Comprehensive Financial Analysis Report: Suncor Energy and Competitors

VerifiedAdded on 2022/10/18

|24

|4180

|107

Report

AI Summary

This comprehensive report offers a detailed financial analysis of Suncor Energy, a Canadian energy company. It assesses the company's current business and financial health using financial ratios, including debt-to-equity, current ratio, earnings per share, and Altman Z-score. The analysis benchmarks Suncor Energy against competitors such as Imperial Oil, Husky Energy, and Cenovus Energy, all operating within the energy sector. The report includes a critical evaluation of the industry sector, comparing the financial strengths and weaknesses of Suncor Energy to its competitors, and evaluates the effectiveness of financial techniques like ratio analysis and Altman Z-score. Recommendations are provided based on the findings, with a reasoned conclusion summarizing the overall financial performance and position of Suncor Energy, supported by relevant financial data and analysis.

Running head: ACCOUNTING STATEMENT ANALYSIS

Accounting Statement Analysis

Name of the Student

Name of the University

Authors Note

Course ID

Accounting Statement Analysis

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING STATEMENT ANALYSIS

Table of Contents

Introduction:...............................................................................................................................2

Analysis of current business and financial health of Suncor Energy:........................................2

Critical analysis of industry sector:............................................................................................8

Financial analysis of three other companies:.............................................................................9

Critical appraisal of financial strengths and weakness of chosen company compared to listed

competitors:..............................................................................................................................11

Critical Evaluation of Financial Techniques:...........................................................................13

Ratio and Z-Score:...............................................................................................................13

Recommendations:...................................................................................................................15

Conclusion:..............................................................................................................................15

References:...............................................................................................................................16

Appendix:.................................................................................................................................19

Computation of Financial Ratios:............................................................................................19

Suncor Energy:.....................................................................................................................19

Imperial Oil:.........................................................................................................................20

Husky Energy:......................................................................................................................21

Cenovus Energy:..................................................................................................................22

Altman Z- Score:..................................................................................................................23

Table of Contents

Introduction:...............................................................................................................................2

Analysis of current business and financial health of Suncor Energy:........................................2

Critical analysis of industry sector:............................................................................................8

Financial analysis of three other companies:.............................................................................9

Critical appraisal of financial strengths and weakness of chosen company compared to listed

competitors:..............................................................................................................................11

Critical Evaluation of Financial Techniques:...........................................................................13

Ratio and Z-Score:...............................................................................................................13

Recommendations:...................................................................................................................15

Conclusion:..............................................................................................................................15

References:...............................................................................................................................16

Appendix:.................................................................................................................................19

Computation of Financial Ratios:............................................................................................19

Suncor Energy:.....................................................................................................................19

Imperial Oil:.........................................................................................................................20

Husky Energy:......................................................................................................................21

Cenovus Energy:..................................................................................................................22

Altman Z- Score:..................................................................................................................23

2ACCOUNTING STATEMENT ANALYSIS

Introduction:

In the modern world of competitive business, analyst often make use of financial

analysis tools as the process of assessing the businesses, projects, budgets and other financial

entities to ascertain their performance and suitability (Williams & Dobelman, 2017).

Characteristically, financial analysis is employed to assess whether the company is stable,

liquid, solvent or profitable enough to warranty the financial investment. The present report is

based on analysing the financial health of Suncor Energy with the help of financial ratios and

Altman Z-Score. The report would accompany a detailed analysis of the industry sector and

also the financial analysis of other three company that are operating in the same sector. The

other three company includes the Imperial Oil, Husky Energy and Cenovus Energy. All the

aforementioned company operate in the energy sector.

To benchmark the financial performance for each company previous year data will be

considered. This would further facilitate the critical appraisal of the financial strength and

weakness of Suncor Energy being the main company against its listed competitors. The report

would also accompany the critical analysis of financial techniques employed in the analysis.

A suitable recommendations would be provided for the chosen company with reasoned

conclusion to summarize the overall findings of the analysis.

Analysis of current business and financial health of Suncor Energy:

Suncor Energy is a Canadian incorporated energy company that specializes itself in

production of synthetic crude oil from the sands. The company current ranks at 134 in the list

of Forbes Global 2000 (Suncor, 2019). The current business of Suncor Energy comprises of

marking of products and services to the retail customers in Ontario with the help of

downstream network of around 280 company owned and approximately 200 customer-

Introduction:

In the modern world of competitive business, analyst often make use of financial

analysis tools as the process of assessing the businesses, projects, budgets and other financial

entities to ascertain their performance and suitability (Williams & Dobelman, 2017).

Characteristically, financial analysis is employed to assess whether the company is stable,

liquid, solvent or profitable enough to warranty the financial investment. The present report is

based on analysing the financial health of Suncor Energy with the help of financial ratios and

Altman Z-Score. The report would accompany a detailed analysis of the industry sector and

also the financial analysis of other three company that are operating in the same sector. The

other three company includes the Imperial Oil, Husky Energy and Cenovus Energy. All the

aforementioned company operate in the energy sector.

To benchmark the financial performance for each company previous year data will be

considered. This would further facilitate the critical appraisal of the financial strength and

weakness of Suncor Energy being the main company against its listed competitors. The report

would also accompany the critical analysis of financial techniques employed in the analysis.

A suitable recommendations would be provided for the chosen company with reasoned

conclusion to summarize the overall findings of the analysis.

Analysis of current business and financial health of Suncor Energy:

Suncor Energy is a Canadian incorporated energy company that specializes itself in

production of synthetic crude oil from the sands. The company current ranks at 134 in the list

of Forbes Global 2000 (Suncor, 2019). The current business of Suncor Energy comprises of

marking of products and services to the retail customers in Ontario with the help of

downstream network of around 280 company owned and approximately 200 customer-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING STATEMENT ANALYSIS

operated retail and Diesel Fuel sites which is mainly located in Ontario under the brand name

of Suncor Energy.

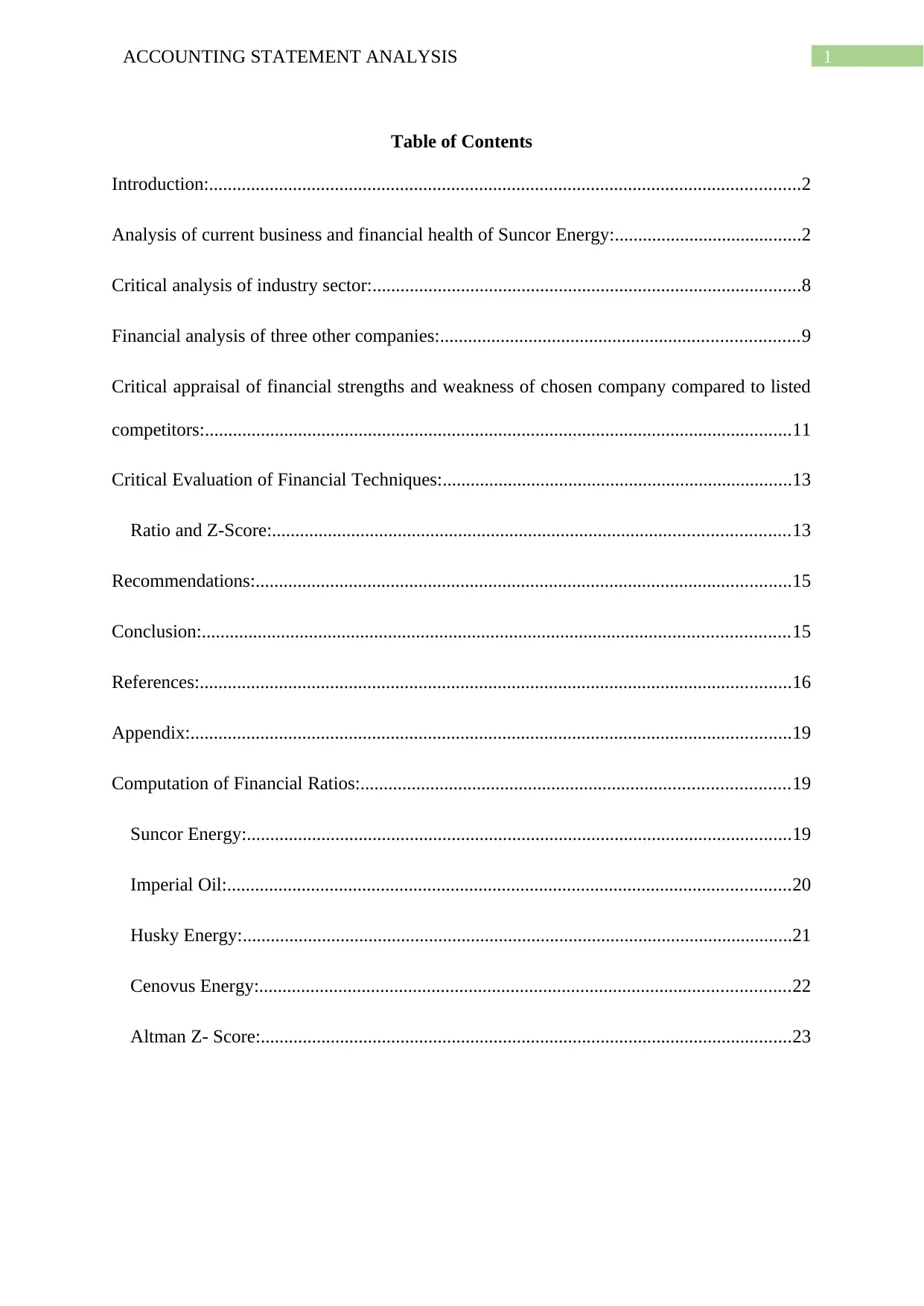

Considering the financial performance of Suncor Energy investors that are looking for

higher market liquidity and small debt on their balance sheet must take into account this

company. Having the market valuation of around CA$69b, Suncor Energy is current safe

haven for the investors in the phase of uncertainty in market because of its strong balance

sheet.

Figure 1: Figure represent Debt to Equity History and Analysis of Suncor Energy

Source: (Suncor Energy, 2019)

Over the previous years, Suncor Energy has ramped up its debts from CA$16b to

CA$17b, that alone accounts for the long-term debt. With such kind of rise in the debt, the

present cash and the level of short-term investment amounts to CA$2.2b which is sufficient

to keep the business going (Wahlen et al., 2014). Furthermore, Suncor Energy has generated

operated retail and Diesel Fuel sites which is mainly located in Ontario under the brand name

of Suncor Energy.

Considering the financial performance of Suncor Energy investors that are looking for

higher market liquidity and small debt on their balance sheet must take into account this

company. Having the market valuation of around CA$69b, Suncor Energy is current safe

haven for the investors in the phase of uncertainty in market because of its strong balance

sheet.

Figure 1: Figure represent Debt to Equity History and Analysis of Suncor Energy

Source: (Suncor Energy, 2019)

Over the previous years, Suncor Energy has ramped up its debts from CA$16b to

CA$17b, that alone accounts for the long-term debt. With such kind of rise in the debt, the

present cash and the level of short-term investment amounts to CA$2.2b which is sufficient

to keep the business going (Wahlen et al., 2014). Furthermore, Suncor Energy has generated

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING STATEMENT ANALYSIS

a cash of $CA$11b from its operations over the last twelve months resulting to the operating

cash to total debt ratio of 61%. This signals that the amount of operating cash of Suncor

Energy is sufficient to meet its debt.

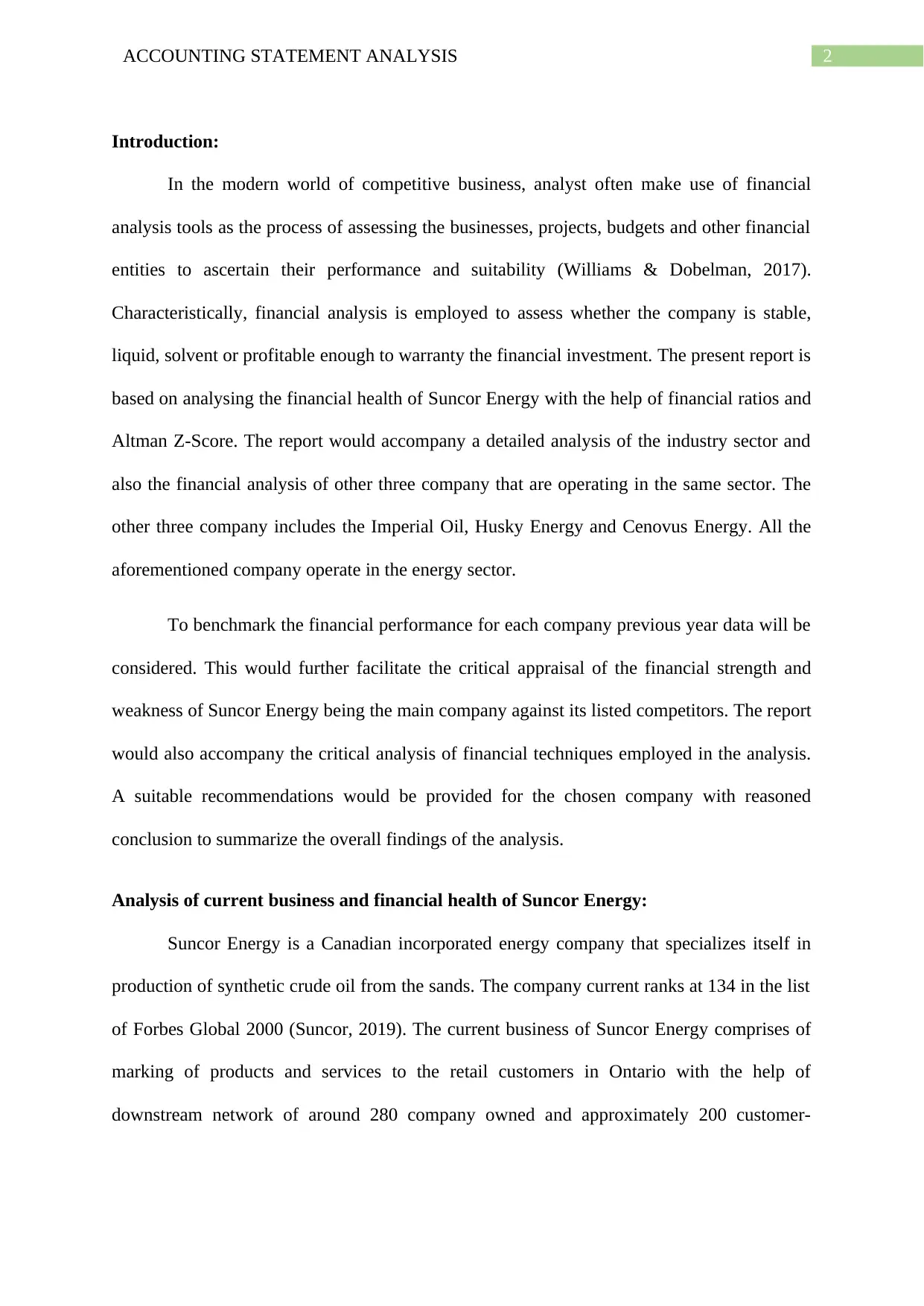

The net profit margin in 2017 stood 13.90% while in 2018 it declined to 8.45%. While

its competitors such as Imperial Oil and Husky Energy posted a relatively lower net profit

margin of 6.59% and 6.55% in 2018 respectively. Cenovus Energy however, reported a

strong net profit margin of 12.80% among the above three companies.

Suncor Energy

Imperial Oil

Husky Energy

Cenovus Energy

0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00%

13.90%

1.67%

4.25%

19.75%

8.45%

6.59%

6.55%

12.80%

Net Profi t Margin

2017 2018

Figure 2: Net Profit Margin

(Source: As Created by Author)

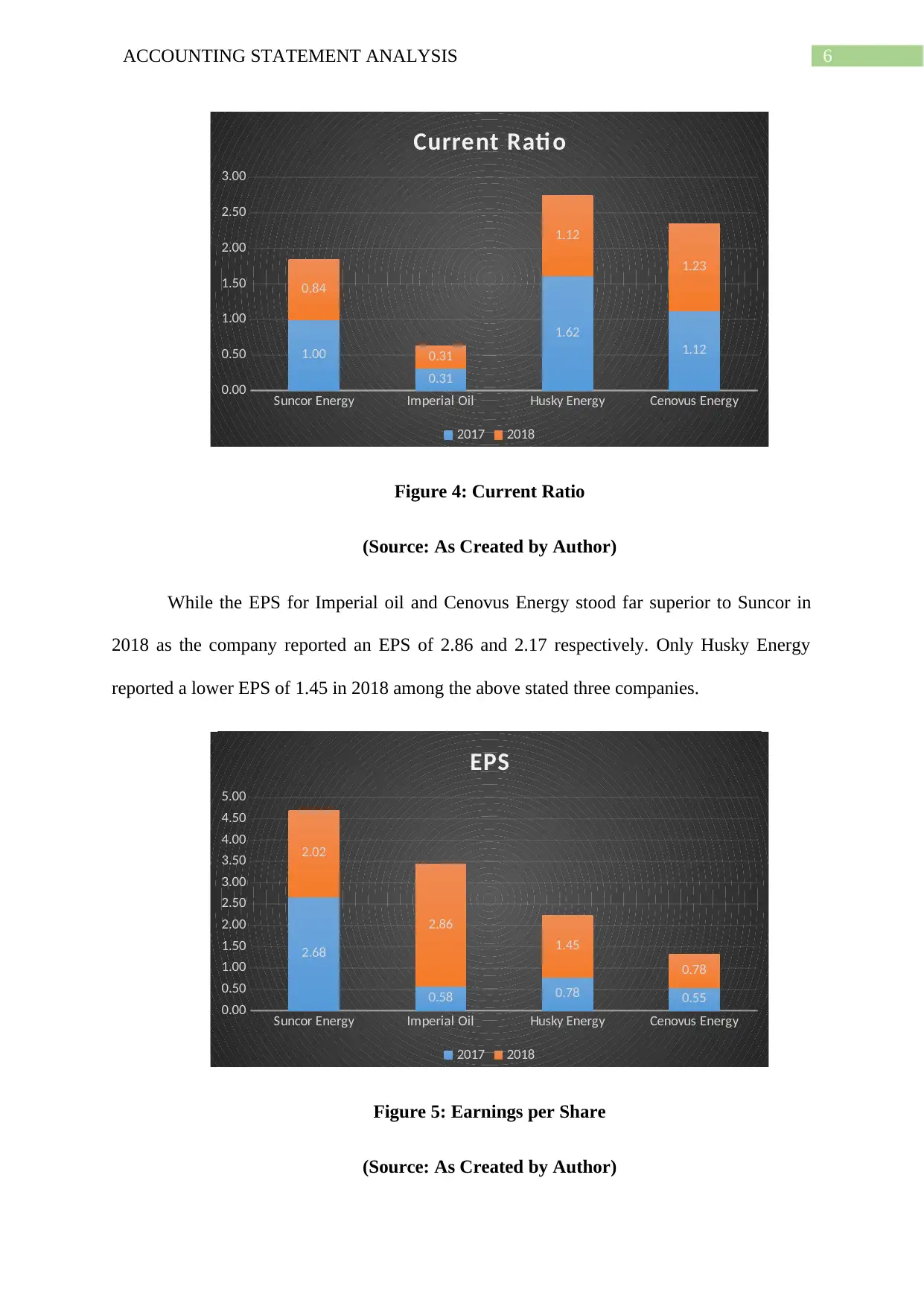

Correspondingly, the current ratio for Suncor Energy stood 0.84 in 2018 which is

ideally below the thumb rule of 2:1. Besides this, its competitors namely Imperial Oil and

Husky Energy posted a current ratio 0.31 and 1.12 in 2018 respectively. While Cenovus

Energy posted a current ratio of 1.23 for 2018.

a cash of $CA$11b from its operations over the last twelve months resulting to the operating

cash to total debt ratio of 61%. This signals that the amount of operating cash of Suncor

Energy is sufficient to meet its debt.

The net profit margin in 2017 stood 13.90% while in 2018 it declined to 8.45%. While

its competitors such as Imperial Oil and Husky Energy posted a relatively lower net profit

margin of 6.59% and 6.55% in 2018 respectively. Cenovus Energy however, reported a

strong net profit margin of 12.80% among the above three companies.

Suncor Energy

Imperial Oil

Husky Energy

Cenovus Energy

0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00%

13.90%

1.67%

4.25%

19.75%

8.45%

6.59%

6.55%

12.80%

Net Profi t Margin

2017 2018

Figure 2: Net Profit Margin

(Source: As Created by Author)

Correspondingly, the current ratio for Suncor Energy stood 0.84 in 2018 which is

ideally below the thumb rule of 2:1. Besides this, its competitors namely Imperial Oil and

Husky Energy posted a current ratio 0.31 and 1.12 in 2018 respectively. While Cenovus

Energy posted a current ratio of 1.23 for 2018.

5ACCOUNTING STATEMENT ANALYSIS

Suncor Energy Imperial Oil Husky Energy Cenovus Energy

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

0.36

0.71

0.56

1.12

0.44

0.85

0.63

1.23

Total Asset Turnover Rati o

2017 2018

Figure 3: Total Asset Turnover Ratio

(Source: As Created by Author)

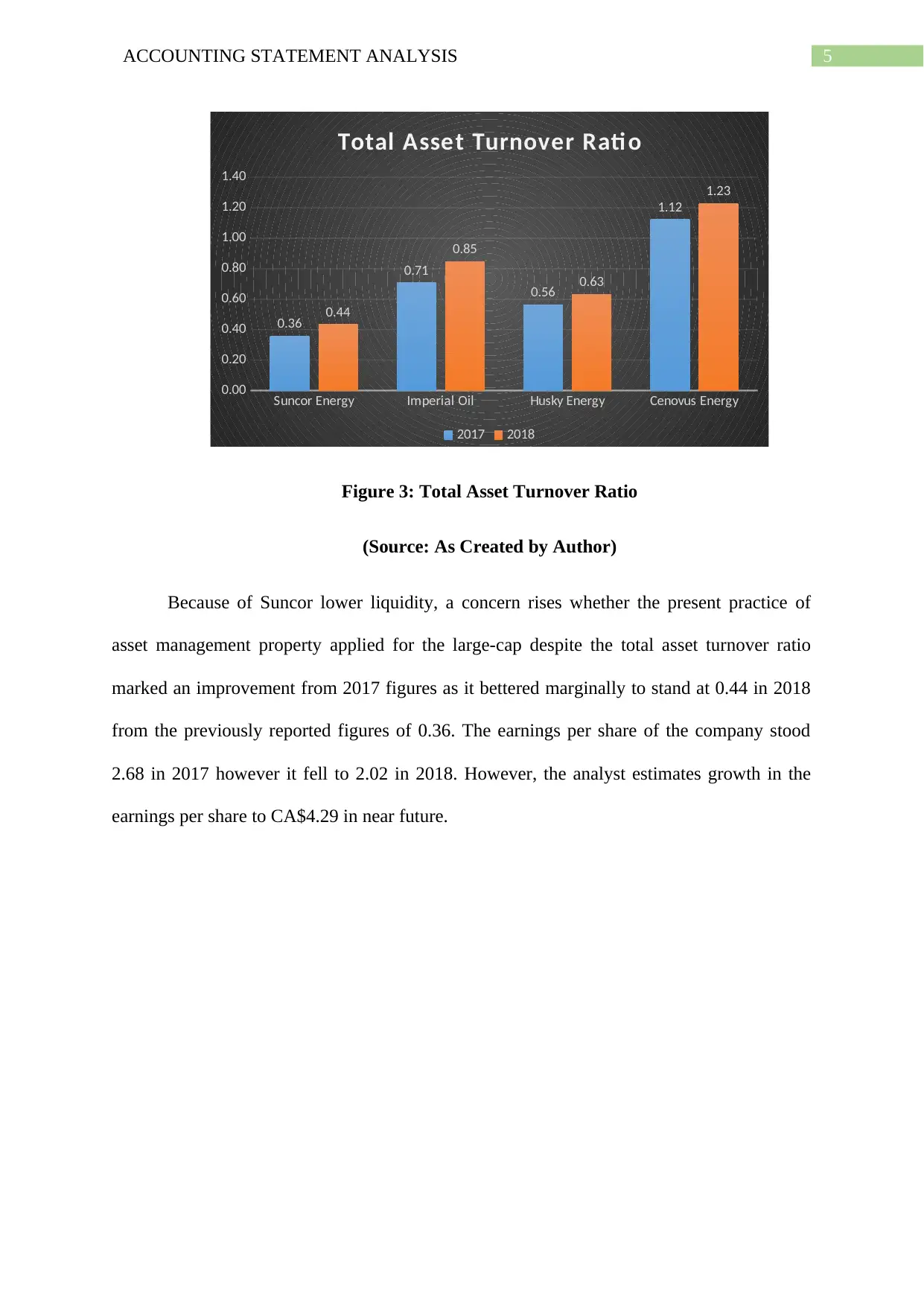

Because of Suncor lower liquidity, a concern rises whether the present practice of

asset management property applied for the large-cap despite the total asset turnover ratio

marked an improvement from 2017 figures as it bettered marginally to stand at 0.44 in 2018

from the previously reported figures of 0.36. The earnings per share of the company stood

2.68 in 2017 however it fell to 2.02 in 2018. However, the analyst estimates growth in the

earnings per share to CA$4.29 in near future.

Suncor Energy Imperial Oil Husky Energy Cenovus Energy

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

0.36

0.71

0.56

1.12

0.44

0.85

0.63

1.23

Total Asset Turnover Rati o

2017 2018

Figure 3: Total Asset Turnover Ratio

(Source: As Created by Author)

Because of Suncor lower liquidity, a concern rises whether the present practice of

asset management property applied for the large-cap despite the total asset turnover ratio

marked an improvement from 2017 figures as it bettered marginally to stand at 0.44 in 2018

from the previously reported figures of 0.36. The earnings per share of the company stood

2.68 in 2017 however it fell to 2.02 in 2018. However, the analyst estimates growth in the

earnings per share to CA$4.29 in near future.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING STATEMENT ANALYSIS

Suncor Energy Imperial Oil Husky Energy Cenovus Energy

0.00

0.50

1.00

1.50

2.00

2.50

3.00

1.00

0.31

1.62

1.12

0.84

0.31

1.12

1.23

Current Rati o

2017 2018

Figure 4: Current Ratio

(Source: As Created by Author)

While the EPS for Imperial oil and Cenovus Energy stood far superior to Suncor in

2018 as the company reported an EPS of 2.86 and 2.17 respectively. Only Husky Energy

reported a lower EPS of 1.45 in 2018 among the above stated three companies.

Suncor Energy Imperial Oil Husky Energy Cenovus Energy

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

2.68

0.58 0.78 0.55

2.02

2.86

1.45

0.78

EPS

2017 2018

Figure 5: Earnings per Share

(Source: As Created by Author)

Suncor Energy Imperial Oil Husky Energy Cenovus Energy

0.00

0.50

1.00

1.50

2.00

2.50

3.00

1.00

0.31

1.62

1.12

0.84

0.31

1.12

1.23

Current Rati o

2017 2018

Figure 4: Current Ratio

(Source: As Created by Author)

While the EPS for Imperial oil and Cenovus Energy stood far superior to Suncor in

2018 as the company reported an EPS of 2.86 and 2.17 respectively. Only Husky Energy

reported a lower EPS of 1.45 in 2018 among the above stated three companies.

Suncor Energy Imperial Oil Husky Energy Cenovus Energy

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

2.68

0.58 0.78 0.55

2.02

2.86

1.45

0.78

EPS

2017 2018

Figure 5: Earnings per Share

(Source: As Created by Author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING STATEMENT ANALYSIS

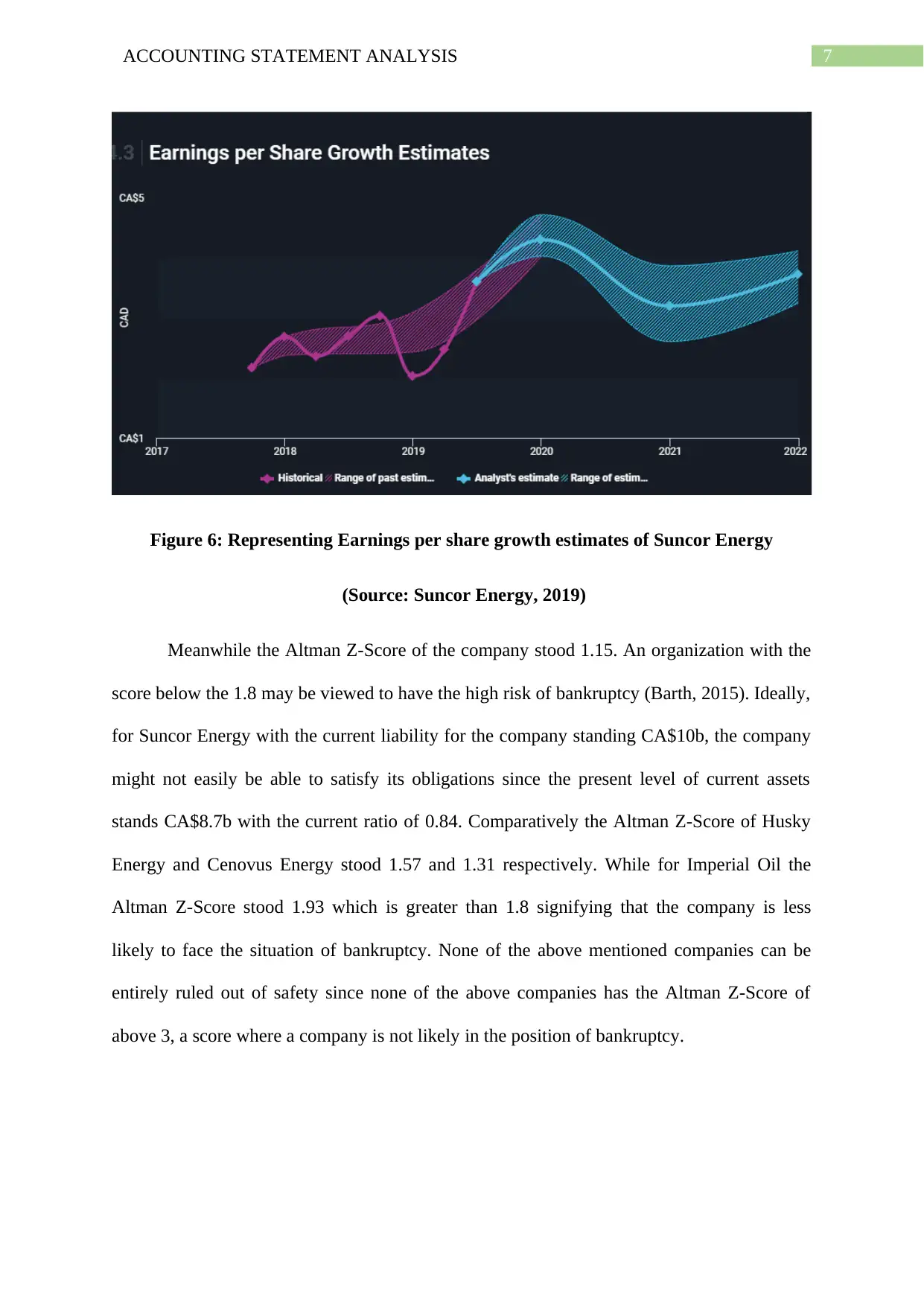

Figure 6: Representing Earnings per share growth estimates of Suncor Energy

(Source: Suncor Energy, 2019)

Meanwhile the Altman Z-Score of the company stood 1.15. An organization with the

score below the 1.8 may be viewed to have the high risk of bankruptcy (Barth, 2015). Ideally,

for Suncor Energy with the current liability for the company standing CA$10b, the company

might not easily be able to satisfy its obligations since the present level of current assets

stands CA$8.7b with the current ratio of 0.84. Comparatively the Altman Z-Score of Husky

Energy and Cenovus Energy stood 1.57 and 1.31 respectively. While for Imperial Oil the

Altman Z-Score stood 1.93 which is greater than 1.8 signifying that the company is less

likely to face the situation of bankruptcy. None of the above mentioned companies can be

entirely ruled out of safety since none of the above companies has the Altman Z-Score of

above 3, a score where a company is not likely in the position of bankruptcy.

Figure 6: Representing Earnings per share growth estimates of Suncor Energy

(Source: Suncor Energy, 2019)

Meanwhile the Altman Z-Score of the company stood 1.15. An organization with the

score below the 1.8 may be viewed to have the high risk of bankruptcy (Barth, 2015). Ideally,

for Suncor Energy with the current liability for the company standing CA$10b, the company

might not easily be able to satisfy its obligations since the present level of current assets

stands CA$8.7b with the current ratio of 0.84. Comparatively the Altman Z-Score of Husky

Energy and Cenovus Energy stood 1.57 and 1.31 respectively. While for Imperial Oil the

Altman Z-Score stood 1.93 which is greater than 1.8 signifying that the company is less

likely to face the situation of bankruptcy. None of the above mentioned companies can be

entirely ruled out of safety since none of the above companies has the Altman Z-Score of

above 3, a score where a company is not likely in the position of bankruptcy.

8ACCOUNTING STATEMENT ANALYSIS

Suncor Energy Imperial Oil Husky Energy Cenovus Energy

1.15

1.93

1.57

1.31

Altman Z-Score

Figure 7: Altman Z-Score

(Source: As Created by Author)

Critical analysis of industry sector:

The Canadian energy sector has reported an increase in operating profit which has

outpaced all the other major industries in Canada. The energy sector of Canada has

experienced a big jump in profit during the first quarter in 2019. As per latest federal

government data the rising prices of oil has helped several businesses to swing their loss from

the previous quarter (CBC News, 2019). According to Statistics Canada the operating profit

of the oil and gas companies increased by $1.6b in the first three months following a loss of

$675 million in the fourth quarter of 2018 to $909 million.

The increase is largely attributable to the rise in price of oil. Despite the volatility in

the global oil price due to trade war between US and China, prices have climbed sharply

since the year began. Meanwhile, Western Canadian Select Oil has increased by more than

45% to over $41 a barrel. The government agency has stated that the level of inventory amid

the oil and gas companies has increased in 2018 and the Alberta government might introduce

the mandatory cuts in production to sustain the Canadian oil prices.

Suncor Energy Imperial Oil Husky Energy Cenovus Energy

1.15

1.93

1.57

1.31

Altman Z-Score

Figure 7: Altman Z-Score

(Source: As Created by Author)

Critical analysis of industry sector:

The Canadian energy sector has reported an increase in operating profit which has

outpaced all the other major industries in Canada. The energy sector of Canada has

experienced a big jump in profit during the first quarter in 2019. As per latest federal

government data the rising prices of oil has helped several businesses to swing their loss from

the previous quarter (CBC News, 2019). According to Statistics Canada the operating profit

of the oil and gas companies increased by $1.6b in the first three months following a loss of

$675 million in the fourth quarter of 2018 to $909 million.

The increase is largely attributable to the rise in price of oil. Despite the volatility in

the global oil price due to trade war between US and China, prices have climbed sharply

since the year began. Meanwhile, Western Canadian Select Oil has increased by more than

45% to over $41 a barrel. The government agency has stated that the level of inventory amid

the oil and gas companies has increased in 2018 and the Alberta government might introduce

the mandatory cuts in production to sustain the Canadian oil prices.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ACCOUNTING STATEMENT ANALYSIS

Financial analysis of three other companies:

Imperial Oil Ltd explores, produces and sells the natural oil and crude oil in Canada.

Imperial Oil Ltd has outperformed the oil and gas industry which provided a return of -21.9%

over the last year. However, Imperial Oil Ltd underperformed in the Canadian market which

returned only -4.6% in the last year (Imperial Oil, 2019). Imperial Oil Ltd is the good value

on the basis of earnings in comparison to the Canadian market however, the company is

overvalued in terms of earnings in comparison to the Canadian Oil and Gas Industry average.

The revenue growth of Imperial Oil Ltd is positive but it is not higher than the Canadian

market average. Additionally, Imperial Oil Ltd has significantly improved the use of its

capital last year against the three years ago with ROCE of the company standing 8.67%.

Figure 8: Financial Position Analysis of Imperial

Source: (Imperial Oil, 2019)

Meanwhile, Husky Energy has reported more than 20% year on year growth in its

earnings in the last five years. However, Husky Energy has not make an effective use of

shareholder’s fund in the last year with ROE standing 7.4% which is less than ideal 20%.

Financial analysis of three other companies:

Imperial Oil Ltd explores, produces and sells the natural oil and crude oil in Canada.

Imperial Oil Ltd has outperformed the oil and gas industry which provided a return of -21.9%

over the last year. However, Imperial Oil Ltd underperformed in the Canadian market which

returned only -4.6% in the last year (Imperial Oil, 2019). Imperial Oil Ltd is the good value

on the basis of earnings in comparison to the Canadian market however, the company is

overvalued in terms of earnings in comparison to the Canadian Oil and Gas Industry average.

The revenue growth of Imperial Oil Ltd is positive but it is not higher than the Canadian

market average. Additionally, Imperial Oil Ltd has significantly improved the use of its

capital last year against the three years ago with ROCE of the company standing 8.67%.

Figure 8: Financial Position Analysis of Imperial

Source: (Imperial Oil, 2019)

Meanwhile, Husky Energy has reported more than 20% year on year growth in its

earnings in the last five years. However, Husky Energy has not make an effective use of

shareholder’s fund in the last year with ROE standing 7.4% which is less than ideal 20%.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ACCOUNTING STATEMENT ANALYSIS

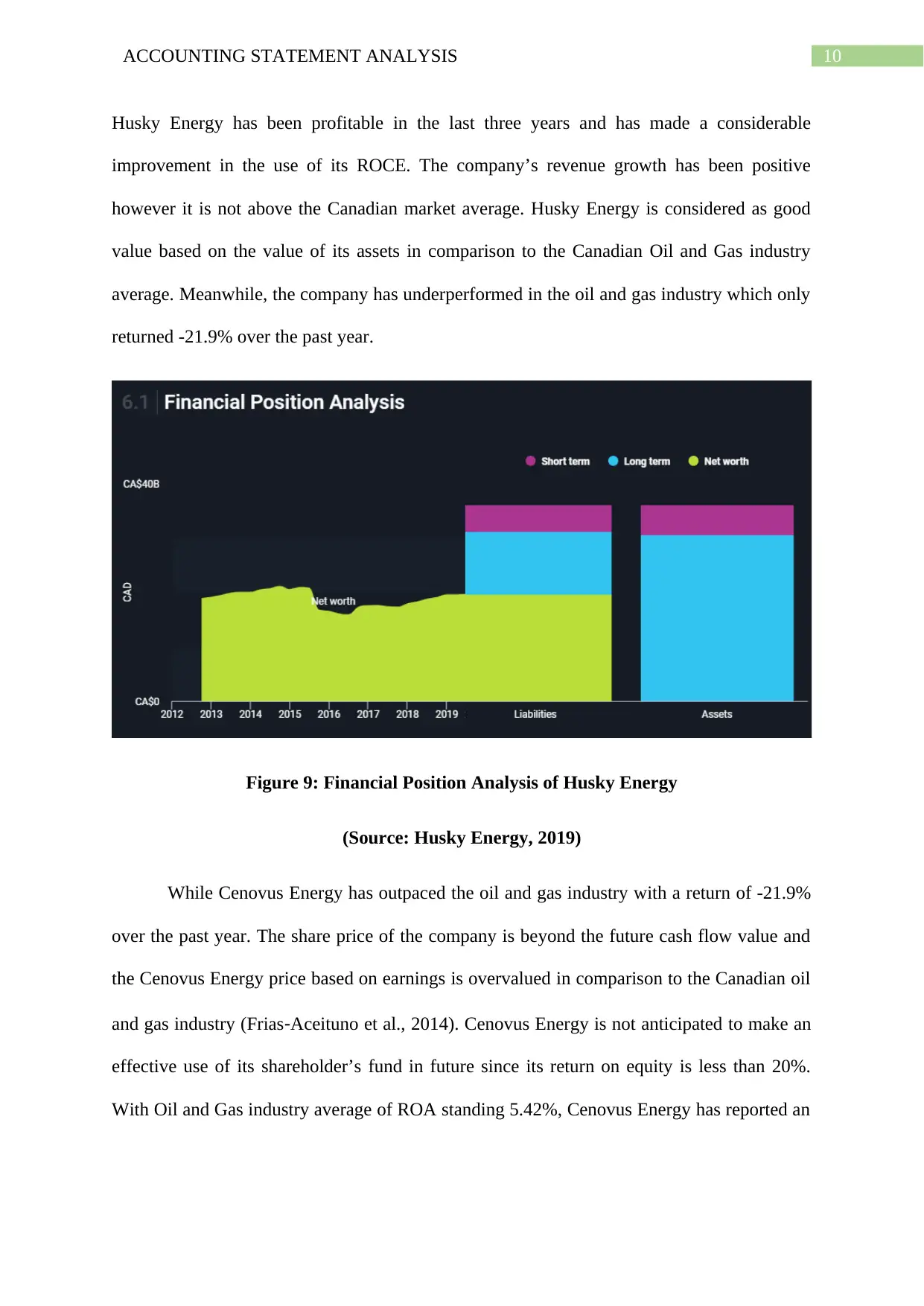

Husky Energy has been profitable in the last three years and has made a considerable

improvement in the use of its ROCE. The company’s revenue growth has been positive

however it is not above the Canadian market average. Husky Energy is considered as good

value based on the value of its assets in comparison to the Canadian Oil and Gas industry

average. Meanwhile, the company has underperformed in the oil and gas industry which only

returned -21.9% over the past year.

Figure 9: Financial Position Analysis of Husky Energy

(Source: Husky Energy, 2019)

While Cenovus Energy has outpaced the oil and gas industry with a return of -21.9%

over the past year. The share price of the company is beyond the future cash flow value and

the Cenovus Energy price based on earnings is overvalued in comparison to the Canadian oil

and gas industry (Frias‐Aceituno et al., 2014). Cenovus Energy is not anticipated to make an

effective use of its shareholder’s fund in future since its return on equity is less than 20%.

With Oil and Gas industry average of ROA standing 5.42%, Cenovus Energy has reported an

Husky Energy has been profitable in the last three years and has made a considerable

improvement in the use of its ROCE. The company’s revenue growth has been positive

however it is not above the Canadian market average. Husky Energy is considered as good

value based on the value of its assets in comparison to the Canadian Oil and Gas industry

average. Meanwhile, the company has underperformed in the oil and gas industry which only

returned -21.9% over the past year.

Figure 9: Financial Position Analysis of Husky Energy

(Source: Husky Energy, 2019)

While Cenovus Energy has outpaced the oil and gas industry with a return of -21.9%

over the past year. The share price of the company is beyond the future cash flow value and

the Cenovus Energy price based on earnings is overvalued in comparison to the Canadian oil

and gas industry (Frias‐Aceituno et al., 2014). Cenovus Energy is not anticipated to make an

effective use of its shareholder’s fund in future since its return on equity is less than 20%.

With Oil and Gas industry average of ROA standing 5.42%, Cenovus Energy has reported an

11ACCOUNTING STATEMENT ANALYSIS

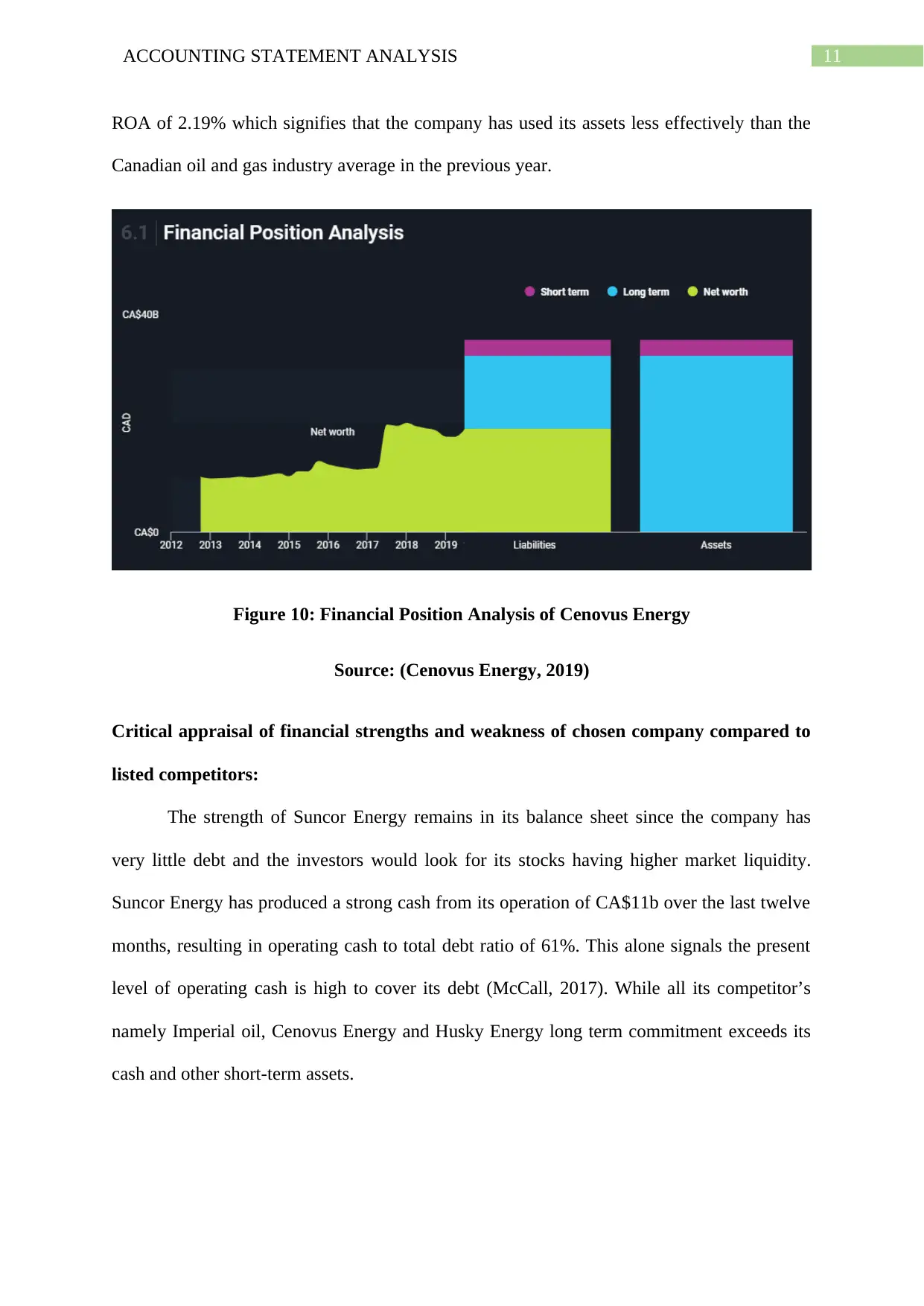

ROA of 2.19% which signifies that the company has used its assets less effectively than the

Canadian oil and gas industry average in the previous year.

Figure 10: Financial Position Analysis of Cenovus Energy

Source: (Cenovus Energy, 2019)

Critical appraisal of financial strengths and weakness of chosen company compared to

listed competitors:

The strength of Suncor Energy remains in its balance sheet since the company has

very little debt and the investors would look for its stocks having higher market liquidity.

Suncor Energy has produced a strong cash from its operation of CA$11b over the last twelve

months, resulting in operating cash to total debt ratio of 61%. This alone signals the present

level of operating cash is high to cover its debt (McCall, 2017). While all its competitor’s

namely Imperial oil, Cenovus Energy and Husky Energy long term commitment exceeds its

cash and other short-term assets.

ROA of 2.19% which signifies that the company has used its assets less effectively than the

Canadian oil and gas industry average in the previous year.

Figure 10: Financial Position Analysis of Cenovus Energy

Source: (Cenovus Energy, 2019)

Critical appraisal of financial strengths and weakness of chosen company compared to

listed competitors:

The strength of Suncor Energy remains in its balance sheet since the company has

very little debt and the investors would look for its stocks having higher market liquidity.

Suncor Energy has produced a strong cash from its operation of CA$11b over the last twelve

months, resulting in operating cash to total debt ratio of 61%. This alone signals the present

level of operating cash is high to cover its debt (McCall, 2017). While all its competitor’s

namely Imperial oil, Cenovus Energy and Husky Energy long term commitment exceeds its

cash and other short-term assets.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.