Technological Disruption Issues and Impact on UK Banking: HSBC Study

VerifiedAdded on 2020/06/04

|16

|4415

|110

Report

AI Summary

This report presents a business proposal investigating the impact of technological disruption on the UK banking sector, with a specific focus on HSBC Bank. The study explores the significance of digitalization, the increasing prevalence of technological disruptions, and the impact of IT failures on online banking, market reputation, and consumer satisfaction. The research methodology includes a case study approach, examining the reasons behind technological disruptions and their effects on HSBC's performance. The report includes relevant literature on digitalization in the UK banking sector, technological disruptions, and their consequences. The research aims to determine the impact of technological disruptions on HSBC's performance and suggest preventive measures to minimize technical failures and improve the bank's operations. The study's significance lies in its potential to assist HSBC and other commercial banks in addressing technical failure issues, improving operational efficiency, and enhancing consumer satisfaction. The report also includes research questions, objectives, and a project plan with a timeline.

Business Proposal

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

Background of the study.........................................................................................................1

Overview of organization.......................................................................................................2

Rationale/Problem statement..................................................................................................2

Conceptual framework...........................................................................................................3

Research aims and objectives.................................................................................................3

Research questions.................................................................................................................3

Significance of the study........................................................................................................3

RELEVANT LITERATURE...........................................................................................................4

1. Significance of digitalization in UK banking sector..........................................................4

2. Increasing prevalence of technological disruption in banking sector................................5

3. Impact of technological failure on online banking, market rputation and consumer

satisfaction..............................................................................................................................7

RESEARCH METHODOLOGY...................................................................................................10

Research philosophy.............................................................................................................10

Research approach................................................................................................................10

Research design....................................................................................................................10

Research method..................................................................................................................10

Data collections....................................................................................................................10

Sampling method..................................................................................................................11

Sample size...........................................................................................................................11

Data analysis.........................................................................................................................11

Reliability & Validity...........................................................................................................11

Ethical issues........................................................................................................................12

Limitation.............................................................................................................................12

Project plan and timescale....................................................................................................12

REFERENCES..............................................................................................................................13

1

INTRODUCTION...........................................................................................................................1

Background of the study.........................................................................................................1

Overview of organization.......................................................................................................2

Rationale/Problem statement..................................................................................................2

Conceptual framework...........................................................................................................3

Research aims and objectives.................................................................................................3

Research questions.................................................................................................................3

Significance of the study........................................................................................................3

RELEVANT LITERATURE...........................................................................................................4

1. Significance of digitalization in UK banking sector..........................................................4

2. Increasing prevalence of technological disruption in banking sector................................5

3. Impact of technological failure on online banking, market rputation and consumer

satisfaction..............................................................................................................................7

RESEARCH METHODOLOGY...................................................................................................10

Research philosophy.............................................................................................................10

Research approach................................................................................................................10

Research design....................................................................................................................10

Research method..................................................................................................................10

Data collections....................................................................................................................10

Sampling method..................................................................................................................11

Sample size...........................................................................................................................11

Data analysis.........................................................................................................................11

Reliability & Validity...........................................................................................................11

Ethical issues........................................................................................................................12

Limitation.............................................................................................................................12

Project plan and timescale....................................................................................................12

REFERENCES..............................................................................................................................13

1

Title: To investigate technological disruption issues and its impact on UK Banking sector: A

case study of HSBC Bank

INTRODUCTION

Background of the study

UK banking sector is extremely devoted to hold others financial assets and savings and

investment it in other growth opportunities so as to create more wealth. According to TheCityUK

report for 2016, financial sector is a main key driver of economy which accounted for 12% of the

total economic output. In 2015/16, banking sector contributed worth 24.4 GBP billion to the

economy. Despite a considerable contribution, industry is experiencing number of issues such as

digital transformation, regulatory change, liquidity issues, fierce competition and many others. In

the current time, technology downtime is a major difficulty faced by UK banks. As per Reenan,

(2017), on an average, banks lose more than 20 minutes productivity on each worker due to

faulty IT. Poor IT system and facilities have a considerable impact on the workforce

productivity. Bringing attention to such matter, the report mentioned that failure of IT could

result in cost of 35GBP bn per year. In such regards, IT users employed in the factor experiences

problems due to slow functioning of system, slow internet connectivity, outdated software, poor

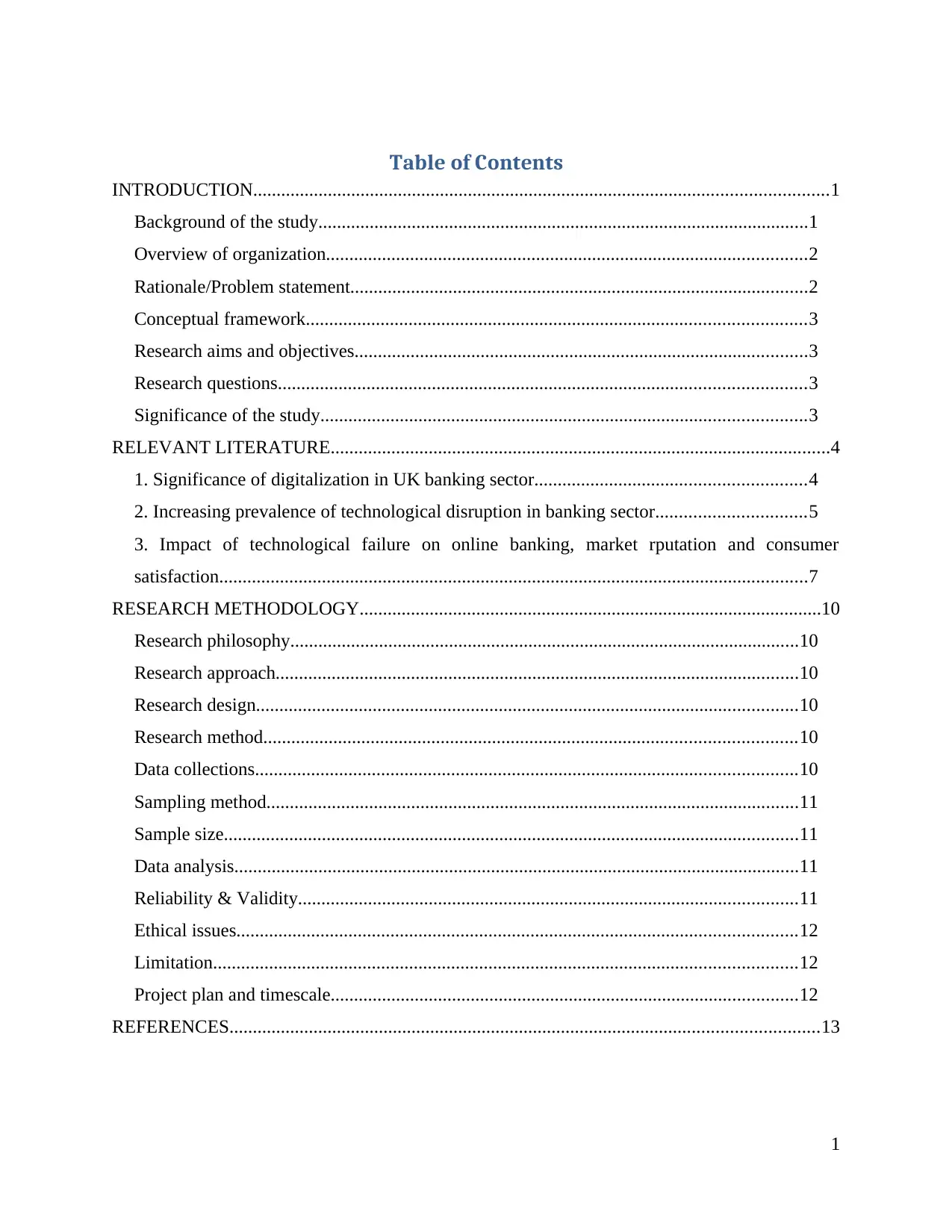

equipment and many others. However, in today’s digitalized age, consumers prefer online

banking because of lack of time availability due to busy life.

(Source: The Biggest Challenges Facing Banks, 2017)

1

case study of HSBC Bank

INTRODUCTION

Background of the study

UK banking sector is extremely devoted to hold others financial assets and savings and

investment it in other growth opportunities so as to create more wealth. According to TheCityUK

report for 2016, financial sector is a main key driver of economy which accounted for 12% of the

total economic output. In 2015/16, banking sector contributed worth 24.4 GBP billion to the

economy. Despite a considerable contribution, industry is experiencing number of issues such as

digital transformation, regulatory change, liquidity issues, fierce competition and many others. In

the current time, technology downtime is a major difficulty faced by UK banks. As per Reenan,

(2017), on an average, banks lose more than 20 minutes productivity on each worker due to

faulty IT. Poor IT system and facilities have a considerable impact on the workforce

productivity. Bringing attention to such matter, the report mentioned that failure of IT could

result in cost of 35GBP bn per year. In such regards, IT users employed in the factor experiences

problems due to slow functioning of system, slow internet connectivity, outdated software, poor

equipment and many others. However, in today’s digitalized age, consumers prefer online

banking because of lack of time availability due to busy life.

(Source: The Biggest Challenges Facing Banks, 2017)

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In a survey, it is found that 58% (see above) service users prefer digitalization wherein

they can get their account details easily on net, provide advices them on wealth creation and

others (The Biggest Challenges Facing Banks, 2017). It is therefore, technological disruption can

be considered as a key concern faced by UK banking sector which resultant productivity crisis

for UK banks. It had a drastic impact on the workers productivity, consumer satisfaction,

operational functionality and bank’s reputation (Locke, 2017). Recently, in G7 and G20, country

is ranked at 7th and 17th position on the basis of per employee productivity. More importantly,

bank’s online banking operations suffer a lot due to technical errors and disruption which results

in excessive consumer complaints. Thus, the thrust of the paper is to investigate the reasons of

technological disruption issues and determines its impact on the HSBC bank’s performance.

Overview of organization

The present study is based on a case study; HSBC Holding Plc which is a UK based

multinational banking & financial service providing company which is headquartered in London.

It operates in both banking and financial service industry and listed on LSE under FTSE 100

Index. It operates in four segments, Investment Banking, Commercial Banking, Wealth

Management and Retail Banking and Global Private Banking. It is one of the largest bank of UK

which operates globally with having 3900 offices across world. The aim of HSBC Holding Plc is

to help people to fulfil their expectations and facilitate organization in fuelling growth. It is

serving 38 million consumers through its worldwide network in 67 countries.

Rationale/Problem statement

In current times, digital revolution and innovation is driving rapid change in the financial

sector. Now-a-days, banks are strongly committed towards digitalization which can be evident

with net banking, mCommerce, mobile banking, mobile apps and others. Such offering provides

consumers with a great level of security, flexibility and control to manage their transactions

effectively. However, recently, as per Tallis (2017), HSBC’s latest IT glitch affected million of

business and personal consumers who hold their bank account resultant in large number of

customer complaints. Although the issue is not new, because previously in 2015, HSBC suffered

technological breakdown issues, as a result, 275,000 payments had not made on time, still, no

research study has been undertaken which explore such matter. Thus, increasing prevalence of

technology downtime issues faced by HSBC Bank brought requirement to determine its reasons

and its possible impact on the bank performance.

2

they can get their account details easily on net, provide advices them on wealth creation and

others (The Biggest Challenges Facing Banks, 2017). It is therefore, technological disruption can

be considered as a key concern faced by UK banking sector which resultant productivity crisis

for UK banks. It had a drastic impact on the workers productivity, consumer satisfaction,

operational functionality and bank’s reputation (Locke, 2017). Recently, in G7 and G20, country

is ranked at 7th and 17th position on the basis of per employee productivity. More importantly,

bank’s online banking operations suffer a lot due to technical errors and disruption which results

in excessive consumer complaints. Thus, the thrust of the paper is to investigate the reasons of

technological disruption issues and determines its impact on the HSBC bank’s performance.

Overview of organization

The present study is based on a case study; HSBC Holding Plc which is a UK based

multinational banking & financial service providing company which is headquartered in London.

It operates in both banking and financial service industry and listed on LSE under FTSE 100

Index. It operates in four segments, Investment Banking, Commercial Banking, Wealth

Management and Retail Banking and Global Private Banking. It is one of the largest bank of UK

which operates globally with having 3900 offices across world. The aim of HSBC Holding Plc is

to help people to fulfil their expectations and facilitate organization in fuelling growth. It is

serving 38 million consumers through its worldwide network in 67 countries.

Rationale/Problem statement

In current times, digital revolution and innovation is driving rapid change in the financial

sector. Now-a-days, banks are strongly committed towards digitalization which can be evident

with net banking, mCommerce, mobile banking, mobile apps and others. Such offering provides

consumers with a great level of security, flexibility and control to manage their transactions

effectively. However, recently, as per Tallis (2017), HSBC’s latest IT glitch affected million of

business and personal consumers who hold their bank account resultant in large number of

customer complaints. Although the issue is not new, because previously in 2015, HSBC suffered

technological breakdown issues, as a result, 275,000 payments had not made on time, still, no

research study has been undertaken which explore such matter. Thus, increasing prevalence of

technology downtime issues faced by HSBC Bank brought requirement to determine its reasons

and its possible impact on the bank performance.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conceptual framework

Research aims and objectives

Aim: The research study targeted at investigating technological disruption issues and its possible

impact on UK banking sector. For this, a specific focus will be paid on one of the largest bank,

HSBC Holding Plc.

Objectives:

1. To determine the significance of digital transformation in banking sector

2. To find out reasons behind increasing prevalence of technological disruption faced by HSBC

Holding Plc

3. To assess how technological failure impact HSBC bank’s online banking operations, market

reputation and customer satisfaction

4. To suggest preventive measures to minimize technical failure problems and succeed growth

Research questions

1. Why digitalization is necessary for the banking sector of the UK economy?

2. What are the causes of technological issues experiencing by HSBC Holding Plc?

3. How IT failure impact online functioning, consumer satisfaction and market image?

4. What are the preventive actions that HSBC Bank must undertaken to minimize technical

issues?

Significance of the study

As, no study has been undertaken previously that explore such issues faced by banking

sector, therefore, it will facilitate all those researchers who may wish to conduct further in-depth

research in future. They can get benefit of this study as a secondary source which helps in

3

Technological

Failure in HSBC

Bank

Factors that causes

technical issues

Bank’s market

image

Consumer

satisfaction

Online banking

functionality

Research aims and objectives

Aim: The research study targeted at investigating technological disruption issues and its possible

impact on UK banking sector. For this, a specific focus will be paid on one of the largest bank,

HSBC Holding Plc.

Objectives:

1. To determine the significance of digital transformation in banking sector

2. To find out reasons behind increasing prevalence of technological disruption faced by HSBC

Holding Plc

3. To assess how technological failure impact HSBC bank’s online banking operations, market

reputation and customer satisfaction

4. To suggest preventive measures to minimize technical failure problems and succeed growth

Research questions

1. Why digitalization is necessary for the banking sector of the UK economy?

2. What are the causes of technological issues experiencing by HSBC Holding Plc?

3. How IT failure impact online functioning, consumer satisfaction and market image?

4. What are the preventive actions that HSBC Bank must undertaken to minimize technical

issues?

Significance of the study

As, no study has been undertaken previously that explore such issues faced by banking

sector, therefore, it will facilitate all those researchers who may wish to conduct further in-depth

research in future. They can get benefit of this study as a secondary source which helps in

3

Technological

Failure in HSBC

Bank

Factors that causes

technical issues

Bank’s market

image

Consumer

satisfaction

Online banking

functionality

developing theoretical foundation. Besides this, the investigation will also assist HSBC Holding

Plc and other commercial banks in examining their technical failure issues and take necessary

actions to control its occurrence and overcome operational hazards. As a result, they can run

their regular business activities and functions successfully.

RELEVANT LITERATURE

1. Significance of digitalization in UK banking sector

In today’s digitalized age, none of the sector remained unaffected with the technological

upgradation & advancement. According to Rousseau and Wachtel (2017), banks are

continuously thriving towards introducing digitalization of their operations and regular business

activities During past, banks starting using digitalized channel such as online servicing & online

sales of their products, presently, they introduced mCommerce, mobile payment, integrated

building and many others so as to provide better facilities to the consumers to make them happy.

Such growth has become really unimaginable as accessing internet has been supplemented

through mobile usage that provided more flexibility and convenience to the services users.

Considering UK, over a few years, UK mobile banking users has been grown at more than thrice

times with monthly rate of 8% in 2010 to 27% in 2014.

Likewise, Kessler and Buck (2017), stated that digitalization of banking services

provided ease of use, greater convenience & control to users. Just by internet login, they can

check their balances, transact and also get advices to maximize their wealth. Besides this, not

only the consumers but also banks benefited from the same as it reduces long queues on their

premises. Technological advancement helped banks to improve their consumer experiences

through transformation of back-office functions and architecture.

However, on the contrary note, Locke (2017), argued that in order to introduce

digitalization, financial institutions need to develop new skills in their administrators and data

managerial team so as to deal with large-scale data. In UK, although the uptake of mobile

banking reported steady growth, yet, despite such commendable growth, banks are still unable to

maximize true potential of such digitalized transactions. Particularly, the main challenge that

banks are facing is providing useful information to the users. In this area, retailers have made

significant change in their business operational model to provide bespoke offerings to client’s

4

Plc and other commercial banks in examining their technical failure issues and take necessary

actions to control its occurrence and overcome operational hazards. As a result, they can run

their regular business activities and functions successfully.

RELEVANT LITERATURE

1. Significance of digitalization in UK banking sector

In today’s digitalized age, none of the sector remained unaffected with the technological

upgradation & advancement. According to Rousseau and Wachtel (2017), banks are

continuously thriving towards introducing digitalization of their operations and regular business

activities During past, banks starting using digitalized channel such as online servicing & online

sales of their products, presently, they introduced mCommerce, mobile payment, integrated

building and many others so as to provide better facilities to the consumers to make them happy.

Such growth has become really unimaginable as accessing internet has been supplemented

through mobile usage that provided more flexibility and convenience to the services users.

Considering UK, over a few years, UK mobile banking users has been grown at more than thrice

times with monthly rate of 8% in 2010 to 27% in 2014.

Likewise, Kessler and Buck (2017), stated that digitalization of banking services

provided ease of use, greater convenience & control to users. Just by internet login, they can

check their balances, transact and also get advices to maximize their wealth. Besides this, not

only the consumers but also banks benefited from the same as it reduces long queues on their

premises. Technological advancement helped banks to improve their consumer experiences

through transformation of back-office functions and architecture.

However, on the contrary note, Locke (2017), argued that in order to introduce

digitalization, financial institutions need to develop new skills in their administrators and data

managerial team so as to deal with large-scale data. In UK, although the uptake of mobile

banking reported steady growth, yet, despite such commendable growth, banks are still unable to

maximize true potential of such digitalized transactions. Particularly, the main challenge that

banks are facing is providing useful information to the users. In this area, retailers have made

significant change in their business operational model to provide bespoke offerings to client’s

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

device. Banks are also need to introduce change in their existing operating model and thereby

provide better consumer experience.

Vieira and Sehgal (2018), opined that digital transformation in the finance sector helps

banks with the benefit of cost-cutting, rising top-line revenue and risk mitigation. Moreover, it

facilitates banks to establish closure connectivity with the consumers and optimize their

experience. However, Omarini (2017), contemplated that technological innovation incur

excessive cost and need skilled workforce, hence, unavailability of both brought significant

challenges. Although branch consolidation helps to reduce cost, for instance, automation of back

office processes, business process management, and document management removes paperwork

and labourers cost. Still, many banks do not present a clear link between digitalization and cost

saving. Despite this, arrival of FinTech is a threat for existing banks because these are quickly

adapting by the consumers.

2. Increasing prevalence of technological disruption in banking sector

As per the views of Skilton (2016), UK banking sector is experiencing technology

downtime issues. In such regards, technical failure, slow internet speed, connection error, use of

outdated software was discovered as a key reasons behind technological failure. In the opinion of

Bhalla (2014), many-times, banks personal portal do not function properly which bring service

issues for the users as they are not been able to log-in their account, check their balance, transfer

their deposits and other transactions.

5

provide better consumer experience.

Vieira and Sehgal (2018), opined that digital transformation in the finance sector helps

banks with the benefit of cost-cutting, rising top-line revenue and risk mitigation. Moreover, it

facilitates banks to establish closure connectivity with the consumers and optimize their

experience. However, Omarini (2017), contemplated that technological innovation incur

excessive cost and need skilled workforce, hence, unavailability of both brought significant

challenges. Although branch consolidation helps to reduce cost, for instance, automation of back

office processes, business process management, and document management removes paperwork

and labourers cost. Still, many banks do not present a clear link between digitalization and cost

saving. Despite this, arrival of FinTech is a threat for existing banks because these are quickly

adapting by the consumers.

2. Increasing prevalence of technological disruption in banking sector

As per the views of Skilton (2016), UK banking sector is experiencing technology

downtime issues. In such regards, technical failure, slow internet speed, connection error, use of

outdated software was discovered as a key reasons behind technological failure. In the opinion of

Bhalla (2014), many-times, banks personal portal do not function properly which bring service

issues for the users as they are not been able to log-in their account, check their balance, transfer

their deposits and other transactions.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

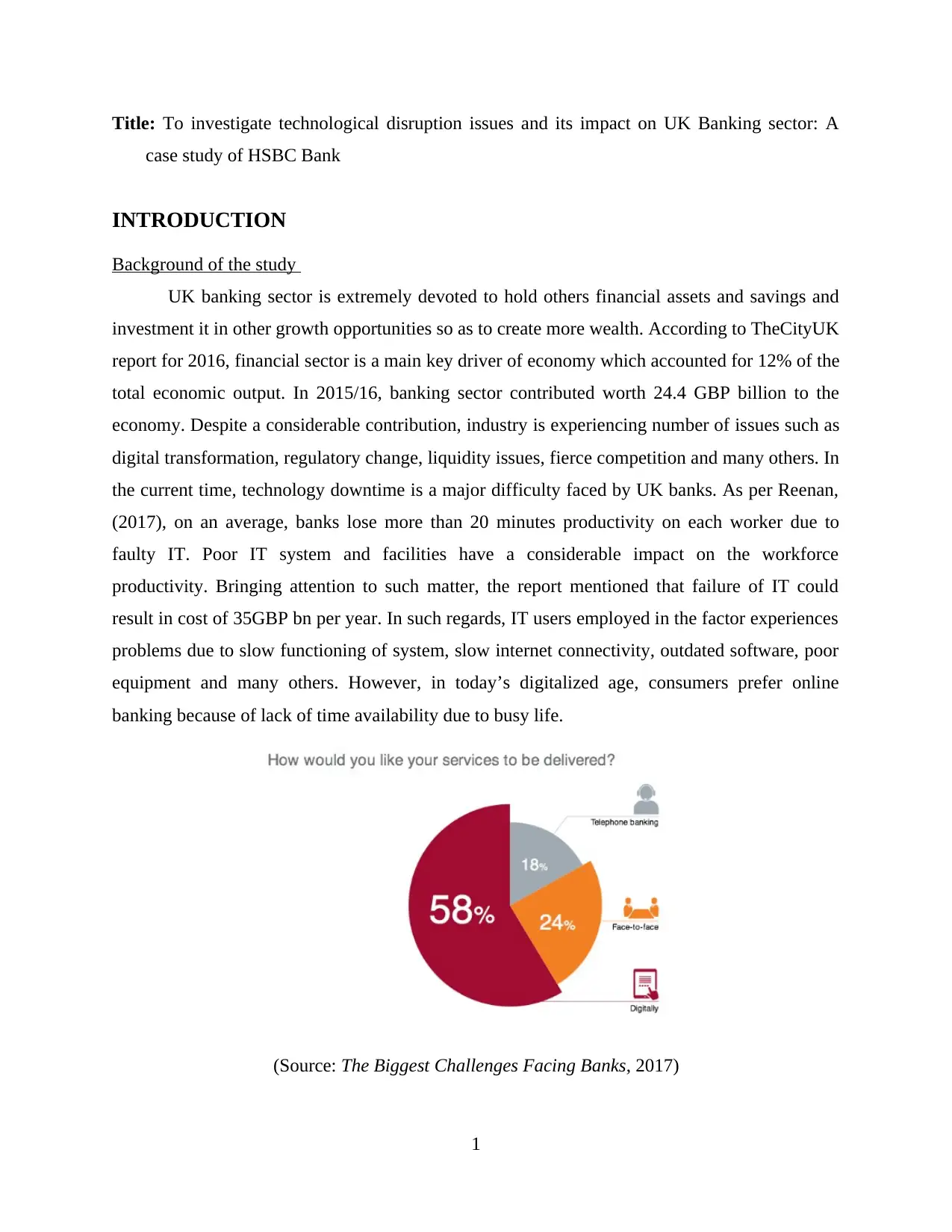

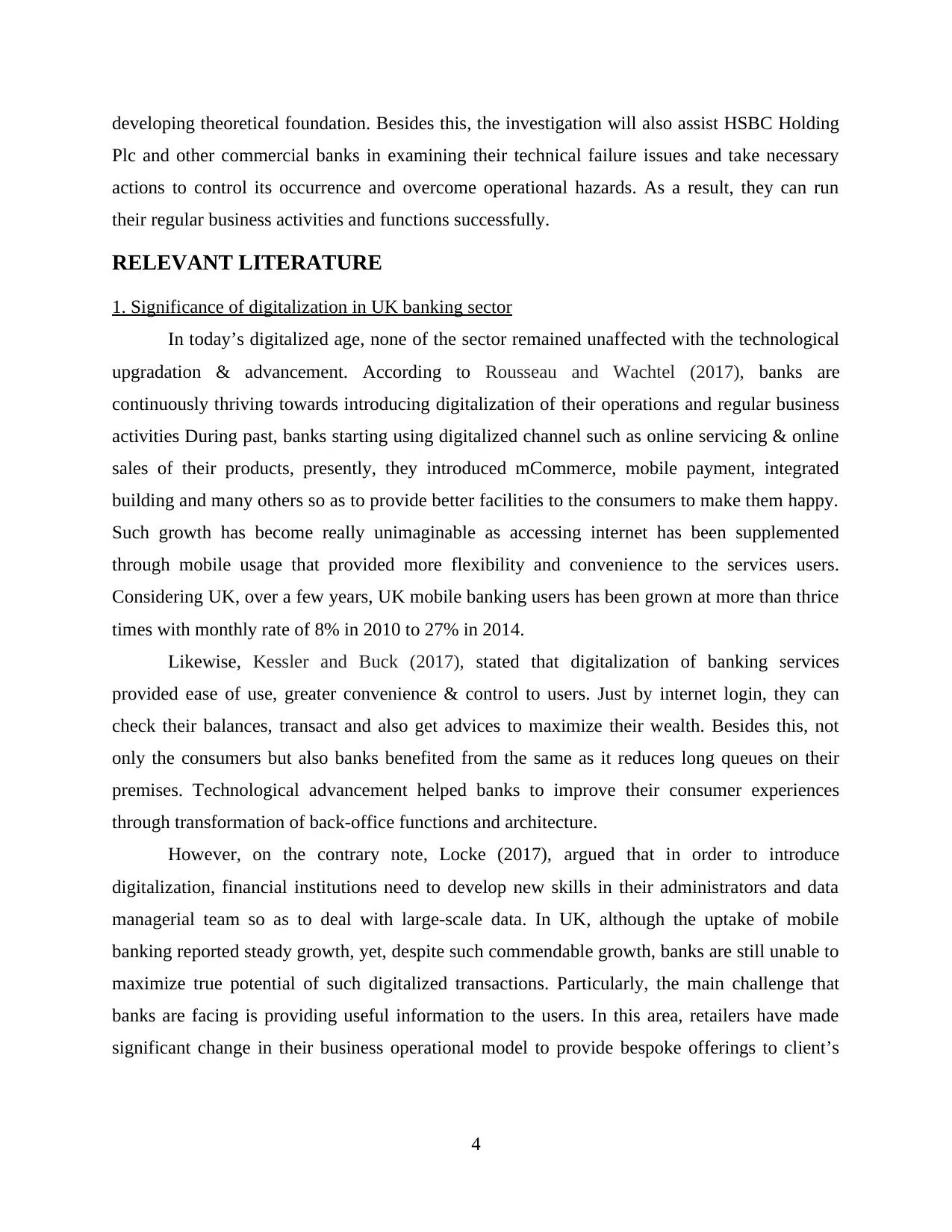

(Source: Bokhari, 2014)

Bokhari (2014), stated that cyber threats such as possibility of attack by hackers to steal

client’s confidential information is a risk faced by banks. A survey of BOE (Bank of England)

presented in the above column graph stated that cyber security threats in the banking sector is

continuously rising. Thus, technological changes are fuelling challenges and rising uncertainties

for the financial institutions which may result adverse outcome. Besides this, poor IT system and

support results in technological failure issues for the financial sector. Due to IT breakdown,

workers productivity also got declined. Evidencing it, in UK, average employee wasted around

22.60 minutes each day.

Outram (2016), found that sound technological management need skilled and talented

specialists. However, due to unavailability of tech experts and talented professional, banks are

not able to overcome technical breakdown quickly. Besides this, as per Associate director for

techUK, inititally, banks were operating through their branches, then ATM focused, then online

banking and then come to mobile banking. Although bank brought such changes in their

operations because it is considered cost-effective, efficient, fast running and less risky, however,

introducing changes continually is really difficult and too complex. IT issues at RBS (Royal

Bank of Scottland), on its computers determined that banks invest heavy on their IT investment,

hence, underinvestment in a given period resultant lay off their IT staff members.

6

Bokhari (2014), stated that cyber threats such as possibility of attack by hackers to steal

client’s confidential information is a risk faced by banks. A survey of BOE (Bank of England)

presented in the above column graph stated that cyber security threats in the banking sector is

continuously rising. Thus, technological changes are fuelling challenges and rising uncertainties

for the financial institutions which may result adverse outcome. Besides this, poor IT system and

support results in technological failure issues for the financial sector. Due to IT breakdown,

workers productivity also got declined. Evidencing it, in UK, average employee wasted around

22.60 minutes each day.

Outram (2016), found that sound technological management need skilled and talented

specialists. However, due to unavailability of tech experts and talented professional, banks are

not able to overcome technical breakdown quickly. Besides this, as per Associate director for

techUK, inititally, banks were operating through their branches, then ATM focused, then online

banking and then come to mobile banking. Although bank brought such changes in their

operations because it is considered cost-effective, efficient, fast running and less risky, however,

introducing changes continually is really difficult and too complex. IT issues at RBS (Royal

Bank of Scottland), on its computers determined that banks invest heavy on their IT investment,

hence, underinvestment in a given period resultant lay off their IT staff members.

6

In addition to this, banks devise plans and policies for a long period about 5 period or

more, hence, it can be said that their digitalized platform is too rigid. However, in the changing

era, they need to continuously introduce changes in their digitalization process considering

consumer expectations, market dynamics and their own capabilities. Thus, their digitalized

operations must be consumer-centred that successfully cater customer expectations and desires.

3. Impact of technological failure on online banking, market rputation and consumer satisfaction

(Source: Dakers, 2016)

As per the views of Dakers (2016), now-a-days, every bank carry out their operations

through online platform, therefore, technical breakdown result in poor functionality of their

online banking system. Slow connectivity and technical error unable service-users to log-in their

accounts results in rising number of complaints and less satisfaction. In 2015, UK newspaper,

Daily Mail reported that bank’s consumers regularly complaint on Twitter that HSBC web page

was not properly functioning and just after few hours, the services were shut down. Due to

closure of customer accounts, personal account holders have no access whereas business

consumers experienced slow processing issues. Due to such technical error, 275,000 bank

payment were not been made on time results in rising number of consumer complaints. Besides

this, technical breakdown brought bank into controversial matter which results in less consumer

satisfaction and build negative market image. Similarly, RBS also suffered technology glitch

resultant in loss of critical business data about consumer payments. After IT failure in 2012, loss

of transaction details about payments to customers and

7

more, hence, it can be said that their digitalized platform is too rigid. However, in the changing

era, they need to continuously introduce changes in their digitalization process considering

consumer expectations, market dynamics and their own capabilities. Thus, their digitalized

operations must be consumer-centred that successfully cater customer expectations and desires.

3. Impact of technological failure on online banking, market rputation and consumer satisfaction

(Source: Dakers, 2016)

As per the views of Dakers (2016), now-a-days, every bank carry out their operations

through online platform, therefore, technical breakdown result in poor functionality of their

online banking system. Slow connectivity and technical error unable service-users to log-in their

accounts results in rising number of complaints and less satisfaction. In 2015, UK newspaper,

Daily Mail reported that bank’s consumers regularly complaint on Twitter that HSBC web page

was not properly functioning and just after few hours, the services were shut down. Due to

closure of customer accounts, personal account holders have no access whereas business

consumers experienced slow processing issues. Due to such technical error, 275,000 bank

payment were not been made on time results in rising number of consumer complaints. Besides

this, technical breakdown brought bank into controversial matter which results in less consumer

satisfaction and build negative market image. Similarly, RBS also suffered technology glitch

resultant in loss of critical business data about consumer payments. After IT failure in 2012, loss

of transaction details about payments to customers and

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

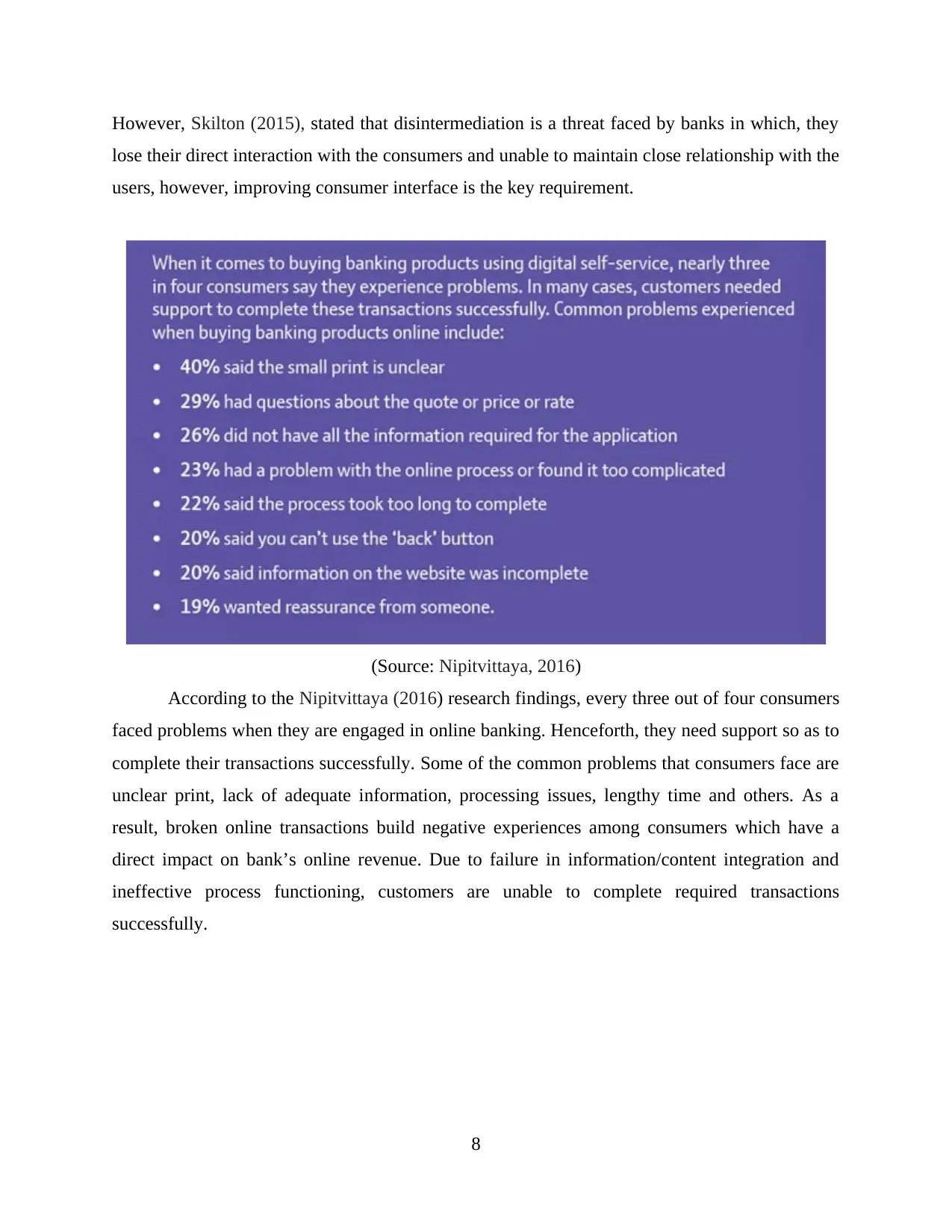

However, Skilton (2015), stated that disintermediation is a threat faced by banks in which, they

lose their direct interaction with the consumers and unable to maintain close relationship with the

users, however, improving consumer interface is the key requirement.

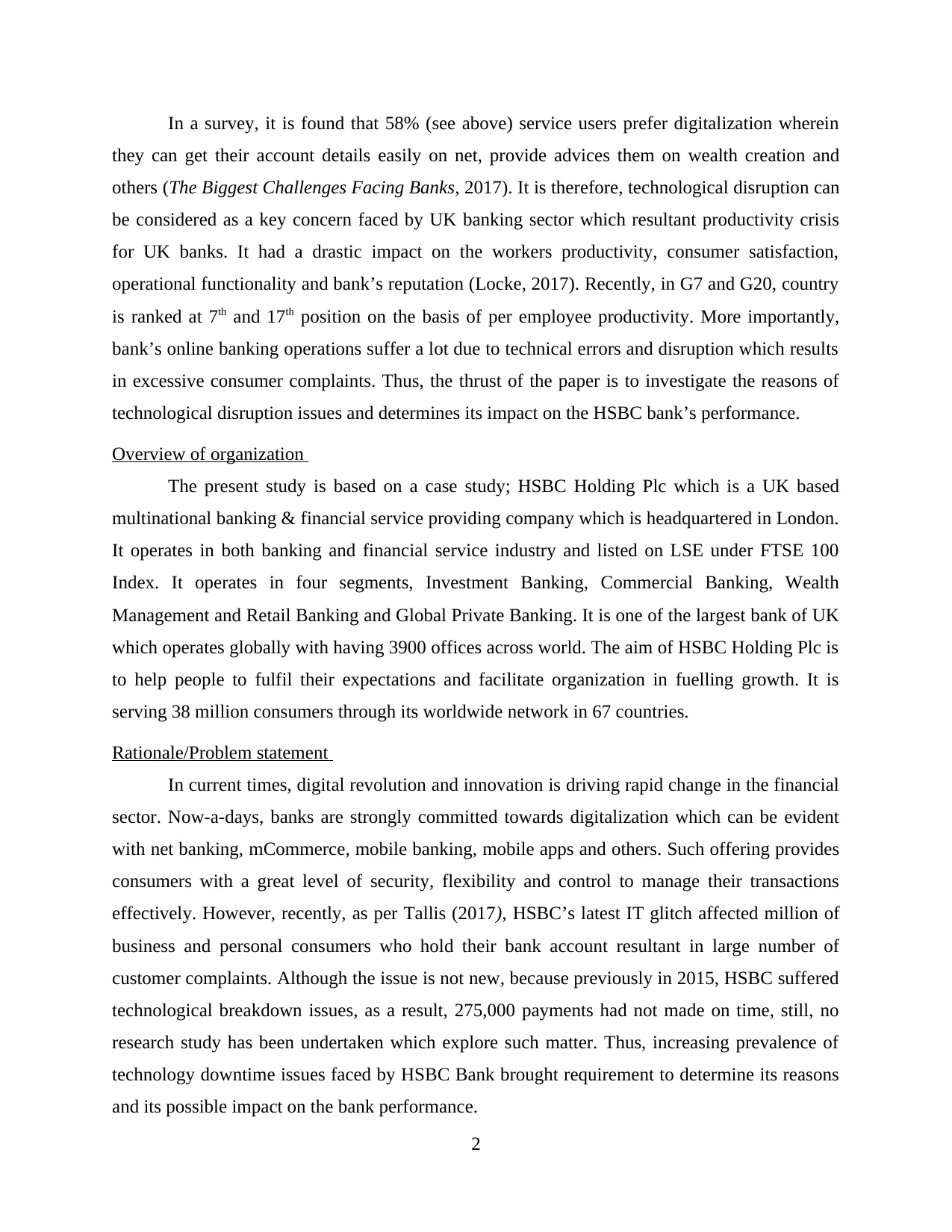

(Source: Nipitvittaya, 2016)

According to the Nipitvittaya (2016) research findings, every three out of four consumers

faced problems when they are engaged in online banking. Henceforth, they need support so as to

complete their transactions successfully. Some of the common problems that consumers face are

unclear print, lack of adequate information, processing issues, lengthy time and others. As a

result, broken online transactions build negative experiences among consumers which have a

direct impact on bank’s online revenue. Due to failure in information/content integration and

ineffective process functioning, customers are unable to complete required transactions

successfully.

8

lose their direct interaction with the consumers and unable to maintain close relationship with the

users, however, improving consumer interface is the key requirement.

(Source: Nipitvittaya, 2016)

According to the Nipitvittaya (2016) research findings, every three out of four consumers

faced problems when they are engaged in online banking. Henceforth, they need support so as to

complete their transactions successfully. Some of the common problems that consumers face are

unclear print, lack of adequate information, processing issues, lengthy time and others. As a

result, broken online transactions build negative experiences among consumers which have a

direct impact on bank’s online revenue. Due to failure in information/content integration and

ineffective process functioning, customers are unable to complete required transactions

successfully.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

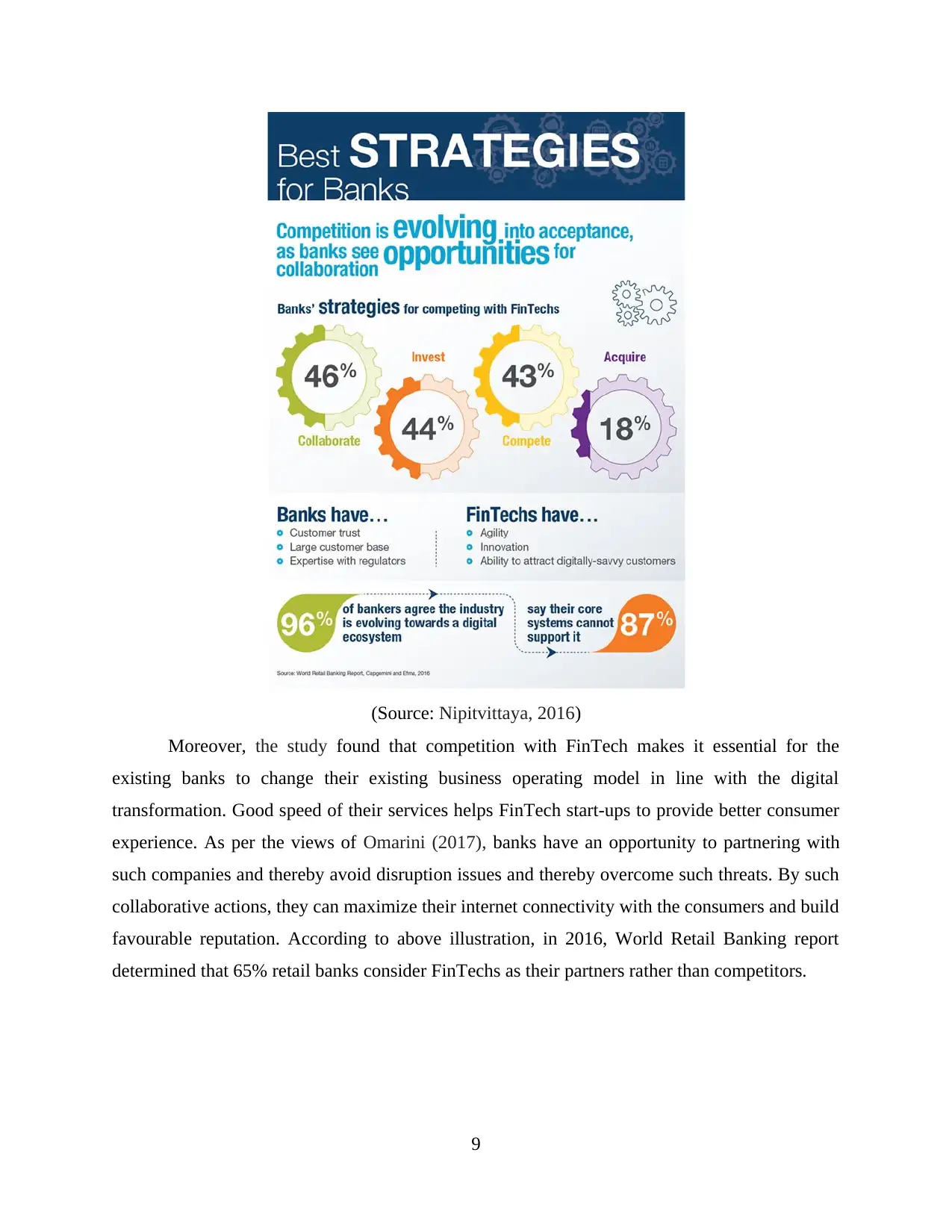

(Source: Nipitvittaya, 2016)

Moreover, the study found that competition with FinTech makes it essential for the

existing banks to change their existing business operating model in line with the digital

transformation. Good speed of their services helps FinTech start-ups to provide better consumer

experience. As per the views of Omarini (2017), banks have an opportunity to partnering with

such companies and thereby avoid disruption issues and thereby overcome such threats. By such

collaborative actions, they can maximize their internet connectivity with the consumers and build

favourable reputation. According to above illustration, in 2016, World Retail Banking report

determined that 65% retail banks consider FinTechs as their partners rather than competitors.

9

Moreover, the study found that competition with FinTech makes it essential for the

existing banks to change their existing business operating model in line with the digital

transformation. Good speed of their services helps FinTech start-ups to provide better consumer

experience. As per the views of Omarini (2017), banks have an opportunity to partnering with

such companies and thereby avoid disruption issues and thereby overcome such threats. By such

collaborative actions, they can maximize their internet connectivity with the consumers and build

favourable reputation. According to above illustration, in 2016, World Retail Banking report

determined that 65% retail banks consider FinTechs as their partners rather than competitors.

9

RESEARCH METHODOLOGY

Research philosophy

Out of interpretivism & positivism, the targeted study will chose former which

subjectively interprets various elements or research phenomenon. It is a social science paradigm

that undertaken qualitative research (Daniel and Sam, 2011). Within the area of chosen study,

scholar use such philosophy to examine qualitative aspects i.e. rising consumer complaint,

reputational issues and online banking difficulties faced by HSBC bank as a reason of IT

breakdown.

Research approach

Out of inductive and deductive, research will be based on inductive approach wherein

scholar key focus is to gather and analyze data addressing all the formulated research questions.

Investigator will begin research without any pre conceived idea and targeted at exploring new

theory (Bhattacharyya, 2009). With the use of inductive approach, researcher will find out

underlying reasons behind technological issues and investigate its threatening impact on market

image, online functioning and satisfaction level among consumers.

Research design

The current study is based on exploring reasons and thereafter identifies their impact on

HSBC bank which requires deep evaluation and analysis. It is therefore, analytical research

design will be perfect through which, investigate will carry out in-depth examination of

technological breakdown issues and its adverse impact on the bank performance (Creswell,

2013).

Research method

It will be a qualitative investigation because finding out causes of IT failure in UK

banking sector and its adverse outcome on market reputation, consumer complaints and online

banking functionality are qualitative factors. Thus, no quantitative facts, figures and information

will be used for investigating the issue.

Data collections

In order to gather required data, researcher has different choices either extracting data

from primary source or secondary source or a mixed of both. First is related with collecting data

through conducting a real investigation through using tools like survey, structured interview,

10

Research philosophy

Out of interpretivism & positivism, the targeted study will chose former which

subjectively interprets various elements or research phenomenon. It is a social science paradigm

that undertaken qualitative research (Daniel and Sam, 2011). Within the area of chosen study,

scholar use such philosophy to examine qualitative aspects i.e. rising consumer complaint,

reputational issues and online banking difficulties faced by HSBC bank as a reason of IT

breakdown.

Research approach

Out of inductive and deductive, research will be based on inductive approach wherein

scholar key focus is to gather and analyze data addressing all the formulated research questions.

Investigator will begin research without any pre conceived idea and targeted at exploring new

theory (Bhattacharyya, 2009). With the use of inductive approach, researcher will find out

underlying reasons behind technological issues and investigate its threatening impact on market

image, online functioning and satisfaction level among consumers.

Research design

The current study is based on exploring reasons and thereafter identifies their impact on

HSBC bank which requires deep evaluation and analysis. It is therefore, analytical research

design will be perfect through which, investigate will carry out in-depth examination of

technological breakdown issues and its adverse impact on the bank performance (Creswell,

2013).

Research method

It will be a qualitative investigation because finding out causes of IT failure in UK

banking sector and its adverse outcome on market reputation, consumer complaints and online

banking functionality are qualitative factors. Thus, no quantitative facts, figures and information

will be used for investigating the issue.

Data collections

In order to gather required data, researcher has different choices either extracting data

from primary source or secondary source or a mixed of both. First is related with collecting data

through conducting a real investigation through using tools like survey, structured interview,

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.