Comprehensive Analysis: Capital Gains and Fringe Benefits Tax

VerifiedAdded on 2023/06/05

|21

|3184

|425

Report

AI Summary

This report provides a comprehensive analysis of the Australian taxation system, focusing on capital gains tax (CGT) and fringe benefits tax (FBT). It includes calculations for net capital gains or losses on various assets such as land, antiques, paintings, and shares, considering relevant legislation and available discounts. The report also examines the FBT consequences for an organization providing a car and loan to an employee, calculating the FBT liability and exploring alternative scenarios. The analysis incorporates statutory formulas and relevant tax laws to determine the taxable amounts and ensure accurate tax reporting. Desklib offers a platform to access similar solved assignments and study resources for students.

Taxation 1

Running Head: Taxation

Taxation

Running Head: Taxation

Taxation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Taxation 2

Executive Summary:

The taxation system in Australia has been subject to various rules and regulations while

concentrating on the various emerging reforms affecting thesystem. In order to assess the

correct taxable incomeof assesse use of theprovisions contained in Income Tax Assessment

Act 1997 and 1936 has been taken while identifying the mandatory requirements to be

fulfilled. The taxation problems will be associated with identifying the assessability of

various items concerned with the transactions entered into by the assesse during a particular

year. The technical announcements and various legislations that have been issued should be

taken into consideration while calculating the taxation liability of the assesse. The various

types of incomes forming part of the total income of assesse will be aggregated and has to be

analysed for the purpose of calculating correct amount of income as per the applicable

legislations.

Executive Summary:

The taxation system in Australia has been subject to various rules and regulations while

concentrating on the various emerging reforms affecting thesystem. In order to assess the

correct taxable incomeof assesse use of theprovisions contained in Income Tax Assessment

Act 1997 and 1936 has been taken while identifying the mandatory requirements to be

fulfilled. The taxation problems will be associated with identifying the assessability of

various items concerned with the transactions entered into by the assesse during a particular

year. The technical announcements and various legislations that have been issued should be

taken into consideration while calculating the taxation liability of the assesse. The various

types of incomes forming part of the total income of assesse will be aggregated and has to be

analysed for the purpose of calculating correct amount of income as per the applicable

legislations.

Taxation 3

Table of Contents

Executive Summary:..................................................................................................................2

Introduction:...............................................................................................................................4

Question 1..................................................................................................................................5

Calculation of net capital gain or loss of the client for the current tax year ending on 30

June.........................................................................................................................................5

Question 2................................................................................................................................11

(a) FBT consequences and calculation of FBT Liability for the year ending 31 March 2018

..............................................................................................................................................11

(b) If Jasmine used $50,000 to purchase shares herself rather than lending to husband......15

Conclusion:..............................................................................................................................17

References:...............................................................................................................................18

Appendices:..............................................................................................................................19

Table of Contents

Executive Summary:..................................................................................................................2

Introduction:...............................................................................................................................4

Question 1..................................................................................................................................5

Calculation of net capital gain or loss of the client for the current tax year ending on 30

June.........................................................................................................................................5

Question 2................................................................................................................................11

(a) FBT consequences and calculation of FBT Liability for the year ending 31 March 2018

..............................................................................................................................................11

(b) If Jasmine used $50,000 to purchase shares herself rather than lending to husband......15

Conclusion:..............................................................................................................................17

References:...............................................................................................................................18

Appendices:..............................................................................................................................19

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Taxation 4

Introduction:

The task is carried out in the context of taxation theory, law and practice. This task manages

the ideas of capital gain and fringe benefits tax that identifies with the pay of taxpayers in

diverse scenarios in Australia. The capital gain tax has been figured for a customer who is an

individual taxpayer. The capital gain for various sorts of benefits, for example, land, shares,

antique bed, paintings, violin and so forth are incorporated into this task. These estimations

are made under various situations keeping in mind the end goal to apply an assortment of

ideas and matters of capital gain. The fringe benefits tax counts identify with the

organizationfewer than two unique situations. The task will be providing an overall learning

on the taxation theories.

Introduction:

The task is carried out in the context of taxation theory, law and practice. This task manages

the ideas of capital gain and fringe benefits tax that identifies with the pay of taxpayers in

diverse scenarios in Australia. The capital gain tax has been figured for a customer who is an

individual taxpayer. The capital gain for various sorts of benefits, for example, land, shares,

antique bed, paintings, violin and so forth are incorporated into this task. These estimations

are made under various situations keeping in mind the end goal to apply an assortment of

ideas and matters of capital gain. The fringe benefits tax counts identify with the

organizationfewer than two unique situations. The task will be providing an overall learning

on the taxation theories.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Taxation 5

Question 1

Calculation of net capital gain or loss of the client for the current tax year ending on 30

June

At the time when a taxpayer sells a capital asset that is produced by him capital gain or loss

arises. Capital gain or loss is the measure of distinction between the sum paid on the securing

of the advantage and the sum got on the transfer of the benefit. A person is required to

incorporate the capital gain or loss in his Income Tax return and make good on the tax

obligation appropriate on such sum. The capital gain charge is a piece of Income tax. At the

point when a person brings about capital gain, it is included the aggregate pay and, in this

way, expands the taxation rate of the person. On the off chance that person acquires capital

loss, it can't be set off against another salary yet can be utilized to lessen the measure of

capital gain whether in present or future years (Harding, 2013). Every one of the advantages

procured after 20 September 1985 is qualified for CGT barring individual resources and

depreciable resources held for tax purposes. If there should arise an occurrence of individual

person capital gain rebate of the half on capital gain is accessible sue to which the capital

gain charge risk of the individual is decreased to half. This markdown is 33.33% for SMSF

and there is no such rebate for organizations. Anyway, indexation technique is likewise

accessible for resources obtained before 21 September 1999. The person can receive any

strategy which gives him the best expense results. Likewise, the rebate strategy and

indexation technique can't be connected to resources held for under a year prior to the deal

(Australian taxation office, 2018).

a.Block of vacant land

For this situation, the block of empty land was sold for $320,000 on 3 June of current year

which was gained on 1 January 2001 for $100,000. The acquirer likewise caused extra costs

Question 1

Calculation of net capital gain or loss of the client for the current tax year ending on 30

June

At the time when a taxpayer sells a capital asset that is produced by him capital gain or loss

arises. Capital gain or loss is the measure of distinction between the sum paid on the securing

of the advantage and the sum got on the transfer of the benefit. A person is required to

incorporate the capital gain or loss in his Income Tax return and make good on the tax

obligation appropriate on such sum. The capital gain charge is a piece of Income tax. At the

point when a person brings about capital gain, it is included the aggregate pay and, in this

way, expands the taxation rate of the person. On the off chance that person acquires capital

loss, it can't be set off against another salary yet can be utilized to lessen the measure of

capital gain whether in present or future years (Harding, 2013). Every one of the advantages

procured after 20 September 1985 is qualified for CGT barring individual resources and

depreciable resources held for tax purposes. If there should arise an occurrence of individual

person capital gain rebate of the half on capital gain is accessible sue to which the capital

gain charge risk of the individual is decreased to half. This markdown is 33.33% for SMSF

and there is no such rebate for organizations. Anyway, indexation technique is likewise

accessible for resources obtained before 21 September 1999. The person can receive any

strategy which gives him the best expense results. Likewise, the rebate strategy and

indexation technique can't be connected to resources held for under a year prior to the deal

(Australian taxation office, 2018).

a.Block of vacant land

For this situation, the block of empty land was sold for $320,000 on 3 June of current year

which was gained on 1 January 2001 for $100,000. The acquirer likewise caused extra costs

Taxation 6

adding up to $20,000. The store was payable to the person on 3 January of one year from

now, however, the agreement was marked on 3 January of the current year (Buchan, Olesen,

and Carberry, 2013).

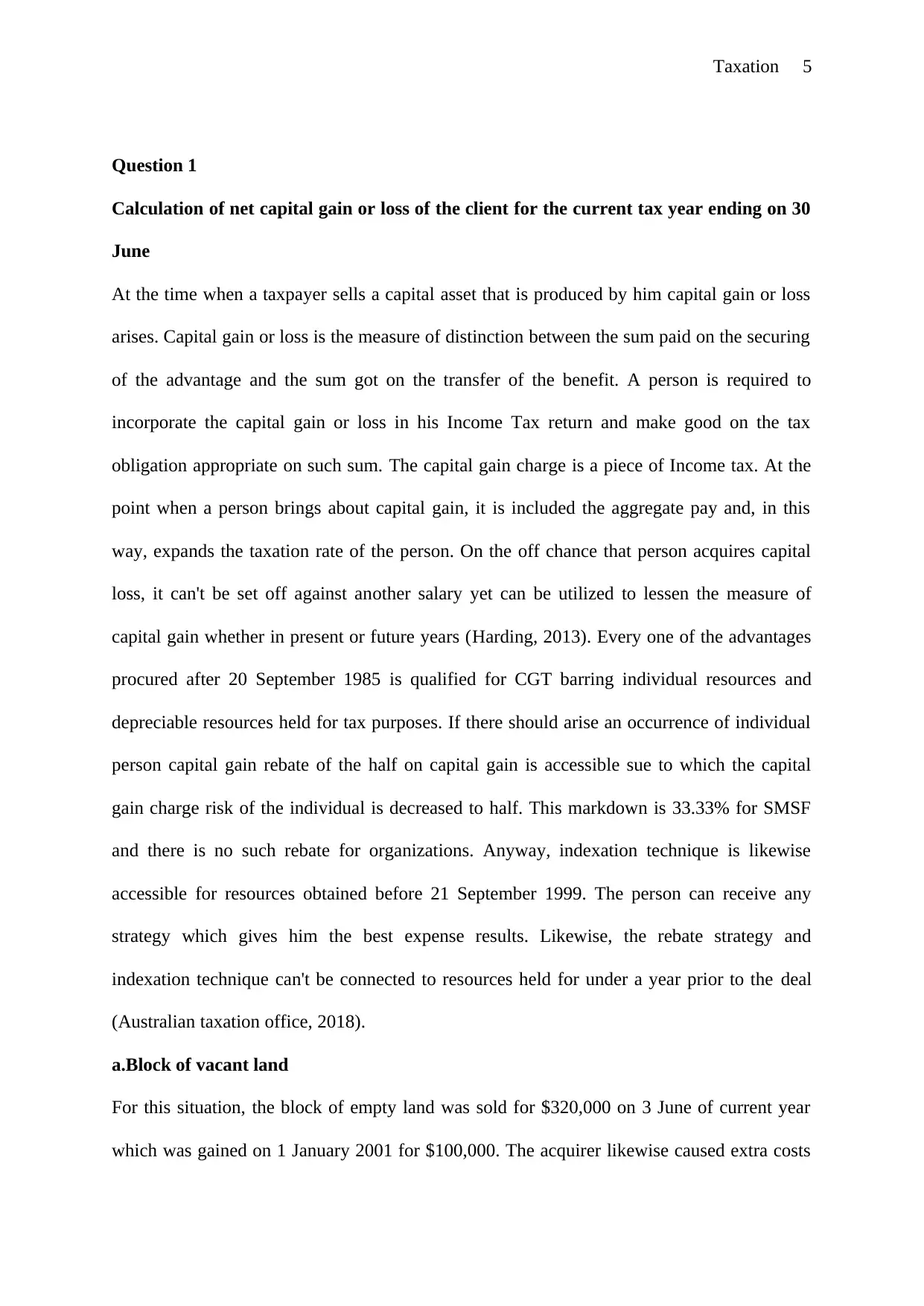

Capital gain tax is accounted for in the year in which the person goes into the agreement of

offer independent of whether the sum is gotten later. In this manner, the capital gain on a

block of empty land will be accounted for in the present year. The benefit was procured after

30 September 1999; consequently, indexation technique for ascertaining capital gain can't be

connected to the land. The customer is an individual; in this way, half rebate rate can be

connected to her capital gain. The capital gain on the offer of a block of empty land can be

figured as takes after:

Working notes:

1. The measure of repairs of $20,000 is added to the expense of procurement since the costs

were brought about for the securing of land and are perpetual in nature.

b. Antique bed

For this situation, the person bought an antique bed on 21 July 1986 and acquired expense of

changes adding up to $1500 on 29 October 1986. Amid the present duty year, the bed was

stolen and was esteemed for protection reason for a measure of $25,000.

Anyway,theinsurance agency paid the customer a measure of $11000 for the stolen bed under

her approach conditions (Burkhauser,Hahn, and Wilkins, 2015).

adding up to $20,000. The store was payable to the person on 3 January of one year from

now, however, the agreement was marked on 3 January of the current year (Buchan, Olesen,

and Carberry, 2013).

Capital gain tax is accounted for in the year in which the person goes into the agreement of

offer independent of whether the sum is gotten later. In this manner, the capital gain on a

block of empty land will be accounted for in the present year. The benefit was procured after

30 September 1999; consequently, indexation technique for ascertaining capital gain can't be

connected to the land. The customer is an individual; in this way, half rebate rate can be

connected to her capital gain. The capital gain on the offer of a block of empty land can be

figured as takes after:

Working notes:

1. The measure of repairs of $20,000 is added to the expense of procurement since the costs

were brought about for the securing of land and are perpetual in nature.

b. Antique bed

For this situation, the person bought an antique bed on 21 July 1986 and acquired expense of

changes adding up to $1500 on 29 October 1986. Amid the present duty year, the bed was

stolen and was esteemed for protection reason for a measure of $25,000.

Anyway,theinsurance agency paid the customer a measure of $11000 for the stolen bed under

her approach conditions (Burkhauser,Hahn, and Wilkins, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Taxation 7

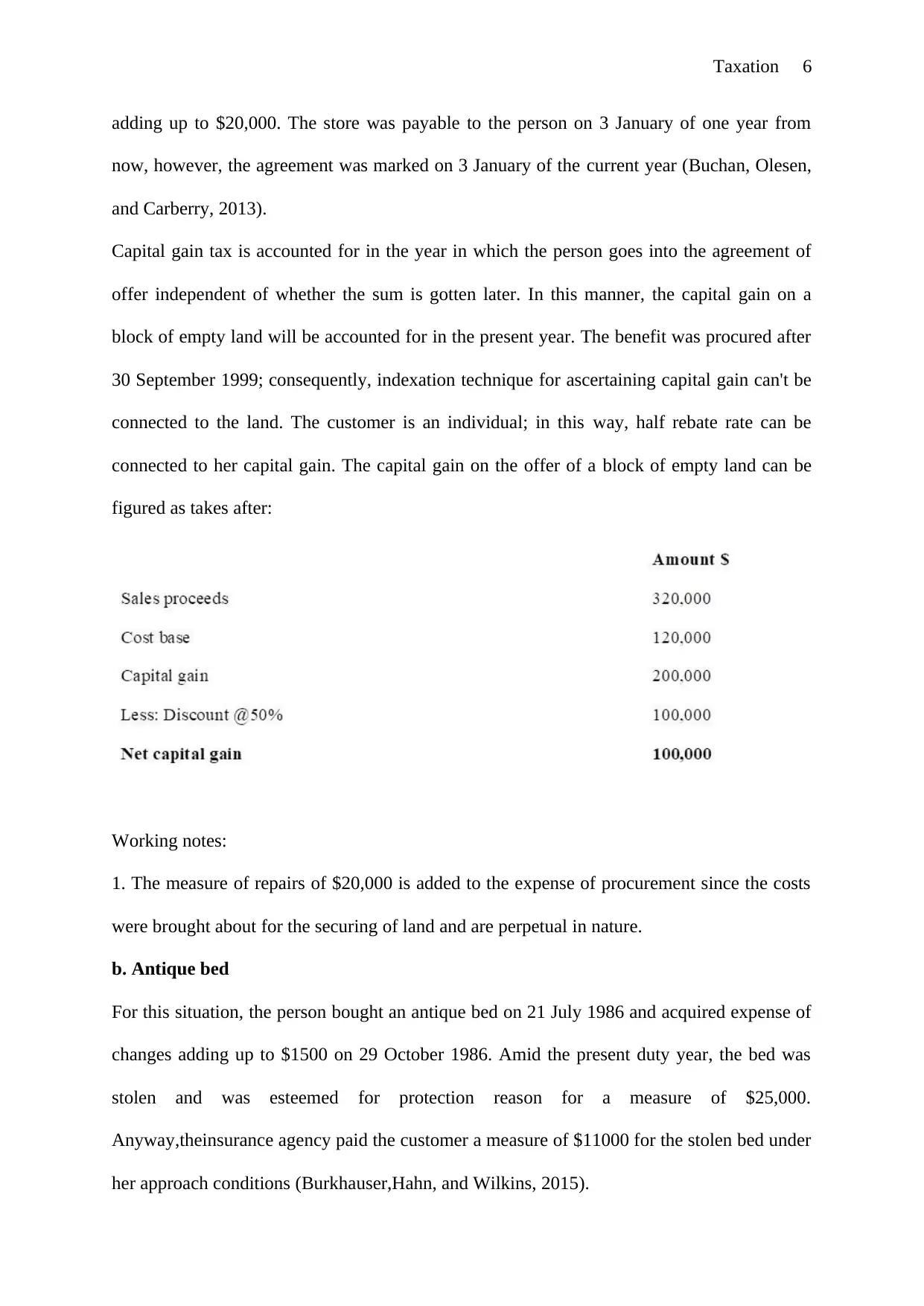

The bed was procured by the customer before 30 September 1999, in this manner indexation

technique is pertinent. Additionally, the customer is an individual; along these lines,therebate

strategy is likewise relevant. We will choose the strategy which results in impose reserve

funds for the customer. The capital gain can be figured as takes after:

The bed was procured by the customer before 30 September 1999, in this manner indexation

technique is pertinent. Additionally, the customer is an individual; along these lines,therebate

strategy is likewise relevant. We will choose the strategy which results in impose reserve

funds for the customer. The capital gain can be figured as takes after:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Taxation 8

Indexation method

Working note:

1. The indexed cost of purchase of bed would be $3500*68.7/43.2 = $5565.97

2. The indexed cost of alteration of bed would be $1500*68.7/44.4 = $2320.95

Discount method

The net capital gain is less under discount method, in this manner discount technique would

be utilized for announcing the capital gain on an antique bed. In this case, discount method

will be applied and therefore capital gain will be $3000 and the capital gain recognized in the

indexation method will not be considered as the same is excessive from the assesse.

(c) Painting

Indexation method

Working note:

1. The indexed cost of purchase of bed would be $3500*68.7/43.2 = $5565.97

2. The indexed cost of alteration of bed would be $1500*68.7/44.4 = $2320.95

Discount method

The net capital gain is less under discount method, in this manner discount technique would

be utilized for announcing the capital gain on an antique bed. In this case, discount method

will be applied and therefore capital gain will be $3000 and the capital gain recognized in the

indexation method will not be considered as the same is excessive from the assesse.

(c) Painting

Taxation 9

In the provided case, customer obtained painting from a craftsman on 2 May 1985 for $2,000

and sold it in workmanship sell-off amid the present expense year for $125,000. Since the

canvas was obtained by the customer before 20 September 1985, the capital gain tax won't be

qualified on such painting. Capital gain tax in Australia began on 20 September 1985 and in

this manner, resources obtained before this date doesn’t go under the ambit of capital gain

impose 9in Australia (Burkhauser, et. al., 2015).

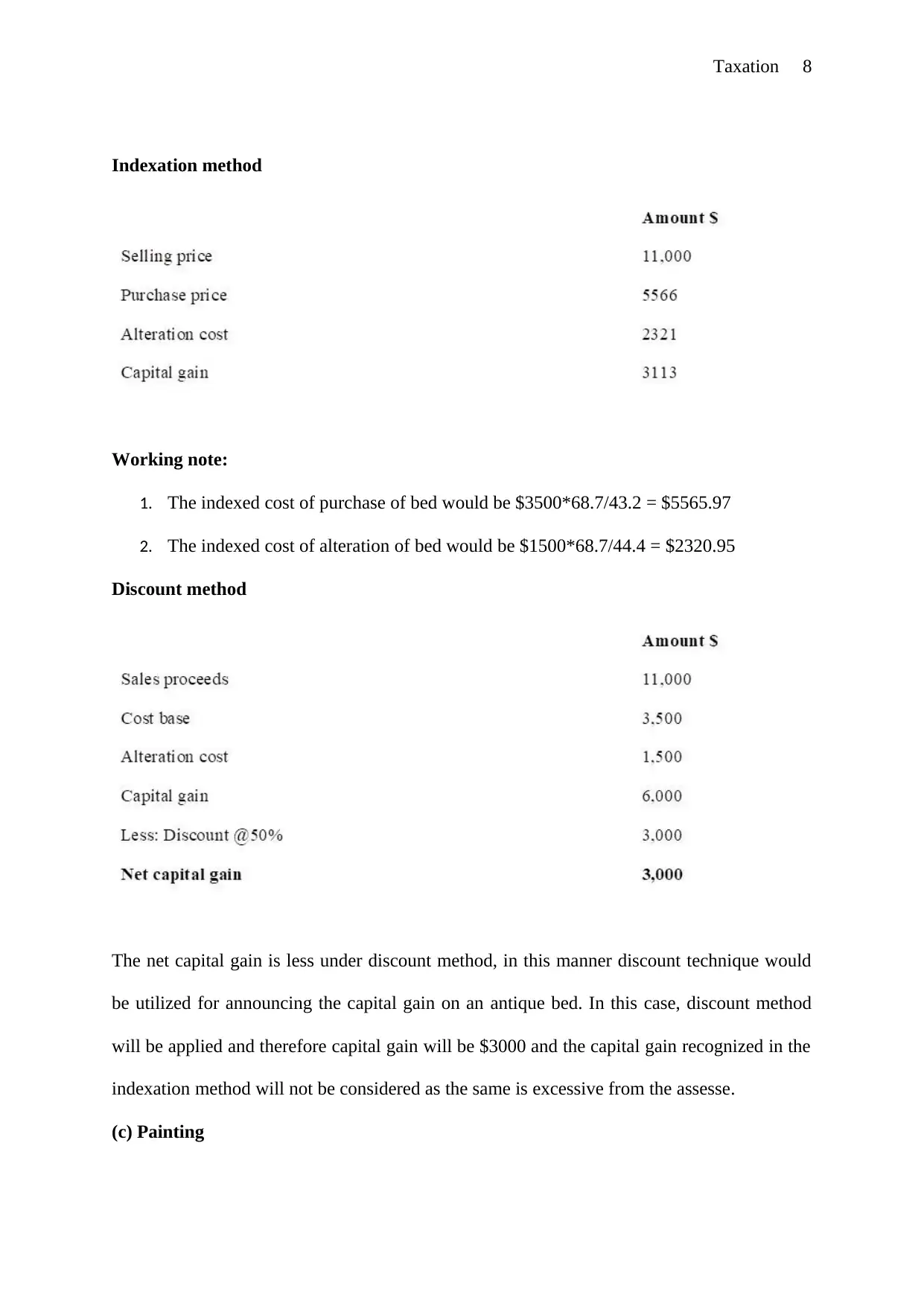

(d) Shares

For this situation,thecustomer has an arrangement of four distinct classes of offers. Every one

of these offers was obtained after 30 September 1999 and accordingly indexation technique

won't be material on the estimation of capital gain marked down of these offers. The capital

gain at a bargain of offers can be figured as takes after:

Working notes:

1. The capital gain loss of $6000 on offers of Young Kids Learning Ltd can be set off

against the capital gain of the present year.

In the provided case, customer obtained painting from a craftsman on 2 May 1985 for $2,000

and sold it in workmanship sell-off amid the present expense year for $125,000. Since the

canvas was obtained by the customer before 20 September 1985, the capital gain tax won't be

qualified on such painting. Capital gain tax in Australia began on 20 September 1985 and in

this manner, resources obtained before this date doesn’t go under the ambit of capital gain

impose 9in Australia (Burkhauser, et. al., 2015).

(d) Shares

For this situation,thecustomer has an arrangement of four distinct classes of offers. Every one

of these offers was obtained after 30 September 1999 and accordingly indexation technique

won't be material on the estimation of capital gain marked down of these offers. The capital

gain at a bargain of offers can be figured as takes after:

Working notes:

1. The capital gain loss of $6000 on offers of Young Kids Learning Ltd can be set off

against the capital gain of the present year.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Taxation 10

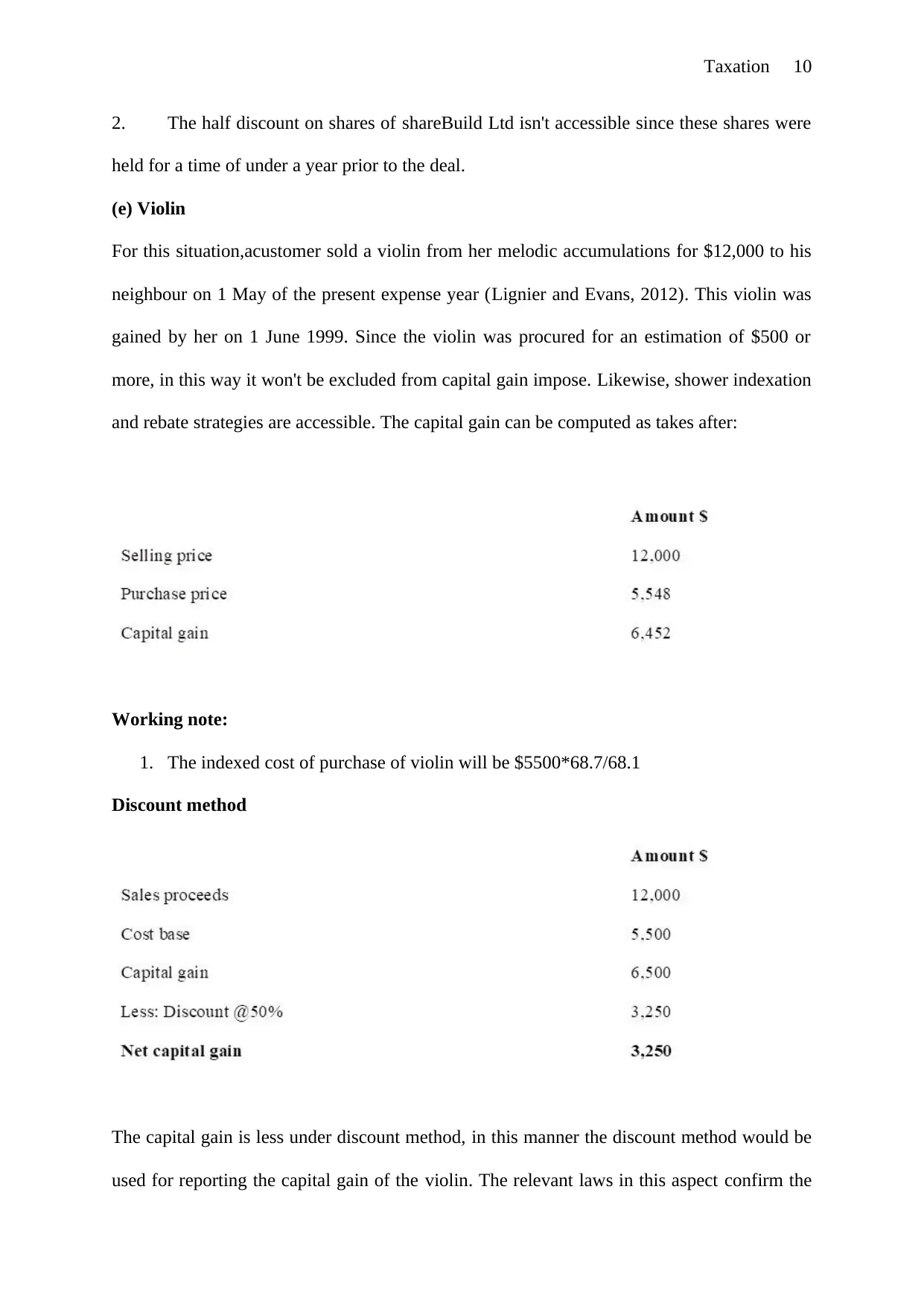

2. The half discount on shares of shareBuild Ltd isn't accessible since these shares were

held for a time of under a year prior to the deal.

(e) Violin

For this situation,acustomer sold a violin from her melodic accumulations for $12,000 to his

neighbour on 1 May of the present expense year (Lignier and Evans, 2012). This violin was

gained by her on 1 June 1999. Since the violin was procured for an estimation of $500 or

more, in this way it won't be excluded from capital gain impose. Likewise, shower indexation

and rebate strategies are accessible. The capital gain can be computed as takes after:

Working note:

1. The indexed cost of purchase of violin will be $5500*68.7/68.1

Discount method

The capital gain is less under discount method, in this manner the discount method would be

used for reporting the capital gain of the violin. The relevant laws in this aspect confirm the

2. The half discount on shares of shareBuild Ltd isn't accessible since these shares were

held for a time of under a year prior to the deal.

(e) Violin

For this situation,acustomer sold a violin from her melodic accumulations for $12,000 to his

neighbour on 1 May of the present expense year (Lignier and Evans, 2012). This violin was

gained by her on 1 June 1999. Since the violin was procured for an estimation of $500 or

more, in this way it won't be excluded from capital gain impose. Likewise, shower indexation

and rebate strategies are accessible. The capital gain can be computed as takes after:

Working note:

1. The indexed cost of purchase of violin will be $5500*68.7/68.1

Discount method

The capital gain is less under discount method, in this manner the discount method would be

used for reporting the capital gain of the violin. The relevant laws in this aspect confirm the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Taxation 11

case where the discounting method will be adopted where the capital gain is recognized as

less while applying the discount method.

case where the discounting method will be adopted where the capital gain is recognized as

less while applying the discount method.

Taxation 12

Calculation of total capital gain

Question 2

(a) FBT consequences and calculation of FBT Liability for the year ending 31 March

2018

Fringe benefits tax is a type of taxthat is forced by the Australian taxation office on the

citizens inside the Australian tax system. This assessment is forced with respect to non-

monetary benefits given by the business to their workers out of the business understanding or

authoritative course of action. These incorporate the advantages given to the family or

partners of the workers also. These advantages are other than the measure of pay paid in real

money frame, anyway, they can either shape Some portion of compensation or compensation

or be notwithstanding the yearly pay or wages paid. The tax ascertained on the aggregate sum

of assessable Fringe benefits tax is known as FBT. The fringe benefit taxationwill be a

statutory tax calculated for the assesse during the relevant year. The same will include all

types of residual benefits, expenses benefits and other benefits which are extended to the

Calculation of total capital gain

Question 2

(a) FBT consequences and calculation of FBT Liability for the year ending 31 March

2018

Fringe benefits tax is a type of taxthat is forced by the Australian taxation office on the

citizens inside the Australian tax system. This assessment is forced with respect to non-

monetary benefits given by the business to their workers out of the business understanding or

authoritative course of action. These incorporate the advantages given to the family or

partners of the workers also. These advantages are other than the measure of pay paid in real

money frame, anyway, they can either shape Some portion of compensation or compensation

or be notwithstanding the yearly pay or wages paid. The tax ascertained on the aggregate sum

of assessable Fringe benefits tax is known as FBT. The fringe benefit taxationwill be a

statutory tax calculated for the assesse during the relevant year. The same will include all

types of residual benefits, expenses benefits and other benefits which are extended to the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.