MNGT3002: Strategic Knowledge Management Report on NAB's KM

VerifiedAdded on 2022/11/11

|17

|5566

|408

Report

AI Summary

This report offers a comprehensive analysis of the strategic knowledge management (KM) practices within the National Australia Bank (NAB). It begins with an introduction to KM, emphasizing its significance in organizational success and productivity. The report provides an overview of NAB's background, including its financial and managerial aspects, and highlights a significant system failure in 2010 that impacted account processing. The current situation section delves into two key incidents: NAB's involvement with fossil fuels and an employee's illegal recommendations to BSI Corporation. A literature review examines essential KM concepts and theories, including the relationship between KM and human resource management, and the impact of KM in the banking sector, with models like Frid’s and McAdams and McCreedy's detailed. The discussion section applies these theories and models to NAB, using Wiig KM matrix and others. The report identifies NAB's KM needs, capacity, and analysis and provides recommendations for improvements and implementation steps. The conclusion emphasizes the importance of enhanced knowledge management for improved productivity at NAB.

Running head: STRATEGIC KNOWLEDGE MANAGEMENT

MNGT3002: Knowledge Management

Assessment 2: Strategic Knowledge Management

Student Name:

University Name:

Student ID:

MNGT3002: Knowledge Management

Assessment 2: Strategic Knowledge Management

Student Name:

University Name:

Student ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1STRATEGIC KNOWLEDGE MANAGEMENT

Executive summary

This report is based on knowledge management. The organisation taken for this report is the

National Australia Bank. A brief introduction has been given on knowledge management. It

explains the importance of knowledge management in an organisation. There is a brief

explanation of the organisation National Australia Bank where there are the financial and the

managerial information is included. The bank is quite famous in the nation and the organisation

uses the best CRM but due to some system malfunctioning, some failure in the account

processing occurred in the year 2010 which has affected it gruesomely. There are two incidents

of the organisation is described where one is fossil fuel related with the bank and another one is

some illegal recommendations of a number of the national Australian bank members to the BSI

corporation by the bank employee Paul Drakos. In the literature review part, there are some key

concepts and the key theories related to knowledge management where the main factors were the

relationship between the knowledge management and the human resource management and the

effect of KM in the banking industry. Some models like Frid’s model, McAdams and McCreedy

model are also described in detail for understanding. A proper discussion is done on KM of

National Australia Bank. Different matrix and models have been used for NAB. Wiig KM

matrix, McAdams and McCreedy model and Frid’s models have been discussed. These are quite

beneficial for the bank in long runs. The KM needs, capacity and analysis have been clearly

shown. NAB uses the knowledge sharing tool and further, they are planning to implement other

tools. A set of recommendations has been provided to the bank and steps of implementation have

been shown. It will be beneficial for the bank in long terms. Conclusion combines everything of

NAB along with KM. It explains that NAB should improve their management of knowledge and

hence gain productivity through it.

Executive summary

This report is based on knowledge management. The organisation taken for this report is the

National Australia Bank. A brief introduction has been given on knowledge management. It

explains the importance of knowledge management in an organisation. There is a brief

explanation of the organisation National Australia Bank where there are the financial and the

managerial information is included. The bank is quite famous in the nation and the organisation

uses the best CRM but due to some system malfunctioning, some failure in the account

processing occurred in the year 2010 which has affected it gruesomely. There are two incidents

of the organisation is described where one is fossil fuel related with the bank and another one is

some illegal recommendations of a number of the national Australian bank members to the BSI

corporation by the bank employee Paul Drakos. In the literature review part, there are some key

concepts and the key theories related to knowledge management where the main factors were the

relationship between the knowledge management and the human resource management and the

effect of KM in the banking industry. Some models like Frid’s model, McAdams and McCreedy

model are also described in detail for understanding. A proper discussion is done on KM of

National Australia Bank. Different matrix and models have been used for NAB. Wiig KM

matrix, McAdams and McCreedy model and Frid’s models have been discussed. These are quite

beneficial for the bank in long runs. The KM needs, capacity and analysis have been clearly

shown. NAB uses the knowledge sharing tool and further, they are planning to implement other

tools. A set of recommendations has been provided to the bank and steps of implementation have

been shown. It will be beneficial for the bank in long terms. Conclusion combines everything of

NAB along with KM. It explains that NAB should improve their management of knowledge and

hence gain productivity through it.

2STRATEGIC KNOWLEDGE MANAGEMENT

Table of Contents

1. Introduction..................................................................................................................................3

2. Organisation background.............................................................................................................3

3. Current situation..........................................................................................................................3

4. Key concepts and theories...........................................................................................................5

5. Discussion..................................................................................................................................10

6. Recommendations and implementation.....................................................................................12

7. Conclusion.................................................................................................................................14

Reference List................................................................................................................................15

Table of Contents

1. Introduction..................................................................................................................................3

2. Organisation background.............................................................................................................3

3. Current situation..........................................................................................................................3

4. Key concepts and theories...........................................................................................................5

5. Discussion..................................................................................................................................10

6. Recommendations and implementation.....................................................................................12

7. Conclusion.................................................................................................................................14

Reference List................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3STRATEGIC KNOWLEDGE MANAGEMENT

1. Introduction

Knowledge Management is a method of making, sharing, managing and using the information

and knowledge of an organisation (Alavi & Leidner, 2001). This is a multidisciplinary approach

so that the organisational objectives can be met. It enhances the learning process of people in an

organisation. Knowledge management is of different types and they are toolkits, intranets,

research databases, practice community and knowledge sharing events. The efficiency and

productivity of the organisation are improved through knowledge management. All kinds of

business information or knowledge are updated, shared and accessed through this management.

Correct information should be available to the correct person in case of knowledge management.

This report is based on the knowledge management of a particular company. Here the National

Australia Bank is taken. The background of the company will be seen. The current situation and

knowledge management discussion will be done. The bank will be linked with the theories and

models of KM. It will show the importance of those models in the banking sector of Australia.

2. Organisation background

The National Australia Bank is well known and considered as one of the four largest financial

institutions situated in Australia. At the year of 1982, the organisation was founded and the

headquarter is situated at the Bourke Street of Docklands Melbourne Australia. The organisation

is now led by the chairman Kenneth R Henry and chairman Andrew Thorburn. The NAB is the

biggest user of the Teradata and Siebel customer relationship management systems. Although the

organisation uses the best CRM due to some system malfunctioning, some failure in the account

processing occurred at the year 2010 and around 60000 banking transactions were lost and

resulted in the manual labour of the accumulation of those data. This issue is considered one of

the biggest failures in the Australian banking system. The revenue of the organisation is 20.176

billion Australian dollars at the end of the year 2017 and the total asset is 945 billion Australian

dollars in the year 2018.

1. Introduction

Knowledge Management is a method of making, sharing, managing and using the information

and knowledge of an organisation (Alavi & Leidner, 2001). This is a multidisciplinary approach

so that the organisational objectives can be met. It enhances the learning process of people in an

organisation. Knowledge management is of different types and they are toolkits, intranets,

research databases, practice community and knowledge sharing events. The efficiency and

productivity of the organisation are improved through knowledge management. All kinds of

business information or knowledge are updated, shared and accessed through this management.

Correct information should be available to the correct person in case of knowledge management.

This report is based on the knowledge management of a particular company. Here the National

Australia Bank is taken. The background of the company will be seen. The current situation and

knowledge management discussion will be done. The bank will be linked with the theories and

models of KM. It will show the importance of those models in the banking sector of Australia.

2. Organisation background

The National Australia Bank is well known and considered as one of the four largest financial

institutions situated in Australia. At the year of 1982, the organisation was founded and the

headquarter is situated at the Bourke Street of Docklands Melbourne Australia. The organisation

is now led by the chairman Kenneth R Henry and chairman Andrew Thorburn. The NAB is the

biggest user of the Teradata and Siebel customer relationship management systems. Although the

organisation uses the best CRM due to some system malfunctioning, some failure in the account

processing occurred at the year 2010 and around 60000 banking transactions were lost and

resulted in the manual labour of the accumulation of those data. This issue is considered one of

the biggest failures in the Australian banking system. The revenue of the organisation is 20.176

billion Australian dollars at the end of the year 2017 and the total asset is 945 billion Australian

dollars in the year 2018.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4STRATEGIC KNOWLEDGE MANAGEMENT

3. Current situation

The NAB is the multinational bank situated in Australia and operates in America, New Zealand

and in some Asian countries and the current rank of the organisation are 21 on a worldwide

basis. Mainly recent 2 scandals regarding the behaviour of the chairman and the key

performances indicate about the poor management system in the organisation. The detailed

description of these scandalous points will help in understanding the poor quality of the

knowledge management inside the company and need attention.

The first one is the recent situation. Since the year 2008, it has been estimated that National

Australian Bank has loaned the 11.2 billion Australian dollars from the fossil fuel industry of the

nation Australia and it has helped the organisation to be positioned as the third largest lender in

this regard. The loans and the renewable energies can be estimated of 2.2 billion Australian

dollars at that time period which is considered as the 20% of the fossil fuel amount (Campanella,

Derhy & Gangi, 2019). The NAB is the part of the big four Australian Banks and it has been

estimated that one-third of the loan is estimated to be provided by the NAB in the fossil fuel

industry. This finance is concerned about the significance of Australian contribution to the

increasing global warming issues and is led to many responses from Australian society. This

incorporates the fossil fuel free creation superannuation as well as the investment products which

have helped in excluding the national Australian bank from the investment area. The

shareholders of the bank asked for the emissions disclosure and the finance was reduced in fossil

fuels. The ATM screens were covered by the protest group and the fear of natural degradation

has been conducted through the awareness raising. The result was escalated up to certain points

where the NAB customers moved the money to those banks which has a portfolio of lesser

financed emission.

Through another investigation it has been found out that in between the years 1997 and 2001 the

financial products seller of the organisation Paul Drakos who was working in the Sydney Branch

made some illegal recommendations of a number of the national Australian bank members as

well as customers to invest in the BSI corporations which entity is considered as NAB non

approved investment productions. From the report of ASIC, it was evident that 6.2 million

dollars were transferred from the accounts in overseas to some private company account of the

Dominican Republic. The account was controlled byte same Paul Drakos only (Campanella,

3. Current situation

The NAB is the multinational bank situated in Australia and operates in America, New Zealand

and in some Asian countries and the current rank of the organisation are 21 on a worldwide

basis. Mainly recent 2 scandals regarding the behaviour of the chairman and the key

performances indicate about the poor management system in the organisation. The detailed

description of these scandalous points will help in understanding the poor quality of the

knowledge management inside the company and need attention.

The first one is the recent situation. Since the year 2008, it has been estimated that National

Australian Bank has loaned the 11.2 billion Australian dollars from the fossil fuel industry of the

nation Australia and it has helped the organisation to be positioned as the third largest lender in

this regard. The loans and the renewable energies can be estimated of 2.2 billion Australian

dollars at that time period which is considered as the 20% of the fossil fuel amount (Campanella,

Derhy & Gangi, 2019). The NAB is the part of the big four Australian Banks and it has been

estimated that one-third of the loan is estimated to be provided by the NAB in the fossil fuel

industry. This finance is concerned about the significance of Australian contribution to the

increasing global warming issues and is led to many responses from Australian society. This

incorporates the fossil fuel free creation superannuation as well as the investment products which

have helped in excluding the national Australian bank from the investment area. The

shareholders of the bank asked for the emissions disclosure and the finance was reduced in fossil

fuels. The ATM screens were covered by the protest group and the fear of natural degradation

has been conducted through the awareness raising. The result was escalated up to certain points

where the NAB customers moved the money to those banks which has a portfolio of lesser

financed emission.

Through another investigation it has been found out that in between the years 1997 and 2001 the

financial products seller of the organisation Paul Drakos who was working in the Sydney Branch

made some illegal recommendations of a number of the national Australian bank members as

well as customers to invest in the BSI corporations which entity is considered as NAB non

approved investment productions. From the report of ASIC, it was evident that 6.2 million

dollars were transferred from the accounts in overseas to some private company account of the

Dominican Republic. The account was controlled byte same Paul Drakos only (Campanella,

5STRATEGIC KNOWLEDGE MANAGEMENT

Derhy & Gangi, 2019). Various funds were applied from this account as well as disguised loans

investment to any number of failed business opportunities. Although the BSI had no relation

with the NAB the funds are transferred back to the strategic investment group of the

organisation.

Using the 7c’s model in case of knowledge management the key areas are highlighted and the

two issues which need to be keeping in attention are discussed.

4. Key concepts and theories

Relationship between knowledge management and HR strategy

It can be said that there is a significant amount of correlation between knowledge management

and human resource management. The knowledge management helps in improving the

performances of the employees rapidly. With the help of proper planning, the performance of the

employees can be improved based on the knowledge and it is very easy to predict the further

condition of the organisation. When the knowledge is passed then it is known as the information

and this information includes facts, deceptions and the concepts and the views. The organisation

can take the proper benefits from these factors and the knowledge management helps in creating

proper plans and improving the employee performance by removing the barriers in the

organisation (Gorelick, Milton & April, 2002). It is evident there is a positive relationship

between knowledge management and the organisational strategy along with the occupational

involvement of the organisation’s employees. In the case of knowledge management, there are

three main factors which need to be developed and those are new skills, products and better ideas

for the productivity growth of the organisation. In the case of the banking industry, there is the

optimal use of the process and development of knowledge management is the help of

information technology in the qualitative and quantitative measurement.

Knowledge management in the banking industry

In every nation or every state or the corporate society or in case of the individual also there is

continuous run always going on. Either these people are trying to pursue the targets or are

continuously being chased by the higher authorities of the organisation for achieving the stiff

targets. It is required for them to be in fast track constantly. It is evident that these people are

Derhy & Gangi, 2019). Various funds were applied from this account as well as disguised loans

investment to any number of failed business opportunities. Although the BSI had no relation

with the NAB the funds are transferred back to the strategic investment group of the

organisation.

Using the 7c’s model in case of knowledge management the key areas are highlighted and the

two issues which need to be keeping in attention are discussed.

4. Key concepts and theories

Relationship between knowledge management and HR strategy

It can be said that there is a significant amount of correlation between knowledge management

and human resource management. The knowledge management helps in improving the

performances of the employees rapidly. With the help of proper planning, the performance of the

employees can be improved based on the knowledge and it is very easy to predict the further

condition of the organisation. When the knowledge is passed then it is known as the information

and this information includes facts, deceptions and the concepts and the views. The organisation

can take the proper benefits from these factors and the knowledge management helps in creating

proper plans and improving the employee performance by removing the barriers in the

organisation (Gorelick, Milton & April, 2002). It is evident there is a positive relationship

between knowledge management and the organisational strategy along with the occupational

involvement of the organisation’s employees. In the case of knowledge management, there are

three main factors which need to be developed and those are new skills, products and better ideas

for the productivity growth of the organisation. In the case of the banking industry, there is the

optimal use of the process and development of knowledge management is the help of

information technology in the qualitative and quantitative measurement.

Knowledge management in the banking industry

In every nation or every state or the corporate society or in case of the individual also there is

continuous run always going on. Either these people are trying to pursue the targets or are

continuously being chased by the higher authorities of the organisation for achieving the stiff

targets. It is required for them to be in fast track constantly. It is evident that these people are

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6STRATEGIC KNOWLEDGE MANAGEMENT

always running against time. Achievement of something extraordinary is essential. It is arising a

question for the survival of the fittest and in this case, the knowledge management is addressing

many issues and finding the solution which will energize the work culture and the workforce.

The bankers always find themselves at the hot seat. They are always under the pressure of the

delivery. They are entrusted with an enormous amount of workload and represent themselves

under the firm grip of the fear in case of taking the decisions on having large financial

implications. The knowledge management should be able to address these kinds of issues in case

of finding the solutions for the encouragement of the decisions and the refinement of the staff

lacks as well as their accountability for being more objective oriented without being subjective

(Pant et al., 2018).

The knowledge management is considered very important in case of the banking industry due to

the simplification of the delivery in time along with the effective information about the

processing planning controlling and lastly the decision making of the organisation. This always

helps the managers in case of formulating the strategic tactical and lastly the operational

activities in the perfect way in order of the achievement of the organisations desires about the

objectives (Denning, 2006).

The modern type banking always investigates about the value importance in case of knowledge

management in the business practice of the banking industry. The knowledge always covers the

entire range of the banking organisation internal capital for the data heel in case of the customer's

transactions.

Banking sector always has the target of improving the satisfaction level of the customers which

result in the increment of revenue. It becomes essential in case of the banking industry to know

about the knowledge process, creation and storage as well as the dispersion of it (Denning,

2006).

The very common fields of knowledge management in the banking industry are risk

management, customer relationship, marketing management and lastly performance

management. Data mining, decision support systems are known as the major bank investments in

case of knowledge management (Denning, 2006).

always running against time. Achievement of something extraordinary is essential. It is arising a

question for the survival of the fittest and in this case, the knowledge management is addressing

many issues and finding the solution which will energize the work culture and the workforce.

The bankers always find themselves at the hot seat. They are always under the pressure of the

delivery. They are entrusted with an enormous amount of workload and represent themselves

under the firm grip of the fear in case of taking the decisions on having large financial

implications. The knowledge management should be able to address these kinds of issues in case

of finding the solutions for the encouragement of the decisions and the refinement of the staff

lacks as well as their accountability for being more objective oriented without being subjective

(Pant et al., 2018).

The knowledge management is considered very important in case of the banking industry due to

the simplification of the delivery in time along with the effective information about the

processing planning controlling and lastly the decision making of the organisation. This always

helps the managers in case of formulating the strategic tactical and lastly the operational

activities in the perfect way in order of the achievement of the organisations desires about the

objectives (Denning, 2006).

The modern type banking always investigates about the value importance in case of knowledge

management in the business practice of the banking industry. The knowledge always covers the

entire range of the banking organisation internal capital for the data heel in case of the customer's

transactions.

Banking sector always has the target of improving the satisfaction level of the customers which

result in the increment of revenue. It becomes essential in case of the banking industry to know

about the knowledge process, creation and storage as well as the dispersion of it (Denning,

2006).

The very common fields of knowledge management in the banking industry are risk

management, customer relationship, marketing management and lastly performance

management. Data mining, decision support systems are known as the major bank investments in

case of knowledge management (Denning, 2006).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STRATEGIC KNOWLEDGE MANAGEMENT

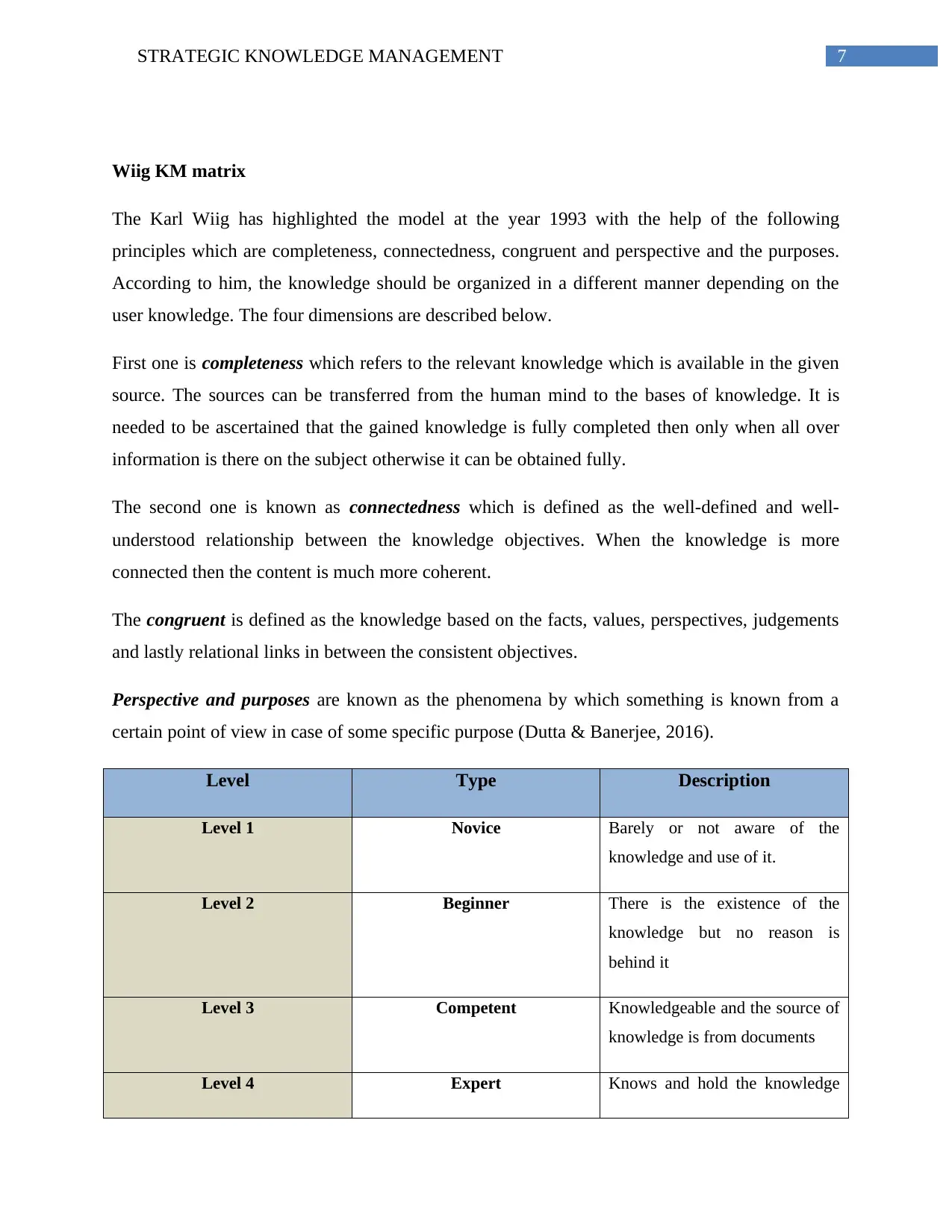

Wiig KM matrix

The Karl Wiig has highlighted the model at the year 1993 with the help of the following

principles which are completeness, connectedness, congruent and perspective and the purposes.

According to him, the knowledge should be organized in a different manner depending on the

user knowledge. The four dimensions are described below.

First one is completeness which refers to the relevant knowledge which is available in the given

source. The sources can be transferred from the human mind to the bases of knowledge. It is

needed to be ascertained that the gained knowledge is fully completed then only when all over

information is there on the subject otherwise it can be obtained fully.

The second one is known as connectedness which is defined as the well-defined and well-

understood relationship between the knowledge objectives. When the knowledge is more

connected then the content is much more coherent.

The congruent is defined as the knowledge based on the facts, values, perspectives, judgements

and lastly relational links in between the consistent objectives.

Perspective and purposes are known as the phenomena by which something is known from a

certain point of view in case of some specific purpose (Dutta & Banerjee, 2016).

Level Type Description

Level 1 Novice Barely or not aware of the

knowledge and use of it.

Level 2 Beginner There is the existence of the

knowledge but no reason is

behind it

Level 3 Competent Knowledgeable and the source of

knowledge is from documents

Level 4 Expert Knows and hold the knowledge

Wiig KM matrix

The Karl Wiig has highlighted the model at the year 1993 with the help of the following

principles which are completeness, connectedness, congruent and perspective and the purposes.

According to him, the knowledge should be organized in a different manner depending on the

user knowledge. The four dimensions are described below.

First one is completeness which refers to the relevant knowledge which is available in the given

source. The sources can be transferred from the human mind to the bases of knowledge. It is

needed to be ascertained that the gained knowledge is fully completed then only when all over

information is there on the subject otherwise it can be obtained fully.

The second one is known as connectedness which is defined as the well-defined and well-

understood relationship between the knowledge objectives. When the knowledge is more

connected then the content is much more coherent.

The congruent is defined as the knowledge based on the facts, values, perspectives, judgements

and lastly relational links in between the consistent objectives.

Perspective and purposes are known as the phenomena by which something is known from a

certain point of view in case of some specific purpose (Dutta & Banerjee, 2016).

Level Type Description

Level 1 Novice Barely or not aware of the

knowledge and use of it.

Level 2 Beginner There is the existence of the

knowledge but no reason is

behind it

Level 3 Competent Knowledgeable and the source of

knowledge is from documents

Level 4 Expert Knows and hold the knowledge

8STRATEGIC KNOWLEDGE MANAGEMENT

in memory and understand the

place to apply.

Level 5 Master Has the deep knowledge and

understanding it properly apply

in the perfect place.

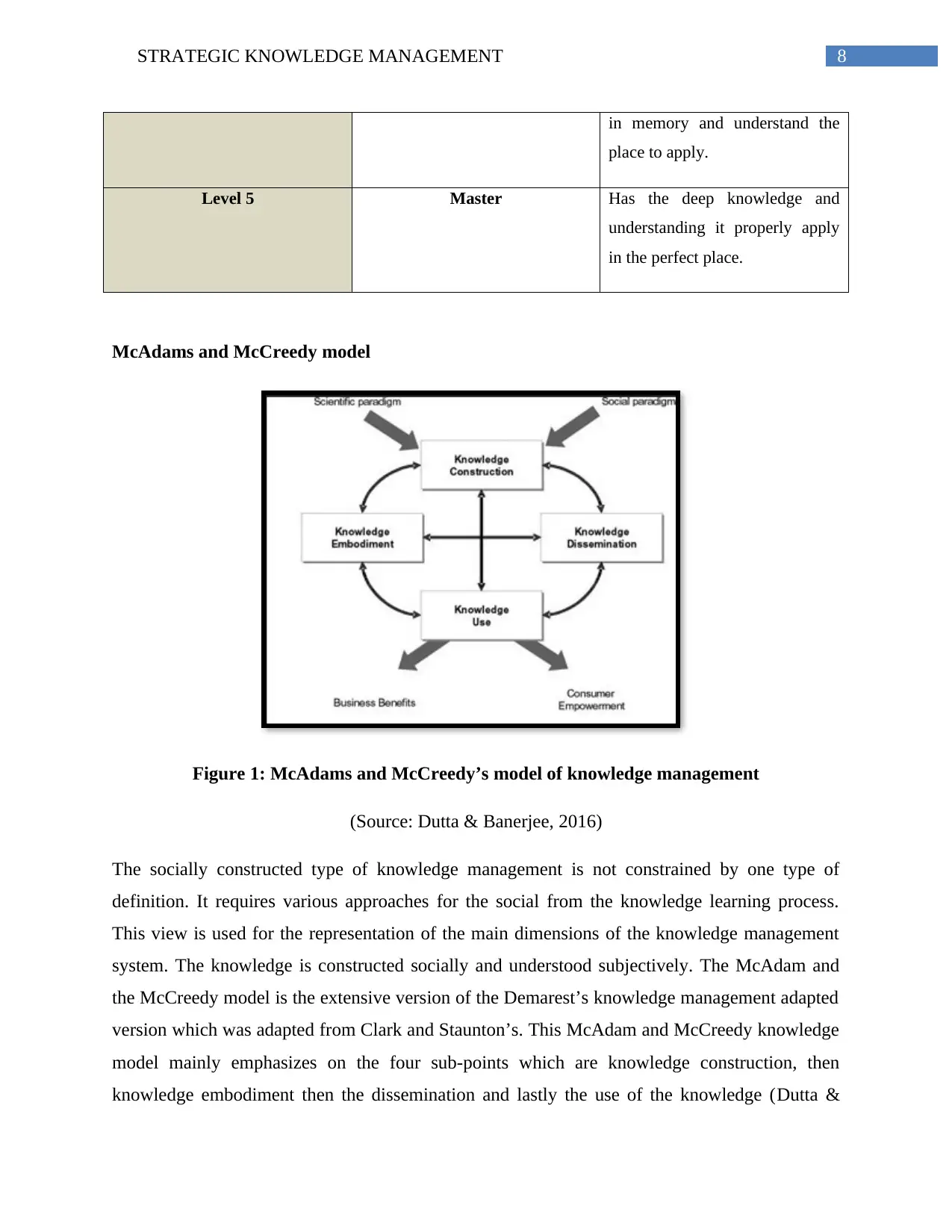

McAdams and McCreedy model

Figure 1: McAdams and McCreedy’s model of knowledge management

(Source: Dutta & Banerjee, 2016)

The socially constructed type of knowledge management is not constrained by one type of

definition. It requires various approaches for the social from the knowledge learning process.

This view is used for the representation of the main dimensions of the knowledge management

system. The knowledge is constructed socially and understood subjectively. The McAdam and

the McCreedy model is the extensive version of the Demarest’s knowledge management adapted

version which was adapted from Clark and Staunton’s. This McAdam and McCreedy knowledge

model mainly emphasizes on the four sub-points which are knowledge construction, then

knowledge embodiment then the dissemination and lastly the use of the knowledge (Dutta &

in memory and understand the

place to apply.

Level 5 Master Has the deep knowledge and

understanding it properly apply

in the perfect place.

McAdams and McCreedy model

Figure 1: McAdams and McCreedy’s model of knowledge management

(Source: Dutta & Banerjee, 2016)

The socially constructed type of knowledge management is not constrained by one type of

definition. It requires various approaches for the social from the knowledge learning process.

This view is used for the representation of the main dimensions of the knowledge management

system. The knowledge is constructed socially and understood subjectively. The McAdam and

the McCreedy model is the extensive version of the Demarest’s knowledge management adapted

version which was adapted from Clark and Staunton’s. This McAdam and McCreedy knowledge

model mainly emphasizes on the four sub-points which are knowledge construction, then

knowledge embodiment then the dissemination and lastly the use of the knowledge (Dutta &

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9STRATEGIC KNOWLEDGE MANAGEMENT

Banerjee, 2016). But it also needs to keep in mind that emancipator enhancements also get

included in this model through the use of employee knowledge usages and the subsequential

empowerment. This model is mainly adopted for the customer focus for the exploration of the

consumers’ empowerment using the gained knowledge.

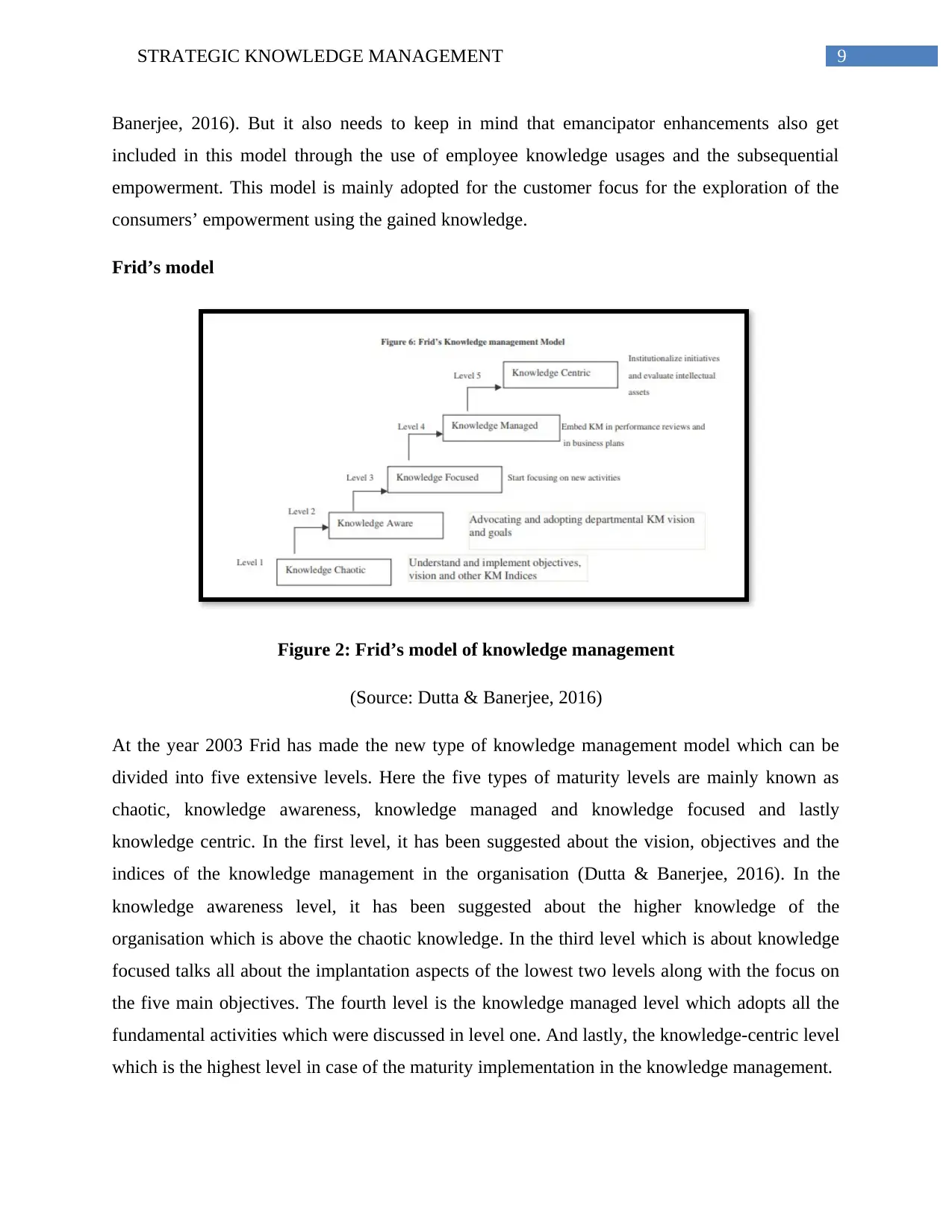

Frid’s model

Figure 2: Frid’s model of knowledge management

(Source: Dutta & Banerjee, 2016)

At the year 2003 Frid has made the new type of knowledge management model which can be

divided into five extensive levels. Here the five types of maturity levels are mainly known as

chaotic, knowledge awareness, knowledge managed and knowledge focused and lastly

knowledge centric. In the first level, it has been suggested about the vision, objectives and the

indices of the knowledge management in the organisation (Dutta & Banerjee, 2016). In the

knowledge awareness level, it has been suggested about the higher knowledge of the

organisation which is above the chaotic knowledge. In the third level which is about knowledge

focused talks all about the implantation aspects of the lowest two levels along with the focus on

the five main objectives. The fourth level is the knowledge managed level which adopts all the

fundamental activities which were discussed in level one. And lastly, the knowledge-centric level

which is the highest level in case of the maturity implementation in the knowledge management.

Banerjee, 2016). But it also needs to keep in mind that emancipator enhancements also get

included in this model through the use of employee knowledge usages and the subsequential

empowerment. This model is mainly adopted for the customer focus for the exploration of the

consumers’ empowerment using the gained knowledge.

Frid’s model

Figure 2: Frid’s model of knowledge management

(Source: Dutta & Banerjee, 2016)

At the year 2003 Frid has made the new type of knowledge management model which can be

divided into five extensive levels. Here the five types of maturity levels are mainly known as

chaotic, knowledge awareness, knowledge managed and knowledge focused and lastly

knowledge centric. In the first level, it has been suggested about the vision, objectives and the

indices of the knowledge management in the organisation (Dutta & Banerjee, 2016). In the

knowledge awareness level, it has been suggested about the higher knowledge of the

organisation which is above the chaotic knowledge. In the third level which is about knowledge

focused talks all about the implantation aspects of the lowest two levels along with the focus on

the five main objectives. The fourth level is the knowledge managed level which adopts all the

fundamental activities which were discussed in level one. And lastly, the knowledge-centric level

which is the highest level in case of the maturity implementation in the knowledge management.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10STRATEGIC KNOWLEDGE MANAGEMENT

5. Discussion

In the above section of Knowledge Management, there are different matrix and models that have

been discussed. According to the Wiig KM matrix, all the information and the knowledge in

NAB is kept safely. This helps in accessing the information when needed the most. There are

many entry and exit paths for the retrieving or accessing the knowledge. There are four

dimensions of Wiig Model that is kept in mind and they are connectedness, completeness,

congruency and purpose and perspective. It helps the bank to keep all the public, personal and

shared knowledge carefully. The four types of knowledge under this matrix are factual,

conceptual, expectational and methodological. In Knowledge Management a model took that

will be helpful for NAB is McAdams and McCreedy model. This creates a link between

knowledge and its social and learning process. The main focus of this model is on the customers.

This model is quite useful for NAB because their priority is customers. The model has four

stages of knowledge management. They are Construction of knowledge, Dissemination of

knowledge, Use of knowledge and Embodiment of knowledge. NAB will be gaining a lot of

benefits through this model. There is a scientific and social paradigm. Through this model, NAB

will get consumer empowerment and business benefits. As the banking system stores a large

amount of information hence, they need to follow knowledge management (Bartol & Srivastava,

2002). Customer is the main asset of the bank and hence they cannot be lost. This model ensures

that a proper cycle is followed in maintaining the knowledge and information of the bank.

Another model of knowledge management taken is Frid’s KM model. This model is usually

implemented by most of the organisations. There are five levels to this model. The organisations

have to implement all the level given. The five levels are knowledge chaotic, knowledge aware,

knowledge focused, knowledge managed and knowledge centric. The first level suggests that

NAB is in the process of implementing Frid’s framework (Grant, 1996). The next level suggests

that they are one step ahead. The visions and goals of the company can be achieved. A road map

of KM is developed at this stage by NAB. In the third level, all the implementation aspects of

knowledge should be covered that were left in the last two levels. The five new activities should

be started by the company. This can be applied to their process, services, training and

5. Discussion

In the above section of Knowledge Management, there are different matrix and models that have

been discussed. According to the Wiig KM matrix, all the information and the knowledge in

NAB is kept safely. This helps in accessing the information when needed the most. There are

many entry and exit paths for the retrieving or accessing the knowledge. There are four

dimensions of Wiig Model that is kept in mind and they are connectedness, completeness,

congruency and purpose and perspective. It helps the bank to keep all the public, personal and

shared knowledge carefully. The four types of knowledge under this matrix are factual,

conceptual, expectational and methodological. In Knowledge Management a model took that

will be helpful for NAB is McAdams and McCreedy model. This creates a link between

knowledge and its social and learning process. The main focus of this model is on the customers.

This model is quite useful for NAB because their priority is customers. The model has four

stages of knowledge management. They are Construction of knowledge, Dissemination of

knowledge, Use of knowledge and Embodiment of knowledge. NAB will be gaining a lot of

benefits through this model. There is a scientific and social paradigm. Through this model, NAB

will get consumer empowerment and business benefits. As the banking system stores a large

amount of information hence, they need to follow knowledge management (Bartol & Srivastava,

2002). Customer is the main asset of the bank and hence they cannot be lost. This model ensures

that a proper cycle is followed in maintaining the knowledge and information of the bank.

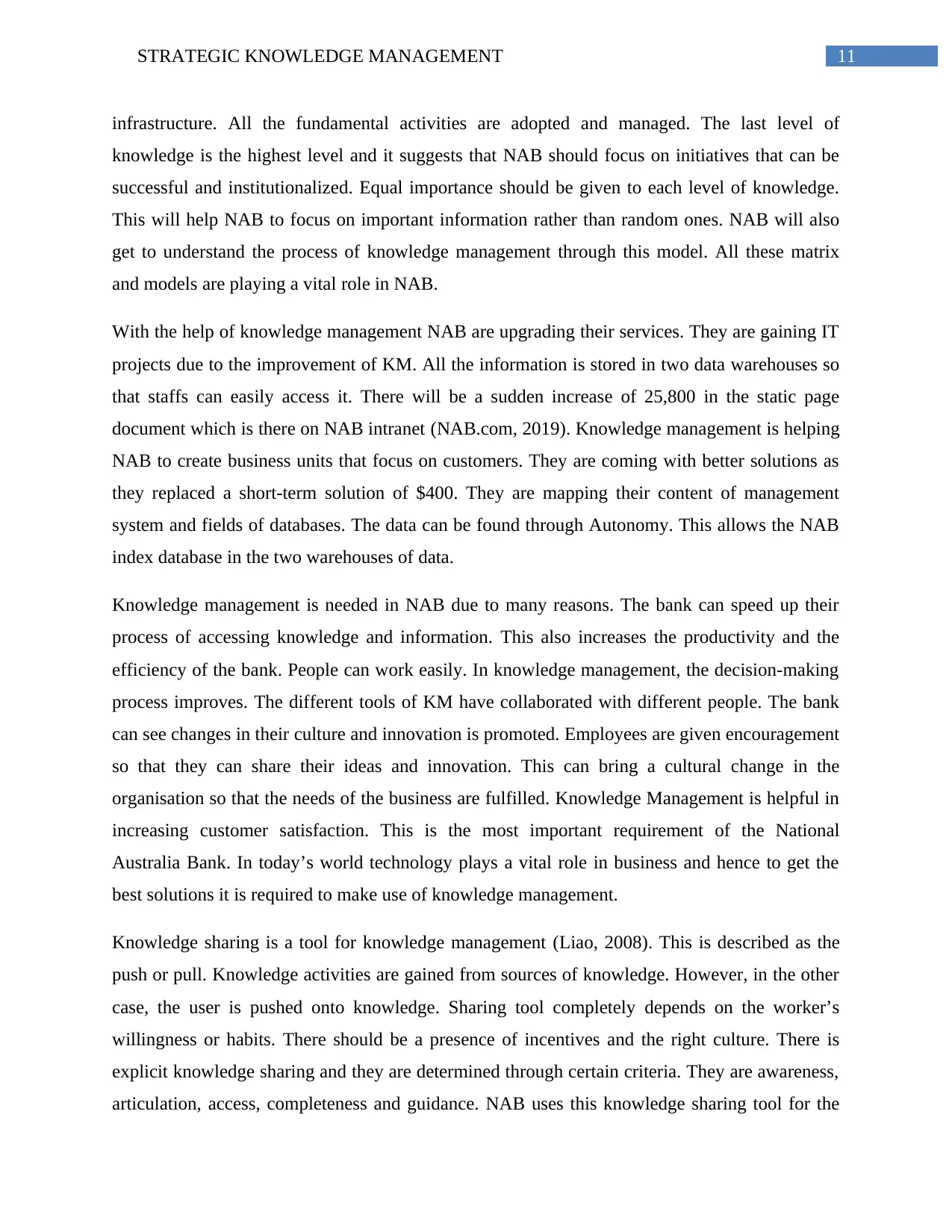

Another model of knowledge management taken is Frid’s KM model. This model is usually

implemented by most of the organisations. There are five levels to this model. The organisations

have to implement all the level given. The five levels are knowledge chaotic, knowledge aware,

knowledge focused, knowledge managed and knowledge centric. The first level suggests that

NAB is in the process of implementing Frid’s framework (Grant, 1996). The next level suggests

that they are one step ahead. The visions and goals of the company can be achieved. A road map

of KM is developed at this stage by NAB. In the third level, all the implementation aspects of

knowledge should be covered that were left in the last two levels. The five new activities should

be started by the company. This can be applied to their process, services, training and

11STRATEGIC KNOWLEDGE MANAGEMENT

infrastructure. All the fundamental activities are adopted and managed. The last level of

knowledge is the highest level and it suggests that NAB should focus on initiatives that can be

successful and institutionalized. Equal importance should be given to each level of knowledge.

This will help NAB to focus on important information rather than random ones. NAB will also

get to understand the process of knowledge management through this model. All these matrix

and models are playing a vital role in NAB.

With the help of knowledge management NAB are upgrading their services. They are gaining IT

projects due to the improvement of KM. All the information is stored in two data warehouses so

that staffs can easily access it. There will be a sudden increase of 25,800 in the static page

document which is there on NAB intranet (NAB.com, 2019). Knowledge management is helping

NAB to create business units that focus on customers. They are coming with better solutions as

they replaced a short-term solution of $400. They are mapping their content of management

system and fields of databases. The data can be found through Autonomy. This allows the NAB

index database in the two warehouses of data.

Knowledge management is needed in NAB due to many reasons. The bank can speed up their

process of accessing knowledge and information. This also increases the productivity and the

efficiency of the bank. People can work easily. In knowledge management, the decision-making

process improves. The different tools of KM have collaborated with different people. The bank

can see changes in their culture and innovation is promoted. Employees are given encouragement

so that they can share their ideas and innovation. This can bring a cultural change in the

organisation so that the needs of the business are fulfilled. Knowledge Management is helpful in

increasing customer satisfaction. This is the most important requirement of the National

Australia Bank. In today’s world technology plays a vital role in business and hence to get the

best solutions it is required to make use of knowledge management.

Knowledge sharing is a tool for knowledge management (Liao, 2008). This is described as the

push or pull. Knowledge activities are gained from sources of knowledge. However, in the other

case, the user is pushed onto knowledge. Sharing tool completely depends on the worker’s

willingness or habits. There should be a presence of incentives and the right culture. There is

explicit knowledge sharing and they are determined through certain criteria. They are awareness,

articulation, access, completeness and guidance. NAB uses this knowledge sharing tool for the

infrastructure. All the fundamental activities are adopted and managed. The last level of

knowledge is the highest level and it suggests that NAB should focus on initiatives that can be

successful and institutionalized. Equal importance should be given to each level of knowledge.

This will help NAB to focus on important information rather than random ones. NAB will also

get to understand the process of knowledge management through this model. All these matrix

and models are playing a vital role in NAB.

With the help of knowledge management NAB are upgrading their services. They are gaining IT

projects due to the improvement of KM. All the information is stored in two data warehouses so

that staffs can easily access it. There will be a sudden increase of 25,800 in the static page

document which is there on NAB intranet (NAB.com, 2019). Knowledge management is helping

NAB to create business units that focus on customers. They are coming with better solutions as

they replaced a short-term solution of $400. They are mapping their content of management

system and fields of databases. The data can be found through Autonomy. This allows the NAB

index database in the two warehouses of data.

Knowledge management is needed in NAB due to many reasons. The bank can speed up their

process of accessing knowledge and information. This also increases the productivity and the

efficiency of the bank. People can work easily. In knowledge management, the decision-making

process improves. The different tools of KM have collaborated with different people. The bank

can see changes in their culture and innovation is promoted. Employees are given encouragement

so that they can share their ideas and innovation. This can bring a cultural change in the

organisation so that the needs of the business are fulfilled. Knowledge Management is helpful in

increasing customer satisfaction. This is the most important requirement of the National

Australia Bank. In today’s world technology plays a vital role in business and hence to get the

best solutions it is required to make use of knowledge management.

Knowledge sharing is a tool for knowledge management (Liao, 2008). This is described as the

push or pull. Knowledge activities are gained from sources of knowledge. However, in the other

case, the user is pushed onto knowledge. Sharing tool completely depends on the worker’s

willingness or habits. There should be a presence of incentives and the right culture. There is

explicit knowledge sharing and they are determined through certain criteria. They are awareness,

articulation, access, completeness and guidance. NAB uses this knowledge sharing tool for the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.