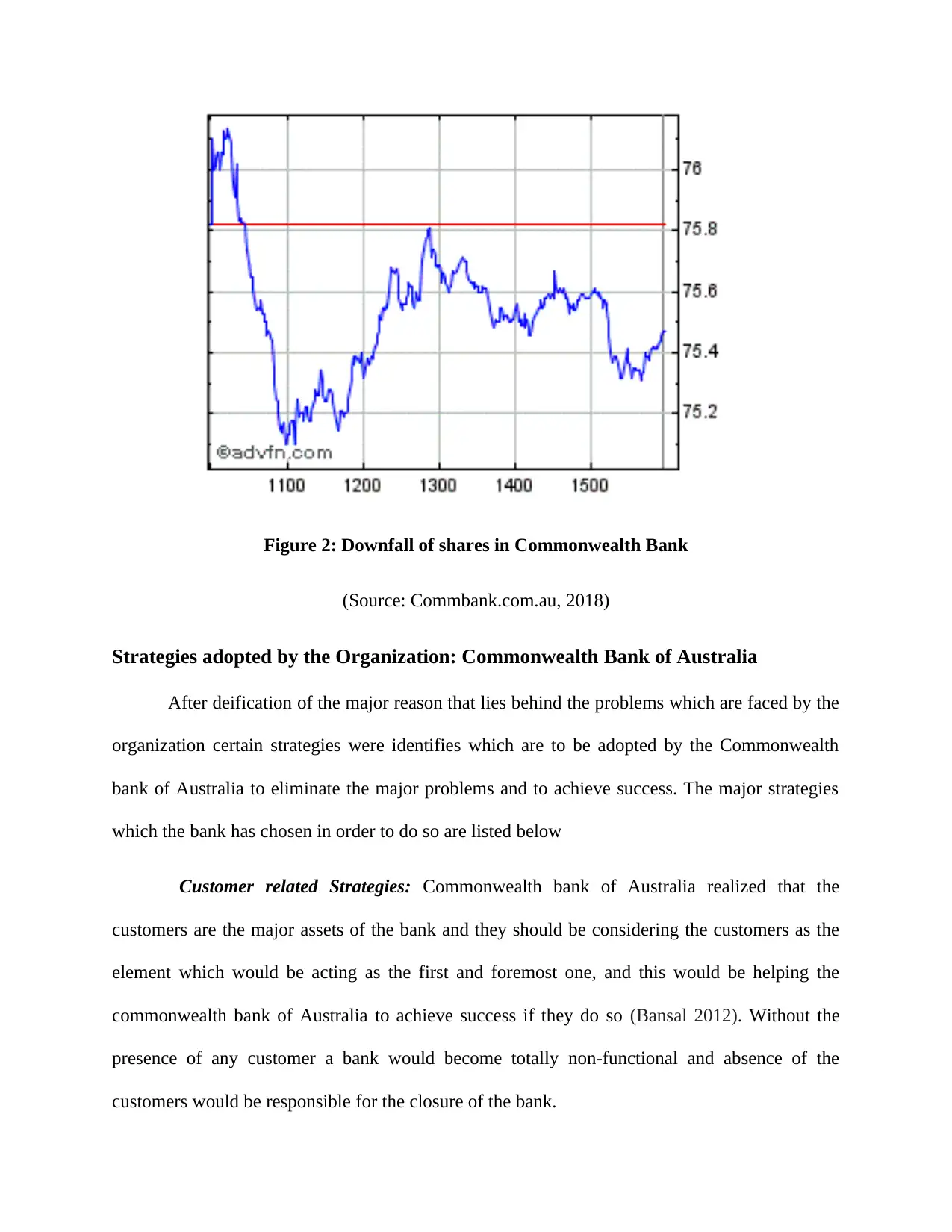

After deification of the major reason that lies behind the problems which are faced by the

organization certain strategies were identifies which are to be adopted by the Commonwealth

bank of Australia to eliminate the major problems and to achieve success. The major strategies

which the bank has chosen in order to do so are listed below

Customer related Strategies: Commonwealth bank of Australia realized that the

customers are the major assets of the bank and they should be considering the customers as the

element which would be acting as the first and foremost one, and this would be helping the

commonwealth bank of Australia to achieve success if they do so (Bansal 2012). Without the

presence of any customer a bank would become totally non-functional and absence of the

customers would be responsible for the closure of the bank.

(Source: Commbank.com.au, 2018)

Strategies adopted by the Organization: Commonwealth Bank of Australia

After deification of the major reason that lies behind the problems which are faced by the

organization certain strategies were identifies which are to be adopted by the Commonwealth

bank of Australia to eliminate the major problems and to achieve success. The major strategies

which the bank has chosen in order to do so are listed below

Customer related Strategies: Commonwealth bank of Australia realized that the

customers are the major assets of the bank and they should be considering the customers as the

element which would be acting as the first and foremost one, and this would be helping the

commonwealth bank of Australia to achieve success if they do so (Bansal 2012). Without the

presence of any customer a bank would become totally non-functional and absence of the

customers would be responsible for the closure of the bank.

Technology: Another major element in which the organization Commonwealth bank of

Australia needs to focus is the technology. It has been seen that the bank is associated with the

usage of traditional technology, so there is an essential need of focusing on this element. The

thought that is bank is having regarding the new technologies relate to banking needs to be

changes along with understanding the ways by which the new technology would be helping the

bank in achieving success and to eliminate the problems which are mainly occurring due to the

usage of traditional technology (Tsai et al. 2012).

Strength: The capabilities that the various teams of the organization Commonwealth

bank of Australia is having is associated with depicting the strength of the bank. The major

responsibilities of the staffs and the employees mainly includes the working together in order to

achieve the various objectives and goals that the Commonwealth bank of Australia is having

(Bryant 2012).

Productivity: Lastly comes the strategies related to productivity which is also one of the

major element associated with helping the bank in achieving success. The major thing which is

to be done by the bank is that they should keep an track of the annual records related to

productivity which the employees are having along with keeping a record of the entire

organization (Kumar and Reinartz 2018).

The figure presented below depicts the strategies and at what percentage they have been

adopted by the Commonwealth bank of Australia.

Australia needs to focus is the technology. It has been seen that the bank is associated with the

usage of traditional technology, so there is an essential need of focusing on this element. The

thought that is bank is having regarding the new technologies relate to banking needs to be

changes along with understanding the ways by which the new technology would be helping the

bank in achieving success and to eliminate the problems which are mainly occurring due to the

usage of traditional technology (Tsai et al. 2012).

Strength: The capabilities that the various teams of the organization Commonwealth

bank of Australia is having is associated with depicting the strength of the bank. The major

responsibilities of the staffs and the employees mainly includes the working together in order to

achieve the various objectives and goals that the Commonwealth bank of Australia is having

(Bryant 2012).

Productivity: Lastly comes the strategies related to productivity which is also one of the

major element associated with helping the bank in achieving success. The major thing which is

to be done by the bank is that they should keep an track of the annual records related to

productivity which the employees are having along with keeping a record of the entire

organization (Kumar and Reinartz 2018).

The figure presented below depicts the strategies and at what percentage they have been

adopted by the Commonwealth bank of Australia.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Customer 40%

40%

Technology 15%

15%

Strength 15%

15%

Productivity 30%

30%

Strategies

Customer 40% Technology 15% Strength 15% Productivity 30%

Figure 3: Strategies of Commonwealth Bank of Australia

(Source: Commbank.com.au, 2018)

System Acquisition method: Commonwealth Bank of Australia

The ERP or the enterprise resource planning has been adopted by almost each and every

organization in order to simplify the business processes. The Commonwealth bank of Australia

has also been associated with the usage of the Enterprise Resource Planning. The major reason

lying behind the usage of the ERP is for the purpose of creating various kind of controls that

would be helping the bank for its various business processes. The ERP used by the bank is also

associated with amalgamating the major portion of the business also (Chen 2012). Besides this

the information system required for the management and the ERP is mainly obtained by

combining the various major areas of the business that includes elements like the marketing,

planning, sales, finance, purchasing and human resources. Additionally the bank has also been

using the SAP or the systems, application and product model in order to manage the different

40%

Technology 15%

15%

Strength 15%

15%

Productivity 30%

30%

Strategies

Customer 40% Technology 15% Strength 15% Productivity 30%

Figure 3: Strategies of Commonwealth Bank of Australia

(Source: Commbank.com.au, 2018)

System Acquisition method: Commonwealth Bank of Australia

The ERP or the enterprise resource planning has been adopted by almost each and every

organization in order to simplify the business processes. The Commonwealth bank of Australia

has also been associated with the usage of the Enterprise Resource Planning. The major reason

lying behind the usage of the ERP is for the purpose of creating various kind of controls that

would be helping the bank for its various business processes. The ERP used by the bank is also

associated with amalgamating the major portion of the business also (Chen 2012). Besides this

the information system required for the management and the ERP is mainly obtained by

combining the various major areas of the business that includes elements like the marketing,

planning, sales, finance, purchasing and human resources. Additionally the bank has also been

using the SAP or the systems, application and product model in order to manage the different

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

processes of the organization. By introducing the SAP in the business model of Commonwealth

bank of Australia the processes would become easy by this process of introduction is a very

complicated process which requires a lot of knowledge along with training in order to achieve

success while using this (Shamsuddin and Xiang 2012). The proficiency of the bank along with

the flexibility of the bank would be greatly increased by the usage of this SAP. This would also

be associated with integrating all the modules of the business at a rapid rate. Besides the usage of

the SAP is also very cost efficient. The major reasons lying being the creation of the problems

were the wrong strategies that were adopted by the bank in last few decades (Padmavathy Balaji

and Sivakumar 2012). The SAP model is updated and renewed at a regular basis for the purpose

of making the shares of the bank become much more stead. Besides this it is also being tried by

the shareholders of the bank to reduce the rate of interest rates of the banks for the purpose of

making the clients getting more interested upon the various processes of the bank.

bank of Australia the processes would become easy by this process of introduction is a very

complicated process which requires a lot of knowledge along with training in order to achieve

success while using this (Shamsuddin and Xiang 2012). The proficiency of the bank along with

the flexibility of the bank would be greatly increased by the usage of this SAP. This would also

be associated with integrating all the modules of the business at a rapid rate. Besides the usage of

the SAP is also very cost efficient. The major reasons lying being the creation of the problems

were the wrong strategies that were adopted by the bank in last few decades (Padmavathy Balaji

and Sivakumar 2012). The SAP model is updated and renewed at a regular basis for the purpose

of making the shares of the bank become much more stead. Besides this it is also being tried by

the shareholders of the bank to reduce the rate of interest rates of the banks for the purpose of

making the clients getting more interested upon the various processes of the bank.

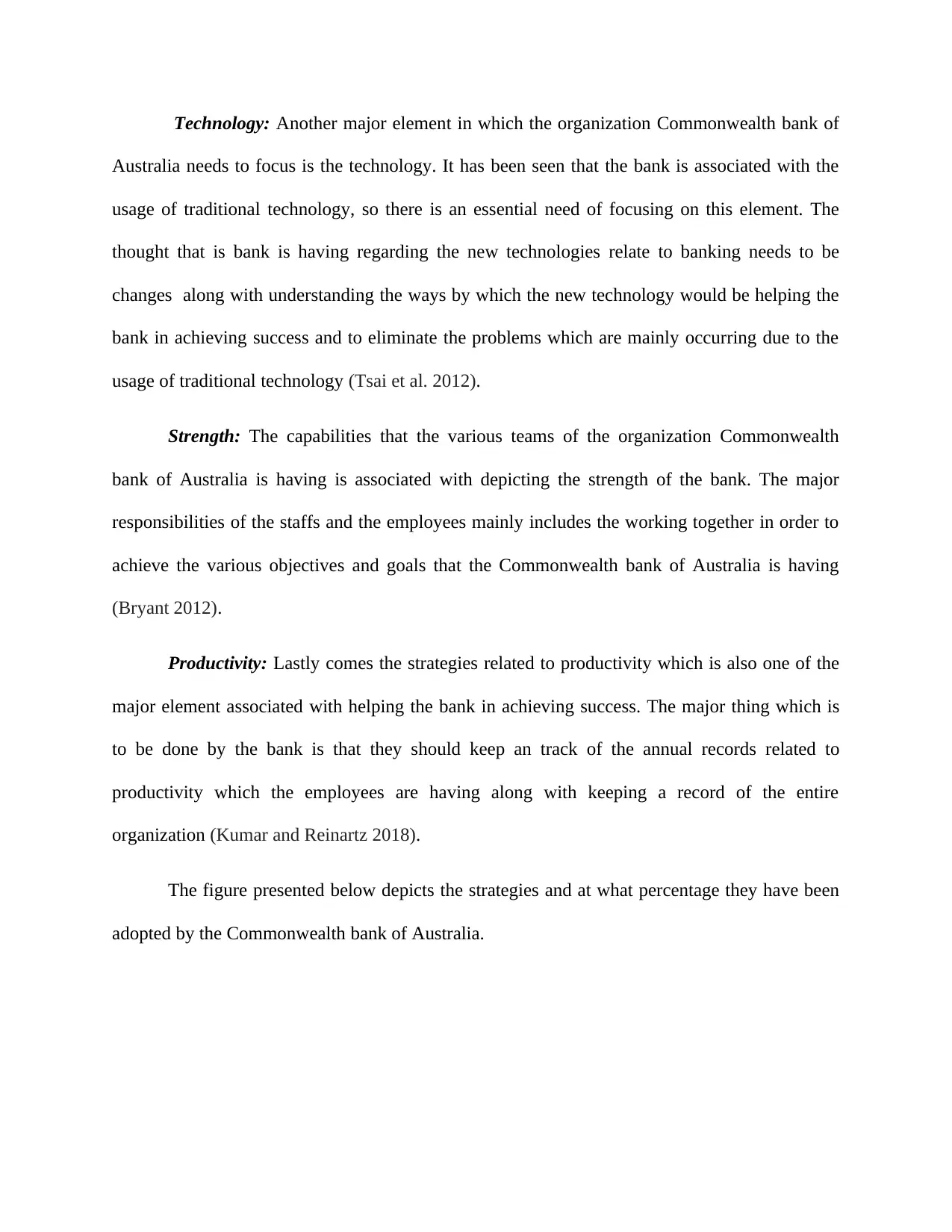

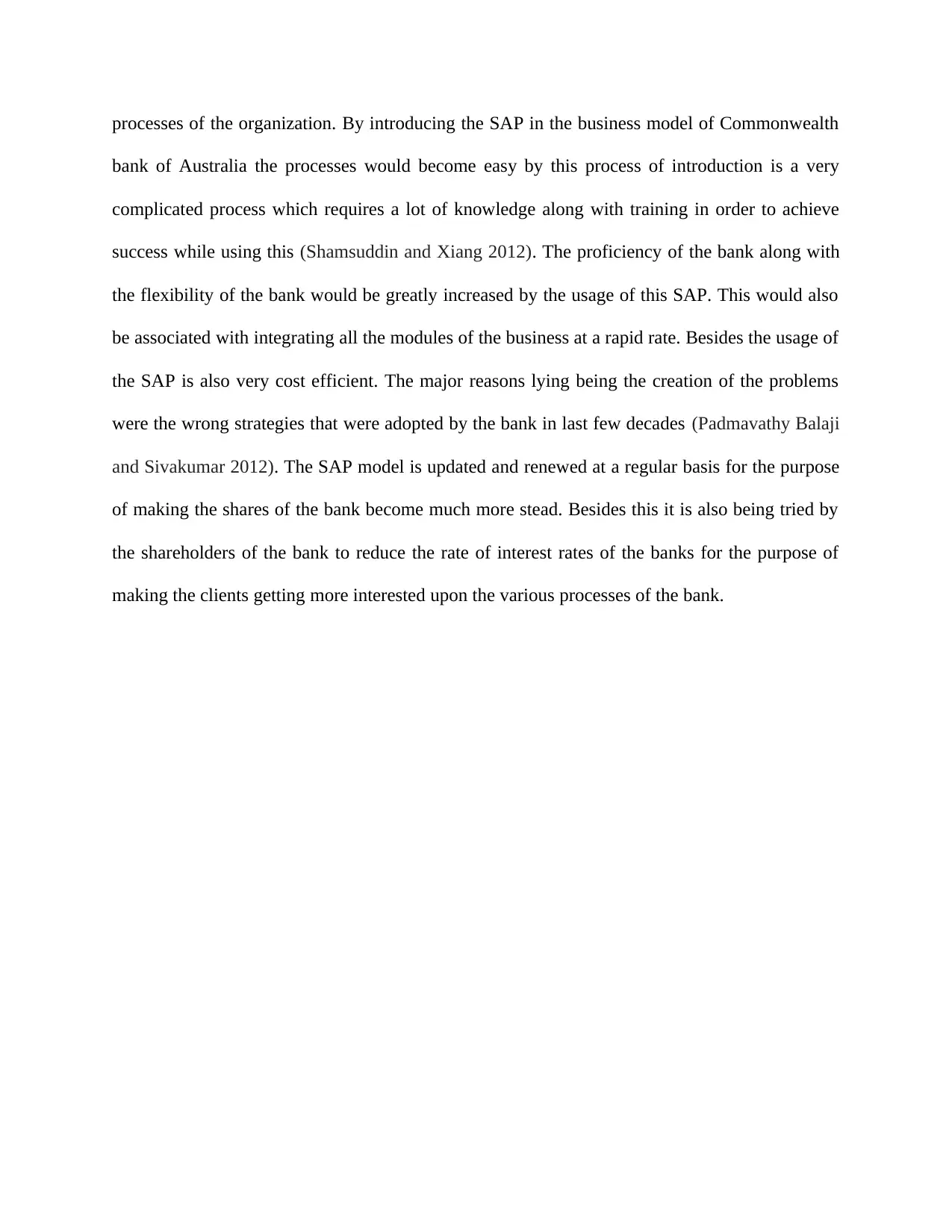

Figure 4: Systems Flowchart of Commonwealth Bank

(Source: Commbank.com.au, 2018)

The figure presented above depicts the flowchart which is associated with showing the flow of

the various processes in the organization, Commonwealth bank of Australia. This figure is

associated with depicting the different kind of processes that are taking place in the

Commonwealth bank of Australia along with helping in the identification of the various

loopholes that are present in the different processes of the Commonwealth bank of Australia. The

flowchart depicted above have been divided into three categories which mainly included the

review, evaluation and lastly the response (Payne and Frow 2013)

(Source: Commbank.com.au, 2018)

The figure presented above depicts the flowchart which is associated with showing the flow of

the various processes in the organization, Commonwealth bank of Australia. This figure is

associated with depicting the different kind of processes that are taking place in the

Commonwealth bank of Australia along with helping in the identification of the various

loopholes that are present in the different processes of the Commonwealth bank of Australia. The

flowchart depicted above have been divided into three categories which mainly included the

review, evaluation and lastly the response (Payne and Frow 2013)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.