HI6028 Taxation Theory: Tax Liability, GST, and Partnerships

VerifiedAdded on 2023/06/18

|7

|2442

|192

Homework Assignment

AI Summary

This assignment solution for HI6028 Taxation Theory, Practice and Law covers various aspects of Australian taxation. It identifies and explains key Commonwealth taxes, including income tax, superannuation tax, customs and excise duties, and capital gains tax. It also includes a calculation of tax liability, medicare levy, and medicare levy surcharge for an individual, considering deductions. The assignment further discusses the deductibility of various business expenses, referencing relevant statutes and case law. It differentiates between general law and tax law definitions of a partnership and explores the GST consequences of returning faulty goods to a manufacturer. Finally, it addresses who must lodge tax returns and the importance of assessments. Desklib provides this and other solved assignments to aid students in their studies.

Student Number: (enter on the line below)

Student Name: (enter on the line below)

HI6028

TAXATION THEORY, PRACTICE AND LAW

SUPPLEMENTARY ASSESSMENT

TRIMESTER 1, 2021

TIME ALLOWED: 4.5 hours

All answers must be submitted within this time frame. Late submissions are not

accepted.

Assessment Weight: 50 total marks

Instructions:

All questions must be answered by using the answer boxes provided in this paper.

Completed answers must be submitted to Blackboard by the published due date

and time.

Submission instructions are at the end of this paper.

Purpose:

This assessment consists of six (6) questions and is designed to assess your level of

knowledge of the key topics covered in this unit

HI6028 Online Supp T1 2021

Student Name: (enter on the line below)

HI6028

TAXATION THEORY, PRACTICE AND LAW

SUPPLEMENTARY ASSESSMENT

TRIMESTER 1, 2021

TIME ALLOWED: 4.5 hours

All answers must be submitted within this time frame. Late submissions are not

accepted.

Assessment Weight: 50 total marks

Instructions:

All questions must be answered by using the answer boxes provided in this paper.

Completed answers must be submitted to Blackboard by the published due date

and time.

Submission instructions are at the end of this paper.

Purpose:

This assessment consists of six (6) questions and is designed to assess your level of

knowledge of the key topics covered in this unit

HI6028 Online Supp T1 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1 (7 marks)

What are the key commonwealth taxes levied in Australia? Explain at least four taxes and the key

features of these taxes.

ANSWER: ** Answer box will enlarge as you type

The most significant of Commonwealth taxes levied in australia are:

1. Income taxes for individuals and companies: It is the most significant form of taxation in

australia which is collected by the federal government through ATO. Australia maintains a lower

tax burden in cmparison to the other wealthy countries. Australia makes use of progressive tax

scale system for taxing indivdiual snad companies.

2. Superannuation taxes: It taxed in australia by ATO at three points which are contribution

received by the superannuation fund, income on the investment earned by the fund and the last

is the benefit paid by the fund. In Australia, every employee is required to pay minimum level of

superannuation to its employees in order to ensure workers have enough moneyset aside for

their retirement.

3. Customs and excise duties: It is the primary source of taxation which is easy to administer and

is also less likely to attract negtaive attention in contrast to the other direct form of taxation. The

rules applying to customs duty in Australia are very complex and the importers are required to

seek advice for every case. The excise duty is paid by the manufacturer at a flat rate. The

applicable rate of excise might increase twice a year in order to reflect inflationary changes.

4. Taxes on capital gains: It is imposed on the capital gains which is realised on the sale of assets

and for the taxation purpose the list of assets which are subjected to CGT are very broad. CG are

included in taxpayer’s assessable income and therefore taxed at each taxpayer’s applicable

income tax rate.

Question 2 (7 marks)

Nick is working for an Indian mining company in an Australian city. Nick is a single resident who

does not have private health insurance. He earned $120,000 and has a $ 15,000 deduction during

the 2020/2021 income year. Calculate his tax liability (income tax, medicare levy, medicare levy

surcharge (if applicable) and low and middle income tax offset for the 2020/2021 income year.

ANSWER:

Income earned = $120000

Less: Deductions = $15000

HI6028 Online Supp T1 2021

What are the key commonwealth taxes levied in Australia? Explain at least four taxes and the key

features of these taxes.

ANSWER: ** Answer box will enlarge as you type

The most significant of Commonwealth taxes levied in australia are:

1. Income taxes for individuals and companies: It is the most significant form of taxation in

australia which is collected by the federal government through ATO. Australia maintains a lower

tax burden in cmparison to the other wealthy countries. Australia makes use of progressive tax

scale system for taxing indivdiual snad companies.

2. Superannuation taxes: It taxed in australia by ATO at three points which are contribution

received by the superannuation fund, income on the investment earned by the fund and the last

is the benefit paid by the fund. In Australia, every employee is required to pay minimum level of

superannuation to its employees in order to ensure workers have enough moneyset aside for

their retirement.

3. Customs and excise duties: It is the primary source of taxation which is easy to administer and

is also less likely to attract negtaive attention in contrast to the other direct form of taxation. The

rules applying to customs duty in Australia are very complex and the importers are required to

seek advice for every case. The excise duty is paid by the manufacturer at a flat rate. The

applicable rate of excise might increase twice a year in order to reflect inflationary changes.

4. Taxes on capital gains: It is imposed on the capital gains which is realised on the sale of assets

and for the taxation purpose the list of assets which are subjected to CGT are very broad. CG are

included in taxpayer’s assessable income and therefore taxed at each taxpayer’s applicable

income tax rate.

Question 2 (7 marks)

Nick is working for an Indian mining company in an Australian city. Nick is a single resident who

does not have private health insurance. He earned $120,000 and has a $ 15,000 deduction during

the 2020/2021 income year. Calculate his tax liability (income tax, medicare levy, medicare levy

surcharge (if applicable) and low and middle income tax offset for the 2020/2021 income year.

ANSWER:

Income earned = $120000

Less: Deductions = $15000

HI6028 Online Supp T1 2021

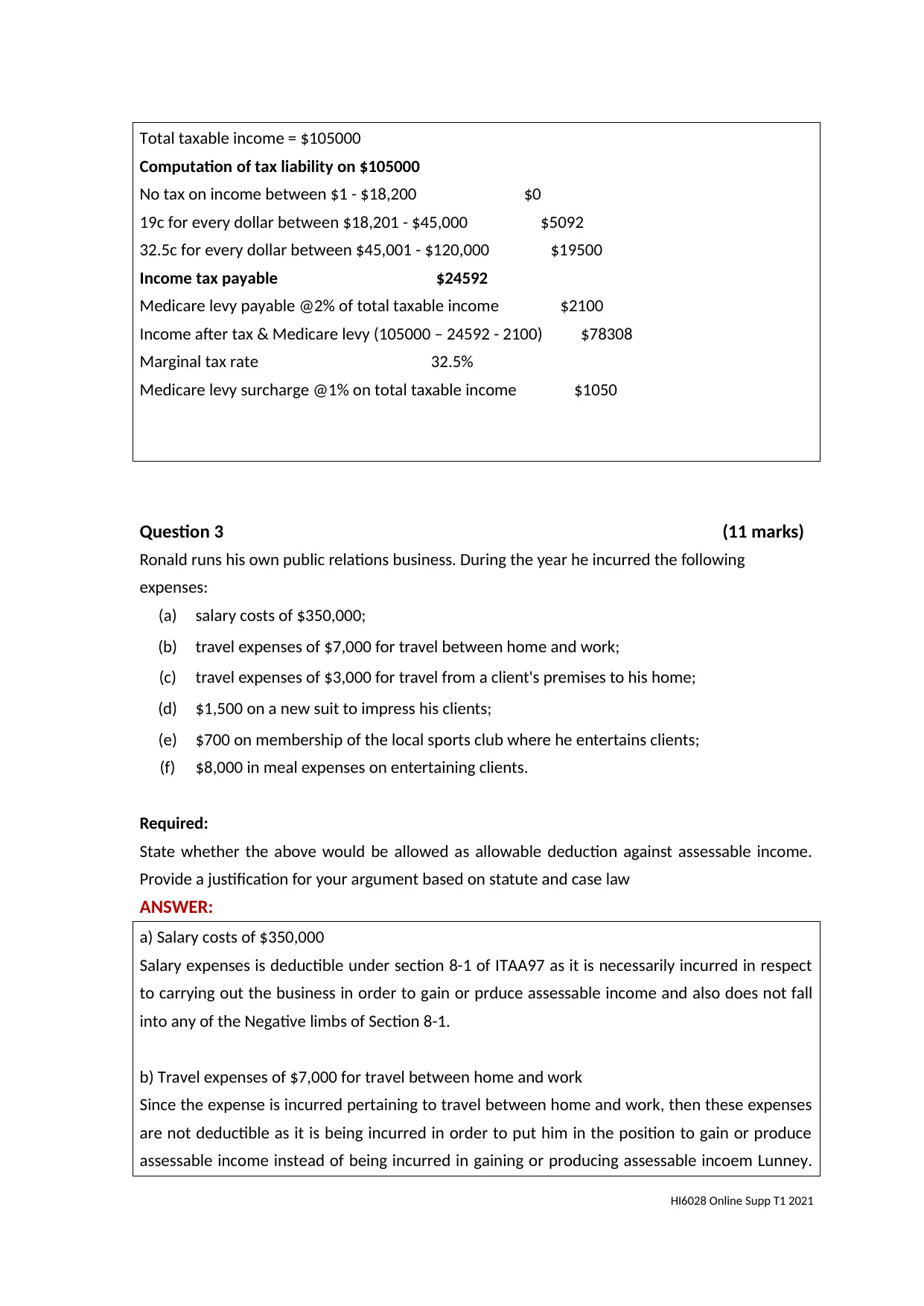

Total taxable income = $105000

Computation of tax liability on $105000

No tax on income between $1 - $18,200 $0

19c for every dollar between $18,201 - $45,000 $5092

32.5c for every dollar between $45,001 - $120,000 $19500

Income tax payable $24592

Medicare levy payable @2% of total taxable income $2100

Income after tax & Medicare levy (105000 – 24592 - 2100) $78308

Marginal tax rate 32.5%

Medicare levy surcharge @1% on total taxable income $1050

Question 3 (11 marks)

Ronald runs his own public relations business. During the year he incurred the following

expenses:

(a) salary costs of $350,000;

(b) travel expenses of $7,000 for travel between home and work;

(c) travel expenses of $3,000 for travel from a client's premises to his home;

(d) $1,500 on a new suit to impress his clients;

(e) $700 on membership of the local sports club where he entertains clients;

(f) $8,000 in meal expenses on entertaining clients.

Required:

State whether the above would be allowed as allowable deduction against assessable income.

Provide a justification for your argument based on statute and case law

ANSWER:

a) Salary costs of $350,000

Salary expenses is deductible under section 8-1 of ITAA97 as it is necessarily incurred in respect

to carrying out the business in order to gain or prduce assessable income and also does not fall

into any of the Negative limbs of Section 8-1.

b) Travel expenses of $7,000 for travel between home and work

Since the expense is incurred pertaining to travel between home and work, then these expenses

are not deductible as it is being incurred in order to put him in the position to gain or produce

assessable income instead of being incurred in gaining or producing assessable incoem Lunney.

HI6028 Online Supp T1 2021

Computation of tax liability on $105000

No tax on income between $1 - $18,200 $0

19c for every dollar between $18,201 - $45,000 $5092

32.5c for every dollar between $45,001 - $120,000 $19500

Income tax payable $24592

Medicare levy payable @2% of total taxable income $2100

Income after tax & Medicare levy (105000 – 24592 - 2100) $78308

Marginal tax rate 32.5%

Medicare levy surcharge @1% on total taxable income $1050

Question 3 (11 marks)

Ronald runs his own public relations business. During the year he incurred the following

expenses:

(a) salary costs of $350,000;

(b) travel expenses of $7,000 for travel between home and work;

(c) travel expenses of $3,000 for travel from a client's premises to his home;

(d) $1,500 on a new suit to impress his clients;

(e) $700 on membership of the local sports club where he entertains clients;

(f) $8,000 in meal expenses on entertaining clients.

Required:

State whether the above would be allowed as allowable deduction against assessable income.

Provide a justification for your argument based on statute and case law

ANSWER:

a) Salary costs of $350,000

Salary expenses is deductible under section 8-1 of ITAA97 as it is necessarily incurred in respect

to carrying out the business in order to gain or prduce assessable income and also does not fall

into any of the Negative limbs of Section 8-1.

b) Travel expenses of $7,000 for travel between home and work

Since the expense is incurred pertaining to travel between home and work, then these expenses

are not deductible as it is being incurred in order to put him in the position to gain or produce

assessable income instead of being incurred in gaining or producing assessable incoem Lunney.

HI6028 Online Supp T1 2021

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In additin to this, it will be considered as a private expense and also none of the rules of the

expception to the general rule appear to be applied here.

c) Travel expenses of $3,000 for travel from a client’s premises to his home

Such type of travel expenses will constiture as the travel between the alternative workplace and

the home and is considered to be incurred in respect to gaining or producing the assessable

income. The tax payer is in the position to gain or produce the assessable income and as such

they would meet with the needs of section 8-1 of ITAA97.

d) $1,500 on a new suit to impress his clients

This expense will not be deducted in accordance with the section 8-1 as it is not being incurred in

respect to gaining or producing assessable income but on the other hand, it is being put by the

tax payer to gain or prodce the asseessable income. Along with this, it would constitute a private

or domestic expense and fall within the negative limbs of s 8-1 of ITAA97.

e) $700 on membership of the local sports club where he entertains clients

The expense of $700 incurred by Ronald on a local sports club in which he entertains clients will

not be deducted as per section 26-45 ITAA 1997 which denies the deductions pertaining to the

recreational club expenses. As such it is also deductible under section 8-1 of ITAA 1997 due to

the s 8-1(2)(d).

f) $8,000 in meal expenses on entertaining clients

Prima facie, the business meals mainly incorporates an ntertainment expense for which

deduction cannot be claimed irrespective of the fact whetehr the business transcation or

discussion have actually taken place with reference to Div 32 ITAA97 section 31-10(2). However,

in case if the food is provided at an in-house dinning facility or considered it as a fringe benefit,

then in that case, it would be deductible with referenec to section 8-1, section 32-30 and section

32-30, Items 1.1-1.3. Coopers case- football player.

Question 4 (7 marks)

How are the general law and tax law definitions of a ‘partnership’ different ? explain what the

difference is important?

ANSWER:

HI6028 Online Supp T1 2021

expception to the general rule appear to be applied here.

c) Travel expenses of $3,000 for travel from a client’s premises to his home

Such type of travel expenses will constiture as the travel between the alternative workplace and

the home and is considered to be incurred in respect to gaining or producing the assessable

income. The tax payer is in the position to gain or produce the assessable income and as such

they would meet with the needs of section 8-1 of ITAA97.

d) $1,500 on a new suit to impress his clients

This expense will not be deducted in accordance with the section 8-1 as it is not being incurred in

respect to gaining or producing assessable income but on the other hand, it is being put by the

tax payer to gain or prodce the asseessable income. Along with this, it would constitute a private

or domestic expense and fall within the negative limbs of s 8-1 of ITAA97.

e) $700 on membership of the local sports club where he entertains clients

The expense of $700 incurred by Ronald on a local sports club in which he entertains clients will

not be deducted as per section 26-45 ITAA 1997 which denies the deductions pertaining to the

recreational club expenses. As such it is also deductible under section 8-1 of ITAA 1997 due to

the s 8-1(2)(d).

f) $8,000 in meal expenses on entertaining clients

Prima facie, the business meals mainly incorporates an ntertainment expense for which

deduction cannot be claimed irrespective of the fact whetehr the business transcation or

discussion have actually taken place with reference to Div 32 ITAA97 section 31-10(2). However,

in case if the food is provided at an in-house dinning facility or considered it as a fringe benefit,

then in that case, it would be deductible with referenec to section 8-1, section 32-30 and section

32-30, Items 1.1-1.3. Coopers case- football player.

Question 4 (7 marks)

How are the general law and tax law definitions of a ‘partnership’ different ? explain what the

difference is important?

ANSWER:

HI6028 Online Supp T1 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The general law defines the partnership as the relationship which exist between people carrying

some common business objective which is generally profit. On the other hand, from the income

tax purpose the partnership is defined under s 995- 1 (1) of income tax assessment act of 1997.

Under this the partnership is defined as an association of person other than a company carrying

the business as partner. In addition to this, they are also in receipt of ordinary and statutory

income jointly or the limited partnership. Both these definitions of the partnership are different

from one another. This is particularly because of the reason that both these contain different

elements.

The major difference between the general law and taxation law of partnership is that the general

law is the traditional partnership which is formed when two or more parties agree to carry the

business as partners. On the other hand, income tax law further extend the definiaton of general

law by adding the “in receipt of income jointly”. This purpose of tax law exist only with the

purpose of tax. Whereas on the other side the general law does not recognize the tax law

partnership.

In addition to this, the general law of partnership does not recognize sthe tenancy within

common or joint or part ownership of property. Only the receipt of income jointly from the

investments if carried on business is outside from the definiation of the partnership under the

general law.

In against of this, there are number of legal consequences in the general law of partnership.

While in against of this, in the tax law partnership is not governed by the terms of written

agreement and the other members of tax law partnership will not be coming under the same

fiduciary obligation.

On the other hand, under general law of partnership is formed when two or more entities

commence carrying the business as partners. In against of this, a tax law partnership come into

existence from the time a perosn jointly commende on activity from which the partners will

jointly receive.

Question 5 (11 marks)

Bebel Sports is a large sports retailer. It purchases ‘tennis racquets’ for $110 for each from A2Z

Sports Goods, a large manufacturer of tennis products. Bebel Sports plans to sell the tennis

racquets at a 200% mark-up to its customers. In January last year, it purchased 100 racquests.

However, in April, it discovered that 10 of these racquets had design faults and it returned them

to the manufacturer and obtained a full refund. Explain the GST consequences of this

arrangement for both parties.

HI6028 Online Supp T1 2021

some common business objective which is generally profit. On the other hand, from the income

tax purpose the partnership is defined under s 995- 1 (1) of income tax assessment act of 1997.

Under this the partnership is defined as an association of person other than a company carrying

the business as partner. In addition to this, they are also in receipt of ordinary and statutory

income jointly or the limited partnership. Both these definitions of the partnership are different

from one another. This is particularly because of the reason that both these contain different

elements.

The major difference between the general law and taxation law of partnership is that the general

law is the traditional partnership which is formed when two or more parties agree to carry the

business as partners. On the other hand, income tax law further extend the definiaton of general

law by adding the “in receipt of income jointly”. This purpose of tax law exist only with the

purpose of tax. Whereas on the other side the general law does not recognize the tax law

partnership.

In addition to this, the general law of partnership does not recognize sthe tenancy within

common or joint or part ownership of property. Only the receipt of income jointly from the

investments if carried on business is outside from the definiation of the partnership under the

general law.

In against of this, there are number of legal consequences in the general law of partnership.

While in against of this, in the tax law partnership is not governed by the terms of written

agreement and the other members of tax law partnership will not be coming under the same

fiduciary obligation.

On the other hand, under general law of partnership is formed when two or more entities

commence carrying the business as partners. In against of this, a tax law partnership come into

existence from the time a perosn jointly commende on activity from which the partners will

jointly receive.

Question 5 (11 marks)

Bebel Sports is a large sports retailer. It purchases ‘tennis racquets’ for $110 for each from A2Z

Sports Goods, a large manufacturer of tennis products. Bebel Sports plans to sell the tennis

racquets at a 200% mark-up to its customers. In January last year, it purchased 100 racquests.

However, in April, it discovered that 10 of these racquets had design faults and it returned them

to the manufacturer and obtained a full refund. Explain the GST consequences of this

arrangement for both parties.

HI6028 Online Supp T1 2021

ANSWER:

In the present case, wherein the company identified that 10 racquets had design faults and they

were returned to the manufacturer and obtained full refund. Hence, as per the GST

consequences when the consumer returns the goods to the company it is not considered as

cancellation of the original sales. Hence, in this case the company is not eligible to take any of

the action and will not be in position to claim the money back. On the other hand the original

sale of the good is not being cancelled. In addition to this, there will not be any change within

the GST obligation for the original sales of the product. Hence, in the present case there will not

be any adjustment required to be conducted by any of the party. Hence, in the present case,

both Beble Sports and A2Z Sports goods will not have to make any of the adjustment relating to

GST paid and received. The major reason pertaining to the fact that in the present case the

goods are not being sold to the consumers and thus, this not involve any of the GST receivable.

Question 6 (7 marks)

Who must lodge tax returns? What is an assessment ? Why are assessments important?

ANSWER:

The lodge tax is being defined as the getting back the taxes which are being paid. Even though

the person has earned the new tax free threshold and paid tax on the income during the year

then they are eligible to lodge a tax return. Under the Australian taxation if the person has

earned more than $18200 within their past financial year then they are required to lodge a tax

return. In against of this in case the perons earns more than the tax free threshold the they

definitely need to lodge the tax retrun and the income tax is calculated on how much the money

the person has made above the tax free threshold.

The amount which is subject to the taxation under the particular statue requires the analysis of

the situation of the taxpayers and all the legal provision which applicable to them. The notive of

assessment highlgihts the amount of tax which the person owe on the taxable income. In

addition to this the credit taken for tax already paid within the income year is also highlighted.

Further the assessment of tax which needs to be paid or refund is also highlighted within the

assessment.

Hence, the assessment are important to be analysed because it provides a informaiton of any

excess of private health reduction or the refund applicable. In addition to this, the notive of

assessment is important in order to check the fact that everything is correct. In addition to this,

the tax assessment is very important to identify the job of determining the value of something

like property, and is used to property tax. Hence, the word tax assessment is being used in

different manner but in general it refers to as the tax liability which is owed by the taxpayer.

HI6028 Online Supp T1 2021

In the present case, wherein the company identified that 10 racquets had design faults and they

were returned to the manufacturer and obtained full refund. Hence, as per the GST

consequences when the consumer returns the goods to the company it is not considered as

cancellation of the original sales. Hence, in this case the company is not eligible to take any of

the action and will not be in position to claim the money back. On the other hand the original

sale of the good is not being cancelled. In addition to this, there will not be any change within

the GST obligation for the original sales of the product. Hence, in the present case there will not

be any adjustment required to be conducted by any of the party. Hence, in the present case,

both Beble Sports and A2Z Sports goods will not have to make any of the adjustment relating to

GST paid and received. The major reason pertaining to the fact that in the present case the

goods are not being sold to the consumers and thus, this not involve any of the GST receivable.

Question 6 (7 marks)

Who must lodge tax returns? What is an assessment ? Why are assessments important?

ANSWER:

The lodge tax is being defined as the getting back the taxes which are being paid. Even though

the person has earned the new tax free threshold and paid tax on the income during the year

then they are eligible to lodge a tax return. Under the Australian taxation if the person has

earned more than $18200 within their past financial year then they are required to lodge a tax

return. In against of this in case the perons earns more than the tax free threshold the they

definitely need to lodge the tax retrun and the income tax is calculated on how much the money

the person has made above the tax free threshold.

The amount which is subject to the taxation under the particular statue requires the analysis of

the situation of the taxpayers and all the legal provision which applicable to them. The notive of

assessment highlgihts the amount of tax which the person owe on the taxable income. In

addition to this the credit taken for tax already paid within the income year is also highlighted.

Further the assessment of tax which needs to be paid or refund is also highlighted within the

assessment.

Hence, the assessment are important to be analysed because it provides a informaiton of any

excess of private health reduction or the refund applicable. In addition to this, the notive of

assessment is important in order to check the fact that everything is correct. In addition to this,

the tax assessment is very important to identify the job of determining the value of something

like property, and is used to property tax. Hence, the word tax assessment is being used in

different manner but in general it refers to as the tax liability which is owed by the taxpayer.

HI6028 Online Supp T1 2021

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

END OF SUPPLEMENTARY ASSESSMENT

Submission instructions:

Save submission with your STUDENT ID NUMBER and UNIT CODE e.g. EMV5897 HI6028

Submission must be in MICROSOFT WORD FORMAT ONLY

Upload your submission to the appropriate link on Blackboard

Only one submission is accepted. Please ensure your submission is the correct

document.

All submissions are automatically passed through SafeAssign to assess academic integrity.

HI6028 Online Supp T1 2021

Submission instructions:

Save submission with your STUDENT ID NUMBER and UNIT CODE e.g. EMV5897 HI6028

Submission must be in MICROSOFT WORD FORMAT ONLY

Upload your submission to the appropriate link on Blackboard

Only one submission is accepted. Please ensure your submission is the correct

document.

All submissions are automatically passed through SafeAssign to assess academic integrity.

HI6028 Online Supp T1 2021

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.