Tech UK Limited: Management Accounting, Costing, Budgeting Report

VerifiedAdded on 2024/05/31

|18

|3386

|339

Report

AI Summary

This management accounting report delves into various aspects of financial management within Tech (UK) Limited, a mobile charger and gadget retailer. It covers the functions of management accounting systems, including inventory and cost accounting, differentiating it from financial accounting. The report highlights the importance of management accounting as a decision-making tool, exploring cost accounting systems (actual, normal, and standard), inventory management systems (FIFO, LIFO, Average), and job costing systems. It also presents different types of managerial accounting reports and emphasizes the importance of accurate financial information presentation. Furthermore, the report discusses absorption and marginal costing methods, comparing their impact. Finally, it examines different kinds of budgets (master, financial, cash flow, static), along with their advantages and disadvantages, and outlines the budget preparation process, including pricing and costing considerations, providing a comprehensive overview of management accounting practices.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction:..........................................................................................................................................2

Task 1: (Report).....................................................................................................................................3

Task 2:...................................................................................................................................................6

Task 3...................................................................................................................................................10

Conclusion...........................................................................................................................................16

References...........................................................................................................................................17

Introduction:..........................................................................................................................................2

Task 1: (Report).....................................................................................................................................3

Task 2:...................................................................................................................................................6

Task 3...................................................................................................................................................10

Conclusion...........................................................................................................................................16

References...........................................................................................................................................17

Introduction:

Being the manager of the company, Tech (UK) Limited, who is the producer and the retailer

of the mobile charger telephone and the other gadgets also, the manager has to maintain the

accounting for the proper functioning of the company. For proper management accounting,

financial report has to be prepared. Due to the lack of financial information in the company

cost accounting system, inventory system, job costing system, etc. and many other

accounting methods have been taken into consideration. The company also uses the

absorption and marginal costing methods for proper decision making. The company has also

make different budgets to forecast the future. The auditor of the company has also compared

the accounting approaches with other companies to examine their financial position.

Being the manager of the company, Tech (UK) Limited, who is the producer and the retailer

of the mobile charger telephone and the other gadgets also, the manager has to maintain the

accounting for the proper functioning of the company. For proper management accounting,

financial report has to be prepared. Due to the lack of financial information in the company

cost accounting system, inventory system, job costing system, etc. and many other

accounting methods have been taken into consideration. The company also uses the

absorption and marginal costing methods for proper decision making. The company has also

make different budgets to forecast the future. The auditor of the company has also compared

the accounting approaches with other companies to examine their financial position.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Task 1: (Report)

Introduction:

The report consists of functions of management accounting systems. It includes the

inventory management system, cost accounting system. Difference between financial and

management accounting. Management accounting a tool for decision making. This report

highlights the facts of management tools and techniques.

a) Explanation of management accounting and the essential requirements of management

accounting system which entails:

I. Distinguishing Management Accounting from Financial Accounting.

Management Accounting: It is a managerial task performed by the top level managers which

involves a process of Identifying, Measuring, Analyzing, Interpreting and communicating

information of the organization. This helps the managers in decision making which able the

company of achieve competitive edge. Examples are product costing, research and

development.

Financial accounting: It must be done with the various accounting standards techniques. It

focuses on doing everything with financial aspects of the firm such as preparing financial

statements, financial report, cash flow, balance sheet. It focuses on external matters. It is

doing everything in financial aspects.

II. The importance of management accounting information as a decision making tool for

department managers.

Management Accounting is a tool which guides to decision making. As it includes the use of

financial information which is an interpersonal tool of decision making. Decision making is

what deciding in the matters of operational and financial and scientific basis, so

Management Accounting guides to that by the management techniques such that risk

management, ABC model approach and financial reports, cash flow analysis, absorption and

marginal costing.

Through advance preparation of plans and actions it helps the managers to guide to decision

making. Managers already know where, when and why of the business so it becomes easy to

guide them in decision.

iii) Cost accounting systems (actual, normal and standard costing)

Also called as costing system used by firms to know the cost of the product for the stock

valuation and profitability analysis. Estimated cost is monitored by the actual cost. This is a

helpful tool as it makes know that how much inventory in each stage of production what is

its cost and how much our cost of production is. It allows to record keeping of the inventory

at each level of production.

Introduction:

The report consists of functions of management accounting systems. It includes the

inventory management system, cost accounting system. Difference between financial and

management accounting. Management accounting a tool for decision making. This report

highlights the facts of management tools and techniques.

a) Explanation of management accounting and the essential requirements of management

accounting system which entails:

I. Distinguishing Management Accounting from Financial Accounting.

Management Accounting: It is a managerial task performed by the top level managers which

involves a process of Identifying, Measuring, Analyzing, Interpreting and communicating

information of the organization. This helps the managers in decision making which able the

company of achieve competitive edge. Examples are product costing, research and

development.

Financial accounting: It must be done with the various accounting standards techniques. It

focuses on doing everything with financial aspects of the firm such as preparing financial

statements, financial report, cash flow, balance sheet. It focuses on external matters. It is

doing everything in financial aspects.

II. The importance of management accounting information as a decision making tool for

department managers.

Management Accounting is a tool which guides to decision making. As it includes the use of

financial information which is an interpersonal tool of decision making. Decision making is

what deciding in the matters of operational and financial and scientific basis, so

Management Accounting guides to that by the management techniques such that risk

management, ABC model approach and financial reports, cash flow analysis, absorption and

marginal costing.

Through advance preparation of plans and actions it helps the managers to guide to decision

making. Managers already know where, when and why of the business so it becomes easy to

guide them in decision.

iii) Cost accounting systems (actual, normal and standard costing)

Also called as costing system used by firms to know the cost of the product for the stock

valuation and profitability analysis. Estimated cost is monitored by the actual cost. This is a

helpful tool as it makes know that how much inventory in each stage of production what is

its cost and how much our cost of production is. It allows to record keeping of the inventory

at each level of production.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Normal costing: used to measure manufactured products.

Actual costing: it involves recording of product cost.

Standard costing: it involves substitution of estimated and actual cost.

IV. Inventory management systems

This system helps in managing the inventory from factory place till the goods are delivered

to the distribution place to the customers. In short its the whole management of inventory at

it each stage of product. It includes keeping a month to month record of inventory. This can

be done by using a ERP system.

Valuation of inventory can be done by methods:

FIFO: “first in first out” means goods added first to the inventory are assumed to be the first

goods. It means the oldest goods are meant to be sold at first and new goods at last.

LIFO: “last in, First out” means goods added last in the category are assumed to be the first

goods. New goods are sold first in place of oldest one.

Average: Its a rarely used method with less accuracy.

Formula; Average cost=(Total quantity of inventory units)/( Total quantity of units).

V. Job costing systems

Job costing or the job order costing is the method of assigning a manufacturing cost to each

product manufactured in a company, this method is used by a company when the companies

product is slightly different from each other.

Job costing method uses some information for its use like:

1. Direct materials: this includes all the materials like raw materials, machines, fuel,

electricity, direct cost of the product and all the direct materials used within the factory.

2. Direct Labour: it includes the labour which includes the wages to the labours. They all are

shown in trading account.

3. Overheads: it includes the depreciation on assets such as fixed assets building, machinery,

furniture it is a part of the overhead cost.

b) Presenting financial information.

I. Different types of managerial accounting reports

Managerial accounting reports are the guide to quantitatively performance of the business

which is based on financial statement, final reports. It is consist of measuring and analysing

the financial performance of the business.

Actual costing: it involves recording of product cost.

Standard costing: it involves substitution of estimated and actual cost.

IV. Inventory management systems

This system helps in managing the inventory from factory place till the goods are delivered

to the distribution place to the customers. In short its the whole management of inventory at

it each stage of product. It includes keeping a month to month record of inventory. This can

be done by using a ERP system.

Valuation of inventory can be done by methods:

FIFO: “first in first out” means goods added first to the inventory are assumed to be the first

goods. It means the oldest goods are meant to be sold at first and new goods at last.

LIFO: “last in, First out” means goods added last in the category are assumed to be the first

goods. New goods are sold first in place of oldest one.

Average: Its a rarely used method with less accuracy.

Formula; Average cost=(Total quantity of inventory units)/( Total quantity of units).

V. Job costing systems

Job costing or the job order costing is the method of assigning a manufacturing cost to each

product manufactured in a company, this method is used by a company when the companies

product is slightly different from each other.

Job costing method uses some information for its use like:

1. Direct materials: this includes all the materials like raw materials, machines, fuel,

electricity, direct cost of the product and all the direct materials used within the factory.

2. Direct Labour: it includes the labour which includes the wages to the labours. They all are

shown in trading account.

3. Overheads: it includes the depreciation on assets such as fixed assets building, machinery,

furniture it is a part of the overhead cost.

b) Presenting financial information.

I. Different types of managerial accounting reports

Managerial accounting reports are the guide to quantitatively performance of the business

which is based on financial statement, final reports. It is consist of measuring and analysing

the financial performance of the business.

It includes managerial accounting reports like:

1. Financial Reports: it consists of making of profit and loss statement, balance sheet and

making financial statements which provides us the information for our net profit/net loss of

the company.

2. Pro Forma Cash Flow: It shows the cash inflow and outflow of the business. It gives a

month to month summary of inflow and outflow of cash from the business operations.

3. Sales reports: Is the successful tool as it shows the profits on sale and let us know the

revenue generation in terms of the company expenses. it also highlight which part of

company is generating more sales.

4. Item cost reports: it helps us to make you more accurate knowing of your expenditures in

terms of direct labour, material and overheads expenses. After knowing that you can came to

the conclusion that if these expenses have invested in some other activity how much your

company can earn.

ii) Why it is important for the information to be presented in manner that must be

Financial information are the final records of the business organisation, it is presented

accurately because they reveal the true value of company. Goodwill of company depends on

net worth, so it should be shown correctly to the public. As well as the public are the

investors so they need accuracy in financial terms. Financial statements, balance sheet, profit

&loss do reveal company true position.

Conclusion:

The basic functions of the management accounting that are involved in this report teach us

that these functions are helpful in decision making, cost allocating. Inventory system method

helps us in managing inventory. It is considered every company should reveal the true

financial information as because it depicts the true value of company.

1. Financial Reports: it consists of making of profit and loss statement, balance sheet and

making financial statements which provides us the information for our net profit/net loss of

the company.

2. Pro Forma Cash Flow: It shows the cash inflow and outflow of the business. It gives a

month to month summary of inflow and outflow of cash from the business operations.

3. Sales reports: Is the successful tool as it shows the profits on sale and let us know the

revenue generation in terms of the company expenses. it also highlight which part of

company is generating more sales.

4. Item cost reports: it helps us to make you more accurate knowing of your expenditures in

terms of direct labour, material and overheads expenses. After knowing that you can came to

the conclusion that if these expenses have invested in some other activity how much your

company can earn.

ii) Why it is important for the information to be presented in manner that must be

Financial information are the final records of the business organisation, it is presented

accurately because they reveal the true value of company. Goodwill of company depends on

net worth, so it should be shown correctly to the public. As well as the public are the

investors so they need accuracy in financial terms. Financial statements, balance sheet, profit

&loss do reveal company true position.

Conclusion:

The basic functions of the management accounting that are involved in this report teach us

that these functions are helpful in decision making, cost allocating. Inventory system method

helps us in managing inventory. It is considered every company should reveal the true

financial information as because it depicts the true value of company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

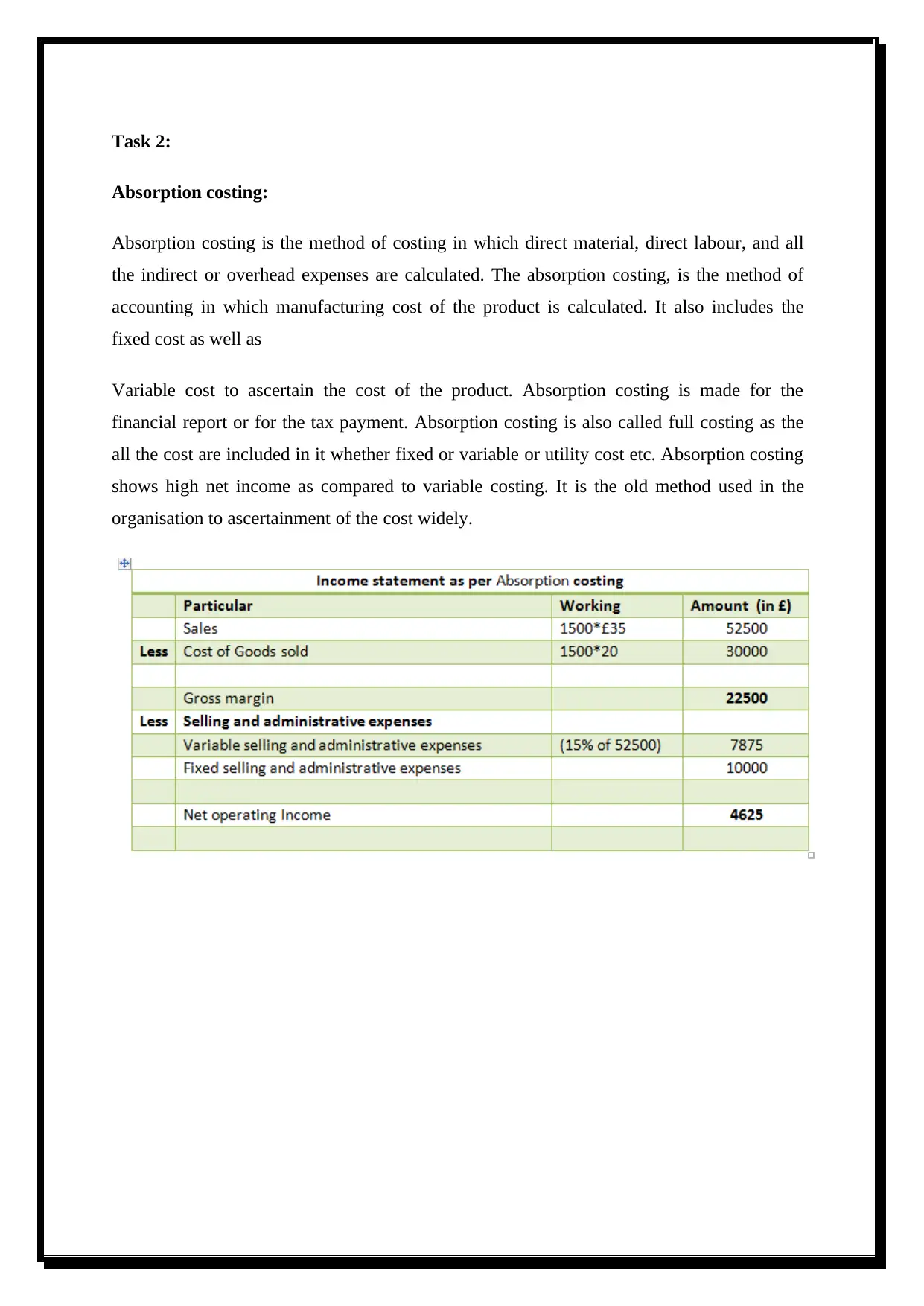

Task 2:

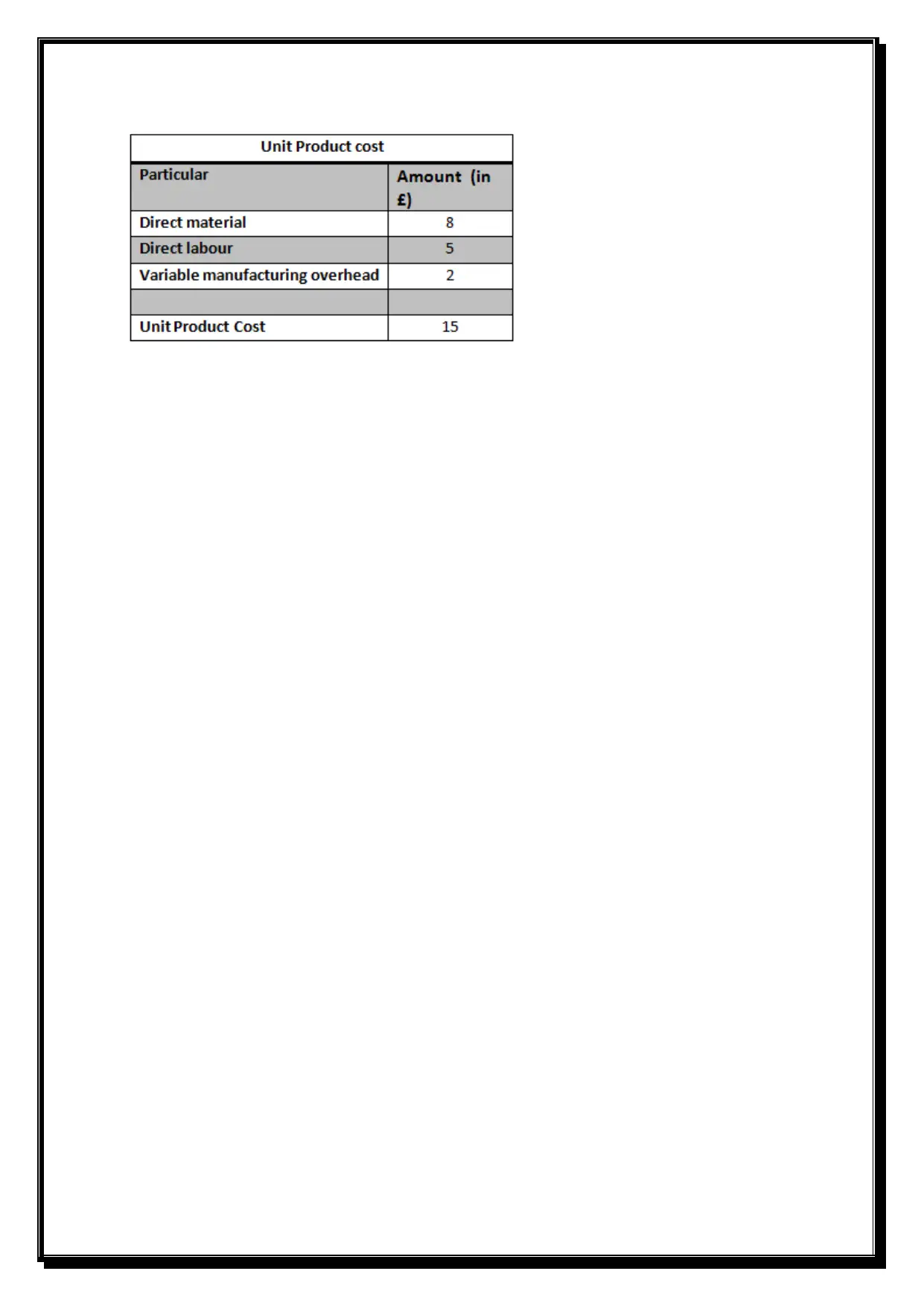

Absorption costing:

Absorption costing is the method of costing in which direct material, direct labour, and all

the indirect or overhead expenses are calculated. The absorption costing, is the method of

accounting in which manufacturing cost of the product is calculated. It also includes the

fixed cost as well as

Variable cost to ascertain the cost of the product. Absorption costing is made for the

financial report or for the tax payment. Absorption costing is also called full costing as the

all the cost are included in it whether fixed or variable or utility cost etc. Absorption costing

shows high net income as compared to variable costing. It is the old method used in the

organisation to ascertainment of the cost widely.

Absorption costing:

Absorption costing is the method of costing in which direct material, direct labour, and all

the indirect or overhead expenses are calculated. The absorption costing, is the method of

accounting in which manufacturing cost of the product is calculated. It also includes the

fixed cost as well as

Variable cost to ascertain the cost of the product. Absorption costing is made for the

financial report or for the tax payment. Absorption costing is also called full costing as the

all the cost are included in it whether fixed or variable or utility cost etc. Absorption costing

shows high net income as compared to variable costing. It is the old method used in the

organisation to ascertainment of the cost widely.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

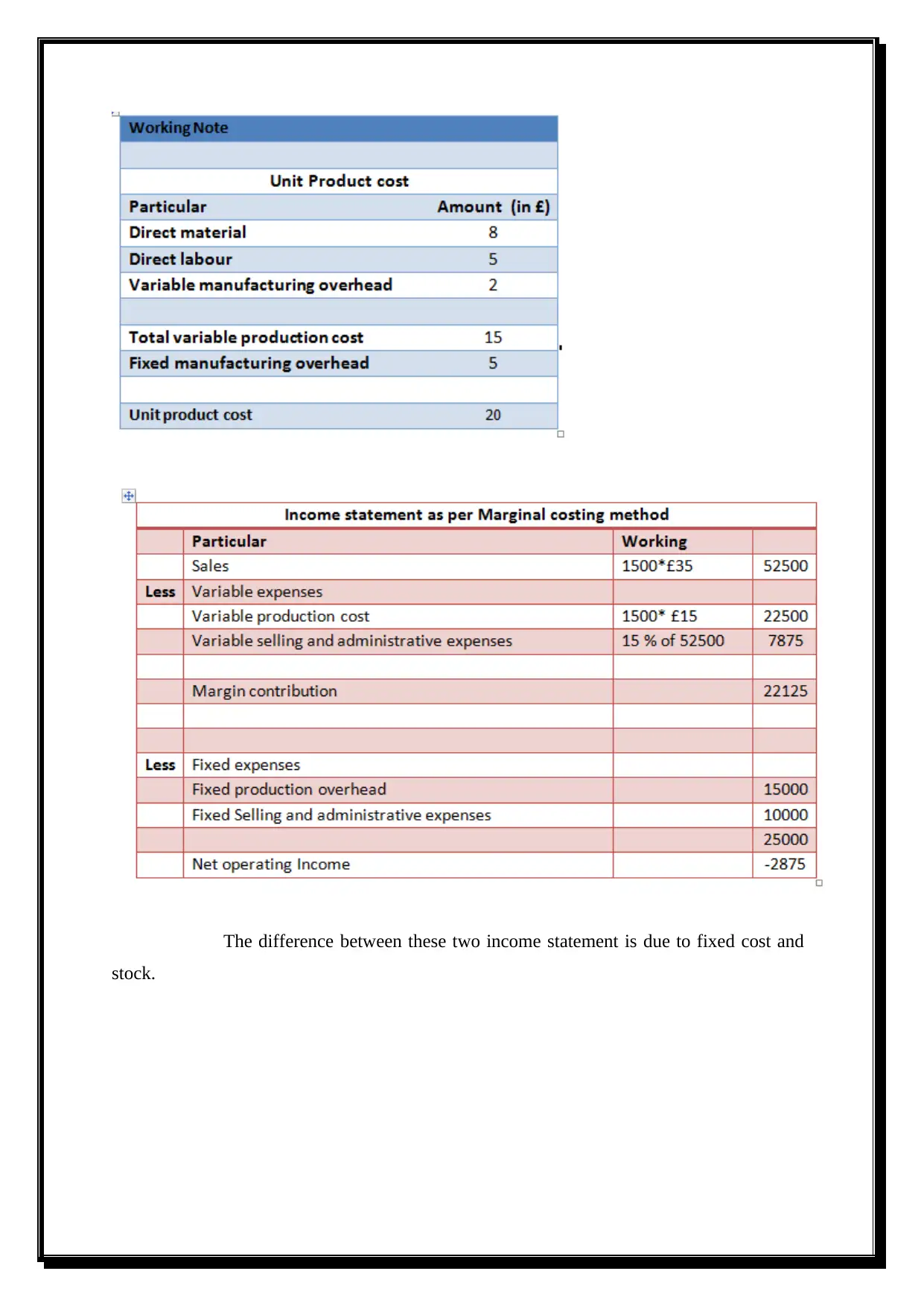

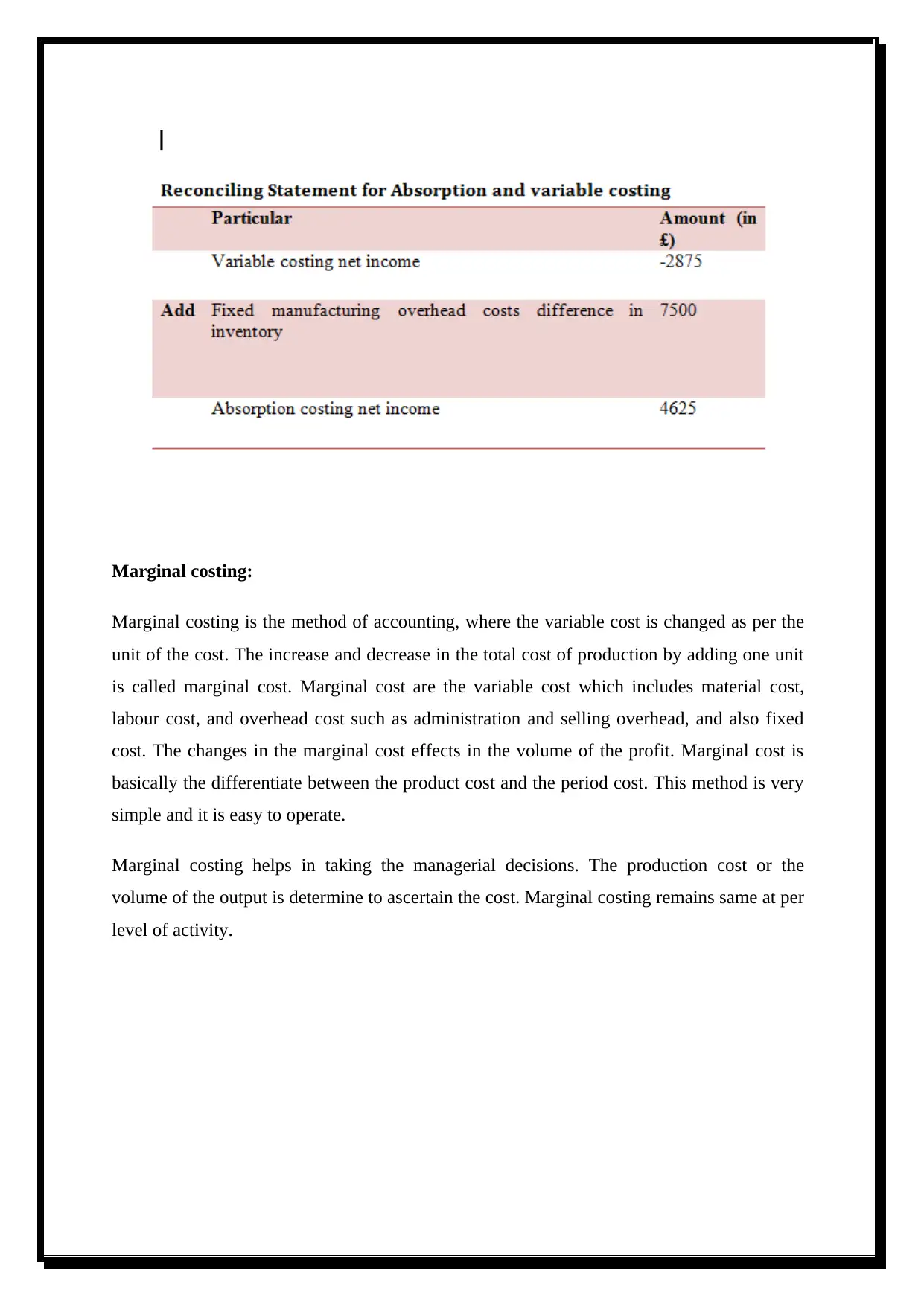

The difference between these two income statement is due to fixed cost and

stock.

stock.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Marginal costing:

Marginal costing is the method of accounting, where the variable cost is changed as per the

unit of the cost. The increase and decrease in the total cost of production by adding one unit

is called marginal cost. Marginal cost are the variable cost which includes material cost,

labour cost, and overhead cost such as administration and selling overhead, and also fixed

cost. The changes in the marginal cost effects in the volume of the profit. Marginal cost is

basically the differentiate between the product cost and the period cost. This method is very

simple and it is easy to operate.

Marginal costing helps in taking the managerial decisions. The production cost or the

volume of the output is determine to ascertain the cost. Marginal costing remains same at per

level of activity.

Marginal costing is the method of accounting, where the variable cost is changed as per the

unit of the cost. The increase and decrease in the total cost of production by adding one unit

is called marginal cost. Marginal cost are the variable cost which includes material cost,

labour cost, and overhead cost such as administration and selling overhead, and also fixed

cost. The changes in the marginal cost effects in the volume of the profit. Marginal cost is

basically the differentiate between the product cost and the period cost. This method is very

simple and it is easy to operate.

Marginal costing helps in taking the managerial decisions. The production cost or the

volume of the output is determine to ascertain the cost. Marginal costing remains same at per

level of activity.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

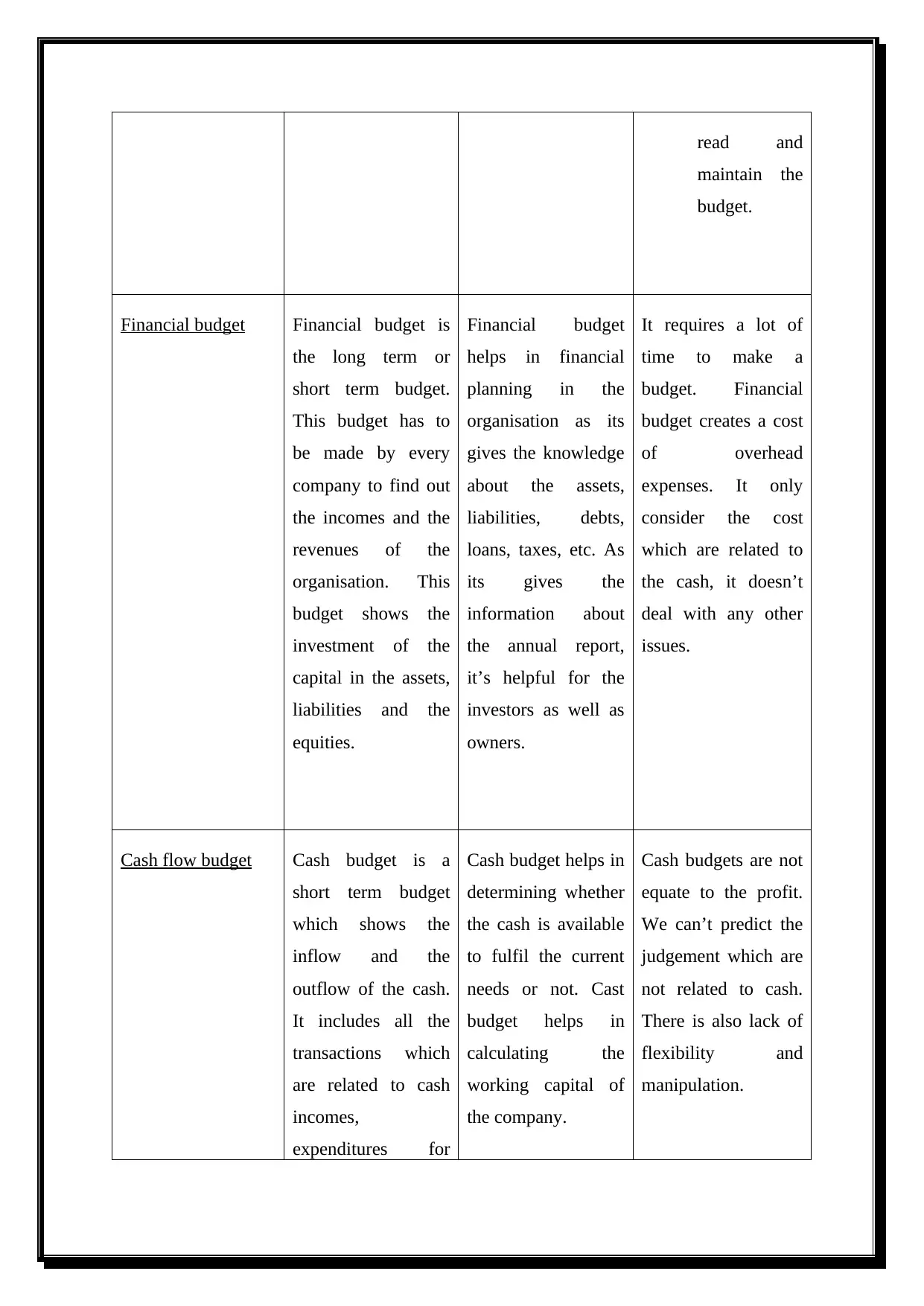

Task 3: (Report)

Executive summary:

Tech (UK) limited, is the company who is the producer and the retailer of the mobile phone

charger and also manufacture the other gadgets in the UK. As the manager of the company,

some reports on budget are prepared and along with their advantages and disadvantages, the

process of the budget, and the importance as the planning and the controlling.

Introduction:

The UK Company, Tech limited, is the retailer and the manufacturer in the UK of the some

gadgets. Being a manager, few reports on the different budgets are prepared. A budget is the

estimate of the future forecast that how much money we have to spend or how much money

we need in the business. Budget helps in showing the financial position of the company.

Different kinds of budget have to be prepared such as financial budget, cash flow budget,

master budget, etc. Budget helps in planning about the future and budgetary controlling

helps in attaining the actual performance.

a) Different kinds of budgets and their advantages and disadvantages:

Budget Define Advantages Disadvantages

Master budget – Master budget is the

short term budget

made by a company

to find out the

functional budget of

the company. This

budget includes

production cost,

overhead expenses,

income, etc.

Master budget is the

overall budget of the

company. The

master budget shows

the Incomes and

expenses of the

company occurred in

monthly, quarterly

or yearly.

There is lack

of specificity

in the budget.

The amount

shows in the

budget is the

total sum of

the different

departments.

It is also

difficult to

Executive summary:

Tech (UK) limited, is the company who is the producer and the retailer of the mobile phone

charger and also manufacture the other gadgets in the UK. As the manager of the company,

some reports on budget are prepared and along with their advantages and disadvantages, the

process of the budget, and the importance as the planning and the controlling.

Introduction:

The UK Company, Tech limited, is the retailer and the manufacturer in the UK of the some

gadgets. Being a manager, few reports on the different budgets are prepared. A budget is the

estimate of the future forecast that how much money we have to spend or how much money

we need in the business. Budget helps in showing the financial position of the company.

Different kinds of budget have to be prepared such as financial budget, cash flow budget,

master budget, etc. Budget helps in planning about the future and budgetary controlling

helps in attaining the actual performance.

a) Different kinds of budgets and their advantages and disadvantages:

Budget Define Advantages Disadvantages

Master budget – Master budget is the

short term budget

made by a company

to find out the

functional budget of

the company. This

budget includes

production cost,

overhead expenses,

income, etc.

Master budget is the

overall budget of the

company. The

master budget shows

the Incomes and

expenses of the

company occurred in

monthly, quarterly

or yearly.

There is lack

of specificity

in the budget.

The amount

shows in the

budget is the

total sum of

the different

departments.

It is also

difficult to

read and

maintain the

budget.

Financial budget Financial budget is

the long term or

short term budget.

This budget has to

be made by every

company to find out

the incomes and the

revenues of the

organisation. This

budget shows the

investment of the

capital in the assets,

liabilities and the

equities.

Financial budget

helps in financial

planning in the

organisation as its

gives the knowledge

about the assets,

liabilities, debts,

loans, taxes, etc. As

its gives the

information about

the annual report,

it’s helpful for the

investors as well as

owners.

It requires a lot of

time to make a

budget. Financial

budget creates a cost

of overhead

expenses. It only

consider the cost

which are related to

the cash, it doesn’t

deal with any other

issues.

Cash flow budget Cash budget is a

short term budget

which shows the

inflow and the

outflow of the cash.

It includes all the

transactions which

are related to cash

incomes,

expenditures for

Cash budget helps in

determining whether

the cash is available

to fulfil the current

needs or not. Cast

budget helps in

calculating the

working capital of

the company.

Cash budgets are not

equate to the profit.

We can’t predict the

judgement which are

not related to cash.

There is also lack of

flexibility and

manipulation.

maintain the

budget.

Financial budget Financial budget is

the long term or

short term budget.

This budget has to

be made by every

company to find out

the incomes and the

revenues of the

organisation. This

budget shows the

investment of the

capital in the assets,

liabilities and the

equities.

Financial budget

helps in financial

planning in the

organisation as its

gives the knowledge

about the assets,

liabilities, debts,

loans, taxes, etc. As

its gives the

information about

the annual report,

it’s helpful for the

investors as well as

owners.

It requires a lot of

time to make a

budget. Financial

budget creates a cost

of overhead

expenses. It only

consider the cost

which are related to

the cash, it doesn’t

deal with any other

issues.

Cash flow budget Cash budget is a

short term budget

which shows the

inflow and the

outflow of the cash.

It includes all the

transactions which

are related to cash

incomes,

expenditures for

Cash budget helps in

determining whether

the cash is available

to fulfil the current

needs or not. Cast

budget helps in

calculating the

working capital of

the company.

Cash budgets are not

equate to the profit.

We can’t predict the

judgement which are

not related to cash.

There is also lack of

flexibility and

manipulation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.