Strategic Analysis of Unilever: Global Strategies and Market Position

VerifiedAdded on 2023/06/10

|21

|4874

|237

Report

AI Summary

This report provides a comprehensive analysis of Unilever's strategic management, focusing on its global market position and key strategies. It examines Unilever's capital acquisition plans, merger and acquisition strategies, and marketing approaches, highlighting their influence on the company's competitive strength. The report also assesses Unilever's position relative to competitors like P&G and Nestle, emphasizing the importance of its diverse product umbrella. Furthermore, it proposes strategic options for Unilever, including expanding its product umbrella and supplying raw materials to competitors, to enhance its global presence and market control. Desklib offers a wealth of similar resources, including past papers and solved assignments, to aid students in their studies.

Running head: STRATEGIC MANAGEMENT AT UNILEVER

Strategic Management at Unilever

Name of the Student

Name of the University

Author note

Strategic Management at Unilever

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

STRATEGIC MANAGEMENT AT UNILEVER

Part 1.0: Strategic organizational plans:

A review of the strategic plans of Unilever PLC would reveal the following types of

plans in which the transnational company engages:

Strategic plan 1: Capital acquisition plans:

Figure 1. Five year stock chart of Unilever

(Source: londonstockexchange.com, 2018)

STRATEGIC MANAGEMENT AT UNILEVER

Part 1.0: Strategic organizational plans:

A review of the strategic plans of Unilever PLC would reveal the following types of

plans in which the transnational company engages:

Strategic plan 1: Capital acquisition plans:

Figure 1. Five year stock chart of Unilever

(Source: londonstockexchange.com, 2018)

2

STRATEGIC MANAGEMENT AT UNILEVER

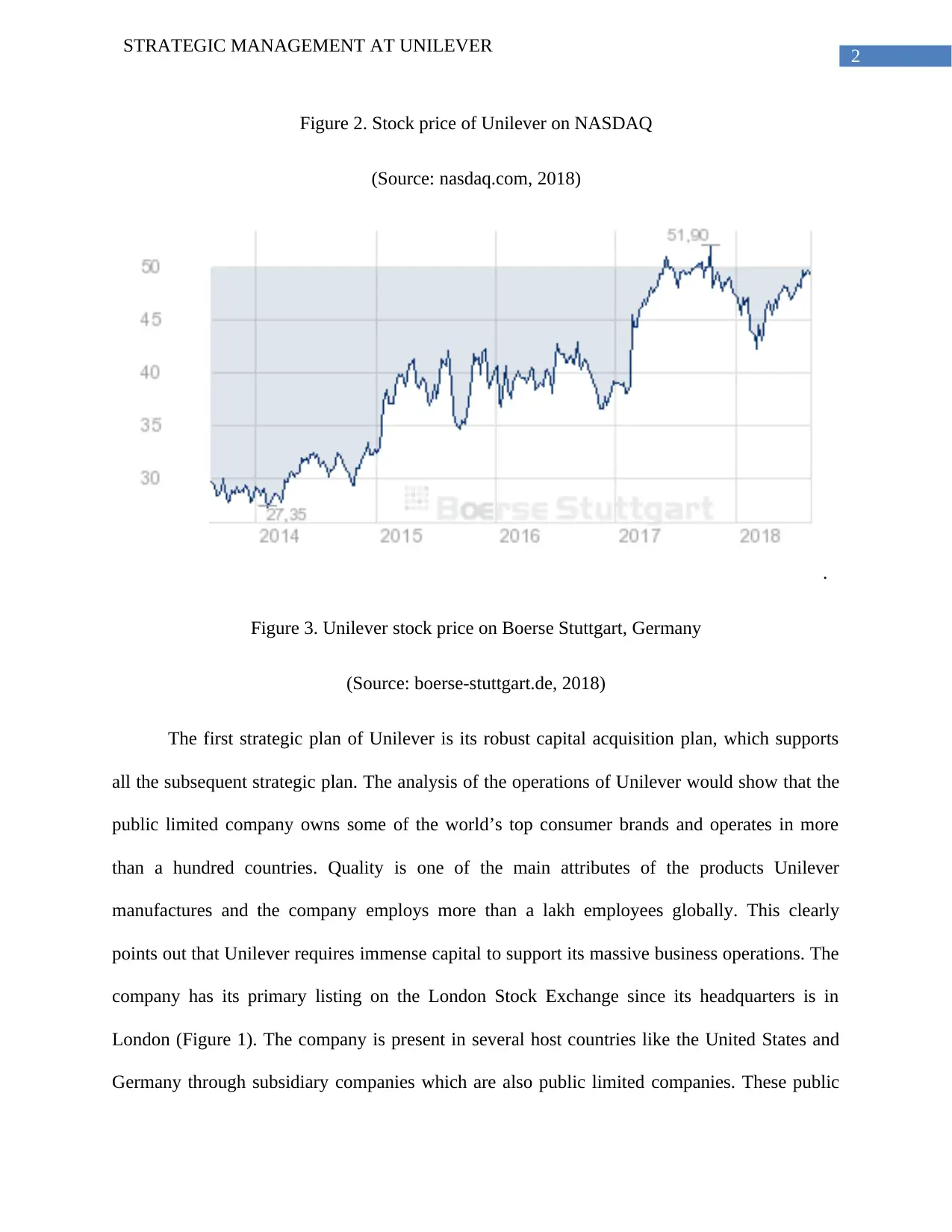

Figure 2. Stock price of Unilever on NASDAQ

(Source: nasdaq.com, 2018)

.

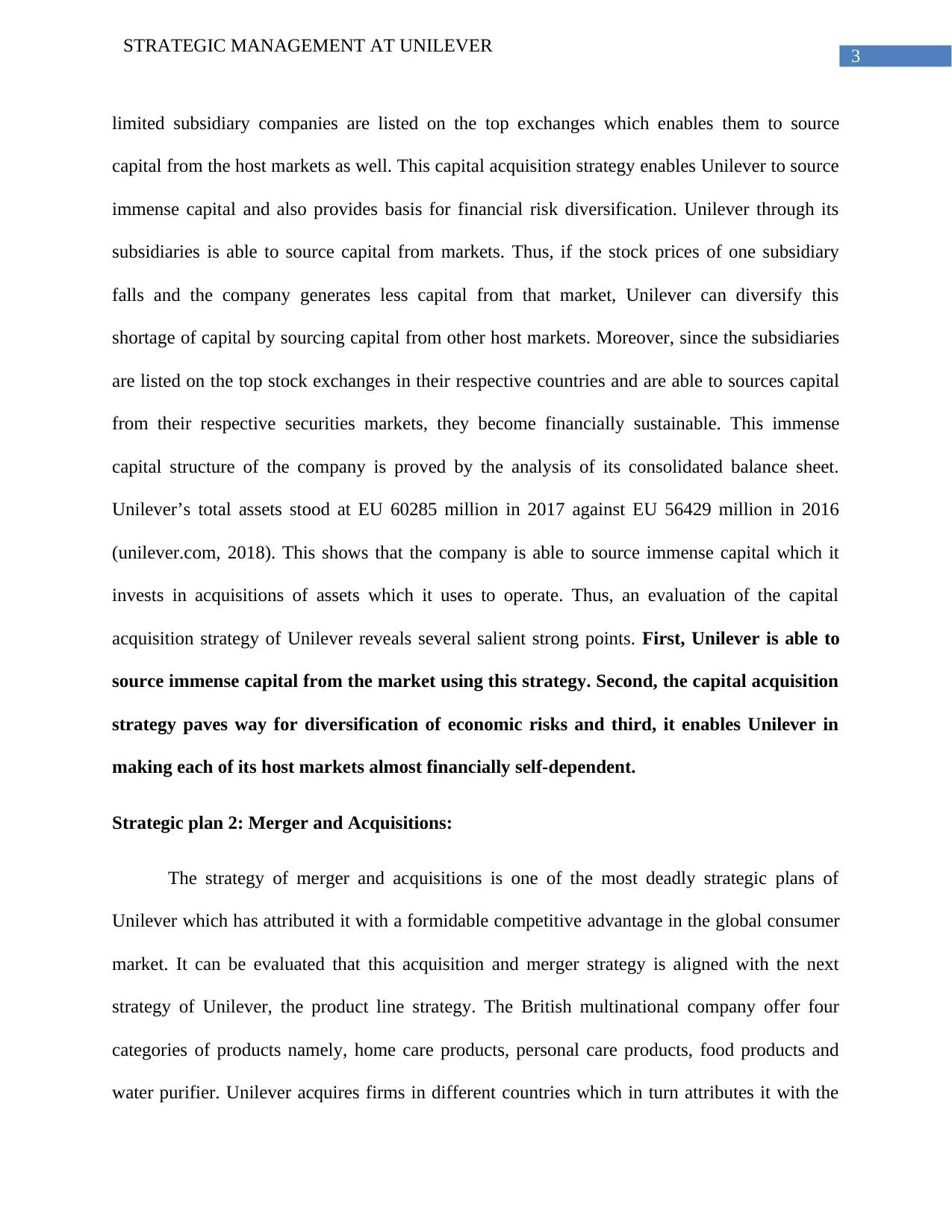

Figure 3. Unilever stock price on Boerse Stuttgart, Germany

(Source: boerse-stuttgart.de, 2018)

The first strategic plan of Unilever is its robust capital acquisition plan, which supports

all the subsequent strategic plan. The analysis of the operations of Unilever would show that the

public limited company owns some of the world’s top consumer brands and operates in more

than a hundred countries. Quality is one of the main attributes of the products Unilever

manufactures and the company employs more than a lakh employees globally. This clearly

points out that Unilever requires immense capital to support its massive business operations. The

company has its primary listing on the London Stock Exchange since its headquarters is in

London (Figure 1). The company is present in several host countries like the United States and

Germany through subsidiary companies which are also public limited companies. These public

STRATEGIC MANAGEMENT AT UNILEVER

Figure 2. Stock price of Unilever on NASDAQ

(Source: nasdaq.com, 2018)

.

Figure 3. Unilever stock price on Boerse Stuttgart, Germany

(Source: boerse-stuttgart.de, 2018)

The first strategic plan of Unilever is its robust capital acquisition plan, which supports

all the subsequent strategic plan. The analysis of the operations of Unilever would show that the

public limited company owns some of the world’s top consumer brands and operates in more

than a hundred countries. Quality is one of the main attributes of the products Unilever

manufactures and the company employs more than a lakh employees globally. This clearly

points out that Unilever requires immense capital to support its massive business operations. The

company has its primary listing on the London Stock Exchange since its headquarters is in

London (Figure 1). The company is present in several host countries like the United States and

Germany through subsidiary companies which are also public limited companies. These public

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

STRATEGIC MANAGEMENT AT UNILEVER

limited subsidiary companies are listed on the top exchanges which enables them to source

capital from the host markets as well. This capital acquisition strategy enables Unilever to source

immense capital and also provides basis for financial risk diversification. Unilever through its

subsidiaries is able to source capital from markets. Thus, if the stock prices of one subsidiary

falls and the company generates less capital from that market, Unilever can diversify this

shortage of capital by sourcing capital from other host markets. Moreover, since the subsidiaries

are listed on the top stock exchanges in their respective countries and are able to sources capital

from their respective securities markets, they become financially sustainable. This immense

capital structure of the company is proved by the analysis of its consolidated balance sheet.

Unilever’s total assets stood at EU 60285 million in 2017 against EU 56429 million in 2016

(unilever.com, 2018). This shows that the company is able to source immense capital which it

invests in acquisitions of assets which it uses to operate. Thus, an evaluation of the capital

acquisition strategy of Unilever reveals several salient strong points. First, Unilever is able to

source immense capital from the market using this strategy. Second, the capital acquisition

strategy paves way for diversification of economic risks and third, it enables Unilever in

making each of its host markets almost financially self-dependent.

Strategic plan 2: Merger and Acquisitions:

The strategy of merger and acquisitions is one of the most deadly strategic plans of

Unilever which has attributed it with a formidable competitive advantage in the global consumer

market. It can be evaluated that this acquisition and merger strategy is aligned with the next

strategy of Unilever, the product line strategy. The British multinational company offer four

categories of products namely, home care products, personal care products, food products and

water purifier. Unilever acquires firms in different countries which in turn attributes it with the

STRATEGIC MANAGEMENT AT UNILEVER

limited subsidiary companies are listed on the top exchanges which enables them to source

capital from the host markets as well. This capital acquisition strategy enables Unilever to source

immense capital and also provides basis for financial risk diversification. Unilever through its

subsidiaries is able to source capital from markets. Thus, if the stock prices of one subsidiary

falls and the company generates less capital from that market, Unilever can diversify this

shortage of capital by sourcing capital from other host markets. Moreover, since the subsidiaries

are listed on the top stock exchanges in their respective countries and are able to sources capital

from their respective securities markets, they become financially sustainable. This immense

capital structure of the company is proved by the analysis of its consolidated balance sheet.

Unilever’s total assets stood at EU 60285 million in 2017 against EU 56429 million in 2016

(unilever.com, 2018). This shows that the company is able to source immense capital which it

invests in acquisitions of assets which it uses to operate. Thus, an evaluation of the capital

acquisition strategy of Unilever reveals several salient strong points. First, Unilever is able to

source immense capital from the market using this strategy. Second, the capital acquisition

strategy paves way for diversification of economic risks and third, it enables Unilever in

making each of its host markets almost financially self-dependent.

Strategic plan 2: Merger and Acquisitions:

The strategy of merger and acquisitions is one of the most deadly strategic plans of

Unilever which has attributed it with a formidable competitive advantage in the global consumer

market. It can be evaluated that this acquisition and merger strategy is aligned with the next

strategy of Unilever, the product line strategy. The British multinational company offer four

categories of products namely, home care products, personal care products, food products and

water purifier. Unilever acquires firms in different countries which in turn attributes it with the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

STRATEGIC MANAGEMENT AT UNILEVER

vast product line. The company has acquired firms like Lakme and Breyers which are among the

top brands in the world in terms of high end beauty products and ice cream respectively. As per

one of the latest news releases of Unilever, the company has acquired 75 percent stake of

Equilibra, an Italian beauty and wellness brand.

Strategic plan 4: Marketing strategy:

The third powerful strategy of Unilever is its powerful product line strategy which has

attributed it with top position in the global consumer market. The marketing strategy of Unilever

stands on four pillars namely, its products, pricing, place and promotion. An analysis of the

product umbrella strategy of Unilever shows that the company markets four types of products

namely, home care, personal care, food and refreshments and water purifier. Dove, Lux, Breyer

and Cif are some of the brands owned by Unilever (unilever.com, 2018). The company also

offers products in packages of different sizes according to the needs of the consumers. Unilever

products are available in different variants which maximize the value of the consumers’

purchase. For example, Surf Excel, one of the biggest detergent brands Unilever owns is

available in packages of different sizes and in different forms like powder, liquid and bar soap.

The company promotes itself using various communication channels like audio-visual and digital

media (Solomon et al, 2014). As far this place strategy is concerned, Unilever products are able

in high-end shopping malls small retail shops. One can evaluate that this place strategy enables

Unilever to market its products before a huge consumer base. This allows the firm to generate

immense revenue, a part of is paid to investors as dividends and bonus, which in turn enables

Unilever to attract further investments. This analysis clearly shows that marketing strategy in fact

supports the capital acquisition strategy of the company. Thus, it can be inferred that marketing

strategy is the base of all the above strategies (Rezaei, S. (2015).

STRATEGIC MANAGEMENT AT UNILEVER

vast product line. The company has acquired firms like Lakme and Breyers which are among the

top brands in the world in terms of high end beauty products and ice cream respectively. As per

one of the latest news releases of Unilever, the company has acquired 75 percent stake of

Equilibra, an Italian beauty and wellness brand.

Strategic plan 4: Marketing strategy:

The third powerful strategy of Unilever is its powerful product line strategy which has

attributed it with top position in the global consumer market. The marketing strategy of Unilever

stands on four pillars namely, its products, pricing, place and promotion. An analysis of the

product umbrella strategy of Unilever shows that the company markets four types of products

namely, home care, personal care, food and refreshments and water purifier. Dove, Lux, Breyer

and Cif are some of the brands owned by Unilever (unilever.com, 2018). The company also

offers products in packages of different sizes according to the needs of the consumers. Unilever

products are available in different variants which maximize the value of the consumers’

purchase. For example, Surf Excel, one of the biggest detergent brands Unilever owns is

available in packages of different sizes and in different forms like powder, liquid and bar soap.

The company promotes itself using various communication channels like audio-visual and digital

media (Solomon et al, 2014). As far this place strategy is concerned, Unilever products are able

in high-end shopping malls small retail shops. One can evaluate that this place strategy enables

Unilever to market its products before a huge consumer base. This allows the firm to generate

immense revenue, a part of is paid to investors as dividends and bonus, which in turn enables

Unilever to attract further investments. This analysis clearly shows that marketing strategy in fact

supports the capital acquisition strategy of the company. Thus, it can be inferred that marketing

strategy is the base of all the above strategies (Rezaei, S. (2015).

5

STRATEGIC MANAGEMENT AT UNILEVER

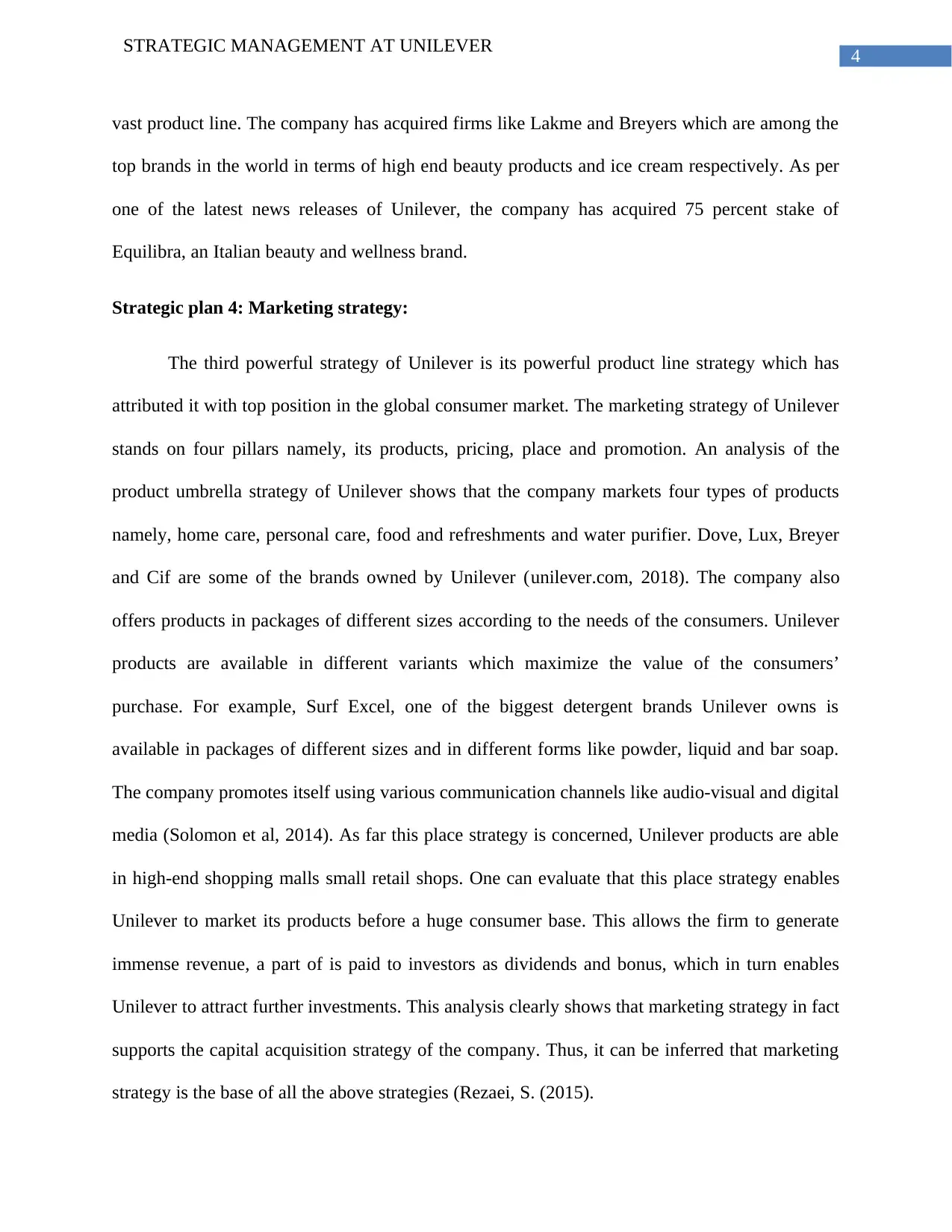

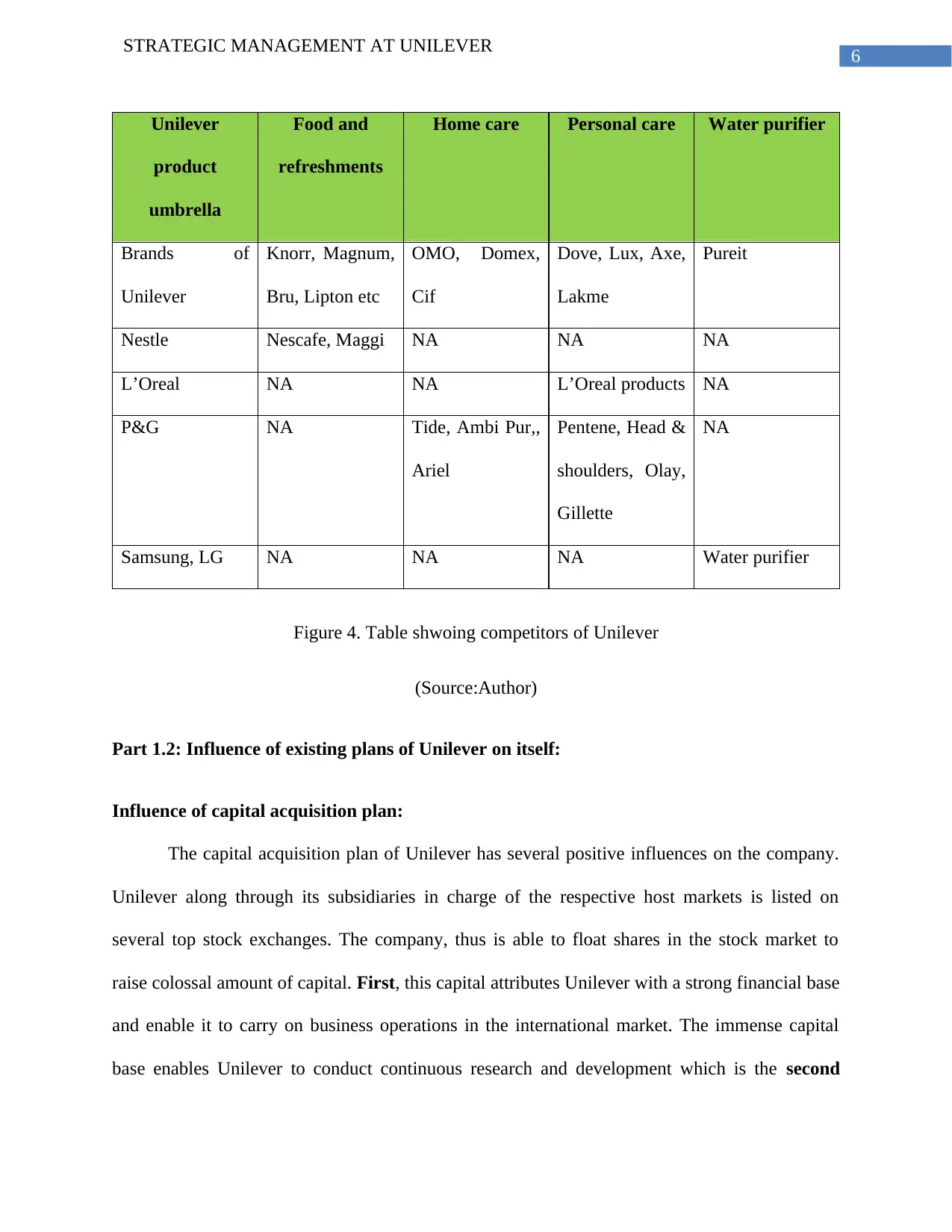

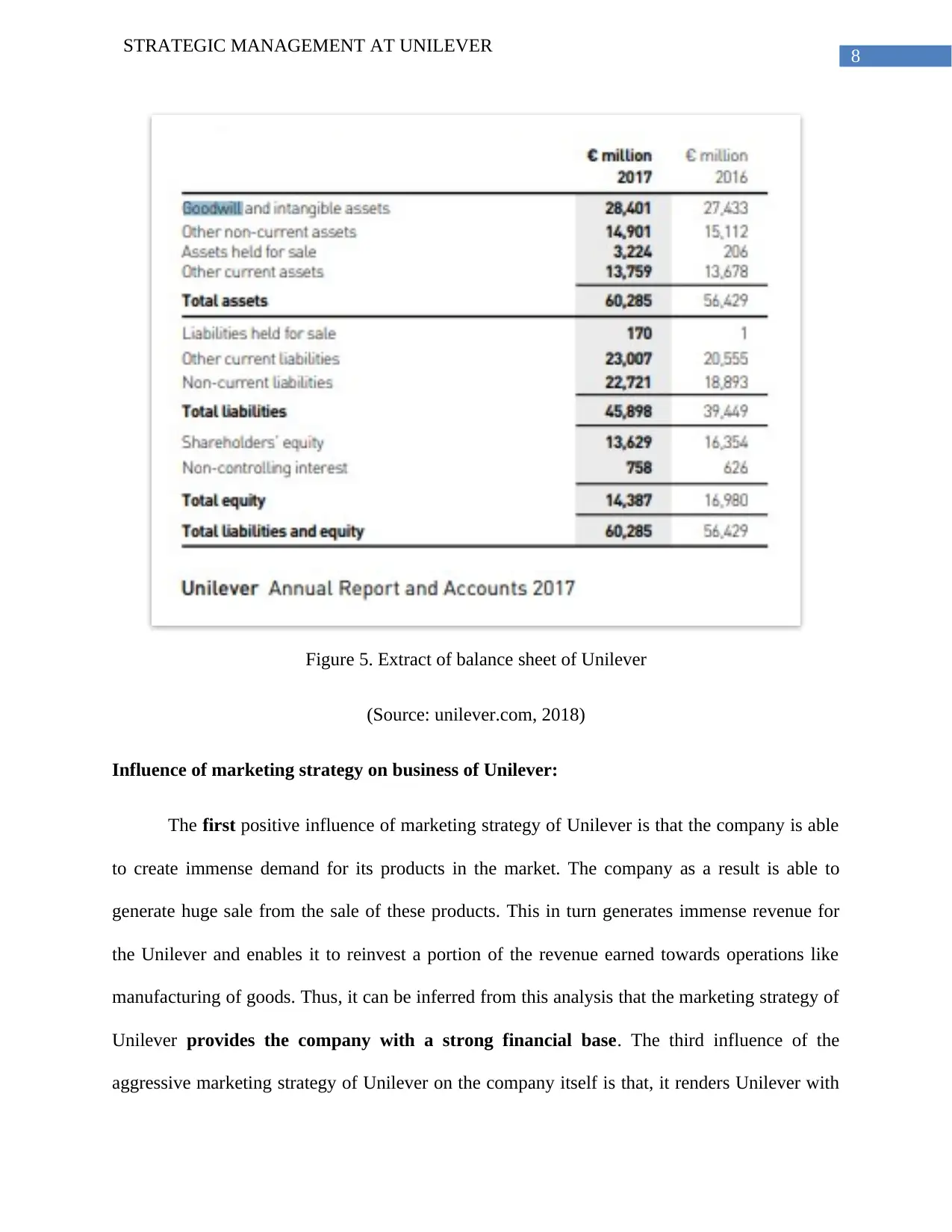

Part 1.1: Position of Unilever in the global market:

Unilever holds one of the top positions in the global consumer market and holds some of

the costliest brands in the world. The company lags behind P&G, the largest consumer goods

manufacturer and Nestle AG, which is the largest food marketing company (chinadaily.com.cn,

2018). Unilever is the largest manufacturer of antiperspirant and holds brands like Axe. As per as

beauty products are concerned, the company faces tough competition from French beauty brand

L’Oreal, the largest cosmetic company. The British multinational company lock horns with

names like Samsung and LG in water purifier segments. An analysis of the global position of

Unilever in all its four product segments would reveal that in none of the segments Unilever

holds leading position. However, the company holds the top position in the market by the virtue

of its unique product umbrella which prevents any one of its competitors from competing totally.

For example, Nestle, the leader in the food market beats Unilever in the food segments but

cannot compete with in the cleaning segments (nestle.com, 2018). Similarly, P&G can compete

in the beauty segments but not in the food segment (us.pg.com, 2018). Thus, the unique product

umbrella enables Unilever to counteract competition from these companies, thus allowing it to

hold leading position in the market.

STRATEGIC MANAGEMENT AT UNILEVER

Part 1.1: Position of Unilever in the global market:

Unilever holds one of the top positions in the global consumer market and holds some of

the costliest brands in the world. The company lags behind P&G, the largest consumer goods

manufacturer and Nestle AG, which is the largest food marketing company (chinadaily.com.cn,

2018). Unilever is the largest manufacturer of antiperspirant and holds brands like Axe. As per as

beauty products are concerned, the company faces tough competition from French beauty brand

L’Oreal, the largest cosmetic company. The British multinational company lock horns with

names like Samsung and LG in water purifier segments. An analysis of the global position of

Unilever in all its four product segments would reveal that in none of the segments Unilever

holds leading position. However, the company holds the top position in the market by the virtue

of its unique product umbrella which prevents any one of its competitors from competing totally.

For example, Nestle, the leader in the food market beats Unilever in the food segments but

cannot compete with in the cleaning segments (nestle.com, 2018). Similarly, P&G can compete

in the beauty segments but not in the food segment (us.pg.com, 2018). Thus, the unique product

umbrella enables Unilever to counteract competition from these companies, thus allowing it to

hold leading position in the market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

STRATEGIC MANAGEMENT AT UNILEVER

Unilever

product

umbrella

Food and

refreshments

Home care Personal care Water purifier

Brands of

Unilever

Knorr, Magnum,

Bru, Lipton etc

OMO, Domex,

Cif

Dove, Lux, Axe,

Lakme

Pureit

Nestle Nescafe, Maggi NA NA NA

L’Oreal NA NA L’Oreal products NA

P&G NA Tide, Ambi Pur,,

Ariel

Pentene, Head &

shoulders, Olay,

Gillette

NA

Samsung, LG NA NA NA Water purifier

Figure 4. Table shwoing competitors of Unilever

(Source:Author)

Part 1.2: Influence of existing plans of Unilever on itself:

Influence of capital acquisition plan:

The capital acquisition plan of Unilever has several positive influences on the company.

Unilever along through its subsidiaries in charge of the respective host markets is listed on

several top stock exchanges. The company, thus is able to float shares in the stock market to

raise colossal amount of capital. First, this capital attributes Unilever with a strong financial base

and enable it to carry on business operations in the international market. The immense capital

base enables Unilever to conduct continuous research and development which is the second

STRATEGIC MANAGEMENT AT UNILEVER

Unilever

product

umbrella

Food and

refreshments

Home care Personal care Water purifier

Brands of

Unilever

Knorr, Magnum,

Bru, Lipton etc

OMO, Domex,

Cif

Dove, Lux, Axe,

Lakme

Pureit

Nestle Nescafe, Maggi NA NA NA

L’Oreal NA NA L’Oreal products NA

P&G NA Tide, Ambi Pur,,

Ariel

Pentene, Head &

shoulders, Olay,

Gillette

NA

Samsung, LG NA NA NA Water purifier

Figure 4. Table shwoing competitors of Unilever

(Source:Author)

Part 1.2: Influence of existing plans of Unilever on itself:

Influence of capital acquisition plan:

The capital acquisition plan of Unilever has several positive influences on the company.

Unilever along through its subsidiaries in charge of the respective host markets is listed on

several top stock exchanges. The company, thus is able to float shares in the stock market to

raise colossal amount of capital. First, this capital attributes Unilever with a strong financial base

and enable it to carry on business operations in the international market. The immense capital

base enables Unilever to conduct continuous research and development which is the second

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

STRATEGIC MANAGEMENT AT UNILEVER

positive influence of the immense capital base (Chinazzi & Fagiolo, 2015). Unilever is thus able

to bring about innovations in its existing product and develop new products to cater to the

evolving needs of the consumers. The third effect of the formidable capital acquisition strategy

of Unilever is that the company is able to diversify the losses it incur due to changes in economic

factors like fall in the exchange rate of GBP (Gaudecker, 2017).

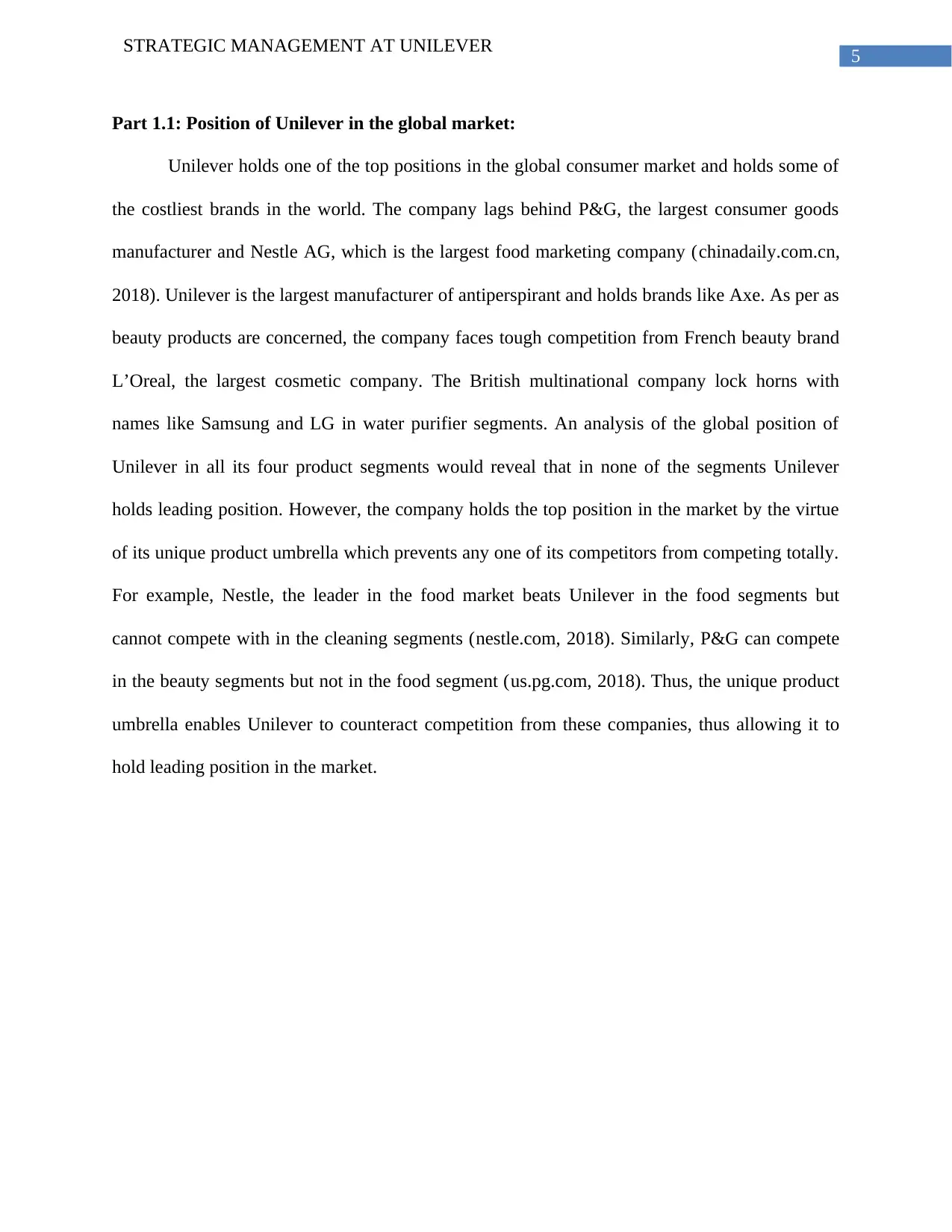

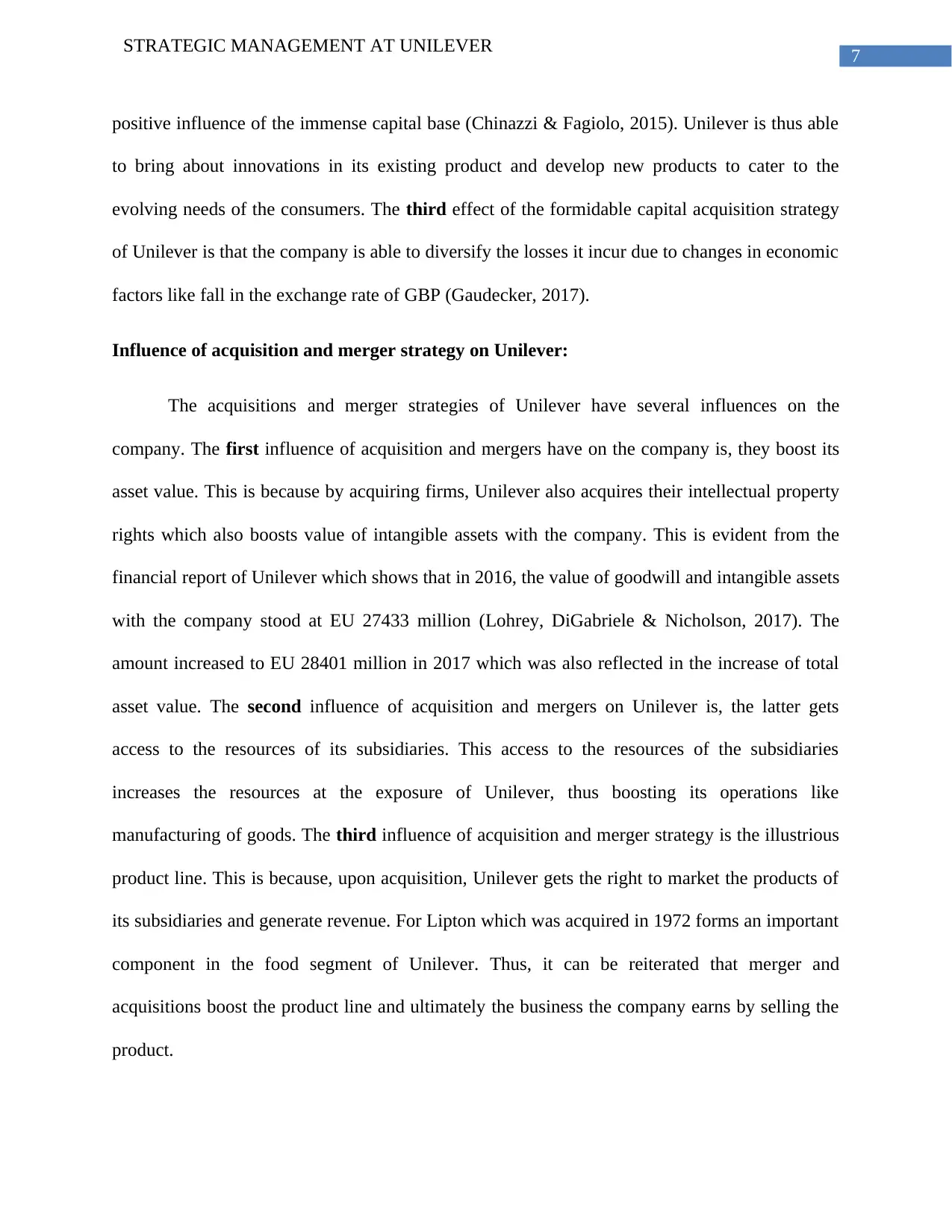

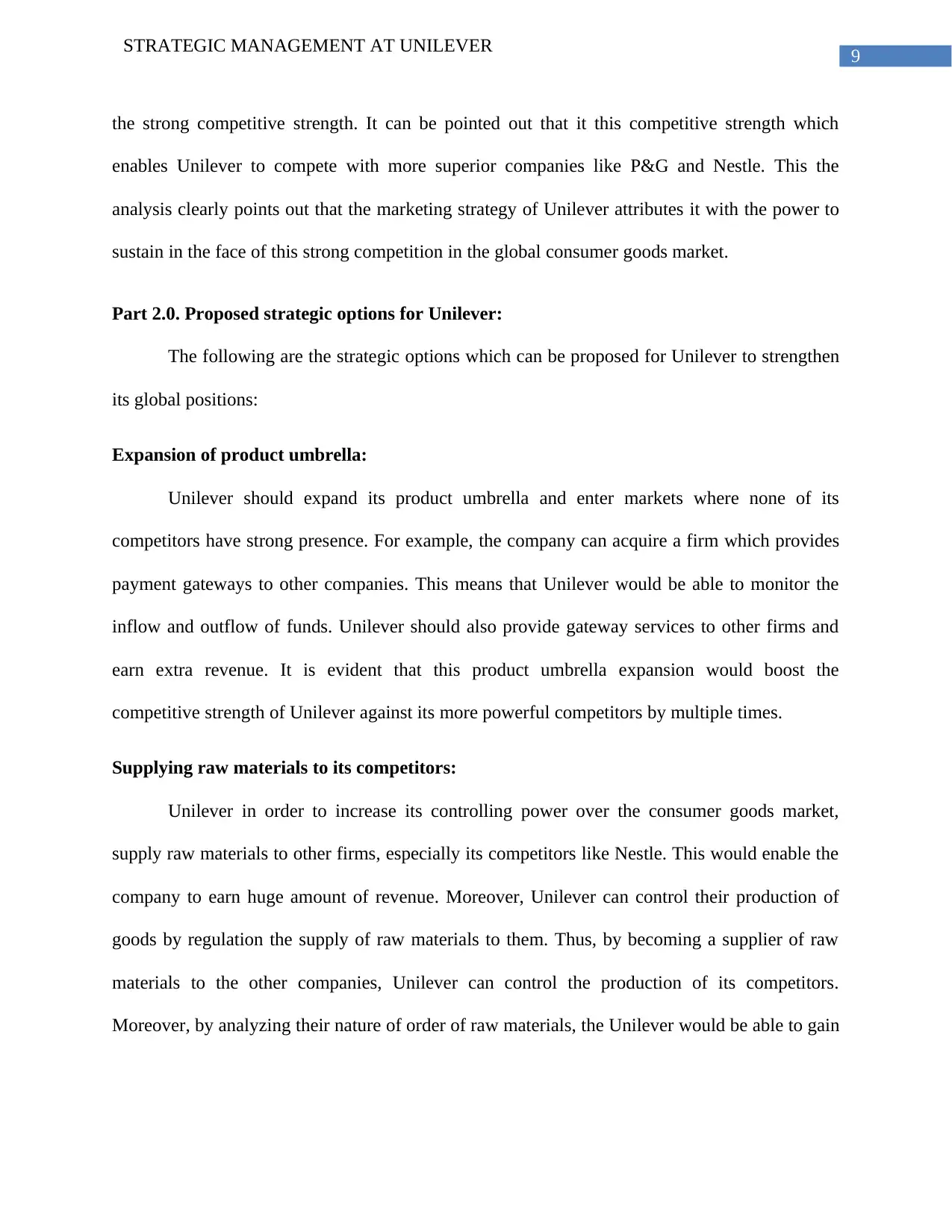

Influence of acquisition and merger strategy on Unilever:

The acquisitions and merger strategies of Unilever have several influences on the

company. The first influence of acquisition and mergers have on the company is, they boost its

asset value. This is because by acquiring firms, Unilever also acquires their intellectual property

rights which also boosts value of intangible assets with the company. This is evident from the

financial report of Unilever which shows that in 2016, the value of goodwill and intangible assets

with the company stood at EU 27433 million (Lohrey, DiGabriele & Nicholson, 2017). The

amount increased to EU 28401 million in 2017 which was also reflected in the increase of total

asset value. The second influence of acquisition and mergers on Unilever is, the latter gets

access to the resources of its subsidiaries. This access to the resources of the subsidiaries

increases the resources at the exposure of Unilever, thus boosting its operations like

manufacturing of goods. The third influence of acquisition and merger strategy is the illustrious

product line. This is because, upon acquisition, Unilever gets the right to market the products of

its subsidiaries and generate revenue. For Lipton which was acquired in 1972 forms an important

component in the food segment of Unilever. Thus, it can be reiterated that merger and

acquisitions boost the product line and ultimately the business the company earns by selling the

product.

STRATEGIC MANAGEMENT AT UNILEVER

positive influence of the immense capital base (Chinazzi & Fagiolo, 2015). Unilever is thus able

to bring about innovations in its existing product and develop new products to cater to the

evolving needs of the consumers. The third effect of the formidable capital acquisition strategy

of Unilever is that the company is able to diversify the losses it incur due to changes in economic

factors like fall in the exchange rate of GBP (Gaudecker, 2017).

Influence of acquisition and merger strategy on Unilever:

The acquisitions and merger strategies of Unilever have several influences on the

company. The first influence of acquisition and mergers have on the company is, they boost its

asset value. This is because by acquiring firms, Unilever also acquires their intellectual property

rights which also boosts value of intangible assets with the company. This is evident from the

financial report of Unilever which shows that in 2016, the value of goodwill and intangible assets

with the company stood at EU 27433 million (Lohrey, DiGabriele & Nicholson, 2017). The

amount increased to EU 28401 million in 2017 which was also reflected in the increase of total

asset value. The second influence of acquisition and mergers on Unilever is, the latter gets

access to the resources of its subsidiaries. This access to the resources of the subsidiaries

increases the resources at the exposure of Unilever, thus boosting its operations like

manufacturing of goods. The third influence of acquisition and merger strategy is the illustrious

product line. This is because, upon acquisition, Unilever gets the right to market the products of

its subsidiaries and generate revenue. For Lipton which was acquired in 1972 forms an important

component in the food segment of Unilever. Thus, it can be reiterated that merger and

acquisitions boost the product line and ultimately the business the company earns by selling the

product.

8

STRATEGIC MANAGEMENT AT UNILEVER

Figure 5. Extract of balance sheet of Unilever

(Source: unilever.com, 2018)

Influence of marketing strategy on business of Unilever:

The first positive influence of marketing strategy of Unilever is that the company is able

to create immense demand for its products in the market. The company as a result is able to

generate huge sale from the sale of these products. This in turn generates immense revenue for

the Unilever and enables it to reinvest a portion of the revenue earned towards operations like

manufacturing of goods. Thus, it can be inferred from this analysis that the marketing strategy of

Unilever provides the company with a strong financial base. The third influence of the

aggressive marketing strategy of Unilever on the company itself is that, it renders Unilever with

STRATEGIC MANAGEMENT AT UNILEVER

Figure 5. Extract of balance sheet of Unilever

(Source: unilever.com, 2018)

Influence of marketing strategy on business of Unilever:

The first positive influence of marketing strategy of Unilever is that the company is able

to create immense demand for its products in the market. The company as a result is able to

generate huge sale from the sale of these products. This in turn generates immense revenue for

the Unilever and enables it to reinvest a portion of the revenue earned towards operations like

manufacturing of goods. Thus, it can be inferred from this analysis that the marketing strategy of

Unilever provides the company with a strong financial base. The third influence of the

aggressive marketing strategy of Unilever on the company itself is that, it renders Unilever with

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

STRATEGIC MANAGEMENT AT UNILEVER

the strong competitive strength. It can be pointed out that it this competitive strength which

enables Unilever to compete with more superior companies like P&G and Nestle. This the

analysis clearly points out that the marketing strategy of Unilever attributes it with the power to

sustain in the face of this strong competition in the global consumer goods market.

Part 2.0. Proposed strategic options for Unilever:

The following are the strategic options which can be proposed for Unilever to strengthen

its global positions:

Expansion of product umbrella:

Unilever should expand its product umbrella and enter markets where none of its

competitors have strong presence. For example, the company can acquire a firm which provides

payment gateways to other companies. This means that Unilever would be able to monitor the

inflow and outflow of funds. Unilever should also provide gateway services to other firms and

earn extra revenue. It is evident that this product umbrella expansion would boost the

competitive strength of Unilever against its more powerful competitors by multiple times.

Supplying raw materials to its competitors:

Unilever in order to increase its controlling power over the consumer goods market,

supply raw materials to other firms, especially its competitors like Nestle. This would enable the

company to earn huge amount of revenue. Moreover, Unilever can control their production of

goods by regulation the supply of raw materials to them. Thus, by becoming a supplier of raw

materials to the other companies, Unilever can control the production of its competitors.

Moreover, by analyzing their nature of order of raw materials, the Unilever would be able to gain

STRATEGIC MANAGEMENT AT UNILEVER

the strong competitive strength. It can be pointed out that it this competitive strength which

enables Unilever to compete with more superior companies like P&G and Nestle. This the

analysis clearly points out that the marketing strategy of Unilever attributes it with the power to

sustain in the face of this strong competition in the global consumer goods market.

Part 2.0. Proposed strategic options for Unilever:

The following are the strategic options which can be proposed for Unilever to strengthen

its global positions:

Expansion of product umbrella:

Unilever should expand its product umbrella and enter markets where none of its

competitors have strong presence. For example, the company can acquire a firm which provides

payment gateways to other companies. This means that Unilever would be able to monitor the

inflow and outflow of funds. Unilever should also provide gateway services to other firms and

earn extra revenue. It is evident that this product umbrella expansion would boost the

competitive strength of Unilever against its more powerful competitors by multiple times.

Supplying raw materials to its competitors:

Unilever in order to increase its controlling power over the consumer goods market,

supply raw materials to other firms, especially its competitors like Nestle. This would enable the

company to earn huge amount of revenue. Moreover, Unilever can control their production of

goods by regulation the supply of raw materials to them. Thus, by becoming a supplier of raw

materials to the other companies, Unilever can control the production of its competitors.

Moreover, by analyzing their nature of order of raw materials, the Unilever would be able to gain

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

STRATEGIC MANAGEMENT AT UNILEVER

idea about their production. The company as a result would be able to form more formidable

business strategies which would contribute towards strengthening its competitive advantage

Part 2.1: Relationship between corporate, business and operational strategies:

Grayson and Hodges (2017) point out that corporate, business and operational strategies

are interrelated. For example, as far as Unilever in concerned, the apex management forms the

corporate strategies. They corporate strategies in turn contribute towards formation of strong

business strategies which in turn results in adoption of strong operational strategy. This analysis

shows that the three strategies are dependent on each other.

Part 2.2: Application of strategic models and tools to develop strategic options:

Strategic models and tools would enable Unilever to implement the two strategic options

discussed above and establish itself in them. The first strategic option is that Unilever must enter

new product markets. The second option is that Unilever should establish itself as a significant

supplier of raw materials to its competitors. It can be pointed out that both the markets are new to

the company and extremely competitive. Moreover, Unilever would have to allocate immense

funds in these two markets. This means that failure to establish itself in these markets would lead

to immense financial loss, thus effecting practically all the significant operations. Thus, in order

to prevent or minimize the risks which Unilever may face on implementing the two strategic

options, the company must use strategic tools and models. The tools can include PESTEL,

SWOT, balanced score card and strategy. The company can use tools like surveys to get more

in depth knowledge about the market. Application of these tools would enable the company to

enter the two new markets suggested above namely, payment gateways and raw materials.

STRATEGIC MANAGEMENT AT UNILEVER

idea about their production. The company as a result would be able to form more formidable

business strategies which would contribute towards strengthening its competitive advantage

Part 2.1: Relationship between corporate, business and operational strategies:

Grayson and Hodges (2017) point out that corporate, business and operational strategies

are interrelated. For example, as far as Unilever in concerned, the apex management forms the

corporate strategies. They corporate strategies in turn contribute towards formation of strong

business strategies which in turn results in adoption of strong operational strategy. This analysis

shows that the three strategies are dependent on each other.

Part 2.2: Application of strategic models and tools to develop strategic options:

Strategic models and tools would enable Unilever to implement the two strategic options

discussed above and establish itself in them. The first strategic option is that Unilever must enter

new product markets. The second option is that Unilever should establish itself as a significant

supplier of raw materials to its competitors. It can be pointed out that both the markets are new to

the company and extremely competitive. Moreover, Unilever would have to allocate immense

funds in these two markets. This means that failure to establish itself in these markets would lead

to immense financial loss, thus effecting practically all the significant operations. Thus, in order

to prevent or minimize the risks which Unilever may face on implementing the two strategic

options, the company must use strategic tools and models. The tools can include PESTEL,

SWOT, balanced score card and strategy. The company can use tools like surveys to get more

in depth knowledge about the market. Application of these tools would enable the company to

enter the two new markets suggested above namely, payment gateways and raw materials.

11

STRATEGIC MANAGEMENT AT UNILEVER

Part 3.0: Strategy implementation plan Unilever:

Unilever should form a strategy implementation plan to adopt the two strategies, gateway

and embarking of business of supplying raw materials. The

Part 3.1: Vision, mission and strategic goals of Unilever:

The vision of Unilever is make the lives of the consumers more sustainable by offering

them high quality products. The mission of Unilever is to exhibit highest standards of corporate

behavior and stakeholder benefits. The goals of Unilever is to working with stakeholders like

suppliers, agents and customers. The British transnational consumer goods manufacturer seeks

tio ensure mutual benefit of all its stakeholders and itself.

Part 3.2: Structure for Unilever to fit into strategic plan:

Unilever being a dynamic company fits into the two strategic plans namely, entering a

new market like payment gateway and turn initiate its own supply chain. The company lays

emphasis on empowering its employees to enable them take more accurate decisions. Secondly,

the Unilever acquires raw materials from the respective host countries to operate in those

countries. The company has thus achieved a great deal of self-sustainability among its

subsidiaries. The apex management of Unilever encourage participation of its employees in

decision making. Thus, structure of Unilever is fit to be adapted according to the needs of the

two strategic options discussed.

Part 3.3: Create resource strategy implementation plan:

Part 4.0: Critical analysis of processes of organizational change:

The organizational change model of Lewin has three processes, namely, unfreeze,

change and refreeze. The first step of change is unfreeze which is the phase when an

STRATEGIC MANAGEMENT AT UNILEVER

Part 3.0: Strategy implementation plan Unilever:

Unilever should form a strategy implementation plan to adopt the two strategies, gateway

and embarking of business of supplying raw materials. The

Part 3.1: Vision, mission and strategic goals of Unilever:

The vision of Unilever is make the lives of the consumers more sustainable by offering

them high quality products. The mission of Unilever is to exhibit highest standards of corporate

behavior and stakeholder benefits. The goals of Unilever is to working with stakeholders like

suppliers, agents and customers. The British transnational consumer goods manufacturer seeks

tio ensure mutual benefit of all its stakeholders and itself.

Part 3.2: Structure for Unilever to fit into strategic plan:

Unilever being a dynamic company fits into the two strategic plans namely, entering a

new market like payment gateway and turn initiate its own supply chain. The company lays

emphasis on empowering its employees to enable them take more accurate decisions. Secondly,

the Unilever acquires raw materials from the respective host countries to operate in those

countries. The company has thus achieved a great deal of self-sustainability among its

subsidiaries. The apex management of Unilever encourage participation of its employees in

decision making. Thus, structure of Unilever is fit to be adapted according to the needs of the

two strategic options discussed.

Part 3.3: Create resource strategy implementation plan:

Part 4.0: Critical analysis of processes of organizational change:

The organizational change model of Lewin has three processes, namely, unfreeze,

change and refreeze. The first step of change is unfreeze which is the phase when an

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.