Taxation Case Study: Capital Gains Tax Implications and Advice for Lin

VerifiedAdded on 2023/04/05

|12

|3415

|224

Case Study

AI Summary

This case study provides a detailed analysis of the capital gains tax (CGT) implications for Lin, a new client. The study examines the tax consequences of selling her inherited family home, which was subdivided into lots. It covers the application of CGT to the sale of furnishings, antiques, and shares. The analysis considers the relevant sections of the ITAA 1997, including CGT event A1 and C1, and evaluates factors such as the intent of the taxpayer, the holding period of assets, and the application of the 50% CGT discount. The study provides advice on the tax treatment of various transactions, including the sale of a subdivided property, collectibles, and shares, offering insights into how CGT applies to different types of assets and transactions, and it covers important aspects like pre-CGT assets and the implications of the sale of assets held for less than a year.

Running head: TAXATION

Taxation

Name of the Student

Name of the University

Authors Note

Course ID

Taxation

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION

Table of Contents

Letter of Advice.........................................................................................................................2

References:...............................................................................................................................10

Table of Contents

Letter of Advice.........................................................................................................................2

References:...............................................................................................................................10

2TAXATION

Letter of Advice

To Lin

From Tax Agent

Date: 19th March 2019

Subject: Capital gains tax implications

CGT Implications on sale of subdivided lots:

Capital gains tax is not treated as the separate tax but it is integrated in to the tax

regimes. According to the “section 102-5, ITAA 1997” the assessable income comprises of

the net capital gains for the year. While the capital losses are quarantined and is only

permitted to offset against the capital gains (Woellner et al. 2016). Under the capital gains

tax, when the net capital gains have been accrued to the taxpayer during the particular income

year, then such capital gains in included into the taxpayer’s taxable income for that year. On

the other hand, the capital loss is not allowed for deduction from the taxable income but it is

allowed for off-set against the capital gains for the year that is occurred or for the future years

to ascertain the net capital gains.

As evident you have inherited the house during the year 2009 following the death of

your aunt. The information furnished suggest that the house was used as the main residence

of your aunt before it was rented out to the tenants following her death. The last tenants that

stayed in the inherited property was till the month of July 2018 before the house was

demolished. Instead of opting to repair the house you decided to demolish and subdivided the

plot for further development of the site.

There are numerous instances where the property owners possess the opportunity of

subdividing and selling the land that is owned by them for a longer period of time (Barkoczy

2016). These generally happens where the primary produces possess the land at the outskirts

of the urban centres and the residential expansion signifies that the best use of land is for the

residential purpose. This brings forward the question that the extent of developmental activity

undertaken may be such that the it signifies carrying on of the business of property

development. However, prior to embarking on the detailed analysis it is necessary to

understand that the developing the land is the mere realisation and also necessary to

determine that if the land was actually acquired or bought with the actual intent of resale at

Letter of Advice

To Lin

From Tax Agent

Date: 19th March 2019

Subject: Capital gains tax implications

CGT Implications on sale of subdivided lots:

Capital gains tax is not treated as the separate tax but it is integrated in to the tax

regimes. According to the “section 102-5, ITAA 1997” the assessable income comprises of

the net capital gains for the year. While the capital losses are quarantined and is only

permitted to offset against the capital gains (Woellner et al. 2016). Under the capital gains

tax, when the net capital gains have been accrued to the taxpayer during the particular income

year, then such capital gains in included into the taxpayer’s taxable income for that year. On

the other hand, the capital loss is not allowed for deduction from the taxable income but it is

allowed for off-set against the capital gains for the year that is occurred or for the future years

to ascertain the net capital gains.

As evident you have inherited the house during the year 2009 following the death of

your aunt. The information furnished suggest that the house was used as the main residence

of your aunt before it was rented out to the tenants following her death. The last tenants that

stayed in the inherited property was till the month of July 2018 before the house was

demolished. Instead of opting to repair the house you decided to demolish and subdivided the

plot for further development of the site.

There are numerous instances where the property owners possess the opportunity of

subdividing and selling the land that is owned by them for a longer period of time (Barkoczy

2016). These generally happens where the primary produces possess the land at the outskirts

of the urban centres and the residential expansion signifies that the best use of land is for the

residential purpose. This brings forward the question that the extent of developmental activity

undertaken may be such that the it signifies carrying on of the business of property

development. However, prior to embarking on the detailed analysis it is necessary to

understand that the developing the land is the mere realisation and also necessary to

determine that if the land was actually acquired or bought with the actual intent of resale at

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION

profit or development (Davison Monotti and Wiseman, 2015). The profit that is made from

the sale or development of the subdivided land would be treated as the ordinary income

notwithstanding of the sale of project. Therefore, when providing you advice in respect of

these issues it is noteworthy to determine whether there is any prevalent indication of

deriving profit while acquiring or inheriting the property.

The same problem was confronted to the taxpayer in the case of “Reiger v

Commissioner of Taxation (2002) AATA 1989” (Saad 2014). The problem for the taxpayer

was that after acquiring the property the intention of the taxpayer was to subdivide the land

with the strategic objective of creating the opportunity of constructing the housing lots.

Therefore, such statement of intention to subdivide the land was regarded as the fatal to the

argument of the taxpayer that the taxpayer intention is to establish the business on the land.

We would like to inform you that, as per the Australian Taxation Office it views the

issues in a manner that the court has considered whether the taxpayer that develops the land

has undertaken the activities of mere realisation or embarked on the profit making activities

or business (Miller and Oats 2016). Similarly, in the case of “Westfield v Commissioner of

Taxation (1991)” once it is understood that activity of buying and selling resulted in the

profit was the activity under the ordinary business course, then the profit that is in question

would only become the part of the taxable income of the appellant by virtue of the being the

income in respect of the ordinary concepts of mankind, provided that the appellant has the

profit making intention during acquisition.

The information furnished by you suggest that you subdivided the land into two lots

and constructed a 700 m2 house on it for a costs of $350,000 while the smaller house costed

you $300,000 for 300 m2. Following the completion of the property you put the property for

sale in the market and eventually sold the larger 700 m2 for a sum of $750,000.

Descending from the above made explanation it is clear that the activity of

subdividing the land and selling the same constituted business activities with the clear

intention of making profit (Barkoczy 2017). You carried the profit making intention at the

time of inheriting the property. The property was developed by you in the enterprising

manner and this development involved carrying on the business of land development. The

gains that that you made from the property would be considered as taxable capital gains.

Citing the example of “Californian Cooper Syndicates v Harris (1904)” held that gains

made from the sale of land was assessable capital gains (Sadiq 2018).

profit or development (Davison Monotti and Wiseman, 2015). The profit that is made from

the sale or development of the subdivided land would be treated as the ordinary income

notwithstanding of the sale of project. Therefore, when providing you advice in respect of

these issues it is noteworthy to determine whether there is any prevalent indication of

deriving profit while acquiring or inheriting the property.

The same problem was confronted to the taxpayer in the case of “Reiger v

Commissioner of Taxation (2002) AATA 1989” (Saad 2014). The problem for the taxpayer

was that after acquiring the property the intention of the taxpayer was to subdivide the land

with the strategic objective of creating the opportunity of constructing the housing lots.

Therefore, such statement of intention to subdivide the land was regarded as the fatal to the

argument of the taxpayer that the taxpayer intention is to establish the business on the land.

We would like to inform you that, as per the Australian Taxation Office it views the

issues in a manner that the court has considered whether the taxpayer that develops the land

has undertaken the activities of mere realisation or embarked on the profit making activities

or business (Miller and Oats 2016). Similarly, in the case of “Westfield v Commissioner of

Taxation (1991)” once it is understood that activity of buying and selling resulted in the

profit was the activity under the ordinary business course, then the profit that is in question

would only become the part of the taxable income of the appellant by virtue of the being the

income in respect of the ordinary concepts of mankind, provided that the appellant has the

profit making intention during acquisition.

The information furnished by you suggest that you subdivided the land into two lots

and constructed a 700 m2 house on it for a costs of $350,000 while the smaller house costed

you $300,000 for 300 m2. Following the completion of the property you put the property for

sale in the market and eventually sold the larger 700 m2 for a sum of $750,000.

Descending from the above made explanation it is clear that the activity of

subdividing the land and selling the same constituted business activities with the clear

intention of making profit (Barkoczy 2017). You carried the profit making intention at the

time of inheriting the property. The property was developed by you in the enterprising

manner and this development involved carrying on the business of land development. The

gains that that you made from the property would be considered as taxable capital gains.

Citing the example of “Californian Cooper Syndicates v Harris (1904)” held that gains

made from the sale of land was assessable capital gains (Sadiq 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION

We would like to inform you that subdividing and selling the newly block of land and

the profits that is made by you will be treated as the taxable capital gains and will be

subjected to capital gains tax. The rationale for this is that, you held the intention or the

purpose of deriving profit or gains at the time of entering into the transaction (Morgan,

Mortimer and Pinto, 2018). Additionally, a transaction was entered into by you and the profit

was eventually made upon the sale of new constructed 700 m2 square house in the due course

of carrying on of the business or executing the business or commercial transaction. A capital

gain was made by you when you sold the land. A “CGT event A1” happened under “section

104-10(1) of the ITAA 1997” when the house was sold (Pert, Chen and Carvosso 2018).

To calculate your capital gains the date when you inherited the property and

subdivided the land is the date you have bought the original parcel of land (Robin 2019). The

costs of the actual land are divided among the subdivided block of land on the reasonable

basis.

CGT implications on the sale of furnishings and antiques:

In the later part of the year you reported the sale of furnishings at the local markets

that fetched you a sum of $3,000 however you made an overall loss of $4,000 from the sale

of furnishings. Additionally, some of the antiques were also sold by you to the dealers which

included the dining sets, wardrobe and the antique dresser.

According to the “section 108-10(2) of the ITAA 1997” collectibles includes any

kind of artwork, jewellery, an antique or the coin or the medallion (Robin and Barkoczy

2019). The collectibles also comprise of the rare portfolio, manuscript or book and includes

the postage stamp or the first day cover. The collectables are generally kept by the taxpayer

for their own personal enjoyment or usage. We would also like to make you aware that there

are some kind of special rules that are applicable to the collectibles (Kenny, Blissenden and

Villios 2018). This includes that the capital gains and capital losses that are made from the

collectables should be disregarded when the first element of a collectable acquisition price is

lower than $500.

We seek to inform you regarding the quarantining rule that relates to collectable. This

includes that the capital loss that are made from the collectibles is only allowed to be offset

against the capital gains that are made from the collectibles (Sheffrin 2018). As per the

transactions reported by you, a capital gain of $3,000 was made from the furnishings of the

We would like to inform you that subdividing and selling the newly block of land and

the profits that is made by you will be treated as the taxable capital gains and will be

subjected to capital gains tax. The rationale for this is that, you held the intention or the

purpose of deriving profit or gains at the time of entering into the transaction (Morgan,

Mortimer and Pinto, 2018). Additionally, a transaction was entered into by you and the profit

was eventually made upon the sale of new constructed 700 m2 square house in the due course

of carrying on of the business or executing the business or commercial transaction. A capital

gain was made by you when you sold the land. A “CGT event A1” happened under “section

104-10(1) of the ITAA 1997” when the house was sold (Pert, Chen and Carvosso 2018).

To calculate your capital gains the date when you inherited the property and

subdivided the land is the date you have bought the original parcel of land (Robin 2019). The

costs of the actual land are divided among the subdivided block of land on the reasonable

basis.

CGT implications on the sale of furnishings and antiques:

In the later part of the year you reported the sale of furnishings at the local markets

that fetched you a sum of $3,000 however you made an overall loss of $4,000 from the sale

of furnishings. Additionally, some of the antiques were also sold by you to the dealers which

included the dining sets, wardrobe and the antique dresser.

According to the “section 108-10(2) of the ITAA 1997” collectibles includes any

kind of artwork, jewellery, an antique or the coin or the medallion (Robin and Barkoczy

2019). The collectibles also comprise of the rare portfolio, manuscript or book and includes

the postage stamp or the first day cover. The collectables are generally kept by the taxpayer

for their own personal enjoyment or usage. We would also like to make you aware that there

are some kind of special rules that are applicable to the collectibles (Kenny, Blissenden and

Villios 2018). This includes that the capital gains and capital losses that are made from the

collectables should be disregarded when the first element of a collectable acquisition price is

lower than $500.

We seek to inform you regarding the quarantining rule that relates to collectable. This

includes that the capital loss that are made from the collectibles is only allowed to be offset

against the capital gains that are made from the collectibles (Sheffrin 2018). As per the

transactions reported by you, a capital gain of $3,000 was made from the furnishings of the

5TAXATION

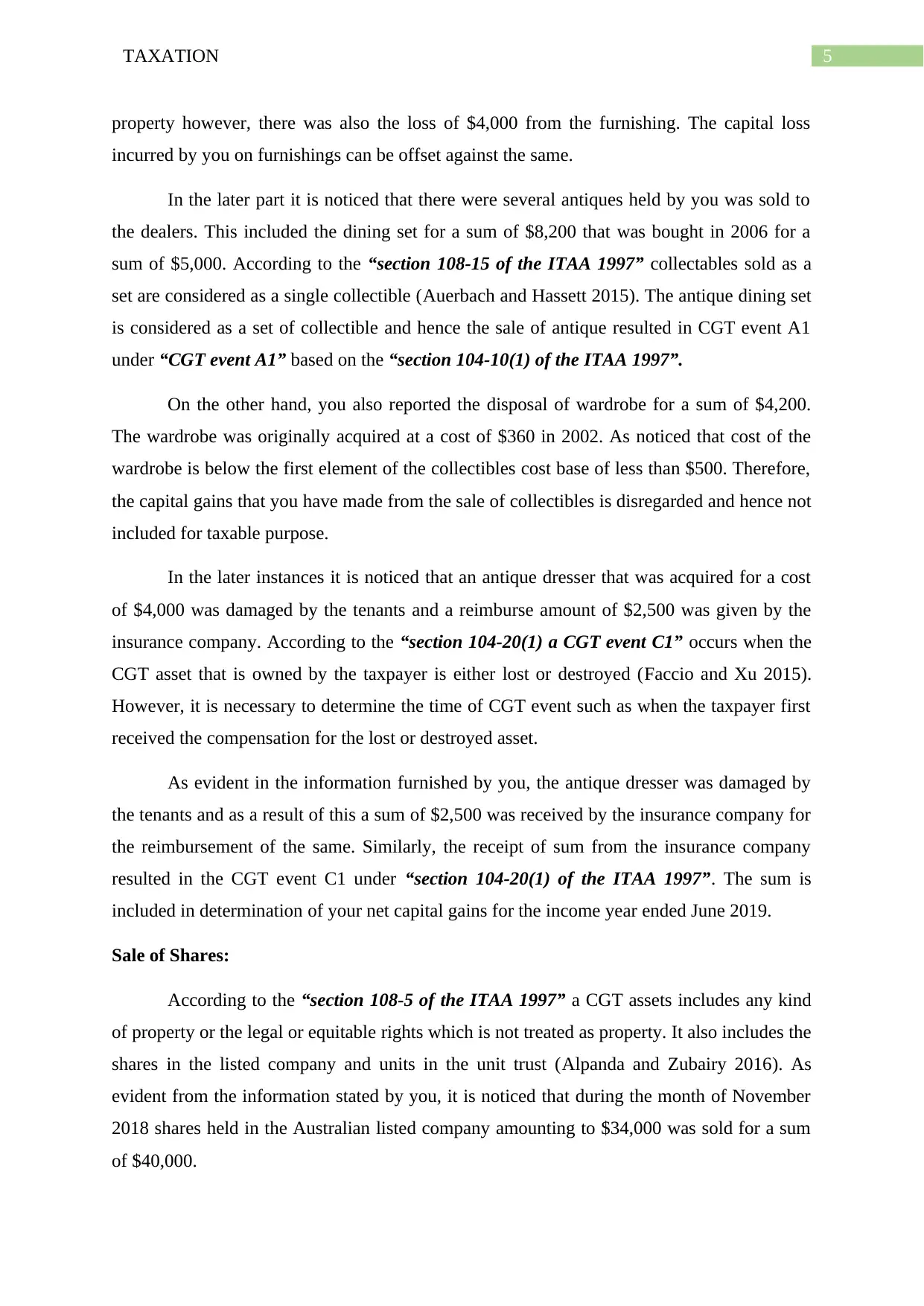

property however, there was also the loss of $4,000 from the furnishing. The capital loss

incurred by you on furnishings can be offset against the same.

In the later part it is noticed that there were several antiques held by you was sold to

the dealers. This included the dining set for a sum of $8,200 that was bought in 2006 for a

sum of $5,000. According to the “section 108-15 of the ITAA 1997” collectables sold as a

set are considered as a single collectible (Auerbach and Hassett 2015). The antique dining set

is considered as a set of collectible and hence the sale of antique resulted in CGT event A1

under “CGT event A1” based on the “section 104-10(1) of the ITAA 1997”.

On the other hand, you also reported the disposal of wardrobe for a sum of $4,200.

The wardrobe was originally acquired at a cost of $360 in 2002. As noticed that cost of the

wardrobe is below the first element of the collectibles cost base of less than $500. Therefore,

the capital gains that you have made from the sale of collectibles is disregarded and hence not

included for taxable purpose.

In the later instances it is noticed that an antique dresser that was acquired for a cost

of $4,000 was damaged by the tenants and a reimburse amount of $2,500 was given by the

insurance company. According to the “section 104-20(1) a CGT event C1” occurs when the

CGT asset that is owned by the taxpayer is either lost or destroyed (Faccio and Xu 2015).

However, it is necessary to determine the time of CGT event such as when the taxpayer first

received the compensation for the lost or destroyed asset.

As evident in the information furnished by you, the antique dresser was damaged by

the tenants and as a result of this a sum of $2,500 was received by the insurance company for

the reimbursement of the same. Similarly, the receipt of sum from the insurance company

resulted in the CGT event C1 under “section 104-20(1) of the ITAA 1997”. The sum is

included in determination of your net capital gains for the income year ended June 2019.

Sale of Shares:

According to the “section 108-5 of the ITAA 1997” a CGT assets includes any kind

of property or the legal or equitable rights which is not treated as property. It also includes the

shares in the listed company and units in the unit trust (Alpanda and Zubairy 2016). As

evident from the information stated by you, it is noticed that during the month of November

2018 shares held in the Australian listed company amounting to $34,000 was sold for a sum

of $40,000.

property however, there was also the loss of $4,000 from the furnishing. The capital loss

incurred by you on furnishings can be offset against the same.

In the later part it is noticed that there were several antiques held by you was sold to

the dealers. This included the dining set for a sum of $8,200 that was bought in 2006 for a

sum of $5,000. According to the “section 108-15 of the ITAA 1997” collectables sold as a

set are considered as a single collectible (Auerbach and Hassett 2015). The antique dining set

is considered as a set of collectible and hence the sale of antique resulted in CGT event A1

under “CGT event A1” based on the “section 104-10(1) of the ITAA 1997”.

On the other hand, you also reported the disposal of wardrobe for a sum of $4,200.

The wardrobe was originally acquired at a cost of $360 in 2002. As noticed that cost of the

wardrobe is below the first element of the collectibles cost base of less than $500. Therefore,

the capital gains that you have made from the sale of collectibles is disregarded and hence not

included for taxable purpose.

In the later instances it is noticed that an antique dresser that was acquired for a cost

of $4,000 was damaged by the tenants and a reimburse amount of $2,500 was given by the

insurance company. According to the “section 104-20(1) a CGT event C1” occurs when the

CGT asset that is owned by the taxpayer is either lost or destroyed (Faccio and Xu 2015).

However, it is necessary to determine the time of CGT event such as when the taxpayer first

received the compensation for the lost or destroyed asset.

As evident in the information furnished by you, the antique dresser was damaged by

the tenants and as a result of this a sum of $2,500 was received by the insurance company for

the reimbursement of the same. Similarly, the receipt of sum from the insurance company

resulted in the CGT event C1 under “section 104-20(1) of the ITAA 1997”. The sum is

included in determination of your net capital gains for the income year ended June 2019.

Sale of Shares:

According to the “section 108-5 of the ITAA 1997” a CGT assets includes any kind

of property or the legal or equitable rights which is not treated as property. It also includes the

shares in the listed company and units in the unit trust (Alpanda and Zubairy 2016). As

evident from the information stated by you, it is noticed that during the month of November

2018 shares held in the Australian listed company amounting to $34,000 was sold for a sum

of $40,000.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION

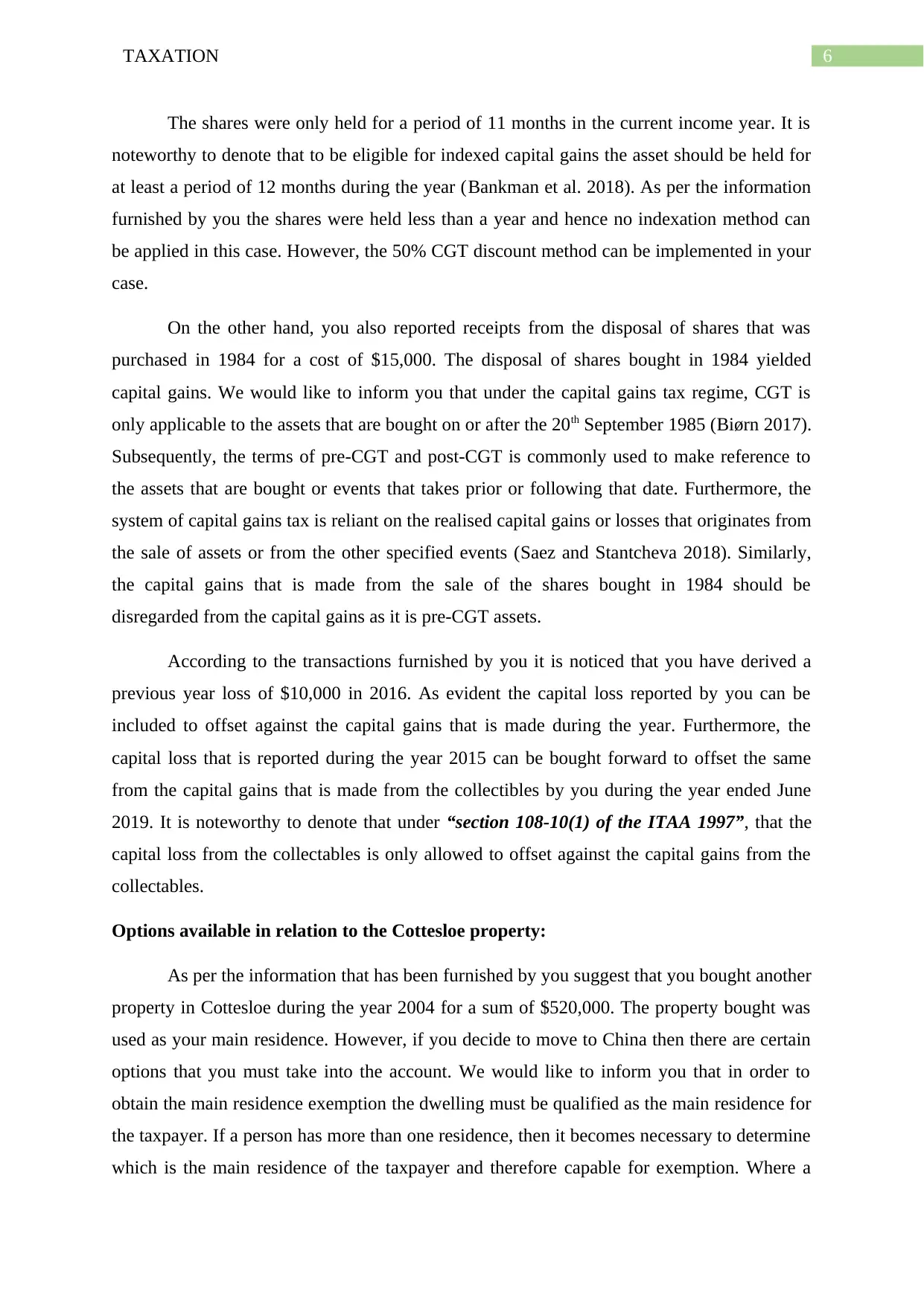

The shares were only held for a period of 11 months in the current income year. It is

noteworthy to denote that to be eligible for indexed capital gains the asset should be held for

at least a period of 12 months during the year (Bankman et al. 2018). As per the information

furnished by you the shares were held less than a year and hence no indexation method can

be applied in this case. However, the 50% CGT discount method can be implemented in your

case.

On the other hand, you also reported receipts from the disposal of shares that was

purchased in 1984 for a cost of $15,000. The disposal of shares bought in 1984 yielded

capital gains. We would like to inform you that under the capital gains tax regime, CGT is

only applicable to the assets that are bought on or after the 20th September 1985 (Biørn 2017).

Subsequently, the terms of pre-CGT and post-CGT is commonly used to make reference to

the assets that are bought or events that takes prior or following that date. Furthermore, the

system of capital gains tax is reliant on the realised capital gains or losses that originates from

the sale of assets or from the other specified events (Saez and Stantcheva 2018). Similarly,

the capital gains that is made from the sale of the shares bought in 1984 should be

disregarded from the capital gains as it is pre-CGT assets.

According to the transactions furnished by you it is noticed that you have derived a

previous year loss of $10,000 in 2016. As evident the capital loss reported by you can be

included to offset against the capital gains that is made during the year. Furthermore, the

capital loss that is reported during the year 2015 can be bought forward to offset the same

from the capital gains that is made from the collectibles by you during the year ended June

2019. It is noteworthy to denote that under “section 108-10(1) of the ITAA 1997”, that the

capital loss from the collectables is only allowed to offset against the capital gains from the

collectables.

Options available in relation to the Cottesloe property:

As per the information that has been furnished by you suggest that you bought another

property in Cottesloe during the year 2004 for a sum of $520,000. The property bought was

used as your main residence. However, if you decide to move to China then there are certain

options that you must take into the account. We would like to inform you that in order to

obtain the main residence exemption the dwelling must be qualified as the main residence for

the taxpayer. If a person has more than one residence, then it becomes necessary to determine

which is the main residence of the taxpayer and therefore capable for exemption. Where a

The shares were only held for a period of 11 months in the current income year. It is

noteworthy to denote that to be eligible for indexed capital gains the asset should be held for

at least a period of 12 months during the year (Bankman et al. 2018). As per the information

furnished by you the shares were held less than a year and hence no indexation method can

be applied in this case. However, the 50% CGT discount method can be implemented in your

case.

On the other hand, you also reported receipts from the disposal of shares that was

purchased in 1984 for a cost of $15,000. The disposal of shares bought in 1984 yielded

capital gains. We would like to inform you that under the capital gains tax regime, CGT is

only applicable to the assets that are bought on or after the 20th September 1985 (Biørn 2017).

Subsequently, the terms of pre-CGT and post-CGT is commonly used to make reference to

the assets that are bought or events that takes prior or following that date. Furthermore, the

system of capital gains tax is reliant on the realised capital gains or losses that originates from

the sale of assets or from the other specified events (Saez and Stantcheva 2018). Similarly,

the capital gains that is made from the sale of the shares bought in 1984 should be

disregarded from the capital gains as it is pre-CGT assets.

According to the transactions furnished by you it is noticed that you have derived a

previous year loss of $10,000 in 2016. As evident the capital loss reported by you can be

included to offset against the capital gains that is made during the year. Furthermore, the

capital loss that is reported during the year 2015 can be bought forward to offset the same

from the capital gains that is made from the collectibles by you during the year ended June

2019. It is noteworthy to denote that under “section 108-10(1) of the ITAA 1997”, that the

capital loss from the collectables is only allowed to offset against the capital gains from the

collectables.

Options available in relation to the Cottesloe property:

As per the information that has been furnished by you suggest that you bought another

property in Cottesloe during the year 2004 for a sum of $520,000. The property bought was

used as your main residence. However, if you decide to move to China then there are certain

options that you must take into the account. We would like to inform you that in order to

obtain the main residence exemption the dwelling must be qualified as the main residence for

the taxpayer. If a person has more than one residence, then it becomes necessary to determine

which is the main residence of the taxpayer and therefore capable for exemption. Where a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

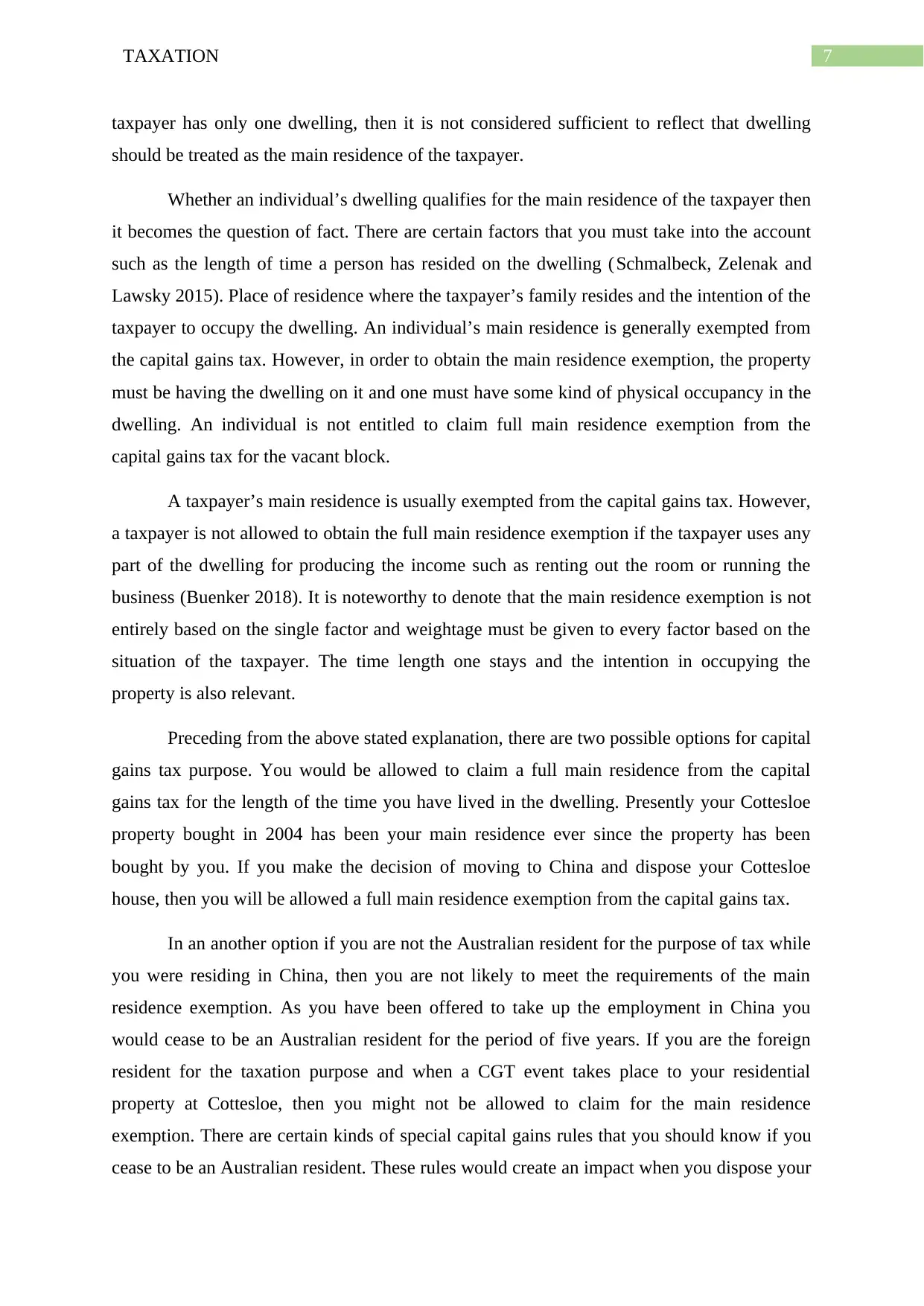

7TAXATION

taxpayer has only one dwelling, then it is not considered sufficient to reflect that dwelling

should be treated as the main residence of the taxpayer.

Whether an individual’s dwelling qualifies for the main residence of the taxpayer then

it becomes the question of fact. There are certain factors that you must take into the account

such as the length of time a person has resided on the dwelling (Schmalbeck, Zelenak and

Lawsky 2015). Place of residence where the taxpayer’s family resides and the intention of the

taxpayer to occupy the dwelling. An individual’s main residence is generally exempted from

the capital gains tax. However, in order to obtain the main residence exemption, the property

must be having the dwelling on it and one must have some kind of physical occupancy in the

dwelling. An individual is not entitled to claim full main residence exemption from the

capital gains tax for the vacant block.

A taxpayer’s main residence is usually exempted from the capital gains tax. However,

a taxpayer is not allowed to obtain the full main residence exemption if the taxpayer uses any

part of the dwelling for producing the income such as renting out the room or running the

business (Buenker 2018). It is noteworthy to denote that the main residence exemption is not

entirely based on the single factor and weightage must be given to every factor based on the

situation of the taxpayer. The time length one stays and the intention in occupying the

property is also relevant.

Preceding from the above stated explanation, there are two possible options for capital

gains tax purpose. You would be allowed to claim a full main residence from the capital

gains tax for the length of the time you have lived in the dwelling. Presently your Cottesloe

property bought in 2004 has been your main residence ever since the property has been

bought by you. If you make the decision of moving to China and dispose your Cottesloe

house, then you will be allowed a full main residence exemption from the capital gains tax.

In an another option if you are not the Australian resident for the purpose of tax while

you were residing in China, then you are not likely to meet the requirements of the main

residence exemption. As you have been offered to take up the employment in China you

would cease to be an Australian resident for the period of five years. If you are the foreign

resident for the taxation purpose and when a CGT event takes place to your residential

property at Cottesloe, then you might not be allowed to claim for the main residence

exemption. There are certain kinds of special capital gains rules that you should know if you

cease to be an Australian resident. These rules would create an impact when you dispose your

taxpayer has only one dwelling, then it is not considered sufficient to reflect that dwelling

should be treated as the main residence of the taxpayer.

Whether an individual’s dwelling qualifies for the main residence of the taxpayer then

it becomes the question of fact. There are certain factors that you must take into the account

such as the length of time a person has resided on the dwelling (Schmalbeck, Zelenak and

Lawsky 2015). Place of residence where the taxpayer’s family resides and the intention of the

taxpayer to occupy the dwelling. An individual’s main residence is generally exempted from

the capital gains tax. However, in order to obtain the main residence exemption, the property

must be having the dwelling on it and one must have some kind of physical occupancy in the

dwelling. An individual is not entitled to claim full main residence exemption from the

capital gains tax for the vacant block.

A taxpayer’s main residence is usually exempted from the capital gains tax. However,

a taxpayer is not allowed to obtain the full main residence exemption if the taxpayer uses any

part of the dwelling for producing the income such as renting out the room or running the

business (Buenker 2018). It is noteworthy to denote that the main residence exemption is not

entirely based on the single factor and weightage must be given to every factor based on the

situation of the taxpayer. The time length one stays and the intention in occupying the

property is also relevant.

Preceding from the above stated explanation, there are two possible options for capital

gains tax purpose. You would be allowed to claim a full main residence from the capital

gains tax for the length of the time you have lived in the dwelling. Presently your Cottesloe

property bought in 2004 has been your main residence ever since the property has been

bought by you. If you make the decision of moving to China and dispose your Cottesloe

house, then you will be allowed a full main residence exemption from the capital gains tax.

In an another option if you are not the Australian resident for the purpose of tax while

you were residing in China, then you are not likely to meet the requirements of the main

residence exemption. As you have been offered to take up the employment in China you

would cease to be an Australian resident for the period of five years. If you are the foreign

resident for the taxation purpose and when a CGT event takes place to your residential

property at Cottesloe, then you might not be allowed to claim for the main residence

exemption. There are certain kinds of special capital gains rules that you should know if you

cease to be an Australian resident. These rules would create an impact when you dispose your

8TAXATION

residential property in Australia (Abrams and Leatherman 2019). If you are not the Australian

resident for the purpose of tax, then your residency status for the previous income year would

become irrelevant.

In the final option if you decide to move to China and let out the property for the

period of your stay away from Australian then you would be entitled to partial main residence

exemption. In other words, as per the Australian Taxation Office, an individual is not allowed

to claim full main residence exemption if you use any portion of the dwelling for producing

the income such as renting out house.

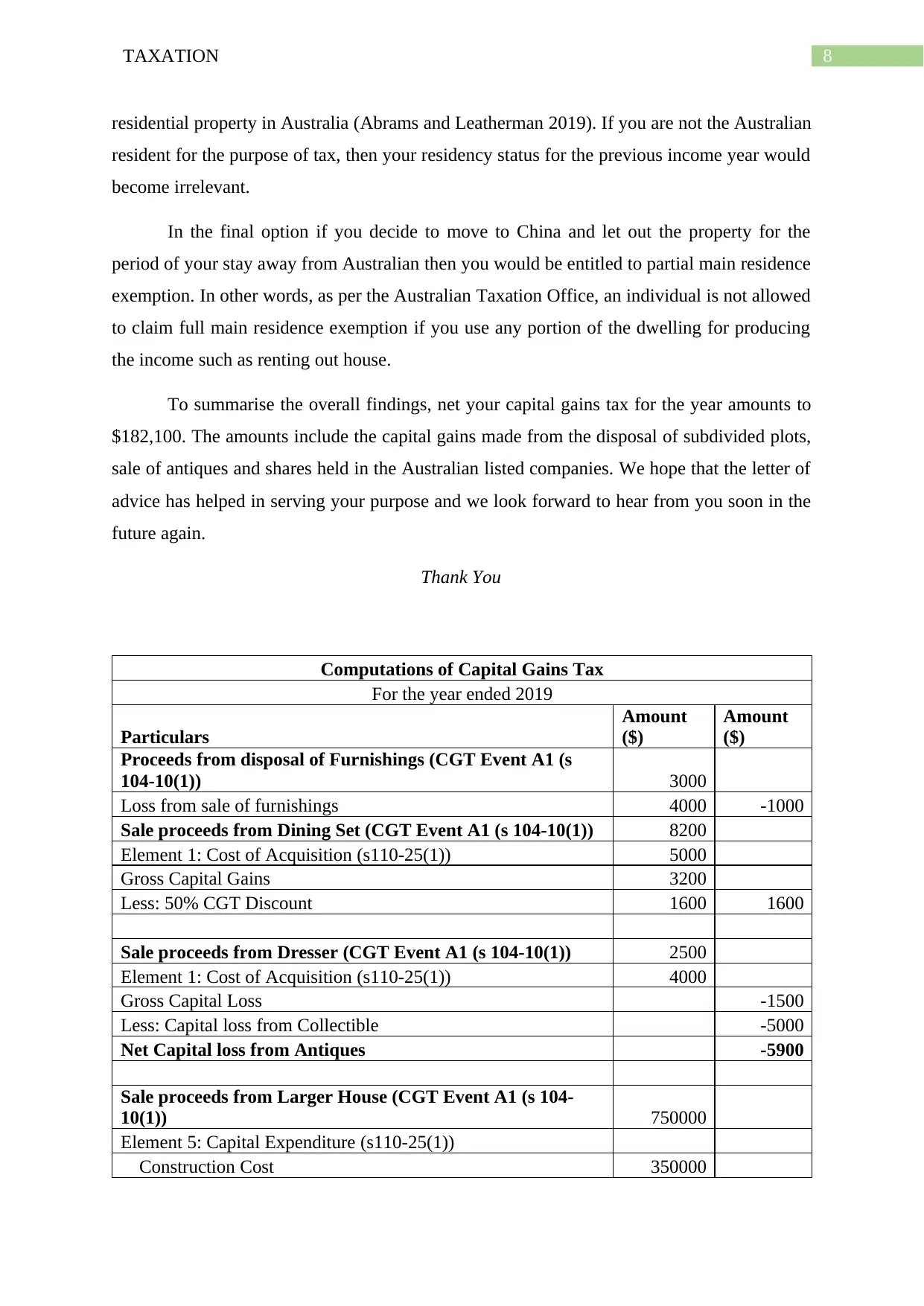

To summarise the overall findings, net your capital gains tax for the year amounts to

$182,100. The amounts include the capital gains made from the disposal of subdivided plots,

sale of antiques and shares held in the Australian listed companies. We hope that the letter of

advice has helped in serving your purpose and we look forward to hear from you soon in the

future again.

Thank You

Computations of Capital Gains Tax

For the year ended 2019

Particulars

Amount

($)

Amount

($)

Proceeds from disposal of Furnishings (CGT Event A1 (s

104-10(1)) 3000

Loss from sale of furnishings 4000 -1000

Sale proceeds from Dining Set (CGT Event A1 (s 104-10(1)) 8200

Element 1: Cost of Acquisition (s110-25(1)) 5000

Gross Capital Gains 3200

Less: 50% CGT Discount 1600 1600

Sale proceeds from Dresser (CGT Event A1 (s 104-10(1)) 2500

Element 1: Cost of Acquisition (s110-25(1)) 4000

Gross Capital Loss -1500

Less: Capital loss from Collectible -5000

Net Capital loss from Antiques -5900

Sale proceeds from Larger House (CGT Event A1 (s 104-

10(1)) 750000

Element 5: Capital Expenditure (s110-25(1))

Construction Cost 350000

residential property in Australia (Abrams and Leatherman 2019). If you are not the Australian

resident for the purpose of tax, then your residency status for the previous income year would

become irrelevant.

In the final option if you decide to move to China and let out the property for the

period of your stay away from Australian then you would be entitled to partial main residence

exemption. In other words, as per the Australian Taxation Office, an individual is not allowed

to claim full main residence exemption if you use any portion of the dwelling for producing

the income such as renting out house.

To summarise the overall findings, net your capital gains tax for the year amounts to

$182,100. The amounts include the capital gains made from the disposal of subdivided plots,

sale of antiques and shares held in the Australian listed companies. We hope that the letter of

advice has helped in serving your purpose and we look forward to hear from you soon in the

future again.

Thank You

Computations of Capital Gains Tax

For the year ended 2019

Particulars

Amount

($)

Amount

($)

Proceeds from disposal of Furnishings (CGT Event A1 (s

104-10(1)) 3000

Loss from sale of furnishings 4000 -1000

Sale proceeds from Dining Set (CGT Event A1 (s 104-10(1)) 8200

Element 1: Cost of Acquisition (s110-25(1)) 5000

Gross Capital Gains 3200

Less: 50% CGT Discount 1600 1600

Sale proceeds from Dresser (CGT Event A1 (s 104-10(1)) 2500

Element 1: Cost of Acquisition (s110-25(1)) 4000

Gross Capital Loss -1500

Less: Capital loss from Collectible -5000

Net Capital loss from Antiques -5900

Sale proceeds from Larger House (CGT Event A1 (s 104-

10(1)) 750000

Element 5: Capital Expenditure (s110-25(1))

Construction Cost 350000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

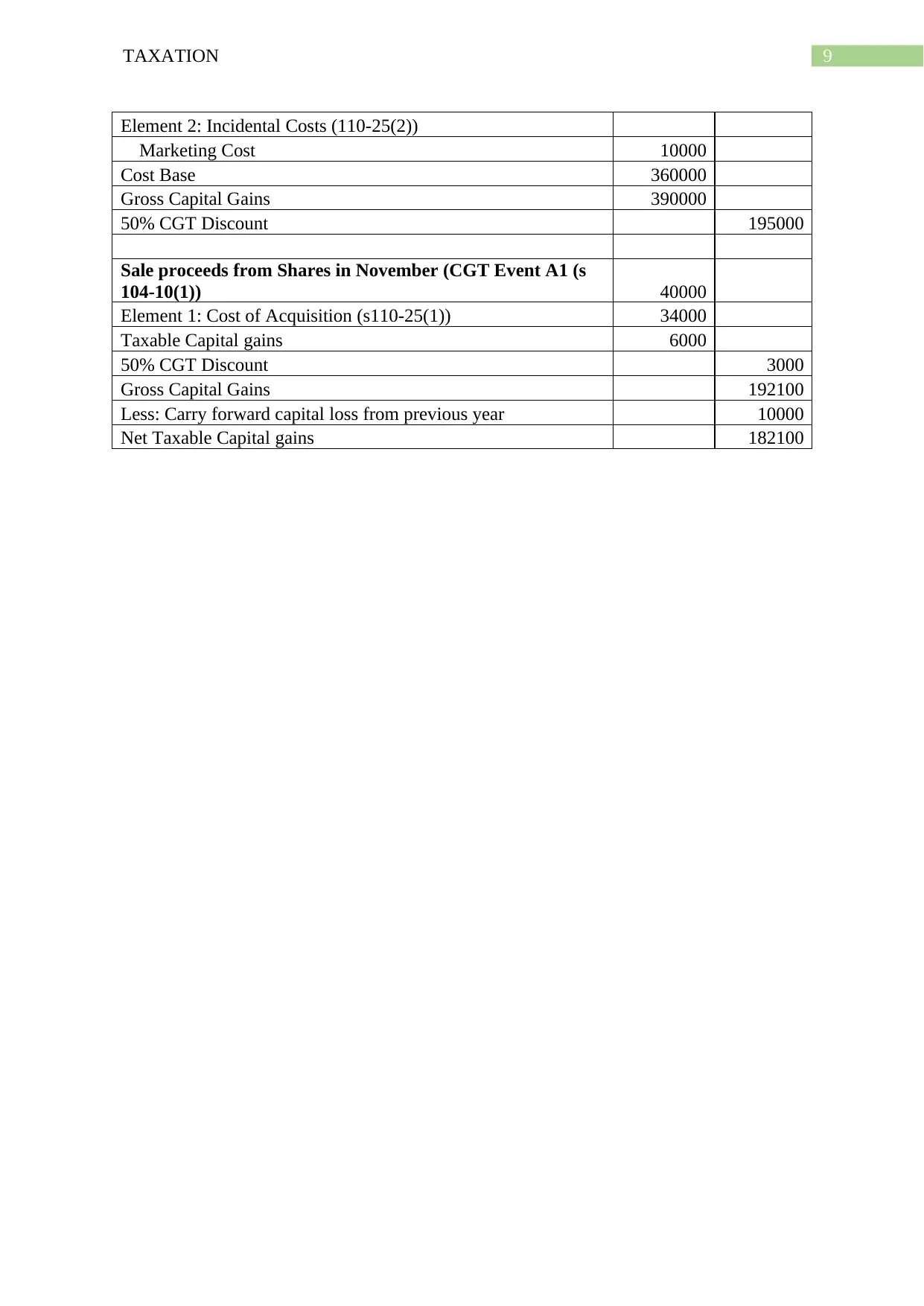

9TAXATION

Element 2: Incidental Costs (110-25(2))

Marketing Cost 10000

Cost Base 360000

Gross Capital Gains 390000

50% CGT Discount 195000

Sale proceeds from Shares in November (CGT Event A1 (s

104-10(1)) 40000

Element 1: Cost of Acquisition (s110-25(1)) 34000

Taxable Capital gains 6000

50% CGT Discount 3000

Gross Capital Gains 192100

Less: Carry forward capital loss from previous year 10000

Net Taxable Capital gains 182100

Element 2: Incidental Costs (110-25(2))

Marketing Cost 10000

Cost Base 360000

Gross Capital Gains 390000

50% CGT Discount 195000

Sale proceeds from Shares in November (CGT Event A1 (s

104-10(1)) 40000

Element 1: Cost of Acquisition (s110-25(1)) 34000

Taxable Capital gains 6000

50% CGT Discount 3000

Gross Capital Gains 192100

Less: Carry forward capital loss from previous year 10000

Net Taxable Capital gains 182100

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION

References:

Abrams, H.E. and Leatherman, D., 2019. Federal income taxation of corporations and

partnerships. Wolters Kluwer Law & Business.

Alpanda, S. and Zubairy, S., 2016. Housing and tax policy. Journal of Money, Credit and

Banking, 48(2-3), pp.485-512.

Auerbach, A.J. and Hassett, K., 2015. Capital taxation in the twenty-first century. American

Economic Review, 105(5), pp.38-42.

Bankman, J., Shaviro, D.N., Stark, K.J. and Kleinbard, E.D., 2018. Federal Income Taxation.

Aspen Casebook.

Barkoczy, S. (2017). Core tax legislation and study guide. OUP Catalogue.

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Biørn, E., 2017. Taxation, technology, and the user cost of capital (Vol. 182). Elsevier.

Buenker, J.D., 2018. The Income Tax and the Progressive Era. Routledge.

Davison, M., Monotti, A. and Wiseman, L., 2015. Australian intellectual property law.

Cambridge University Press.

Faccio, M. and Xu, J., 2015. Taxes and capital structure. Journal of Financial and

Quantitative Analysis, 50(3), pp.277-300.

Kenny, P., Blissenden, M. and Villios, S., 2018. Australian Tax 2018.

Miller, A. and Oats, L., 2016. Principles of international taxation. Bloomsbury Publishing.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian taxation

law 2018.

Pert, A., Chen, H. and Carvosso, R., 2018. 'Federal Commissioner of Taxation v

Jayasinghe'(2016) 247 FCR 40. Australian Year Book of International Law, 35, p.260.

ROBIN & BARKOCZY WOELLNER (STEPHEN & MURPHY, SHIRLEY ET AL.),

2019. AUSTRALIAN TAXATION LAW SELECT 2019: Legislation and Commentary.

OXFORD University Press.

ROBIN, H., 2019. AUSTRALIAN TAXATION LAW 2019. OXFORD University Press.

References:

Abrams, H.E. and Leatherman, D., 2019. Federal income taxation of corporations and

partnerships. Wolters Kluwer Law & Business.

Alpanda, S. and Zubairy, S., 2016. Housing and tax policy. Journal of Money, Credit and

Banking, 48(2-3), pp.485-512.

Auerbach, A.J. and Hassett, K., 2015. Capital taxation in the twenty-first century. American

Economic Review, 105(5), pp.38-42.

Bankman, J., Shaviro, D.N., Stark, K.J. and Kleinbard, E.D., 2018. Federal Income Taxation.

Aspen Casebook.

Barkoczy, S. (2017). Core tax legislation and study guide. OUP Catalogue.

Barkoczy, S., 2016. Foundations of taxation law 2016. OUP Catalogue.

Biørn, E., 2017. Taxation, technology, and the user cost of capital (Vol. 182). Elsevier.

Buenker, J.D., 2018. The Income Tax and the Progressive Era. Routledge.

Davison, M., Monotti, A. and Wiseman, L., 2015. Australian intellectual property law.

Cambridge University Press.

Faccio, M. and Xu, J., 2015. Taxes and capital structure. Journal of Financial and

Quantitative Analysis, 50(3), pp.277-300.

Kenny, P., Blissenden, M. and Villios, S., 2018. Australian Tax 2018.

Miller, A. and Oats, L., 2016. Principles of international taxation. Bloomsbury Publishing.

Morgan, A., Mortimer, C. and Pinto, D., 2018. A practical introduction to Australian taxation

law 2018.

Pert, A., Chen, H. and Carvosso, R., 2018. 'Federal Commissioner of Taxation v

Jayasinghe'(2016) 247 FCR 40. Australian Year Book of International Law, 35, p.260.

ROBIN & BARKOCZY WOELLNER (STEPHEN & MURPHY, SHIRLEY ET AL.),

2019. AUSTRALIAN TAXATION LAW SELECT 2019: Legislation and Commentary.

OXFORD University Press.

ROBIN, H., 2019. AUSTRALIAN TAXATION LAW 2019. OXFORD University Press.

11TAXATION

Saad, N., 2014. Tax knowledge, tax complexity and tax compliance: Taxpayers’

view. Procedia-Social and Behavioral Sciences, 109, pp.1069-1075.

Sadiq, K., 2018. Australian Tax Law Cases 2018. Thomson Reuters.

Saez, E. and Stantcheva, S., 2018. A simpler theory of optimal capital taxation. Journal of

Public Economics, 162, pp.120-142.

Schmalbeck, R., Zelenak, L. and Lawsky, S.B., 2015. Federal Income Taxation. Wolters

Kluwer Law & Business.

Sheffrin, S.M., 2018. The Domain of Desert Principles for Taxation. Erasmus Journal for

Philosophy and Economics, 11(2), pp.220-244.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

Saad, N., 2014. Tax knowledge, tax complexity and tax compliance: Taxpayers’

view. Procedia-Social and Behavioral Sciences, 109, pp.1069-1075.

Sadiq, K., 2018. Australian Tax Law Cases 2018. Thomson Reuters.

Saez, E. and Stantcheva, S., 2018. A simpler theory of optimal capital taxation. Journal of

Public Economics, 162, pp.120-142.

Schmalbeck, R., Zelenak, L. and Lawsky, S.B., 2015. Federal Income Taxation. Wolters

Kluwer Law & Business.

Sheffrin, S.M., 2018. The Domain of Desert Principles for Taxation. Erasmus Journal for

Philosophy and Economics, 11(2), pp.220-244.

Woellner, R., Barkoczy, S., Murphy, S., Evans, C. and Pinto, D., 2016. Australian Taxation

Law 2016. OUP Catalogue.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.