Strategic Analysis of FELDA BHD: Challenges and Recommendations

VerifiedAdded on 2022/08/12

|20

|5068

|15

Report

AI Summary

This report presents a comprehensive strategic analysis of FELDA BHD, a major Malaysian government agency and plantation operator. It identifies key problems such as mismanagement, financial losses, and organizational culture issues. The analysis includes a detailed examination of FELDA's internal environment using value chain analysis, a milestone table tracing the company's history, and a financial analysis. Tangible and intangible resources are assessed, and a SWOT analysis is conducted. The external environment is evaluated through PESTLE and Porter's Five Forces analyses. A competitor matrix is presented, followed by recommendations to address the identified challenges. The report concludes with a discussion of planned strategies, their formulation, and implementation, supported by a list of references.

STRATEGIC

MANAGEMENT

MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

Contents

Introduction...........................................................................................................................................1

Identification and elaboration of problems............................................................................................1

Internal analysis.....................................................................................................................................2

Value Chain Analysis........................................................................................................................2

Milestone Table.................................................................................................................................4

Financial Analysis.............................................................................................................................5

Tangible resources.............................................................................................................................8

Intangible resources...........................................................................................................................8

SWOT...............................................................................................................................................8

External analysis....................................................................................................................................9

PESTLE analysis...............................................................................................................................9

Porter’s five force analysis..............................................................................................................10

Competitor Matrix Table and Summary..............................................................................................12

Recommendation.................................................................................................................................13

Conclusion...........................................................................................................................................15

References...........................................................................................................................................16

Contents

Introduction...........................................................................................................................................1

Identification and elaboration of problems............................................................................................1

Internal analysis.....................................................................................................................................2

Value Chain Analysis........................................................................................................................2

Milestone Table.................................................................................................................................4

Financial Analysis.............................................................................................................................5

Tangible resources.............................................................................................................................8

Intangible resources...........................................................................................................................8

SWOT...............................................................................................................................................8

External analysis....................................................................................................................................9

PESTLE analysis...............................................................................................................................9

Porter’s five force analysis..............................................................................................................10

Competitor Matrix Table and Summary..............................................................................................12

Recommendation.................................................................................................................................13

Conclusion...........................................................................................................................................15

References...........................................................................................................................................16

2

Introduction

The global environment for business has become highly complex. This increase in the

complexity of the business environment has created many kinds of challenges for the firms.

Both strategic and functional issues are faced by the firms in Malaysia. Even the public

limited firms are under serious pressure to improve their business model in order to ensure

that their growth remains on the higher side. It is mandatory that firms look at the factors

present in the internal and external environment that would allow them to design their

strategies accordingly so that the challenges that they are facing can be reduced (Alwee,

Roowi, Teng & Othman, 2010). The strategies must also be designed on the basis of the

strategies that are made by the competitors. The Federal Land Development Authority or

FELDA BHD is a government agency from Malaysia. It operates to manage the resettlement

of the rural poor into the new developed areas and also organise smallholder farms growing

cash crops. However now it has expanded its activities. It is now the world’s largest

plantation operator. This company came into existence on 1 July 1956. This report identifies

the problems faced by Felda BHD. The internal and external analysis of the company has also

been provided in the report. This report will also provide competitor’s matrix. In the later

section of the report recommendation for overcoming these challenges will be illustrated. In

the last section of the report there will be illustration of planned strategies, its formulation and

implementation.

Identification and elaboration of problems

Organisations in Malaysia are facing many kinds of challenges. Same is the case with

FELDA BHD. Some of the challenges faced by the company include:

Improving the life of settlers: It is seen that FELDA BHD is facing challenges in

improving the livelihood of the people due to failure in policies and the role of the

parent agency. The income of the FELDA BHD is reducing hence some of the people

have again gone into the clutches of poverty. In the last 50 years very few have been

able to move from their status (Arshad, 2019). Even when FELDA succeeded in its

business very little amount of horizontal and upward mobility of people can be seen.

Introduction

The global environment for business has become highly complex. This increase in the

complexity of the business environment has created many kinds of challenges for the firms.

Both strategic and functional issues are faced by the firms in Malaysia. Even the public

limited firms are under serious pressure to improve their business model in order to ensure

that their growth remains on the higher side. It is mandatory that firms look at the factors

present in the internal and external environment that would allow them to design their

strategies accordingly so that the challenges that they are facing can be reduced (Alwee,

Roowi, Teng & Othman, 2010). The strategies must also be designed on the basis of the

strategies that are made by the competitors. The Federal Land Development Authority or

FELDA BHD is a government agency from Malaysia. It operates to manage the resettlement

of the rural poor into the new developed areas and also organise smallholder farms growing

cash crops. However now it has expanded its activities. It is now the world’s largest

plantation operator. This company came into existence on 1 July 1956. This report identifies

the problems faced by Felda BHD. The internal and external analysis of the company has also

been provided in the report. This report will also provide competitor’s matrix. In the later

section of the report recommendation for overcoming these challenges will be illustrated. In

the last section of the report there will be illustration of planned strategies, its formulation and

implementation.

Identification and elaboration of problems

Organisations in Malaysia are facing many kinds of challenges. Same is the case with

FELDA BHD. Some of the challenges faced by the company include:

Improving the life of settlers: It is seen that FELDA BHD is facing challenges in

improving the livelihood of the people due to failure in policies and the role of the

parent agency. The income of the FELDA BHD is reducing hence some of the people

have again gone into the clutches of poverty. In the last 50 years very few have been

able to move from their status (Arshad, 2019). Even when FELDA succeeded in its

business very little amount of horizontal and upward mobility of people can be seen.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Mismanagement: The biggest problem that FELDA is facing is related to the

mismanagement. FELDA officials claimed many a time the company did not invested

in the projects effectively or properly. There was no financial reporting in an effective

manner. They have also not been able to use their resources effectively for caring of

the people (Barrock, 2019). Even the acquisition that was made by the company has

not been able to provide desired benefits to the people. Some of the joint ventures are

also underperforming and the management has not been able to rectify it.

Financial loses after listing on FGV: It can be seen that FELDA BHD had faced large

financial problems especially in terms of mounting debts once it got listed on the FGV

Holdings Berhad in the year 2012 and investing on the non-financial sector. The

conflict of interest between the operations and management after the Chairman Tan

Sri Mohd Isa Abdul Samad sat on the chair of board of directors. This resulted in the

lack of check and balance for the investment decision of the firm (The sun daily,

2019). It is seen that lack of accountability in the company has resulted in huge loses

to the company at many times. This is the major reason why they have been failing to

provide the benefits to the stakeholders that they could have.

Organisational culture: It is seen that culture of the firm is not consistent that can help

the firm in progressing in the right direction. They have not been able to develop a

culture that is consumer centric and finding resource gaps and prioritising the

workforce development program within the organisation (New Straight Times, 2019).

The market perception about the firm is not going good.

Internal analysis

For dealing with the challenges that they are facing, it is critical that firm does internal

analysis in an effective manner.

Value Chain Analysis

Primary activities

Inbound logistics: This Company has accumulated a good suppliers group that helps

them in obtaining high quality materials which is necessary for producing effective

end products. From housing to development of poor people they are acquiring raw

materials from all the good suppliers.

Mismanagement: The biggest problem that FELDA is facing is related to the

mismanagement. FELDA officials claimed many a time the company did not invested

in the projects effectively or properly. There was no financial reporting in an effective

manner. They have also not been able to use their resources effectively for caring of

the people (Barrock, 2019). Even the acquisition that was made by the company has

not been able to provide desired benefits to the people. Some of the joint ventures are

also underperforming and the management has not been able to rectify it.

Financial loses after listing on FGV: It can be seen that FELDA BHD had faced large

financial problems especially in terms of mounting debts once it got listed on the FGV

Holdings Berhad in the year 2012 and investing on the non-financial sector. The

conflict of interest between the operations and management after the Chairman Tan

Sri Mohd Isa Abdul Samad sat on the chair of board of directors. This resulted in the

lack of check and balance for the investment decision of the firm (The sun daily,

2019). It is seen that lack of accountability in the company has resulted in huge loses

to the company at many times. This is the major reason why they have been failing to

provide the benefits to the stakeholders that they could have.

Organisational culture: It is seen that culture of the firm is not consistent that can help

the firm in progressing in the right direction. They have not been able to develop a

culture that is consumer centric and finding resource gaps and prioritising the

workforce development program within the organisation (New Straight Times, 2019).

The market perception about the firm is not going good.

Internal analysis

For dealing with the challenges that they are facing, it is critical that firm does internal

analysis in an effective manner.

Value Chain Analysis

Primary activities

Inbound logistics: This Company has accumulated a good suppliers group that helps

them in obtaining high quality materials which is necessary for producing effective

end products. From housing to development of poor people they are acquiring raw

materials from all the good suppliers.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

Outbound logistics: They know that their end consumers are the people that are not so

wealthy hence they ensure that products are being delivered for making improvement

in their livelihood. However they have not been able to deliver as per the

requirements of the people.

Operations: In the last few years the mismanagement has been the biggest challenge

that has not allowed their operations to become effective. In spite of the fact that they

have got support of the government, there has been laziness from the management for

reacting towards the challenges that they are facing (Rasidi, Ngah & Ramli, 2014).

Marketing and sales: They have not been able to improve the image of the firm in the

last few years especially in terms of the fact that the objective that they have made.

Continuous reporting of the mismanagement has been reported which has taken down

the image of the company and the most critical impact of it can be seen on benefits

that they could provide to their stakeholders (Junaidah, Rafii, Chin & Saleh, 2011).

Services: The Services that is provided by the firm has not been so effective

especially in the time when it comes to continuously handling the resources that they

have. They have been training their employees but due to lack of management’s

support they have not been able to deliver it as expected.

Support activities

Firm’s infrastructure: There has been continuous change that has been made by the

company in its infrastructure so as to be ready for the operations that they are

performing. Their infrastructures have helped them in utilisation of the resources in

the long term.

Human Resource Management: They have been continuously improving the skills of

the individuals so that they are ready for all the challenges that are confronting their

business. It is their efforts towards improving HRM that has helped them in winning

the “50 Best Global Employer Brand Award 2015” at the 23rd edition of the World

HRD congress (FGVholdings, 2020).

Technology development: The technology development at FELDA has been slow and

it is due to this that they have failed to do operations as per their objectives. Their

technology development has been slow and hence they have not been able to provide

benefits to their stakeholders as they have expected.

Procurement: They have managed their suppliers in a manner where they are

procuring things from the best suppliers from all across the globe. Regular analysis of

Outbound logistics: They know that their end consumers are the people that are not so

wealthy hence they ensure that products are being delivered for making improvement

in their livelihood. However they have not been able to deliver as per the

requirements of the people.

Operations: In the last few years the mismanagement has been the biggest challenge

that has not allowed their operations to become effective. In spite of the fact that they

have got support of the government, there has been laziness from the management for

reacting towards the challenges that they are facing (Rasidi, Ngah & Ramli, 2014).

Marketing and sales: They have not been able to improve the image of the firm in the

last few years especially in terms of the fact that the objective that they have made.

Continuous reporting of the mismanagement has been reported which has taken down

the image of the company and the most critical impact of it can be seen on benefits

that they could provide to their stakeholders (Junaidah, Rafii, Chin & Saleh, 2011).

Services: The Services that is provided by the firm has not been so effective

especially in the time when it comes to continuously handling the resources that they

have. They have been training their employees but due to lack of management’s

support they have not been able to deliver it as expected.

Support activities

Firm’s infrastructure: There has been continuous change that has been made by the

company in its infrastructure so as to be ready for the operations that they are

performing. Their infrastructures have helped them in utilisation of the resources in

the long term.

Human Resource Management: They have been continuously improving the skills of

the individuals so that they are ready for all the challenges that are confronting their

business. It is their efforts towards improving HRM that has helped them in winning

the “50 Best Global Employer Brand Award 2015” at the 23rd edition of the World

HRD congress (FGVholdings, 2020).

Technology development: The technology development at FELDA has been slow and

it is due to this that they have failed to do operations as per their objectives. Their

technology development has been slow and hence they have not been able to provide

benefits to their stakeholders as they have expected.

Procurement: They have managed their suppliers in a manner where they are

procuring things from the best suppliers from all across the globe. Regular analysis of

5

the supplier’s quality is being done so as to ensure that procurements are done

effectively.

Milestone Table

Year Milestone

1956 The land development ordinance came into existence and FELDA

was established with a starting capital of RM10 million.

1971 FELDA made his first joint venture with Perlis Plantation Berhad to

start Kilang Gula Felda Gula Felda Perlis Sendirian Berhad, a

milling and refining sugar facility.

1978 Establishment of Agricultural Services Corporation that produces

planting stock for oil palm.

1980 FELDA established an investment cooperative that gave the

opportunity to the workers of the FELDA company to invest in the

firm.

1985 FELDA Rubber Corporation Industries was established to operate

rubber processing factories.

1992 Commercial planting operations started under the name FELDA

PLANTATIONS SDN BHD.

1995 FELDA PLANTATIONS SDN BHD was established as FELDA

commercial arm.

2004 FELDA commissioned the Sahabat biomass power plant in Lahad

Datu.

2007 FELDA incorporated Felda Global Ventures Holdings Sdn Bhd to

operate as a commercial arm for their investments in downstream

and upstream palm oil businesses.

2008 FGV acquired FELDA’s investments in North America which

includes Twin Rivers Technologies Holdings Inc.

2009 FGV have acquired 50% equity interest in FELDA IFFCO SDN

BHD as well as TRURICH RESOURCES SDN BHD (Alwee,

Roowi, Teng & Othman, 2010).

2010 This group became the world’s first smallholder firm to achieve the

Roundtable on sustainable palm oil certification (FGVholdings,

the supplier’s quality is being done so as to ensure that procurements are done

effectively.

Milestone Table

Year Milestone

1956 The land development ordinance came into existence and FELDA

was established with a starting capital of RM10 million.

1971 FELDA made his first joint venture with Perlis Plantation Berhad to

start Kilang Gula Felda Gula Felda Perlis Sendirian Berhad, a

milling and refining sugar facility.

1978 Establishment of Agricultural Services Corporation that produces

planting stock for oil palm.

1980 FELDA established an investment cooperative that gave the

opportunity to the workers of the FELDA company to invest in the

firm.

1985 FELDA Rubber Corporation Industries was established to operate

rubber processing factories.

1992 Commercial planting operations started under the name FELDA

PLANTATIONS SDN BHD.

1995 FELDA PLANTATIONS SDN BHD was established as FELDA

commercial arm.

2004 FELDA commissioned the Sahabat biomass power plant in Lahad

Datu.

2007 FELDA incorporated Felda Global Ventures Holdings Sdn Bhd to

operate as a commercial arm for their investments in downstream

and upstream palm oil businesses.

2008 FGV acquired FELDA’s investments in North America which

includes Twin Rivers Technologies Holdings Inc.

2009 FGV have acquired 50% equity interest in FELDA IFFCO SDN

BHD as well as TRURICH RESOURCES SDN BHD (Alwee,

Roowi, Teng & Othman, 2010).

2010 This group became the world’s first smallholder firm to achieve the

Roundtable on sustainable palm oil certification (FGVholdings,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

2020).

2011 A subsidiary of MSM Malaysia Holdings Berhad got listed on the

Main Market of Bursa Malaysia Securities Bhd.

2012 The initial public offering of the company is the third largest in the

year 2012.

2013 FGV CNS started producing the high grade carbon Nanotube and

Graphene.

2015 They entered in The Brand Finance TOP 100 Malaysia Brands

2015.

2018 Felda Global Ventures Holdings Berhad got incorporated under the

Companies Act 1965 as a public company.

Financial Analysis

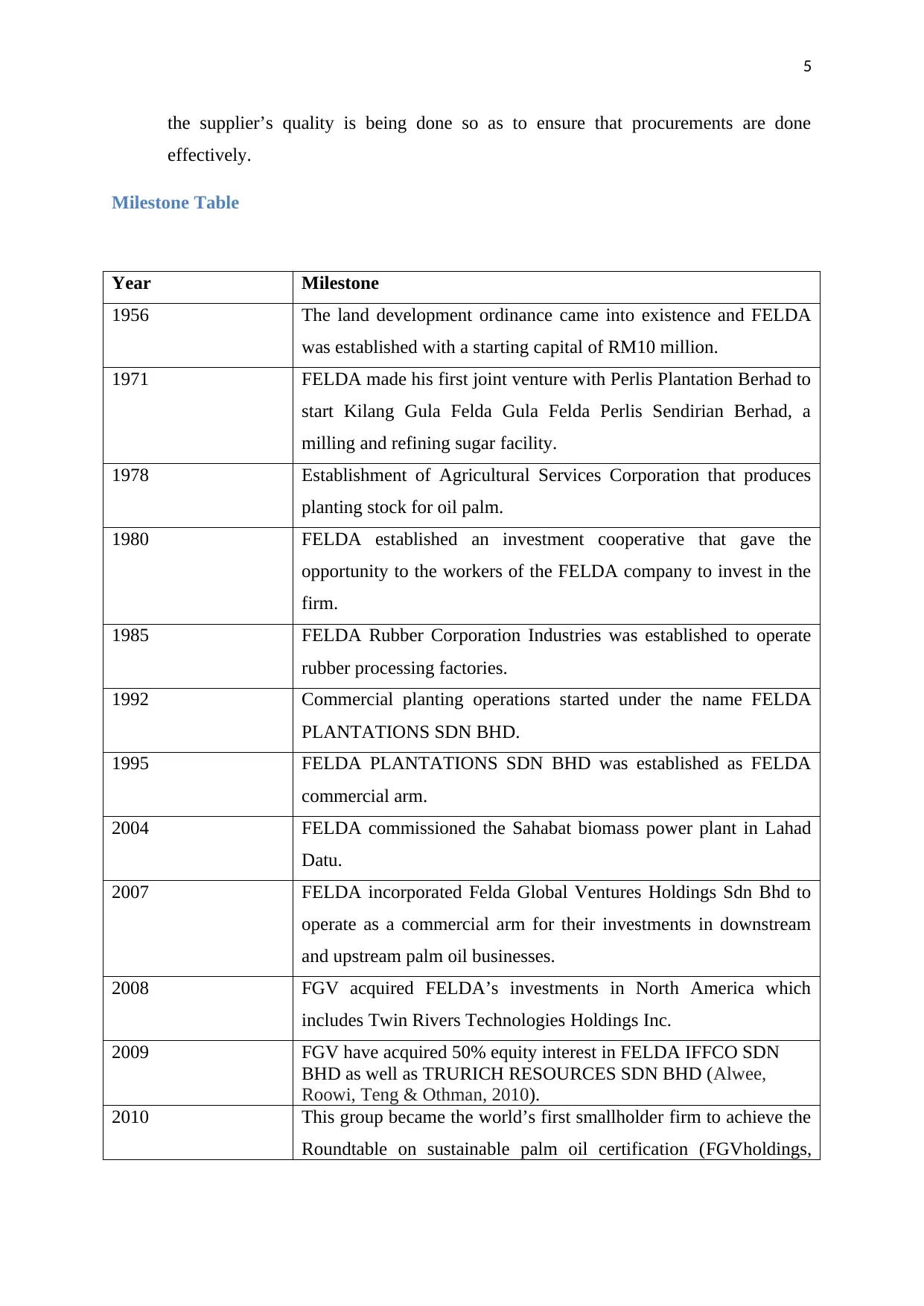

Figure 1: Market value ratios

The market value ratios suggest that that the company’s performance when compared with

industry is not at all good. This depicts that in the long term company will not be able to

achieve which it could have.

2020).

2011 A subsidiary of MSM Malaysia Holdings Berhad got listed on the

Main Market of Bursa Malaysia Securities Bhd.

2012 The initial public offering of the company is the third largest in the

year 2012.

2013 FGV CNS started producing the high grade carbon Nanotube and

Graphene.

2015 They entered in The Brand Finance TOP 100 Malaysia Brands

2015.

2018 Felda Global Ventures Holdings Berhad got incorporated under the

Companies Act 1965 as a public company.

Financial Analysis

Figure 1: Market value ratios

The market value ratios suggest that that the company’s performance when compared with

industry is not at all good. This depicts that in the long term company will not be able to

achieve which it could have.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

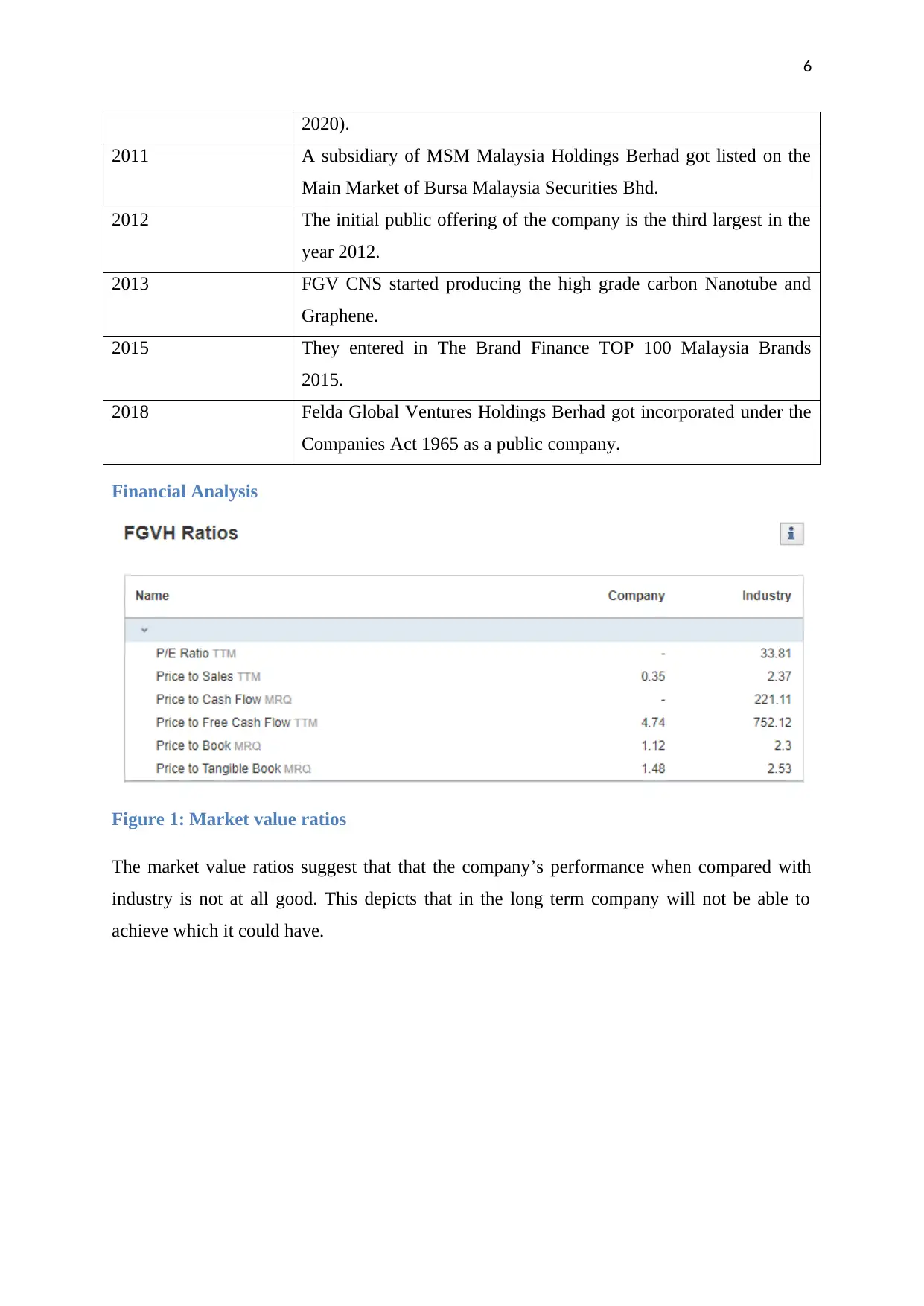

Figure 2: Profitability ratios

Again on these parameters of financials the firm is not performing when compared with

industry standards. It is also showing that the company is doing its sales but still it is going

into losses. Some factors even go on the negative side which illustrates the fact that the way

in which company is performing is not so well.

Figure 3: Cash flow ratios

Cash flow ratios within the firm illustrates that the firm is unable to provide desired benefits

to the stakeholders that they could have. This is not a good sign for the company and their

future investment programs (Investing, 2020).

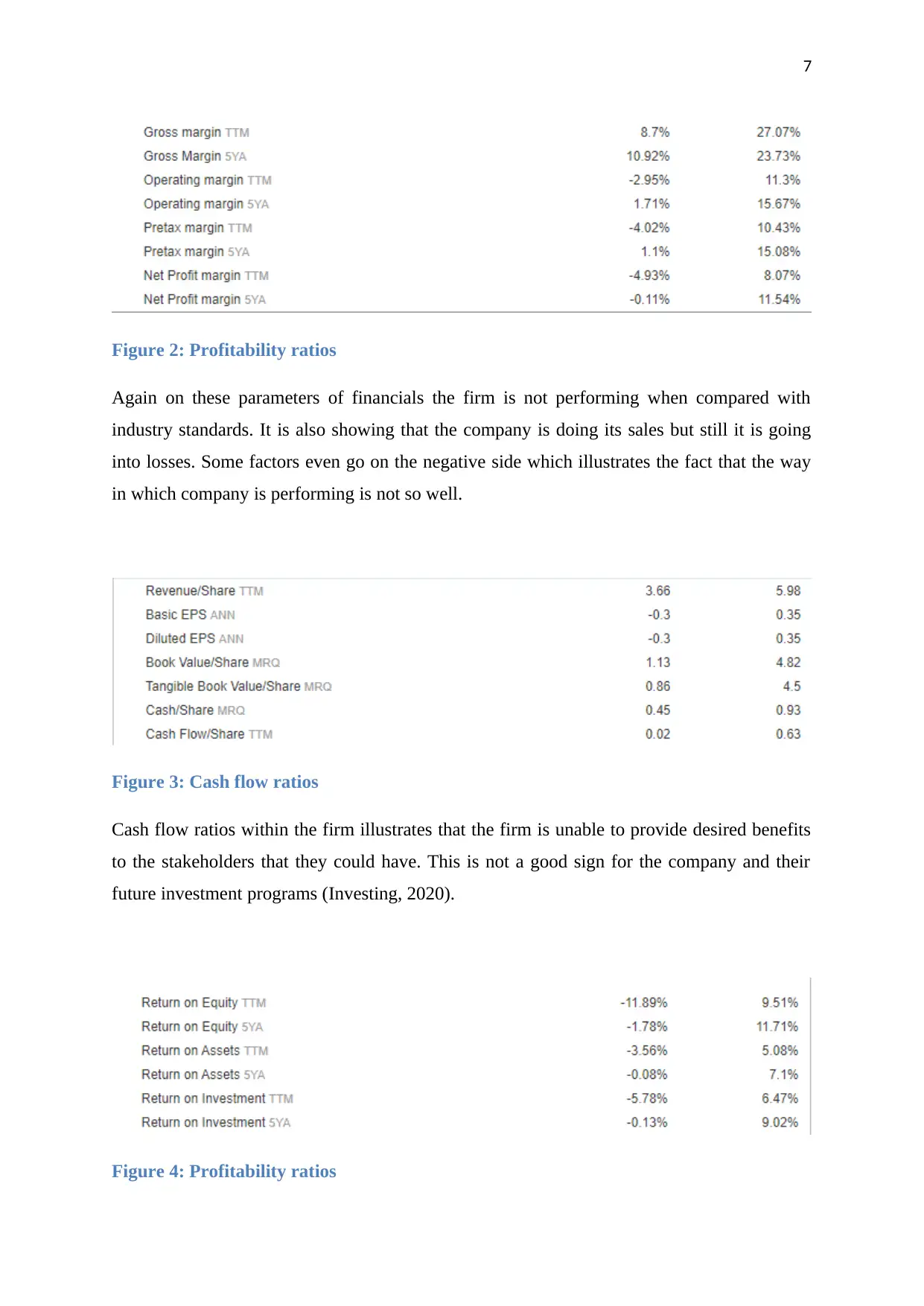

Figure 4: Profitability ratios

Figure 2: Profitability ratios

Again on these parameters of financials the firm is not performing when compared with

industry standards. It is also showing that the company is doing its sales but still it is going

into losses. Some factors even go on the negative side which illustrates the fact that the way

in which company is performing is not so well.

Figure 3: Cash flow ratios

Cash flow ratios within the firm illustrates that the firm is unable to provide desired benefits

to the stakeholders that they could have. This is not a good sign for the company and their

future investment programs (Investing, 2020).

Figure 4: Profitability ratios

8

All the returns that are getting on the investment done by the company is on the negative side

and hence no new investors will be adding to the company as they will get nothing.

Figure 5: Liquidity Ratios

The liquidity ratios suggests that the company’s debts are increasing day by day and it has

gone much higher than equity. The debts of the company are on the increasing side i.e. the

company is investing on the debts only which is not giving them significant benefits.

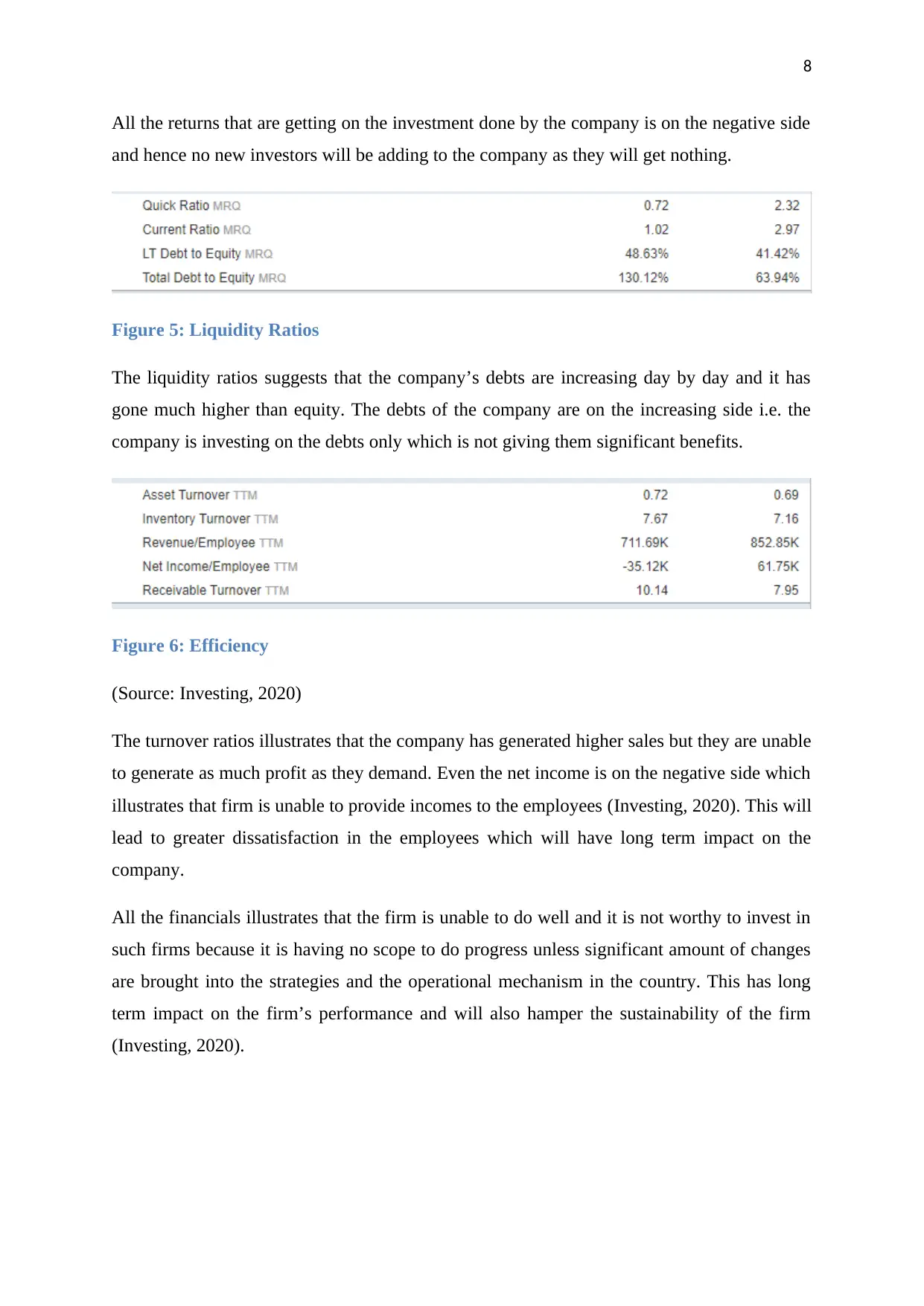

Figure 6: Efficiency

(Source: Investing, 2020)

The turnover ratios illustrates that the company has generated higher sales but they are unable

to generate as much profit as they demand. Even the net income is on the negative side which

illustrates that firm is unable to provide incomes to the employees (Investing, 2020). This will

lead to greater dissatisfaction in the employees which will have long term impact on the

company.

All the financials illustrates that the firm is unable to do well and it is not worthy to invest in

such firms because it is having no scope to do progress unless significant amount of changes

are brought into the strategies and the operational mechanism in the country. This has long

term impact on the firm’s performance and will also hamper the sustainability of the firm

(Investing, 2020).

All the returns that are getting on the investment done by the company is on the negative side

and hence no new investors will be adding to the company as they will get nothing.

Figure 5: Liquidity Ratios

The liquidity ratios suggests that the company’s debts are increasing day by day and it has

gone much higher than equity. The debts of the company are on the increasing side i.e. the

company is investing on the debts only which is not giving them significant benefits.

Figure 6: Efficiency

(Source: Investing, 2020)

The turnover ratios illustrates that the company has generated higher sales but they are unable

to generate as much profit as they demand. Even the net income is on the negative side which

illustrates that firm is unable to provide incomes to the employees (Investing, 2020). This will

lead to greater dissatisfaction in the employees which will have long term impact on the

company.

All the financials illustrates that the firm is unable to do well and it is not worthy to invest in

such firms because it is having no scope to do progress unless significant amount of changes

are brought into the strategies and the operational mechanism in the country. This has long

term impact on the firm’s performance and will also hamper the sustainability of the firm

(Investing, 2020).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

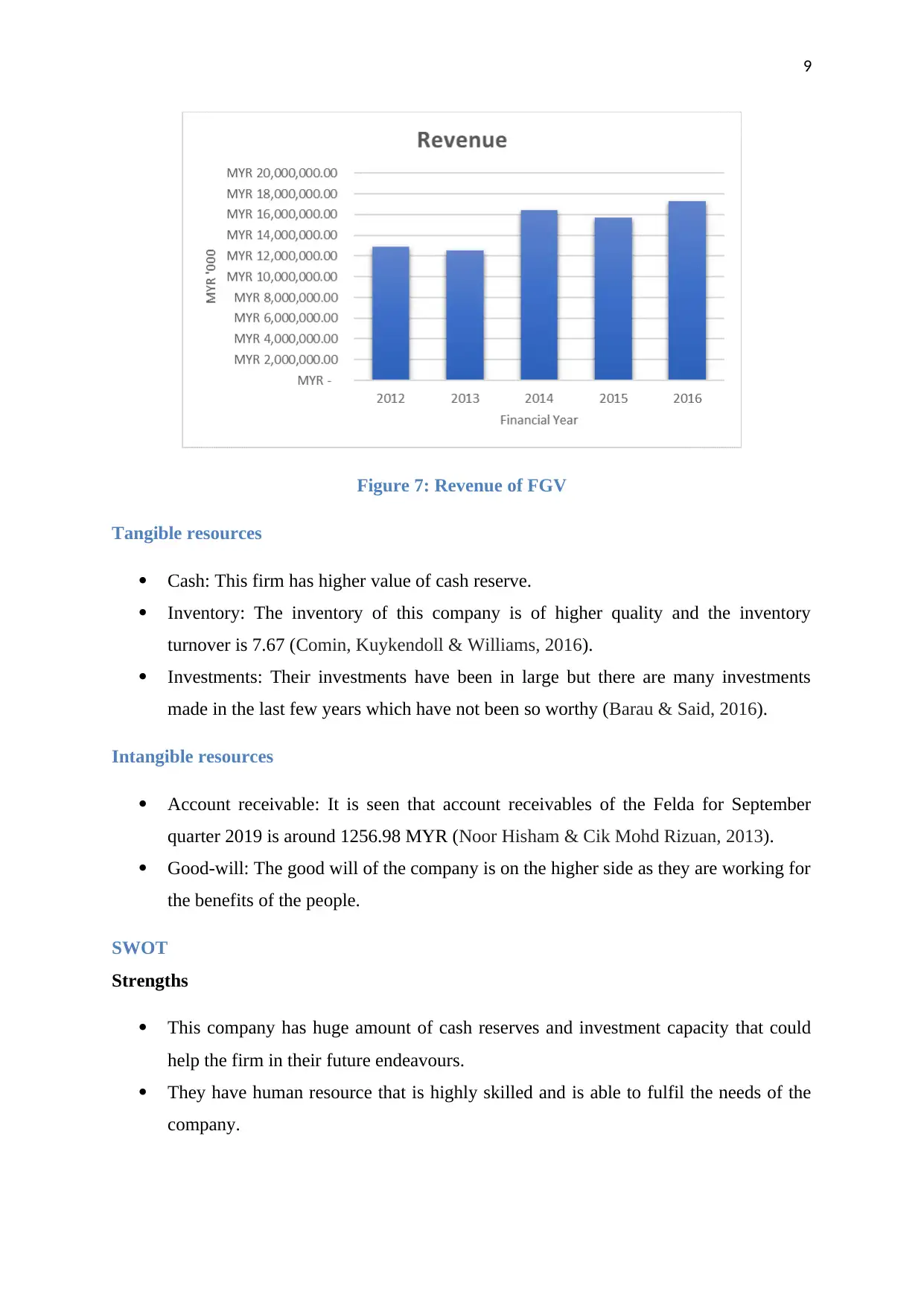

Figure 7: Revenue of FGV

Tangible resources

Cash: This firm has higher value of cash reserve.

Inventory: The inventory of this company is of higher quality and the inventory

turnover is 7.67 (Comin, Kuykendoll & Williams, 2016).

Investments: Their investments have been in large but there are many investments

made in the last few years which have not been so worthy (Barau & Said, 2016).

Intangible resources

Account receivable: It is seen that account receivables of the Felda for September

quarter 2019 is around 1256.98 MYR (Noor Hisham & Cik Mohd Rizuan, 2013).

Good-will: The good will of the company is on the higher side as they are working for

the benefits of the people.

SWOT

Strengths

This company has huge amount of cash reserves and investment capacity that could

help the firm in their future endeavours.

They have human resource that is highly skilled and is able to fulfil the needs of the

company.

Figure 7: Revenue of FGV

Tangible resources

Cash: This firm has higher value of cash reserve.

Inventory: The inventory of this company is of higher quality and the inventory

turnover is 7.67 (Comin, Kuykendoll & Williams, 2016).

Investments: Their investments have been in large but there are many investments

made in the last few years which have not been so worthy (Barau & Said, 2016).

Intangible resources

Account receivable: It is seen that account receivables of the Felda for September

quarter 2019 is around 1256.98 MYR (Noor Hisham & Cik Mohd Rizuan, 2013).

Good-will: The good will of the company is on the higher side as they are working for

the benefits of the people.

SWOT

Strengths

This company has huge amount of cash reserves and investment capacity that could

help the firm in their future endeavours.

They have human resource that is highly skilled and is able to fulfil the needs of the

company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

They have the support of the government which helps them in terms of resources they

have (Rasidi, Ngah & Ramli, 2014).

Weaknesses

Company has been failing to address the mismanagement happening in the firm.

They have been unable to maintain the life standards of the people that have been

once up lifted the company (Kushairi, et al 2019).

The growth of financials in the company has been poor.

Opportunities

This Company has opportunities in many new areas especially the ones that are

related to people development in Malaysia.

They can work in public private partnership so as to ensure that they have been able to

enhance the base of their firm (Manaf & Ibrahim, 2017).

They have opportunities in going into new kinds of joint ventures that will allow them

to enhance their synergy.

They will also look for the opportunities in other developing nation where they could

do the same operations so as to generate the adequate capital for the company.

Threats

The global market is facing economic slowdown hence the impact on the global

investments have been poor.

Threats related to the sustainability also lies in front of the company where it is seen

that due to mismanagement of resources an organisation will not be able to ensure its

sustainability in the long term (Joshi, 2018).

External analysis

In order to excel in the development of strategies, it is critical for the organisations to reduce

the impact of the external factors on the business.

PESTLE analysis

Political: This Company has the support of the government especially in the areas like

tax exemptions and policy making. Government’s expenditure on the welfare

programs has been reduced and this has impact on the development of the programs

They have the support of the government which helps them in terms of resources they

have (Rasidi, Ngah & Ramli, 2014).

Weaknesses

Company has been failing to address the mismanagement happening in the firm.

They have been unable to maintain the life standards of the people that have been

once up lifted the company (Kushairi, et al 2019).

The growth of financials in the company has been poor.

Opportunities

This Company has opportunities in many new areas especially the ones that are

related to people development in Malaysia.

They can work in public private partnership so as to ensure that they have been able to

enhance the base of their firm (Manaf & Ibrahim, 2017).

They have opportunities in going into new kinds of joint ventures that will allow them

to enhance their synergy.

They will also look for the opportunities in other developing nation where they could

do the same operations so as to generate the adequate capital for the company.

Threats

The global market is facing economic slowdown hence the impact on the global

investments have been poor.

Threats related to the sustainability also lies in front of the company where it is seen

that due to mismanagement of resources an organisation will not be able to ensure its

sustainability in the long term (Joshi, 2018).

External analysis

In order to excel in the development of strategies, it is critical for the organisations to reduce

the impact of the external factors on the business.

PESTLE analysis

Political: This Company has the support of the government especially in the areas like

tax exemptions and policy making. Government’s expenditure on the welfare

programs has been reduced and this has impact on the development of the programs

11

by the FELDA BHD also. However Malaysian government has good relations with

other nations and hence the development of the company in other parts of the world

will be easier (Keong & Keng, 2012).

Economic: The economic condition of world is not so healthy and this is producing a

condition where finding global investors will be easier. This gets worse with the fact

that the internal financial management of the organisation is not so effective and they

are incurring many kinds of loses. However the support of the government will help

FELDA in improving their financial condition. The reduction in the price of palm oil

has also affected the economic condition of FELDA.

Social: The society of Malaysia has changed and there are large numbers of people

that requires welfare programs to come out of poverty. Affordable housing and

cleaner and greener environment is something that is needed by the people and failing

to do so has long term impact on the development of the organisations (Junaidah,

Rafii, Chin & Saleh, 2011).

Technological: Technological infrastructure in Malaysia is still growing and it is seen

that companies in Malaysia like FELDA BHD have still not invested heavily on

utilisation of technology in the workplace. If technology would have been used

effectively in FELDA then the changes of mismanagement would have been seriously

reduced.

Legal: The legalities in Malaysia have changed and it has become more consumers

centric and companies have to ensure that they get everything right so that they do not

have to face any kinds of legal complications.

Environment: The greatest impact on the business of FELDA BHD is of the

environmental concerns especially in terms of the fact that the production of the palm

oil is effected by the change in the environment. Since they are working towards

plantation hence they need to be more precise over the way in which they can deal

with environment related parameters especially in the infrastructure and housing

development (Noor Hisham & Cik Mohd Rizuan, 2013).

Porter’s five force analysis

In order to deal with the industry environment, the use of Porter’s five force analysis can be

critical.

Bargaining power of suppliers: There are large numbers of suppliers available in the

market both in Malaysia and international market. However this company has not

by the FELDA BHD also. However Malaysian government has good relations with

other nations and hence the development of the company in other parts of the world

will be easier (Keong & Keng, 2012).

Economic: The economic condition of world is not so healthy and this is producing a

condition where finding global investors will be easier. This gets worse with the fact

that the internal financial management of the organisation is not so effective and they

are incurring many kinds of loses. However the support of the government will help

FELDA in improving their financial condition. The reduction in the price of palm oil

has also affected the economic condition of FELDA.

Social: The society of Malaysia has changed and there are large numbers of people

that requires welfare programs to come out of poverty. Affordable housing and

cleaner and greener environment is something that is needed by the people and failing

to do so has long term impact on the development of the organisations (Junaidah,

Rafii, Chin & Saleh, 2011).

Technological: Technological infrastructure in Malaysia is still growing and it is seen

that companies in Malaysia like FELDA BHD have still not invested heavily on

utilisation of technology in the workplace. If technology would have been used

effectively in FELDA then the changes of mismanagement would have been seriously

reduced.

Legal: The legalities in Malaysia have changed and it has become more consumers

centric and companies have to ensure that they get everything right so that they do not

have to face any kinds of legal complications.

Environment: The greatest impact on the business of FELDA BHD is of the

environmental concerns especially in terms of the fact that the production of the palm

oil is effected by the change in the environment. Since they are working towards

plantation hence they need to be more precise over the way in which they can deal

with environment related parameters especially in the infrastructure and housing

development (Noor Hisham & Cik Mohd Rizuan, 2013).

Porter’s five force analysis

In order to deal with the industry environment, the use of Porter’s five force analysis can be

critical.

Bargaining power of suppliers: There are large numbers of suppliers available in the

market both in Malaysia and international market. However this company has not

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.