University Economics: Tariff and Quota Analysis for a Small Country

VerifiedAdded on 2023/02/01

|7

|790

|70

Homework Assignment

AI Summary

This assignment analyzes the effects of tariffs and quotas in a small country. It begins by illustrating the impact of an import tariff using a supply and demand diagram, explaining the changes in producer and consumer surplus, government revenue, and deadweight loss. The analysis distinguishes between normal and discriminatory tariffs. The assignment then examines tariff rate quotas (TRQ), illustrating the concept with a diagram and explaining the allocation of quota rent and tariff revenue. It highlights the benefits of TRQs for foreign producers. The document includes diagrams to visually represent the economic concepts and concludes with a list of references. The assignment provides a comprehensive overview of how tariffs and quotas influence international trade and the welfare of different economic actors.

Running head: TARIFF AND QUOTA IN A SMALL COUNTRY

Tariff and Quota in a Small Country

Name of the Student:

Name of the University:

Author Note:

Tariff and Quota in a Small Country

Name of the Student:

Name of the University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TARIFF AND QUOTA IN A SMALL COUNTRY

Table of Contents

Answer 4.a..................................................................................................................................2

Answer 4.b.................................................................................................................................2

Answer 5.a..................................................................................................................................3

Answer 5.b.................................................................................................................................4

Answer 5.c..................................................................................................................................4

Reference....................................................................................................................................5

Table of Contents

Answer 4.a..................................................................................................................................2

Answer 4.b.................................................................................................................................2

Answer 5.a..................................................................................................................................3

Answer 5.b.................................................................................................................................4

Answer 5.c..................................................................................................................................4

Reference....................................................................................................................................5

2TARIFF AND QUOTA IN A SMALL COUNTRY

PW*+

T PW

*

S2+X2

S1+X

1 D

1

D2

S2

S

1 Q

PW

*

PW*+T

P

D

S

S+X

a

b

c

d

e

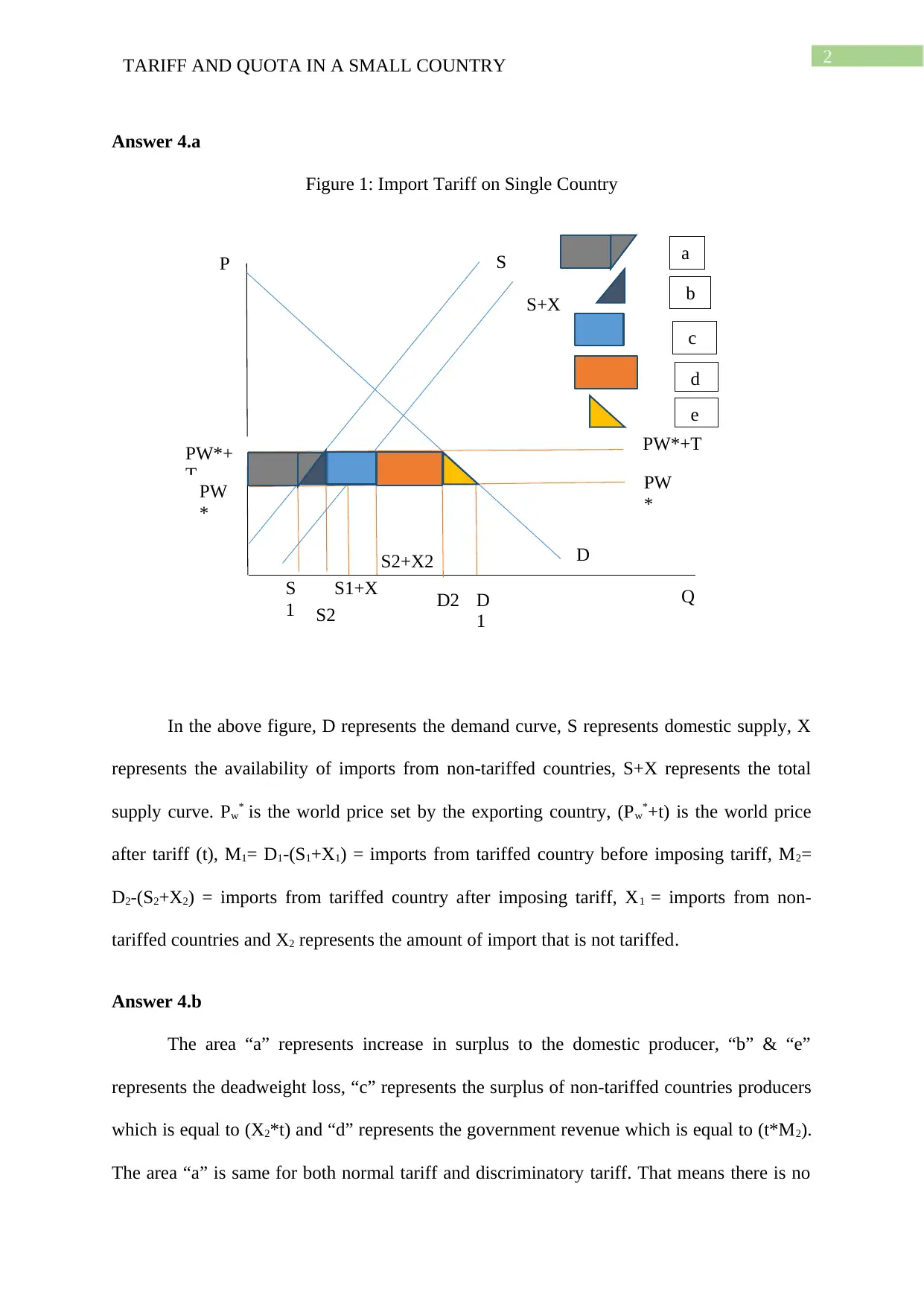

Answer 4.a

Figure 1: Import Tariff on Single Country

In the above figure, D represents the demand curve, S represents domestic supply, X

represents the availability of imports from non-tariffed countries, S+X represents the total

supply curve. Pw* is the world price set by the exporting country, (Pw*+t) is the world price

after tariff (t), M1= D1-(S1+X1) = imports from tariffed country before imposing tariff, M2=

D2-(S2+X2) = imports from tariffed country after imposing tariff, X1 = imports from non-

tariffed countries and X2 represents the amount of import that is not tariffed.

Answer 4.b

The area “a” represents increase in surplus to the domestic producer, “b” & “e”

represents the deadweight loss, “c” represents the surplus of non-tariffed countries producers

which is equal to (X2*t) and “d” represents the government revenue which is equal to (t*M2).

The area “a” is same for both normal tariff and discriminatory tariff. That means there is no

PW*+

T PW

*

S2+X2

S1+X

1 D

1

D2

S2

S

1 Q

PW

*

PW*+T

P

D

S

S+X

a

b

c

d

e

Answer 4.a

Figure 1: Import Tariff on Single Country

In the above figure, D represents the demand curve, S represents domestic supply, X

represents the availability of imports from non-tariffed countries, S+X represents the total

supply curve. Pw* is the world price set by the exporting country, (Pw*+t) is the world price

after tariff (t), M1= D1-(S1+X1) = imports from tariffed country before imposing tariff, M2=

D2-(S2+X2) = imports from tariffed country after imposing tariff, X1 = imports from non-

tariffed countries and X2 represents the amount of import that is not tariffed.

Answer 4.b

The area “a” represents increase in surplus to the domestic producer, “b” & “e”

represents the deadweight loss, “c” represents the surplus of non-tariffed countries producers

which is equal to (X2*t) and “d” represents the government revenue which is equal to (t*M2).

The area “a” is same for both normal tariff and discriminatory tariff. That means there is no

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TARIFF AND QUOTA IN A SMALL COUNTRY

PW

*

PW*+

t

PQ

P

Import Demand

C

Imports

Import Supply

BA

Quota Rent

In-Quota Tariff Revenue

Over-Quota Tariff Revenue

M’ MT

D

change in the surplus of domestic producers due to increase in the price because of tariff. The

dead weight loss is also same for both kind of tariffs. The impact is seen in case of

government revenue and the producer surplus to the producer of non-tariffed country which

are represented by the area “d” and “c”. In case of, non-discriminatory tariff there was no

producer surplus for the foreign producer while the discriminating tariff encourages the

producers of non-tariffed countries to export by providing them producer’s surplus by the

amount of area represented by “c” (Nguyen and Kinnucan 2019).

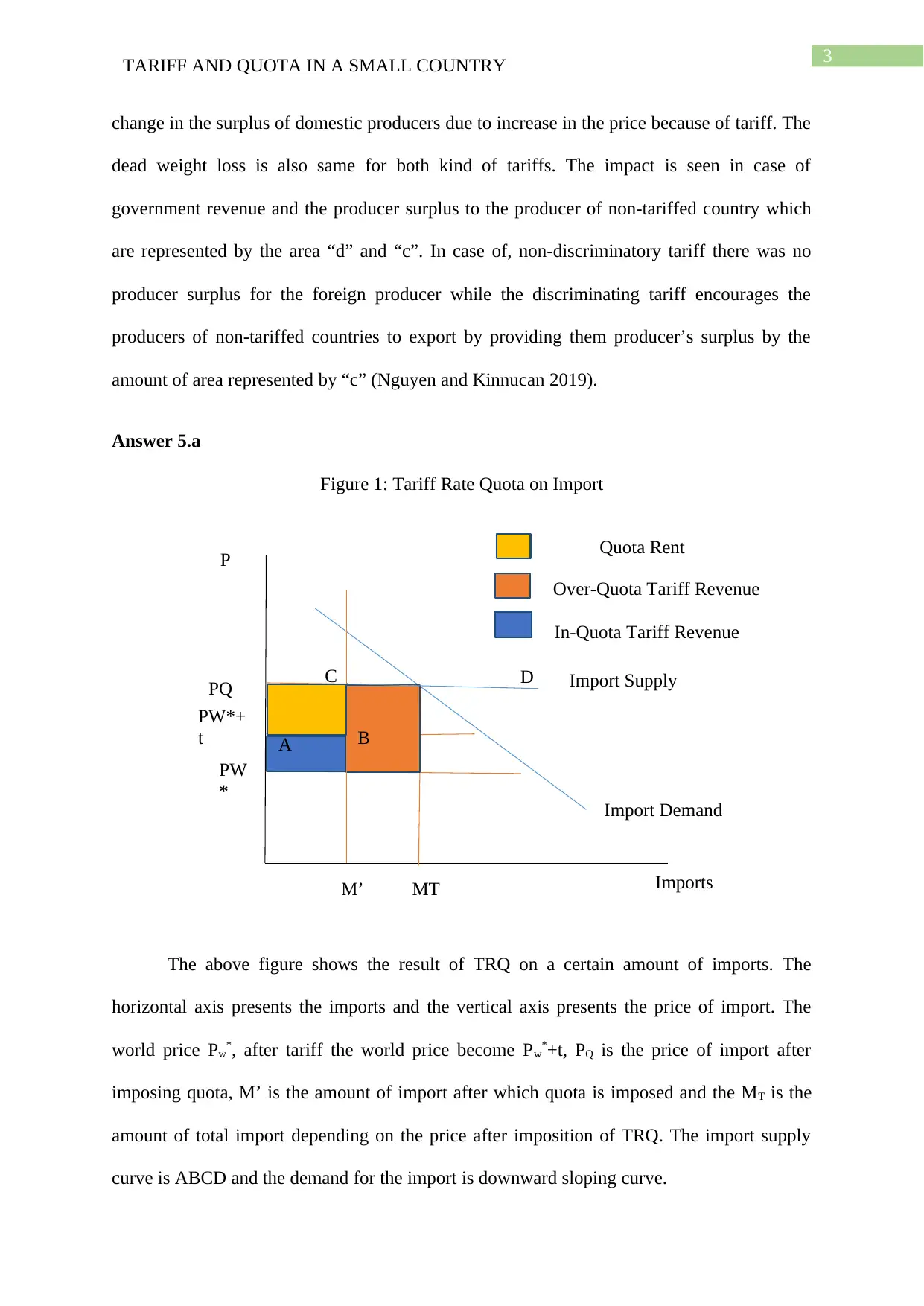

Answer 5.a

Figure 1: Tariff Rate Quota on Import

The above figure shows the result of TRQ on a certain amount of imports. The

horizontal axis presents the imports and the vertical axis presents the price of import. The

world price Pw*, after tariff the world price become Pw*+t, PQ is the price of import after

imposing quota, M’ is the amount of import after which quota is imposed and the MT is the

amount of total import depending on the price after imposition of TRQ. The import supply

curve is ABCD and the demand for the import is downward sloping curve.

PW

*

PW*+

t

PQ

P

Import Demand

C

Imports

Import Supply

BA

Quota Rent

In-Quota Tariff Revenue

Over-Quota Tariff Revenue

M’ MT

D

change in the surplus of domestic producers due to increase in the price because of tariff. The

dead weight loss is also same for both kind of tariffs. The impact is seen in case of

government revenue and the producer surplus to the producer of non-tariffed country which

are represented by the area “d” and “c”. In case of, non-discriminatory tariff there was no

producer surplus for the foreign producer while the discriminating tariff encourages the

producers of non-tariffed countries to export by providing them producer’s surplus by the

amount of area represented by “c” (Nguyen and Kinnucan 2019).

Answer 5.a

Figure 1: Tariff Rate Quota on Import

The above figure shows the result of TRQ on a certain amount of imports. The

horizontal axis presents the imports and the vertical axis presents the price of import. The

world price Pw*, after tariff the world price become Pw*+t, PQ is the price of import after

imposing quota, M’ is the amount of import after which quota is imposed and the MT is the

amount of total import depending on the price after imposition of TRQ. The import supply

curve is ABCD and the demand for the import is downward sloping curve.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TARIFF AND QUOTA IN A SMALL COUNTRY

Answer 5.b

The quota rent and tariff revenue is labelled by using different colours. The quota

rents go to the importer or the buyer of the good at Pw* and sell at price PQ. The larger part of

the over-quota tariff revenue goes to the foreign producers and the smaller part which comes

from the tariff part goes to the domestic government. In-quota tariff revenue goes to the

domestic producers (Nagurney and Dong 2019).

Answer 5.c

The TRQ is beneficial for the foreign producers as it gives them a chance to earn

more than a normal tariff. If the foreign producers sell more than the quota barrier, they will

gain a huge amount of surplus.

Answer 5.b

The quota rent and tariff revenue is labelled by using different colours. The quota

rents go to the importer or the buyer of the good at Pw* and sell at price PQ. The larger part of

the over-quota tariff revenue goes to the foreign producers and the smaller part which comes

from the tariff part goes to the domestic government. In-quota tariff revenue goes to the

domestic producers (Nagurney and Dong 2019).

Answer 5.c

The TRQ is beneficial for the foreign producers as it gives them a chance to earn

more than a normal tariff. If the foreign producers sell more than the quota barrier, they will

gain a huge amount of surplus.

5TARIFF AND QUOTA IN A SMALL COUNTRY

Reference

Nagurney, A., Besik, D. and Dong, J., 2019. Tariffs and quotas in world trade: A unified

variational inequality framework. European Journal of Operational Research, 275(1),

pp.347-360.

Nguyen, L. and Kinnucan, H.W., 2019. The US solar panel anti-dumping duties versus

uniform tariff. Energy Policy, 127, pp.523-532.

Reference

Nagurney, A., Besik, D. and Dong, J., 2019. Tariffs and quotas in world trade: A unified

variational inequality framework. European Journal of Operational Research, 275(1),

pp.347-360.

Nguyen, L. and Kinnucan, H.W., 2019. The US solar panel anti-dumping duties versus

uniform tariff. Energy Policy, 127, pp.523-532.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TARIFF AND QUOTA IN A SMALL COUNTRY

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.