Assessment Workbook Y1: Prepare Legally Compliant Tax Returns

VerifiedAdded on 2020/04/21

|43

|9628

|56

Homework Assignment

AI Summary

This document presents a completed assessment workbook for the unit FNSACC502, focusing on preparing legally compliant tax returns for individuals. The workbook includes a variety of questions, exercises, and a case study designed to test the student's understanding of Australian taxation law and concepts. The assignment covers topics such as the principal legislation governing taxation, the progressive tax system, PAYG tax, calculation of income tax based on different income levels, Medicare Levy Surcharge, assessable income determination, and the application of cash and accruals basis for income calculation. The assessment requires the student to answer both theoretical and practical questions, including calculations of tax payable, and the application of tax principles to various scenarios. The workbook demonstrates the application of tax law to specific situations and provides a detailed breakdown of the calculation processes, ensuring a comprehensive understanding of the subject matter.

Prepare Legally Compliant Tax Returns for Individuals

This course is based on the nationally recognised unit of competency:

● FNSACC502 Prepare Legally Compliant Tax Returns for Individuals

It covers the skills and knowledge required to prepare, document and

manage budgets and forecasts, and encompasses forecasting estimates

and monitoring budgeted outcomes.

ASSESSMENT WORKBOOK

Participant Name:

Learner ID/Username:

This course is based on the nationally recognised unit of competency:

● FNSACC502 Prepare Legally Compliant Tax Returns for Individuals

It covers the skills and knowledge required to prepare, document and

manage budgets and forecasts, and encompasses forecasting estimates

and monitoring budgeted outcomes.

ASSESSMENT WORKBOOK

Participant Name:

Learner ID/Username:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

Assessment Workbook Y1

Prepare Legally Compliant Tax Returns for Individuals

V1.0

Produced 1 February 2016

Copyright © 2016

All rights reserved. No part of this publication maybe reproduced or distributed in any form or by

any means, or stored in a database or retrieval system other than pursuant to the terms of the

Copyright Act 1968 (Commonwealth).

Date Summary of Modifications

Made

Version

1/02/16 Version 1 produced following

assessment validation

V1.0

Page 1

Assessment Workbook Y1

Prepare Legally Compliant Tax Returns for Individuals

V1.0

Produced 1 February 2016

Copyright © 2016

All rights reserved. No part of this publication maybe reproduced or distributed in any form or by

any means, or stored in a database or retrieval system other than pursuant to the terms of the

Copyright Act 1968 (Commonwealth).

Date Summary of Modifications

Made

Version

1/02/16 Version 1 produced following

assessment validation

V1.0

Page 1

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

Getting Started

Instructions

There is one (1) workbook for this unit and it contains one (1) assessment

made up of:

● Written Questions – A set of generic questions testing the student’s

general knowledge and understanding of the general theory behind

the unit.

● Exercises - A set of exercises to test the student’s knowledge,

analytical skills in problem solving and performing numerical

calculations.

● Case Study – A hypothetical exercise to test the student’s knowledge,

analytical skills in problem solving and performing numerical

calculations.

The following questions are divided into the following categories.

The first part of the assessment covers generic underpinning knowledge of

tax law and concepts. These questions are all in a short answer format. The

longer questions requiring creative thought processes are covered in the

second part of the assessment and the case study and involve the

calculation of tax transactions. You must answer all questions using your

own words. However you may reference your learner guide, the PMBOK

guide and other online or hard copy resources to complete this

assessment.

The second part of the assessment covers exercises relating to the

calculation and processing of taxation information. Ideally you should be

able to answer these questions based on the processes that are currently

in place in your workplace. If this is not the case, then answer the

questions based on processes that should be implemented in your

workplace.

The final part of the assessment is based on a case study involving the

completion of a tax return for an individual.

Page 2

Getting Started

Instructions

There is one (1) workbook for this unit and it contains one (1) assessment

made up of:

● Written Questions – A set of generic questions testing the student’s

general knowledge and understanding of the general theory behind

the unit.

● Exercises - A set of exercises to test the student’s knowledge,

analytical skills in problem solving and performing numerical

calculations.

● Case Study – A hypothetical exercise to test the student’s knowledge,

analytical skills in problem solving and performing numerical

calculations.

The following questions are divided into the following categories.

The first part of the assessment covers generic underpinning knowledge of

tax law and concepts. These questions are all in a short answer format. The

longer questions requiring creative thought processes are covered in the

second part of the assessment and the case study and involve the

calculation of tax transactions. You must answer all questions using your

own words. However you may reference your learner guide, the PMBOK

guide and other online or hard copy resources to complete this

assessment.

The second part of the assessment covers exercises relating to the

calculation and processing of taxation information. Ideally you should be

able to answer these questions based on the processes that are currently

in place in your workplace. If this is not the case, then answer the

questions based on processes that should be implemented in your

workplace.

The final part of the assessment is based on a case study involving the

completion of a tax return for an individual.

Page 2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

Requirements for satisfactory completion

For a ‘satisfactory’ result for each component of this workbook, all tasks

must be addressed to a ‘satisfactory’ standard. It is important you;

1. Provide responses using complete sentences, making direct

reference to the question.

2. Specifically address all parts of the question providing examples

where appropriate.

Competency Based Assessment

Competency based assessment focuses on whether you are able to

perform the task to the standard expected in the workplace. It relies on

you providing evidence that supports your claim of competence. This

evidence is in the form of your completion of the assessments set for each

unit.

Once you have submitted your completed assessments, your instructor will

assess your submission to determine your competence. To be deemed

competent in each course, you are required to achieve a satisfactory result

for all of the assessment components that make up that unit. Where a ‘not

yet satisfactory’ judgement is made, you will be given guidance on steps to

take to improve your performance and provided the opportunity to re-

submit evidence to demonstrate competence. Once a ‘satisfactory’

judgement has been made on all components for a unit, you will be

deemed ‘competent’ in that unit.

Submission

Only submit your workbook once all activities inside are complete. Should

you have any questions regarding your assessments, or not understand

what is required for you to complete your assessment, please feel free to

ask your instructor.

Keep your answers succinct and make sure you are answering the

question. Re-read the question after you have drafted up your response

just to be sure you have covered all that is needed.

Your final assessment result will either be ‘Competent’ or ‘Not Yet

Competent’.

When submitting your assessments please ensure that

Page 3

Requirements for satisfactory completion

For a ‘satisfactory’ result for each component of this workbook, all tasks

must be addressed to a ‘satisfactory’ standard. It is important you;

1. Provide responses using complete sentences, making direct

reference to the question.

2. Specifically address all parts of the question providing examples

where appropriate.

Competency Based Assessment

Competency based assessment focuses on whether you are able to

perform the task to the standard expected in the workplace. It relies on

you providing evidence that supports your claim of competence. This

evidence is in the form of your completion of the assessments set for each

unit.

Once you have submitted your completed assessments, your instructor will

assess your submission to determine your competence. To be deemed

competent in each course, you are required to achieve a satisfactory result

for all of the assessment components that make up that unit. Where a ‘not

yet satisfactory’ judgement is made, you will be given guidance on steps to

take to improve your performance and provided the opportunity to re-

submit evidence to demonstrate competence. Once a ‘satisfactory’

judgement has been made on all components for a unit, you will be

deemed ‘competent’ in that unit.

Submission

Only submit your workbook once all activities inside are complete. Should

you have any questions regarding your assessments, or not understand

what is required for you to complete your assessment, please feel free to

ask your instructor.

Keep your answers succinct and make sure you are answering the

question. Re-read the question after you have drafted up your response

just to be sure you have covered all that is needed.

Your final assessment result will either be ‘Competent’ or ‘Not Yet

Competent’.

When submitting your assessments please ensure that

Page 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

1. All assessment tasks within the workbook have been completed

2. You have proof read your assessment

Candidate Declaration

Submission of this workbook means you agree to abide by the terms of the

candidate declaration below.

By submitting this work, I declare that:

● I have been advised of the assessment requirements, have been

made aware of my rights and responsibilities as an assessment

candidate, and choose to be assessed at this time.

● I am aware that there is a limit to the number of submissions that I

can make for each assessment and I am submitting all documents

required to complete this Assessment Workbook.

● I have organised and named the files I am submitting according to

the instructions provided and I am aware that my assessor will not

assess work that cannot be clearly identified and may request the

work be resubmitted according to the correct process.

● This work is my own and contains no material written by another

person except where due reference is made. I am aware that a false

declaration may lead to the withdrawal of a qualification or

statement of attainment.

● I am aware that there is a policy of checking the validity of

qualifications that I submit as evidence as well as the

qualifications/evidence of parties who verify my performance or

observable skills. I give my consent to contact these parties for

verification purposes.

Page 4

1. All assessment tasks within the workbook have been completed

2. You have proof read your assessment

Candidate Declaration

Submission of this workbook means you agree to abide by the terms of the

candidate declaration below.

By submitting this work, I declare that:

● I have been advised of the assessment requirements, have been

made aware of my rights and responsibilities as an assessment

candidate, and choose to be assessed at this time.

● I am aware that there is a limit to the number of submissions that I

can make for each assessment and I am submitting all documents

required to complete this Assessment Workbook.

● I have organised and named the files I am submitting according to

the instructions provided and I am aware that my assessor will not

assess work that cannot be clearly identified and may request the

work be resubmitted according to the correct process.

● This work is my own and contains no material written by another

person except where due reference is made. I am aware that a false

declaration may lead to the withdrawal of a qualification or

statement of attainment.

● I am aware that there is a policy of checking the validity of

qualifications that I submit as evidence as well as the

qualifications/evidence of parties who verify my performance or

observable skills. I give my consent to contact these parties for

verification purposes.

Page 4

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

Written Questions

Instructions

The following questions are divided into two categories.

The first part of the assessment covers generic underpinning knowledge of

tax law and concepts. These questions are all in a short answer format. The

longer questions requiring creative thought processes are covered in the

second part of the assessment and the case study and involve the

calculation of tax transactions. You must answer all questions using your

own words. However you may reference your learner guide, the PMBOK

guide and other online or hard copy resources to complete this

assessment.

The second part of the assessment covers exercises relating to the

calculation and processing of taxation information. Ideally you should be

able to answer these questions based on the processes that are currently

in place in your workplace. If this is not the case, then answer the

questions based on processes that should be implemented in your

workplace.

The final part of the assessment is based on a case study involving the

completion of a tax return for an individual.

Generic Questions

Y1Q1: Name the principal legislation that governs taxation law in

Australia (Two (2) required).

Under section 51(ii) of the Australian Constitution it is stated that for the

Commonwealth of Australia, the Commonwealth Parliament have the

authority and power to develop legislations for order and peace. Thus the

primary legislations which governs taxation laws in Australia constitute:

Income Tax Assessment Act 1936 or ITAA 1936

Income Tax Assessment Act 1997 or ITAA 1997

Y1Q2: Income tax is imposed upon an individual taxpayer’s taxable

income for the current year. The Australian taxation system is a

Page 5

Written Questions

Instructions

The following questions are divided into two categories.

The first part of the assessment covers generic underpinning knowledge of

tax law and concepts. These questions are all in a short answer format. The

longer questions requiring creative thought processes are covered in the

second part of the assessment and the case study and involve the

calculation of tax transactions. You must answer all questions using your

own words. However you may reference your learner guide, the PMBOK

guide and other online or hard copy resources to complete this

assessment.

The second part of the assessment covers exercises relating to the

calculation and processing of taxation information. Ideally you should be

able to answer these questions based on the processes that are currently

in place in your workplace. If this is not the case, then answer the

questions based on processes that should be implemented in your

workplace.

The final part of the assessment is based on a case study involving the

completion of a tax return for an individual.

Generic Questions

Y1Q1: Name the principal legislation that governs taxation law in

Australia (Two (2) required).

Under section 51(ii) of the Australian Constitution it is stated that for the

Commonwealth of Australia, the Commonwealth Parliament have the

authority and power to develop legislations for order and peace. Thus the

primary legislations which governs taxation laws in Australia constitute:

Income Tax Assessment Act 1936 or ITAA 1936

Income Tax Assessment Act 1997 or ITAA 1997

Y1Q2: Income tax is imposed upon an individual taxpayer’s taxable

income for the current year. The Australian taxation system is a

Page 5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

progressive tax system. What is meant by the terms “progressive tax

system” and “PAYG tax”?

The obligatory contribution towards the state revenue by any individual,

businesses or other entities is known as Tax. On the basis of an

individual’s or company’s or entity’s taxable income for the present

financial year income tax is levied upon them. Moreover in Australia, the

system of progressive taxation system is followed which implies that with

an increase in an individual’s taxable income, taxes that are levied on

them also increases gradually. Thus the more an individual will earn, the

more he had to pay the tax. Hence this concept is known as progressive

tax system.

In case of any employee who is a taxpayer in Australia an amount is

withheld from the gross salaries or wages of the individual as

installments of that person’s total tax liability. This withholding is known

as the system of Pay As You Go Tax or PAYG Tax.

Y1Q3: Based on the individual income tax rates for Australian residents

able to claim the tax free threshold for 2013-2014 (exclusive of the

medicare levy of 1.5%), calculate the amount of income tax to be paid for

the following amounts of taxable income:

Y1Q3A $95,000

Y1Q3B $36,000

Y1Q3C $250,000

Y1Q3D $19,500

Y1Q3A

Tax Payable= 17547+ (95000-80000) X37%= $23097.

Y1Q3B

Tax Payable= (36000-18200)X 19%= $3382

Y1Q3C

Tax payable= 54547+ (250000-180000) X 45%= $86047.

Page 6

progressive tax system. What is meant by the terms “progressive tax

system” and “PAYG tax”?

The obligatory contribution towards the state revenue by any individual,

businesses or other entities is known as Tax. On the basis of an

individual’s or company’s or entity’s taxable income for the present

financial year income tax is levied upon them. Moreover in Australia, the

system of progressive taxation system is followed which implies that with

an increase in an individual’s taxable income, taxes that are levied on

them also increases gradually. Thus the more an individual will earn, the

more he had to pay the tax. Hence this concept is known as progressive

tax system.

In case of any employee who is a taxpayer in Australia an amount is

withheld from the gross salaries or wages of the individual as

installments of that person’s total tax liability. This withholding is known

as the system of Pay As You Go Tax or PAYG Tax.

Y1Q3: Based on the individual income tax rates for Australian residents

able to claim the tax free threshold for 2013-2014 (exclusive of the

medicare levy of 1.5%), calculate the amount of income tax to be paid for

the following amounts of taxable income:

Y1Q3A $95,000

Y1Q3B $36,000

Y1Q3C $250,000

Y1Q3D $19,500

Y1Q3A

Tax Payable= 17547+ (95000-80000) X37%= $23097.

Y1Q3B

Tax Payable= (36000-18200)X 19%= $3382

Y1Q3C

Tax payable= 54547+ (250000-180000) X 45%= $86047.

Page 6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

Y1Q3D

Tax Payable= (19500-18200)X19%= $247.

Y1Q4: Richard has a taxable income of $125,000 for the year ended 2011

2012. His wife Emily has a taxable income of $35,000. They have two

(2) dependent children and do not have private hospital cover. Will

Richard and Emily have to pay a medicare levy surcharge in the 2011-

2012 income year? Give reasons for your decision.

As per Medicare Levy Surcharge legislations, any individual who is a

resident of Australia and families as well who’s annual taxable income is

above the threshold limit and also do not have a proper private patient

hospital coverage might need to pay an additional surcharge. This

surcharge is called Medicare Levy Surcharge. In this case Richard and

Emily is considered as a family where their total taxable income is

$160,000 plus $1,500 for one child after the first child. Thus this makes

their total family threshold for Medicare Levy Surcharge is $161,000. But

as per legislation if any family have a family threshold of $168,000 or

less, then the rate of Medicare Levy Surcharge is 0.00%. This clarifies

that there will be no Medicare Levy Surcharge applicable to Richard and

Emily.

Y1Q5: In the following situations determine whether the amount is

classified as assessable income and give an explanation for your

decision:

Y1Q5A Joan receives a fuel allowance of $2,000 each year from her

employer;

Y1Q5B Michael suffers an eye injury at work and receives a lump

sum compensation payment of $40,000 in compensation from his

employer;

Y1Q5C Jill slips on some tiles and breaks her leg while performing her

Page 7

Y1Q3D

Tax Payable= (19500-18200)X19%= $247.

Y1Q4: Richard has a taxable income of $125,000 for the year ended 2011

2012. His wife Emily has a taxable income of $35,000. They have two

(2) dependent children and do not have private hospital cover. Will

Richard and Emily have to pay a medicare levy surcharge in the 2011-

2012 income year? Give reasons for your decision.

As per Medicare Levy Surcharge legislations, any individual who is a

resident of Australia and families as well who’s annual taxable income is

above the threshold limit and also do not have a proper private patient

hospital coverage might need to pay an additional surcharge. This

surcharge is called Medicare Levy Surcharge. In this case Richard and

Emily is considered as a family where their total taxable income is

$160,000 plus $1,500 for one child after the first child. Thus this makes

their total family threshold for Medicare Levy Surcharge is $161,000. But

as per legislation if any family have a family threshold of $168,000 or

less, then the rate of Medicare Levy Surcharge is 0.00%. This clarifies

that there will be no Medicare Levy Surcharge applicable to Richard and

Emily.

Y1Q5: In the following situations determine whether the amount is

classified as assessable income and give an explanation for your

decision:

Y1Q5A Joan receives a fuel allowance of $2,000 each year from her

employer;

Y1Q5B Michael suffers an eye injury at work and receives a lump

sum compensation payment of $40,000 in compensation from his

employer;

Y1Q5C Jill slips on some tiles and breaks her leg while performing her

Page 7

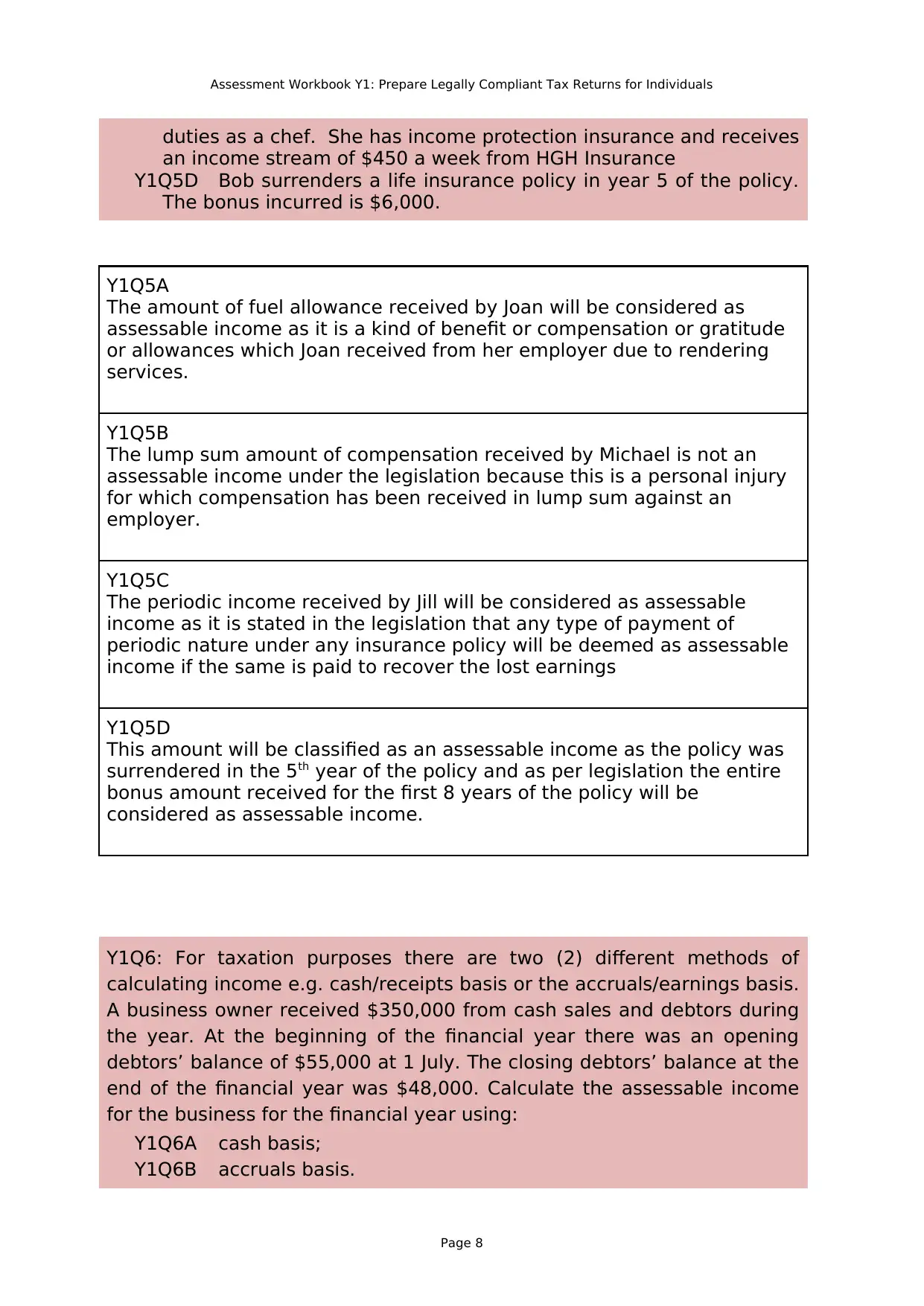

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

duties as a chef. She has income protection insurance and receives

an income stream of $450 a week from HGH Insurance

Y1Q5D Bob surrenders a life insurance policy in year 5 of the policy.

The bonus incurred is $6,000.

Y1Q5A

The amount of fuel allowance received by Joan will be considered as

assessable income as it is a kind of benefit or compensation or gratitude

or allowances which Joan received from her employer due to rendering

services.

Y1Q5B

The lump sum amount of compensation received by Michael is not an

assessable income under the legislation because this is a personal injury

for which compensation has been received in lump sum against an

employer.

Y1Q5C

The periodic income received by Jill will be considered as assessable

income as it is stated in the legislation that any type of payment of

periodic nature under any insurance policy will be deemed as assessable

income if the same is paid to recover the lost earnings

Y1Q5D

This amount will be classified as an assessable income as the policy was

surrendered in the 5th year of the policy and as per legislation the entire

bonus amount received for the first 8 years of the policy will be

considered as assessable income.

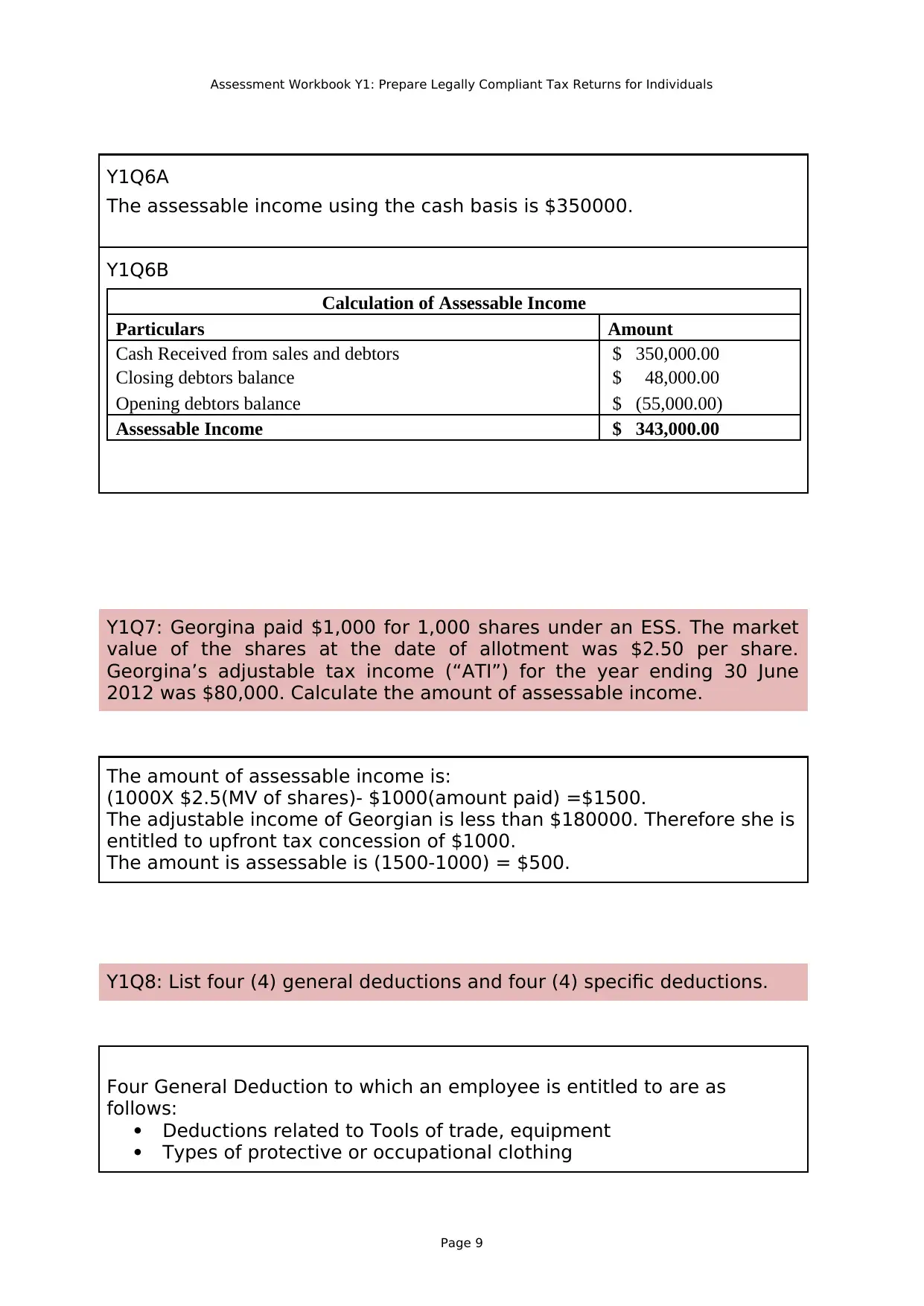

Y1Q6: For taxation purposes there are two (2) different methods of

calculating income e.g. cash/receipts basis or the accruals/earnings basis.

A business owner received $350,000 from cash sales and debtors during

the year. At the beginning of the financial year there was an opening

debtors’ balance of $55,000 at 1 July. The closing debtors’ balance at the

end of the financial year was $48,000. Calculate the assessable income

for the business for the financial year using:

Y1Q6A cash basis;

Y1Q6B accruals basis.

Page 8

duties as a chef. She has income protection insurance and receives

an income stream of $450 a week from HGH Insurance

Y1Q5D Bob surrenders a life insurance policy in year 5 of the policy.

The bonus incurred is $6,000.

Y1Q5A

The amount of fuel allowance received by Joan will be considered as

assessable income as it is a kind of benefit or compensation or gratitude

or allowances which Joan received from her employer due to rendering

services.

Y1Q5B

The lump sum amount of compensation received by Michael is not an

assessable income under the legislation because this is a personal injury

for which compensation has been received in lump sum against an

employer.

Y1Q5C

The periodic income received by Jill will be considered as assessable

income as it is stated in the legislation that any type of payment of

periodic nature under any insurance policy will be deemed as assessable

income if the same is paid to recover the lost earnings

Y1Q5D

This amount will be classified as an assessable income as the policy was

surrendered in the 5th year of the policy and as per legislation the entire

bonus amount received for the first 8 years of the policy will be

considered as assessable income.

Y1Q6: For taxation purposes there are two (2) different methods of

calculating income e.g. cash/receipts basis or the accruals/earnings basis.

A business owner received $350,000 from cash sales and debtors during

the year. At the beginning of the financial year there was an opening

debtors’ balance of $55,000 at 1 July. The closing debtors’ balance at the

end of the financial year was $48,000. Calculate the assessable income

for the business for the financial year using:

Y1Q6A cash basis;

Y1Q6B accruals basis.

Page 8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

Y1Q6A

The assessable income using the cash basis is $350000.

Y1Q6B

Calculation of Assessable Income

Particulars Amount

Cash Received from sales and debtors $ 350,000.00

Closing debtors balance $ 48,000.00

Opening debtors balance $ (55,000.00)

Assessable Income $ 343,000.00

Y1Q7: Georgina paid $1,000 for 1,000 shares under an ESS. The market

value of the shares at the date of allotment was $2.50 per share.

Georgina’s adjustable tax income (“ATI”) for the year ending 30 June

2012 was $80,000. Calculate the amount of assessable income.

The amount of assessable income is:

(1000X $2.5(MV of shares)- $1000(amount paid) =$1500.

The adjustable income of Georgian is less than $180000. Therefore she is

entitled to upfront tax concession of $1000.

The amount is assessable is (1500-1000) = $500.

Y1Q8: List four (4) general deductions and four (4) specific deductions.

Four General Deduction to which an employee is entitled to are as

follows:

Deductions related to Tools of trade, equipment

Types of protective or occupational clothing

Page 9

Y1Q6A

The assessable income using the cash basis is $350000.

Y1Q6B

Calculation of Assessable Income

Particulars Amount

Cash Received from sales and debtors $ 350,000.00

Closing debtors balance $ 48,000.00

Opening debtors balance $ (55,000.00)

Assessable Income $ 343,000.00

Y1Q7: Georgina paid $1,000 for 1,000 shares under an ESS. The market

value of the shares at the date of allotment was $2.50 per share.

Georgina’s adjustable tax income (“ATI”) for the year ending 30 June

2012 was $80,000. Calculate the amount of assessable income.

The amount of assessable income is:

(1000X $2.5(MV of shares)- $1000(amount paid) =$1500.

The adjustable income of Georgian is less than $180000. Therefore she is

entitled to upfront tax concession of $1000.

The amount is assessable is (1500-1000) = $500.

Y1Q8: List four (4) general deductions and four (4) specific deductions.

Four General Deduction to which an employee is entitled to are as

follows:

Deductions related to Tools of trade, equipment

Types of protective or occupational clothing

Page 9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

Allowances related to travel

Subscriptions to Union

Insurance for accident and sickness

Mean allowances

Four Specific Deduction to which an employee is entitled to are as

follows:

Expenses related to Taxation

Expenses on repairs

Expenses incurred on lease documents

Bad debt expenses

Borrowing expenses

Y1Q9: Section 6.5(1) and Division 52 of the ITAA97 set out the social

security payments that are assessable or exempt from income tax.

Indicate whether income received by the taxpayers below is generally

assessable or exempt. All taxpayers are Australian residents for tax

purposes:

Y1Q9A George receives a family tax benefit of $5,200;

Y1Q9B Bill receives a veteran’s disability pension of $8,900;

Y1Q9C Millie received a New Start allowance of $9,400;

Y1Q9D Sonia received a one off disaster relief payment of $1,000;

Y1Q9E Andrea receives an age pension.

Y1Q9A

Family tax benefit of amount $5,200 received by George is exempted

from income tax under Division 52 of the ITAA 1997.

Y1Q9B

The veteran’s disability pension of $8,900 is generally considered as

exempted income under Division 52 of the ITAA 1997.

Y1Q9C

New Start Allowance of amount $9,400 received by Millie is considered as

assessable income under section 6.5 (1).

Page 10

Allowances related to travel

Subscriptions to Union

Insurance for accident and sickness

Mean allowances

Four Specific Deduction to which an employee is entitled to are as

follows:

Expenses related to Taxation

Expenses on repairs

Expenses incurred on lease documents

Bad debt expenses

Borrowing expenses

Y1Q9: Section 6.5(1) and Division 52 of the ITAA97 set out the social

security payments that are assessable or exempt from income tax.

Indicate whether income received by the taxpayers below is generally

assessable or exempt. All taxpayers are Australian residents for tax

purposes:

Y1Q9A George receives a family tax benefit of $5,200;

Y1Q9B Bill receives a veteran’s disability pension of $8,900;

Y1Q9C Millie received a New Start allowance of $9,400;

Y1Q9D Sonia received a one off disaster relief payment of $1,000;

Y1Q9E Andrea receives an age pension.

Y1Q9A

Family tax benefit of amount $5,200 received by George is exempted

from income tax under Division 52 of the ITAA 1997.

Y1Q9B

The veteran’s disability pension of $8,900 is generally considered as

exempted income under Division 52 of the ITAA 1997.

Y1Q9C

New Start Allowance of amount $9,400 received by Millie is considered as

assessable income under section 6.5 (1).

Page 10

Assessment Workbook Y1: Prepare Legally Compliant Tax Returns for Individuals

Y1Q9D

An One off disaster relied payment of $1,000 received by Sonia is always

exempted from income tax

Y1Q9E

Age pension is an assessable income which Andrea has received.

Y1Q10: Access the Australian Taxation Office (“ATO”) website and briefly

summarise in your own words the tests undertaken to determine

residency status. How does the ATO determine a temporary residency

status of a taxpayer?

In order to determine the residential status of an individual, he/ she has

to undergo certain tests subject to the fulfillment of which the individual

will be considered as an Australian resident. As framed by the Australian

Taxation Office the test are:

Primary or Ordinary Test which states that if an individual is born in

Australia and is residing in Australia since birth then the individual

is considered as an Australian resident without performing any

further tests.

Domicile Test states that if an individual’s permanent place of

abode in in Australia where he/she resides permanently and does

not hold the citizenship or does not reside in any foreign country,

then the individual will be deemed to be a resident of Australia.

183 Days Test requires an individual to reside in Australia for a

period of 183 days or more to be considered as an Australian

resident.

Superannuation Test is states that the employees of the Govt. of

Australia who are posted abroad for official purpose will be

considered as an Australian resident.

The temporary status of residency of any taxpayer is determined by ATO

if the taxpayer:

Have a visa of temporary nature under the Migration Act 1958;

Within the term of Social Security Act 1991, is not a resident of

Australia;

Do not have a spouse who is a resident of Australia within the sense of

Social Security Act 1991.

Page 11

Y1Q9D

An One off disaster relied payment of $1,000 received by Sonia is always

exempted from income tax

Y1Q9E

Age pension is an assessable income which Andrea has received.

Y1Q10: Access the Australian Taxation Office (“ATO”) website and briefly

summarise in your own words the tests undertaken to determine

residency status. How does the ATO determine a temporary residency

status of a taxpayer?

In order to determine the residential status of an individual, he/ she has

to undergo certain tests subject to the fulfillment of which the individual

will be considered as an Australian resident. As framed by the Australian

Taxation Office the test are:

Primary or Ordinary Test which states that if an individual is born in

Australia and is residing in Australia since birth then the individual

is considered as an Australian resident without performing any

further tests.

Domicile Test states that if an individual’s permanent place of

abode in in Australia where he/she resides permanently and does

not hold the citizenship or does not reside in any foreign country,

then the individual will be deemed to be a resident of Australia.

183 Days Test requires an individual to reside in Australia for a

period of 183 days or more to be considered as an Australian

resident.

Superannuation Test is states that the employees of the Govt. of

Australia who are posted abroad for official purpose will be

considered as an Australian resident.

The temporary status of residency of any taxpayer is determined by ATO

if the taxpayer:

Have a visa of temporary nature under the Migration Act 1958;

Within the term of Social Security Act 1991, is not a resident of

Australia;

Do not have a spouse who is a resident of Australia within the sense of

Social Security Act 1991.

Page 11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 43

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.