University Taxation Law Assignment: LAWS20060, Term 2, 2019

VerifiedAdded on 2023/01/03

|16

|3246

|218

Homework Assignment

AI Summary

This document presents a comprehensive solution to a Taxation Law assignment, addressing key aspects of Australian taxation. It begins by defining 'usual place of abode' and its implications for residency, differentiating it from 'permanent place of abode' and referencing relevant case law like *Miller v FCT* and *Jenkins v FCT*. The solution then analyzes various tax deductions, including HECS-HELP payments, travel expenses, book costs, childcare expenses, and clothing expenses, referencing relevant sections of the Income Tax Assessment Act 1997 and tax rulings. The assignment further explores Capital Gains Tax (CGT), including event F1, CGT discounts, main residence exemptions, and the cost base and reduced cost base, with reference to specific sections of the ITAA 1997. The solution also examines the taxability of income derived from illegal activities and presents an analysis of different tax scenarios, including the assessment of income and expenses.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 2:.................................................................................................................2

Answer to question 3:.................................................................................................................3

Answer to question 4:.................................................................................................................6

Answer to question 5:...............................................................................................................10

References:...............................................................................................................................13

Table of Contents

Answer to question 2:.................................................................................................................2

Answer to question 3:.................................................................................................................3

Answer to question 4:.................................................................................................................6

Answer to question 5:...............................................................................................................10

References:...............................................................................................................................13

2TAXATION LAW

Answer to question 2:

The word “usual place of abode” must not be allocated the similar meaning just like

the phrase “permanent place of abode”1. The 183 days generally treats a person as the

Australian occupant when they are actually living in Australia uninterruptedly for six months.

While the materials concerning the “usual place of abode” is viewed as the topic of

fact. The term “usual place of abode” is interpreted as the abode that is mainly used by

someone when they are actually in Australia. As a general rule the home of the taxpayer is

ought to be fixed and must be depicting the characteristics of residence and should not be

exhibiting a temporary place of an overnight stay.

While, the “TR of IT 2650” states that “resident” and the “resident of Australia”

explained in “subsection 6(1), ITAA 1936” as a person that has been existent in Australia for

a uninterrupted time period for greater than six months2. A person may not be said as

Australian dweller if the tax administrator is contented that the “usual place of abode” is out

of Australia with no objective of taking up Australian citizenship.

The term “permanent place of abode” represents that a person has set up their

domicile in Australia. While “subparagraph (a)(i) of the definition” “resident” needs the

commissioner to be contented that an person’s “permanent place of abode” is not out

Australia. The law court in “Miller v FCT (1946)” held that the word “place of abode”

means the residence of an individual where one exists and sleeps. As a general rule, a

1 Sadiq, Kerrie, et al. Principles of Taxation Law 2016. Ninth ed., Thomson Reuters, 2016.

2 Taxation Ruling IT 2650

Answer to question 2:

The word “usual place of abode” must not be allocated the similar meaning just like

the phrase “permanent place of abode”1. The 183 days generally treats a person as the

Australian occupant when they are actually living in Australia uninterruptedly for six months.

While the materials concerning the “usual place of abode” is viewed as the topic of

fact. The term “usual place of abode” is interpreted as the abode that is mainly used by

someone when they are actually in Australia. As a general rule the home of the taxpayer is

ought to be fixed and must be depicting the characteristics of residence and should not be

exhibiting a temporary place of an overnight stay.

While, the “TR of IT 2650” states that “resident” and the “resident of Australia”

explained in “subsection 6(1), ITAA 1936” as a person that has been existent in Australia for

a uninterrupted time period for greater than six months2. A person may not be said as

Australian dweller if the tax administrator is contented that the “usual place of abode” is out

of Australia with no objective of taking up Australian citizenship.

The term “permanent place of abode” represents that a person has set up their

domicile in Australia. While “subparagraph (a)(i) of the definition” “resident” needs the

commissioner to be contented that an person’s “permanent place of abode” is not out

Australia. The law court in “Miller v FCT (1946)” held that the word “place of abode”

means the residence of an individual where one exists and sleeps. As a general rule, a

1 Sadiq, Kerrie, et al. Principles of Taxation Law 2016. Ninth ed., Thomson Reuters, 2016.

2 Taxation Ruling IT 2650

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

person’s “place of abode” constitute the place of dwelling or the physical nearby where a

person lives.

The leading case of “Jenkins v FCT (1982) ATC 4089” alleged that taxpayer had the

“permanent place of abode” out of Australia3. The court adjudged the taxpayer as non-

resident in the concerned year of income. The law court explained that the word “permanent”

should be viewed in the perspective which it appears.

In overturning the decision of commissioner in “Harding v FC of T (2019)”, the

federal court stated that word “place” in “permanent place of abode” calls for consideration

of a country or town where a person physically lives “permanently”4. Given that the

individual has the left Australia on permanent basis, it should not be requirement that the

specific house or apartment in an overseas nation is lived in. Furthermore, the intention of the

taxpayer relating to the duration of their overseas was only considered relevant factor into

consideration.

The explanation of “Jenkins” and “Harding” made above makes it clear that a

person’s “permanent place of abode” cannot be determined by simply applying any hard and

fast procedures. The matter of fact ought to be discovered in every cases.

Answer to question 3:

HECS-HELP $850:

There are certain types of self-education outlays that are non-deductible. Under “sec

26-20, ITAA 1997” payments that are made under the HECS-HELP as fees are considered

3 Jenkins v FCT (1982) ATC 4089

4 Harding v Federal Commissioner of Taxation (2019) FCAFC 29

person’s “place of abode” constitute the place of dwelling or the physical nearby where a

person lives.

The leading case of “Jenkins v FCT (1982) ATC 4089” alleged that taxpayer had the

“permanent place of abode” out of Australia3. The court adjudged the taxpayer as non-

resident in the concerned year of income. The law court explained that the word “permanent”

should be viewed in the perspective which it appears.

In overturning the decision of commissioner in “Harding v FC of T (2019)”, the

federal court stated that word “place” in “permanent place of abode” calls for consideration

of a country or town where a person physically lives “permanently”4. Given that the

individual has the left Australia on permanent basis, it should not be requirement that the

specific house or apartment in an overseas nation is lived in. Furthermore, the intention of the

taxpayer relating to the duration of their overseas was only considered relevant factor into

consideration.

The explanation of “Jenkins” and “Harding” made above makes it clear that a

person’s “permanent place of abode” cannot be determined by simply applying any hard and

fast procedures. The matter of fact ought to be discovered in every cases.

Answer to question 3:

HECS-HELP $850:

There are certain types of self-education outlays that are non-deductible. Under “sec

26-20, ITAA 1997” payments that are made under the HECS-HELP as fees are considered

3 Jenkins v FCT (1982) ATC 4089

4 Harding v Federal Commissioner of Taxation (2019) FCAFC 29

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

non-allowable deduction. The trainee made a payment of $850 under the HECS-HELP.

Denoting “sec 26-20, ITAA 1997” no deduction will be allowed in this context for self-

education expenses.

Travel – work to university $110:

Payments made for traveling between home and further education college or from

workplace to educational institution is permissible tax deduction expenses. The expense

should relate to income earning improving capacity of the taxpayer.

Similarly, the travel from the work place to the university will be permissible as

deduction under “sec8-1, ITAA 1997” to the trainee based on the assumption that the self-

education incidentals are sustained in earning the future income earning opportunity from the

present in which he is currently engaged5.

Books $200:

The “TR 98/9” cost incurred for self-education study materials such as the textbooks,

stationary, calculators etc. are considered as allowable deductions under “sec 8-1, ITAA

1997”6. The costs sustained by trainee accountant for books will be allowed for deduction

under “sec 8-1, ITAA 1997”.

Childcare expenses during evening classes $80:

“Sec 8-1, ITAA 1997” states that childcare incidentals are non-deductible. In “Lodge

v FCT (1972)” deductions were not permissible to the taxpayer for childcare costs that was

incurred to have her child minded while she attends her work. Similarly, the childcare

5 Section 8-1, Income Tax Assessment Act 1997 (Cth)

6 Taxation Ruling of TR 98/9

non-allowable deduction. The trainee made a payment of $850 under the HECS-HELP.

Denoting “sec 26-20, ITAA 1997” no deduction will be allowed in this context for self-

education expenses.

Travel – work to university $110:

Payments made for traveling between home and further education college or from

workplace to educational institution is permissible tax deduction expenses. The expense

should relate to income earning improving capacity of the taxpayer.

Similarly, the travel from the work place to the university will be permissible as

deduction under “sec8-1, ITAA 1997” to the trainee based on the assumption that the self-

education incidentals are sustained in earning the future income earning opportunity from the

present in which he is currently engaged5.

Books $200:

The “TR 98/9” cost incurred for self-education study materials such as the textbooks,

stationary, calculators etc. are considered as allowable deductions under “sec 8-1, ITAA

1997”6. The costs sustained by trainee accountant for books will be allowed for deduction

under “sec 8-1, ITAA 1997”.

Childcare expenses during evening classes $80:

“Sec 8-1, ITAA 1997” states that childcare incidentals are non-deductible. In “Lodge

v FCT (1972)” deductions were not permissible to the taxpayer for childcare costs that was

incurred to have her child minded while she attends her work. Similarly, the childcare

5 Section 8-1, Income Tax Assessment Act 1997 (Cth)

6 Taxation Ruling of TR 98/9

5TAXATION LAW

expenses of $80 incurred for attending evening classes were non-deductible7. Referring

“Lodge v FCT (1972)” the childcare outlays were not relevant in the derivation of calculable

wages.

Repair to fridge at home $250:

Under the “sec 25-10, ITAA 1997” a taxpayer can be permitted to deduct expenses

they incur for maintenances or repairs to the depreciating asset held by them completely for

generating calculable income8. The repairs to fridge at home by trainee accountant cannot be

considered as acceptable tax deduction under “sec 25-10, ITAA 1997” since the asset is not

used for producing assessable income and hence non allowed as deduction.

Black trousers and shirt required to be worn at office $145:

“Sec 8-1, ITAA 1997” explains that conventional clothing or ordinary clothing items

is not allowed for deduction in spite of the fact that the taxpayer is required to maintain an

appearance in the office. In “Westcott v FCT (1997)” no deduction was permitted for

conventional clothing irrespective of fact whether the clothing was required for maintaining a

suitable appearance9.

The expenses occurred by trainee accountant for black trouser and shirt needed to

worn at workplace is not eligible as tax deduction under “sec 8-1, ITAA 1997”. Citing

“Westcott v FCT (1997)” the expenditures were not relevant in making of wages.

7 Lodge v Federal Commissioner of Taxation (1972) HCA 49

8 Section 25-10, Income Tax Assessment Act 1997 (Cth).

9 Westcott v FCT (1997)

expenses of $80 incurred for attending evening classes were non-deductible7. Referring

“Lodge v FCT (1972)” the childcare outlays were not relevant in the derivation of calculable

wages.

Repair to fridge at home $250:

Under the “sec 25-10, ITAA 1997” a taxpayer can be permitted to deduct expenses

they incur for maintenances or repairs to the depreciating asset held by them completely for

generating calculable income8. The repairs to fridge at home by trainee accountant cannot be

considered as acceptable tax deduction under “sec 25-10, ITAA 1997” since the asset is not

used for producing assessable income and hence non allowed as deduction.

Black trousers and shirt required to be worn at office $145:

“Sec 8-1, ITAA 1997” explains that conventional clothing or ordinary clothing items

is not allowed for deduction in spite of the fact that the taxpayer is required to maintain an

appearance in the office. In “Westcott v FCT (1997)” no deduction was permitted for

conventional clothing irrespective of fact whether the clothing was required for maintaining a

suitable appearance9.

The expenses occurred by trainee accountant for black trouser and shirt needed to

worn at workplace is not eligible as tax deduction under “sec 8-1, ITAA 1997”. Citing

“Westcott v FCT (1997)” the expenditures were not relevant in making of wages.

7 Lodge v Federal Commissioner of Taxation (1972) HCA 49

8 Section 25-10, Income Tax Assessment Act 1997 (Cth).

9 Westcott v FCT (1997)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

Legal expenses incurred in writing up new employment contract with new employer

$300:

As explained in “sec 8-1, ITAA 1997” no deduction is permitted for expense that are

arose in attainment new work because they are not related to production of returns. In

“Maddalena v FCT (1971)” expenses incurred in traveling new club for negotiating

payments were not allowed for deduction10. Similarly, the legal outgoing occurred in writing

up the new employment contract will not be acceptable as tax deduction under “sec 8-1,

ITAA 1997”, since they are not related to production of returns.

Answer to question 4:

Answer A:

“S-104.110, ITAA 1997” is associated with the CGT event F1. Under “s104.110 (2),

ITAA 1997” the time of “CGT event F1” arises while granting the lease. This includes time

when the agreement for the renewal or extension of lease is formed. The taxpayer ought to

take into the account that no CGT discount is permissible under CGT event F1. As evident

John has been the owner of land for which he has granted the lease for seven years at a

premium of $7,000. When the lease was granted by John has resulted in CGT event F1 under

“sec 104-110 (2)” while the no CGT discount is applicable to John.

Answer B:

Issues:

Whether the taxpayer will be entitled to CGT discount for the sale of shares under

“sec 104-10 (1), ITAA 1997”.

10 Maddalena v FCT (1971) 45 ALJR 426

Legal expenses incurred in writing up new employment contract with new employer

$300:

As explained in “sec 8-1, ITAA 1997” no deduction is permitted for expense that are

arose in attainment new work because they are not related to production of returns. In

“Maddalena v FCT (1971)” expenses incurred in traveling new club for negotiating

payments were not allowed for deduction10. Similarly, the legal outgoing occurred in writing

up the new employment contract will not be acceptable as tax deduction under “sec 8-1,

ITAA 1997”, since they are not related to production of returns.

Answer to question 4:

Answer A:

“S-104.110, ITAA 1997” is associated with the CGT event F1. Under “s104.110 (2),

ITAA 1997” the time of “CGT event F1” arises while granting the lease. This includes time

when the agreement for the renewal or extension of lease is formed. The taxpayer ought to

take into the account that no CGT discount is permissible under CGT event F1. As evident

John has been the owner of land for which he has granted the lease for seven years at a

premium of $7,000. When the lease was granted by John has resulted in CGT event F1 under

“sec 104-110 (2)” while the no CGT discount is applicable to John.

Answer B:

Issues:

Whether the taxpayer will be entitled to CGT discount for the sale of shares under

“sec 104-10 (1), ITAA 1997”.

10 Maddalena v FCT (1971) 45 ALJR 426

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

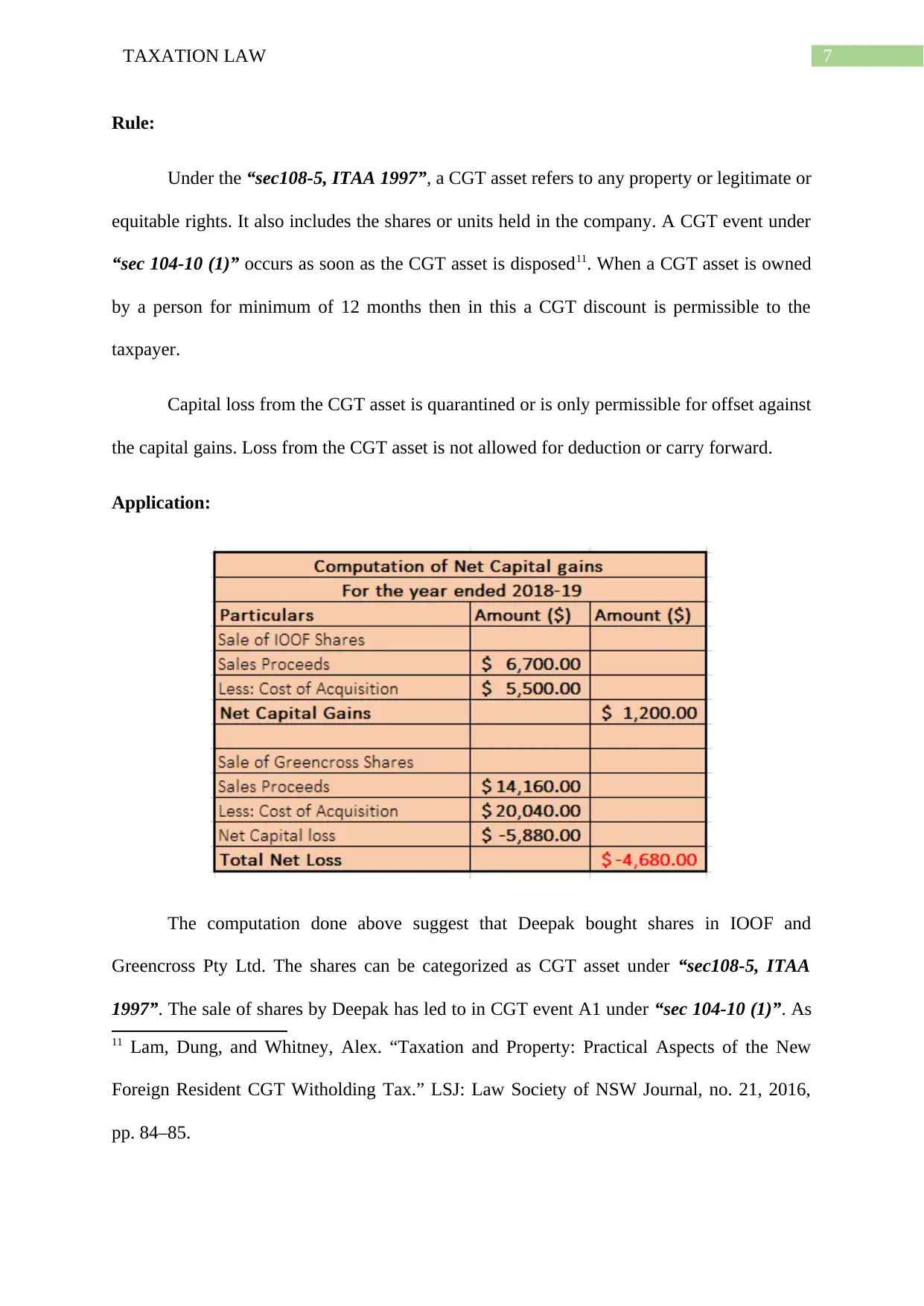

Rule:

Under the “sec108-5, ITAA 1997”, a CGT asset refers to any property or legitimate or

equitable rights. It also includes the shares or units held in the company. A CGT event under

“sec 104-10 (1)” occurs as soon as the CGT asset is disposed11. When a CGT asset is owned

by a person for minimum of 12 months then in this a CGT discount is permissible to the

taxpayer.

Capital loss from the CGT asset is quarantined or is only permissible for offset against

the capital gains. Loss from the CGT asset is not allowed for deduction or carry forward.

Application:

The computation done above suggest that Deepak bought shares in IOOF and

Greencross Pty Ltd. The shares can be categorized as CGT asset under “sec108-5, ITAA

1997”. The sale of shares by Deepak has led to in CGT event A1 under “sec 104-10 (1)”. As

11 Lam, Dung, and Whitney, Alex. “Taxation and Property: Practical Aspects of the New

Foreign Resident CGT Witholding Tax.” LSJ: Law Society of NSW Journal, no. 21, 2016,

pp. 84–85.

Rule:

Under the “sec108-5, ITAA 1997”, a CGT asset refers to any property or legitimate or

equitable rights. It also includes the shares or units held in the company. A CGT event under

“sec 104-10 (1)” occurs as soon as the CGT asset is disposed11. When a CGT asset is owned

by a person for minimum of 12 months then in this a CGT discount is permissible to the

taxpayer.

Capital loss from the CGT asset is quarantined or is only permissible for offset against

the capital gains. Loss from the CGT asset is not allowed for deduction or carry forward.

Application:

The computation done above suggest that Deepak bought shares in IOOF and

Greencross Pty Ltd. The shares can be categorized as CGT asset under “sec108-5, ITAA

1997”. The sale of shares by Deepak has led to in CGT event A1 under “sec 104-10 (1)”. As

11 Lam, Dung, and Whitney, Alex. “Taxation and Property: Practical Aspects of the New

Foreign Resident CGT Witholding Tax.” LSJ: Law Society of NSW Journal, no. 21, 2016,

pp. 84–85.

8TAXATION LAW

noted, sale of IOOF shares has given rise to in capital gains while the sale of Greencross

shares has yielded capital loss12. As the IOOF shares were not under the 12 month ownership

rule, no CGT discount will be allowed to Deepak. Whereas the net loss made from the

Greencross can be carried forward to successive period.

Conclusion:

As the taxpayer here did not satisfy the “twelve-month ownership rule”, no CGT

discount can be claimed in this context.

Answer C:

Issues:

Is the taxpayer permissible to claim full exemption from CGT for main residence

under “sec 118-110, ITAA 1997”?

Rule:

General principles of “division 118-B” states that a capital gains or loss from the sale

of main dwelling is exempt from tax under “sec118-110”. Nonetheless, a tax payer is allowed

partial main dwelling exemption if they use any portion of the house for conducting business

to produce assessable income.

Application:

The taxpayer here Li has bought a house for $200,000 in 2010 and converted the

house in producing the assessable income. She started conducting physiotherapy business and

used 20% of entire floor area. In 2019, Li sold her house for $700,000. As the house was used

by Li for conducting business, she will not be eligible to obtain full main dwelling exemption

12 Kenny, Paul, et al. Australian Tax 2016. 2016.

noted, sale of IOOF shares has given rise to in capital gains while the sale of Greencross

shares has yielded capital loss12. As the IOOF shares were not under the 12 month ownership

rule, no CGT discount will be allowed to Deepak. Whereas the net loss made from the

Greencross can be carried forward to successive period.

Conclusion:

As the taxpayer here did not satisfy the “twelve-month ownership rule”, no CGT

discount can be claimed in this context.

Answer C:

Issues:

Is the taxpayer permissible to claim full exemption from CGT for main residence

under “sec 118-110, ITAA 1997”?

Rule:

General principles of “division 118-B” states that a capital gains or loss from the sale

of main dwelling is exempt from tax under “sec118-110”. Nonetheless, a tax payer is allowed

partial main dwelling exemption if they use any portion of the house for conducting business

to produce assessable income.

Application:

The taxpayer here Li has bought a house for $200,000 in 2010 and converted the

house in producing the assessable income. She started conducting physiotherapy business and

used 20% of entire floor area. In 2019, Li sold her house for $700,000. As the house was used

by Li for conducting business, she will not be eligible to obtain full main dwelling exemption

12 Kenny, Paul, et al. Australian Tax 2016. 2016.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

under “sec 118-110, ITAA 1997”. Instead the capital gains that would be derived by will be

eligible for partial main residence13. Additionally, the dwelling was under Li’s ownership for

the period of twelve months. Hence, she will be eligible for claiming 50% discount in this

respect.

Capital gain x Percentage of floor area = Assessable portion

= $700,000 – $400,000 = $300,000 (net capital gain)

= 300,000 x 20% = $60,000

Conclusion:

Li would not be allowed to claim full exemption for her main residence however she

will be permitted to partial exemption from CGT for her dwelling under “sec 118-110, ITAA

1997”.

Answer D:

The cost base viewed as the total cost that is linked with the CGT asset. The cost base

is lowered till the degree of CGT input tax credits that are claimed by taxpayer. The cost base

item classified under sec 110-25 (1) includes five elements. While the reduced cost base

simultaneously involves the situation when a CGT event has occurred and no gains is earned

in that respect to the taxpayer. The reduced cost base is used in ascertaining any capital loss

while it can also be used in reducing the capital loss as well. The five elements of the reduced

cost are very much similar to that of the cost base of CGT asset however the third element is

different which encompasses the balancing adjustment.

13 Sadiq, Kerrie & Coleman Cynthia & Hanegbi, Rami Et AL., et al. Principles of Taxation

Law 2017. 10th ed., THOMSON LAWBOOK CO, 2017.

under “sec 118-110, ITAA 1997”. Instead the capital gains that would be derived by will be

eligible for partial main residence13. Additionally, the dwelling was under Li’s ownership for

the period of twelve months. Hence, she will be eligible for claiming 50% discount in this

respect.

Capital gain x Percentage of floor area = Assessable portion

= $700,000 – $400,000 = $300,000 (net capital gain)

= 300,000 x 20% = $60,000

Conclusion:

Li would not be allowed to claim full exemption for her main residence however she

will be permitted to partial exemption from CGT for her dwelling under “sec 118-110, ITAA

1997”.

Answer D:

The cost base viewed as the total cost that is linked with the CGT asset. The cost base

is lowered till the degree of CGT input tax credits that are claimed by taxpayer. The cost base

item classified under sec 110-25 (1) includes five elements. While the reduced cost base

simultaneously involves the situation when a CGT event has occurred and no gains is earned

in that respect to the taxpayer. The reduced cost base is used in ascertaining any capital loss

while it can also be used in reducing the capital loss as well. The five elements of the reduced

cost are very much similar to that of the cost base of CGT asset however the third element is

different which encompasses the balancing adjustment.

13 Sadiq, Kerrie & Coleman Cynthia & Hanegbi, Rami Et AL., et al. Principles of Taxation

Law 2017. 10th ed., THOMSON LAWBOOK CO, 2017.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

Answer to question 5:

Answer A:

In “sec 6-5, ITAA 1997” an item that carries income nature is earned when it has “come-

home” to the taxpayer. The existence of any such immorality or illegal means does not

prevents the taxability of the income. Similarly, in “Partridge v Mallandaine(1856) 2 TC

179”, the law court of law clarified that an item having the characteristic of earnings will be

derived and will be taxable irrespective of its nature14. Similarly, the income from illegal

means will be considered chargeable ordinary earnings under “sec 6-5, ITAA 1997”.

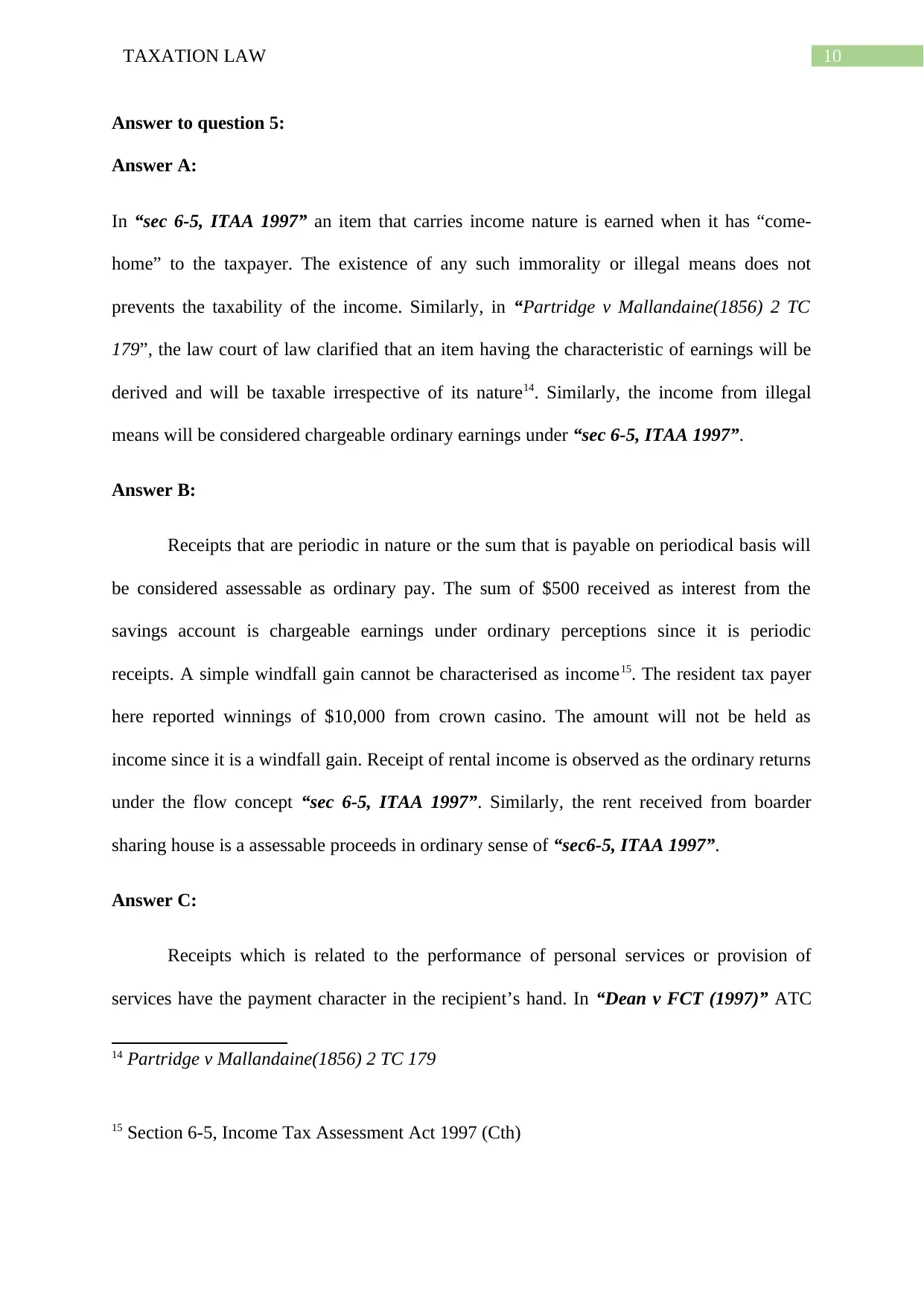

Answer B:

Receipts that are periodic in nature or the sum that is payable on periodical basis will

be considered assessable as ordinary pay. The sum of $500 received as interest from the

savings account is chargeable earnings under ordinary perceptions since it is periodic

receipts. A simple windfall gain cannot be characterised as income15. The resident tax payer

here reported winnings of $10,000 from crown casino. The amount will not be held as

income since it is a windfall gain. Receipt of rental income is observed as the ordinary returns

under the flow concept “sec 6-5, ITAA 1997”. Similarly, the rent received from boarder

sharing house is a assessable proceeds in ordinary sense of “sec6-5, ITAA 1997”.

Answer C:

Receipts which is related to the performance of personal services or provision of

services have the payment character in the recipient’s hand. In “Dean v FCT (1997)” ATC

14 Partridge v Mallandaine(1856) 2 TC 179

15 Section 6-5, Income Tax Assessment Act 1997 (Cth)

Answer to question 5:

Answer A:

In “sec 6-5, ITAA 1997” an item that carries income nature is earned when it has “come-

home” to the taxpayer. The existence of any such immorality or illegal means does not

prevents the taxability of the income. Similarly, in “Partridge v Mallandaine(1856) 2 TC

179”, the law court of law clarified that an item having the characteristic of earnings will be

derived and will be taxable irrespective of its nature14. Similarly, the income from illegal

means will be considered chargeable ordinary earnings under “sec 6-5, ITAA 1997”.

Answer B:

Receipts that are periodic in nature or the sum that is payable on periodical basis will

be considered assessable as ordinary pay. The sum of $500 received as interest from the

savings account is chargeable earnings under ordinary perceptions since it is periodic

receipts. A simple windfall gain cannot be characterised as income15. The resident tax payer

here reported winnings of $10,000 from crown casino. The amount will not be held as

income since it is a windfall gain. Receipt of rental income is observed as the ordinary returns

under the flow concept “sec 6-5, ITAA 1997”. Similarly, the rent received from boarder

sharing house is a assessable proceeds in ordinary sense of “sec6-5, ITAA 1997”.

Answer C:

Receipts which is related to the performance of personal services or provision of

services have the payment character in the recipient’s hand. In “Dean v FCT (1997)” ATC

14 Partridge v Mallandaine(1856) 2 TC 179

15 Section 6-5, Income Tax Assessment Act 1997 (Cth)

11TAXATION LAW

4762 remuneration that is received from employment is treated as taxable earnings for

rendering personal services16.

The allowance of $500 paid to the employee by the employer is an assessable income

to the employee since it constitutes an income from the personal services. Referring “Dean v

FCT (1997)” ATC 4762 the amount will be treated as taxable under the ordinary sense of

“sec 6-5, ITAA 1997”.

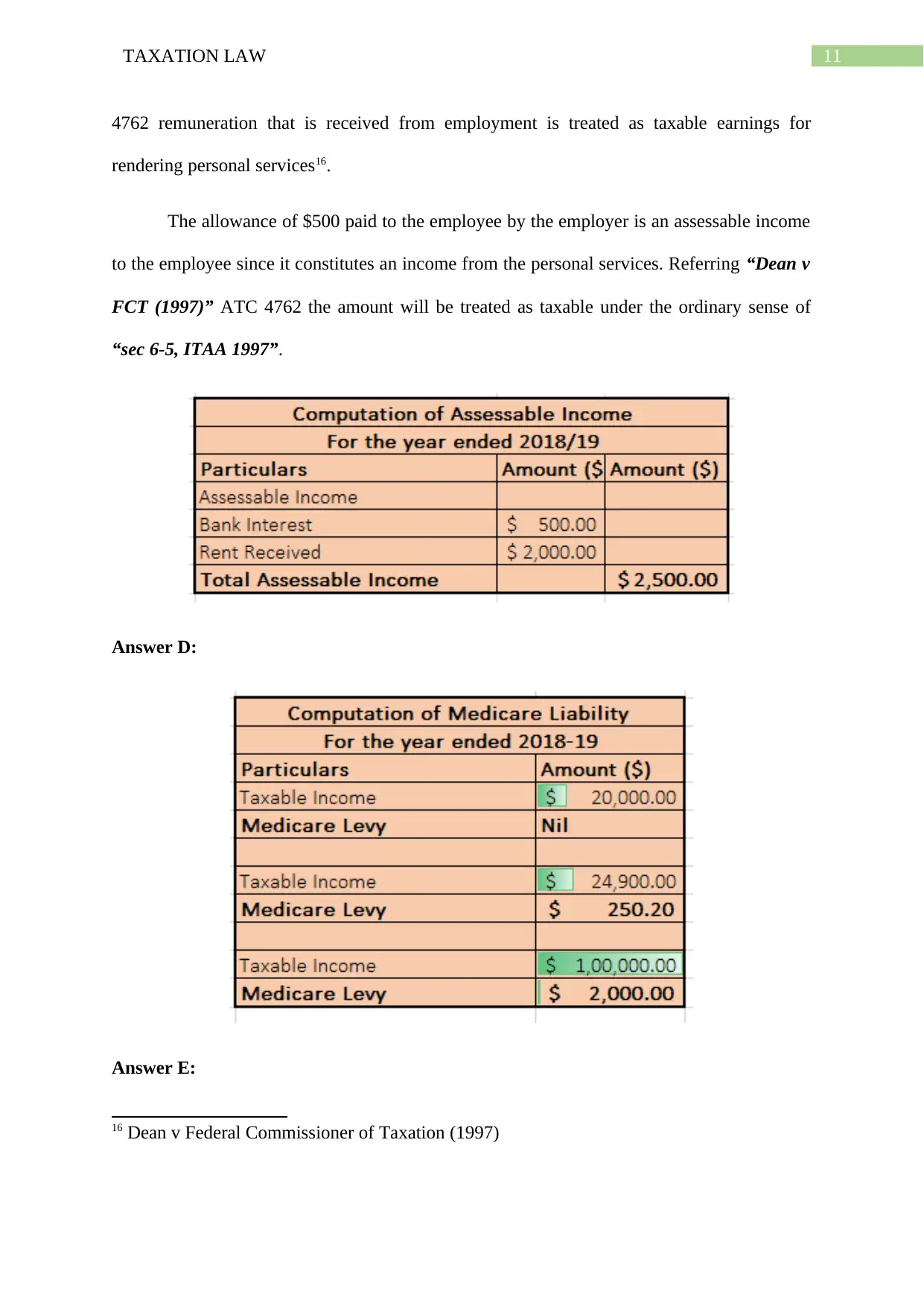

Answer D:

Answer E:

16 Dean v Federal Commissioner of Taxation (1997)

4762 remuneration that is received from employment is treated as taxable earnings for

rendering personal services16.

The allowance of $500 paid to the employee by the employer is an assessable income

to the employee since it constitutes an income from the personal services. Referring “Dean v

FCT (1997)” ATC 4762 the amount will be treated as taxable under the ordinary sense of

“sec 6-5, ITAA 1997”.

Answer D:

Answer E:

16 Dean v Federal Commissioner of Taxation (1997)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.