Taxation Law Assignment - Principles of Australian Taxation

VerifiedAdded on 2023/01/17

|12

|3477

|82

Homework Assignment

AI Summary

This taxation law assignment provides detailed answers to questions related to Australian taxation law. The assignment covers a range of topics including the Commissioner's procedure for computing effective life of assets, tax offsets, top tax rates, capital gains tax (CGT) exemptions and events, income tax calculation formulas, and the deductibility of expenses. It explores the differences between average and marginal tax rates, and defines consumption tax. The assignment then delves into specific scenarios involving tax deductions, including expenses incurred in income generation, partially business and personal expenses, and losses. CGT events F2 and B1 are explained, along with exemptions for permanent residents. Finally, it includes a capital gains tax computation example and discusses the tax treatment of prize winnings, referencing relevant case law and legislation such as the Income Tax Assessment Act 1997 (Cth).

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Author Note

Taxation Law

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Q. 1.

a)

The Taxation Ruling TR 2018/41 covers the procedure that the Commissioner implements

to compute the effective life with respect to the assets, which suffers depreciation.

b)

The Income Tax Assessment Act 1997(Cth) under Div 132 details available tax details the

claim in relation to tax offset.

c)

The top tax rate that is to be applied to a resident taxpayer for the 2018/19 tax year is

54,097 plus 45% for every $ 1 over 180,001 or above.

d)

An example of an asset that is exempt from capital gains tax is gains from shares, which

has been provided under section 118.13 to section of the Income Tax Assessment Act

1997(Cth)3.

e)

The CGT event B1 that has been provide under section 104.15 of the Income Tax

Assessment Act 1997(Cth)4. Provides for the right conferred upon a person in relation to the

use and enjoyment relating to a CGT asset prior to the actual passing of the ownership of the

same.

1 Taxation Ruling TR 2018/4

2 The Income Tax Assessment Act 1997 (Cth), Div. 13

3 The Income Tax Assessment Act 1997 (Cth), s. 118.10

4 The Income Tax Assessment Act 1997 (Cth), s. 104.15

Q. 1.

a)

The Taxation Ruling TR 2018/41 covers the procedure that the Commissioner implements

to compute the effective life with respect to the assets, which suffers depreciation.

b)

The Income Tax Assessment Act 1997(Cth) under Div 132 details available tax details the

claim in relation to tax offset.

c)

The top tax rate that is to be applied to a resident taxpayer for the 2018/19 tax year is

54,097 plus 45% for every $ 1 over 180,001 or above.

d)

An example of an asset that is exempt from capital gains tax is gains from shares, which

has been provided under section 118.13 to section of the Income Tax Assessment Act

1997(Cth)3.

e)

The CGT event B1 that has been provide under section 104.15 of the Income Tax

Assessment Act 1997(Cth)4. Provides for the right conferred upon a person in relation to the

use and enjoyment relating to a CGT asset prior to the actual passing of the ownership of the

same.

1 Taxation Ruling TR 2018/4

2 The Income Tax Assessment Act 1997 (Cth), Div. 13

3 The Income Tax Assessment Act 1997 (Cth), s. 118.10

4 The Income Tax Assessment Act 1997 (Cth), s. 104.15

2TAXATION LAW

f)

The formula for the computation of the amount of income tax has been provided under the

Income Tax Assessment Act 1997(Cth) in section 4.10(3)5. It needs to be calculated by

making deduction of the taxable income of a person, which has been multiplied by the tax

offsets available.

g)

The High Court, in the case of FC of T v Day 2008 ATC 20-0646 has allowed all the

expenditures that has been incurred in the furtherance of generation of the taxable income of

a taxpayer as a general deduction under the income tax assessment Act 1997 in section 8.17.

Previously, expenditures that a person incurred for personal purposes were not allowed as a

deduction under this section. However, with this case, if it can be establish that the

expenditure that has been incurred to the taxpayer, has in anyway made a contribution in the

process of generation of income, which taxable would be permitted as a deduction

irrespective of its nature.

h)

Average rate of tax and marginal rate of tax are required to be differentiated with respect to

the target they impact. Firstly, it can be stated that in case of average rate of tax, the

calculation needs to be carried out upon the taxable income of a person, in its entirety.

Whereas the marginal rate of tax of a person needs to be computed over the increments

relating to the income that has been taxable pertaining to the taxpayer. Secondly, it can be

said that in case of average rate of tax all the incomes that are assessed and taxable for the

taxpayer needs to be considered. Whereas in case of marginal rate of tax only those part of

the income of a taxpayer is to be considered, which relates to the increment. The calculation

5 The Income Tax Assessment Act 1997 (Cth), s. 4.10(3)

6 FC of T v Day 2008 ATC 20-064

7 The Income Tax Assessment Act 1997 (Cth), s. 8.1

f)

The formula for the computation of the amount of income tax has been provided under the

Income Tax Assessment Act 1997(Cth) in section 4.10(3)5. It needs to be calculated by

making deduction of the taxable income of a person, which has been multiplied by the tax

offsets available.

g)

The High Court, in the case of FC of T v Day 2008 ATC 20-0646 has allowed all the

expenditures that has been incurred in the furtherance of generation of the taxable income of

a taxpayer as a general deduction under the income tax assessment Act 1997 in section 8.17.

Previously, expenditures that a person incurred for personal purposes were not allowed as a

deduction under this section. However, with this case, if it can be establish that the

expenditure that has been incurred to the taxpayer, has in anyway made a contribution in the

process of generation of income, which taxable would be permitted as a deduction

irrespective of its nature.

h)

Average rate of tax and marginal rate of tax are required to be differentiated with respect to

the target they impact. Firstly, it can be stated that in case of average rate of tax, the

calculation needs to be carried out upon the taxable income of a person, in its entirety.

Whereas the marginal rate of tax of a person needs to be computed over the increments

relating to the income that has been taxable pertaining to the taxpayer. Secondly, it can be

said that in case of average rate of tax all the incomes that are assessed and taxable for the

taxpayer needs to be considered. Whereas in case of marginal rate of tax only those part of

the income of a taxpayer is to be considered, which relates to the increment. The calculation

5 The Income Tax Assessment Act 1997 (Cth), s. 4.10(3)

6 FC of T v Day 2008 ATC 20-064

7 The Income Tax Assessment Act 1997 (Cth), s. 8.1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

of the average tax rate is to be done by treating the income tax payable by the taxpayer with

the total taxable income of the taxpayer. On the other hand, the marginal tax is required to be

calculated by treating the increment incurred with respect to the tax rate.

i)

Any tax that has been imposed or levied upon the usage or consumption relating to services

and goods to a person either directly or indirectly can be construed as a consumption tax.

These taxes includes sales tax, GST, duties and other forms of taxes that a person consuming

services or goods needs to make payment for. The spending upon the consumer goods and

services needs to be considered for the purpose of assessment. The amount of the goods and

services is irrelevant in this aspect. In Australia, the main consumption tax is the Goods and

Services Tax (GST) and the same imposes a tax rate of 10% upon most of the consumer

goods and services.

Q. 2.

a)

Expenses or costs that a taxpayer may incur in the course of income generation process,

which can be subjected to taxation, would be construed as a deduction under the Income Tax

Assessment Act 1997 (Cth), section 8.18. It can be stated that the amounts incurred by the

taxpayer as an expense while earning the taxable income would only be allowed as deduction

under this section. In this case, although the loan availed by Brett was against his personal

home, but the same has been availed for the purpose of paying the wages of the employees he

has for the purpose of running his business. This can be construed as an expense incurred

while earning taxable income and will be permitted as a deduction.

8 The Income Tax Assessment Act 1997 (Cth), s. 8.1

of the average tax rate is to be done by treating the income tax payable by the taxpayer with

the total taxable income of the taxpayer. On the other hand, the marginal tax is required to be

calculated by treating the increment incurred with respect to the tax rate.

i)

Any tax that has been imposed or levied upon the usage or consumption relating to services

and goods to a person either directly or indirectly can be construed as a consumption tax.

These taxes includes sales tax, GST, duties and other forms of taxes that a person consuming

services or goods needs to make payment for. The spending upon the consumer goods and

services needs to be considered for the purpose of assessment. The amount of the goods and

services is irrelevant in this aspect. In Australia, the main consumption tax is the Goods and

Services Tax (GST) and the same imposes a tax rate of 10% upon most of the consumer

goods and services.

Q. 2.

a)

Expenses or costs that a taxpayer may incur in the course of income generation process,

which can be subjected to taxation, would be construed as a deduction under the Income Tax

Assessment Act 1997 (Cth), section 8.18. It can be stated that the amounts incurred by the

taxpayer as an expense while earning the taxable income would only be allowed as deduction

under this section. In this case, although the loan availed by Brett was against his personal

home, but the same has been availed for the purpose of paying the wages of the employees he

has for the purpose of running his business. This can be construed as an expense incurred

while earning taxable income and will be permitted as a deduction.

8 The Income Tax Assessment Act 1997 (Cth), s. 8.1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

b)

Under section 8.1 of the Act9, the expenses that can be attributed partly for the income

generation and partly for personal use, will be allowed as deduction only for that part, which

has been incurred for the profit generation. Julie has incurred $500 with respect to charges for

mobile phone. In this charge, 60% has been incurred for making business calls and the rest

for personal use. Hence, only $300 would be allowed as a deduction.

c)

Under section 8.1 of the Act10, only that part of the expense will be allowed as deduction,

which has a direct connection with the income generation. Any expenses which has been

incurred for personal use will not be treated as a deduction. In this case, the expense incurred

by Sally of $1,200 for the purpose of babysitting hot children cannot be construed as an

expense in the furtherance of income generation, although she needed it for the purpose of

going to work. Hence, this amount will not be allowed for the purpose of deduction.

d)

Losses that has the effect of reducing the financial resources of a person is required to be

treated as a deduction under section 8.1 of the Act11. This includes any property that has been

stolen from the taxpayer. In this case, an employee of Jerry has stolen $20000 from his

business during the year of taxation. This will be allowed as a deduction as it has reduced the

financial resources of the taxpayer.

e)

For availing deduction under section 8.1 of the Act12, the expenditure or loss needs to be

carried out while conducting the profit generating activity. The initiation of the venture,

9 The Income Tax Assessment Act 1997 (Cth), s. 8.1

10 The Income Tax Assessment Act 1997 (Cth), s. 8.1

11 The Income Tax Assessment Act 1997 (Cth), s. 8.1

12 The Income Tax Assessment Act 1997 (Cth), s. 8.1

b)

Under section 8.1 of the Act9, the expenses that can be attributed partly for the income

generation and partly for personal use, will be allowed as deduction only for that part, which

has been incurred for the profit generation. Julie has incurred $500 with respect to charges for

mobile phone. In this charge, 60% has been incurred for making business calls and the rest

for personal use. Hence, only $300 would be allowed as a deduction.

c)

Under section 8.1 of the Act10, only that part of the expense will be allowed as deduction,

which has a direct connection with the income generation. Any expenses which has been

incurred for personal use will not be treated as a deduction. In this case, the expense incurred

by Sally of $1,200 for the purpose of babysitting hot children cannot be construed as an

expense in the furtherance of income generation, although she needed it for the purpose of

going to work. Hence, this amount will not be allowed for the purpose of deduction.

d)

Losses that has the effect of reducing the financial resources of a person is required to be

treated as a deduction under section 8.1 of the Act11. This includes any property that has been

stolen from the taxpayer. In this case, an employee of Jerry has stolen $20000 from his

business during the year of taxation. This will be allowed as a deduction as it has reduced the

financial resources of the taxpayer.

e)

For availing deduction under section 8.1 of the Act12, the expenditure or loss needs to be

carried out while conducting the profit generating activity. The initiation of the venture,

9 The Income Tax Assessment Act 1997 (Cth), s. 8.1

10 The Income Tax Assessment Act 1997 (Cth), s. 8.1

11 The Income Tax Assessment Act 1997 (Cth), s. 8.1

12 The Income Tax Assessment Act 1997 (Cth), s. 8.1

5TAXATION LAW

which would amount to profit generation will not be treated as a deduction under the section.

Hence, it can be stated that, in this case, expenditure that has been incurred for contesting

local government election cannot be treated as an expenditure that is permitted as a deduction

under the section.

Q. 3.

a)

In case the person, who is the owner of the property is renting out the property for the

purpose of lease or sublease will be treated as CGT event F2. This treatment of such a

property is also applicable while granting a lease or renewal relating to an existing lease or

even for an extension with respect to a long-term lease. Again, in this kind of CGT event, the

50% discount rule will not be applicable. In the present situation, Andy, the owner of a land

has granted a lease to Bryan for a period of 5 years. The premium of the same was $5,000.

Andy is the owner of the land and has been leasing it. This event will fall under the CGT

event F2 and cannot be subjected to the 50% discount.

b)

The CGT event B1 that has been provide under section 104.15 of the Income Tax

Assessment Act 1997(Cth)13. Provides for the right conferred upon a person in relation to the

use and enjoyment relating to a CGT asset prior to the actual passing of the ownership of the

same. This CGT event would make a person eligible for the purpose of availing the 50%

discount. In this case, John has provided Farm Ltd. with an option to make purchase of his

land of 100 acre for just a price of $ 800, 000 with an additional payment of $ 40, 000, which

he has bought 10 years ago. This needs to be construed as CGT event B1 and the discount of

50% will be permitted.

13 The Income Tax Assessment Act 1997 (Cth), s. 104.15

which would amount to profit generation will not be treated as a deduction under the section.

Hence, it can be stated that, in this case, expenditure that has been incurred for contesting

local government election cannot be treated as an expenditure that is permitted as a deduction

under the section.

Q. 3.

a)

In case the person, who is the owner of the property is renting out the property for the

purpose of lease or sublease will be treated as CGT event F2. This treatment of such a

property is also applicable while granting a lease or renewal relating to an existing lease or

even for an extension with respect to a long-term lease. Again, in this kind of CGT event, the

50% discount rule will not be applicable. In the present situation, Andy, the owner of a land

has granted a lease to Bryan for a period of 5 years. The premium of the same was $5,000.

Andy is the owner of the land and has been leasing it. This event will fall under the CGT

event F2 and cannot be subjected to the 50% discount.

b)

The CGT event B1 that has been provide under section 104.15 of the Income Tax

Assessment Act 1997(Cth)13. Provides for the right conferred upon a person in relation to the

use and enjoyment relating to a CGT asset prior to the actual passing of the ownership of the

same. This CGT event would make a person eligible for the purpose of availing the 50%

discount. In this case, John has provided Farm Ltd. with an option to make purchase of his

land of 100 acre for just a price of $ 800, 000 with an additional payment of $ 40, 000, which

he has bought 10 years ago. This needs to be construed as CGT event B1 and the discount of

50% will be permitted.

13 The Income Tax Assessment Act 1997 (Cth), s. 104.15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

c)

A permanent resident in relation to a taxpayer is an exemption from the tax with respect to

capital gain. It is provided under section 118.10 of the Act14. However, for the purpose of

claiming this exemption, the tax payer is required to establish that the house has been used

for residential purposes and the tax payer has resided in that. A mere renting out or giving the

house on lease would not make the taxpayer eligible for availing this exemption. The sale

proceeds, which might accrue from the sale of a residential house will also be exempted from

tax and the rule of 50% discount will also be allowed in case of such property. In this

situation, Olivia and Jimmy has purchased a house in 2016. After the purchase of the same,

they had given the house out in rent and the travelled overseas afterwards. In 2008 they

occupied the house as a main residence. However, in 2018, they sold the house and gained a

receipt of $3000000. This house can be considered to have been used for residential purposes

for a part of the time and rented for the other part. Therefore, for the purpose of tax

assessment, only a portion of the sale proceeds will be treated under the exemption and the

rest will be rendered to have the discount of 50%.

d)

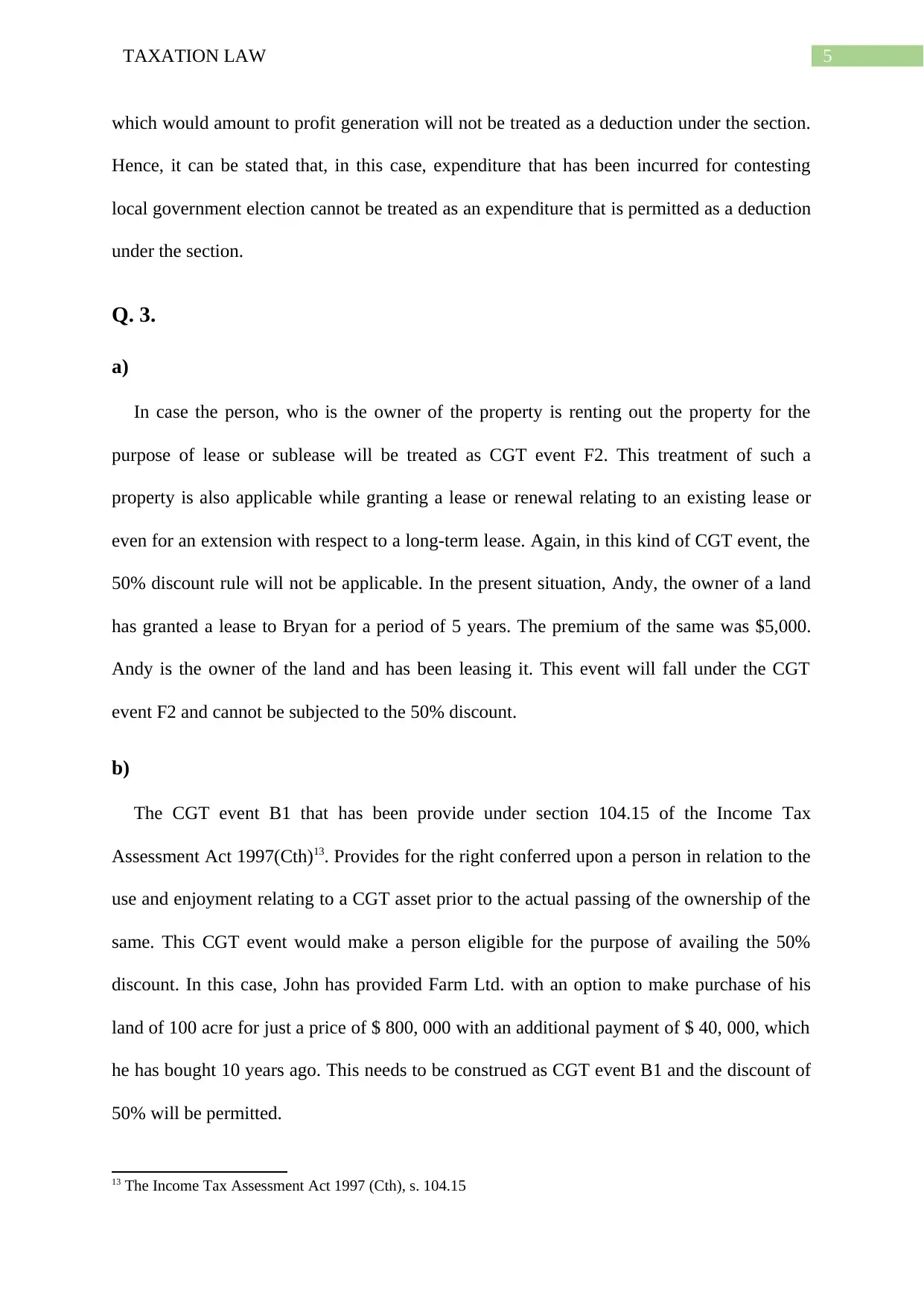

Capital Gain Tax Computation

In the Books of Chris

For the year ended 2019

Particulars Amount Amount

BHP shares sale proceed (CGT Event A1) 18720

Acquisition Cost 5400

Taxable Capital Gain 13320

14 The Income Tax Assessment Act 1997 (Cth), s. 118.10

c)

A permanent resident in relation to a taxpayer is an exemption from the tax with respect to

capital gain. It is provided under section 118.10 of the Act14. However, for the purpose of

claiming this exemption, the tax payer is required to establish that the house has been used

for residential purposes and the tax payer has resided in that. A mere renting out or giving the

house on lease would not make the taxpayer eligible for availing this exemption. The sale

proceeds, which might accrue from the sale of a residential house will also be exempted from

tax and the rule of 50% discount will also be allowed in case of such property. In this

situation, Olivia and Jimmy has purchased a house in 2016. After the purchase of the same,

they had given the house out in rent and the travelled overseas afterwards. In 2008 they

occupied the house as a main residence. However, in 2018, they sold the house and gained a

receipt of $3000000. This house can be considered to have been used for residential purposes

for a part of the time and rented for the other part. Therefore, for the purpose of tax

assessment, only a portion of the sale proceeds will be treated under the exemption and the

rest will be rendered to have the discount of 50%.

d)

Capital Gain Tax Computation

In the Books of Chris

For the year ended 2019

Particulars Amount Amount

BHP shares sale proceed (CGT Event A1) 18720

Acquisition Cost 5400

Taxable Capital Gain 13320

14 The Income Tax Assessment Act 1997 (Cth), s. 118.10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

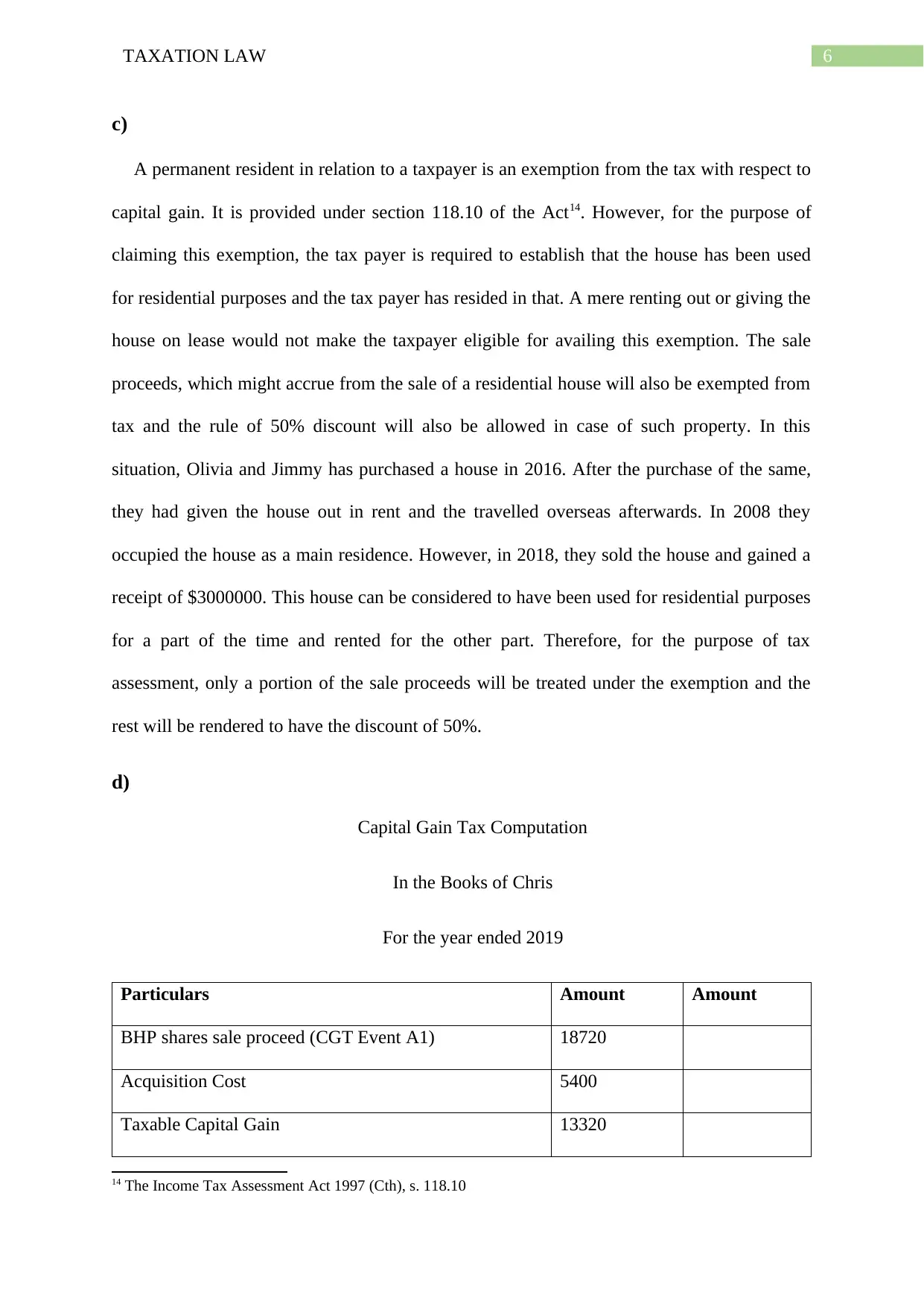

Wesfarmers shares sale proceed (CGT Event A1) 10500

Acquisition Cost 26000

Loss on Sale 15500

Net Capital Loss 2180

In the present situation, the capital gain of $13320 as accrued to Chris in making the sale

of the BHP shares needs to be subjected to taxation in the present tax year. However, as the

shares has not been owned by Chris for a period exceeding 12 months, the same 50%

discount is not available. However, the capital loss needs to treated in the subsequent year

and carried forward in this year.

Q. 4.

a)

No tax assessment is required to be carried out with respect to winnings of prizes that has

been gained by the taxpayer. Again, it can be stated that any such winning that has accrued to

the taxpayer in the process of income generation relating to the taxpayer, needs to be

assessed. This can further be illustrated with the case of Kelly v FCT 85 ATC 428315. In the

present case, prize of $2000 was received by the taxpayer for the best advertisement on

television. Advertisements on television can be treated as an venture carried out for making

the promotion of a business that is probable to generate income, which is taxable. Hence, it

will be taxable under section 6.5 of the Act16.

b)

Any income of the taxpayer that he has received while working as an employee and the

payment of the same has been made by the employer would be treated as an income to be

assessed for the purpose of taxation under section 6.1 of the Income Tax Assessment Act

15 Kelly v FCT 85 ATC 4283

16 The Income Tax Assessment Act 1997 (Cth), s. 6.5

Wesfarmers shares sale proceed (CGT Event A1) 10500

Acquisition Cost 26000

Loss on Sale 15500

Net Capital Loss 2180

In the present situation, the capital gain of $13320 as accrued to Chris in making the sale

of the BHP shares needs to be subjected to taxation in the present tax year. However, as the

shares has not been owned by Chris for a period exceeding 12 months, the same 50%

discount is not available. However, the capital loss needs to treated in the subsequent year

and carried forward in this year.

Q. 4.

a)

No tax assessment is required to be carried out with respect to winnings of prizes that has

been gained by the taxpayer. Again, it can be stated that any such winning that has accrued to

the taxpayer in the process of income generation relating to the taxpayer, needs to be

assessed. This can further be illustrated with the case of Kelly v FCT 85 ATC 428315. In the

present case, prize of $2000 was received by the taxpayer for the best advertisement on

television. Advertisements on television can be treated as an venture carried out for making

the promotion of a business that is probable to generate income, which is taxable. Hence, it

will be taxable under section 6.5 of the Act16.

b)

Any income of the taxpayer that he has received while working as an employee and the

payment of the same has been made by the employer would be treated as an income to be

assessed for the purpose of taxation under section 6.1 of the Income Tax Assessment Act

15 Kelly v FCT 85 ATC 4283

16 The Income Tax Assessment Act 1997 (Cth), s. 6.5

8TAXATION LAW

199717. This includes any salary, wage or allowance. In the present situation, the money

received by the employee of amount $500 for the purpose of travelling cost to the place of

work will not be treated income. This is because it is more a reimbursement of expenses over

an income. Hence, will not be subjected to taxation.

c)

Under the tax assessment, gifts, which are simple is not to be subjected to tax. On the

other hand, any gift that has been affected in the furtherance of an activity, which can be

construed as a business would be treated under tax. This can be illustrated with the case of

Squatting Investment Co Ltd v Federal Commissioner of Taxation [1953] HCA 1318. In this

case, the iPhone has been provided by the client as a gift. Hence, it will not be assessed for

the purpose of taxation.

d)

Again, a lump sum accrued to a tax payer is needed to be assessed as a capital gain under

the Income Tax Assessment Act 199719. On the other hand, section 118. 37 of the Act20 will

not consider any lump sum that has accrued to the taxpayer in a personal capacity for the

purpose of compensating and injury or harm that has been caused to him, under the

assessment of taxation. In instant situation, the amount of $10000 cannot be treated as an

income for the purpose of taxation as it has been received by the taxpayer against personal

injuries that has been caused cost to him in the car accident and is better to be treated as a

compensation then the capital gain.

17 The Income Tax Assessment Act 1997 (Cth), s. 6.1

18 Squatting Investment Co Ltd v Federal Commissioner of Taxation [1953] HCA 13

19 The Income Tax Assessment Act 1997 (Cth)

20 The Income Tax Assessment Act 1997 (Cth), s. 118.37

199717. This includes any salary, wage or allowance. In the present situation, the money

received by the employee of amount $500 for the purpose of travelling cost to the place of

work will not be treated income. This is because it is more a reimbursement of expenses over

an income. Hence, will not be subjected to taxation.

c)

Under the tax assessment, gifts, which are simple is not to be subjected to tax. On the

other hand, any gift that has been affected in the furtherance of an activity, which can be

construed as a business would be treated under tax. This can be illustrated with the case of

Squatting Investment Co Ltd v Federal Commissioner of Taxation [1953] HCA 1318. In this

case, the iPhone has been provided by the client as a gift. Hence, it will not be assessed for

the purpose of taxation.

d)

Again, a lump sum accrued to a tax payer is needed to be assessed as a capital gain under

the Income Tax Assessment Act 199719. On the other hand, section 118. 37 of the Act20 will

not consider any lump sum that has accrued to the taxpayer in a personal capacity for the

purpose of compensating and injury or harm that has been caused to him, under the

assessment of taxation. In instant situation, the amount of $10000 cannot be treated as an

income for the purpose of taxation as it has been received by the taxpayer against personal

injuries that has been caused cost to him in the car accident and is better to be treated as a

compensation then the capital gain.

17 The Income Tax Assessment Act 1997 (Cth), s. 6.1

18 Squatting Investment Co Ltd v Federal Commissioner of Taxation [1953] HCA 13

19 The Income Tax Assessment Act 1997 (Cth)

20 The Income Tax Assessment Act 1997 (Cth), s. 118.37

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

e)

In in the present situation, although the price of the share that the taxpayer has bought

increased from $ 5 to $ 7.5, the same cannot be treated as an income as the same is required

to be construed as anticipated income and not income that has already been earned. This

would render the amount not to be subjected to taxation as the shares are yet to be sold.

Q. 5.

The issue arising from the given scenario is whether Nisu would be considered as a

resident in Australia for taxation pertaining to the 2018/19 income year.

There are certain test relating to the determination of the residency of a person in Australia

that has been provided under section 6(1) of the Income Tax Assessment Act 1936 (Cth)21.

By virtue of this section, a person can be construed as a resident if he has been residing

within the precincts of Australia and can be identified as a domicile in Australia. In this

regard, the first test that needs to be considered and applied for the determination of the

residency of a person in Australia is the domicile test. Under this test, the domicile of a

person needs to be traced. If the person can be traced as a domicile in Australia he will be

rendered a resident in Australia. This test has been contained in Tax Ruling 265022. However,

to avail the applicability of this test, the person needs to have a place of abode, which is

permanently situated within Australia. If such a place of abode is situated in a place outside

Australia, the person will not be considered for this test. This can be illustrated with the case

of R v. Hammond (1852) 117 E.R. 1477 at p. 148823.

After the determination of the domicile test, the taxpayer would have to satisfy a 183 Day test

for being rendered as a resident in Australia. Under this 183 Day test, the person who is

elected as a resident in Australia, needs to be present and have been residing in Australia for

21 The Income Tax Assessment Act 1936 (Cth), s. 6(1)

22 The Tax Ruling 2650

23 R v. Hammond (1852) 117 E.R. 1477 at p. 1488

e)

In in the present situation, although the price of the share that the taxpayer has bought

increased from $ 5 to $ 7.5, the same cannot be treated as an income as the same is required

to be construed as anticipated income and not income that has already been earned. This

would render the amount not to be subjected to taxation as the shares are yet to be sold.

Q. 5.

The issue arising from the given scenario is whether Nisu would be considered as a

resident in Australia for taxation pertaining to the 2018/19 income year.

There are certain test relating to the determination of the residency of a person in Australia

that has been provided under section 6(1) of the Income Tax Assessment Act 1936 (Cth)21.

By virtue of this section, a person can be construed as a resident if he has been residing

within the precincts of Australia and can be identified as a domicile in Australia. In this

regard, the first test that needs to be considered and applied for the determination of the

residency of a person in Australia is the domicile test. Under this test, the domicile of a

person needs to be traced. If the person can be traced as a domicile in Australia he will be

rendered a resident in Australia. This test has been contained in Tax Ruling 265022. However,

to avail the applicability of this test, the person needs to have a place of abode, which is

permanently situated within Australia. If such a place of abode is situated in a place outside

Australia, the person will not be considered for this test. This can be illustrated with the case

of R v. Hammond (1852) 117 E.R. 1477 at p. 148823.

After the determination of the domicile test, the taxpayer would have to satisfy a 183 Day test

for being rendered as a resident in Australia. Under this 183 Day test, the person who is

elected as a resident in Australia, needs to be present and have been residing in Australia for

21 The Income Tax Assessment Act 1936 (Cth), s. 6(1)

22 The Tax Ruling 2650

23 R v. Hammond (1852) 117 E.R. 1477 at p. 1488

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

at least 183 day or more in a particular year of income. This can be further be illustrated

treated with the case of Buswell v. I.R.C (1974) 2 All E.R. 52024.

In the instant situation, Nishu has arrived in Australia on the 30th of December in the year

2018. He has came to Australia from Nepal for the purpose of studying Masters of

Accounting Program at CQU Sydney campus. His arrival in Australia was with the intention

of carrying out the course of study for three years and staying in Australia during that time.

During this stay, Nishu manages to avail a part time job with a roommate of his. Four

students including him has rented house for their saty in Australia. He made a lot of friends in

Australia and joined the soccer team. Although she has he has been residing in Australia and

was staying in Australia but the rented place that he has residing in, cannot be construed as a

permanent place of abode. Moreover, the rented place cannot be construed as a domicile for

him. Hence, the domicile test will not be cleared by him. Moreover, he has left Australia for

Nepal on the 13th of June 2019. He has withdrawn from the university and had no intention

of returning to the same. This will have the effect of rendering Nisu as a non-resident in

Australia for the purpose of taxation in income year 2018-19.

Nisu would be considered as a resident in Australia for taxation pertaining to the 2018/19

income year.

24 Buswell v. I.R.C (1974) 2 All E.R. 520

at least 183 day or more in a particular year of income. This can be further be illustrated

treated with the case of Buswell v. I.R.C (1974) 2 All E.R. 52024.

In the instant situation, Nishu has arrived in Australia on the 30th of December in the year

2018. He has came to Australia from Nepal for the purpose of studying Masters of

Accounting Program at CQU Sydney campus. His arrival in Australia was with the intention

of carrying out the course of study for three years and staying in Australia during that time.

During this stay, Nishu manages to avail a part time job with a roommate of his. Four

students including him has rented house for their saty in Australia. He made a lot of friends in

Australia and joined the soccer team. Although she has he has been residing in Australia and

was staying in Australia but the rented place that he has residing in, cannot be construed as a

permanent place of abode. Moreover, the rented place cannot be construed as a domicile for

him. Hence, the domicile test will not be cleared by him. Moreover, he has left Australia for

Nepal on the 13th of June 2019. He has withdrawn from the university and had no intention

of returning to the same. This will have the effect of rendering Nisu as a non-resident in

Australia for the purpose of taxation in income year 2018-19.

Nisu would be considered as a resident in Australia for taxation pertaining to the 2018/19

income year.

24 Buswell v. I.R.C (1974) 2 All E.R. 520

11TAXATION LAW

Reference

Buswell v. I.R.C (1974) 2 All E.R. 520

FC of T v Day 2008 ATC 20-064

Kelly v FCT 85 ATC 4283

R v. Hammond (1852) 117 E.R. 1477 at p. 1488

Squatting Investment Co Ltd v Federal Commissioner of Taxation [1953] HCA 13

Taxation Ruling TR 2018/4

The Income Tax Assessment Act 1936 (Cth)

The Income Tax Assessment Act 1997 (Cth)

The Tax Ruling 2650

Reference

Buswell v. I.R.C (1974) 2 All E.R. 520

FC of T v Day 2008 ATC 20-064

Kelly v FCT 85 ATC 4283

R v. Hammond (1852) 117 E.R. 1477 at p. 1488

Squatting Investment Co Ltd v Federal Commissioner of Taxation [1953] HCA 13

Taxation Ruling TR 2018/4

The Income Tax Assessment Act 1936 (Cth)

The Income Tax Assessment Act 1997 (Cth)

The Tax Ruling 2650

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.