Taxation Law: Income, Fringe Benefits, and Capital Gains Analysis

VerifiedAdded on 2021/06/16

|8

|2352

|23

Homework Assignment

AI Summary

This assignment solution addresses several key taxation issues. Question 1 examines whether payments for writing an autobiography, sale of photographs, and a manuscript constitute income from personal exertion, concluding they are capital receipts exempt from tax. Question 2 calculates the taxable value of a car fringe benefit using the statutory formula, considering the cost base, statutory percentage, and employee expenses. Question 3 analyzes the tax implications of a son repaying a debt to his parent, including the tax treatment of the principal and interest, and determining that the additional payment is a gift. Finally, Question 4 deals with capital gains tax (CGT) on the sale of a property, considering the pre-CGT status of the land and post-CGT status of the house, calculating the CGT liability, and discussing the impact of selling the property to a daughter at a lower price and the implications for a company.

TAXATION

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

Issue

The key concern in the given scenario is whether the payments derived by Hilary through

writing autobiography, sale of photographs and manuscript can be considered as income

derived on account of personal exertion.

Rule

In order for a given stream of payments to be considered as income in ordinary sense, it is

imperative that a given section from the following choices must be applicable (CCH, 2013).

1) Section 6(5) – In accordance with this section, ordinary income would comprise of the

income that is earned in accordance to ordinary concepts. With reference to appropriate

cases, the ordinary income under this section would include personal exertion related

income (employment or business) coupled with investment related income derived as rent,

interest or dividends.

2) Section 15(15) – The profits that are earned by engaging in an isolated transaction driven

by profit motive would also be tagged as ordinary income.

Besides, a key aspect is that capital receipts obtained when there is liquidation of a capital

asset are not subject to taxation but any capital gains can potentially be taxed as per CGT

(Woellner, 2014).

In order to analyse the better situation in a better manner, it is imperative to consider Brent vs

Federal Commissioner of Taxation (1971) 125 CLR case. In this case, the relevant taxpayer

was the wife of the a robber having involvement in a famous robbery at the time. She was

approached by a newspaper that offered her money in lieu of sharing various intimate details

about her marital relationship. This information was shared by the taxpayer through the

medium of interviews that stretched over several days (Sadiq et. al., 2016). There was

disagreement between the taxpayer and the tax commissioner with regards to the assessability

of the tax receipt. Subsequently, the case was taken to court where the decision came in the

favour of taxpayer since the court indicated that there was the transfer of a capital asset which

is information about martial relationship. The income would not be considered arising from

personal exertion since the act of attending interviews did not produce anything of

1

Issue

The key concern in the given scenario is whether the payments derived by Hilary through

writing autobiography, sale of photographs and manuscript can be considered as income

derived on account of personal exertion.

Rule

In order for a given stream of payments to be considered as income in ordinary sense, it is

imperative that a given section from the following choices must be applicable (CCH, 2013).

1) Section 6(5) – In accordance with this section, ordinary income would comprise of the

income that is earned in accordance to ordinary concepts. With reference to appropriate

cases, the ordinary income under this section would include personal exertion related

income (employment or business) coupled with investment related income derived as rent,

interest or dividends.

2) Section 15(15) – The profits that are earned by engaging in an isolated transaction driven

by profit motive would also be tagged as ordinary income.

Besides, a key aspect is that capital receipts obtained when there is liquidation of a capital

asset are not subject to taxation but any capital gains can potentially be taxed as per CGT

(Woellner, 2014).

In order to analyse the better situation in a better manner, it is imperative to consider Brent vs

Federal Commissioner of Taxation (1971) 125 CLR case. In this case, the relevant taxpayer

was the wife of the a robber having involvement in a famous robbery at the time. She was

approached by a newspaper that offered her money in lieu of sharing various intimate details

about her marital relationship. This information was shared by the taxpayer through the

medium of interviews that stretched over several days (Sadiq et. al., 2016). There was

disagreement between the taxpayer and the tax commissioner with regards to the assessability

of the tax receipt. Subsequently, the case was taken to court where the decision came in the

favour of taxpayer since the court indicated that there was the transfer of a capital asset which

is information about martial relationship. The income would not be considered arising from

personal exertion since the act of attending interviews did not produce anything of

1

commercial value but only acted as a medium to share information or facilitate the asset

transfer (Gilders et. al., 2016).

Application

Hilary has derived three payments whose appropriate tax treatment would be outlined

considering the case law and statute identified above.

Story Receipts

The given facts highlight that even though Hilary has never engaged in writing but yet a

newspaper was willing to give her $ 10,000 for writing. This clearly highlights the interest of

the newspaper in the details of Hilary’s life and not her writing. The details about her life are

of utility to the newspaper considering that she was a famous person and hence people would

like to know about her life. Besides, the act of writing does not produce anything which is

commercially of any value and hence this only acted as a transferring mode of information

related to her life to the newspaper. It did not lead to creation of any incremental asset. Thus,

the payment derived would be labelled as capital receipts and considered as exempt from tax.

Manuscript and Photograph Receipts

The argument highlighted above can also be extended to these assets which have commercial

value on account of the underlying subject which they capture rather than the underlying

skills of the person who engaged in photography or writing. Therefore, if the photos did not

pertain to Hilary’s expeditions, the commercial worth would not exist. Hence, through the

means of manuscript and photos essentially valuable subject related information is being

transferred and hence the receipts from these would also fall within the ambit of capital

receipts and thereby would not be levied tax.

Change of Motive

Now if there is change of the underlying motive which is driving Hilary to write her

autobiography, the question is whether there would be any change in the tax treatment. Under

this situation also, no alteration in tax treatment would happen considering the fact that intent

with which writing activity has been undertaken is immaterial considering that writing does

not have any commercial worth owing to Hillary not being a famous writer (Barkoczy, 2015).

Conclusion

2

transfer (Gilders et. al., 2016).

Application

Hilary has derived three payments whose appropriate tax treatment would be outlined

considering the case law and statute identified above.

Story Receipts

The given facts highlight that even though Hilary has never engaged in writing but yet a

newspaper was willing to give her $ 10,000 for writing. This clearly highlights the interest of

the newspaper in the details of Hilary’s life and not her writing. The details about her life are

of utility to the newspaper considering that she was a famous person and hence people would

like to know about her life. Besides, the act of writing does not produce anything which is

commercially of any value and hence this only acted as a transferring mode of information

related to her life to the newspaper. It did not lead to creation of any incremental asset. Thus,

the payment derived would be labelled as capital receipts and considered as exempt from tax.

Manuscript and Photograph Receipts

The argument highlighted above can also be extended to these assets which have commercial

value on account of the underlying subject which they capture rather than the underlying

skills of the person who engaged in photography or writing. Therefore, if the photos did not

pertain to Hilary’s expeditions, the commercial worth would not exist. Hence, through the

means of manuscript and photos essentially valuable subject related information is being

transferred and hence the receipts from these would also fall within the ambit of capital

receipts and thereby would not be levied tax.

Change of Motive

Now if there is change of the underlying motive which is driving Hilary to write her

autobiography, the question is whether there would be any change in the tax treatment. Under

this situation also, no alteration in tax treatment would happen considering the fact that intent

with which writing activity has been undertaken is immaterial considering that writing does

not have any commercial worth owing to Hillary not being a famous writer (Barkoczy, 2015).

Conclusion

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

None of the receipts would be considered as income from personal exertion. Instead these

receipts are capital receipts which are exempt from tax. This treatment would not alter even if

Hilary had written the book for her self-satisfaction and not for earning profit.

Question 2

Issue

The central issue is to determine the taxable value of the car fringe benefit that has been

extended to the employee in accordance with the relevant provisions of Fringe Benefit Tax

Assessment Act, 1986 (FBTAA)

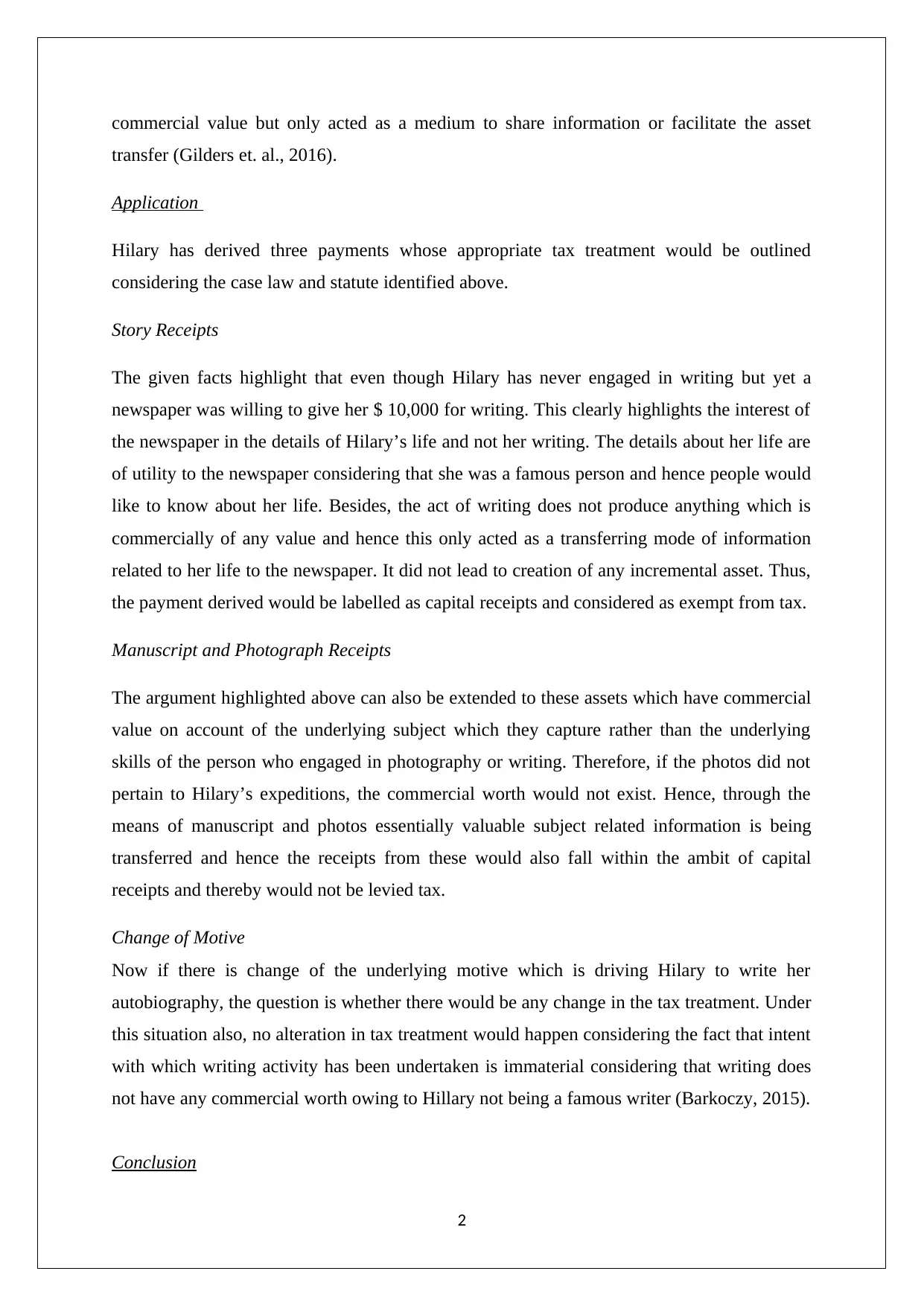

Relevant Rule

In accordance with section 9, FBTAA, the statutory formula for determination of car fringe

benefit taxable value is as highlighted below (Woellner, 2014).

As highlighted under s.9, the base value of the car is usually the purchase value. Depreciation

is not applicable on annual basis but after 4 years. Also, the value of statutory percentage in

the above formula is always pegged at 20% without any reference to the distance travelled by

the employee for personal use. Also, s. 10A allows that expense contributions be deducted

but only if these have proof in terms of relevant documentation and records to establish that

the expense was indeed done (Sadiq et. al., 2016).

Application

Considering the information given in the question, the input values are highlighted as

mentioned below.

Cost base of the car = $ 50,000

Statutory Percentage is 20%

Days of utilisation is 183

Employee expenses are $1,000 and also relevant documentation exists to establish the same.

3

receipts are capital receipts which are exempt from tax. This treatment would not alter even if

Hilary had written the book for her self-satisfaction and not for earning profit.

Question 2

Issue

The central issue is to determine the taxable value of the car fringe benefit that has been

extended to the employee in accordance with the relevant provisions of Fringe Benefit Tax

Assessment Act, 1986 (FBTAA)

Relevant Rule

In accordance with section 9, FBTAA, the statutory formula for determination of car fringe

benefit taxable value is as highlighted below (Woellner, 2014).

As highlighted under s.9, the base value of the car is usually the purchase value. Depreciation

is not applicable on annual basis but after 4 years. Also, the value of statutory percentage in

the above formula is always pegged at 20% without any reference to the distance travelled by

the employee for personal use. Also, s. 10A allows that expense contributions be deducted

but only if these have proof in terms of relevant documentation and records to establish that

the expense was indeed done (Sadiq et. al., 2016).

Application

Considering the information given in the question, the input values are highlighted as

mentioned below.

Cost base of the car = $ 50,000

Statutory Percentage is 20%

Days of utilisation is 183

Employee expenses are $1,000 and also relevant documentation exists to establish the same.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion

On the basis of the above computation, it is evident that requisite taxable value arising on

account of car fringe benefit is $ 4,014 approximately.

Question 3

Issue

The major issue in the given scenario is to outline based on relevant tax statutes and case law

the potential tax implications of the money that the son has paid to the parent for clearing the

outstanding debt.

Rule

In the context of payment received by the lender for settlement of debt, there would be

essentially two components namely interest and principal. The requisite tax treatment of these

two items is indicated below.

o Principal – The repayment of principal does not have any tax implications as it is a

capital receipt and hence does not attract any tax (Deutsch et. al., 2016).

o Interest= Tax may be levied on the interest component especially if it falls within the

ambit of either s. 6(5) or s. 15(15). The interest income would fall within s. 6(5) if this

is a regular source of income for the taxpayer whereby a business involving lending of

money exists. On the other hand, the interest income falls within s. 15(15) when a

particular transaction which is not regular and hence isolated is there where money

lending has been done so as to gain income through interest (Sadiq et. al., 2016).

Besides, there is another possibility when such an interest payment may not attract any tax

owing to it being considered as gift. However, in accordance with TR2005/13, this is possible

only if certain pre-requisites are fulfilled which are mentioned as follows (ATO, 2005).

A mandatory change of ownership where transferee is the beneficiary.

This transfer should come about in a voluntary manner.

This transfer should not be prompted by any expectations of any return favours.

Benefaction should be key objective which should drive the transfer.

Application

4

On the basis of the above computation, it is evident that requisite taxable value arising on

account of car fringe benefit is $ 4,014 approximately.

Question 3

Issue

The major issue in the given scenario is to outline based on relevant tax statutes and case law

the potential tax implications of the money that the son has paid to the parent for clearing the

outstanding debt.

Rule

In the context of payment received by the lender for settlement of debt, there would be

essentially two components namely interest and principal. The requisite tax treatment of these

two items is indicated below.

o Principal – The repayment of principal does not have any tax implications as it is a

capital receipt and hence does not attract any tax (Deutsch et. al., 2016).

o Interest= Tax may be levied on the interest component especially if it falls within the

ambit of either s. 6(5) or s. 15(15). The interest income would fall within s. 6(5) if this

is a regular source of income for the taxpayer whereby a business involving lending of

money exists. On the other hand, the interest income falls within s. 15(15) when a

particular transaction which is not regular and hence isolated is there where money

lending has been done so as to gain income through interest (Sadiq et. al., 2016).

Besides, there is another possibility when such an interest payment may not attract any tax

owing to it being considered as gift. However, in accordance with TR2005/13, this is possible

only if certain pre-requisites are fulfilled which are mentioned as follows (ATO, 2005).

A mandatory change of ownership where transferee is the beneficiary.

This transfer should come about in a voluntary manner.

This transfer should not be prompted by any expectations of any return favours.

Benefaction should be key objective which should drive the transfer.

Application

4

In the case under consideration, the total principal that has been given as financial assistance

to the son is $ 40,000. The son while making the repayment of this financial assistance has

also extended incremental amount to the tune of $ 4,000. The key issue is to ascertain if the $

4,000 would contribute to assessable income of the parent or not since $ 40,000 would be tax

exempt capital receipt.

Section 6(5) – The money obtained by the parent would not be classified under this

section as the given evidence does not suggest that parent has any business which

deals with money lending. Also, the parent’s conduct in the given transaction does not

seem business like conduct. Thus, $ 4,000 is not ordinary income under this section.

Section 15(15) – One of the key facts is that the parent while extending financial

assistance made her intentions clear that she did not expect any interest on the amount

The absence of profit motive clearly makes this section inoperative for the $ 4,000.

The only remaining choice is for $ 4,000 to be treated as a gift which is true in this

case as the following conditions are met.

Change of ownership already facilitated through cheque.

The incremental payment was made by son despite parent having no such

expectations.

The payment made by the son is not driven by future favours.

Gratitude seems to be the driver of this payment.

Conclusion

The key arguments highlighted above lead to the conclusion that the receipt of $ 44,000

cheque from son has no tax impact for the parent as the entire amount is not subject to tax.

Question 4

Part a)

In the scenario presented, the asset is to be sub-divided into two assets i.e, land and house.

This becomes necessary considering the origin of the assets happens at different times. The

land originated in the pre-CGT era whereas house construction was done post introduction of

CGT. As a result, no CGT would apply on the land but the opposite treatment would be

extended to house. The current market price of the property is $ 800,000 which comprises

5

to the son is $ 40,000. The son while making the repayment of this financial assistance has

also extended incremental amount to the tune of $ 4,000. The key issue is to ascertain if the $

4,000 would contribute to assessable income of the parent or not since $ 40,000 would be tax

exempt capital receipt.

Section 6(5) – The money obtained by the parent would not be classified under this

section as the given evidence does not suggest that parent has any business which

deals with money lending. Also, the parent’s conduct in the given transaction does not

seem business like conduct. Thus, $ 4,000 is not ordinary income under this section.

Section 15(15) – One of the key facts is that the parent while extending financial

assistance made her intentions clear that she did not expect any interest on the amount

The absence of profit motive clearly makes this section inoperative for the $ 4,000.

The only remaining choice is for $ 4,000 to be treated as a gift which is true in this

case as the following conditions are met.

Change of ownership already facilitated through cheque.

The incremental payment was made by son despite parent having no such

expectations.

The payment made by the son is not driven by future favours.

Gratitude seems to be the driver of this payment.

Conclusion

The key arguments highlighted above lead to the conclusion that the receipt of $ 44,000

cheque from son has no tax impact for the parent as the entire amount is not subject to tax.

Question 4

Part a)

In the scenario presented, the asset is to be sub-divided into two assets i.e, land and house.

This becomes necessary considering the origin of the assets happens at different times. The

land originated in the pre-CGT era whereas house construction was done post introduction of

CGT. As a result, no CGT would apply on the land but the opposite treatment would be

extended to house. The current market price of the property is $ 800,000 which comprises

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

both land and house. The market value of house can be predicted taking into consideration

the % contribution to value of property at the time of construction in 1986 (Barkoczy, 2015).

House share in property total value in 1986 = (60000/(60000+90000)) = 0.4

Thus, current market value of house = 0.4*800000 = $320,000

Either of the two methods highlighted below can be used for capital gains computations

based on the sale of property (Gilders et. al., 2016).

1) Indexation Method- This method is outlined in s. 110.36, ITAA 1997 and allows capital

gains to be derived on the basis of inflation adjusted asset cost base. This is exhibited

below.

2) Discount method- The various aspects of this method are outlined under Division 115 and

offers s 50% discount of any capital gains derived but these should be long term i.e. the

asset must be held for more than a year.

Thus, capital gains on the property sale for Scott would be $ 130,000.

Part b)

The situation highlights the sale of property to daughter for a price which is significantly

lower than the applicable market value. However, despite this, the capital gains computation

would not be impacted and would yield the same. Section 116-30 recommends that capital

gains calculation must consider the higher value between actual selling price and market

price for determination of capital gains (Austlii, nd). Thus, taxable capital gains would still be

$ 130,000.

Part c)

There is an ownership change which implies that the taxpayer that holds the ownership of the

property being sold is a company. The capital gains taxable would change as Division 15

6

the % contribution to value of property at the time of construction in 1986 (Barkoczy, 2015).

House share in property total value in 1986 = (60000/(60000+90000)) = 0.4

Thus, current market value of house = 0.4*800000 = $320,000

Either of the two methods highlighted below can be used for capital gains computations

based on the sale of property (Gilders et. al., 2016).

1) Indexation Method- This method is outlined in s. 110.36, ITAA 1997 and allows capital

gains to be derived on the basis of inflation adjusted asset cost base. This is exhibited

below.

2) Discount method- The various aspects of this method are outlined under Division 115 and

offers s 50% discount of any capital gains derived but these should be long term i.e. the

asset must be held for more than a year.

Thus, capital gains on the property sale for Scott would be $ 130,000.

Part b)

The situation highlights the sale of property to daughter for a price which is significantly

lower than the applicable market value. However, despite this, the capital gains computation

would not be impacted and would yield the same. Section 116-30 recommends that capital

gains calculation must consider the higher value between actual selling price and market

price for determination of capital gains (Austlii, nd). Thus, taxable capital gains would still be

$ 130,000.

Part c)

There is an ownership change which implies that the taxpayer that holds the ownership of the

property being sold is a company. The capital gains taxable would change as Division 15

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

discount does not extend to companies and thus the taxable capital gains would be computed

using indexation method which would yield the taxable gains as $ 224,600 (CCH, 2013).

References

ATO (2005), TR 2005/13 [online] Available at http://law.ato.gov.au/atolaw/view.htm?

Docid=TXR/TR200513/NAT/ATO/00001 (Accessed on May 20, 2018)

Austlii (nd), INCOME TAX ASSESSMENT ACT 1997 - SECT 116.30, [online] Available at

http://www.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/s116.30.html (Accessed on

May 20, 2018)

Barkoczy, S. (2015) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University

Press.

CCH (2013), Australian Master Tax Guide 2013, 51st ed., Sydney: Wolters Kluwer

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., & Snape, T. (2016) Australian tax

handbook. 8th ed. Pymont: Thomson Reuters.

Gilders, F., Taylor, J., Walpole, M., Burton, M. & Ciro, T. (2016) Understanding taxation

law 2016. 9th ed. Sydney: LexisNexis/Butterworths.

Sadiq, K, Coleman, C, Hanegbi, R, Jogarajan, S, Krever, R, Obst, W, & Ting, A

(2016) , Principles of Taxation Law 2016, 8th ed., Pymont: Thomson Reuters

Woellner, R (2014), Australian taxation law 2014 7th ed. North Ryde: CCH Australia

7

using indexation method which would yield the taxable gains as $ 224,600 (CCH, 2013).

References

ATO (2005), TR 2005/13 [online] Available at http://law.ato.gov.au/atolaw/view.htm?

Docid=TXR/TR200513/NAT/ATO/00001 (Accessed on May 20, 2018)

Austlii (nd), INCOME TAX ASSESSMENT ACT 1997 - SECT 116.30, [online] Available at

http://www.austlii.edu.au/au/legis/cth/consol_act/itaa1997240/s116.30.html (Accessed on

May 20, 2018)

Barkoczy, S. (2015) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University

Press.

CCH (2013), Australian Master Tax Guide 2013, 51st ed., Sydney: Wolters Kluwer

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., & Snape, T. (2016) Australian tax

handbook. 8th ed. Pymont: Thomson Reuters.

Gilders, F., Taylor, J., Walpole, M., Burton, M. & Ciro, T. (2016) Understanding taxation

law 2016. 9th ed. Sydney: LexisNexis/Butterworths.

Sadiq, K, Coleman, C, Hanegbi, R, Jogarajan, S, Krever, R, Obst, W, & Ting, A

(2016) , Principles of Taxation Law 2016, 8th ed., Pymont: Thomson Reuters

Woellner, R (2014), Australian taxation law 2014 7th ed. North Ryde: CCH Australia

7

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.