Strategic Management: M&A Concept and Dell-EMC Case Study Analysis

VerifiedAdded on 2021/04/21

|20

|6249

|25

Report

AI Summary

This report delves into the strategic management concept of mergers and acquisitions (M&A), examining its definition, historical evolution through six waves, and the arguments for its creation, including product diversification, financial improvements, and operational efficiency. The report analyzes the M&A process, supported by theories and models. A real-life case study of the Dell-EMC merger is presented to illustrate the practical application of M&A, highlighting its benefits, customer opportunities, and challenges. The report aims to provide a comprehensive understanding of M&A's role in strategic management and its impact on business operations, offering valuable insights for students and professionals alike. The analysis covers the strategic fit of M&A, its implications for various stakeholders, and its contribution to achieving business growth and market competitiveness.

Running Head: Strategic Management 1

Concept of Merger and Acquisition

Concept of Merger and Acquisition

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic Management 2

Executive Summary

Strategic management is important for the enterprises in order to achieve success and

growth in the operating market. It is not easy for the companies to operate in the new market so;

there are various strategic concepts that help the business to deal with the challenges in the

market. In order to operate successfully in the market, there is the need to adopt some effective

strategies by the companies. This report will identify one of the strategic concepts in strategic

management. For the discussion, the concept ‘merger and acquisition’ is selected. Merger and

acquisition is a new step form a new company by combining two companies due to global

recession. This is also beneficial to shareholders and investors of both the companies. The report

will examine the concept and provide the arguments from its creation. This part includes six

waves with the evolution of the concept of merger and acquisition. Along with this, the report

will also explain the factors by which this concept is fit in the strategic management. In second

part, a real life case of the concept will be discussed with the support of theories and models. The

objective of the case is to analyze the importance of role of that strategic management concept in

the business operations.

Executive Summary

Strategic management is important for the enterprises in order to achieve success and

growth in the operating market. It is not easy for the companies to operate in the new market so;

there are various strategic concepts that help the business to deal with the challenges in the

market. In order to operate successfully in the market, there is the need to adopt some effective

strategies by the companies. This report will identify one of the strategic concepts in strategic

management. For the discussion, the concept ‘merger and acquisition’ is selected. Merger and

acquisition is a new step form a new company by combining two companies due to global

recession. This is also beneficial to shareholders and investors of both the companies. The report

will examine the concept and provide the arguments from its creation. This part includes six

waves with the evolution of the concept of merger and acquisition. Along with this, the report

will also explain the factors by which this concept is fit in the strategic management. In second

part, a real life case of the concept will be discussed with the support of theories and models. The

objective of the case is to analyze the importance of role of that strategic management concept in

the business operations.

Strategic Management 3

Contents

Part 1................................................................................................................................................4

Concept of strategic management: Merger and acquisition.........................................................4

Definition of merger and acquisition...........................................................................................4

Starting of M&A..........................................................................................................................5

Arguments for the creation of M&A............................................................................................7

Arguments in favor......................................................................................................................9

Arguments in against.................................................................................................................10

Strategic fit.....................................................................................................................................11

Part two..........................................................................................................................................12

Dell-EMC merger..........................................................................................................................12

Vision for the future...................................................................................................................13

Theories applied in merger............................................................................................................13

Benefits of merger.........................................................................................................................14

Opportunities for the customers.................................................................................................15

Challenges in the merger...............................................................................................................15

References......................................................................................................................................17

List of Figures

Figure 1: Types of Mergers.............................................................................................................4

Contents

Part 1................................................................................................................................................4

Concept of strategic management: Merger and acquisition.........................................................4

Definition of merger and acquisition...........................................................................................4

Starting of M&A..........................................................................................................................5

Arguments for the creation of M&A............................................................................................7

Arguments in favor......................................................................................................................9

Arguments in against.................................................................................................................10

Strategic fit.....................................................................................................................................11

Part two..........................................................................................................................................12

Dell-EMC merger..........................................................................................................................12

Vision for the future...................................................................................................................13

Theories applied in merger............................................................................................................13

Benefits of merger.........................................................................................................................14

Opportunities for the customers.................................................................................................15

Challenges in the merger...............................................................................................................15

References......................................................................................................................................17

List of Figures

Figure 1: Types of Mergers.............................................................................................................4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic Management 4

Part 1

Concept of strategic management: Merger and acquisition

The strategic management has important role in identifying various needs of an

organization. It basically includes of setting the organizational objectives and analyzing internal

and external factors that impact on the business activities of the organization. In current time,

setting objectives, selecting and implementing strategies are the most vital activities for every

organization. The strategic management is helpful for the organizations in improving its

effectiveness as it aligns the priorities with the shareholders, market conditions and potential of

corporate. This report focuses on a concept of strategic management and use of that concept in

current business operations in order to deal with various business challenges. For the discussion,

the concept ‘merger and acquisition’ is selected.

M&A is one of the important business activities that attract the attention of every

business administrators in the economic conditions. In the high level of competition in the

market, companies have to deal with various challenges while they are trying to get high level of

profits. Companies cannot achieve high market share and deal with the competition without

adopting new technology, and human resource especially from M&A activities. It is considered

as the most powerful relationship between two companies. Its operations regularly make the

headlines in the media. The process is perceived as the preferred strategy of most of the

organizations. Basically, M&A is the primary mean of continuous growth and development.

These operations have position impact on the organizations, employees, shareholders and

consumers (Angwin, 2012).

Definition of merger and acquisition

The term Merger and Acquisition includes two realities and they have different impacts.

The merger operations can be described as the fact that whole assets of one or more than one

companies can be transferred to another for the distribution of shares of the absorbing company.

Further, the term acquisition has broad concept. The process of acquisition includes the transfer

of property in total or in parts and the selling company continues the operations till end. In the

simple words, M&A can be defined as the transfer of activity between two companies by the

transfer of property. The process of M&A can be characterized based on size of transaction, legal

Part 1

Concept of strategic management: Merger and acquisition

The strategic management has important role in identifying various needs of an

organization. It basically includes of setting the organizational objectives and analyzing internal

and external factors that impact on the business activities of the organization. In current time,

setting objectives, selecting and implementing strategies are the most vital activities for every

organization. The strategic management is helpful for the organizations in improving its

effectiveness as it aligns the priorities with the shareholders, market conditions and potential of

corporate. This report focuses on a concept of strategic management and use of that concept in

current business operations in order to deal with various business challenges. For the discussion,

the concept ‘merger and acquisition’ is selected.

M&A is one of the important business activities that attract the attention of every

business administrators in the economic conditions. In the high level of competition in the

market, companies have to deal with various challenges while they are trying to get high level of

profits. Companies cannot achieve high market share and deal with the competition without

adopting new technology, and human resource especially from M&A activities. It is considered

as the most powerful relationship between two companies. Its operations regularly make the

headlines in the media. The process is perceived as the preferred strategy of most of the

organizations. Basically, M&A is the primary mean of continuous growth and development.

These operations have position impact on the organizations, employees, shareholders and

consumers (Angwin, 2012).

Definition of merger and acquisition

The term Merger and Acquisition includes two realities and they have different impacts.

The merger operations can be described as the fact that whole assets of one or more than one

companies can be transferred to another for the distribution of shares of the absorbing company.

Further, the term acquisition has broad concept. The process of acquisition includes the transfer

of property in total or in parts and the selling company continues the operations till end. In the

simple words, M&A can be defined as the transfer of activity between two companies by the

transfer of property. The process of M&A can be characterized based on size of transaction, legal

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic Management 5

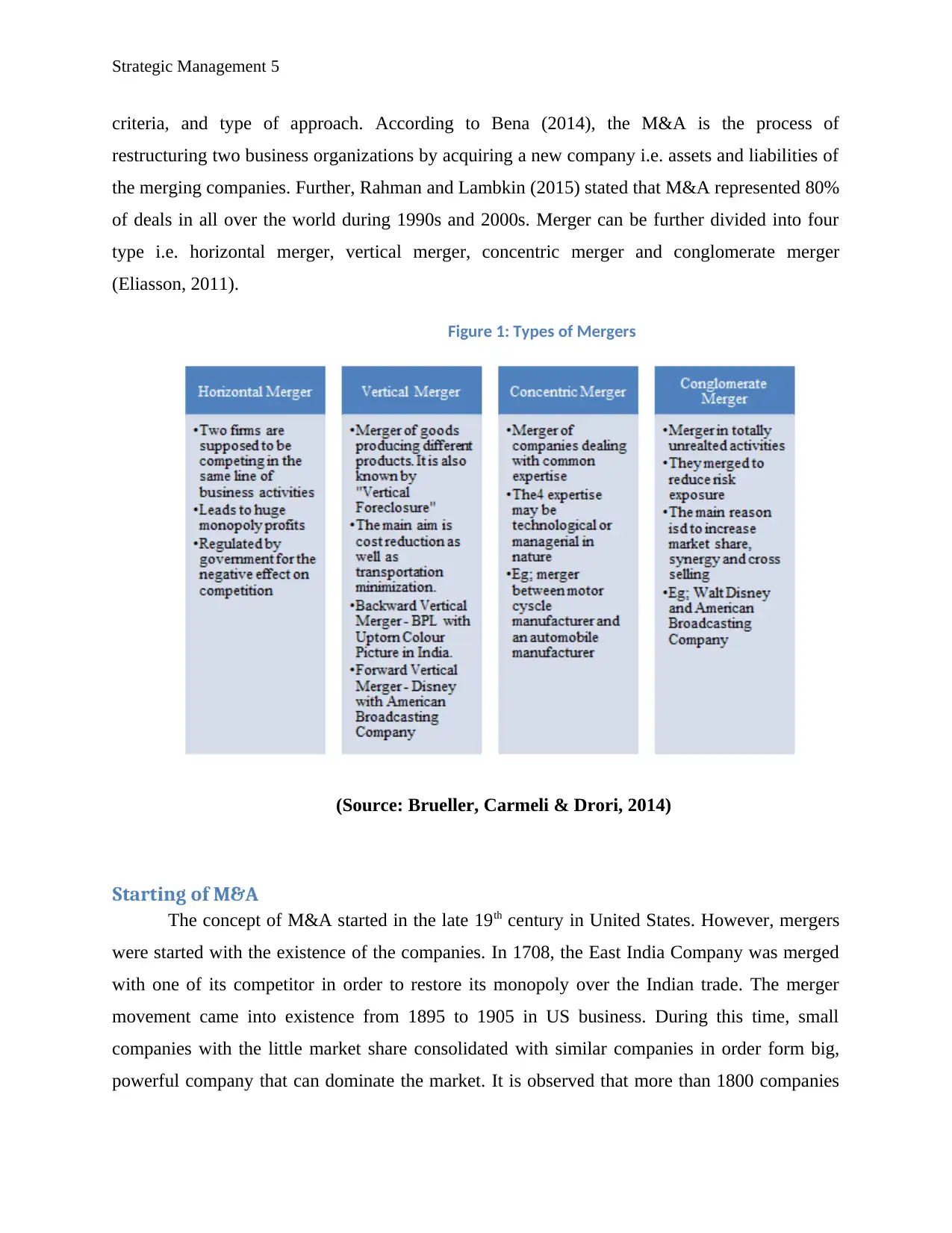

criteria, and type of approach. According to Bena (2014), the M&A is the process of

restructuring two business organizations by acquiring a new company i.e. assets and liabilities of

the merging companies. Further, Rahman and Lambkin (2015) stated that M&A represented 80%

of deals in all over the world during 1990s and 2000s. Merger can be further divided into four

type i.e. horizontal merger, vertical merger, concentric merger and conglomerate merger

(Eliasson, 2011).

Figure 1: Types of Mergers

(Source: Brueller, Carmeli & Drori, 2014)

Starting of M&A

The concept of M&A started in the late 19th century in United States. However, mergers

were started with the existence of the companies. In 1708, the East India Company was merged

with one of its competitor in order to restore its monopoly over the Indian trade. The merger

movement came into existence from 1895 to 1905 in US business. During this time, small

companies with the little market share consolidated with similar companies in order form big,

powerful company that can dominate the market. It is observed that more than 1800 companies

criteria, and type of approach. According to Bena (2014), the M&A is the process of

restructuring two business organizations by acquiring a new company i.e. assets and liabilities of

the merging companies. Further, Rahman and Lambkin (2015) stated that M&A represented 80%

of deals in all over the world during 1990s and 2000s. Merger can be further divided into four

type i.e. horizontal merger, vertical merger, concentric merger and conglomerate merger

(Eliasson, 2011).

Figure 1: Types of Mergers

(Source: Brueller, Carmeli & Drori, 2014)

Starting of M&A

The concept of M&A started in the late 19th century in United States. However, mergers

were started with the existence of the companies. In 1708, the East India Company was merged

with one of its competitor in order to restore its monopoly over the Indian trade. The merger

movement came into existence from 1895 to 1905 in US business. During this time, small

companies with the little market share consolidated with similar companies in order form big,

powerful company that can dominate the market. It is observed that more than 1800 companies

Strategic Management 6

disappeared into consolidation and many of the companies got substantial shares in the market in

which they were operating. Martynova and Renneboog (2008) explained the reason why it

occurs by the waves. According to them, mergers usually occur at the time of economic

recovery. Further, Harford (2005) stated that mergers waves occur in the specific industry needs

large scale of reallocation of assets. This concept was started with the existence of the

companies. According to Lipton (2006), there are six key waves with the evolution of the

concept of merger and acquisition.

First wave of merger-

From 1897 to 1904, there was the evolution of horizontal M&A and creation of first

monopolies. This wave was take place in USA and enabled the emergence of the economy that

still exists. These groups have achieved leading position in the sector of activity and able to

manage their monopoly (Lipton, 2006).

Second wave of merger-

Next, from 1916 to 1929, there was the evolution of vertical merger and the formulation of

oligopolies. At that time, mergers were done between oligopolies rather than monopolies. The

economic boom after the post world war gave rise to these mergers. There were technological

developments i.e. developments of transportation and railroads that provided essential

infrastructure for such type of mergers and acquisitions to take place. Along with this, the

government policy encouraged the companies to operate in unity. The 2nd wave of merger was

horizontal or conglomerate in the nature. The companies that adopted merger during this period

were generally producers of food products, primary metals, petroleum products, chemicals and

transportation equipments. The investment banks also played an important role in the process of

mergers and acquisitions (Roivas & Randeniya, 2004).

Third wave of merger-

The merger that took place in period of 1965-69 was basically conglomerate mergers.

During that period, mergers were inspired by the interest rates, high stock prices, and strict

enforcement of antitrust laws. The bidder companies in 3rd wave of merger were smaller as

disappeared into consolidation and many of the companies got substantial shares in the market in

which they were operating. Martynova and Renneboog (2008) explained the reason why it

occurs by the waves. According to them, mergers usually occur at the time of economic

recovery. Further, Harford (2005) stated that mergers waves occur in the specific industry needs

large scale of reallocation of assets. This concept was started with the existence of the

companies. According to Lipton (2006), there are six key waves with the evolution of the

concept of merger and acquisition.

First wave of merger-

From 1897 to 1904, there was the evolution of horizontal M&A and creation of first

monopolies. This wave was take place in USA and enabled the emergence of the economy that

still exists. These groups have achieved leading position in the sector of activity and able to

manage their monopoly (Lipton, 2006).

Second wave of merger-

Next, from 1916 to 1929, there was the evolution of vertical merger and the formulation of

oligopolies. At that time, mergers were done between oligopolies rather than monopolies. The

economic boom after the post world war gave rise to these mergers. There were technological

developments i.e. developments of transportation and railroads that provided essential

infrastructure for such type of mergers and acquisitions to take place. Along with this, the

government policy encouraged the companies to operate in unity. The 2nd wave of merger was

horizontal or conglomerate in the nature. The companies that adopted merger during this period

were generally producers of food products, primary metals, petroleum products, chemicals and

transportation equipments. The investment banks also played an important role in the process of

mergers and acquisitions (Roivas & Randeniya, 2004).

Third wave of merger-

The merger that took place in period of 1965-69 was basically conglomerate mergers.

During that period, mergers were inspired by the interest rates, high stock prices, and strict

enforcement of antitrust laws. The bidder companies in 3rd wave of merger were smaller as

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic Management 7

compared to target companies. Along with this, mergers were financed from equities so

investment banks did not have any role in the merger.

Forth wave merger-

The 4th wave merger was started from 1981 and ended in 1989. The merger was

characterized by acquisition targets that were larger as compared to 3rd wave merger. During that

period, mergers were took place between pharmaceutical industries, oil and gas industries, airline

and banking industries. Foreign takeovers were become essential as most of them were hostile

takeovers. This wave merger was ended with the anti takeover laws and financial institution

reform (Mager & Fackle, 2017).

Fifth wave merger-

This wave merger was started from 1992 and ended in 2000. This wave merger was

inspired by the stock market, globalization and deregulation. This merger were generally took

place in telecommunication and banking industries. Rather than debt financing, they were equity

financed. Along with this, the mergers were driven long term rather than focusing on short term

profit objectives (Larsson & Wallenberg, 2002).

Sixth wave merger-

The sixth wave merger of M&A was started in 2003 and ended in late 2007. In this wave,

value of merger and acquisition in the market exceeded. In this wave, mergers were done in

telecom companies, and automobile companies. The market for corporate control was less

competitive, offers involved lower premium that indicates more rational acquisition decisions.

The evolution of M&A has been long drawn. There are various economic factors that

contributed in the evolution of merger and acquisition. Along with this, there are various factors

that have impact on the growth also.

Arguments for the creation of M&A

The objective of M&A is to protect or enhance the strength or profitability of the

company. There were various arguments while creating M&A for the business. The most

common reason for the business combination is economic at its core. This is important to shape

compared to target companies. Along with this, mergers were financed from equities so

investment banks did not have any role in the merger.

Forth wave merger-

The 4th wave merger was started from 1981 and ended in 1989. The merger was

characterized by acquisition targets that were larger as compared to 3rd wave merger. During that

period, mergers were took place between pharmaceutical industries, oil and gas industries, airline

and banking industries. Foreign takeovers were become essential as most of them were hostile

takeovers. This wave merger was ended with the anti takeover laws and financial institution

reform (Mager & Fackle, 2017).

Fifth wave merger-

This wave merger was started from 1992 and ended in 2000. This wave merger was

inspired by the stock market, globalization and deregulation. This merger were generally took

place in telecommunication and banking industries. Rather than debt financing, they were equity

financed. Along with this, the mergers were driven long term rather than focusing on short term

profit objectives (Larsson & Wallenberg, 2002).

Sixth wave merger-

The sixth wave merger of M&A was started in 2003 and ended in late 2007. In this wave,

value of merger and acquisition in the market exceeded. In this wave, mergers were done in

telecom companies, and automobile companies. The market for corporate control was less

competitive, offers involved lower premium that indicates more rational acquisition decisions.

The evolution of M&A has been long drawn. There are various economic factors that

contributed in the evolution of merger and acquisition. Along with this, there are various factors

that have impact on the growth also.

Arguments for the creation of M&A

The objective of M&A is to protect or enhance the strength or profitability of the

company. There were various arguments while creating M&A for the business. The most

common reason for the business combination is economic at its core. This is important to shape

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic Management 8

the local and global business landscape. Based on the definition, it is well known that merger

includes two companies bringing together in order to become one. On the other hand, acquisition

includes takeover of another company either by purchasing an interest or by purchasing whole

business and assets. M&A aimed at driving business growth. There are some specific arguments

to adopt this process in the business process (Motis, 2007).

Product investment and diversification-

Mergers are beneficial for the diversification of product offerings. For instance, if a large

company thinks that it has much exposure to risk as it has invested too much business in one

specific industry. Then the company can diversify its business by acquiring another company.

The key motive of M&A is to reduce the risk in the business. If a company with the strong

product line is seeking for market shift then it may acquire another company that is active in that

specific industry. New trends in the industry and evolving market behaviors are the reasons that

drive a company to merge with its competitions. Further, there is high degree of competition and

internal management problems that could also drive a company to acquisition by another

company (Kummer, 2011).

Example- The merger of Mobilink Telecom Inc. by Broadcom is the perfect example of this

type of merger. Broadcom basically deals in the manufacturing process of Bluetooth personal

area network hardware systems and wireless LAN. Further, Mobilink Telecom is engaged in the

manufacturing of handsets equipped with the global system for the mobile communication

technology. By the merger, the products of both the companies are complementing each other.

Improving financial position-

This is another objective for M&A in the business. It is well known that larger companies

have better access of funding in the business as compared to smaller companies. by the merger,

companies may have access of debt or equity financing. For instance, Apple Inc. is one the

largest company in the world has issued $60 billion in bonds despite of the fact that the company

has large amount of capital. This is beneficial for smaller companies like Dell to get success with

the bond issue of this size. If any company is facing financial issues, then the company may look

for other company to acquire it.

the local and global business landscape. Based on the definition, it is well known that merger

includes two companies bringing together in order to become one. On the other hand, acquisition

includes takeover of another company either by purchasing an interest or by purchasing whole

business and assets. M&A aimed at driving business growth. There are some specific arguments

to adopt this process in the business process (Motis, 2007).

Product investment and diversification-

Mergers are beneficial for the diversification of product offerings. For instance, if a large

company thinks that it has much exposure to risk as it has invested too much business in one

specific industry. Then the company can diversify its business by acquiring another company.

The key motive of M&A is to reduce the risk in the business. If a company with the strong

product line is seeking for market shift then it may acquire another company that is active in that

specific industry. New trends in the industry and evolving market behaviors are the reasons that

drive a company to merge with its competitions. Further, there is high degree of competition and

internal management problems that could also drive a company to acquisition by another

company (Kummer, 2011).

Example- The merger of Mobilink Telecom Inc. by Broadcom is the perfect example of this

type of merger. Broadcom basically deals in the manufacturing process of Bluetooth personal

area network hardware systems and wireless LAN. Further, Mobilink Telecom is engaged in the

manufacturing of handsets equipped with the global system for the mobile communication

technology. By the merger, the products of both the companies are complementing each other.

Improving financial position-

This is another objective for M&A in the business. It is well known that larger companies

have better access of funding in the business as compared to smaller companies. by the merger,

companies may have access of debt or equity financing. For instance, Apple Inc. is one the

largest company in the world has issued $60 billion in bonds despite of the fact that the company

has large amount of capital. This is beneficial for smaller companies like Dell to get success with

the bond issue of this size. If any company is facing financial issues, then the company may look

for other company to acquire it.

Strategic Management 9

Example- Verizon took control of wireless unit from Vodafone Group plc. In order to acquire

Vodafone’s 45% stake in Verizon wireless, Verizon was working from last few decades and the

efforts of the company were successful in 2013. The US telecom was agreed to pay $130 billion

for taking full control of its wireless unit that was brining in around $21.8 billion every year.

This merger strengthened the financial position of Verizon and the company was able to invest

for the better infrastructure and enhance the competitiveness in the market (Campbell, 2017).

Advantage of tax and operational efficiency-

M&A have some tax advantages for the companies like tax loss carry forward. According

to M&A scheme, the company operating in the high corporate-tax-rate country needs to merge

only with another company in low corporate-tax-rate country. The new company is legally

located the low-tax country avoids million and billions in the corporate taxes. If two companies

are merging in the same general line of industry and business the operating business may get

profit from the merger. Business functions are very expensive for the small business companies.

The combined companies are able to afford the important activities of the business. But the

operating economies can be attained by large level of merger and acquisitions as well (Boschma

& Hartog, 2014).

Arguments in favor

There are some motives found in the evolution of the concept of merger and acquisition.

Those motives are diversification, synergy, internationalization and stagnation, replacing

management and manager hubris.

Synergy gains-Synergies are those efficiencies that can be achieved by the process of merger.

Synergies are generally connected with the shifts in the production possibilities if the merging

companies that go beyond the technical efficiency (Brief, 2014). The process of M&A is helpful

for the organizations to gain synergies by combining the business activities. With the synergy

gain, organizations are able to enhance the performance and decrease the costs. A business

attempts to merge with another business that has complementary strengths and weakness

(Renaud, 2017).

Growth and internationalization- next factor that support merger and acquisition is growth and

internationalization. Every business need growth and wants to operate at the global level. There

Example- Verizon took control of wireless unit from Vodafone Group plc. In order to acquire

Vodafone’s 45% stake in Verizon wireless, Verizon was working from last few decades and the

efforts of the company were successful in 2013. The US telecom was agreed to pay $130 billion

for taking full control of its wireless unit that was brining in around $21.8 billion every year.

This merger strengthened the financial position of Verizon and the company was able to invest

for the better infrastructure and enhance the competitiveness in the market (Campbell, 2017).

Advantage of tax and operational efficiency-

M&A have some tax advantages for the companies like tax loss carry forward. According

to M&A scheme, the company operating in the high corporate-tax-rate country needs to merge

only with another company in low corporate-tax-rate country. The new company is legally

located the low-tax country avoids million and billions in the corporate taxes. If two companies

are merging in the same general line of industry and business the operating business may get

profit from the merger. Business functions are very expensive for the small business companies.

The combined companies are able to afford the important activities of the business. But the

operating economies can be attained by large level of merger and acquisitions as well (Boschma

& Hartog, 2014).

Arguments in favor

There are some motives found in the evolution of the concept of merger and acquisition.

Those motives are diversification, synergy, internationalization and stagnation, replacing

management and manager hubris.

Synergy gains-Synergies are those efficiencies that can be achieved by the process of merger.

Synergies are generally connected with the shifts in the production possibilities if the merging

companies that go beyond the technical efficiency (Brief, 2014). The process of M&A is helpful

for the organizations to gain synergies by combining the business activities. With the synergy

gain, organizations are able to enhance the performance and decrease the costs. A business

attempts to merge with another business that has complementary strengths and weakness

(Renaud, 2017).

Growth and internationalization- next factor that support merger and acquisition is growth and

internationalization. Every business need growth and wants to operate at the global level. There

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic Management 10

are various examples of the companies that merged with other companies in order to operate the

business in the international market (Alluru et al, 2016). This fact can be supported by the

example of the merger of Procter & Gamble and Gillette. In order to operate in the global

market, Procter and Gamble (P&G) incorporated with the business processes of Gillette in 2005.

This was the key to retain the top talent from Gillette.

This argument is also accepted in recent time as companies are expanding their business

in the global markets. In current time, big companies are also acquiring other companies in order

to expand their business. For instance, famous German drug maker company Bayer made a deal

of $66 billion to acquire US Seeds Company named Monsanto in September 2017. This deal has

made Bayer a one-stop shop for the agricultural requirements (Indian Express, 2016).

Deal with the competition- At the initial stages, the concept of M&A was evolved to deal with

the competition in the market. Now, this concept is widely accepted by the companies to stay

competitive in the market (Athreye, 2009). In order to stay competitive in the market, Samsung

Electronics announced to deal of $8 billion with the audio and infotainment company Harman

International. This was the biggest international acquisition by the South Korean company. This

deal was helpful in the growth prospects of Samsung.

Arguments in against

Merger and acquisition can be valuable for the companies for various reasons i.e.

enhancing products and services, gateway for the global market, hiring talented people, and

intellectual property, change of direction etc. but, some reports and researchers claimed their

most of the merger destroyed the shareholder values. The reason for failure of merger includes

operation failures, culture differences and dealing with various people (Weber & YedidiaTarba,

2012). There can be financial reason also that fails mergers. Overvaluation is one of the reasons

for the failure of merger. For instance, in 2007, Microsoft had to pay $6.3 billion for the digital

marketing company named aQuantive by taking $6.2 billion write down for it. Because of fraud

or error, overvaluation is the key reason the mergers or acquisition fail in adding value. Further,

culture is also a factor by which h the merger or acquisition can be failed. At the evolving stage

of M&A, this factor was identified in against. In 1968, two longtime railway competitors,

Pennsylvania Railroad and New York Central Railroad merged and became Penn Central which

was the sixth largest corporation in America. But, due to strong competition, it was impossible

are various examples of the companies that merged with other companies in order to operate the

business in the international market (Alluru et al, 2016). This fact can be supported by the

example of the merger of Procter & Gamble and Gillette. In order to operate in the global

market, Procter and Gamble (P&G) incorporated with the business processes of Gillette in 2005.

This was the key to retain the top talent from Gillette.

This argument is also accepted in recent time as companies are expanding their business

in the global markets. In current time, big companies are also acquiring other companies in order

to expand their business. For instance, famous German drug maker company Bayer made a deal

of $66 billion to acquire US Seeds Company named Monsanto in September 2017. This deal has

made Bayer a one-stop shop for the agricultural requirements (Indian Express, 2016).

Deal with the competition- At the initial stages, the concept of M&A was evolved to deal with

the competition in the market. Now, this concept is widely accepted by the companies to stay

competitive in the market (Athreye, 2009). In order to stay competitive in the market, Samsung

Electronics announced to deal of $8 billion with the audio and infotainment company Harman

International. This was the biggest international acquisition by the South Korean company. This

deal was helpful in the growth prospects of Samsung.

Arguments in against

Merger and acquisition can be valuable for the companies for various reasons i.e.

enhancing products and services, gateway for the global market, hiring talented people, and

intellectual property, change of direction etc. but, some reports and researchers claimed their

most of the merger destroyed the shareholder values. The reason for failure of merger includes

operation failures, culture differences and dealing with various people (Weber & YedidiaTarba,

2012). There can be financial reason also that fails mergers. Overvaluation is one of the reasons

for the failure of merger. For instance, in 2007, Microsoft had to pay $6.3 billion for the digital

marketing company named aQuantive by taking $6.2 billion write down for it. Because of fraud

or error, overvaluation is the key reason the mergers or acquisition fail in adding value. Further,

culture is also a factor by which h the merger or acquisition can be failed. At the evolving stage

of M&A, this factor was identified in against. In 1968, two longtime railway competitors,

Pennsylvania Railroad and New York Central Railroad merged and became Penn Central which

was the sixth largest corporation in America. But, due to strong competition, it was impossible

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic Management 11

for the companies to work together. The company was filed for bankruptcy after two years of

merger (Jacobsen, 2012).

Next, there is one more example that supports this argument. In March 1994,

WordPerfect, the best-selling word processing software company, merged with Novell Inc. But

the management of both the companies was conflicts in starting. The merger was done by layoffs

at the companies and that drop in share value. Due to the internal conflicts, WordPerfect lost its

leadership position in the market. After two years, Novell sold it to Corell in the amount less

than they paid (Martin Roll, 2014).

So, it is observed that there are several arguments in favor and against of merger and

arguments. This is widely accepted concepts by the companies as they want success and growth

in the international market. There are some drawbacks also in this concept as merger is

sometimes failed due to financial reasons or cultural differences (Bradt, 2015). But, merger or

acquisition is accepted by the companies for the long-term business growth. The arguments

provided in the favor M&A at the time of its evolution are adopted by the companies in order to

get growth and success in the business.

Strategic fit

Merger and acquisition is the important concept of strategic management. This concept is

also fit with the other strategic concepts as the key motive of this concept is to enhance the

business performance in the respective industry. M&A share the common goal, that the value to

merged companies will be greater in the industry. The success of this process depends upon its

strategic fit. There are some points that support the strategic fit of this concept in the strategic

management. Also, this is also helpful in dealing with the business challenges i.e. competition,

substitute products, entering in the global market etc.

Enhancing capacity- In M&A, companies compete directly with similar products, services and

markets. The new combined company is able to gain synergies and enhance the capacity by

rationalizing operations. It is also helpful in dealing with the competition by the combined

management operations.

for the companies to work together. The company was filed for bankruptcy after two years of

merger (Jacobsen, 2012).

Next, there is one more example that supports this argument. In March 1994,

WordPerfect, the best-selling word processing software company, merged with Novell Inc. But

the management of both the companies was conflicts in starting. The merger was done by layoffs

at the companies and that drop in share value. Due to the internal conflicts, WordPerfect lost its

leadership position in the market. After two years, Novell sold it to Corell in the amount less

than they paid (Martin Roll, 2014).

So, it is observed that there are several arguments in favor and against of merger and

arguments. This is widely accepted concepts by the companies as they want success and growth

in the international market. There are some drawbacks also in this concept as merger is

sometimes failed due to financial reasons or cultural differences (Bradt, 2015). But, merger or

acquisition is accepted by the companies for the long-term business growth. The arguments

provided in the favor M&A at the time of its evolution are adopted by the companies in order to

get growth and success in the business.

Strategic fit

Merger and acquisition is the important concept of strategic management. This concept is

also fit with the other strategic concepts as the key motive of this concept is to enhance the

business performance in the respective industry. M&A share the common goal, that the value to

merged companies will be greater in the industry. The success of this process depends upon its

strategic fit. There are some points that support the strategic fit of this concept in the strategic

management. Also, this is also helpful in dealing with the business challenges i.e. competition,

substitute products, entering in the global market etc.

Enhancing capacity- In M&A, companies compete directly with similar products, services and

markets. The new combined company is able to gain synergies and enhance the capacity by

rationalizing operations. It is also helpful in dealing with the competition by the combined

management operations.

Strategic Management 12

Product and market expansion- Most of the company focus on the expansion of product line

and business in the international market. When two companies are providing similar products in

the different market or different products in the similar markets then M&A can be helpful for

them to enhance the profit in the same market. Companies need motivation to expand the

business. In such case, it is beneficial for the companies to provide relevant knowledge of new

market (Cartwright & Cooper, 2012).

Integration planning- M&A is helpful in adding value at every point. This is increasingly

becoming as an important part of the corporate strategy of the business. It fits into the strategy of

the company and enhances the growth, market position and strategy for the value creation. By

this, companies are able to make necessary decisions in the marketplace. It is helpful for the

companies to take advantage of the scales in the mature market and gain access of new

technologies, products, markets and distribution channels. It is also helpful in responding the

disruption in the industries such as energy, technology and financial services. By managing

correctly, the process of merger and acquisition can save the company from unwanted risks

(PWC, 2016).

It can be seen that M&A is one of the important business activities that attract the

attention of every business administrators in the economic conditions. The process of M&A is

helpful for the organizations to gain synergies by combining the business activities. If two

companies are merging in the same general line of industry and business the operating business

may get profit from the merger. Companies cannot achieve high market share and deal with the

competition without adopting new technology and human resource especially by this concept.

Along with this, the process is perceived as the preferred strategy of most of the organizations

that is helpful in dealing with the various challenges in the respective markets.

Part two

Dell-EMC merger

The merger of Dell and EMC is one of the largest acquisitions in the technology industry.

This merger was complicated as compared to simple purchase of one company. The meaning of

acquisition of EMC is purchasing all the smaller companies under this. Due to its size, EMC was

Product and market expansion- Most of the company focus on the expansion of product line

and business in the international market. When two companies are providing similar products in

the different market or different products in the similar markets then M&A can be helpful for

them to enhance the profit in the same market. Companies need motivation to expand the

business. In such case, it is beneficial for the companies to provide relevant knowledge of new

market (Cartwright & Cooper, 2012).

Integration planning- M&A is helpful in adding value at every point. This is increasingly

becoming as an important part of the corporate strategy of the business. It fits into the strategy of

the company and enhances the growth, market position and strategy for the value creation. By

this, companies are able to make necessary decisions in the marketplace. It is helpful for the

companies to take advantage of the scales in the mature market and gain access of new

technologies, products, markets and distribution channels. It is also helpful in responding the

disruption in the industries such as energy, technology and financial services. By managing

correctly, the process of merger and acquisition can save the company from unwanted risks

(PWC, 2016).

It can be seen that M&A is one of the important business activities that attract the

attention of every business administrators in the economic conditions. The process of M&A is

helpful for the organizations to gain synergies by combining the business activities. If two

companies are merging in the same general line of industry and business the operating business

may get profit from the merger. Companies cannot achieve high market share and deal with the

competition without adopting new technology and human resource especially by this concept.

Along with this, the process is perceived as the preferred strategy of most of the organizations

that is helpful in dealing with the various challenges in the respective markets.

Part two

Dell-EMC merger

The merger of Dell and EMC is one of the largest acquisitions in the technology industry.

This merger was complicated as compared to simple purchase of one company. The meaning of

acquisition of EMC is purchasing all the smaller companies under this. Due to its size, EMC was

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.