Taxation Theory, Practice & Law HI6028: CGT and FBT Liability Analysis

VerifiedAdded on 2021/06/17

|12

|3013

|52

Homework Assignment

AI Summary

This assignment solution analyzes the capital gains tax (CGT) and fringe benefits tax (FBT) implications for a client's financial transactions. Question 1 examines CGT liabilities arising from the sale of assets, including vacant land, an antique bed, shares, and a violin, considering cost base determination, pre-CGT assets, and the application of the discount method. The analysis includes detailed calculations of capital gains or losses, adjustments for previous losses, and the timing of CGT. Question 2 provides legal advice to Rapid Heat regarding its fringe benefits tax (FBT) consequences, specifically addressing the provision of a car, a loan, and an electric heater to an employee. It covers the calculation of FBT liabilities, including car fringe benefits based on the statutory formula, and loan fringe benefits considering concessional rates. The solution outlines the relevant provisions of the FBTAA 1986 and provides computations for each benefit, culminating in the determination of the FBT payable by Rapid Heat.

Taxation Theory, Practice & Law

HI6028

Student Name

[Pick the date]

HI6028

Student Name

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

The key issue in the context of scenario presented is to highlight the resulting capital gains or

losses from the various transactions that have been enacted by the client in the given financial

year. The cumulative capital gains or losses on which CGT (Capital Gains Tax) would be

applicable are also highlighted in the discussion and computation highlighted as follows.

Asset 1- Vacant Land

A key check for application of CGT related liability is whether the underlying asset is a pre-CGT

asset or not. This is ascertained as per s. 149(10) ITAA 1997 which clearly highlights that assets

which are bought on or before September 20, 1985 are categorised as pre-CGT asset. This

classification is essential considering that pre-CGT assets are CGT exempt (Nethercott,

Richardson and Devos, 2016).

In order to compute the capital gains or loss arising from a given transaction, it is required to

determine the appropriate event as per s. 104-5 ITAA 1997 where the underlying capital event

would fall. This is critical since the underlying event determines the precise formula for CGT

computation. With regards to land being sold, the relevant event as per s. 104-5 would be

classified as A1 event. As per this event, the capital gains or losses (as may be applicable) can be

calculated by the following formula (Sadique, et. al., 2015).

Applicable capital gains or losses = Proceeds from sales generated – Land bank cost base

Additional aspect to consider is the cost base determination which ought to be performed as

highlighted in s. 110-25 ITAA 1997. There are essentially five elements which constitute the cost

base of the asset (Reuters, 2017). These are summarised below.

Element 1: The acquisition cost associated with the asset as per ss. 110-25(2)

Element 2: The related costs while selling or buying of underlying asset as per ss. 110-25(3)

Element 3: The ownership costs related to the asset which includes cost incurred when the asset

is owned by the taxpayer and includes sewerage tax, land tax in case of vacant land as per ss.

110-25(4).

The key issue in the context of scenario presented is to highlight the resulting capital gains or

losses from the various transactions that have been enacted by the client in the given financial

year. The cumulative capital gains or losses on which CGT (Capital Gains Tax) would be

applicable are also highlighted in the discussion and computation highlighted as follows.

Asset 1- Vacant Land

A key check for application of CGT related liability is whether the underlying asset is a pre-CGT

asset or not. This is ascertained as per s. 149(10) ITAA 1997 which clearly highlights that assets

which are bought on or before September 20, 1985 are categorised as pre-CGT asset. This

classification is essential considering that pre-CGT assets are CGT exempt (Nethercott,

Richardson and Devos, 2016).

In order to compute the capital gains or loss arising from a given transaction, it is required to

determine the appropriate event as per s. 104-5 ITAA 1997 where the underlying capital event

would fall. This is critical since the underlying event determines the precise formula for CGT

computation. With regards to land being sold, the relevant event as per s. 104-5 would be

classified as A1 event. As per this event, the capital gains or losses (as may be applicable) can be

calculated by the following formula (Sadique, et. al., 2015).

Applicable capital gains or losses = Proceeds from sales generated – Land bank cost base

Additional aspect to consider is the cost base determination which ought to be performed as

highlighted in s. 110-25 ITAA 1997. There are essentially five elements which constitute the cost

base of the asset (Reuters, 2017). These are summarised below.

Element 1: The acquisition cost associated with the asset as per ss. 110-25(2)

Element 2: The related costs while selling or buying of underlying asset as per ss. 110-25(3)

Element 3: The ownership costs related to the asset which includes cost incurred when the asset

is owned by the taxpayer and includes sewerage tax, land tax in case of vacant land as per ss.

110-25(4).

Element 4: An expenditure which is capital in nature and incurred for value preservation or value

appreciation as per s. 110-25(4).

Element 5: An expenditure which is capital in nature and incurred for title preservation as per s.

110-25(5).

The computation of land cost base can be carried out as shown below.

Element 1: Price of acquisition = $ 100,000

Element 3: Expenses during period of ownership = $ 20,000

Land block cost base = Element 1 + Element 3 = $ 120,000

A key issue pertaining to the given transaction is in regards to the timing of CGT especially with

regards to those transactions where thee contract to sell the asset and settlement of the same do

not proceed in the same tax year. In such cases, tax ruling TR 94/29 requires that CGT

implications ought to be captured in the tax year when the sale contract enactment happens rather

than the year of settlement as payment on the contract can be made later (Sadique, et. al., 2015).

In line with this understanding, the CGT liability on the sale of land would arise in the current

tax year even though the corresponding cash would be received only in next year.

Also, it is known that the given client has a pending capital loss of $ 7,000 which ought to be

adjusted with the capital gains derived from sale of land. Therefore, net capital gains after

adjustment would amount to (200000-7000) or $ 193,000

With regards to long term capital gains for individual taxpayer, s. 115-25(1) offers the

application of discount method where half of the capital gains are provided concession on

(Sadique, et. al., 2015).

Asset 2: Antique Bed

appreciation as per s. 110-25(4).

Element 5: An expenditure which is capital in nature and incurred for title preservation as per s.

110-25(5).

The computation of land cost base can be carried out as shown below.

Element 1: Price of acquisition = $ 100,000

Element 3: Expenses during period of ownership = $ 20,000

Land block cost base = Element 1 + Element 3 = $ 120,000

A key issue pertaining to the given transaction is in regards to the timing of CGT especially with

regards to those transactions where thee contract to sell the asset and settlement of the same do

not proceed in the same tax year. In such cases, tax ruling TR 94/29 requires that CGT

implications ought to be captured in the tax year when the sale contract enactment happens rather

than the year of settlement as payment on the contract can be made later (Sadique, et. al., 2015).

In line with this understanding, the CGT liability on the sale of land would arise in the current

tax year even though the corresponding cash would be received only in next year.

Also, it is known that the given client has a pending capital loss of $ 7,000 which ought to be

adjusted with the capital gains derived from sale of land. Therefore, net capital gains after

adjustment would amount to (200000-7000) or $ 193,000

With regards to long term capital gains for individual taxpayer, s. 115-25(1) offers the

application of discount method where half of the capital gains are provided concession on

(Sadique, et. al., 2015).

Asset 2: Antique Bed

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

With regards to antique bed being sold, the relevant event as per s. 104-5 would be classified as

A1 event (Nethercott, Richardson and Devos, 2016). As per this event, the capital gains or losses

(as may be applicable) can be calculated by the following formula.

Applicable capital gains or losses = Proceeds from sales generated – Antique bed cost base

The antique bed on account of the purchase date is a post CGT asset with an acquisition price

exceeding $ 500. The net result would be that CGT would be applied on the net capital gains or

losses derived from the asset disposal. The computation of cost base for the asset under

consideration is highlighted as follows.

Element 1: Acquisition price = $ 3,500

Element 4: Expenditure of capital nature for increase in asset value = $ 1,500

Antique bed cost base = Element 1 + Element 4= $ 5,000

The asset disposal in this case is involuntary which has led to proceeds of $ 11,000 being

generated on account of insurance proceeds.

Hence, capital gains = 11000 – 5000 = $ 6,000

A previous capital loss to the tune of $ 1,500 exists from sculpture (a type of collectible) and

therefore will be adjusted in the capital gains before application of discount method. Hence,

capital gains after adjustment of previous losses = 6000-1500 = $ 4,500

With regards to long term capital gains for individual taxpayer, s. 115-25(1) offers the

application of discount method where half of the capital gains are provided concession on

(Sadique, et. al., 2015).

Asset 3: Painting

With regards to this asset, the data of purchase lies in the era when no CGT was applied on

capital gains. This, the painting is a pre CGT asset as per s. 149(10) ITAA 1997 and hence no

CGT implications would result from any capital gains or loss derived on the sale of this asset.

A1 event (Nethercott, Richardson and Devos, 2016). As per this event, the capital gains or losses

(as may be applicable) can be calculated by the following formula.

Applicable capital gains or losses = Proceeds from sales generated – Antique bed cost base

The antique bed on account of the purchase date is a post CGT asset with an acquisition price

exceeding $ 500. The net result would be that CGT would be applied on the net capital gains or

losses derived from the asset disposal. The computation of cost base for the asset under

consideration is highlighted as follows.

Element 1: Acquisition price = $ 3,500

Element 4: Expenditure of capital nature for increase in asset value = $ 1,500

Antique bed cost base = Element 1 + Element 4= $ 5,000

The asset disposal in this case is involuntary which has led to proceeds of $ 11,000 being

generated on account of insurance proceeds.

Hence, capital gains = 11000 – 5000 = $ 6,000

A previous capital loss to the tune of $ 1,500 exists from sculpture (a type of collectible) and

therefore will be adjusted in the capital gains before application of discount method. Hence,

capital gains after adjustment of previous losses = 6000-1500 = $ 4,500

With regards to long term capital gains for individual taxpayer, s. 115-25(1) offers the

application of discount method where half of the capital gains are provided concession on

(Sadique, et. al., 2015).

Asset 3: Painting

With regards to this asset, the data of purchase lies in the era when no CGT was applied on

capital gains. This, the painting is a pre CGT asset as per s. 149(10) ITAA 1997 and hence no

CGT implications would result from any capital gains or loss derived on the sale of this asset.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Asset 4: Shares

Share disposal corresponds to A1 event as per s. 104-5 ITAA 1997 (Nethercott, Richardson and

Devos, 2016). With regards to shares being sold, the relevant event as per s. 104-5 would be

classified as A1 event. As per this event, the capital gains or losses (as may be applicable) can be

calculated by the following formula.

Applicable capital gains or losses = Proceeds from sales generated –Shares cost base

(i) Element 1: Cost of acquisition = $15*1000 = $ 15,000

Element 2: Related incidental costs = $ 1,300 (750 on stamp duty and 550 brokerage related fee).

Cost base: Share Asset = 15000 +1300 = $ 16,300

Sales proceeds = 47*1000 = $ 47,000

Realised capital gains on share asset = 47000 – 16300 = $ 30,700

The resultant capital gain is long term owing to share being held by client for more than a year.

(ii) Element 1: Cost of acquisition = $12*2500 = $ 30,000

Element 2: Related incidental costs = $ 2,500 (1500 on stamp duty and 1000 brokerage related

fee).

Cost base: Share Asset = 30000 +2500 = $ 32,500

Sales proceeds = 25*2500 = $ 62,500

Realised capital gains on share asset = 62500 - 32500 = $ 30,000

The resultant capital gain is long term owing to share being held by client for more than a year.

Share disposal corresponds to A1 event as per s. 104-5 ITAA 1997 (Nethercott, Richardson and

Devos, 2016). With regards to shares being sold, the relevant event as per s. 104-5 would be

classified as A1 event. As per this event, the capital gains or losses (as may be applicable) can be

calculated by the following formula.

Applicable capital gains or losses = Proceeds from sales generated –Shares cost base

(i) Element 1: Cost of acquisition = $15*1000 = $ 15,000

Element 2: Related incidental costs = $ 1,300 (750 on stamp duty and 550 brokerage related fee).

Cost base: Share Asset = 15000 +1300 = $ 16,300

Sales proceeds = 47*1000 = $ 47,000

Realised capital gains on share asset = 47000 – 16300 = $ 30,700

The resultant capital gain is long term owing to share being held by client for more than a year.

(ii) Element 1: Cost of acquisition = $12*2500 = $ 30,000

Element 2: Related incidental costs = $ 2,500 (1500 on stamp duty and 1000 brokerage related

fee).

Cost base: Share Asset = 30000 +2500 = $ 32,500

Sales proceeds = 25*2500 = $ 62,500

Realised capital gains on share asset = 62500 - 32500 = $ 30,000

The resultant capital gain is long term owing to share being held by client for more than a year.

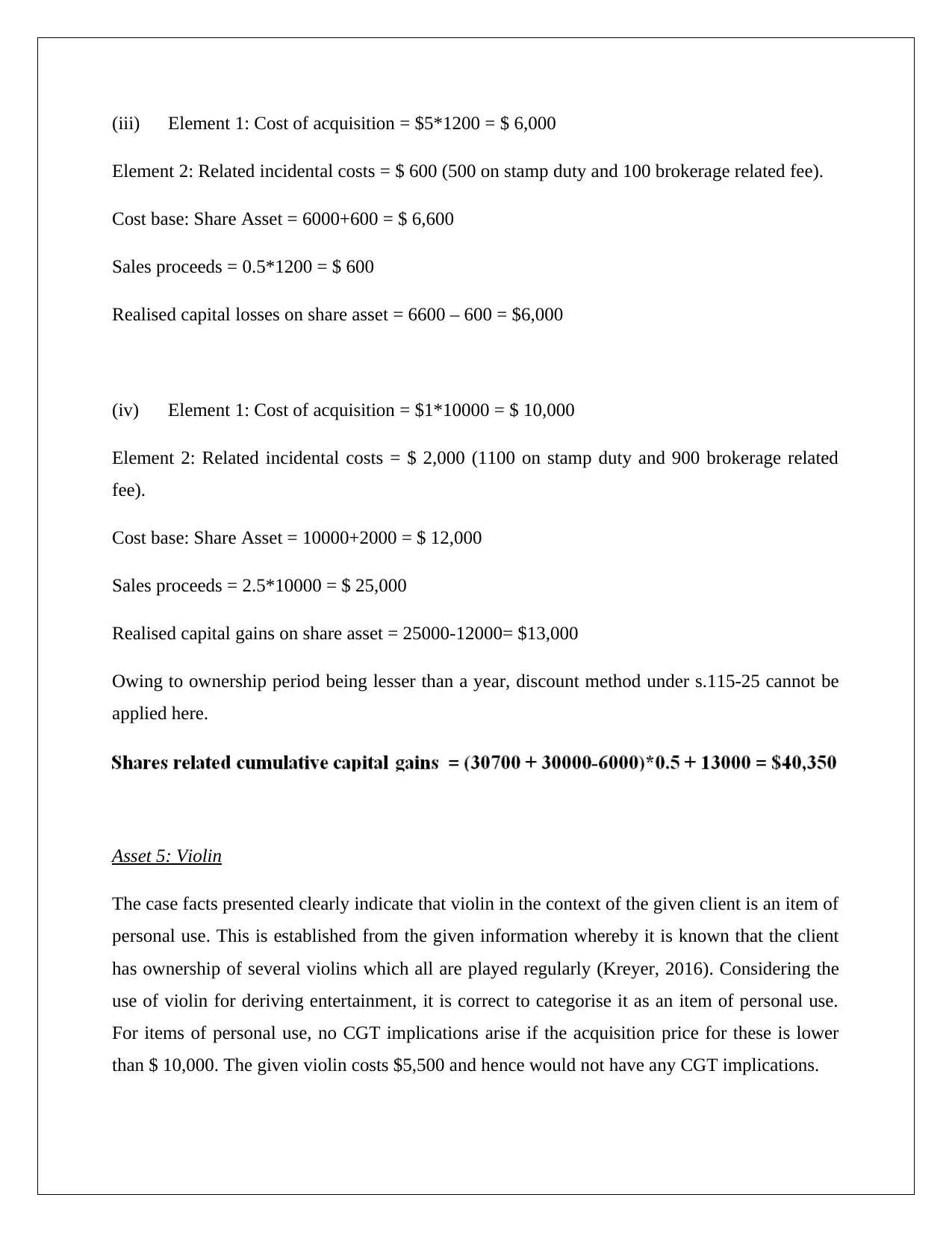

(iii) Element 1: Cost of acquisition = $5*1200 = $ 6,000

Element 2: Related incidental costs = $ 600 (500 on stamp duty and 100 brokerage related fee).

Cost base: Share Asset = 6000+600 = $ 6,600

Sales proceeds = 0.5*1200 = $ 600

Realised capital losses on share asset = 6600 – 600 = $6,000

(iv) Element 1: Cost of acquisition = $1*10000 = $ 10,000

Element 2: Related incidental costs = $ 2,000 (1100 on stamp duty and 900 brokerage related

fee).

Cost base: Share Asset = 10000+2000 = $ 12,000

Sales proceeds = 2.5*10000 = $ 25,000

Realised capital gains on share asset = 25000-12000= $13,000

Owing to ownership period being lesser than a year, discount method under s.115-25 cannot be

applied here.

Asset 5: Violin

The case facts presented clearly indicate that violin in the context of the given client is an item of

personal use. This is established from the given information whereby it is known that the client

has ownership of several violins which all are played regularly (Kreyer, 2016). Considering the

use of violin for deriving entertainment, it is correct to categorise it as an item of personal use.

For items of personal use, no CGT implications arise if the acquisition price for these is lower

than $ 10,000. The given violin costs $5,500 and hence would not have any CGT implications.

Element 2: Related incidental costs = $ 600 (500 on stamp duty and 100 brokerage related fee).

Cost base: Share Asset = 6000+600 = $ 6,600

Sales proceeds = 0.5*1200 = $ 600

Realised capital losses on share asset = 6600 – 600 = $6,000

(iv) Element 1: Cost of acquisition = $1*10000 = $ 10,000

Element 2: Related incidental costs = $ 2,000 (1100 on stamp duty and 900 brokerage related

fee).

Cost base: Share Asset = 10000+2000 = $ 12,000

Sales proceeds = 2.5*10000 = $ 25,000

Realised capital gains on share asset = 25000-12000= $13,000

Owing to ownership period being lesser than a year, discount method under s.115-25 cannot be

applied here.

Asset 5: Violin

The case facts presented clearly indicate that violin in the context of the given client is an item of

personal use. This is established from the given information whereby it is known that the client

has ownership of several violins which all are played regularly (Kreyer, 2016). Considering the

use of violin for deriving entertainment, it is correct to categorise it as an item of personal use.

For items of personal use, no CGT implications arise if the acquisition price for these is lower

than $ 10,000. The given violin costs $5,500 and hence would not have any CGT implications.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

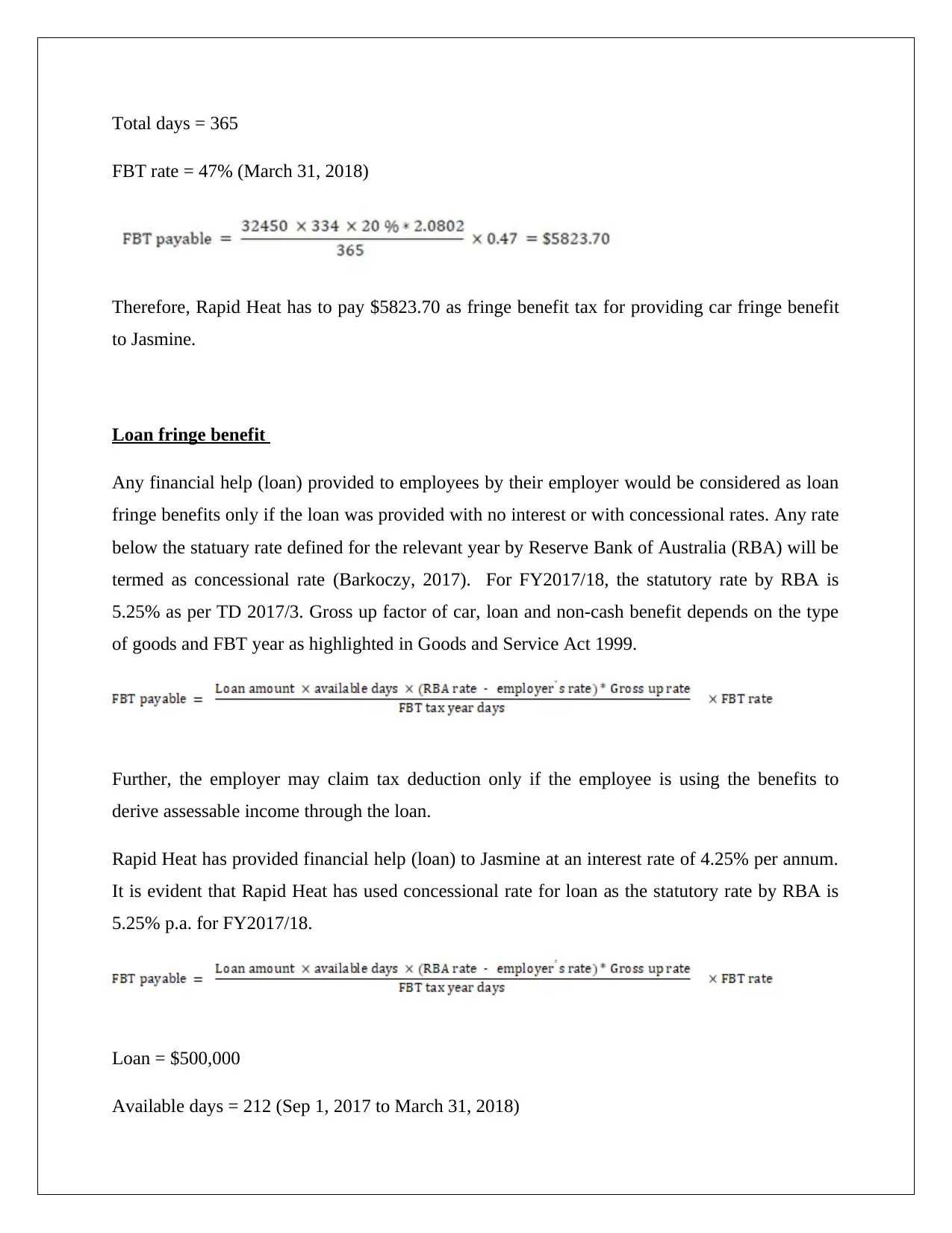

Summary (Conclusion)

Capital gains: Block of Land = $96,500

Capital gains: Antique bed = $2,250

Capital gains: Shares = $40.350

Question 2

(a) The issue is to offer a legal advice to Rapid Heat about its Fringe Benefits Tax (FBT)

consequences based on given information and also, the computation of FBT liabilities for

year ending 31 March 2018

Taxpayer (employer) would be held accountable for the FBT liability only when they have

provided benefits to employee that the employee can use for private purpose as per Fringe

Benefits Tax Assessment Act 1986 (Sadique, et. al., 2015). It is noteworthy that the benefits

provided to employee would not be categorised under fringe benefits when the usage of the

benefit is restricted to professional work only. FBT liabilities will not be applicable on the

employees and would only be imposed on employer for the respective FBT year. Further, the

employer may claim tax deduction only when the employee is using the benefits to derive

assessable income (Coleman, 2016).

Employer - Rapid Heat and Employee – Jasmine

Rapid Heat has provided three fringe benefits i.e. a car, a loan of sum $500,000 and an electric

heater to Jasmine during the FBT year which would be taken into account to find the FBT

consequences and FBT liability.

Car fringe benefit

Capital gains: Block of Land = $96,500

Capital gains: Antique bed = $2,250

Capital gains: Shares = $40.350

Question 2

(a) The issue is to offer a legal advice to Rapid Heat about its Fringe Benefits Tax (FBT)

consequences based on given information and also, the computation of FBT liabilities for

year ending 31 March 2018

Taxpayer (employer) would be held accountable for the FBT liability only when they have

provided benefits to employee that the employee can use for private purpose as per Fringe

Benefits Tax Assessment Act 1986 (Sadique, et. al., 2015). It is noteworthy that the benefits

provided to employee would not be categorised under fringe benefits when the usage of the

benefit is restricted to professional work only. FBT liabilities will not be applicable on the

employees and would only be imposed on employer for the respective FBT year. Further, the

employer may claim tax deduction only when the employee is using the benefits to derive

assessable income (Coleman, 2016).

Employer - Rapid Heat and Employee – Jasmine

Rapid Heat has provided three fringe benefits i.e. a car, a loan of sum $500,000 and an electric

heater to Jasmine during the FBT year which would be taken into account to find the FBT

consequences and FBT liability.

Car fringe benefit

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

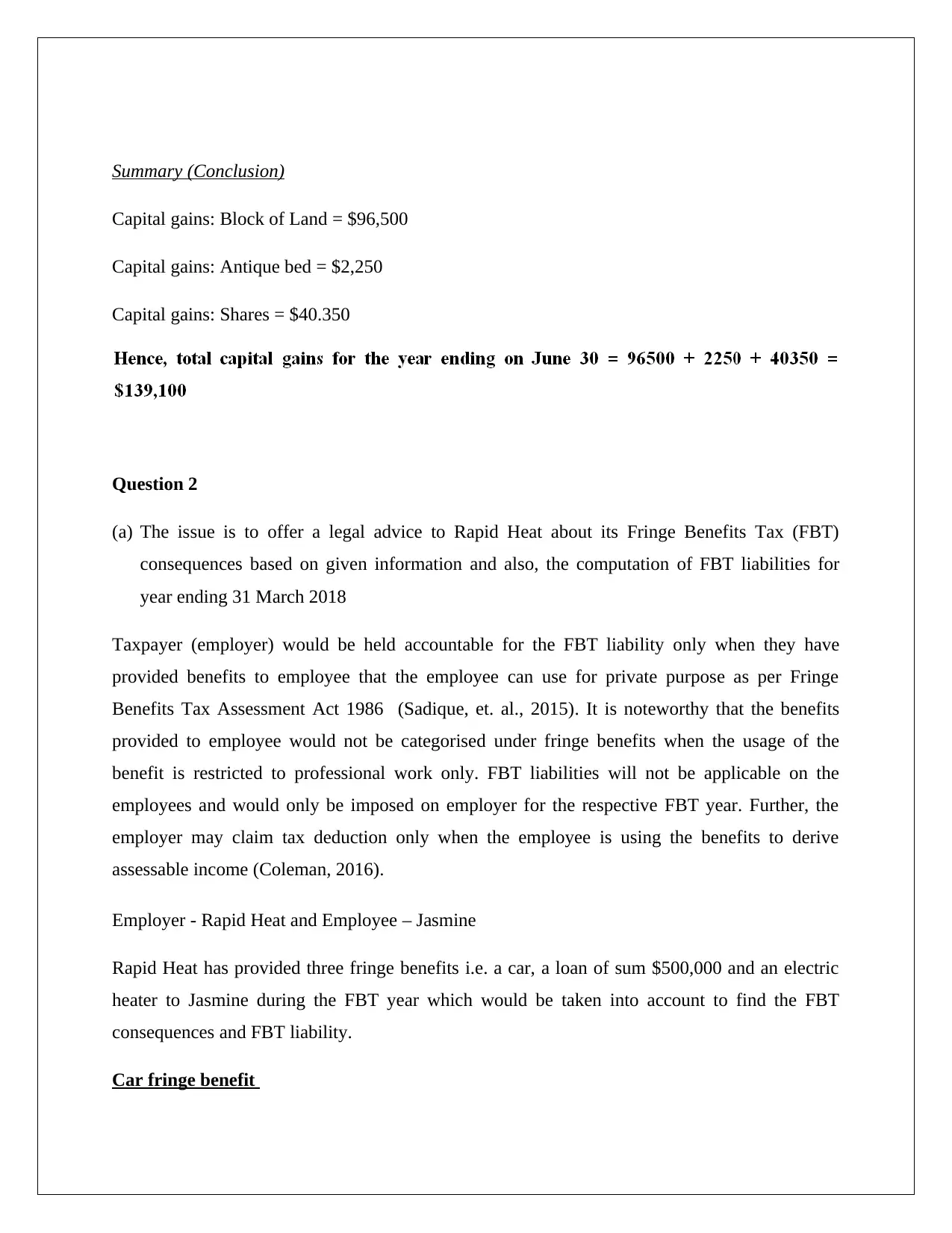

The relevant provisions are discussed in s.8, FBTAA 1986 which defines that car fringe benefit

will be provided to employee by the employer when the car is given for the private purpose of

employee. Taxable value of car is an imperative factor to determine the car related fringe benefit

tax liability on employer. The statutory formula as per s. 9, FBTAA 1986 for car fringe benefits

computation and is shown below (Gilders et. al., 2016).

Base value of car is also known as capital value which would be calculated by deducting the

expenses resulting from minor repairs. Available days will be the days between 31 March 2018

and the date when the car was available for private purpose to employee. Days will not be

deducted from available days when the car is held present for employee for private use. Further,

the days will also not deduct when the car was at garage for the minor repairs but days deduction

for major repairs is available (Deutsch, et. al., 2017).

Rapid has provided a car to Jasmine for private purpose on September 1, 2017 and hence, car

fringe benefit has been provided to Jasmine. Rapid has also paid $550 for minor expenses. The

FBT liability will be raised on Rapid Heat.

Base value = (33000-550) = $32,450

Car purchased after 2011 and thus, statutory % = 20%

Available days = 334 (May 1, 2017 to March 31, 2018)

Gross up rate = 2.0802 (Type I goods)

will be provided to employee by the employer when the car is given for the private purpose of

employee. Taxable value of car is an imperative factor to determine the car related fringe benefit

tax liability on employer. The statutory formula as per s. 9, FBTAA 1986 for car fringe benefits

computation and is shown below (Gilders et. al., 2016).

Base value of car is also known as capital value which would be calculated by deducting the

expenses resulting from minor repairs. Available days will be the days between 31 March 2018

and the date when the car was available for private purpose to employee. Days will not be

deducted from available days when the car is held present for employee for private use. Further,

the days will also not deduct when the car was at garage for the minor repairs but days deduction

for major repairs is available (Deutsch, et. al., 2017).

Rapid has provided a car to Jasmine for private purpose on September 1, 2017 and hence, car

fringe benefit has been provided to Jasmine. Rapid has also paid $550 for minor expenses. The

FBT liability will be raised on Rapid Heat.

Base value = (33000-550) = $32,450

Car purchased after 2011 and thus, statutory % = 20%

Available days = 334 (May 1, 2017 to March 31, 2018)

Gross up rate = 2.0802 (Type I goods)

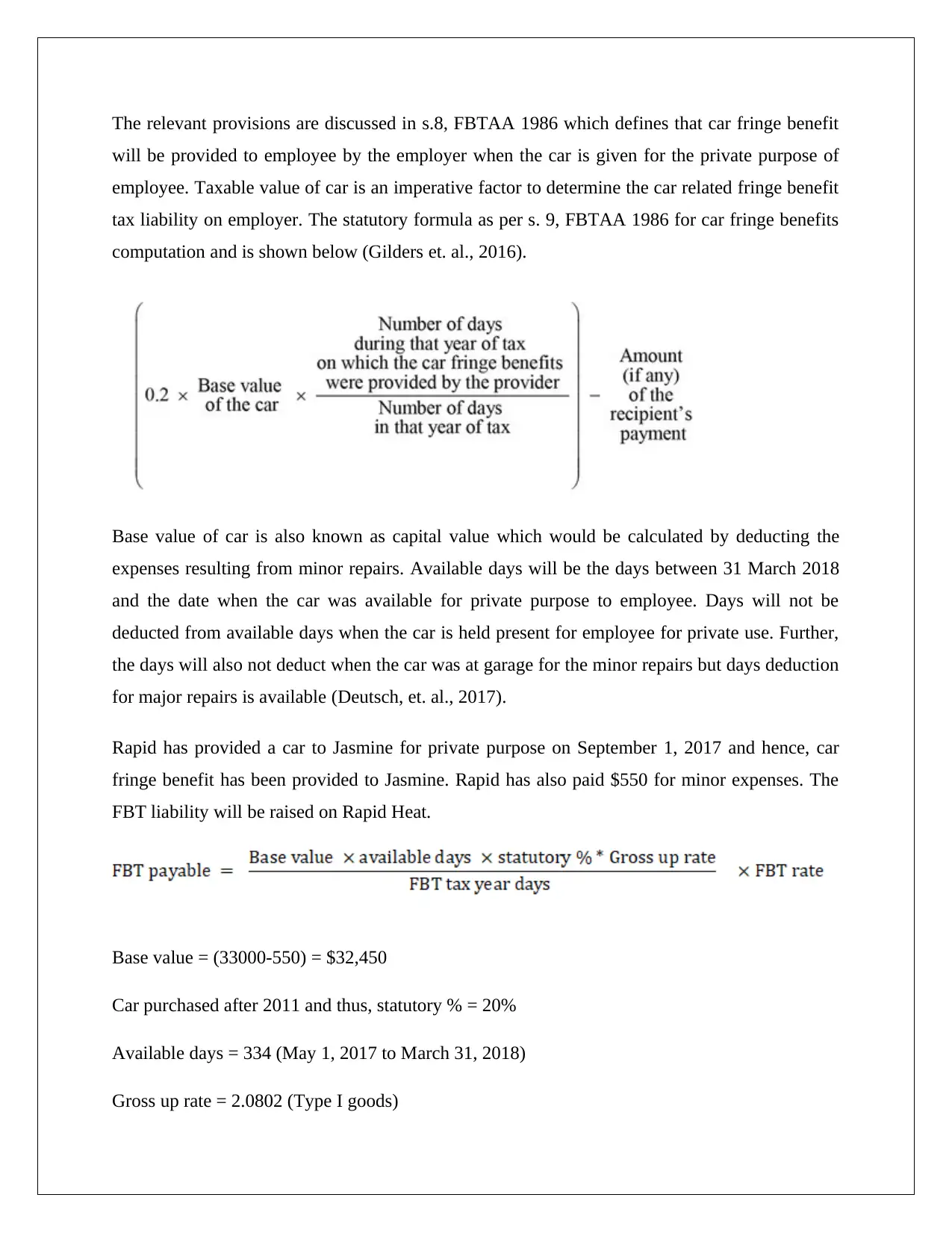

Total days = 365

FBT rate = 47% (March 31, 2018)

Therefore, Rapid Heat has to pay $5823.70 as fringe benefit tax for providing car fringe benefit

to Jasmine.

Loan fringe benefit

Any financial help (loan) provided to employees by their employer would be considered as loan

fringe benefits only if the loan was provided with no interest or with concessional rates. Any rate

below the statuary rate defined for the relevant year by Reserve Bank of Australia (RBA) will be

termed as concessional rate (Barkoczy, 2017). For FY2017/18, the statutory rate by RBA is

5.25% as per TD 2017/3. Gross up factor of car, loan and non-cash benefit depends on the type

of goods and FBT year as highlighted in Goods and Service Act 1999.

Further, the employer may claim tax deduction only if the employee is using the benefits to

derive assessable income through the loan.

Rapid Heat has provided financial help (loan) to Jasmine at an interest rate of 4.25% per annum.

It is evident that Rapid Heat has used concessional rate for loan as the statutory rate by RBA is

5.25% p.a. for FY2017/18.

Loan = $500,000

Available days = 212 (Sep 1, 2017 to March 31, 2018)

FBT rate = 47% (March 31, 2018)

Therefore, Rapid Heat has to pay $5823.70 as fringe benefit tax for providing car fringe benefit

to Jasmine.

Loan fringe benefit

Any financial help (loan) provided to employees by their employer would be considered as loan

fringe benefits only if the loan was provided with no interest or with concessional rates. Any rate

below the statuary rate defined for the relevant year by Reserve Bank of Australia (RBA) will be

termed as concessional rate (Barkoczy, 2017). For FY2017/18, the statutory rate by RBA is

5.25% as per TD 2017/3. Gross up factor of car, loan and non-cash benefit depends on the type

of goods and FBT year as highlighted in Goods and Service Act 1999.

Further, the employer may claim tax deduction only if the employee is using the benefits to

derive assessable income through the loan.

Rapid Heat has provided financial help (loan) to Jasmine at an interest rate of 4.25% per annum.

It is evident that Rapid Heat has used concessional rate for loan as the statutory rate by RBA is

5.25% p.a. for FY2017/18.

Loan = $500,000

Available days = 212 (Sep 1, 2017 to March 31, 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

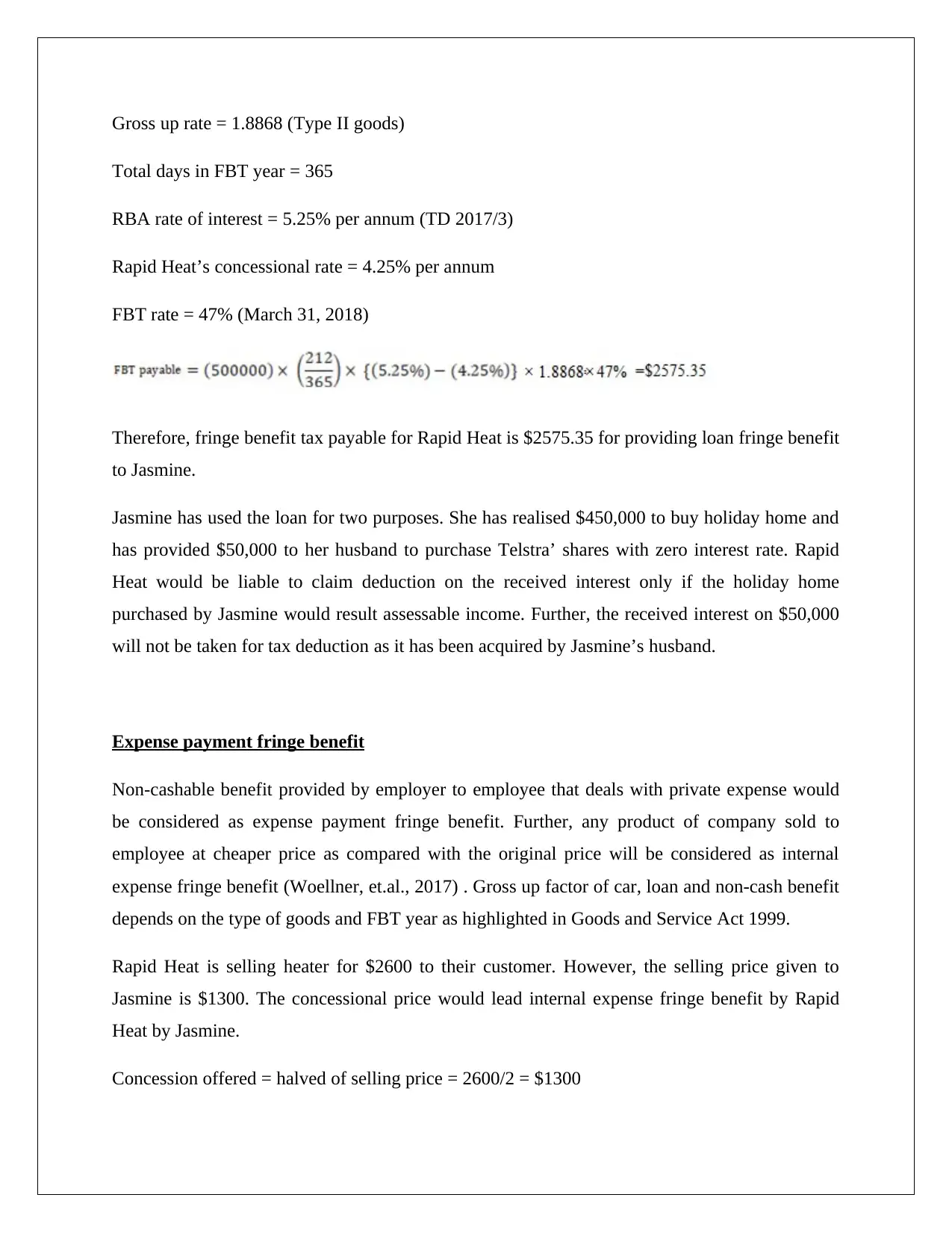

Gross up rate = 1.8868 (Type II goods)

Total days in FBT year = 365

RBA rate of interest = 5.25% per annum (TD 2017/3)

Rapid Heat’s concessional rate = 4.25% per annum

FBT rate = 47% (March 31, 2018)

Therefore, fringe benefit tax payable for Rapid Heat is $2575.35 for providing loan fringe benefit

to Jasmine.

Jasmine has used the loan for two purposes. She has realised $450,000 to buy holiday home and

has provided $50,000 to her husband to purchase Telstra’ shares with zero interest rate. Rapid

Heat would be liable to claim deduction on the received interest only if the holiday home

purchased by Jasmine would result assessable income. Further, the received interest on $50,000

will not be taken for tax deduction as it has been acquired by Jasmine’s husband.

Expense payment fringe benefit

Non-cashable benefit provided by employer to employee that deals with private expense would

be considered as expense payment fringe benefit. Further, any product of company sold to

employee at cheaper price as compared with the original price will be considered as internal

expense fringe benefit (Woellner, et.al., 2017) . Gross up factor of car, loan and non-cash benefit

depends on the type of goods and FBT year as highlighted in Goods and Service Act 1999.

Rapid Heat is selling heater for $2600 to their customer. However, the selling price given to

Jasmine is $1300. The concessional price would lead internal expense fringe benefit by Rapid

Heat by Jasmine.

Concession offered = halved of selling price = 2600/2 = $1300

Total days in FBT year = 365

RBA rate of interest = 5.25% per annum (TD 2017/3)

Rapid Heat’s concessional rate = 4.25% per annum

FBT rate = 47% (March 31, 2018)

Therefore, fringe benefit tax payable for Rapid Heat is $2575.35 for providing loan fringe benefit

to Jasmine.

Jasmine has used the loan for two purposes. She has realised $450,000 to buy holiday home and

has provided $50,000 to her husband to purchase Telstra’ shares with zero interest rate. Rapid

Heat would be liable to claim deduction on the received interest only if the holiday home

purchased by Jasmine would result assessable income. Further, the received interest on $50,000

will not be taken for tax deduction as it has been acquired by Jasmine’s husband.

Expense payment fringe benefit

Non-cashable benefit provided by employer to employee that deals with private expense would

be considered as expense payment fringe benefit. Further, any product of company sold to

employee at cheaper price as compared with the original price will be considered as internal

expense fringe benefit (Woellner, et.al., 2017) . Gross up factor of car, loan and non-cash benefit

depends on the type of goods and FBT year as highlighted in Goods and Service Act 1999.

Rapid Heat is selling heater for $2600 to their customer. However, the selling price given to

Jasmine is $1300. The concessional price would lead internal expense fringe benefit by Rapid

Heat by Jasmine.

Concession offered = halved of selling price = 2600/2 = $1300

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

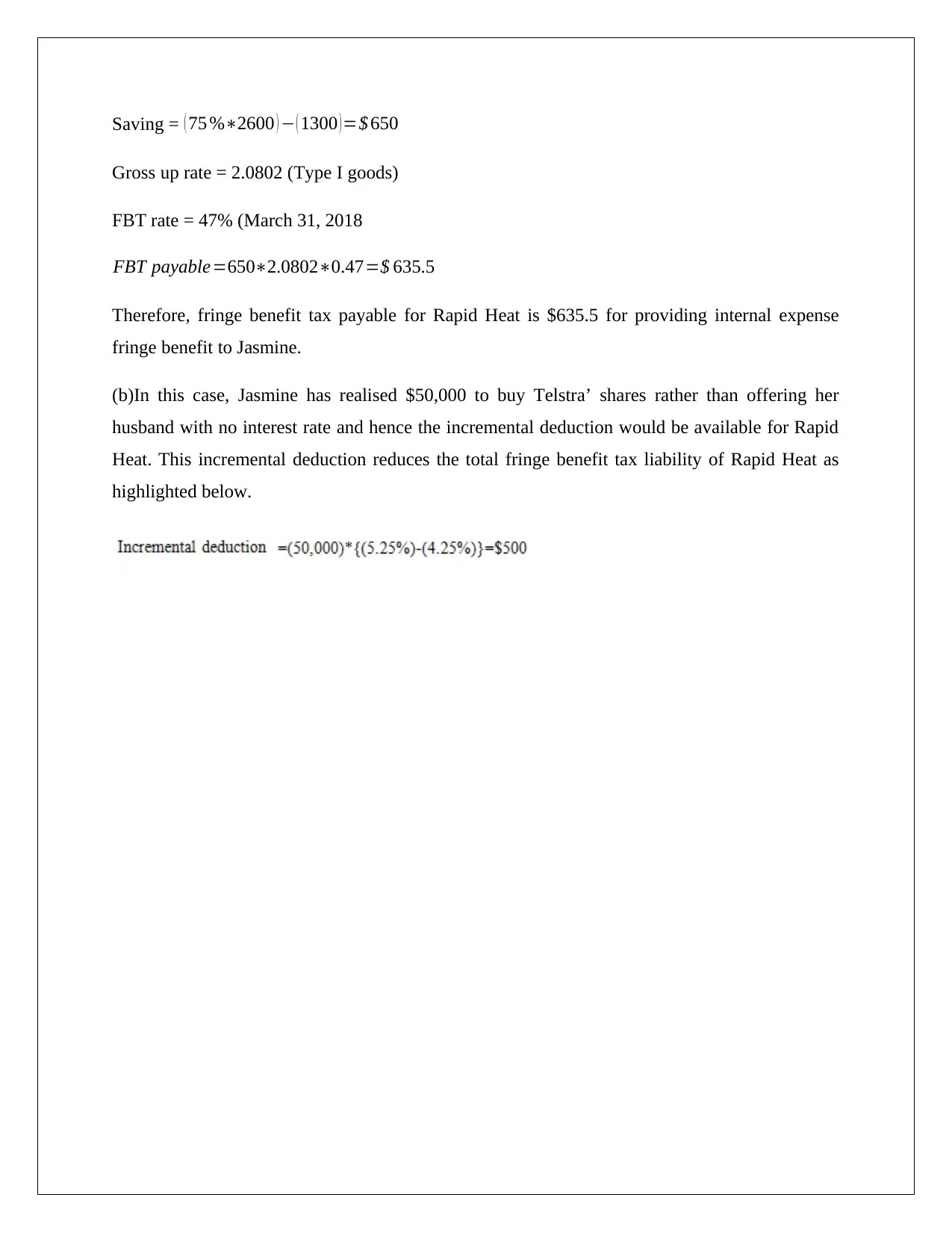

Saving = ( 75 %∗2600 ) − ( 1300 ) =$ 650

Gross up rate = 2.0802 (Type I goods)

FBT rate = 47% (March 31, 2018

FBT payable=650∗2.0802∗0.47=$ 635.5

Therefore, fringe benefit tax payable for Rapid Heat is $635.5 for providing internal expense

fringe benefit to Jasmine.

(b)In this case, Jasmine has realised $50,000 to buy Telstra’ shares rather than offering her

husband with no interest rate and hence the incremental deduction would be available for Rapid

Heat. This incremental deduction reduces the total fringe benefit tax liability of Rapid Heat as

highlighted below.

Gross up rate = 2.0802 (Type I goods)

FBT rate = 47% (March 31, 2018

FBT payable=650∗2.0802∗0.47=$ 635.5

Therefore, fringe benefit tax payable for Rapid Heat is $635.5 for providing internal expense

fringe benefit to Jasmine.

(b)In this case, Jasmine has realised $50,000 to buy Telstra’ shares rather than offering her

husband with no interest rate and hence the incremental deduction would be available for Rapid

Heat. This incremental deduction reduces the total fringe benefit tax liability of Rapid Heat as

highlighted below.

References

Barkoczy, S. (2017) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University Press.

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters (Professional)

Australia.

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., and Snape, T. (2015) Australian tax handbook.

8th ed. Pymont: Thomson Reuters.

Gilders, F., Taylor, J., Walpole, M., Burton, M. and Ciro, T. (2016) Understanding taxation law

2016. 9th ed. Sydney: LexisNexis/Butterworths.

Krever, R. (2016) Australian Taxation Law Cases 2017. 2nd ed. Brisbane: THOMSON

LAWBOOK Company.

Nethercott, L., Richardson, G., & Devos, K. (2016) Australian Taxation Study Manual 2016. 8th

ed. Sydney: Oxford University Press.

Reuters, T. (2017) Australian Tax Legislation (2017). 4th ed. Sydney. THOMSON REUTERS.

Sadiq, K., Coleman, C., Hanegbi, R., Jogarajan, S., Krever, R., Obst, W., and Ting, A.

(2015) Principles of Taxation Law 2015. 7th ed. Pymont: Thomson Reuters.

Woellner, R., Barkoczy, S., Murphy, S. and Pinto, D. (2017) Australian Taxation Law 2017 27th

ed. Sydney: Oxford University Press Australia.

Barkoczy, S. (2017) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University Press.

Coleman, C. (2016) Australian Tax Analysis. 4th ed. Sydney: Thomson Reuters (Professional)

Australia.

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., and Snape, T. (2015) Australian tax handbook.

8th ed. Pymont: Thomson Reuters.

Gilders, F., Taylor, J., Walpole, M., Burton, M. and Ciro, T. (2016) Understanding taxation law

2016. 9th ed. Sydney: LexisNexis/Butterworths.

Krever, R. (2016) Australian Taxation Law Cases 2017. 2nd ed. Brisbane: THOMSON

LAWBOOK Company.

Nethercott, L., Richardson, G., & Devos, K. (2016) Australian Taxation Study Manual 2016. 8th

ed. Sydney: Oxford University Press.

Reuters, T. (2017) Australian Tax Legislation (2017). 4th ed. Sydney. THOMSON REUTERS.

Sadiq, K., Coleman, C., Hanegbi, R., Jogarajan, S., Krever, R., Obst, W., and Ting, A.

(2015) Principles of Taxation Law 2015. 7th ed. Pymont: Thomson Reuters.

Woellner, R., Barkoczy, S., Murphy, S. and Pinto, D. (2017) Australian Taxation Law 2017 27th

ed. Sydney: Oxford University Press Australia.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.