Taxation Law Assignment: Individual Assessment - HA3042 T2 2019

VerifiedAdded on 2022/12/30

|13

|2975

|27

Homework Assignment

AI Summary

This Taxation Law assignment presents a comprehensive analysis of various tax-related scenarios. The first part of the assignment delves into capital gains tax (CGT), examining the tax implications of selling a family home, a car, a business, furniture, and paintings. It explores the application of CGT rules, including exemptions and concessions, such as the main residence exemption and small business entity concessions. The second part focuses on depreciating assets, specifically a CNC machine, and addresses whether a deduction for capital allowances is claimable. It examines the relevant provisions of the Income Tax Assessment Act 1997 (ITAA 1997), including Division 40, and how to determine the cost base of a depreciating asset. The assignment demonstrates the application of tax law principles to practical situations, providing a detailed understanding of CGT and depreciation rules.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:.................................................................................................................2

A: The capital gain on sale of the family home:....................................................................2

B: Capital gain or loss made from the car:.............................................................................3

C: The capital gain in relation to the sale of business:...........................................................3

D: The capital gain in relation to selling the furniture:..........................................................4

E: The capital gain in relation to selling the paintings:..........................................................5

Answer to question 2:.................................................................................................................7

Issues:.....................................................................................................................................7

Laws:......................................................................................................................................7

Application:............................................................................................................................8

Conclusion:............................................................................................................................9

References:...............................................................................................................................10

Table of Contents

Answer to question 1:.................................................................................................................2

A: The capital gain on sale of the family home:....................................................................2

B: Capital gain or loss made from the car:.............................................................................3

C: The capital gain in relation to the sale of business:...........................................................3

D: The capital gain in relation to selling the furniture:..........................................................4

E: The capital gain in relation to selling the paintings:..........................................................5

Answer to question 2:.................................................................................................................7

Issues:.....................................................................................................................................7

Laws:......................................................................................................................................7

Application:............................................................................................................................8

Conclusion:............................................................................................................................9

References:...............................................................................................................................10

2TAXATION LAW

Answer to question 1:

A: The capital gain on sale of the family home:

Not all the assets that are purchased or acquired following 20th sept 1985 falls within

the purview of CGT rules. As per the “division 118 of the ITAA 1997” it lay down numerous

exemptions that covers the exempted assets, exempted transactions and anti-over lapping

provisions (Lam and Whitney 2016). In some of the cases the capital gains tax is not

applicable on the capital gains since there are other provisions of the taxation laws is applied

in its place.

Capital gains or loss that takes place to the dwelling which forms the main dwelling

or residence of the taxpayer is ignored if the following conditions are met;

a. The taxpayer is regarded as the individual

b. The dwelling was the main residence of the taxpayer all through the ownership

period; and

c. Under “section 118-10, ITAA 1997” the dwelling ownership failed to pass to the

beneficiary of the deceased estate (Sadiq 2016).

The case facts obtained suggest that a house was acquired by Jasmine during 1981 for

a sum of $40,000. The taxpayer later sold the house for a sum of $650,000 in the present tax

year. The house acquired by Jasmine should be termed as the Pre-CGT asset. This is because

the asset was purchased before the introduction of the CGT regime. Additionally, Jasmine

dwelt in that house right from the time when she first acquired it. With respect to “sec 118-

110 (1), ITAA 1997” the house of Jasmine meet the requirements for the main residence

exemption. The net amount of capital gains that is made by Jasmine following the sale of her

main residence is exempted from CGT.

Answer to question 1:

A: The capital gain on sale of the family home:

Not all the assets that are purchased or acquired following 20th sept 1985 falls within

the purview of CGT rules. As per the “division 118 of the ITAA 1997” it lay down numerous

exemptions that covers the exempted assets, exempted transactions and anti-over lapping

provisions (Lam and Whitney 2016). In some of the cases the capital gains tax is not

applicable on the capital gains since there are other provisions of the taxation laws is applied

in its place.

Capital gains or loss that takes place to the dwelling which forms the main dwelling

or residence of the taxpayer is ignored if the following conditions are met;

a. The taxpayer is regarded as the individual

b. The dwelling was the main residence of the taxpayer all through the ownership

period; and

c. Under “section 118-10, ITAA 1997” the dwelling ownership failed to pass to the

beneficiary of the deceased estate (Sadiq 2016).

The case facts obtained suggest that a house was acquired by Jasmine during 1981 for

a sum of $40,000. The taxpayer later sold the house for a sum of $650,000 in the present tax

year. The house acquired by Jasmine should be termed as the Pre-CGT asset. This is because

the asset was purchased before the introduction of the CGT regime. Additionally, Jasmine

dwelt in that house right from the time when she first acquired it. With respect to “sec 118-

110 (1), ITAA 1997” the house of Jasmine meet the requirements for the main residence

exemption. The net amount of capital gains that is made by Jasmine following the sale of her

main residence is exempted from CGT.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

B: Capital gain or loss made from the car:

In almost every case where something is sold results in “CGT event A1” under

“section 104-10, ITAA 1997”. The CGT asset should have been disposed to the entity and it

should not be lost or destroyed (Villios 2014). A CGT asset under “sec 108-20, ITAA 1997”

includes the personal use assets apart from the collectibles that is largely held in possession

of taxpayer for their private usage and enjoyment. Certain special rules are laid down for the

personal use assets. Under the “sec 108-20, ITAA 1997” the capital loss that is occurred upon

selling the personal use assets should always be disregarded.

The case facts obtained puts forward that a car was purchased in 2011 having

acquisition cost of $31,000 and it now worth approximately $10,000 when she sold it. The

car is classified under “section 108-20, ITAA 1997” as the personal use asset which Jasmine

kept for her private use. The sale of Car has given rise to “CGT event A1” under “section

104-10, ITAA 1997”. However, Jasmine must denote that upon disposal of car a capital loss

occurred. As the car has been classified as the personal use asset, the capital loss incurred

should be ignored by her under “sec 108-20, ITAA 1997”.

C: The capital gain in relation to the sale of business:

As per “Div-152” small business are given concession (Friend 2015). To claim CGT

concession certain conditions needs to be satisfied, which are as follows;

a. The business must be a small business entity and the aggregate turnover in the current

year or past year must not be greater than $2 million or the assets net value should not

be greater than $6 million (Sadiq and Marsden 2014).

b. The assets must be an active asset

Small business entity can avail four types of concessions, which are as follows;

a. 15-Year Exemption: The taxpayer should hold the asset for at least 15 years.

B: Capital gain or loss made from the car:

In almost every case where something is sold results in “CGT event A1” under

“section 104-10, ITAA 1997”. The CGT asset should have been disposed to the entity and it

should not be lost or destroyed (Villios 2014). A CGT asset under “sec 108-20, ITAA 1997”

includes the personal use assets apart from the collectibles that is largely held in possession

of taxpayer for their private usage and enjoyment. Certain special rules are laid down for the

personal use assets. Under the “sec 108-20, ITAA 1997” the capital loss that is occurred upon

selling the personal use assets should always be disregarded.

The case facts obtained puts forward that a car was purchased in 2011 having

acquisition cost of $31,000 and it now worth approximately $10,000 when she sold it. The

car is classified under “section 108-20, ITAA 1997” as the personal use asset which Jasmine

kept for her private use. The sale of Car has given rise to “CGT event A1” under “section

104-10, ITAA 1997”. However, Jasmine must denote that upon disposal of car a capital loss

occurred. As the car has been classified as the personal use asset, the capital loss incurred

should be ignored by her under “sec 108-20, ITAA 1997”.

C: The capital gain in relation to the sale of business:

As per “Div-152” small business are given concession (Friend 2015). To claim CGT

concession certain conditions needs to be satisfied, which are as follows;

a. The business must be a small business entity and the aggregate turnover in the current

year or past year must not be greater than $2 million or the assets net value should not

be greater than $6 million (Sadiq and Marsden 2014).

b. The assets must be an active asset

Small business entity can avail four types of concessions, which are as follows;

a. 15-Year Exemption: The taxpayer should hold the asset for at least 15 years.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

b. 50% CGT Reduction: A 50% reduction from net capital gains is available to

taxpayer under this regime (Minas et al. 2018).

c. Retirement Concession: The taxpayers are allowed to ignore the capital gain upon

disposal of capital gains tax asset related with business if the proceeds from sale is

used for retirement purpose.

d. Roll-over relief: When the taxpayer purchases any replacement assets then the capital

gains is deferred under this scheme.

Jasmine is now retiring from her business and plans to go back UK. A buyer would

take up her cleaning business for $125,000. All the assets of business were disposed for

$65,000 while her goodwill was disposed for $60,000. With respect to “Div-152” Jasmine

can claim small business entity concession since the value of her assets is below $6 million

since the assets sold active asset in business. As a result she can get a 15-Year CGT

exemption as it is assumed that she held the asset for 15 years.

Whereas the disposal of goodwill has resulted in “CGT event C1” because her

business was ended perpetually. As per “Taxation ruling of TR 1999/16” upon permanent

cessation of business the business goodwill is either destroyed or lost (Kenny, Blissenden and

Villios 2016). Therefore, with respect to “SubDiv-152-C” for the sale of business goodwill,

Jasmine can obtain a 50% reduction from the CGT.

D: The capital gain in relation to selling the furniture:

Jasmine in her bid to retirement sold her furniture for $5,000 which she acquired for

$2,000. As per the special rules of “section 118-10(3), ITAA 1997” capital gains must be

disregarded upon purchasing the personal use asset for $10,000 or less. Consequently,

Jasmine must disregard the capital gains made from disposing her furniture as it is a personal

use asset and the cost base of asset is below $10,000.

b. 50% CGT Reduction: A 50% reduction from net capital gains is available to

taxpayer under this regime (Minas et al. 2018).

c. Retirement Concession: The taxpayers are allowed to ignore the capital gain upon

disposal of capital gains tax asset related with business if the proceeds from sale is

used for retirement purpose.

d. Roll-over relief: When the taxpayer purchases any replacement assets then the capital

gains is deferred under this scheme.

Jasmine is now retiring from her business and plans to go back UK. A buyer would

take up her cleaning business for $125,000. All the assets of business were disposed for

$65,000 while her goodwill was disposed for $60,000. With respect to “Div-152” Jasmine

can claim small business entity concession since the value of her assets is below $6 million

since the assets sold active asset in business. As a result she can get a 15-Year CGT

exemption as it is assumed that she held the asset for 15 years.

Whereas the disposal of goodwill has resulted in “CGT event C1” because her

business was ended perpetually. As per “Taxation ruling of TR 1999/16” upon permanent

cessation of business the business goodwill is either destroyed or lost (Kenny, Blissenden and

Villios 2016). Therefore, with respect to “SubDiv-152-C” for the sale of business goodwill,

Jasmine can obtain a 50% reduction from the CGT.

D: The capital gain in relation to selling the furniture:

Jasmine in her bid to retirement sold her furniture for $5,000 which she acquired for

$2,000. As per the special rules of “section 118-10(3), ITAA 1997” capital gains must be

disregarded upon purchasing the personal use asset for $10,000 or less. Consequently,

Jasmine must disregard the capital gains made from disposing her furniture as it is a personal

use asset and the cost base of asset is below $10,000.

5TAXATION LAW

E: The capital gain in relation to selling the paintings:

As per the “section 108-10, ITAA 1997” collectibles is well-defined as the asset that;

1. The taxpayer has largely kept it for their personal enjoyment and usage

2. Assets that are listed under the “section 108-20 (2), ITAA 1997” which includes

a. Antiques and jewellery

b. Paintings, sculptures or any work of art

c. Rare coins, stamps etc.

There are certain special rules for the collectibles;

1. Upon suffering any capital loss from the collectibles then it must be quarantined and it

is only allowed to be offset under “sec108-10 (1), ITAA 1997” against the capital

gains that is from the other collectibles (Kenny 2015).

2. The capital loss is simply ignored under “sec 118-10 (1), ITAA 1997” if the

collectibles has the purchase price of $500 or less.

The case facts obtained suggest that Jasmine purchased numerous painting where the

cost of every painting was not greater than $500. All the paintings was sold by Jasmine for

$500. By referring the special rules explained in sec “108-10 (1)”, the capital gains which

Jasmine has made from disposal of her numerous painting should be simply disregarded

because the purchase price for each painting was not greater than $500.

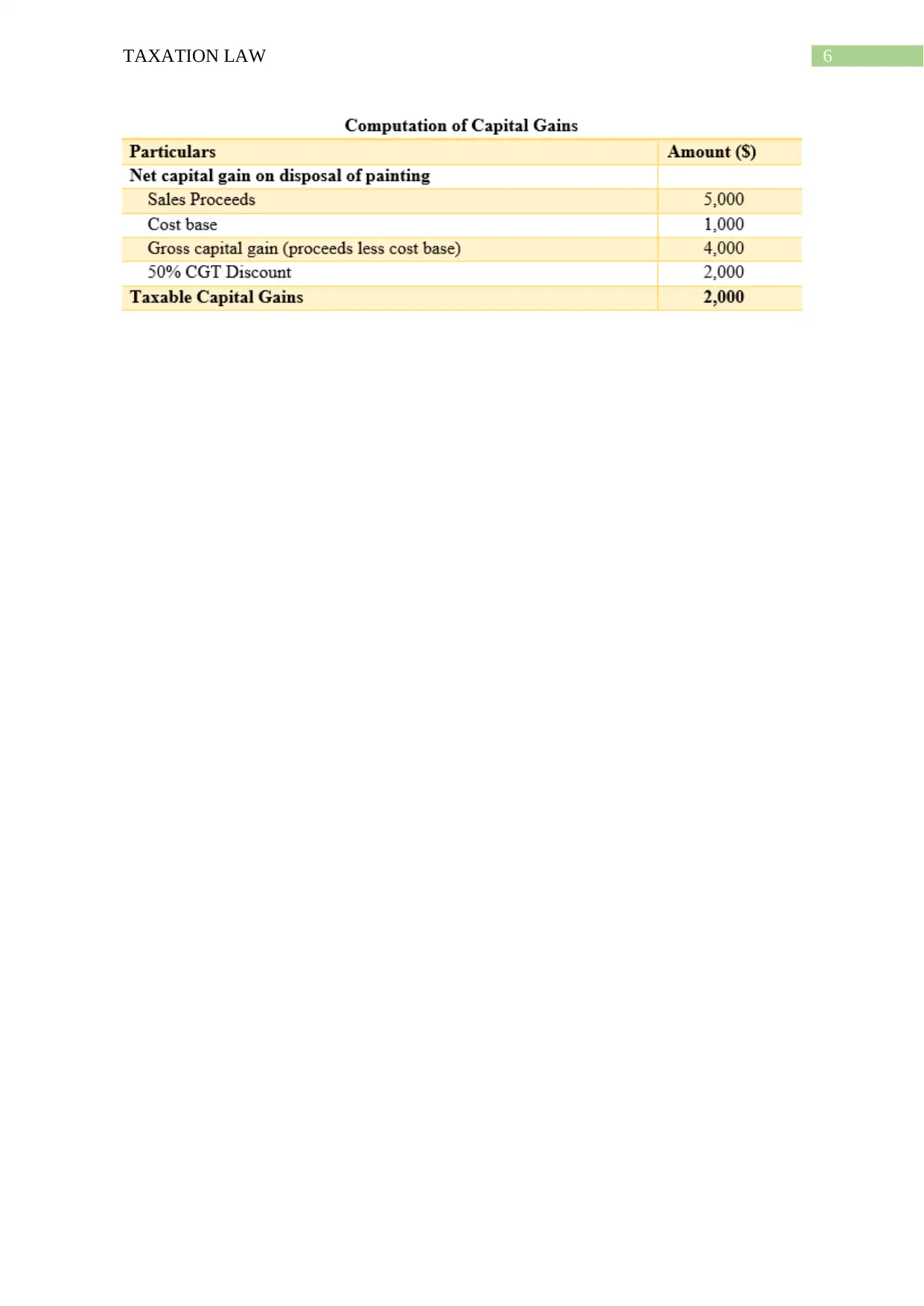

While Jasmine sold one painting for $5,000 that she acquired for $1,000. The sale of

painting has given rise to capital gains. Consequently, Jasmine will be required to pay capital

gains tax for the profits made from selling her painting.

E: The capital gain in relation to selling the paintings:

As per the “section 108-10, ITAA 1997” collectibles is well-defined as the asset that;

1. The taxpayer has largely kept it for their personal enjoyment and usage

2. Assets that are listed under the “section 108-20 (2), ITAA 1997” which includes

a. Antiques and jewellery

b. Paintings, sculptures or any work of art

c. Rare coins, stamps etc.

There are certain special rules for the collectibles;

1. Upon suffering any capital loss from the collectibles then it must be quarantined and it

is only allowed to be offset under “sec108-10 (1), ITAA 1997” against the capital

gains that is from the other collectibles (Kenny 2015).

2. The capital loss is simply ignored under “sec 118-10 (1), ITAA 1997” if the

collectibles has the purchase price of $500 or less.

The case facts obtained suggest that Jasmine purchased numerous painting where the

cost of every painting was not greater than $500. All the paintings was sold by Jasmine for

$500. By referring the special rules explained in sec “108-10 (1)”, the capital gains which

Jasmine has made from disposal of her numerous painting should be simply disregarded

because the purchase price for each painting was not greater than $500.

While Jasmine sold one painting for $5,000 that she acquired for $1,000. The sale of

painting has given rise to capital gains. Consequently, Jasmine will be required to pay capital

gains tax for the profits made from selling her painting.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

Answer to question 2:

Issues:

Whether a deduction for capital allowances equivalent to the decline in value of the

depreciating asset can be claimed by the taxpayer under the “sec 40-25 (1), ITAA 1997”?

Laws:

As per the “Div-40, ITAA 1997” a taxpayer is permitted to obtain deduction

equivalent to the decline in value of the asset which is held during the year (Jogarajan 2016).

Under “sec 40-25 (1), ITAA 1997”, the deduction is lowered up to the extent that the

depreciating asset is used by the taxpayer for a purpose apart from the taxable purpose. As

explained in “sec 40-25 (1), ITAA 1997” a deduction is allowed up to an amount which is

equivalent to the decline in value of the depreciating asset that is installed for taxable

purpose.

According to “sec 40-30 (1), ITAA 1997” a depreciating asset refers to an asset that

has the limited effective life and it is anticipated to fall in value based on the time of its usage

(Kaza 2015). Under “sec 40-60 (1)”, a depreciating asset that is held by taxpayer commences

to fall in value right from its start time (Anderson, Dickfos and Brown 2016). While under

“sec40-60 (2), ITAA 1997” the start time of the depreciating asset commences when the

taxpayer makes the first use of asset or has installed it for ready use.

As explained in the “Subdiv-40-C” depreciation is charged on the cost of depreciating

asset. As common rule, the cost price of the depreciating asset would not only comprise of its

purchase price but would comprise of any incidental costs relating to the delivery and

installation as well (Khoury 2014). Additionally, any kind of slight expenses that is occurred

in the re-arrangement or removal of the other plant to accommodate the new plant may also

be included into the cost price. The full federal court in “FC of T v Broken Hill Pty Co Ltd

Answer to question 2:

Issues:

Whether a deduction for capital allowances equivalent to the decline in value of the

depreciating asset can be claimed by the taxpayer under the “sec 40-25 (1), ITAA 1997”?

Laws:

As per the “Div-40, ITAA 1997” a taxpayer is permitted to obtain deduction

equivalent to the decline in value of the asset which is held during the year (Jogarajan 2016).

Under “sec 40-25 (1), ITAA 1997”, the deduction is lowered up to the extent that the

depreciating asset is used by the taxpayer for a purpose apart from the taxable purpose. As

explained in “sec 40-25 (1), ITAA 1997” a deduction is allowed up to an amount which is

equivalent to the decline in value of the depreciating asset that is installed for taxable

purpose.

According to “sec 40-30 (1), ITAA 1997” a depreciating asset refers to an asset that

has the limited effective life and it is anticipated to fall in value based on the time of its usage

(Kaza 2015). Under “sec 40-60 (1)”, a depreciating asset that is held by taxpayer commences

to fall in value right from its start time (Anderson, Dickfos and Brown 2016). While under

“sec40-60 (2), ITAA 1997” the start time of the depreciating asset commences when the

taxpayer makes the first use of asset or has installed it for ready use.

As explained in the “Subdiv-40-C” depreciation is charged on the cost of depreciating

asset. As common rule, the cost price of the depreciating asset would not only comprise of its

purchase price but would comprise of any incidental costs relating to the delivery and

installation as well (Khoury 2014). Additionally, any kind of slight expenses that is occurred

in the re-arrangement or removal of the other plant to accommodate the new plant may also

be included into the cost price. The full federal court in “FC of T v Broken Hill Pty Co Ltd

8TAXATION LAW

(1969-70) 120 CLR 240” stated that the cost would not only comprise of the purchase price

but would also comprise of the incidental cost associated to the delivery and installation.

“Section 40-175, ITAA 1997” classifies the cost of depreciating asset into two

elements. “Subsection 40-180 (1)” provides direction to the taxpayer that this element must

be worked out when the taxpayer commences to hold the depreciating asset (Bell 2016). “Sec

110-25, ITAA 1997” explains that the “First element” would usually be the purchase price

of the depreciating asset. While “section 40-90” is associated with the “second element”

which widely comprises of the cost delivery, installation and capital improvements to the

asset.

Application:

The case facts obtained suggest that on 1st November 2014 a CNC machine was

imported by John from Germany. John acquired the machine at a cost of $300,000. As

explained in the “sec 40-30 (1), ITAA 1997” the CNC machine is regarded as the

depreciating asset because the machine has the limited effective life over the time of its usage

and the machine is anticipated to decline in value for taxation purpose based on its use.

Following the import of CNC machine from Germany John installed it on 15th January

as ready to use asset for taxable purpose. In agreement with the “sec 40-60 (1), ITAA 1997”

the start time for computing the decline in value of the CNC machine is from 15th January

2015. The machine was installed and ready to use for taxable purpose is from that date

onwards.

In the meantime, there were additional cost that was incurred by John following the

commencement of the usage of CNC machine. John on 1st February 2015 installed a guiding

rod with the view of making the machine more effective. John should refer to “Sub-div 40-

C” to determine the overall cost of the depreciating asset (Stilwell 2016). This will not only

(1969-70) 120 CLR 240” stated that the cost would not only comprise of the purchase price

but would also comprise of the incidental cost associated to the delivery and installation.

“Section 40-175, ITAA 1997” classifies the cost of depreciating asset into two

elements. “Subsection 40-180 (1)” provides direction to the taxpayer that this element must

be worked out when the taxpayer commences to hold the depreciating asset (Bell 2016). “Sec

110-25, ITAA 1997” explains that the “First element” would usually be the purchase price

of the depreciating asset. While “section 40-90” is associated with the “second element”

which widely comprises of the cost delivery, installation and capital improvements to the

asset.

Application:

The case facts obtained suggest that on 1st November 2014 a CNC machine was

imported by John from Germany. John acquired the machine at a cost of $300,000. As

explained in the “sec 40-30 (1), ITAA 1997” the CNC machine is regarded as the

depreciating asset because the machine has the limited effective life over the time of its usage

and the machine is anticipated to decline in value for taxation purpose based on its use.

Following the import of CNC machine from Germany John installed it on 15th January

as ready to use asset for taxable purpose. In agreement with the “sec 40-60 (1), ITAA 1997”

the start time for computing the decline in value of the CNC machine is from 15th January

2015. The machine was installed and ready to use for taxable purpose is from that date

onwards.

In the meantime, there were additional cost that was incurred by John following the

commencement of the usage of CNC machine. John on 1st February 2015 installed a guiding

rod with the view of making the machine more effective. John should refer to “Sub-div 40-

C” to determine the overall cost of the depreciating asset (Stilwell 2016). This will not only

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

include the purchase price but would also include the installation expense of guiding rod into

the cost base. Citing the judgement of court in “FC of T v Broken Hill Pty Co Ltd (1969-70)

120 CLR 240” the cost base of CNC machine will include the expenses for guiding rod that

was installed by John.

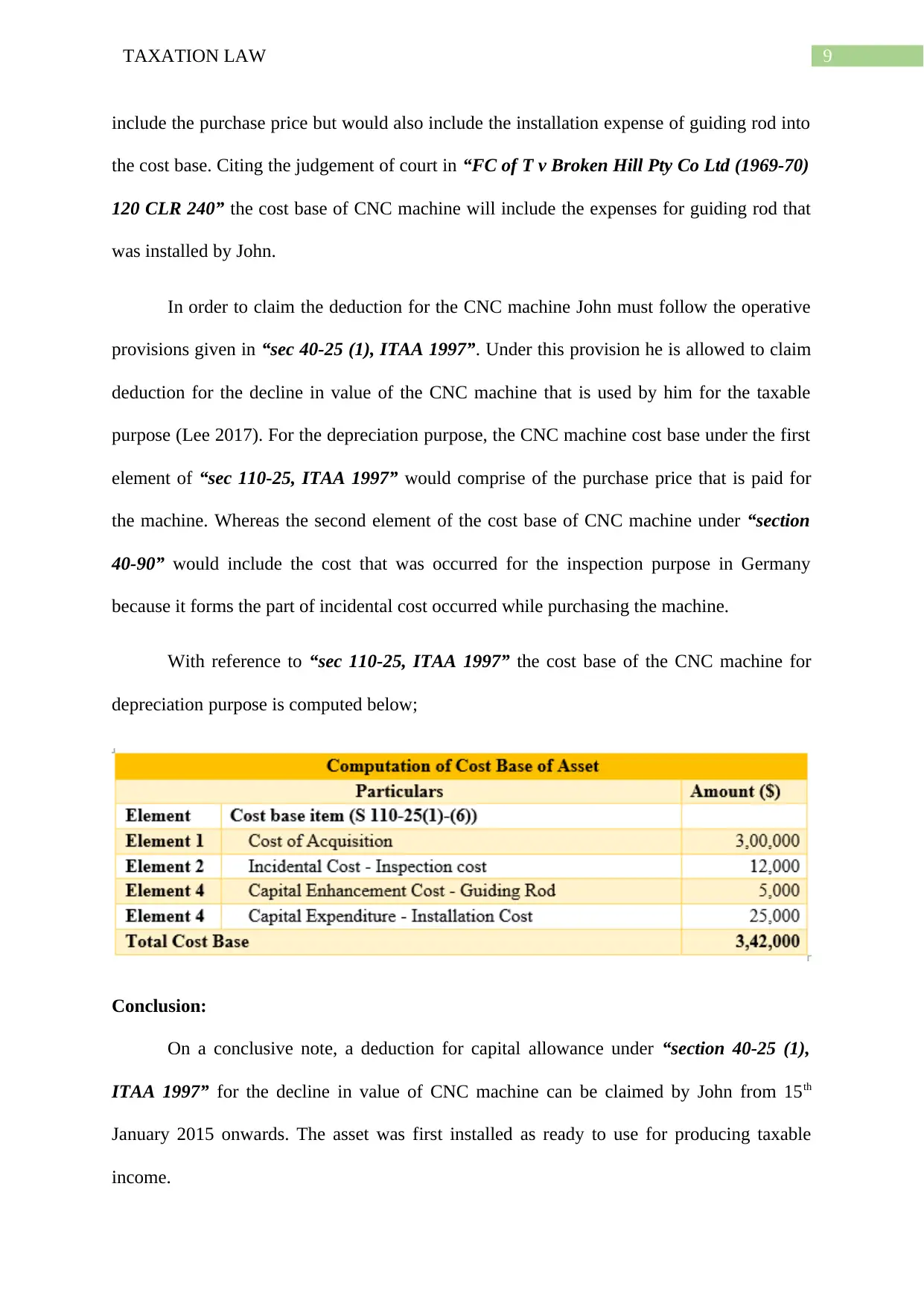

In order to claim the deduction for the CNC machine John must follow the operative

provisions given in “sec 40-25 (1), ITAA 1997”. Under this provision he is allowed to claim

deduction for the decline in value of the CNC machine that is used by him for the taxable

purpose (Lee 2017). For the depreciation purpose, the CNC machine cost base under the first

element of “sec 110-25, ITAA 1997” would comprise of the purchase price that is paid for

the machine. Whereas the second element of the cost base of CNC machine under “section

40-90” would include the cost that was occurred for the inspection purpose in Germany

because it forms the part of incidental cost occurred while purchasing the machine.

With reference to “sec 110-25, ITAA 1997” the cost base of the CNC machine for

depreciation purpose is computed below;

Conclusion:

On a conclusive note, a deduction for capital allowance under “section 40-25 (1),

ITAA 1997” for the decline in value of CNC machine can be claimed by John from 15th

January 2015 onwards. The asset was first installed as ready to use for producing taxable

income.

include the purchase price but would also include the installation expense of guiding rod into

the cost base. Citing the judgement of court in “FC of T v Broken Hill Pty Co Ltd (1969-70)

120 CLR 240” the cost base of CNC machine will include the expenses for guiding rod that

was installed by John.

In order to claim the deduction for the CNC machine John must follow the operative

provisions given in “sec 40-25 (1), ITAA 1997”. Under this provision he is allowed to claim

deduction for the decline in value of the CNC machine that is used by him for the taxable

purpose (Lee 2017). For the depreciation purpose, the CNC machine cost base under the first

element of “sec 110-25, ITAA 1997” would comprise of the purchase price that is paid for

the machine. Whereas the second element of the cost base of CNC machine under “section

40-90” would include the cost that was occurred for the inspection purpose in Germany

because it forms the part of incidental cost occurred while purchasing the machine.

With reference to “sec 110-25, ITAA 1997” the cost base of the CNC machine for

depreciation purpose is computed below;

Conclusion:

On a conclusive note, a deduction for capital allowance under “section 40-25 (1),

ITAA 1997” for the decline in value of CNC machine can be claimed by John from 15th

January 2015 onwards. The asset was first installed as ready to use for producing taxable

income.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

11TAXATION LAW

References:

Anderson, C., Dickfos, J. and Brown, C., 2016. The Australian Taxation Office - what role

does it play in anti-phoenix activity? Insolvency Law Journal, 24(2), pp.127–140.

Bell, C.D., 2016. Taxation. University of Richmond Law Review, 51(1), pp.103–123.

Friend, R, 2015. The CGT small business concessions: issues, anomalies and opportunities.

(capital gains tax) (Australia). Australian Tax Review, 40(2), pp.108–137.

Jogarajan, S., 2016. Regulating the regulator: assessing the effectiveness of the ATO's

external scrutiny arrangements. Journal of Australian Taxation, 18(1), pp.23–41.

Kaza, G., 2015. Many pay state capital gains tax. Arkansas Business, 32(19), p.31.

Kenny, P., 2015. LexisNexis concise tax legislation 2016,

Kenny, P., Blissenden, M. and Villios, S., 2016. Australian tax 2016,

Khoury, D, 2014. Widening the availability of deductions under Australian taxation law. Tax

Specialist, 14(4), pp.207–211.

Lam, D and Whitney, 2016. Taxation and property: Practical aspects of the new foreign

resident CGT witholding tax. LSJ: Law Society of NSW Journal, (21), pp.84–85.

Lee, Y., 2017. Australian Practice in International Law 2016. Australian Yearbook of

International Law, 35, pp.373–508.

Minas, John, Lim, Youngdeok and Evans, Chris, 2018. The impact of tax rate changes on

capital gains realisations: Evidence from Australia. Australian Tax Forum, 33(4), pp.635–

666.

Sadiq, K. and Marsden, S., 2014. The small business CGT concessions: evidence from the

perspective of the tax practitioner. Revenue Law Journal, 24, pp.1–21.

References:

Anderson, C., Dickfos, J. and Brown, C., 2016. The Australian Taxation Office - what role

does it play in anti-phoenix activity? Insolvency Law Journal, 24(2), pp.127–140.

Bell, C.D., 2016. Taxation. University of Richmond Law Review, 51(1), pp.103–123.

Friend, R, 2015. The CGT small business concessions: issues, anomalies and opportunities.

(capital gains tax) (Australia). Australian Tax Review, 40(2), pp.108–137.

Jogarajan, S., 2016. Regulating the regulator: assessing the effectiveness of the ATO's

external scrutiny arrangements. Journal of Australian Taxation, 18(1), pp.23–41.

Kaza, G., 2015. Many pay state capital gains tax. Arkansas Business, 32(19), p.31.

Kenny, P., 2015. LexisNexis concise tax legislation 2016,

Kenny, P., Blissenden, M. and Villios, S., 2016. Australian tax 2016,

Khoury, D, 2014. Widening the availability of deductions under Australian taxation law. Tax

Specialist, 14(4), pp.207–211.

Lam, D and Whitney, 2016. Taxation and property: Practical aspects of the new foreign

resident CGT witholding tax. LSJ: Law Society of NSW Journal, (21), pp.84–85.

Lee, Y., 2017. Australian Practice in International Law 2016. Australian Yearbook of

International Law, 35, pp.373–508.

Minas, John, Lim, Youngdeok and Evans, Chris, 2018. The impact of tax rate changes on

capital gains realisations: Evidence from Australia. Australian Tax Forum, 33(4), pp.635–

666.

Sadiq, K. and Marsden, S., 2014. The small business CGT concessions: evidence from the

perspective of the tax practitioner. Revenue Law Journal, 24, pp.1–21.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.