ACCT 2301 Taxation Project: Computing Income, Liabilities and Advice

VerifiedAdded on 2023/05/28

|22

|1980

|344

Project

AI Summary

This project focuses on computing the income and tax liabilities for Steve and Brenda, providing tax planning advice to minimize their tax obligations. The project details Steve's salary, bonus, contributions, and benefits, along with long-term capital gains and rental income. It also covers Brenda's business income, capital gains, and specific deductions. The federal tax owing is calculated for both individuals, and recommendations are provided, including maintaining receipts, using vehicle log books, paying salaries to reduce business profit, investing in tax-deductible schemes, maintaining proper books of accounts, and maximizing contributions to registered retirement funds. Notes clarify the treatment of expenditures, business expenses, contributions, tuition fees, and charitable contributions in the calculations.

Running head: TAXATION

Taxation

Name of the Student:

Name of the University:

Authors Note:

Taxation

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

TAXATION

Contents

Part 1:...............................................................................................................................................2

Part 2:...............................................................................................................................................6

Part 3:...............................................................................................................................................8

Part 4:.............................................................................................................................................19

Notes:.............................................................................................................................................20

References:....................................................................................................................................22

TAXATION

Contents

Part 1:...............................................................................................................................................2

Part 2:...............................................................................................................................................6

Part 3:...............................................................................................................................................8

Part 4:.............................................................................................................................................19

Notes:.............................................................................................................................................20

References:....................................................................................................................................22

2

TAXATION

Part 1:

All amounts are in CAD:

Income of Steve

Particulars Amount ($) Amount ($)

Salary 93,000.00

Bonus 18,000.00

CPP contributions (2,564.00)

El Contributions (836.00)

Charitable deductions (720.00)

Registered retirement contribution (6,400.00)

Health and dental coverage paid by employer

taxable

800.00

Disability insurance exempt

Life insurance paid by the employer is taxable 1,020.00

Tuition payment for photography is taxable 3,500.00

Partial travelling expenses (8550 x 50%) (4,425.00)

Work related expenses

TAXATION

Part 1:

All amounts are in CAD:

Income of Steve

Particulars Amount ($) Amount ($)

Salary 93,000.00

Bonus 18,000.00

CPP contributions (2,564.00)

El Contributions (836.00)

Charitable deductions (720.00)

Registered retirement contribution (6,400.00)

Health and dental coverage paid by employer

taxable

800.00

Disability insurance exempt

Life insurance paid by the employer is taxable 1,020.00

Tuition payment for photography is taxable 3,500.00

Partial travelling expenses (8550 x 50%) (4,425.00)

Work related expenses

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

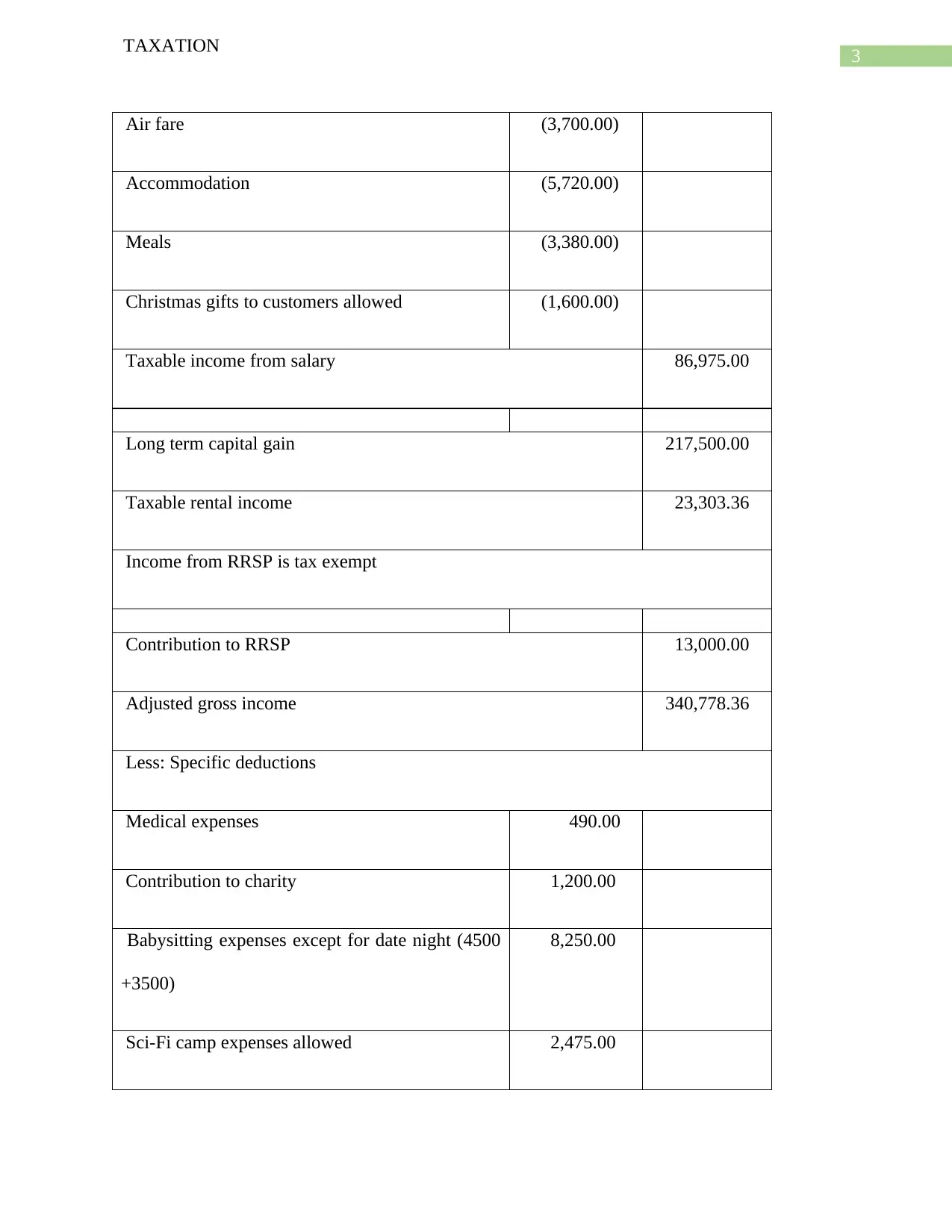

TAXATION

Air fare (3,700.00)

Accommodation (5,720.00)

Meals (3,380.00)

Christmas gifts to customers allowed (1,600.00)

Taxable income from salary 86,975.00

Long term capital gain 217,500.00

Taxable rental income 23,303.36

Income from RRSP is tax exempt

Contribution to RRSP 13,000.00

Adjusted gross income 340,778.36

Less: Specific deductions

Medical expenses 490.00

Contribution to charity 1,200.00

Babysitting expenses except for date night (4500

+3500)

8,250.00

Sci-Fi camp expenses allowed 2,475.00

TAXATION

Air fare (3,700.00)

Accommodation (5,720.00)

Meals (3,380.00)

Christmas gifts to customers allowed (1,600.00)

Taxable income from salary 86,975.00

Long term capital gain 217,500.00

Taxable rental income 23,303.36

Income from RRSP is tax exempt

Contribution to RRSP 13,000.00

Adjusted gross income 340,778.36

Less: Specific deductions

Medical expenses 490.00

Contribution to charity 1,200.00

Babysitting expenses except for date night (4500

+3500)

8,250.00

Sci-Fi camp expenses allowed 2,475.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

TAXATION

12,415.00

Net income 328,363.36

(Li, Magee &

Wilkie, 2017)

Net income Brenda

Particulars Amount Amount Amount

Revenue 581,000.

00

Profit on sale of C1 building (135000 -40000) 95,000.

00

Loss on sale of delivery van (4500 - 6175) (1,675.

00)

674,325.

00

Less:

General expenses 398,250.

00

TAXATION

12,415.00

Net income 328,363.36

(Li, Magee &

Wilkie, 2017)

Net income Brenda

Particulars Amount Amount Amount

Revenue 581,000.

00

Profit on sale of C1 building (135000 -40000) 95,000.

00

Loss on sale of delivery van (4500 - 6175) (1,675.

00)

674,325.

00

Less:

General expenses 398,250.

00

5

TAXATION

Amortization on fixed assets 35,810.

00

Amortization on client list

(32000/10)

3,200.

00

437,260.

00

Income from business 237,065.

00

Income from capital gain (120000 -75000) 45,000.

00

Income from capital gains (partnership) 1,125.

00

Income from interest (Partnership) 1,125.

00

Adjusted gross income 284,315.

00

Less: Deductions specific

Food and clothing expenses is not allowed as deduction

Medical expenses 18,805.

TAXATION

Amortization on fixed assets 35,810.

00

Amortization on client list

(32000/10)

3,200.

00

437,260.

00

Income from business 237,065.

00

Income from capital gain (120000 -75000) 45,000.

00

Income from capital gains (partnership) 1,125.

00

Income from interest (Partnership) 1,125.

00

Adjusted gross income 284,315.

00

Less: Deductions specific

Food and clothing expenses is not allowed as deduction

Medical expenses 18,805.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

TAXATION

00

Contribution to registered charities 1,900.

00

20,705.

00

Net income 263,610.

00 (Tanzi,

2014)

Part 2:

Federal tax owing from Steve

On first $46,,605 @15% 6,990

.75

From $46606 to $93208 @20.5% 9,553

.62

From $93208 to $144489 @26% 13,333

.06

From $144489 to $205482 @29% 17,792

.37

29,877.43

TAXATION

00

Contribution to registered charities 1,900.

00

20,705.

00

Net income 263,610.

00 (Tanzi,

2014)

Part 2:

Federal tax owing from Steve

On first $46,,605 @15% 6,990

.75

From $46606 to $93208 @20.5% 9,553

.62

From $93208 to $144489 @26% 13,333

.06

From $144489 to $205482 @29% 17,792

.37

29,877.43

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

TAXATION

Above @205842 @33% 40,431

.93

Federal tax owing from Steve 88,101.73

Federal tax owing from Brenda

On first $46,,605 @15% 6,990.75

From $46606 to $93208 @20.5% 9,553.62

From $93208 to $144489 @26% 13,333.06

From $144489 to $205482 @29% 17,792.37

Above @205842 @33% 19,063.44

Federal tax owing from Brenda 66,733.

24

Part 3:

Income of Steve

Particulars Amount

($)

Amount

($)

Salary 93,000

TAXATION

Above @205842 @33% 40,431

.93

Federal tax owing from Steve 88,101.73

Federal tax owing from Brenda

On first $46,,605 @15% 6,990.75

From $46606 to $93208 @20.5% 9,553.62

From $93208 to $144489 @26% 13,333.06

From $144489 to $205482 @29% 17,792.37

Above @205842 @33% 19,063.44

Federal tax owing from Brenda 66,733.

24

Part 3:

Income of Steve

Particulars Amount

($)

Amount

($)

Salary 93,000

8

TAXATION

.00

Bonus 18,000

.00

CPP contributions (2,564.

00)

El Contributions (836

.00)

Charitable deductions (720

.00)

Registered retirement contribution (6,400.

00)

Health and dental coverage paid by employer

taxable

80

0.00

Disability insurance exempt

Life insurance paid by the employer is taxable 1,020

.00

Tuition payment for photography is taxable 3,500

.00

Partial travelling expenses (8550 x 50%) (4,425.

TAXATION

.00

Bonus 18,000

.00

CPP contributions (2,564.

00)

El Contributions (836

.00)

Charitable deductions (720

.00)

Registered retirement contribution (6,400.

00)

Health and dental coverage paid by employer

taxable

80

0.00

Disability insurance exempt

Life insurance paid by the employer is taxable 1,020

.00

Tuition payment for photography is taxable 3,500

.00

Partial travelling expenses (8550 x 50%) (4,425.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

TAXATION

00)

Work related expenses

Air fare (3,700.

00)

Accommodation (5,720.

00)

Meals (3,380.

00)

Christmas gifts to customers allowed (1,600.

00)

Taxable income from salary 86,975.

00

Long term capital gain 217,500.

00

Taxable rental income 23,303.

36

Income from RRSP is tax exempt

Contribution to RRSP 13,000.

TAXATION

00)

Work related expenses

Air fare (3,700.

00)

Accommodation (5,720.

00)

Meals (3,380.

00)

Christmas gifts to customers allowed (1,600.

00)

Taxable income from salary 86,975.

00

Long term capital gain 217,500.

00

Taxable rental income 23,303.

36

Income from RRSP is tax exempt

Contribution to RRSP 13,000.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

TAXATION

00

Adjusted gross income 340,778.

36

Less: Specific deductions

Medical expenses 49

0.00

Contribution to charity 1,200

.00

Babysitting expenses except for date night (4500

+3500)

8,250

.00

Sci-Fi camp expenses allowed 2,475

.00

12,415.

00

Net income 328,363.

36

Federal tax owing from Steve

On first $46,,605 @15% 6,990

TAXATION

00

Adjusted gross income 340,778.

36

Less: Specific deductions

Medical expenses 49

0.00

Contribution to charity 1,200

.00

Babysitting expenses except for date night (4500

+3500)

8,250

.00

Sci-Fi camp expenses allowed 2,475

.00

12,415.

00

Net income 328,363.

36

Federal tax owing from Steve

On first $46,,605 @15% 6,990

11

TAXATION

.75

From $46606 to $93208 @20.5% 9,553

.62

From $93208 to $144489 @26% 13,333

.06

From $144489 to $205482 @29% 17,792

.37

29,877.

43

Above @205842 @33% 40,431

.93

Federal tax owing from Steve 88,101.

73

(Azémar

&

Hubbard,

2015)

Schedules:

Notes and schedules:

Capital gain of Steve

TAXATION

.75

From $46606 to $93208 @20.5% 9,553

.62

From $93208 to $144489 @26% 13,333

.06

From $144489 to $205482 @29% 17,792

.37

29,877.

43

Above @205842 @33% 40,431

.93

Federal tax owing from Steve 88,101.

73

(Azémar

&

Hubbard,

2015)

Schedules:

Notes and schedules:

Capital gain of Steve

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.