ACCT20074 Report: Analyzing Contemporary Accounting Theory and CSR

VerifiedAdded on 2022/10/06

|19

|4598

|16

Report

AI Summary

This report delves into contemporary accounting theory, with a specific focus on corporate social responsibility (CSR) and sustainability reporting. Part A explores the increasing importance of CSR for firms with financial objectives, examining its representation in relation to other reporting concepts and identifying relevant theories like legitimacy and stakeholder theory. Part B presents an overview of Charter Hall Long WALE REIT, including its ownership, history, governance, and financial performance. The report then evaluates the quality of Charter Hall's sustainability reporting against the Global Reporting Initiative (GRI) scoring index. The analysis incorporates literature reviews, theoretical frameworks, and practical application to assess the integration of CSR principles and the effectiveness of sustainability reporting practices. The report concludes with a summary of the key findings and implications of the analysis.

Running head: CONTEMPORARY ACCOUNTING THEORY

Contemporary accounting theory

Name of the Student

Name of the University

Author Note

Contemporary accounting theory

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTEMPORARY ACCOUNTING THEORY

Executive summary:

The paper discussed below outlines the importance of the corporate sustainability reporting

and determining the existence of relationship between corporate sustainability reporting and

sustainability reporting. This whole paper incorporates the discussion on the theoretical

knowledge of sustainability reporting and the practical application of such knowledge in

evaluating the quality of sustainability report prepared by business entities. A holistic view of

corporate social responsibility and the essence of sustainability reporting has been provided

by applying relevant and applicable theories. The evaluation of sustainability report has been

done by referring to the guidelines and framework of Global Reporting Initiative.

Executive summary:

The paper discussed below outlines the importance of the corporate sustainability reporting

and determining the existence of relationship between corporate sustainability reporting and

sustainability reporting. This whole paper incorporates the discussion on the theoretical

knowledge of sustainability reporting and the practical application of such knowledge in

evaluating the quality of sustainability report prepared by business entities. A holistic view of

corporate social responsibility and the essence of sustainability reporting has been provided

by applying relevant and applicable theories. The evaluation of sustainability report has been

done by referring to the guidelines and framework of Global Reporting Initiative.

CONTEMPORARY ACCOUNTING THEORY

Table of Contents

Introduction:...............................................................................................................................2

Part A:........................................................................................................................................2

i. Evaluating the corporate social responsibility relevance to the firms with financial

objectives:..................................................................................................................................2

ii. Evaluating the representation of holistic view of corporate social responsibility in

relation to other reporting concepts............................................................................................2

iii. Identification of relevant theories for explaining the sustainability reporting essence:..3

Part B:.........................................................................................................................................3

iv. Presenting the overview of ownership, history, governance and financial performance

of Charter hall Long WALE REIT:...........................................................................................3

v. Evaluating the quality of sustainability reporting of the company against the scoring

index of sustainability reporting:...............................................................................................4

Conclusion:................................................................................................................................5

Reference list:.............................................................................................................................6

Table of Contents

Introduction:...............................................................................................................................2

Part A:........................................................................................................................................2

i. Evaluating the corporate social responsibility relevance to the firms with financial

objectives:..................................................................................................................................2

ii. Evaluating the representation of holistic view of corporate social responsibility in

relation to other reporting concepts............................................................................................2

iii. Identification of relevant theories for explaining the sustainability reporting essence:..3

Part B:.........................................................................................................................................3

iv. Presenting the overview of ownership, history, governance and financial performance

of Charter hall Long WALE REIT:...........................................................................................3

v. Evaluating the quality of sustainability reporting of the company against the scoring

index of sustainability reporting:...............................................................................................4

Conclusion:................................................................................................................................5

Reference list:.............................................................................................................................6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONTEMPORARY ACCOUNTING THEORY

Introduction:

The paper demonstrate the discussion about the theoretical knowledge of the

corporate social responsibility of the organization and explaining the reporting practices by

the company with the application of theoretical knowledge. The first section outlines the

explanation of the corporate social responsibility for the firms having financial objectives

using the relevant literature review. It also incorporates identification of two theories that is

relevant to the explanation of the sustainability reporting concepts. In the next section, a brief

introduction the ownership, governance and the financial performance of the chosen company

that is Charter Hall is outlined. The sustainability report of Charter Hall is evaluated against

the scoring index of sustainability reporting of GRI (Global reporting Initiative) which helps

in assessing the quality of report by referring tom different aspects of sustainability (Jones et

al., 2016).

Part A:

i. Evaluating the corporate social responsibility relevance to the firms with

financial objectives:

Corporate social responsibility has become a very prominent business practice for

every individual organization. Their major goal is to obtain a good output and a positive

impact on the society. CSR ensures that all the business practices are ethical which, are

practiced within the organization by taking social, economic and environmental practices.

Every individual enterprise or any organization aims to create a maximum share value for the

owners in the company as well as the employees, shareholders and other stakeholders. Today,

almost every business organization are adopting the corporate social responsibility intending

to work for the stakeholders on a much wider scale including the environmental protection,

championing of the women and elimination poverty and unemployment globally (Hummel &

Introduction:

The paper demonstrate the discussion about the theoretical knowledge of the

corporate social responsibility of the organization and explaining the reporting practices by

the company with the application of theoretical knowledge. The first section outlines the

explanation of the corporate social responsibility for the firms having financial objectives

using the relevant literature review. It also incorporates identification of two theories that is

relevant to the explanation of the sustainability reporting concepts. In the next section, a brief

introduction the ownership, governance and the financial performance of the chosen company

that is Charter Hall is outlined. The sustainability report of Charter Hall is evaluated against

the scoring index of sustainability reporting of GRI (Global reporting Initiative) which helps

in assessing the quality of report by referring tom different aspects of sustainability (Jones et

al., 2016).

Part A:

i. Evaluating the corporate social responsibility relevance to the firms with

financial objectives:

Corporate social responsibility has become a very prominent business practice for

every individual organization. Their major goal is to obtain a good output and a positive

impact on the society. CSR ensures that all the business practices are ethical which, are

practiced within the organization by taking social, economic and environmental practices.

Every individual enterprise or any organization aims to create a maximum share value for the

owners in the company as well as the employees, shareholders and other stakeholders. Today,

almost every business organization are adopting the corporate social responsibility intending

to work for the stakeholders on a much wider scale including the environmental protection,

championing of the women and elimination poverty and unemployment globally (Hummel &

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTEMPORARY ACCOUNTING THEORY

Schlick, 2016). The companies are taking their focus into corporate social responsibility for

the overall growth and development of the organization by enhancing the loyalty towards the

staff by higher productivity in sales and consequently attracting more personnel to the

company. Corporate citizenship may be also termed as corporate social responsibility. CSR is

also practiced in the company with the strategy of implementing ethical practices in the

company so as to attain maximum profitability in order to meet the needs and demands of

today’s changing top talent (Domingues et al., 2017).

CSR has to allocate the resources and do the research and development so as to

integrate socially responsible methods and the materials in production. It can also be said that

the organization which incorporates the corporate social responsibility eventually results in

enhancing the long term social and economic creation. It helps to improve the management of

the risks associated with business and the arising opportunities which will eventually result in

enhancing the long term social and environmental sustainability. Furthermore, a rising

number of it has assured to divide the corporate social responsibilities into strategies and

operations, thereby making and developing robust measurements and reporting frameworks

so as to obtain both the strategic implementation of CSR and measurement and consequently

reporting frameworks in order to implement CSR and respond to the stakeholder’s

accountability requirements (De Villiers & Sharma, 2017).

ii. Evaluating the representation of holistic view of corporate social responsibility in

relation to other reporting concepts

CSR have a made it a strategy that need to implement into the organization that assist to

obtain the maximum profitability from it along with matching the changing needs of today’s

top talent that is innovation. CSR also makes it essential responsibility to allocate the

resources and do the research and development so as to integrate socially responsible

Schlick, 2016). The companies are taking their focus into corporate social responsibility for

the overall growth and development of the organization by enhancing the loyalty towards the

staff by higher productivity in sales and consequently attracting more personnel to the

company. Corporate citizenship may be also termed as corporate social responsibility. CSR is

also practiced in the company with the strategy of implementing ethical practices in the

company so as to attain maximum profitability in order to meet the needs and demands of

today’s changing top talent (Domingues et al., 2017).

CSR has to allocate the resources and do the research and development so as to

integrate socially responsible methods and the materials in production. It can also be said that

the organization which incorporates the corporate social responsibility eventually results in

enhancing the long term social and economic creation. It helps to improve the management of

the risks associated with business and the arising opportunities which will eventually result in

enhancing the long term social and environmental sustainability. Furthermore, a rising

number of it has assured to divide the corporate social responsibilities into strategies and

operations, thereby making and developing robust measurements and reporting frameworks

so as to obtain both the strategic implementation of CSR and measurement and consequently

reporting frameworks in order to implement CSR and respond to the stakeholder’s

accountability requirements (De Villiers & Sharma, 2017).

ii. Evaluating the representation of holistic view of corporate social responsibility in

relation to other reporting concepts

CSR have a made it a strategy that need to implement into the organization that assist to

obtain the maximum profitability from it along with matching the changing needs of today’s

top talent that is innovation. CSR also makes it essential responsibility to allocate the

resources and do the research and development so as to integrate socially responsible

CONTEMPORARY ACCOUNTING THEORY

methods and the materials in production. Corporate social responsibility and corporate social

sustainability can be used by the enterprises to incorporate social, environmental as well as

the economic creation. It is very essential to manage the organization by focusing on making

and maximizing the economic, social and the environmental value on a large term basis.

Talking about sustainability , it can be said that it is a comprehensive approach in order to

manage and to maintain the organization by focusing on maximizing the overall value

including the social, economic and the environmental values and ethics (Grushina, 2017).

Corporate social responsibility can also be described as a broad concept that can take

many forms depending on the company and industry. Through it can said that CSR programs,

philanthropy, and volunteer efforts, businesses can be useful to the entire society while

boosting their own brands. As important as CSR is for the community, it is also equally

valuable for a company. CSR activities can also be used to forge a stronger bond in between

employee and corporation, consequently it can be said that it can boost morale and can help

both employees and employers feel more connected with the world around them (Tschopp &

Huefner, 2015).

For any company to be socially responsible at first the most essential requisite to be

responsible to itself and to its shareholders. It is known that companies that adopt CSR

programs have grown their business to the extent where they can give back to society.

Thereby, it can considered that CSR is primarily a strategy of large corporations. Moreover,

the more visible and successful a corporation is, the more responsibility it has to set standards

of ethical behavior for its peers, competition, and industry (Rupley et al., 2017). Therefore,

this is one of the primary factors effecting having the incorporation of CSR in any

organization.

methods and the materials in production. Corporate social responsibility and corporate social

sustainability can be used by the enterprises to incorporate social, environmental as well as

the economic creation. It is very essential to manage the organization by focusing on making

and maximizing the economic, social and the environmental value on a large term basis.

Talking about sustainability , it can be said that it is a comprehensive approach in order to

manage and to maintain the organization by focusing on maximizing the overall value

including the social, economic and the environmental values and ethics (Grushina, 2017).

Corporate social responsibility can also be described as a broad concept that can take

many forms depending on the company and industry. Through it can said that CSR programs,

philanthropy, and volunteer efforts, businesses can be useful to the entire society while

boosting their own brands. As important as CSR is for the community, it is also equally

valuable for a company. CSR activities can also be used to forge a stronger bond in between

employee and corporation, consequently it can be said that it can boost morale and can help

both employees and employers feel more connected with the world around them (Tschopp &

Huefner, 2015).

For any company to be socially responsible at first the most essential requisite to be

responsible to itself and to its shareholders. It is known that companies that adopt CSR

programs have grown their business to the extent where they can give back to society.

Thereby, it can considered that CSR is primarily a strategy of large corporations. Moreover,

the more visible and successful a corporation is, the more responsibility it has to set standards

of ethical behavior for its peers, competition, and industry (Rupley et al., 2017). Therefore,

this is one of the primary factors effecting having the incorporation of CSR in any

organization.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONTEMPORARY ACCOUNTING THEORY

iii. Identification of relevant theories for explaining the sustainability reporting

essence:

Legitimacy theory can be referred to the mechanism that assist the organization in the

development and implementation of voluntary environmental and social disclosures that let

them fulfilment of the social contract of recognizing the objectives in the ever changing

environment. When it comes to disclose the environmental information, the role of justifiable

factor is played by the legitimacy theory. Hence, in order to legitimate their legitimacy, it is

essential for the organization to disclose the performance of environmental and social

information. It is posited by the legitimacy theory that it is continuously ensured by the

organization that they operate in the norms and boundaries of their respective societies (Rossi

& Tarquinio, 2017). There is voluntarily reporting on the activities which is perceived to be

important enough to be reported and are expected by the communities in the event of

adoption of perspective of legitimacy theory. A number of studies have found a direct or

indirect impact on the disclosure of CSR activities by the companies. In the event of some

organizations having poor environmental performance, adoption of legitimacy theory helps

them in curbing the legitimacy threat as there is a voluntary disclosure of social,

environmental of governance performance.

In recent years, there is increasing attention of the role of corporations and enterprise

in encouraging the sustainability in the context of growing environmental and social

concerns. The development pf sustainability concepts was attribute to the demand created by

stakeholders and there has been increased application of the sustainability theory and

managing the stakeholder relations concerning sustainability is faced with some challenges. It

is argued by stakeholder theory that the organization should treat all the stakeholders fairly

iii. Identification of relevant theories for explaining the sustainability reporting

essence:

Legitimacy theory can be referred to the mechanism that assist the organization in the

development and implementation of voluntary environmental and social disclosures that let

them fulfilment of the social contract of recognizing the objectives in the ever changing

environment. When it comes to disclose the environmental information, the role of justifiable

factor is played by the legitimacy theory. Hence, in order to legitimate their legitimacy, it is

essential for the organization to disclose the performance of environmental and social

information. It is posited by the legitimacy theory that it is continuously ensured by the

organization that they operate in the norms and boundaries of their respective societies (Rossi

& Tarquinio, 2017). There is voluntarily reporting on the activities which is perceived to be

important enough to be reported and are expected by the communities in the event of

adoption of perspective of legitimacy theory. A number of studies have found a direct or

indirect impact on the disclosure of CSR activities by the companies. In the event of some

organizations having poor environmental performance, adoption of legitimacy theory helps

them in curbing the legitimacy threat as there is a voluntary disclosure of social,

environmental of governance performance.

In recent years, there is increasing attention of the role of corporations and enterprise

in encouraging the sustainability in the context of growing environmental and social

concerns. The development pf sustainability concepts was attribute to the demand created by

stakeholders and there has been increased application of the sustainability theory and

managing the stakeholder relations concerning sustainability is faced with some challenges. It

is argued by stakeholder theory that the organization should treat all the stakeholders fairly

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTEMPORARY ACCOUNTING THEORY

irrespective of the fact that they contribute to the improved financial performance. The

stakeholder reengaged strategy of the company is associated with the characteristics such as

clarity of what is being reported, communication directness, broadness of inclusiveness of

stakeholders and collecting the feedback (Evans et al., 2017).

Part B:

iv. Presenting the overview of ownership, history, governance and financial

performance of Charter hall Long WALE REIT:

Charter Hall Long WALE REIT is one of the leading fully integrated property groups

of Australia and is managed by Charter group. The focus of the group is to manage and invest

in the qualified, high quality and portfolio of diversified real estate that is leased to the

government and corporate tenants on the long term. Charter hall has experience of twenty

seven years in managing high quality real estate on behalf of wholesale, institutional and

retail clients. The group manages 330 properties across the industrial, office and retail

sectors. Providing investors with the secure and stable income is the ultimate objective of the

group as it has the potentiality of exposure to the ling WALE projects for both capital and

income growth (Grushina, 2017).

The strong financial performance of the company reflects the ability of the company

to grow and manage the REIT through long WALE acquisitions, strategic and active

management of portfolio. Value of portfolio in the financial year 2018 through acquisition

grew to $ 1.53 billion along with increase in the valuation of property that resulted in the

annual growth of net tangible asset of 2.9%. There has been secured capital and income

growth and delivering amount of EPS and DPS of 26.4 cents per security. This indicated an

annual increase in the growth of 3.9% and value of NTA per security of $ 4.5 and this implies

irrespective of the fact that they contribute to the improved financial performance. The

stakeholder reengaged strategy of the company is associated with the characteristics such as

clarity of what is being reported, communication directness, broadness of inclusiveness of

stakeholders and collecting the feedback (Evans et al., 2017).

Part B:

iv. Presenting the overview of ownership, history, governance and financial

performance of Charter hall Long WALE REIT:

Charter Hall Long WALE REIT is one of the leading fully integrated property groups

of Australia and is managed by Charter group. The focus of the group is to manage and invest

in the qualified, high quality and portfolio of diversified real estate that is leased to the

government and corporate tenants on the long term. Charter hall has experience of twenty

seven years in managing high quality real estate on behalf of wholesale, institutional and

retail clients. The group manages 330 properties across the industrial, office and retail

sectors. Providing investors with the secure and stable income is the ultimate objective of the

group as it has the potentiality of exposure to the ling WALE projects for both capital and

income growth (Grushina, 2017).

The strong financial performance of the company reflects the ability of the company

to grow and manage the REIT through long WALE acquisitions, strategic and active

management of portfolio. Value of portfolio in the financial year 2018 through acquisition

grew to $ 1.53 billion along with increase in the valuation of property that resulted in the

annual growth of net tangible asset of 2.9%. There has been secured capital and income

growth and delivering amount of EPS and DPS of 26.4 cents per security. This indicated an

annual increase in the growth of 3.9% and value of NTA per security of $ 4.5 and this implies

CONTEMPORARY ACCOUNTING THEORY

an increase of 2.9% since financial year 2017. Some of the capital management initiatives

under taken by Charter include extension of hedging maturity to 5.2 years, expansion of debt

facility in the balance sheet to $ 470 million and completion of non-renounceable entitlement

offer of amount $ 94.1 million. The comprehensive income of the company has increased

significantly from $ 34.6 million in year 2017 to $ 83.3 million in year 2018

(charterhall.com.au 2019). Therefore, it is demonstrated by this financial year that the

portfolio can be optimized through divestments, acquisition and extensions of lease and these

helps in ensuring secured income for long term.

The governance framework of Charter assist the organization in monitoring and

assessing the business risks and achieving and setting up the business objectives along with

balancing the needs of stakeholders, business, regulators and market. Charter strive to imbibe

the best practice when it comes to governance by adhering to the principles and

recommendation of the corporate governance council of ASX. It complies with all the eight

principles that is laid down by the ASX principles of governance and thereby and there is

adequate disclosure of any departure from such principles in the corporate governance

statement. The board of directors of the group is engaged in setting the tone concerning the

governance that is regarded critical for achieving the objectives of REIT. The framework of

governance helps in ensuring that the there is an effective management of REIT by

reinforcing the culture of integrity and meeting the statutory regulations (Hussain et al.,

2018).

vii) Preparation of sustainability reporting scoring index according to the guidelines of

GRI:

The sustainability metrics is computed by accounting for ranking and transparent

ratings of several companies and also comprising of other sources of data such as publication,

an increase of 2.9% since financial year 2017. Some of the capital management initiatives

under taken by Charter include extension of hedging maturity to 5.2 years, expansion of debt

facility in the balance sheet to $ 470 million and completion of non-renounceable entitlement

offer of amount $ 94.1 million. The comprehensive income of the company has increased

significantly from $ 34.6 million in year 2017 to $ 83.3 million in year 2018

(charterhall.com.au 2019). Therefore, it is demonstrated by this financial year that the

portfolio can be optimized through divestments, acquisition and extensions of lease and these

helps in ensuring secured income for long term.

The governance framework of Charter assist the organization in monitoring and

assessing the business risks and achieving and setting up the business objectives along with

balancing the needs of stakeholders, business, regulators and market. Charter strive to imbibe

the best practice when it comes to governance by adhering to the principles and

recommendation of the corporate governance council of ASX. It complies with all the eight

principles that is laid down by the ASX principles of governance and thereby and there is

adequate disclosure of any departure from such principles in the corporate governance

statement. The board of directors of the group is engaged in setting the tone concerning the

governance that is regarded critical for achieving the objectives of REIT. The framework of

governance helps in ensuring that the there is an effective management of REIT by

reinforcing the culture of integrity and meeting the statutory regulations (Hussain et al.,

2018).

vii) Preparation of sustainability reporting scoring index according to the guidelines of

GRI:

The sustainability metrics is computed by accounting for ranking and transparent

ratings of several companies and also comprising of other sources of data such as publication,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONTEMPORARY ACCOUNTING THEORY

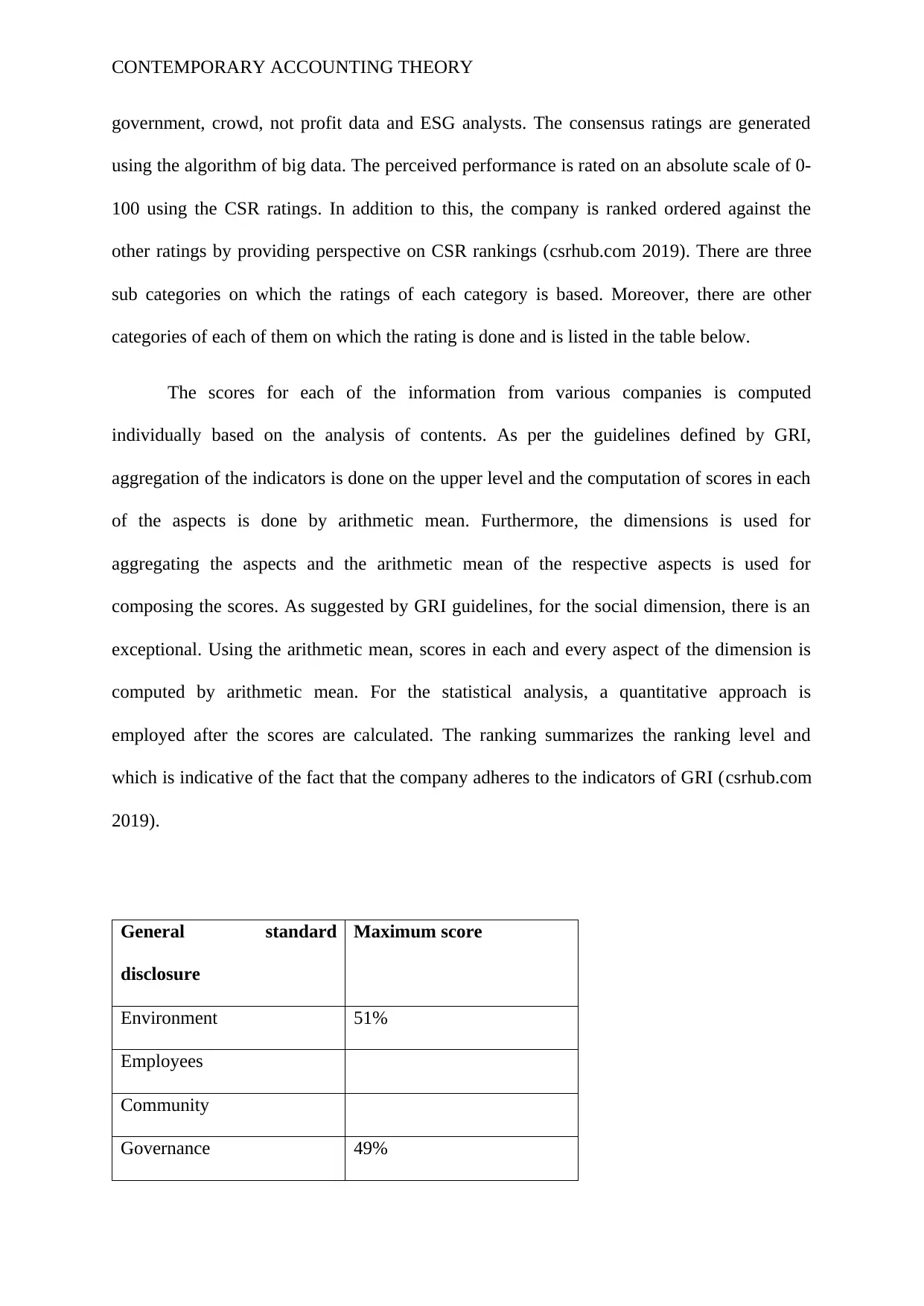

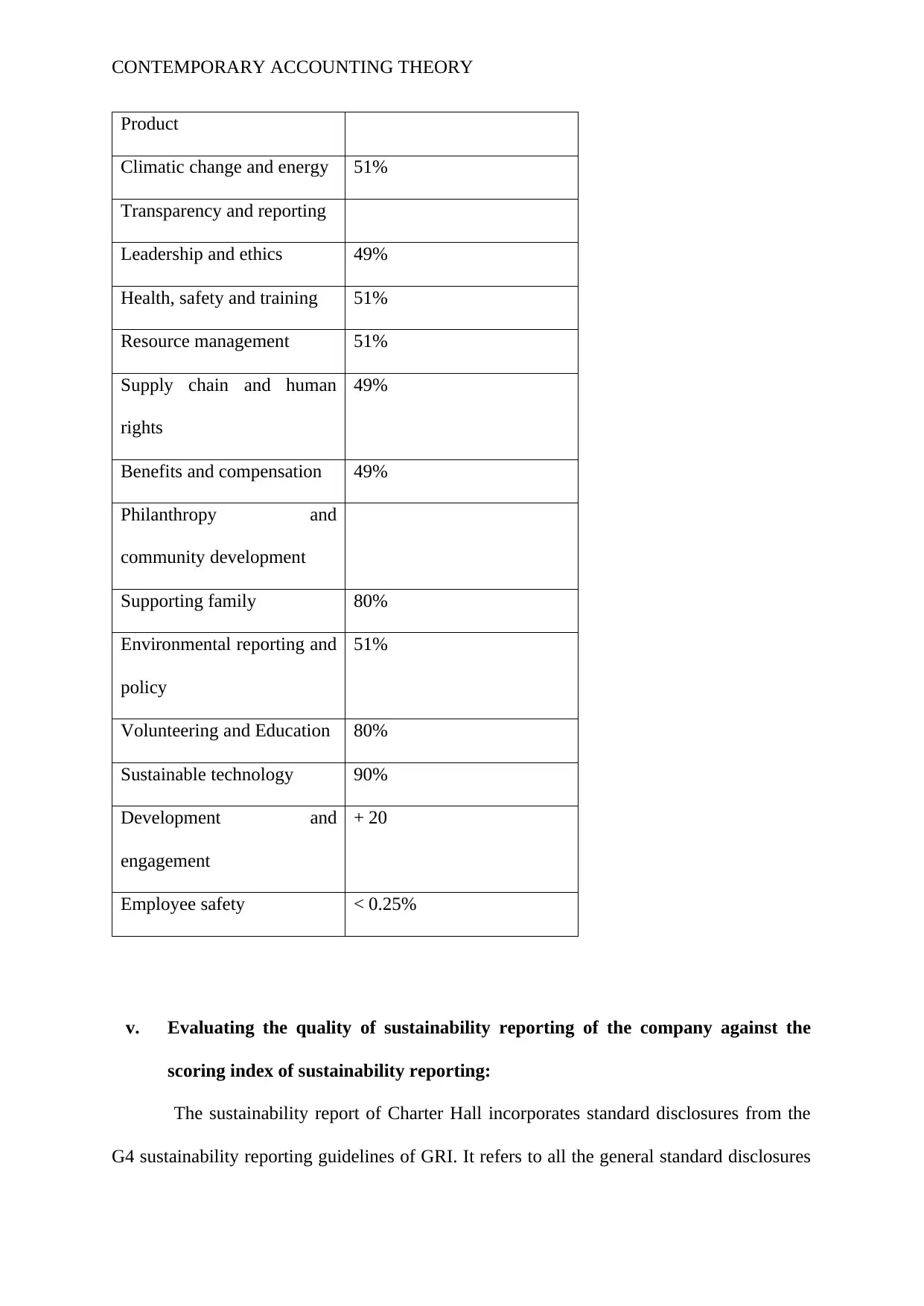

government, crowd, not profit data and ESG analysts. The consensus ratings are generated

using the algorithm of big data. The perceived performance is rated on an absolute scale of 0-

100 using the CSR ratings. In addition to this, the company is ranked ordered against the

other ratings by providing perspective on CSR rankings (csrhub.com 2019). There are three

sub categories on which the ratings of each category is based. Moreover, there are other

categories of each of them on which the rating is done and is listed in the table below.

The scores for each of the information from various companies is computed

individually based on the analysis of contents. As per the guidelines defined by GRI,

aggregation of the indicators is done on the upper level and the computation of scores in each

of the aspects is done by arithmetic mean. Furthermore, the dimensions is used for

aggregating the aspects and the arithmetic mean of the respective aspects is used for

composing the scores. As suggested by GRI guidelines, for the social dimension, there is an

exceptional. Using the arithmetic mean, scores in each and every aspect of the dimension is

computed by arithmetic mean. For the statistical analysis, a quantitative approach is

employed after the scores are calculated. The ranking summarizes the ranking level and

which is indicative of the fact that the company adheres to the indicators of GRI (csrhub.com

2019).

General standard

disclosure

Maximum score

Environment 51%

Employees

Community

Governance 49%

government, crowd, not profit data and ESG analysts. The consensus ratings are generated

using the algorithm of big data. The perceived performance is rated on an absolute scale of 0-

100 using the CSR ratings. In addition to this, the company is ranked ordered against the

other ratings by providing perspective on CSR rankings (csrhub.com 2019). There are three

sub categories on which the ratings of each category is based. Moreover, there are other

categories of each of them on which the rating is done and is listed in the table below.

The scores for each of the information from various companies is computed

individually based on the analysis of contents. As per the guidelines defined by GRI,

aggregation of the indicators is done on the upper level and the computation of scores in each

of the aspects is done by arithmetic mean. Furthermore, the dimensions is used for

aggregating the aspects and the arithmetic mean of the respective aspects is used for

composing the scores. As suggested by GRI guidelines, for the social dimension, there is an

exceptional. Using the arithmetic mean, scores in each and every aspect of the dimension is

computed by arithmetic mean. For the statistical analysis, a quantitative approach is

employed after the scores are calculated. The ranking summarizes the ranking level and

which is indicative of the fact that the company adheres to the indicators of GRI (csrhub.com

2019).

General standard

disclosure

Maximum score

Environment 51%

Employees

Community

Governance 49%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONTEMPORARY ACCOUNTING THEORY

Product

Climatic change and energy 51%

Transparency and reporting

Leadership and ethics 49%

Health, safety and training 51%

Resource management 51%

Supply chain and human

rights

49%

Benefits and compensation 49%

Philanthropy and

community development

Supporting family 80%

Environmental reporting and

policy

51%

Volunteering and Education 80%

Sustainable technology 90%

Development and

engagement

+ 20

Employee safety < 0.25%

v. Evaluating the quality of sustainability reporting of the company against the

scoring index of sustainability reporting:

The sustainability report of Charter Hall incorporates standard disclosures from the

G4 sustainability reporting guidelines of GRI. It refers to all the general standard disclosures

Product

Climatic change and energy 51%

Transparency and reporting

Leadership and ethics 49%

Health, safety and training 51%

Resource management 51%

Supply chain and human

rights

49%

Benefits and compensation 49%

Philanthropy and

community development

Supporting family 80%

Environmental reporting and

policy

51%

Volunteering and Education 80%

Sustainable technology 90%

Development and

engagement

+ 20

Employee safety < 0.25%

v. Evaluating the quality of sustainability reporting of the company against the

scoring index of sustainability reporting:

The sustainability report of Charter Hall incorporates standard disclosures from the

G4 sustainability reporting guidelines of GRI. It refers to all the general standard disclosures

CONTEMPORARY ACCOUNTING THEORY

of G4 for disclosing its sustainability improvement and the related areas. Hence, the

sustainability reporting framework of the company has been prepared according to the

principles and requirements of GRI. It is also ensured that the organization is complying with

the applicable regulations and the environmental standards. The sustainability policy of the

group is designed to carry out the operations in an ethical manner and it cover all the aspects

of sustainable design, environmental management, safety, occupational health, and

community engagement and supplier relationship. Assessment of the risks associated with the

social, environmental and governance ate done at both the asset and company level. In

addition to this, the sustainable development goals of UN is also recognized by the group and

focusing on the creation of three themes such as place creation, eco innovation and wellbeing.

The group makes quantitative disclosure of the impact created by its operation of

environment and people, certifications and rating of assets (Bellantuono et al., 2016).

At Charter Hall, community and sustainability is embedded in everything ranging

from development of large scale commercial property, decisions that is made across the

business using sustainable lens to volunteering of local community.

The sustainability performance data is published by Charter Hall in their sustainability

report for assisting their stakeholders to gain an insight into the social, environmental and

economic challenges faced by the business and how the group responds to such challenges to

deliver and maintain long term sustainable growth. The Global reporting initiative statement

prepared by the group provides a detailed information on the performance against different

indicators incorporating the complete disclosure and whether or not such information has

been verified or assured (Ehnert et al., 2016).

General standard disclosure Maximum score

of G4 for disclosing its sustainability improvement and the related areas. Hence, the

sustainability reporting framework of the company has been prepared according to the

principles and requirements of GRI. It is also ensured that the organization is complying with

the applicable regulations and the environmental standards. The sustainability policy of the

group is designed to carry out the operations in an ethical manner and it cover all the aspects

of sustainable design, environmental management, safety, occupational health, and

community engagement and supplier relationship. Assessment of the risks associated with the

social, environmental and governance ate done at both the asset and company level. In

addition to this, the sustainable development goals of UN is also recognized by the group and

focusing on the creation of three themes such as place creation, eco innovation and wellbeing.

The group makes quantitative disclosure of the impact created by its operation of

environment and people, certifications and rating of assets (Bellantuono et al., 2016).

At Charter Hall, community and sustainability is embedded in everything ranging

from development of large scale commercial property, decisions that is made across the

business using sustainable lens to volunteering of local community.

The sustainability performance data is published by Charter Hall in their sustainability

report for assisting their stakeholders to gain an insight into the social, environmental and

economic challenges faced by the business and how the group responds to such challenges to

deliver and maintain long term sustainable growth. The Global reporting initiative statement

prepared by the group provides a detailed information on the performance against different

indicators incorporating the complete disclosure and whether or not such information has

been verified or assured (Ehnert et al., 2016).

General standard disclosure Maximum score

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.