Economics Assignment (Course ID: ECON101): Tax and Price Analysis

VerifiedAdded on 2021/06/16

|12

|876

|118

Homework Assignment

AI Summary

This economics assignment delves into two key areas: tax incidence and price regulation. Part I analyzes the impact of a per-unit tax on pizza, determining the new equilibrium price and quantity, the burden on buyers and sellers, and government revenue. The assignment utilizes supply and demand functions to illustrate these effects. Part II examines price regulation, specifically using the US Farm Bill as a case study. It assesses the impact of a price floor on the wheat market, including surplus generation, and analyzes changes in consumer surplus, producer surplus, and deadweight loss. The assignment also discusses the fairness implications of price intervention, highlighting how price supports can lead to market inefficiencies and uneven distribution of benefits, challenging the notion of equitable wealth transfer within the economic system. The assignment provides detailed calculations, graphical representations, and a discussion of the economic principles at play.

Running Head: ECONOMIC ASSIGNMENT

Economic Assignment

Name of the Student

Name of the University

Course ID

Economic Assignment

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMIC ASSIGNMENT

Table of Contents

Answer 2..........................................................................................................................................2

Part I: Tax incidence....................................................................................................................2

Part II: Price regulation................................................................................................................5

Answer a..................................................................................................................................5

Answer b..................................................................................................................................6

Answer c..................................................................................................................................6

Answer d..................................................................................................................................8

References......................................................................................................................................10

Table of Contents

Answer 2..........................................................................................................................................2

Part I: Tax incidence....................................................................................................................2

Part II: Price regulation................................................................................................................5

Answer a..................................................................................................................................5

Answer b..................................................................................................................................6

Answer c..................................................................................................................................6

Answer d..................................................................................................................................8

References......................................................................................................................................10

2ECONOMIC ASSIGNMENT

Answer 2

Part I: Tax incidence

Given the demand and supply function of pizzas are

QD=20−2 P

QS =P−1

Before tax

The equilibrium price and quantity in the Pizza market can be determined as

QD=QS

¿ , 20−2 P=P−1

¿ , 3 P=21

¿ , P=7

Quantity=P−1

¿ 7−1

¿ 6

Now, the government imposes a tax of $3 tax for per units of pizza purchased. The tax altered

the demand equation as

QD=20−2 ( P+ 3 )

¿ 20−2 P−6

Answer 2

Part I: Tax incidence

Given the demand and supply function of pizzas are

QD=20−2 P

QS =P−1

Before tax

The equilibrium price and quantity in the Pizza market can be determined as

QD=QS

¿ , 20−2 P=P−1

¿ , 3 P=21

¿ , P=7

Quantity=P−1

¿ 7−1

¿ 6

Now, the government imposes a tax of $3 tax for per units of pizza purchased. The tax altered

the demand equation as

QD=20−2 ( P+ 3 )

¿ 20−2 P−6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMIC ASSIGNMENT

¿ 14−2 P

Given the new demand and existing supply function new equilibrium is

QD=QS

¿ , 14−2 P=P−1

¿ , 3 P=15

¿ , P=5

New equilibrium quanity=P−1

¿ 5−1

¿ 4

The equilibrium price represent the price received by the sellers. The buyers however paid a

much higher price.

The old demand function

QD=20−2 P

From this the inverse demand function can be obtained as

P= 20−QD

2

The price that buyers pay after tax is obtained as

¿ 20−QD

2

¿ 14−2 P

Given the new demand and existing supply function new equilibrium is

QD=QS

¿ , 14−2 P=P−1

¿ , 3 P=15

¿ , P=5

New equilibrium quanity=P−1

¿ 5−1

¿ 4

The equilibrium price represent the price received by the sellers. The buyers however paid a

much higher price.

The old demand function

QD=20−2 P

From this the inverse demand function can be obtained as

P= 20−QD

2

The price that buyers pay after tax is obtained as

¿ 20−QD

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMIC ASSIGNMENT

¿ 20−4

2

¿ 16

2

¿ 8

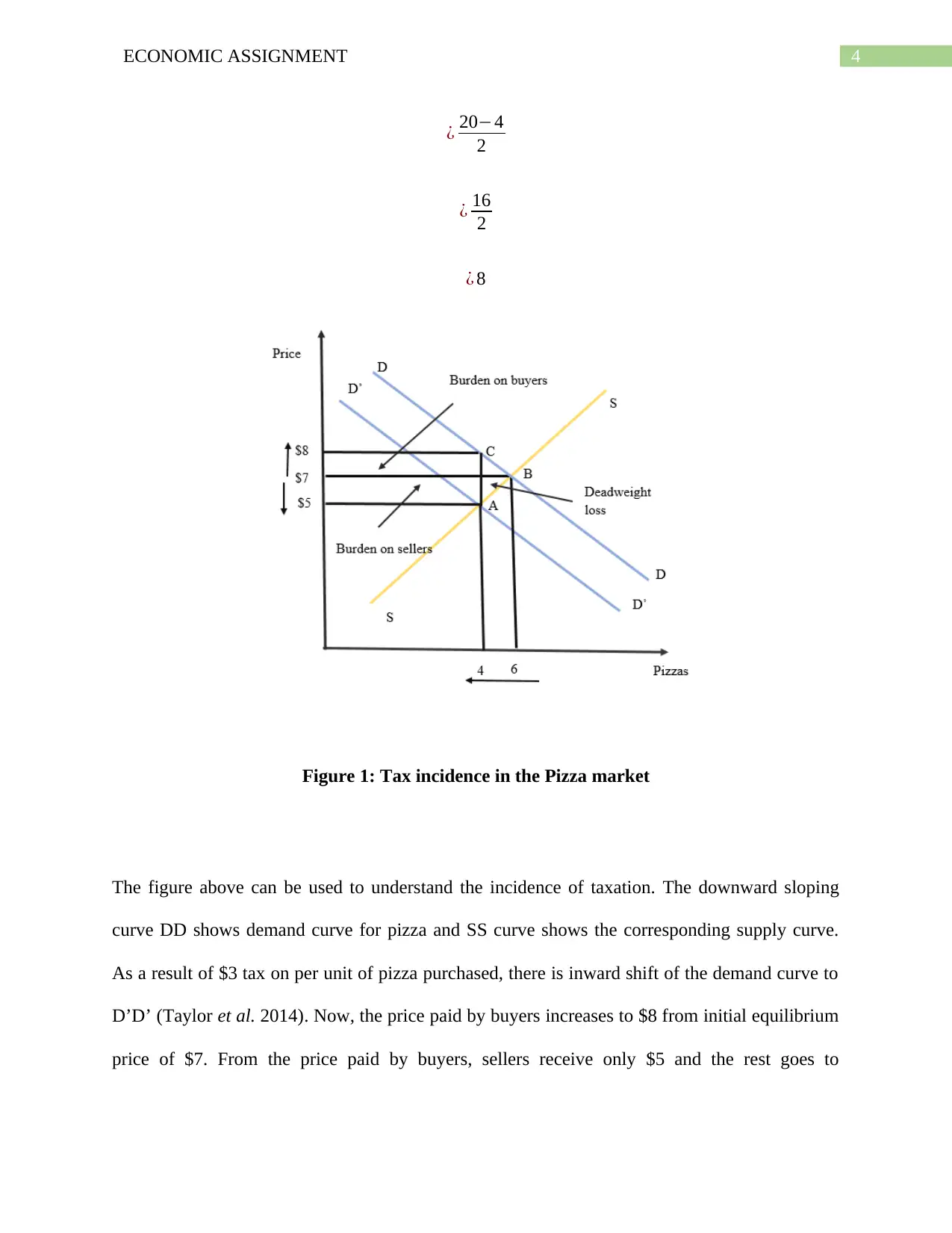

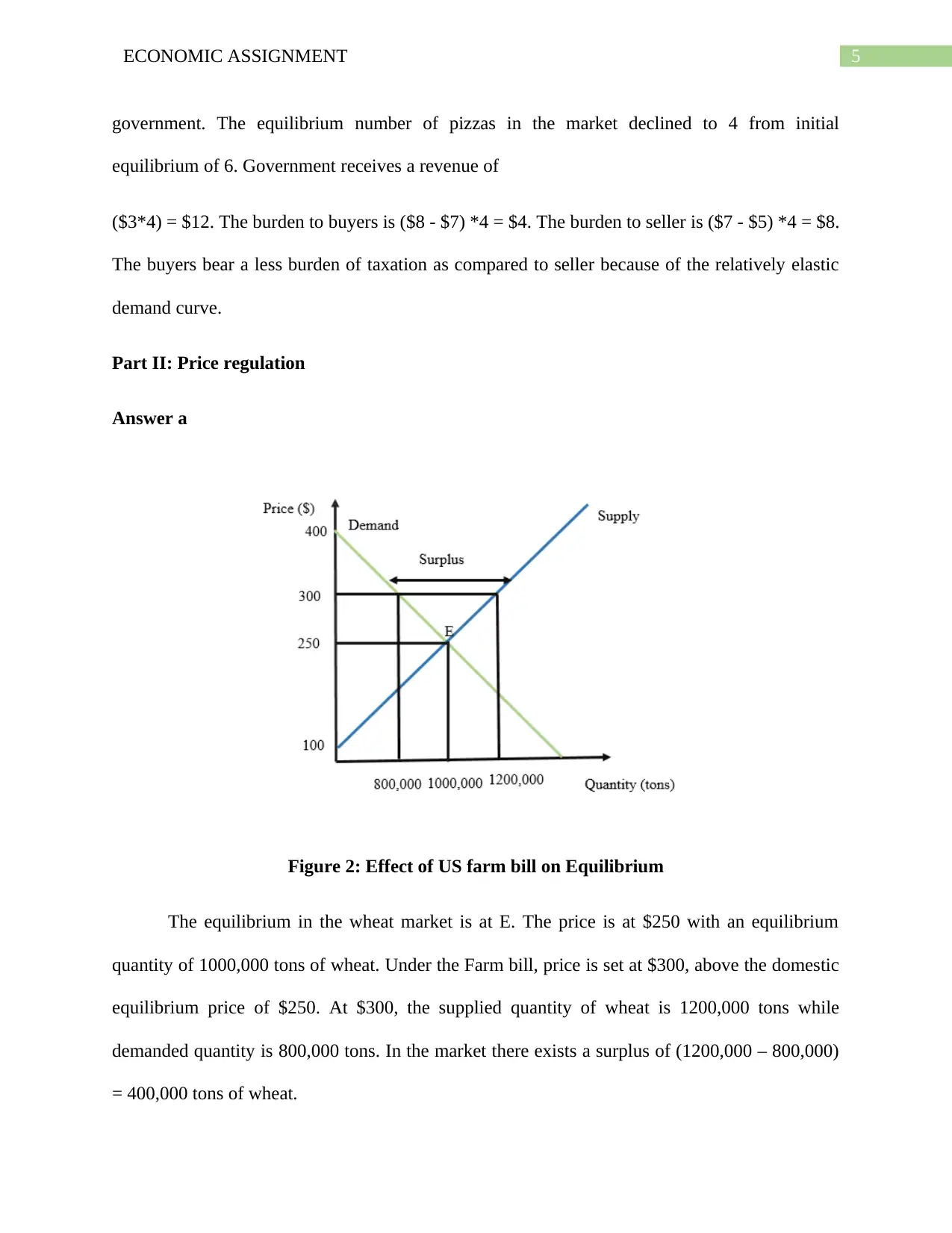

Figure 1: Tax incidence in the Pizza market

The figure above can be used to understand the incidence of taxation. The downward sloping

curve DD shows demand curve for pizza and SS curve shows the corresponding supply curve.

As a result of $3 tax on per unit of pizza purchased, there is inward shift of the demand curve to

D’D’ (Taylor et al. 2014). Now, the price paid by buyers increases to $8 from initial equilibrium

price of $7. From the price paid by buyers, sellers receive only $5 and the rest goes to

¿ 20−4

2

¿ 16

2

¿ 8

Figure 1: Tax incidence in the Pizza market

The figure above can be used to understand the incidence of taxation. The downward sloping

curve DD shows demand curve for pizza and SS curve shows the corresponding supply curve.

As a result of $3 tax on per unit of pizza purchased, there is inward shift of the demand curve to

D’D’ (Taylor et al. 2014). Now, the price paid by buyers increases to $8 from initial equilibrium

price of $7. From the price paid by buyers, sellers receive only $5 and the rest goes to

5ECONOMIC ASSIGNMENT

government. The equilibrium number of pizzas in the market declined to 4 from initial

equilibrium of 6. Government receives a revenue of

($3*4) = $12. The burden to buyers is ($8 - $7) *4 = $4. The burden to seller is ($7 - $5) *4 = $8.

The buyers bear a less burden of taxation as compared to seller because of the relatively elastic

demand curve.

Part II: Price regulation

Answer a

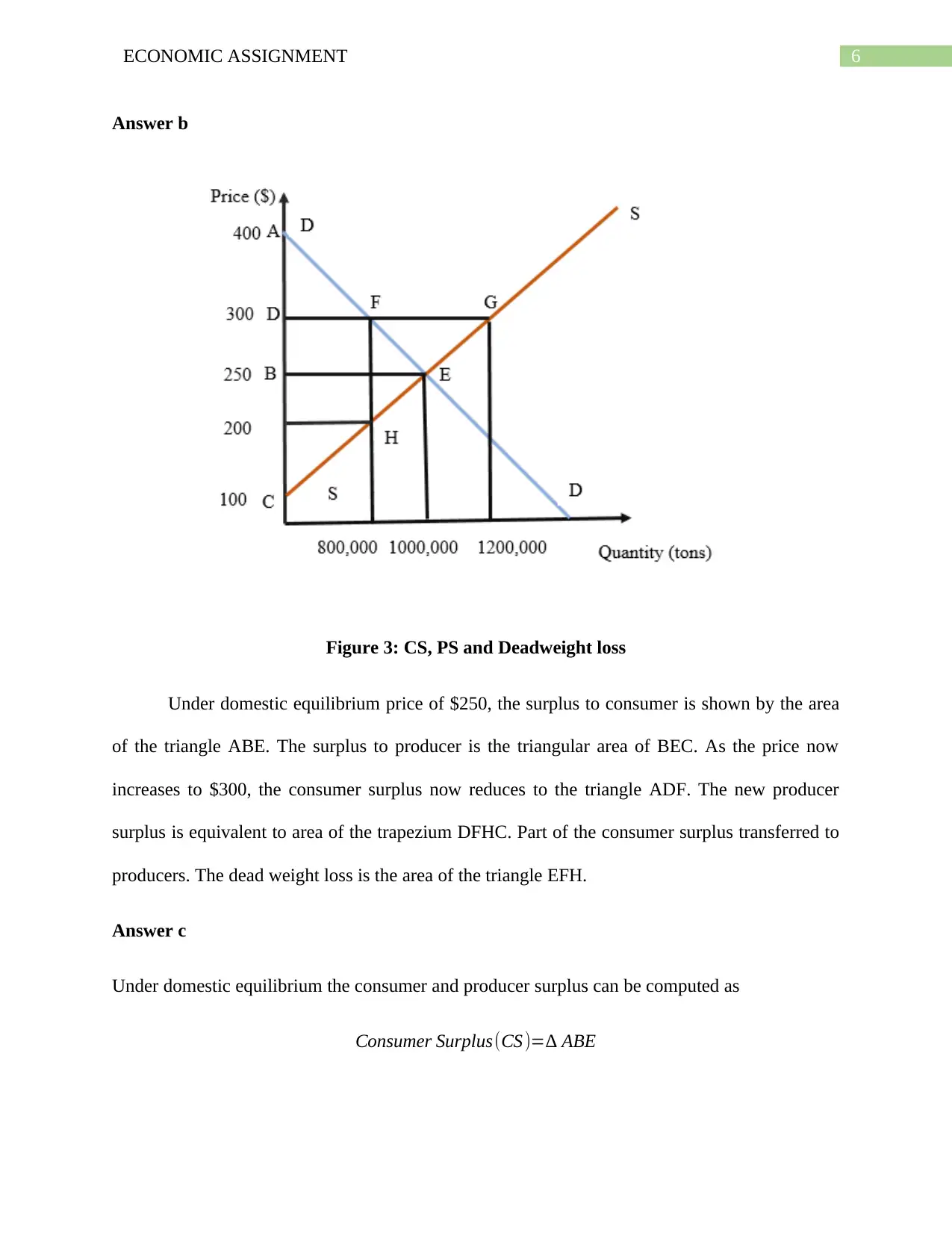

Figure 2: Effect of US farm bill on Equilibrium

The equilibrium in the wheat market is at E. The price is at $250 with an equilibrium

quantity of 1000,000 tons of wheat. Under the Farm bill, price is set at $300, above the domestic

equilibrium price of $250. At $300, the supplied quantity of wheat is 1200,000 tons while

demanded quantity is 800,000 tons. In the market there exists a surplus of (1200,000 – 800,000)

= 400,000 tons of wheat.

government. The equilibrium number of pizzas in the market declined to 4 from initial

equilibrium of 6. Government receives a revenue of

($3*4) = $12. The burden to buyers is ($8 - $7) *4 = $4. The burden to seller is ($7 - $5) *4 = $8.

The buyers bear a less burden of taxation as compared to seller because of the relatively elastic

demand curve.

Part II: Price regulation

Answer a

Figure 2: Effect of US farm bill on Equilibrium

The equilibrium in the wheat market is at E. The price is at $250 with an equilibrium

quantity of 1000,000 tons of wheat. Under the Farm bill, price is set at $300, above the domestic

equilibrium price of $250. At $300, the supplied quantity of wheat is 1200,000 tons while

demanded quantity is 800,000 tons. In the market there exists a surplus of (1200,000 – 800,000)

= 400,000 tons of wheat.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMIC ASSIGNMENT

Answer b

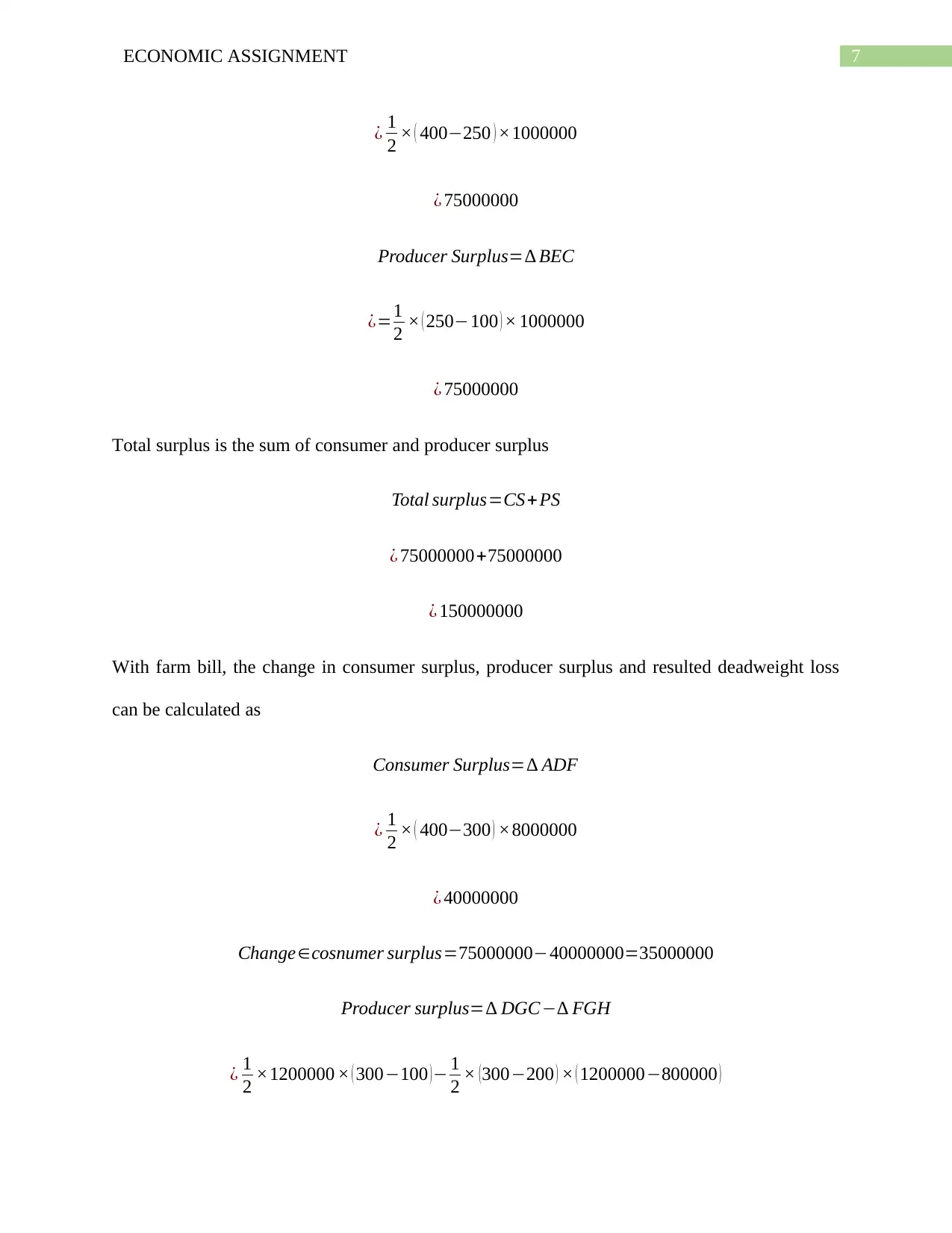

Figure 3: CS, PS and Deadweight loss

Under domestic equilibrium price of $250, the surplus to consumer is shown by the area

of the triangle ABE. The surplus to producer is the triangular area of BEC. As the price now

increases to $300, the consumer surplus now reduces to the triangle ADF. The new producer

surplus is equivalent to area of the trapezium DFHC. Part of the consumer surplus transferred to

producers. The dead weight loss is the area of the triangle EFH.

Answer c

Under domestic equilibrium the consumer and producer surplus can be computed as

Consumer Surplus(CS)=∆ ABE

Answer b

Figure 3: CS, PS and Deadweight loss

Under domestic equilibrium price of $250, the surplus to consumer is shown by the area

of the triangle ABE. The surplus to producer is the triangular area of BEC. As the price now

increases to $300, the consumer surplus now reduces to the triangle ADF. The new producer

surplus is equivalent to area of the trapezium DFHC. Part of the consumer surplus transferred to

producers. The dead weight loss is the area of the triangle EFH.

Answer c

Under domestic equilibrium the consumer and producer surplus can be computed as

Consumer Surplus(CS)=∆ ABE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMIC ASSIGNMENT

¿ 1

2 × ( 400−250 ) ×1000000

¿ 75000000

Producer Surplus=∆ BEC

¿=1

2 × ( 250−100 ) × 1000000

¿ 75000000

Total surplus is the sum of consumer and producer surplus

Total surplus=CS+PS

¿ 75000000+75000000

¿ 150000000

With farm bill, the change in consumer surplus, producer surplus and resulted deadweight loss

can be calculated as

Consumer Surplus=∆ ADF

¿ 1

2 × ( 400−300 ) ×8000000

¿ 40000000

Change∈cosnumer surplus=75000000−40000000=35000000

Producer surplus=∆ DGC−∆ FGH

¿ 1

2 ×1200000 × ( 300−100 )− 1

2 × (300−200 ) × ( 1200000−800000 )

¿ 1

2 × ( 400−250 ) ×1000000

¿ 75000000

Producer Surplus=∆ BEC

¿=1

2 × ( 250−100 ) × 1000000

¿ 75000000

Total surplus is the sum of consumer and producer surplus

Total surplus=CS+PS

¿ 75000000+75000000

¿ 150000000

With farm bill, the change in consumer surplus, producer surplus and resulted deadweight loss

can be calculated as

Consumer Surplus=∆ ADF

¿ 1

2 × ( 400−300 ) ×8000000

¿ 40000000

Change∈cosnumer surplus=75000000−40000000=35000000

Producer surplus=∆ DGC−∆ FGH

¿ 1

2 ×1200000 × ( 300−100 )− 1

2 × (300−200 ) × ( 1200000−800000 )

8ECONOMIC ASSIGNMENT

¿ 1

2 ×1200000 ×200−1

2 ×100 ×400000

¿ 120000000−20000000

¿ 100000000

Change∈ producer surplus=100000000−75000000=25000000

Total Surplus=40000000+100000000=140000000

Change∈total surplus=150000000−140000000=10000000

Deadweight loss=∆ E F H=2 × 1

2 × ( 300−250 ) × ( 1000000−800000 )

¿ 50 ×2000000

¿ 10000000

Answer d

The notion of fairness in economics implies that the wealth that is take out of the system

should be proportional to the contribution put into the system. Under any form of price

intervention, there is not absolute transfer of welfare from one party to another. Like in case of

US farm bill, price in the market artificially increases to $300. The buyers face a high price and

hence experiences a reduction in surplus. However, the reduced surplus does not completely

transfer to the farmers. The agricultural price support program results in a marketed surplus in

the economy. The surplus needs to be purchased by government (Frank 2015). This additional

burden of government budget is again fall on the buyers in form of a higher taxation. The surplus

to farmers though increases but at the cost of other groups in the society. The fruits of price

¿ 1

2 ×1200000 ×200−1

2 ×100 ×400000

¿ 120000000−20000000

¿ 100000000

Change∈ producer surplus=100000000−75000000=25000000

Total Surplus=40000000+100000000=140000000

Change∈total surplus=150000000−140000000=10000000

Deadweight loss=∆ E F H=2 × 1

2 × ( 300−250 ) × ( 1000000−800000 )

¿ 50 ×2000000

¿ 10000000

Answer d

The notion of fairness in economics implies that the wealth that is take out of the system

should be proportional to the contribution put into the system. Under any form of price

intervention, there is not absolute transfer of welfare from one party to another. Like in case of

US farm bill, price in the market artificially increases to $300. The buyers face a high price and

hence experiences a reduction in surplus. However, the reduced surplus does not completely

transfer to the farmers. The agricultural price support program results in a marketed surplus in

the economy. The surplus needs to be purchased by government (Frank 2015). This additional

burden of government budget is again fall on the buyers in form of a higher taxation. The surplus

to farmers though increases but at the cost of other groups in the society. The fruits of price

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMIC ASSIGNMENT

support program are not even fairly distributed among the farmers. Large farmers generally gain

at the expense of small and medium sized farmers. The result of US farm bill is thus not fair.

support program are not even fairly distributed among the farmers. Large farmers generally gain

at the expense of small and medium sized farmers. The result of US farm bill is thus not fair.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMIC ASSIGNMENT

References

Frank, R.H., 2015. Principles of microeconomics, brief edition. Mcgraw-Hill.

Taylor, T., Greenlaw, S.A., Dodge, E.R., Gamez, C., Jauregui, A., Keenan, D., MacDonald, D.,

Moledina, A., Richardson, C., Shapiro, D. and Sonenshine, R., 2014. Principles of

microeconomics. OpenStax College, Rice University.

References

Frank, R.H., 2015. Principles of microeconomics, brief edition. Mcgraw-Hill.

Taylor, T., Greenlaw, S.A., Dodge, E.R., Gamez, C., Jauregui, A., Keenan, D., MacDonald, D.,

Moledina, A., Richardson, C., Shapiro, D. and Sonenshine, R., 2014. Principles of

microeconomics. OpenStax College, Rice University.

11ECONOMIC ASSIGNMENT

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.