BX3083 Strategic Marketing: Dairy Industry Analysis & Strategies

VerifiedAdded on 2023/04/21

|19

|4346

|299

Case Study

AI Summary

This case study analyzes the Australian dairy industry, focusing on the product life cycle (PLC) of cheese and butter, and the marketing strategies that dairy producers can employ at each stage. It examines the sales growth rates and market share of Dairy Producer A (DP A) across different milk products, using the BCG matrix for portfolio analysis. The study also discusses the impact of supermarket pricing on the attractiveness of the dairy industry and explores the relationship between dairy farmers, supermarkets, and dairy producers. Finally, it recommends strategies for increasing market power among farmers, considering both collective (supply management, collective marketing) and individual (contract farming) approaches, providing a comprehensive overview of the dairy industry's strategic marketing landscape. Desklib provides similar solved assignments and past papers for students.

Running head: MARKETING AND STRATEGY

Marketing and Strategy

Name of the Student

Name of the University

Author’s Note

Marketing and Strategy

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MARKETING AND STRATEGY

Table of Contents

Introduction..........................................................................................................................3

Answer to Question 1..........................................................................................................3

1. PLC of Cheese.................................................................................................................3

2. PLC of Butter...................................................................................................................4

3. Challenges which needs to be overcome by the marketer of cheese and butter..............5

4. Marketing strategy suggested at each stage of PLC........................................................6

4.1 Development Phase...................................................................................................6

4.2 Introduction stage......................................................................................................6

4.3 Growth stage..............................................................................................................7

4.4 Maturity stage............................................................................................................7

4.5 Decline Stage.............................................................................................................7

Answer to Question 2..........................................................................................................8

5. Sales growth rate of the products.....................................................................................8

6. Market share of DP A......................................................................................................8

7. Supermarket pricing affecting the attractiveness of their industry................................10

8. Connection between dairy farmers, supermarkets and dairy producers........................11

9. Strategies recommended for increasing market power among the farmers...................12

10. Benefits of considering collective strategies...............................................................13

10.1 Management of supply..........................................................................................13

10.2 Collective Marketing Approach............................................................................13

Table of Contents

Introduction..........................................................................................................................3

Answer to Question 1..........................................................................................................3

1. PLC of Cheese.................................................................................................................3

2. PLC of Butter...................................................................................................................4

3. Challenges which needs to be overcome by the marketer of cheese and butter..............5

4. Marketing strategy suggested at each stage of PLC........................................................6

4.1 Development Phase...................................................................................................6

4.2 Introduction stage......................................................................................................6

4.3 Growth stage..............................................................................................................7

4.4 Maturity stage............................................................................................................7

4.5 Decline Stage.............................................................................................................7

Answer to Question 2..........................................................................................................8

5. Sales growth rate of the products.....................................................................................8

6. Market share of DP A......................................................................................................8

7. Supermarket pricing affecting the attractiveness of their industry................................10

8. Connection between dairy farmers, supermarkets and dairy producers........................11

9. Strategies recommended for increasing market power among the farmers...................12

10. Benefits of considering collective strategies...............................................................13

10.1 Management of supply..........................................................................................13

10.2 Collective Marketing Approach............................................................................13

2MARKETING AND STRATEGY

11. Benefits of adoption of individual strategies...............................................................13

11.1 Contract farming....................................................................................................13

Conclusion.........................................................................................................................14

References..........................................................................................................................15

List of appendixes..............................................................................................................17

11. Benefits of adoption of individual strategies...............................................................13

11.1 Contract farming....................................................................................................13

Conclusion.........................................................................................................................14

References..........................................................................................................................15

List of appendixes..............................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MARKETING AND STRATEGY

Introduction

The study is intended to discuss on the PLC which are needed to be addressed by Beyond

the Dairy Farm Gate. In order to address this, the study has included the discussion on the

marketing strategies which may be used by diary producers at every stage. The next section of

the sturdy has referred to exhibits provided with the study to elaborate and determine the

portfolio matrix pertaining to the dairy producer DP A. in response to this the main question is

concerned with including only the milk sales for 2008- 2009 and 2009-2010. The latter part of

the study has discussed the manner in which is concerned with the pricing of the major

supermarket which are seen to affect the attractiveness of the dairy industry. In order to address

this, the study shown the steps which the diary producers take for dealing with market power

(Ulubasoglu et al. 2016).

Answer to Question 1

1. PLC of Cheese

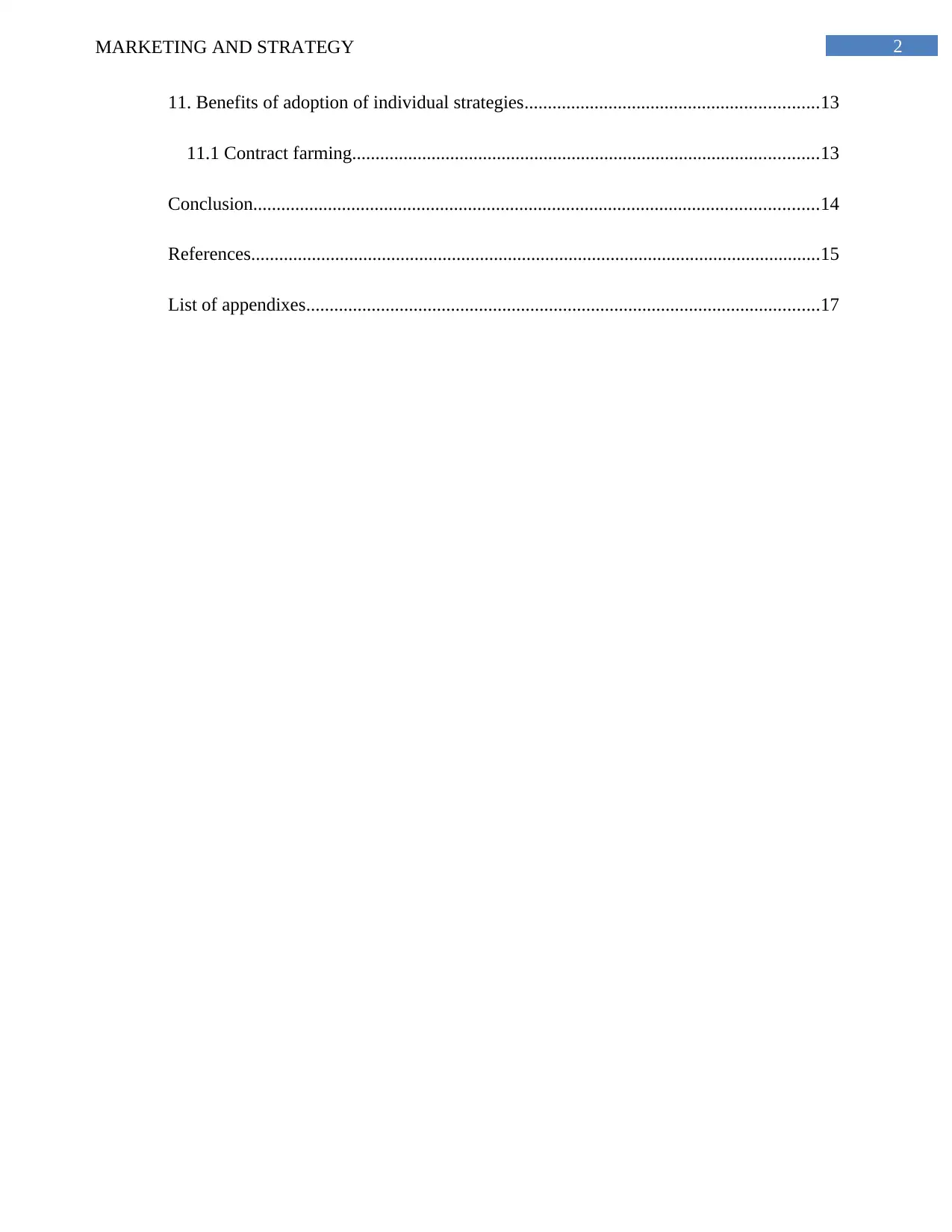

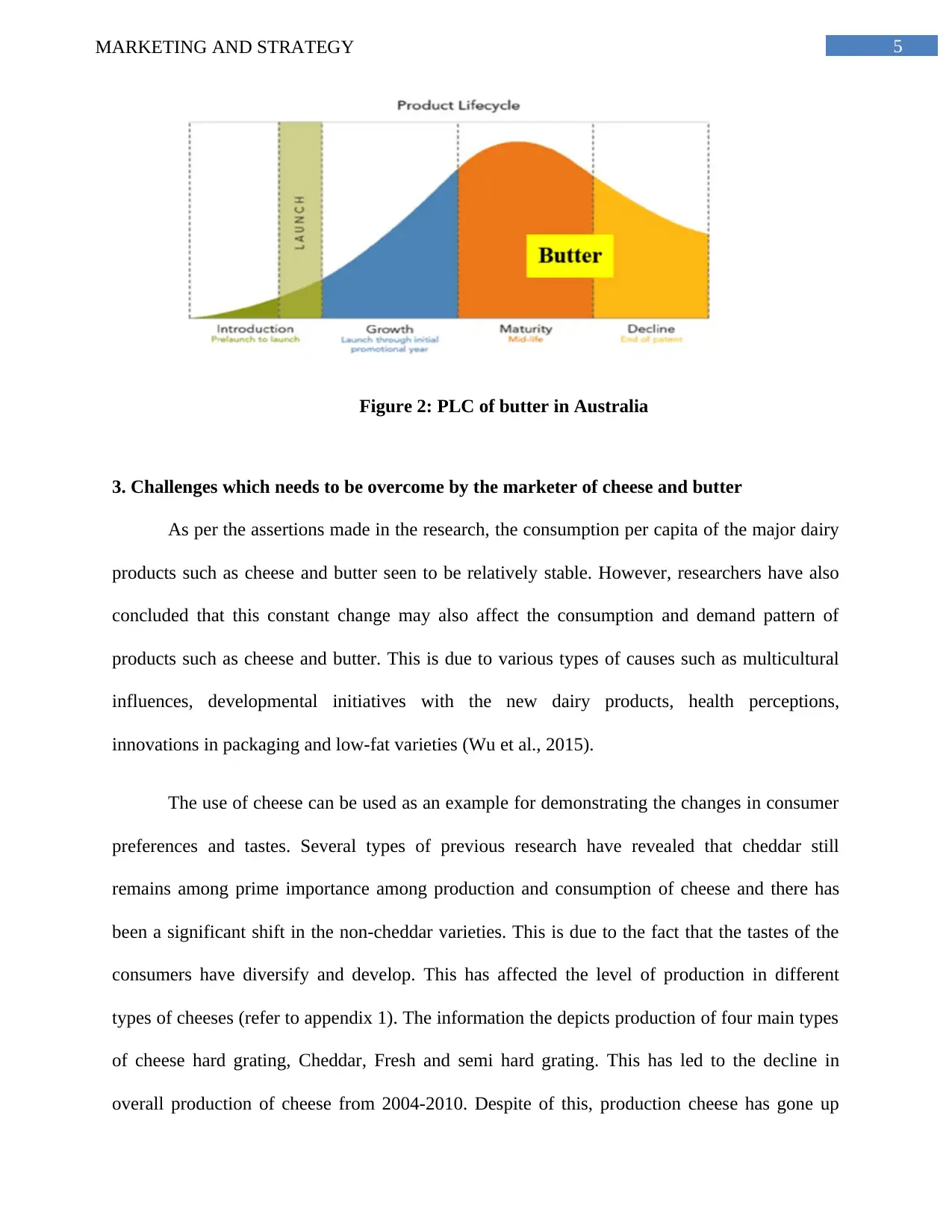

It needs to be discerned that GFC of 2008 has led to reduction in the process and demand

of the Australian dairy products. Therefore, cheese and butter are no exception to this. From

Appendix 1, the production for Cheddar cheese went down from 195,000 to 164,000 tonnes

during 2004 to 2010. The total production of the cheese has been further seen to go down from

388,000 to 349,000 tonnes. The reducing sales, changes in trends and production has led to

diminishing stage of PLC (Accorsi et al., 2016).

Introduction

The study is intended to discuss on the PLC which are needed to be addressed by Beyond

the Dairy Farm Gate. In order to address this, the study has included the discussion on the

marketing strategies which may be used by diary producers at every stage. The next section of

the sturdy has referred to exhibits provided with the study to elaborate and determine the

portfolio matrix pertaining to the dairy producer DP A. in response to this the main question is

concerned with including only the milk sales for 2008- 2009 and 2009-2010. The latter part of

the study has discussed the manner in which is concerned with the pricing of the major

supermarket which are seen to affect the attractiveness of the dairy industry. In order to address

this, the study shown the steps which the diary producers take for dealing with market power

(Ulubasoglu et al. 2016).

Answer to Question 1

1. PLC of Cheese

It needs to be discerned that GFC of 2008 has led to reduction in the process and demand

of the Australian dairy products. Therefore, cheese and butter are no exception to this. From

Appendix 1, the production for Cheddar cheese went down from 195,000 to 164,000 tonnes

during 2004 to 2010. The total production of the cheese has been further seen to go down from

388,000 to 349,000 tonnes. The reducing sales, changes in trends and production has led to

diminishing stage of PLC (Accorsi et al., 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MARKETING AND STRATEGY

Figure 1: PLC of cheese in Australia

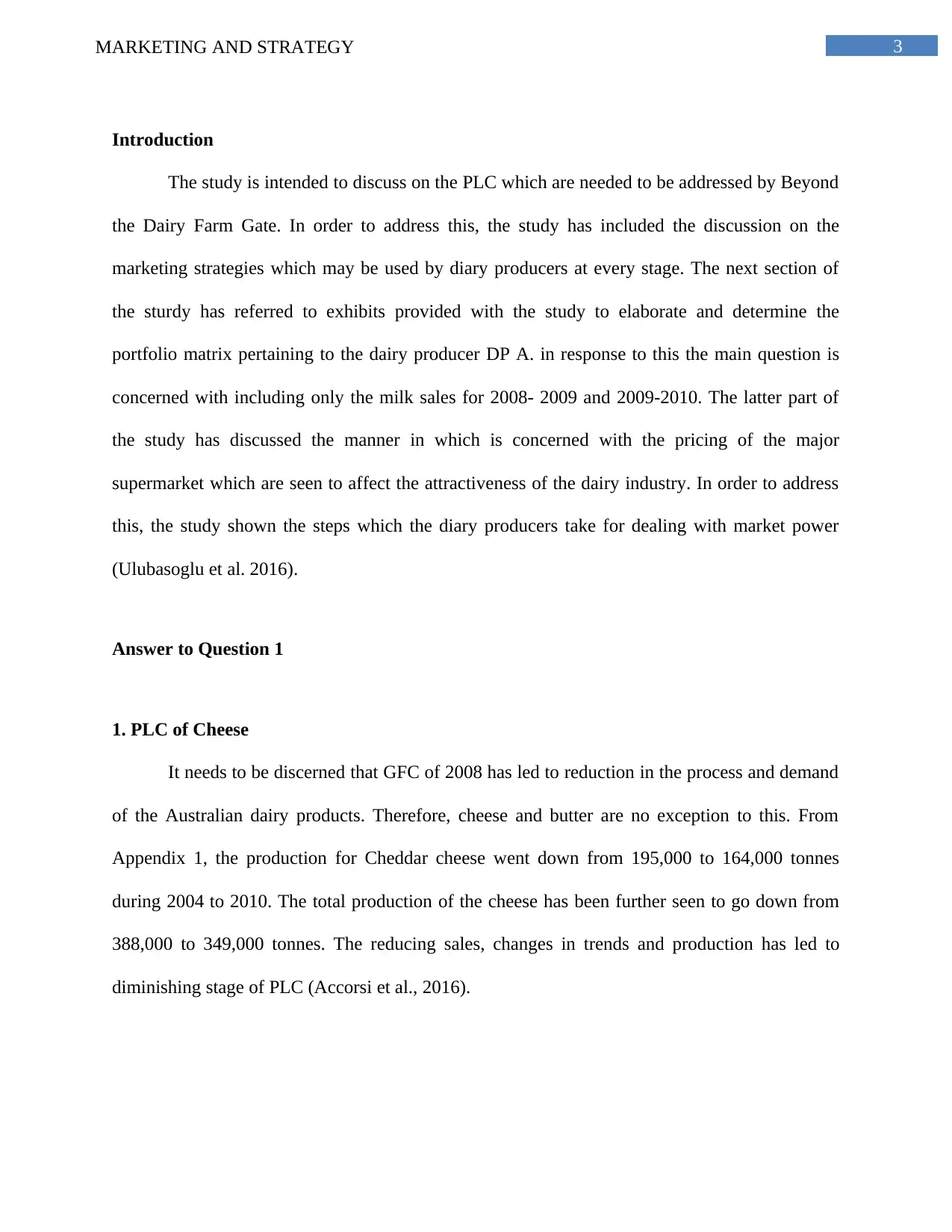

2. PLC of Butter

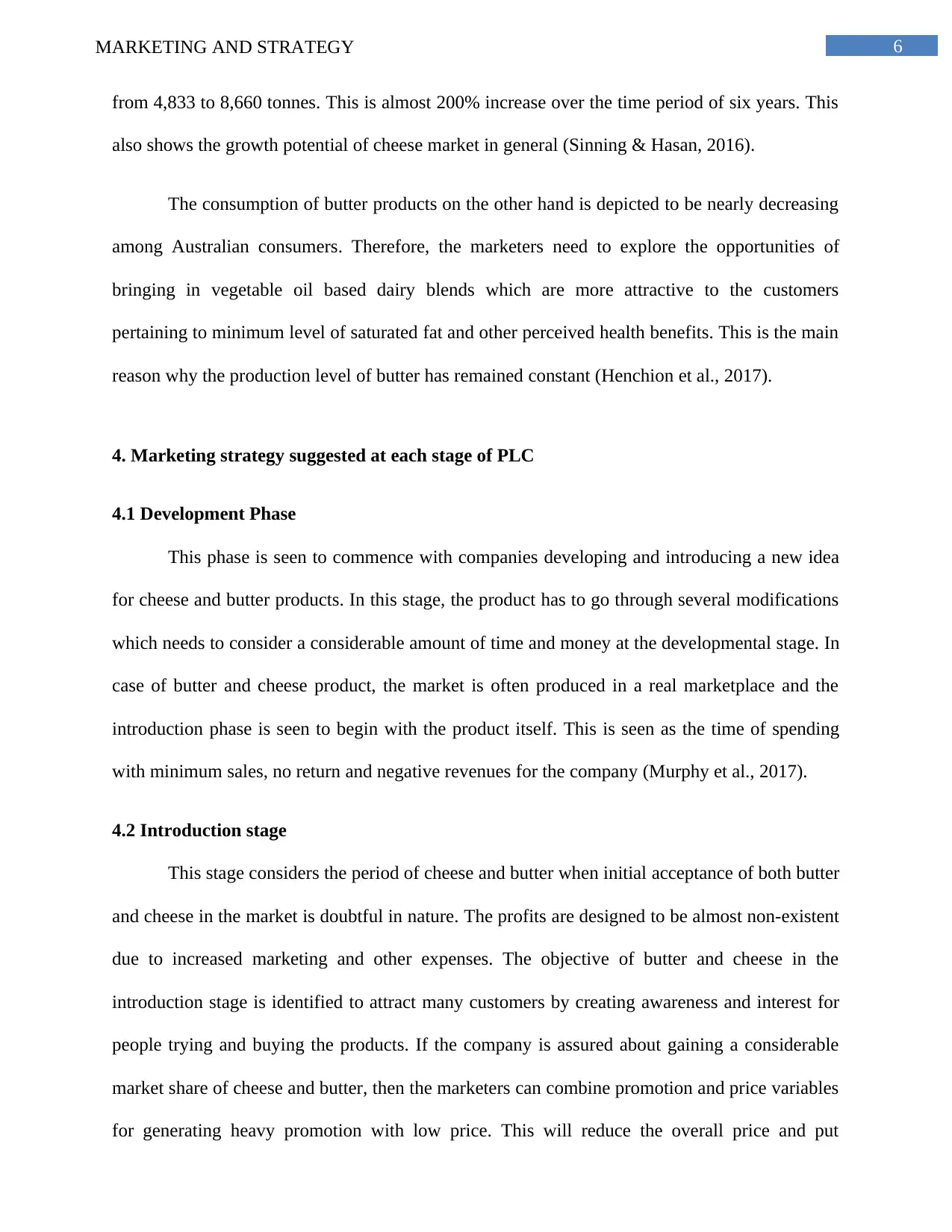

In terms of consideration of the consumption of butter, it can be seen that pure butter

consumption in Australia is decreasing. Additionally, the customers are more concerned about

consumption of margarine which is reducing in terms of demand, thereby paving the way for the

dairy spreads the over margarine (DairyAustralia, 2015). Despite of this, the daily based on

vegetable oil are particularly appealing to the customer with a low level of saturated fat. This has

enabled the product to have a stimulus position in the market in the last two decades. This is seen

after a sustained decline since 1970 and 1980s. Based on the PLC curve there is a consistency in

the production level of butter and curve is ranging between maturity and decline phases (Golley

et al., 2015).

Figure 1: PLC of cheese in Australia

2. PLC of Butter

In terms of consideration of the consumption of butter, it can be seen that pure butter

consumption in Australia is decreasing. Additionally, the customers are more concerned about

consumption of margarine which is reducing in terms of demand, thereby paving the way for the

dairy spreads the over margarine (DairyAustralia, 2015). Despite of this, the daily based on

vegetable oil are particularly appealing to the customer with a low level of saturated fat. This has

enabled the product to have a stimulus position in the market in the last two decades. This is seen

after a sustained decline since 1970 and 1980s. Based on the PLC curve there is a consistency in

the production level of butter and curve is ranging between maturity and decline phases (Golley

et al., 2015).

5MARKETING AND STRATEGY

Figure 2: PLC of butter in Australia

3. Challenges which needs to be overcome by the marketer of cheese and butter

As per the assertions made in the research, the consumption per capita of the major dairy

products such as cheese and butter seen to be relatively stable. However, researchers have also

concluded that this constant change may also affect the consumption and demand pattern of

products such as cheese and butter. This is due to various types of causes such as multicultural

influences, developmental initiatives with the new dairy products, health perceptions,

innovations in packaging and low-fat varieties (Wu et al., 2015).

The use of cheese can be used as an example for demonstrating the changes in consumer

preferences and tastes. Several types of previous research have revealed that cheddar still

remains among prime importance among production and consumption of cheese and there has

been a significant shift in the non-cheddar varieties. This is due to the fact that the tastes of the

consumers have diversify and develop. This has affected the level of production in different

types of cheeses (refer to appendix 1). The information the depicts production of four main types

of cheese hard grating, Cheddar, Fresh and semi hard grating. This has led to the decline in

overall production of cheese from 2004-2010. Despite of this, production cheese has gone up

Figure 2: PLC of butter in Australia

3. Challenges which needs to be overcome by the marketer of cheese and butter

As per the assertions made in the research, the consumption per capita of the major dairy

products such as cheese and butter seen to be relatively stable. However, researchers have also

concluded that this constant change may also affect the consumption and demand pattern of

products such as cheese and butter. This is due to various types of causes such as multicultural

influences, developmental initiatives with the new dairy products, health perceptions,

innovations in packaging and low-fat varieties (Wu et al., 2015).

The use of cheese can be used as an example for demonstrating the changes in consumer

preferences and tastes. Several types of previous research have revealed that cheddar still

remains among prime importance among production and consumption of cheese and there has

been a significant shift in the non-cheddar varieties. This is due to the fact that the tastes of the

consumers have diversify and develop. This has affected the level of production in different

types of cheeses (refer to appendix 1). The information the depicts production of four main types

of cheese hard grating, Cheddar, Fresh and semi hard grating. This has led to the decline in

overall production of cheese from 2004-2010. Despite of this, production cheese has gone up

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MARKETING AND STRATEGY

from 4,833 to 8,660 tonnes. This is almost 200% increase over the time period of six years. This

also shows the growth potential of cheese market in general (Sinning & Hasan, 2016).

The consumption of butter products on the other hand is depicted to be nearly decreasing

among Australian consumers. Therefore, the marketers need to explore the opportunities of

bringing in vegetable oil based dairy blends which are more attractive to the customers

pertaining to minimum level of saturated fat and other perceived health benefits. This is the main

reason why the production level of butter has remained constant (Henchion et al., 2017).

4. Marketing strategy suggested at each stage of PLC

4.1 Development Phase

This phase is seen to commence with companies developing and introducing a new idea

for cheese and butter products. In this stage, the product has to go through several modifications

which needs to consider a considerable amount of time and money at the developmental stage. In

case of butter and cheese product, the market is often produced in a real marketplace and the

introduction phase is seen to begin with the product itself. This is seen as the time of spending

with minimum sales, no return and negative revenues for the company (Murphy et al., 2017).

4.2 Introduction stage

This stage considers the period of cheese and butter when initial acceptance of both butter

and cheese in the market is doubtful in nature. The profits are designed to be almost non-existent

due to increased marketing and other expenses. The objective of butter and cheese in the

introduction stage is identified to attract many customers by creating awareness and interest for

people trying and buying the products. If the company is assured about gaining a considerable

market share of cheese and butter, then the marketers can combine promotion and price variables

for generating heavy promotion with low price. This will reduce the overall price and put

from 4,833 to 8,660 tonnes. This is almost 200% increase over the time period of six years. This

also shows the growth potential of cheese market in general (Sinning & Hasan, 2016).

The consumption of butter products on the other hand is depicted to be nearly decreasing

among Australian consumers. Therefore, the marketers need to explore the opportunities of

bringing in vegetable oil based dairy blends which are more attractive to the customers

pertaining to minimum level of saturated fat and other perceived health benefits. This is the main

reason why the production level of butter has remained constant (Henchion et al., 2017).

4. Marketing strategy suggested at each stage of PLC

4.1 Development Phase

This phase is seen to commence with companies developing and introducing a new idea

for cheese and butter products. In this stage, the product has to go through several modifications

which needs to consider a considerable amount of time and money at the developmental stage. In

case of butter and cheese product, the market is often produced in a real marketplace and the

introduction phase is seen to begin with the product itself. This is seen as the time of spending

with minimum sales, no return and negative revenues for the company (Murphy et al., 2017).

4.2 Introduction stage

This stage considers the period of cheese and butter when initial acceptance of both butter

and cheese in the market is doubtful in nature. The profits are designed to be almost non-existent

due to increased marketing and other expenses. The objective of butter and cheese in the

introduction stage is identified to attract many customers by creating awareness and interest for

people trying and buying the products. If the company is assured about gaining a considerable

market share of cheese and butter, then the marketers can combine promotion and price variables

for generating heavy promotion with low price. This will reduce the overall price and put

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MARKETING AND STRATEGY

stronger emphasis on promotion of the products despite of reducing the amount of profit. This

may be also compensated with high volumes and at times there may be no profit in this stage

however if the market share is a cash cow tomorrow then should be accepted (Gale, Hansen &

Jewison, 2015).

4.3 Growth stage

At the time of the growth period, there may be a substantial improvement in the profit of

cheese and butter companies. In this phase, the marketing strategy may shift from the customer

acquisition and retention and brand loyalty. The main objective in this case is seen with

maximising the market share and focusing on advertising and promotion which may not be like

the introductory phase as it is not focused towards taking advantage of increased consumer

demand of the product. It is also a suitable stage for building intensive distribution so that the

forms can tend to incorporate the strategies in UK shops and supermarkets for convenience of

the customers and ensuring the availability of better cheese and butter products (Hogan, 2017).

4.4 Maturity stage

The stage comprises of intense rivalry pertaining to the mature market. The firms are

having the scope of obtaining high profit and low cost per customer. However, there is a scope

for peak sales to occur in the state. The maturity phase is seen as the period where there is a

decline in sales growth and margins reduces leading to decreasing profit. Thus, the strategies of

butter and cheese is often pushed forward by the marketers by introducing new marketing

channels, attractive advertising and granting price concessions for varied users of the product

(Benkerroum, 2016).

4.5 Decline Stage

It can be final in four that the butter and the sales tend to go downwards and it is

sometimes difficult for the firms to conceptualize declining trend of the product. In this phase,

stronger emphasis on promotion of the products despite of reducing the amount of profit. This

may be also compensated with high volumes and at times there may be no profit in this stage

however if the market share is a cash cow tomorrow then should be accepted (Gale, Hansen &

Jewison, 2015).

4.3 Growth stage

At the time of the growth period, there may be a substantial improvement in the profit of

cheese and butter companies. In this phase, the marketing strategy may shift from the customer

acquisition and retention and brand loyalty. The main objective in this case is seen with

maximising the market share and focusing on advertising and promotion which may not be like

the introductory phase as it is not focused towards taking advantage of increased consumer

demand of the product. It is also a suitable stage for building intensive distribution so that the

forms can tend to incorporate the strategies in UK shops and supermarkets for convenience of

the customers and ensuring the availability of better cheese and butter products (Hogan, 2017).

4.4 Maturity stage

The stage comprises of intense rivalry pertaining to the mature market. The firms are

having the scope of obtaining high profit and low cost per customer. However, there is a scope

for peak sales to occur in the state. The maturity phase is seen as the period where there is a

decline in sales growth and margins reduces leading to decreasing profit. Thus, the strategies of

butter and cheese is often pushed forward by the marketers by introducing new marketing

channels, attractive advertising and granting price concessions for varied users of the product

(Benkerroum, 2016).

4.5 Decline Stage

It can be final in four that the butter and the sales tend to go downwards and it is

sometimes difficult for the firms to conceptualize declining trend of the product. In this phase,

8MARKETING AND STRATEGY

the main objective of the marketing is identified with reducing overall expenditure on branding

of milk. Despite of this, the exit barrier may restrict the forms for easy exit due to costs

associated to labour settlements and contingent liabilities for land uses. Therefore, all benefits

need to be thoroughly analyzed with respect to marketing objectives of the decline phase (Valin

et al., 2014).

Answer to Question 2

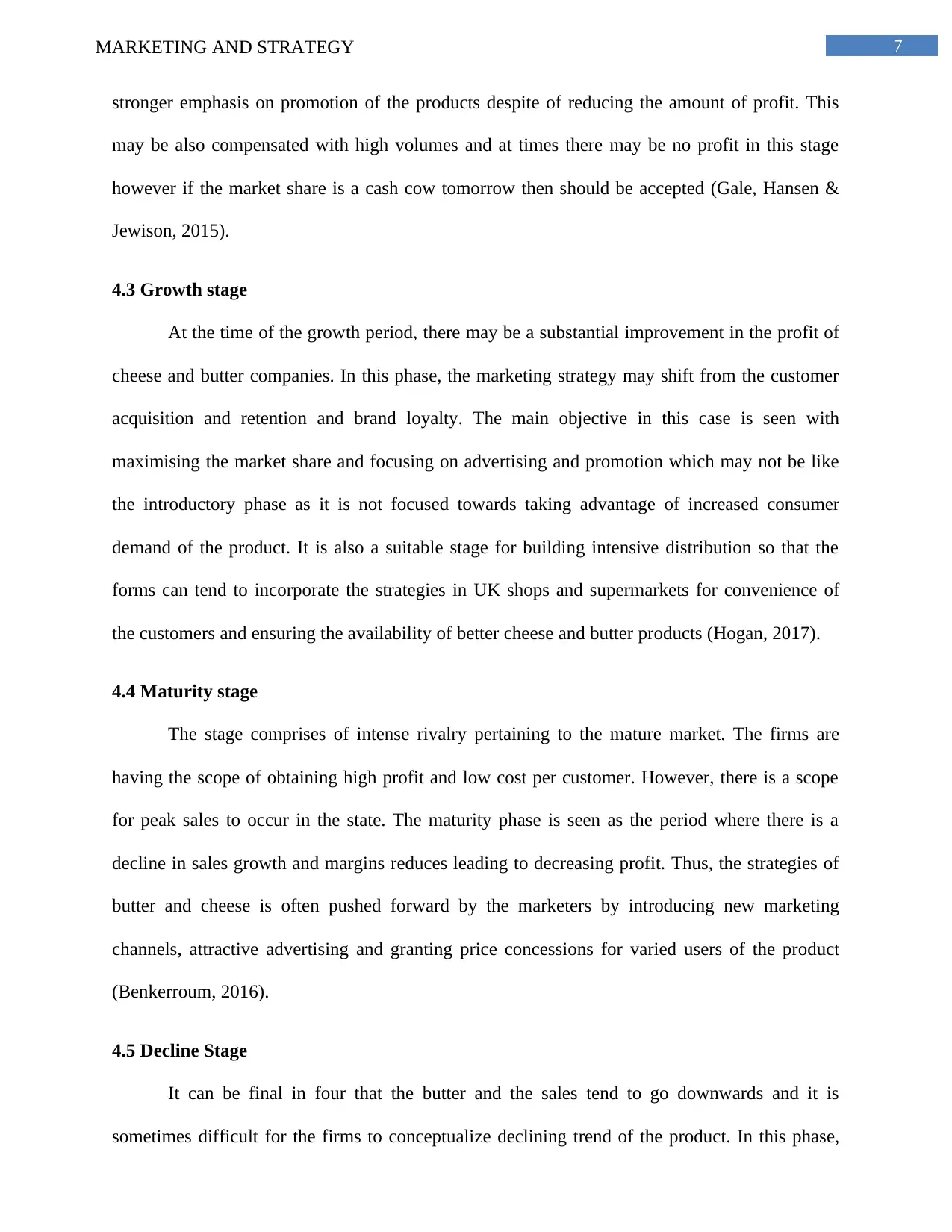

5. Sales growth rate of the products

Table 1: Growth rate of sales of the products

6. Market share of DP A

Table 2: Market Share of DP A

the main objective of the marketing is identified with reducing overall expenditure on branding

of milk. Despite of this, the exit barrier may restrict the forms for easy exit due to costs

associated to labour settlements and contingent liabilities for land uses. Therefore, all benefits

need to be thoroughly analyzed with respect to marketing objectives of the decline phase (Valin

et al., 2014).

Answer to Question 2

5. Sales growth rate of the products

Table 1: Growth rate of sales of the products

6. Market share of DP A

Table 2: Market Share of DP A

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MARKETING AND STRATEGY

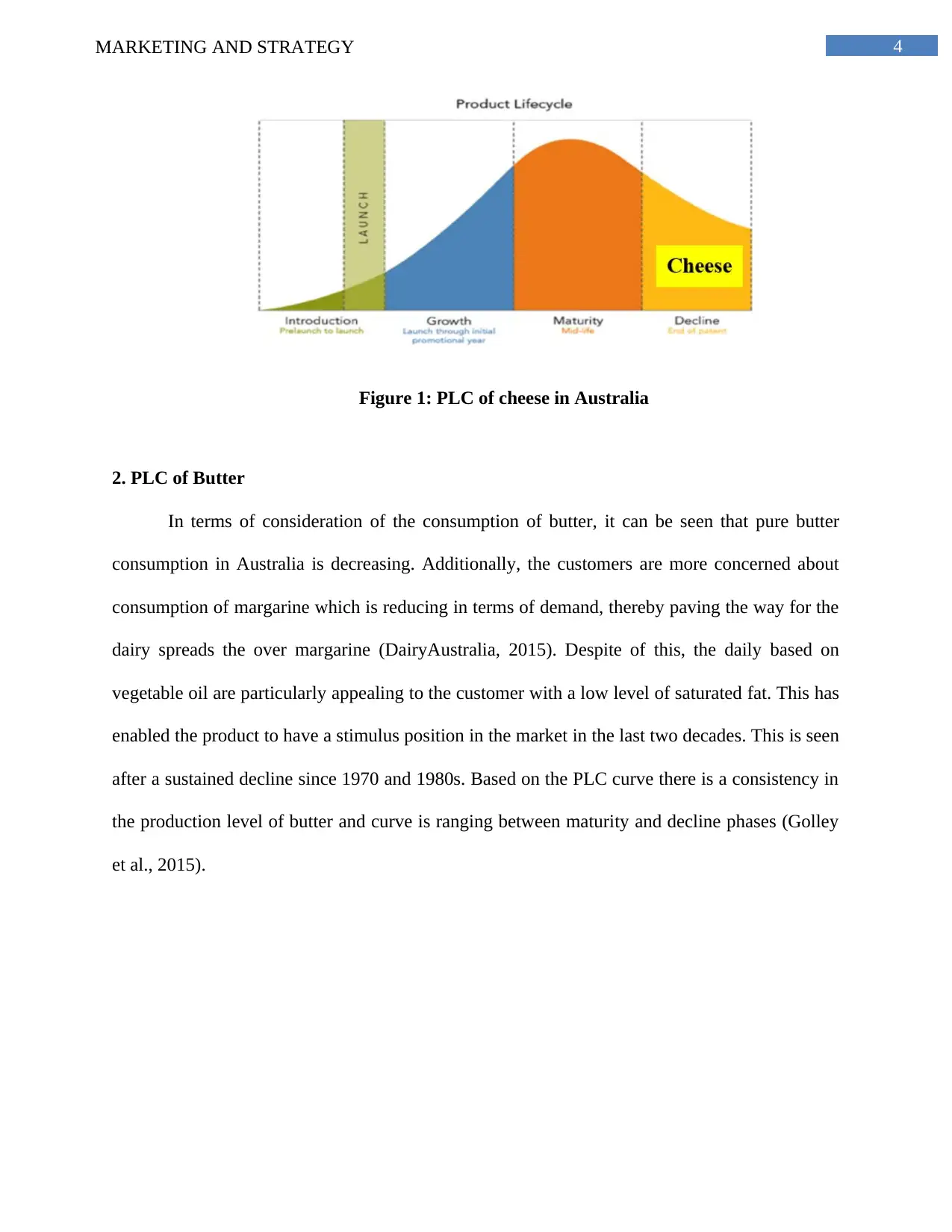

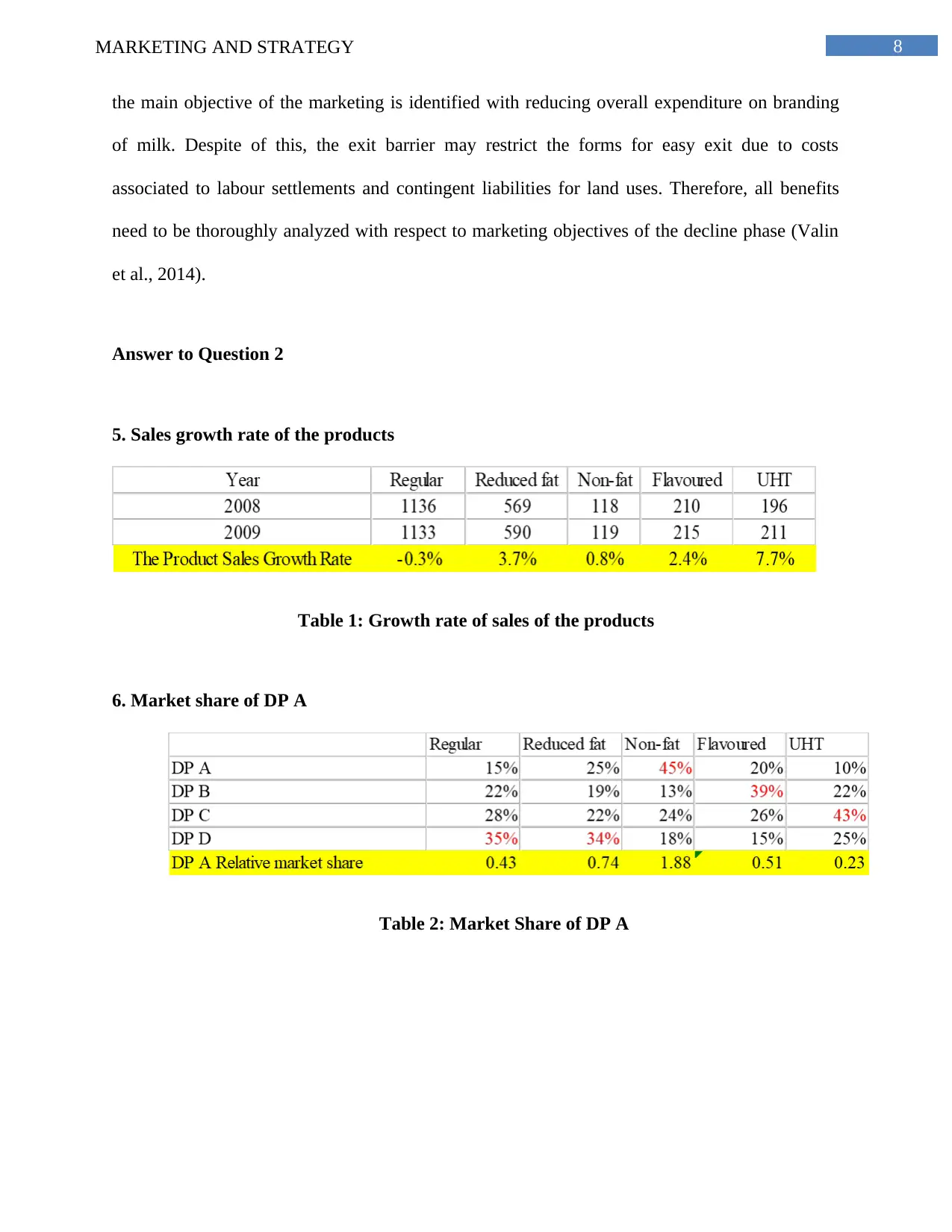

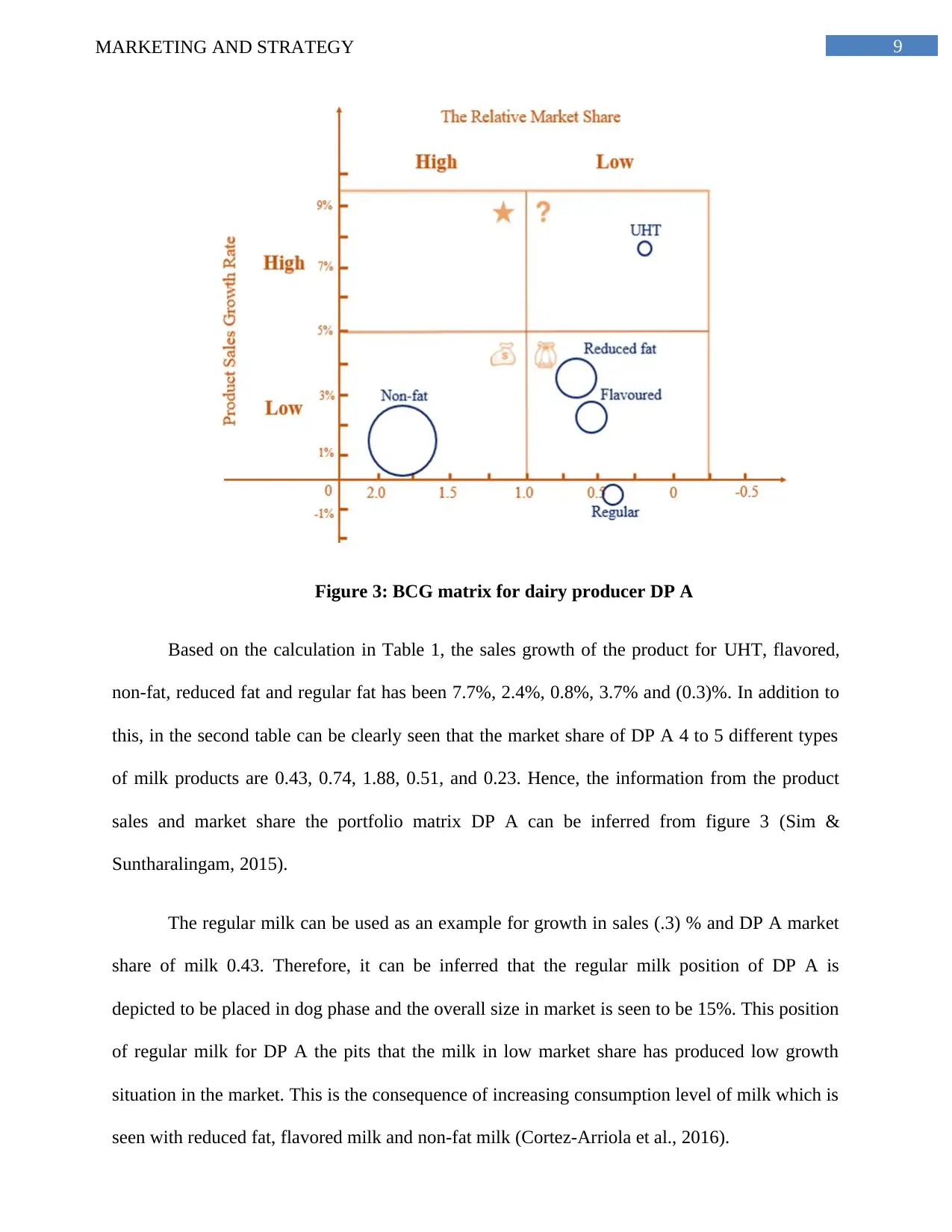

Figure 3: BCG matrix for dairy producer DP A

Based on the calculation in Table 1, the sales growth of the product for UHT, flavored,

non-fat, reduced fat and regular fat has been 7.7%, 2.4%, 0.8%, 3.7% and (0.3)%. In addition to

this, in the second table can be clearly seen that the market share of DP A 4 to 5 different types

of milk products are 0.43, 0.74, 1.88, 0.51, and 0.23. Hence, the information from the product

sales and market share the portfolio matrix DP A can be inferred from figure 3 (Sim &

Suntharalingam, 2015).

The regular milk can be used as an example for growth in sales (.3) % and DP A market

share of milk 0.43. Therefore, it can be inferred that the regular milk position of DP A is

depicted to be placed in dog phase and the overall size in market is seen to be 15%. This position

of regular milk for DP A the pits that the milk in low market share has produced low growth

situation in the market. This is the consequence of increasing consumption level of milk which is

seen with reduced fat, flavored milk and non-fat milk (Cortez-Arriola et al., 2016).

Figure 3: BCG matrix for dairy producer DP A

Based on the calculation in Table 1, the sales growth of the product for UHT, flavored,

non-fat, reduced fat and regular fat has been 7.7%, 2.4%, 0.8%, 3.7% and (0.3)%. In addition to

this, in the second table can be clearly seen that the market share of DP A 4 to 5 different types

of milk products are 0.43, 0.74, 1.88, 0.51, and 0.23. Hence, the information from the product

sales and market share the portfolio matrix DP A can be inferred from figure 3 (Sim &

Suntharalingam, 2015).

The regular milk can be used as an example for growth in sales (.3) % and DP A market

share of milk 0.43. Therefore, it can be inferred that the regular milk position of DP A is

depicted to be placed in dog phase and the overall size in market is seen to be 15%. This position

of regular milk for DP A the pits that the milk in low market share has produced low growth

situation in the market. This is the consequence of increasing consumption level of milk which is

seen with reduced fat, flavored milk and non-fat milk (Cortez-Arriola et al., 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MARKETING AND STRATEGY

It needs to be further seen that the UHT is the highest product sales among different

variants of milk, which is identified with increasing apartment culture and urbanization leading

to overall growth in the demand of milk. The weakening global economic conditions are

however another factor which is enhancing the UHT milk consumption and a greater number of

consumers are switching to such a variant at a reduced price. Despite of this, the combination of

related market share has led to UHT positioned in question marks phase, which shows that the

products are growing in the market but was able to obtain a low share of 10%. Therefore, UHT

has a good opportunity if it can be funded for increasing market share. There is a possibility for it

to become a star at later stages when there is a drip in the growth and it becomes a cash cow. It

may be requiring more amount of cash in the short run and an plenty of the same may be

included in the question mark Phase for winning the majority of sharing the market. However, in

the long run strategy will pave the way for developing a sound business (Matthews et al.,

2016).

7. Supermarket pricing affecting the attractiveness of their industry

It is depicted that the supermarkets have showed continued effort for most of the import

channels existing in Australia for the purpose of selling milk products. This is accounted for 51%

sales in 2009 to 2010. There have also focused on marketing campaigns which are aimed at

lowering the prices for avoiding any dicey move.

The usage of private level branding can be regarded as an example for the supermarkets

in setting a low price which has created a big gap in terms of price difference among the

operating brands. From the viewpoint of customers, the pricing psychology has suggested a

direct relationship among the customers for the make with the price and quality. This can result

in customers feeling doubtful about the quality of milk and impact on the attractiveness of other

dairy products. This also suggests that the customer valuing by high-quality milk needs to

It needs to be further seen that the UHT is the highest product sales among different

variants of milk, which is identified with increasing apartment culture and urbanization leading

to overall growth in the demand of milk. The weakening global economic conditions are

however another factor which is enhancing the UHT milk consumption and a greater number of

consumers are switching to such a variant at a reduced price. Despite of this, the combination of

related market share has led to UHT positioned in question marks phase, which shows that the

products are growing in the market but was able to obtain a low share of 10%. Therefore, UHT

has a good opportunity if it can be funded for increasing market share. There is a possibility for it

to become a star at later stages when there is a drip in the growth and it becomes a cash cow. It

may be requiring more amount of cash in the short run and an plenty of the same may be

included in the question mark Phase for winning the majority of sharing the market. However, in

the long run strategy will pave the way for developing a sound business (Matthews et al.,

2016).

7. Supermarket pricing affecting the attractiveness of their industry

It is depicted that the supermarkets have showed continued effort for most of the import

channels existing in Australia for the purpose of selling milk products. This is accounted for 51%

sales in 2009 to 2010. There have also focused on marketing campaigns which are aimed at

lowering the prices for avoiding any dicey move.

The usage of private level branding can be regarded as an example for the supermarkets

in setting a low price which has created a big gap in terms of price difference among the

operating brands. From the viewpoint of customers, the pricing psychology has suggested a

direct relationship among the customers for the make with the price and quality. This can result

in customers feeling doubtful about the quality of milk and impact on the attractiveness of other

dairy products. This also suggests that the customer valuing by high-quality milk needs to

11MARKETING AND STRATEGY

perceive the quality of private label as poorer in nature. In addition to this, the supermarkets have

set milk price to as low as $ 1 milk per liter and the customers those who are price sensitive are

able to easily compare the prices of two products which has resulted in increased sales of lower

priced private label milk similar to regular and reduced fat (Yantcheva et al., 2016).

8. Connection between dairy farmers, supermarkets and dairy producers

The relationship of dairy farmers, supermarkets and dairy producers is intricate in nature.

The Australian dairy farmers have warned about running short of milk supply is soon and the

industry may face severe deregulation. The farmers have also accused the supermarkets and

processors responsible for such a dispute. An appropriate example of complexity in the industry

is evident with the price war which occurred between Coles and Woolworths in 2011 and lead to

reduced prices. This particular case has confirmed our farmers aware of the considerable

imbalance in the market power and weakening bargaining position. In addition to this, the

processors often, under pressure from the export market competition and supermarkets for using

relative bargaining power and shifting risks on the dairy farmers (Wu et al., 2015).

Due to this incident, the farmers get paid same for milk whether it was sold as private

label or under a more expensive branding. The increase in the retail milk prices showed the

probability of likely results of supermarkets in earning higher profits and creating no difference

for the struggling farmers as processor would have been set for farm gate prices just to the level

which would have been significant to secure the milk which they needed. Additionally, the

imbalance of power was seen among the farmers by entering into supply contracts pertaining to

an unclear pricing terms which discouraged them from changing a rival processor. Henceforth,

measures need to be taken for addressing such poor positioning of dairy farmers in the country

(Golley et al., 2015).

perceive the quality of private label as poorer in nature. In addition to this, the supermarkets have

set milk price to as low as $ 1 milk per liter and the customers those who are price sensitive are

able to easily compare the prices of two products which has resulted in increased sales of lower

priced private label milk similar to regular and reduced fat (Yantcheva et al., 2016).

8. Connection between dairy farmers, supermarkets and dairy producers

The relationship of dairy farmers, supermarkets and dairy producers is intricate in nature.

The Australian dairy farmers have warned about running short of milk supply is soon and the

industry may face severe deregulation. The farmers have also accused the supermarkets and

processors responsible for such a dispute. An appropriate example of complexity in the industry

is evident with the price war which occurred between Coles and Woolworths in 2011 and lead to

reduced prices. This particular case has confirmed our farmers aware of the considerable

imbalance in the market power and weakening bargaining position. In addition to this, the

processors often, under pressure from the export market competition and supermarkets for using

relative bargaining power and shifting risks on the dairy farmers (Wu et al., 2015).

Due to this incident, the farmers get paid same for milk whether it was sold as private

label or under a more expensive branding. The increase in the retail milk prices showed the

probability of likely results of supermarkets in earning higher profits and creating no difference

for the struggling farmers as processor would have been set for farm gate prices just to the level

which would have been significant to secure the milk which they needed. Additionally, the

imbalance of power was seen among the farmers by entering into supply contracts pertaining to

an unclear pricing terms which discouraged them from changing a rival processor. Henceforth,

measures need to be taken for addressing such poor positioning of dairy farmers in the country

(Golley et al., 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.