Business Strategy Report: Sustainable Practices at NatWest Bank

VerifiedAdded on 2020/04/21

|21

|4023

|30

Report

AI Summary

This report analyzes the sustainable strategy of NatWest Bank, a major UK retail and commercial bank. It begins with a problem statement addressing online banking failures and their impact on reputation and stakeholder relations. The report then delves into a PESTEL analysis, examining political (Brexit), economic, social, technological, environmental, and legal factors influencing the bank. Competitive dynamics are explored using Porter's Five Forces, assessing buyer and supplier power, competitive rivalry, and the threat of substitution and new entrants. Critical success factors, including strategic planning, sponsorships, and collaborations, are also identified. Task 2 focuses on the bank's position statement, strategy diamond, sustainability arena, vehicle (Ansoff Matrix), differentiation (Bowman's Strategy Clock), staging, and economic logic. Finally, it evaluates measures for sustainable strategy implementation, providing a comprehensive overview of NatWest's strategic approach.

Running head: BUSINESS STRATEGY

Sustainable strategy report

Name of the student

Name of the university

Author Note:

Sustainable strategy report

Name of the student

Name of the university

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

BUSINESS STRATEGY

Table of Contents

Task 1...............................................................................................................................................4

Introduction......................................................................................................................................4

1.1 Problem Statement.....................................................................................................................4

1.2 Key Forces for Change..............................................................................................................4

PESTEL Analysis............................................................................................................................4

1.3 Competitive Dynamics..............................................................................................................7

Figure No 1– Porter’s Five Forces Diagram....................................................................................9

1.4 Critical Success Factors...........................................................................................................11

Task 2.............................................................................................................................................12

2.1 Position Statement...................................................................................................................12

Figure 2- Strategy Diamond..........................................................................................................12

2.2 Sustainability Arena.................................................................................................................14

Figure No 3 – Sustainability Arena...............................................................................................14

2.3 Sustainability Vehicle..............................................................................................................15

Table No 1– Ansoff Matrix...........................................................................................................15

2.4 Differentiation..........................................................................................................................16

Figure No 4- Bowman’s Strategy Clock.......................................................................................16

2.5 Sustainability Staging..............................................................................................................18

BUSINESS STRATEGY

Table of Contents

Task 1...............................................................................................................................................4

Introduction......................................................................................................................................4

1.1 Problem Statement.....................................................................................................................4

1.2 Key Forces for Change..............................................................................................................4

PESTEL Analysis............................................................................................................................4

1.3 Competitive Dynamics..............................................................................................................7

Figure No 1– Porter’s Five Forces Diagram....................................................................................9

1.4 Critical Success Factors...........................................................................................................11

Task 2.............................................................................................................................................12

2.1 Position Statement...................................................................................................................12

Figure 2- Strategy Diamond..........................................................................................................12

2.2 Sustainability Arena.................................................................................................................14

Figure No 3 – Sustainability Arena...............................................................................................14

2.3 Sustainability Vehicle..............................................................................................................15

Table No 1– Ansoff Matrix...........................................................................................................15

2.4 Differentiation..........................................................................................................................16

Figure No 4- Bowman’s Strategy Clock.......................................................................................16

2.5 Sustainability Staging..............................................................................................................18

3

BUSINESS STRATEGY

2.6 Economic Logic.......................................................................................................................18

2.7 Evaluating Measures for Sustainable Strategy Implementation..............................................19

References......................................................................................................................................20

BUSINESS STRATEGY

2.6 Economic Logic.......................................................................................................................18

2.7 Evaluating Measures for Sustainable Strategy Implementation..............................................19

References......................................................................................................................................20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

BUSINESS STRATEGY

Task 1

Introduction

NatWest or National Westminster Bank is one of the largest retail and commercial bank

of United Kingdom. The bank was established in the year 1968 by the merger of Westminster

Bank and the National provincial Bank. The following report is based on the sustainable strategy

report of NatWest Bank.

1.1 Problem Statement

Natwest Bank has seen torrid times in the last few years with a number of problems emerging

one after the other. The main problem as of now is the failure of the online banking system

which has resulted in a huge customer backlash from the bank. The customers face huge risk as

they are in the fear that their online accounts may be hacked. The online failure of the bank will

have a direct impact on its reputation and will prevent them from attracting potential customers.

The bank will also lose the support of the stakeholders in such a case. The management of

Natwest must issue a strong statement to the media and assure the customers about the safety of

the accounts as well as appoint a networking expert to make sure such incidents do not happen in

the future.

BUSINESS STRATEGY

Task 1

Introduction

NatWest or National Westminster Bank is one of the largest retail and commercial bank

of United Kingdom. The bank was established in the year 1968 by the merger of Westminster

Bank and the National provincial Bank. The following report is based on the sustainable strategy

report of NatWest Bank.

1.1 Problem Statement

Natwest Bank has seen torrid times in the last few years with a number of problems emerging

one after the other. The main problem as of now is the failure of the online banking system

which has resulted in a huge customer backlash from the bank. The customers face huge risk as

they are in the fear that their online accounts may be hacked. The online failure of the bank will

have a direct impact on its reputation and will prevent them from attracting potential customers.

The bank will also lose the support of the stakeholders in such a case. The management of

Natwest must issue a strong statement to the media and assure the customers about the safety of

the accounts as well as appoint a networking expert to make sure such incidents do not happen in

the future.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

BUSINESS STRATEGY

1.2 Key Forces for Change

PESTEL Analysis

The PESTEL analysis of Natwest Bank is an analysis of the macro environment that has

a direct impact on the mentioned bank of United Kingdom. The external factors usually are not

in the hands of the business organization and thus they may act as a threat or opportunity to the

success of the business organization (Armstrong et al. 2015).

Political

2016 was a challenging political environment for United Kingdom because of the present

situation of BREXIT. The political situation of Britain is thus quite problematic for the

bank to make progress.

As a result of BREXIT the UK government has to amend the constitution and change the

legal, economic and political rules and regulations of the country. Therefore the

management of the mentioned bank has to amend their own rules and regulations which

was earlier based on European Union laws and regulations

Trade regulations will be implemented on UK which will have a direct and long lasting

impact on the business transactions of Natwest bank as they will have to abide to a

number of different rules that will affect their performance

Economical

The economic system in UK is in shambles after the announcement of the country’s

separation from the European Union (Armstrong et al. 2015). The management of the

bank will have to come up with new policies to effectively deal with the situation.

BUSINESS STRATEGY

1.2 Key Forces for Change

PESTEL Analysis

The PESTEL analysis of Natwest Bank is an analysis of the macro environment that has

a direct impact on the mentioned bank of United Kingdom. The external factors usually are not

in the hands of the business organization and thus they may act as a threat or opportunity to the

success of the business organization (Armstrong et al. 2015).

Political

2016 was a challenging political environment for United Kingdom because of the present

situation of BREXIT. The political situation of Britain is thus quite problematic for the

bank to make progress.

As a result of BREXIT the UK government has to amend the constitution and change the

legal, economic and political rules and regulations of the country. Therefore the

management of the mentioned bank has to amend their own rules and regulations which

was earlier based on European Union laws and regulations

Trade regulations will be implemented on UK which will have a direct and long lasting

impact on the business transactions of Natwest bank as they will have to abide to a

number of different rules that will affect their performance

Economical

The economic system in UK is in shambles after the announcement of the country’s

separation from the European Union (Armstrong et al. 2015). The management of the

bank will have to come up with new policies to effectively deal with the situation.

6

BUSINESS STRATEGY

However the bank can attain profit from its overseas facilities where there are no such

risks involved.

The success of the bank depends on the economic growth rate of the country and vice

versa.

Social

The social network of the organization depends on the demographics like age, gender,

income and other such related elements (Bhardwaj and Malhotra 2013) Education is one of the key aspects in the determination of the social analysis of the

Natwest bank. The leisure habits of the people are also another important consideration of the

organization.

Technological

The implementation of the latest technologies has been of great help for the mentioned

bank as because they have been able to easily cope up with the complex pressures of

modern banking (Armstrong et al. 2015)

The implementation of the latest ERP software in the server of the bank proves the

efficiency of the bank to handle both domestic and international banking with ease

The use of the technology has been of great use for Natwest to make sure that they

maintain a competitive edge over their rivals

Environmental

BUSINESS STRATEGY

However the bank can attain profit from its overseas facilities where there are no such

risks involved.

The success of the bank depends on the economic growth rate of the country and vice

versa.

Social

The social network of the organization depends on the demographics like age, gender,

income and other such related elements (Bhardwaj and Malhotra 2013) Education is one of the key aspects in the determination of the social analysis of the

Natwest bank. The leisure habits of the people are also another important consideration of the

organization.

Technological

The implementation of the latest technologies has been of great help for the mentioned

bank as because they have been able to easily cope up with the complex pressures of

modern banking (Armstrong et al. 2015)

The implementation of the latest ERP software in the server of the bank proves the

efficiency of the bank to handle both domestic and international banking with ease

The use of the technology has been of great use for Natwest to make sure that they

maintain a competitive edge over their rivals

Environmental

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

BUSINESS STRATEGY

Environmental concerns are one of the biggest challenges that the bank faces and

increasing pressures has forced them to rethink and formulate a new environmental

policy to address the concerns.

The bank aims to stop the printing of statements and intends to start issuing e statements

to all the customers within the coming years. The following plan is a part of the green

banking initiative of the management

Some of the corporate offices of the bank and some branches have installed solar panels

that have been a positive development for the installation of the green energy of the bank.

Legal

As mentioned earlier the legal system of UK is to be amended in the coming years as a

result of BREXIT. As a result of the change the management of the bank has to amend

the constitution to make sure that they adhere to the new banking regulations of the

country.

The bank also needs to adhere to the different rules and regulations of the different

countries outside United Kingdom where they operate.

1.3 Competitive Dynamics

The sudden change in the business environment is one of the most important factors for the

paradigm shift in the policy of the organization. Some of the main forces for the change are;

1. The New Normal- The new mindset of the new business organizations, increased

competitions from the other market forces and the use of latest technologies and

innovations has been the new trend of the banking industry (Bhardwaj and Malhotra

2013).

BUSINESS STRATEGY

Environmental concerns are one of the biggest challenges that the bank faces and

increasing pressures has forced them to rethink and formulate a new environmental

policy to address the concerns.

The bank aims to stop the printing of statements and intends to start issuing e statements

to all the customers within the coming years. The following plan is a part of the green

banking initiative of the management

Some of the corporate offices of the bank and some branches have installed solar panels

that have been a positive development for the installation of the green energy of the bank.

Legal

As mentioned earlier the legal system of UK is to be amended in the coming years as a

result of BREXIT. As a result of the change the management of the bank has to amend

the constitution to make sure that they adhere to the new banking regulations of the

country.

The bank also needs to adhere to the different rules and regulations of the different

countries outside United Kingdom where they operate.

1.3 Competitive Dynamics

The sudden change in the business environment is one of the most important factors for the

paradigm shift in the policy of the organization. Some of the main forces for the change are;

1. The New Normal- The new mindset of the new business organizations, increased

competitions from the other market forces and the use of latest technologies and

innovations has been the new trend of the banking industry (Bhardwaj and Malhotra

2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

BUSINESS STRATEGY

2. Disruptive Technologies- The main problem that exists in NatWest is the use of

disruptive technologies. The ERP system used by the bank is way too old for the modern

business transactions. The customers of the bank expects hassle free and fast services

which forces the bank to install new technologies ion the bank.

3. Shifting values- After the announcement of the British Prime Minister about the

complete separation of United Kingdom from European Union has made the bank to start

shifting jobs from UK to the European Union region (Bhardwaj and Malhotra 2013). This

is done basically to make sure that the organization can do as much as business which

would be deemed off if they decide to keep their main business within the United

Kingdom.

4. Increasing Stakeholder Influence- Stakeholder influence is one of the most important

aspects for the success of the business organization. Involving the stakeholders in all the

activities of the banks helps them to stay updated and provides room for a smooth

transaction. Some of the different strategies by which the bank has involved the

stakeholders are;

1. The creation of local business growth enablers to support SME’s

2. Conduction of regular meetings and conferences with the stakeholders of the bank to

make them aware of the different steps and plans of the future.

5. Climate Change and finite Resources- Climate change and finite resources are two of

the most important factors that determine the corporate social responsibility of the bank.

The management of NatWest has involve4d themselves in different environmental

initiatives and provides funds at a very low rate of interest for projects involved in the

betterment of the environment. In a bid to save the finite resources of the world, the bank

BUSINESS STRATEGY

2. Disruptive Technologies- The main problem that exists in NatWest is the use of

disruptive technologies. The ERP system used by the bank is way too old for the modern

business transactions. The customers of the bank expects hassle free and fast services

which forces the bank to install new technologies ion the bank.

3. Shifting values- After the announcement of the British Prime Minister about the

complete separation of United Kingdom from European Union has made the bank to start

shifting jobs from UK to the European Union region (Bhardwaj and Malhotra 2013). This

is done basically to make sure that the organization can do as much as business which

would be deemed off if they decide to keep their main business within the United

Kingdom.

4. Increasing Stakeholder Influence- Stakeholder influence is one of the most important

aspects for the success of the business organization. Involving the stakeholders in all the

activities of the banks helps them to stay updated and provides room for a smooth

transaction. Some of the different strategies by which the bank has involved the

stakeholders are;

1. The creation of local business growth enablers to support SME’s

2. Conduction of regular meetings and conferences with the stakeholders of the bank to

make them aware of the different steps and plans of the future.

5. Climate Change and finite Resources- Climate change and finite resources are two of

the most important factors that determine the corporate social responsibility of the bank.

The management of NatWest has involve4d themselves in different environmental

initiatives and provides funds at a very low rate of interest for projects involved in the

betterment of the environment. In a bid to save the finite resources of the world, the bank

9

BUSINESS STRATEGY

has tied up with a number of Governments of the countries where they operate to provide

necessary funding to take preventive measures to stop the degradation of the finite

resources in that country.

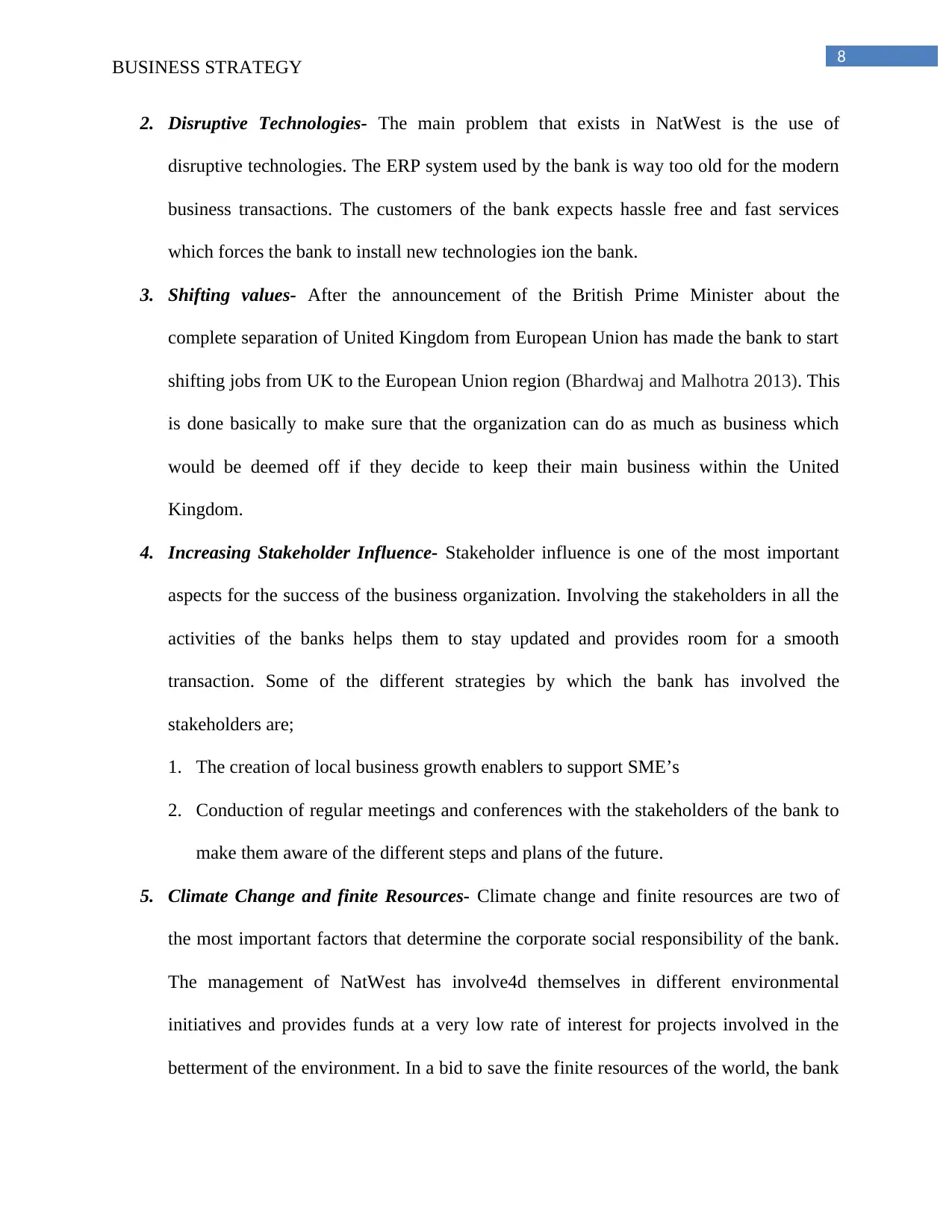

The competitive dynamics of the particular organization can be best explained by the use

of the Porter’s Five Forces Analysis.

Figure No 1– Porter’s Five Forces Diagram

Source- (Bhardwaj and Malhotra 2013)

Porter’s Five Forces Analysis is one of the business tools that analyses the market and

determines the profit percentage of the given product or service. There are four different

components of the Analysis namely;

BUSINESS STRATEGY

has tied up with a number of Governments of the countries where they operate to provide

necessary funding to take preventive measures to stop the degradation of the finite

resources in that country.

The competitive dynamics of the particular organization can be best explained by the use

of the Porter’s Five Forces Analysis.

Figure No 1– Porter’s Five Forces Diagram

Source- (Bhardwaj and Malhotra 2013)

Porter’s Five Forces Analysis is one of the business tools that analyses the market and

determines the profit percentage of the given product or service. There are four different

components of the Analysis namely;

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

BUSINESS STRATEGY

1. Buyer Power- The power of the buyers is perhaps the most important concept that needs

to be considered by the management of the bank before the launch of new product or

service in the market. The presence of a large number of powerful buyers makes the

management powerless. This happens just because the bank has a large number of

competitors in the market who offer the same kind of products in the market, thus

increasing the options for the consumers to choose from such vast range.

2. Supplier Power- The suppliers in a bank do not offer physical products but rather offers

software and other solutions that are needed to maintain the business in a proper way.

The main suppliers of such kind of products and services are Microsoft, Quick Heal and

many other computers based graphical products that are needed for the organization to

prove the main determinants of the organization. The products are less important as

because they can be replaced with other existing products at any given point of time.

3. Competitive Rivalry- Competitive Rivalry is one of the most important aspects of

consideration for NatWest as because there are a number of main competitors in the UK

market that throws a direct challenge to the bank. Banks like Barclays, RBS has a huge

customer base in their ranks which makes it difficult for the organization to attract

customers and sell their products.

4. Threat of Substitution- The threat of substitution is an essential factor when the

management considers the balance of power in the UK market (Bhardwaj and Malhotra

2013). The main threat to NatWest is the emergence of digital currencies like bit coin and

the increasing importance of digital payment gateways like PayPal and Stripe. The more

these digital

BUSINESS STRATEGY

1. Buyer Power- The power of the buyers is perhaps the most important concept that needs

to be considered by the management of the bank before the launch of new product or

service in the market. The presence of a large number of powerful buyers makes the

management powerless. This happens just because the bank has a large number of

competitors in the market who offer the same kind of products in the market, thus

increasing the options for the consumers to choose from such vast range.

2. Supplier Power- The suppliers in a bank do not offer physical products but rather offers

software and other solutions that are needed to maintain the business in a proper way.

The main suppliers of such kind of products and services are Microsoft, Quick Heal and

many other computers based graphical products that are needed for the organization to

prove the main determinants of the organization. The products are less important as

because they can be replaced with other existing products at any given point of time.

3. Competitive Rivalry- Competitive Rivalry is one of the most important aspects of

consideration for NatWest as because there are a number of main competitors in the UK

market that throws a direct challenge to the bank. Banks like Barclays, RBS has a huge

customer base in their ranks which makes it difficult for the organization to attract

customers and sell their products.

4. Threat of Substitution- The threat of substitution is an essential factor when the

management considers the balance of power in the UK market (Bhardwaj and Malhotra

2013). The main threat to NatWest is the emergence of digital currencies like bit coin and

the increasing importance of digital payment gateways like PayPal and Stripe. The more

these digital

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

BUSINESS STRATEGY

5. Threat of New Entrants— The threat to new entrants in the traditional financial markets

has raised serious doubts on the existence of the banks. The bank lies in a typical

environment with big guns in the industry like Barclays and RBS while new business

competitors in the form of digital transactions. However the amount of funds and the

large scale investment in the UK market by NatWest will prove to be the superior force

and will thus have no effect on the entry of new forces in the market (Bhardwaj and

Malhotra 2013).

1.4 Critical Success Factors

NatWest has relied on some special strategies to survive in the market. The strategies have

been designed in such a way that it curves a successful growth for the organization.

a. One step at a time- A proper planning by the efficient management of the organization

helps in the growth of NatWest globally and also across UK. The products of the bank

are launched one at a time to make sure that the organization does not fails to deliver the

value of a certain product.

b. Sponsoring- The bank tries to grow its brand value by means of proper and efficient

advertising. The bank is the proud sponsors of the England national cricket team and is

also sponsors other sports and other events.

c. Collaboration- NatWest Bank has collaborated with quite a number of foreign banks and

other financial institutions in order to deliver the best value for the business. Apart from

this regionally it has tied up with different other corporate to deliver additional products

for their customers (Bocken et al. 2014).

BUSINESS STRATEGY

5. Threat of New Entrants— The threat to new entrants in the traditional financial markets

has raised serious doubts on the existence of the banks. The bank lies in a typical

environment with big guns in the industry like Barclays and RBS while new business

competitors in the form of digital transactions. However the amount of funds and the

large scale investment in the UK market by NatWest will prove to be the superior force

and will thus have no effect on the entry of new forces in the market (Bhardwaj and

Malhotra 2013).

1.4 Critical Success Factors

NatWest has relied on some special strategies to survive in the market. The strategies have

been designed in such a way that it curves a successful growth for the organization.

a. One step at a time- A proper planning by the efficient management of the organization

helps in the growth of NatWest globally and also across UK. The products of the bank

are launched one at a time to make sure that the organization does not fails to deliver the

value of a certain product.

b. Sponsoring- The bank tries to grow its brand value by means of proper and efficient

advertising. The bank is the proud sponsors of the England national cricket team and is

also sponsors other sports and other events.

c. Collaboration- NatWest Bank has collaborated with quite a number of foreign banks and

other financial institutions in order to deliver the best value for the business. Apart from

this regionally it has tied up with different other corporate to deliver additional products

for their customers (Bocken et al. 2014).

12

BUSINESS STRATEGY

Task 2

2.1 Position Statement

Figure 2- Strategy Diamond

Source- (Bocken et al. 2014)

Strategy is all about making some important choices and decisions for the future. The

Strategy diamond is a business tool that shows the way on how the actual bits and pieces of the

strategy are and what are the ways in which they fit together. The main objectives of the strategy

diamond are it to integrate important choices into a much bigger picture. The five elements in the

BUSINESS STRATEGY

Task 2

2.1 Position Statement

Figure 2- Strategy Diamond

Source- (Bocken et al. 2014)

Strategy is all about making some important choices and decisions for the future. The

Strategy diamond is a business tool that shows the way on how the actual bits and pieces of the

strategy are and what are the ways in which they fit together. The main objectives of the strategy

diamond are it to integrate important choices into a much bigger picture. The five elements in the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.