Economics Report: Market Structure of Telecom Industry Analysis

VerifiedAdded on 2022/08/16

|17

|2739

|25

Report

AI Summary

This report analyzes the market structure of the telecommunications industry in Australia, New Zealand, and the UK. It examines market concentration for fixed broadband and mobile phone services using the Herfindahl-Hirschman Index (HHI), revealing an oligopoly market structure dominated by a few firms. The report discusses the potential for price premiums charged by these dominant players and their impact on consumers. Furthermore, it explores government strategies to boost competition, reduce prices, and improve consumer welfare within the telecommunications sector. The analysis includes detailed market share breakdowns, HHI calculations, and a discussion of premium pricing strategies, concluding with recommendations for fostering a more competitive market environment.

Running head: ECONOMICS

Economics

Name of the Student

Name of the University

Course ID

Economics

Name of the Student

Name of the University

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS

Executive Summary

The report intends to analyze market structure of telecommunication industry in

Australia, New Zealand and UK. Market concentration has been examined separately for fixed

broadband and mobile phone service. The computed value of Herfindahl-Hirschman Index

suggests high degree of concentration in the telecommunication industry. Because of dominance

of three or four firms the telecommunication market has an oligopoly market structure. Sellers

have significant market power and charge premium price for telecom services. This higher price

increases consumers’ burden and hinders different other areas of development. Government

should encourage competition in the industry and adapt strategies to bring down prices in the

telecom sector.

Executive Summary

The report intends to analyze market structure of telecommunication industry in

Australia, New Zealand and UK. Market concentration has been examined separately for fixed

broadband and mobile phone service. The computed value of Herfindahl-Hirschman Index

suggests high degree of concentration in the telecommunication industry. Because of dominance

of three or four firms the telecommunication market has an oligopoly market structure. Sellers

have significant market power and charge premium price for telecom services. This higher price

increases consumers’ burden and hinders different other areas of development. Government

should encourage competition in the industry and adapt strategies to bring down prices in the

telecom sector.

2ECONOMICS

Table of Contents

Introduction......................................................................................................................................3

Market structure of telecommunication industry.............................................................................3

Fixed Broadband..........................................................................................................................4

Mobile phone service...................................................................................................................7

Premiums in pricing.......................................................................................................................11

Government strategy to boost competition in telecommunication industry of Australia..............13

Conclusion.....................................................................................................................................14

References......................................................................................................................................15

Table of Contents

Introduction......................................................................................................................................3

Market structure of telecommunication industry.............................................................................3

Fixed Broadband..........................................................................................................................4

Mobile phone service...................................................................................................................7

Premiums in pricing.......................................................................................................................11

Government strategy to boost competition in telecommunication industry of Australia..............13

Conclusion.....................................................................................................................................14

References......................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS

Introduction

Telecommunication industry in Australia plays an important role in maintain strong

connectivity among the dispersed population. Government has significant contribution in

development of telecommunication and plays a critical role in designing regulation of the sector

(Pugh, 2019). In the financial year of 2017-18, the sector generated an annual revenue of $44

billion. The revenue is expected to increase to $47 billion by 2021-22. The report evaluates

market structure based on degree of concentration in the telecommunication industry of

Australia. In addition to evaluating market structure of telecom sector in Australia, the paper also

examines the market structure of telecom in New Zealand and UK. After analyzing the market

structure the paper attempts to find out whether sellers in the industry are in a position to obtain

price premium and winners and losers of such premium pricing. Finally, some recommendations

are given regarding the strategy that government of Australia can adapt to lower prices in the

industry.

Market structure of telecommunication industry

Market structure of a particular product or service is determined from the number of

buyers and sellers in the market and degree of competition (Fine, 2016). In order to evaluate

market structure of telecommunication industry of Australia, New Zealand and UK the market

share of major operators have been analyzed. Herfindahl-Hirschman Index (HHI) is an important

tool used for determining degree of concentration and competitiveness within the market. The

index is computed by taking sum of squares of market share of firms operating in the market.

The value of HHI varies from near zero to 1000. Based on the value of the HHI, market

concentration is determined. As per U.S. department of Justice, a value of HHI less than 1500

indicates market place to be competitive (Cracau & Lima, 2016). Value of HHI between 1500

Introduction

Telecommunication industry in Australia plays an important role in maintain strong

connectivity among the dispersed population. Government has significant contribution in

development of telecommunication and plays a critical role in designing regulation of the sector

(Pugh, 2019). In the financial year of 2017-18, the sector generated an annual revenue of $44

billion. The revenue is expected to increase to $47 billion by 2021-22. The report evaluates

market structure based on degree of concentration in the telecommunication industry of

Australia. In addition to evaluating market structure of telecom sector in Australia, the paper also

examines the market structure of telecom in New Zealand and UK. After analyzing the market

structure the paper attempts to find out whether sellers in the industry are in a position to obtain

price premium and winners and losers of such premium pricing. Finally, some recommendations

are given regarding the strategy that government of Australia can adapt to lower prices in the

industry.

Market structure of telecommunication industry

Market structure of a particular product or service is determined from the number of

buyers and sellers in the market and degree of competition (Fine, 2016). In order to evaluate

market structure of telecommunication industry of Australia, New Zealand and UK the market

share of major operators have been analyzed. Herfindahl-Hirschman Index (HHI) is an important

tool used for determining degree of concentration and competitiveness within the market. The

index is computed by taking sum of squares of market share of firms operating in the market.

The value of HHI varies from near zero to 1000. Based on the value of the HHI, market

concentration is determined. As per U.S. department of Justice, a value of HHI less than 1500

indicates market place to be competitive (Cracau & Lima, 2016). Value of HHI between 1500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS

and 2500 indicates market to be moderately concentrated while value exceeding 2500 or larger

means a highly concentrated market. The formula for HHI is given as

HHI =s1

2 + s2

2 +s2

2 +… … … …+sn

2

Sn: Market share of firm n which is represented as whole number.

In order to get a clear idea about degree of competition in the telecommunication

industry, it is divided into two segment namely ‘Fixed Broadband’ and ‘Mobile Phone Service’.

Market concentration has been evaluated separately for each segment.

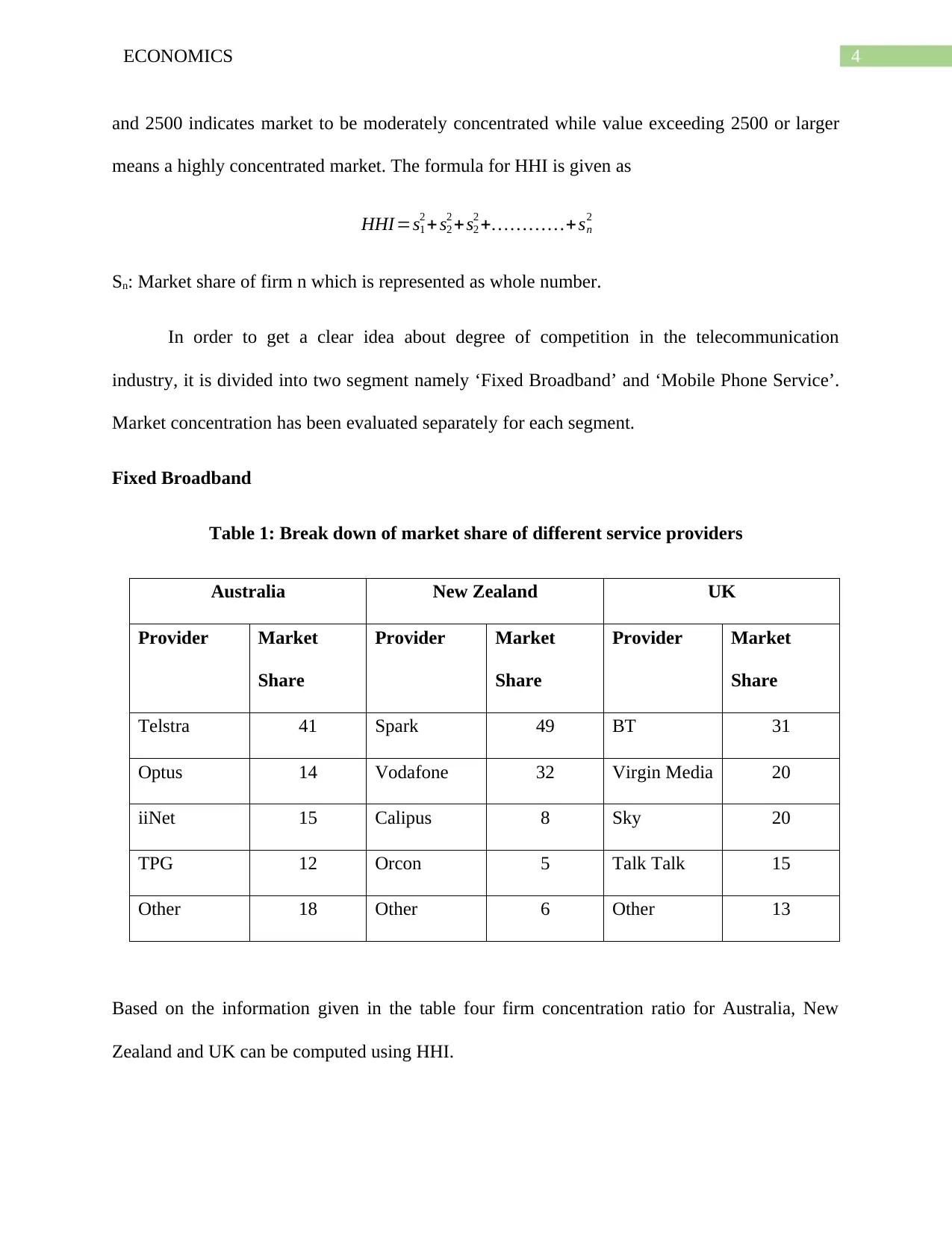

Fixed Broadband

Table 1: Break down of market share of different service providers

Australia New Zealand UK

Provider Market

Share

Provider Market

Share

Provider Market

Share

Telstra 41 Spark 49 BT 31

Optus 14 Vodafone 32 Virgin Media 20

iiNet 15 Calipus 8 Sky 20

TPG 12 Orcon 5 Talk Talk 15

Other 18 Other 6 Other 13

Based on the information given in the table four firm concentration ratio for Australia, New

Zealand and UK can be computed using HHI.

and 2500 indicates market to be moderately concentrated while value exceeding 2500 or larger

means a highly concentrated market. The formula for HHI is given as

HHI =s1

2 + s2

2 +s2

2 +… … … …+sn

2

Sn: Market share of firm n which is represented as whole number.

In order to get a clear idea about degree of competition in the telecommunication

industry, it is divided into two segment namely ‘Fixed Broadband’ and ‘Mobile Phone Service’.

Market concentration has been evaluated separately for each segment.

Fixed Broadband

Table 1: Break down of market share of different service providers

Australia New Zealand UK

Provider Market

Share

Provider Market

Share

Provider Market

Share

Telstra 41 Spark 49 BT 31

Optus 14 Vodafone 32 Virgin Media 20

iiNet 15 Calipus 8 Sky 20

TPG 12 Orcon 5 Talk Talk 15

Other 18 Other 6 Other 13

Based on the information given in the table four firm concentration ratio for Australia, New

Zealand and UK can be computed using HHI.

5ECONOMICS

HHI Austrlia=412+142 +152+122

¿ 1681+196+225+144

¿ 144

HHI New Zealand=492 +322+ 82 +52

¿ 2401+1024+64 +25

¿ 3514

HHI UK=312 +202 +202 +152

¿ 961+ 400+400+225

¿ 1986

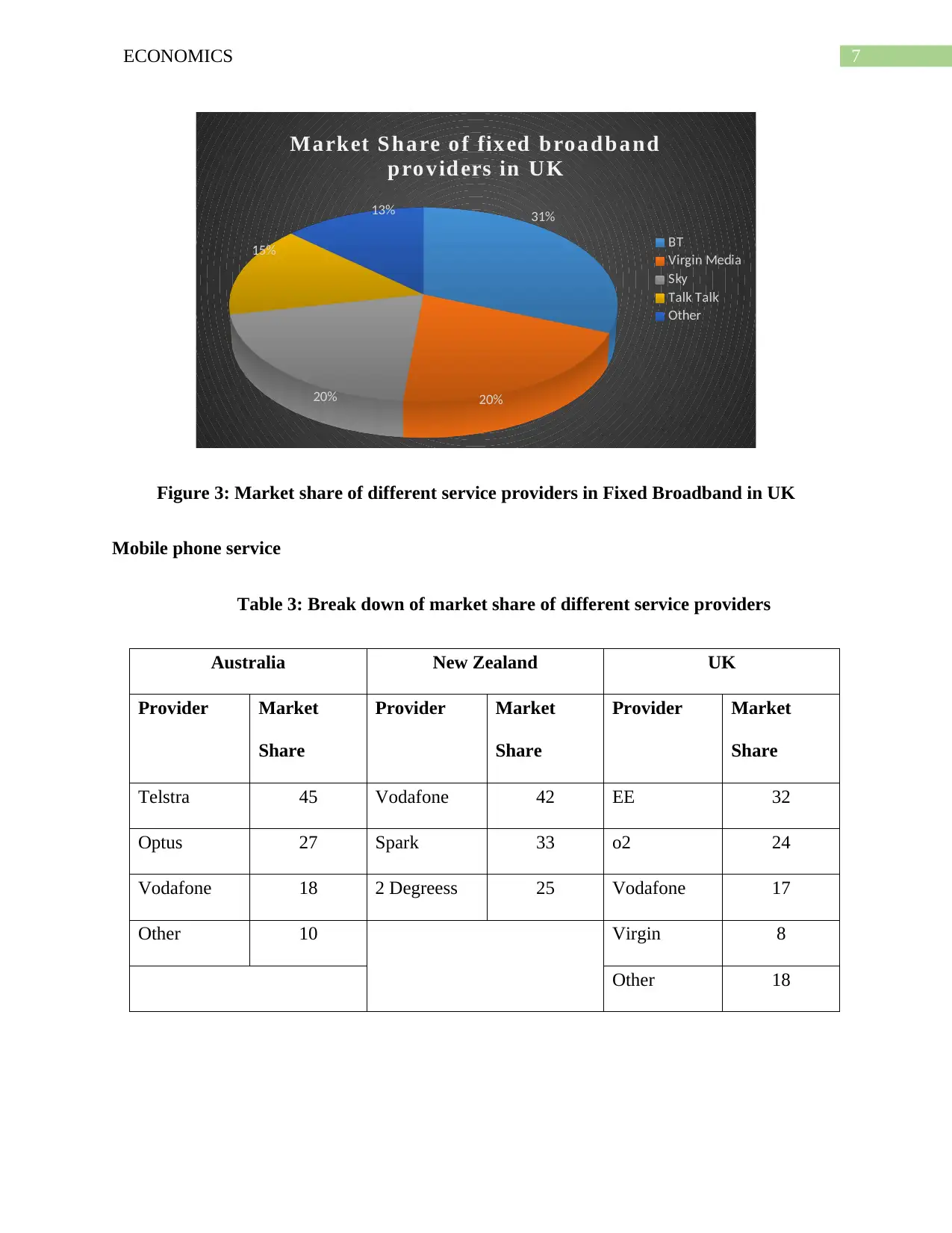

Table 2: Degree of concentration in Fixed Broadband segment

Country HHI Degree of Concentration

Australia 2246 Moderately Concentrated

New Zealand 3514 Highly Concentrated

UK 1986 Moderately Concentrated

HHI Austrlia=412+142 +152+122

¿ 1681+196+225+144

¿ 144

HHI New Zealand=492 +322+ 82 +52

¿ 2401+1024+64 +25

¿ 3514

HHI UK=312 +202 +202 +152

¿ 961+ 400+400+225

¿ 1986

Table 2: Degree of concentration in Fixed Broadband segment

Country HHI Degree of Concentration

Australia 2246 Moderately Concentrated

New Zealand 3514 Highly Concentrated

UK 1986 Moderately Concentrated

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS

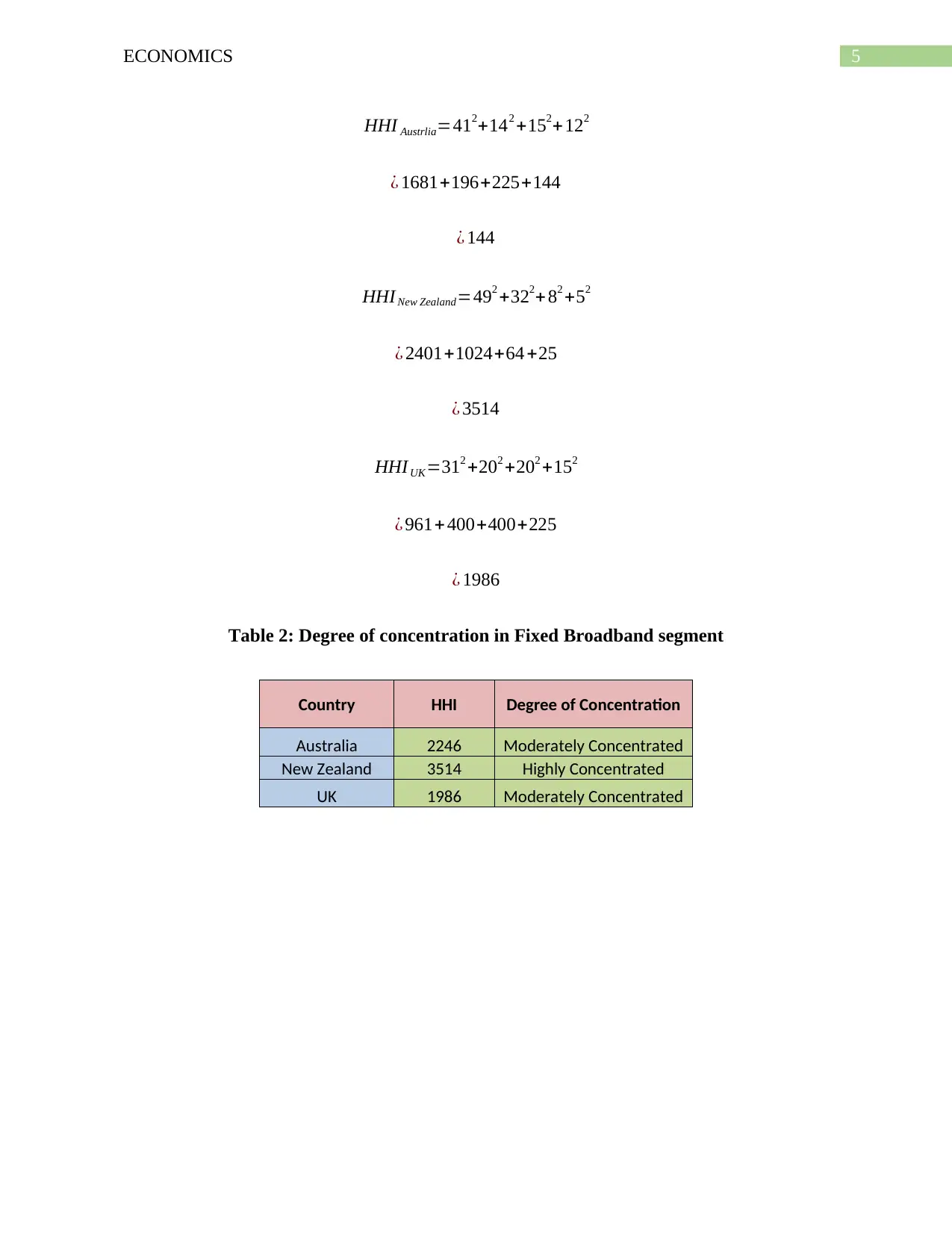

41%

14%15%

12%

18%

Ma rket Sh a re o f fix ed b roa d ba nk

pro v id ers in Au stra lia

Telstra

Optus

iiNet

TPG

Other

Figure 1: Market share of different service providers in Fixed Broadband in Australia

49%

32%

8%

5% 6%

Ma rket Sh a re o f fix ed b roa d ba nd

pro v id ers in New Z ea la n d

Spark

Vodafone

Calipus

Orcon

Other

Figure 2: Market share of different service providers in Fixed Broadband in New Zealand

41%

14%15%

12%

18%

Ma rket Sh a re o f fix ed b roa d ba nk

pro v id ers in Au stra lia

Telstra

Optus

iiNet

TPG

Other

Figure 1: Market share of different service providers in Fixed Broadband in Australia

49%

32%

8%

5% 6%

Ma rket Sh a re o f fix ed b roa d ba nd

pro v id ers in New Z ea la n d

Spark

Vodafone

Calipus

Orcon

Other

Figure 2: Market share of different service providers in Fixed Broadband in New Zealand

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS

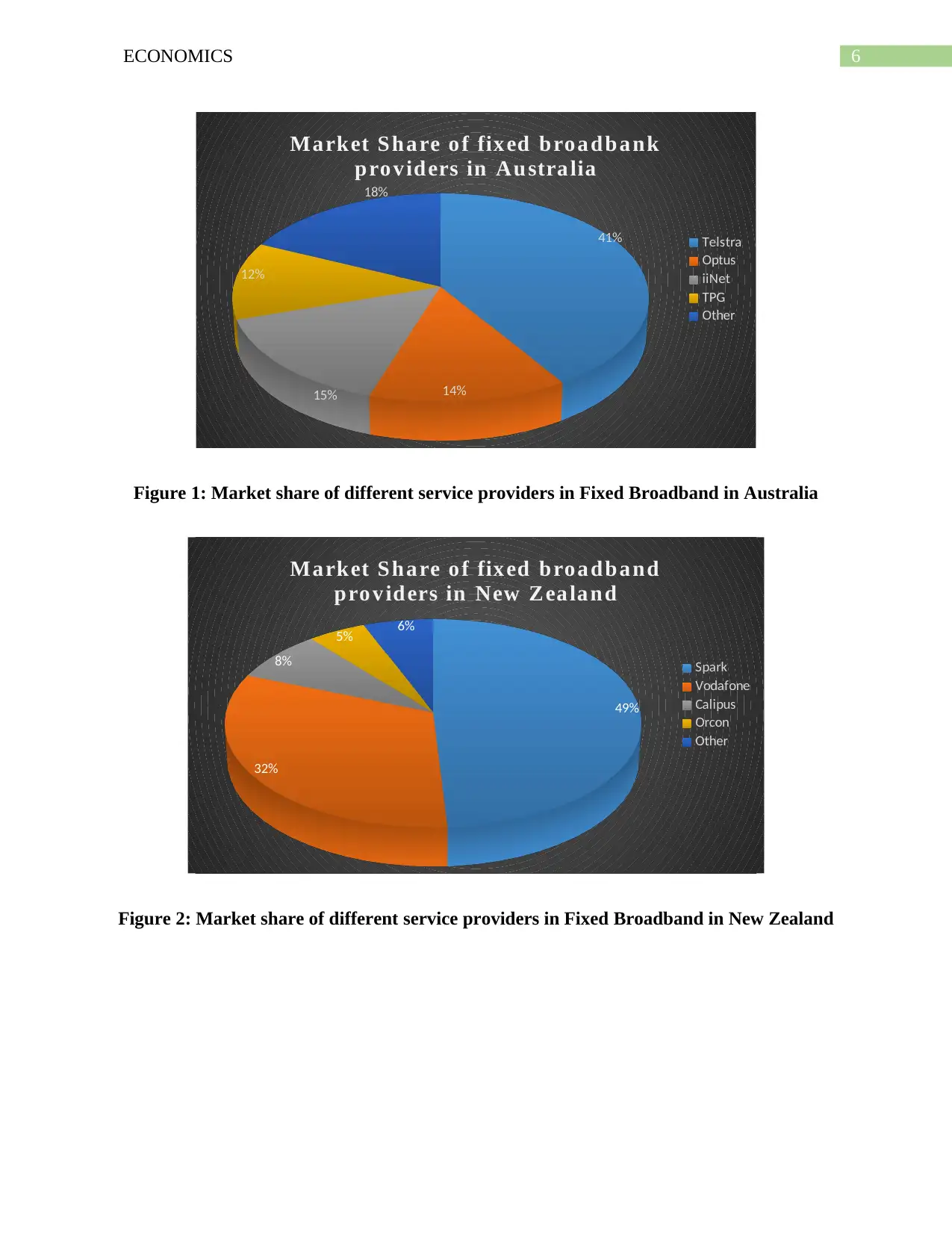

31%

20%20%

15%

13%

Ma rket Sh a re o f fix ed b roa d ba nd

pro v id ers in UK

BT

Virgin Media

Sky

Talk Talk

Other

Figure 3: Market share of different service providers in Fixed Broadband in UK

Mobile phone service

Table 3: Break down of market share of different service providers

Australia New Zealand UK

Provider Market

Share

Provider Market

Share

Provider Market

Share

Telstra 45 Vodafone 42 EE 32

Optus 27 Spark 33 o2 24

Vodafone 18 2 Degreess 25 Vodafone 17

Other 10 Virgin 8

Other 18

31%

20%20%

15%

13%

Ma rket Sh a re o f fix ed b roa d ba nd

pro v id ers in UK

BT

Virgin Media

Sky

Talk Talk

Other

Figure 3: Market share of different service providers in Fixed Broadband in UK

Mobile phone service

Table 3: Break down of market share of different service providers

Australia New Zealand UK

Provider Market

Share

Provider Market

Share

Provider Market

Share

Telstra 45 Vodafone 42 EE 32

Optus 27 Spark 33 o2 24

Vodafone 18 2 Degreess 25 Vodafone 17

Other 10 Virgin 8

Other 18

8ECONOMICS

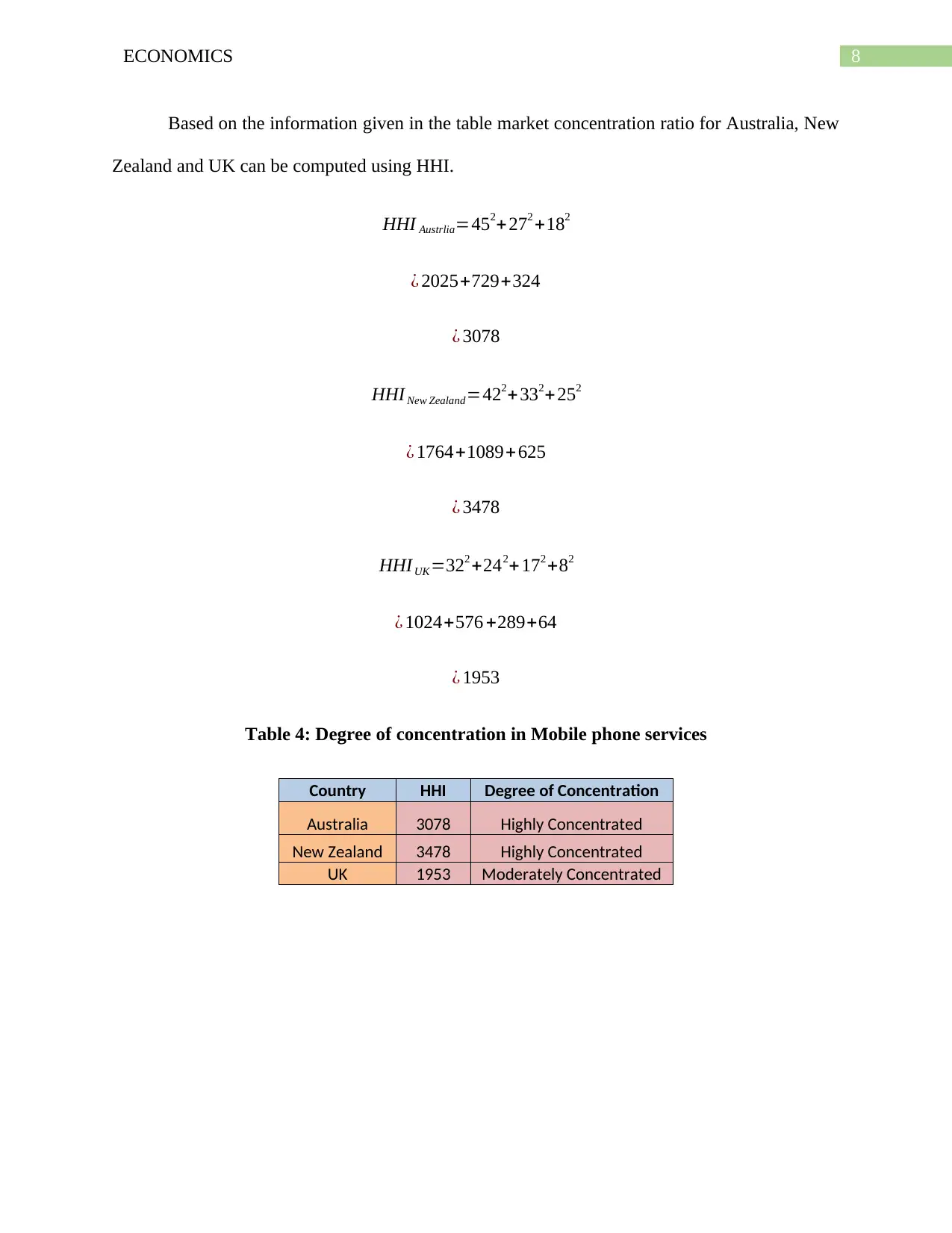

Based on the information given in the table market concentration ratio for Australia, New

Zealand and UK can be computed using HHI.

HHI Austrlia=452+272 +182

¿ 2025+729+324

¿ 3078

HHI New Zealand=422+332+252

¿ 1764+1089+625

¿ 3478

HHIUK=322 +242+ 172 +82

¿ 1024+576 +289+64

¿ 1953

Table 4: Degree of concentration in Mobile phone services

Country HHI Degree of Concentration

Australia 3078 Highly Concentrated

New Zealand 3478 Highly Concentrated

UK 1953 Moderately Concentrated

Based on the information given in the table market concentration ratio for Australia, New

Zealand and UK can be computed using HHI.

HHI Austrlia=452+272 +182

¿ 2025+729+324

¿ 3078

HHI New Zealand=422+332+252

¿ 1764+1089+625

¿ 3478

HHIUK=322 +242+ 172 +82

¿ 1024+576 +289+64

¿ 1953

Table 4: Degree of concentration in Mobile phone services

Country HHI Degree of Concentration

Australia 3078 Highly Concentrated

New Zealand 3478 Highly Concentrated

UK 1953 Moderately Concentrated

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMICS

45%

27%

18%

10%

Ma rket Sh a re o f mo bile pho n e serv ice

pro v id ers in Au stra lia

Telstra

Optus

Vodafone

Other

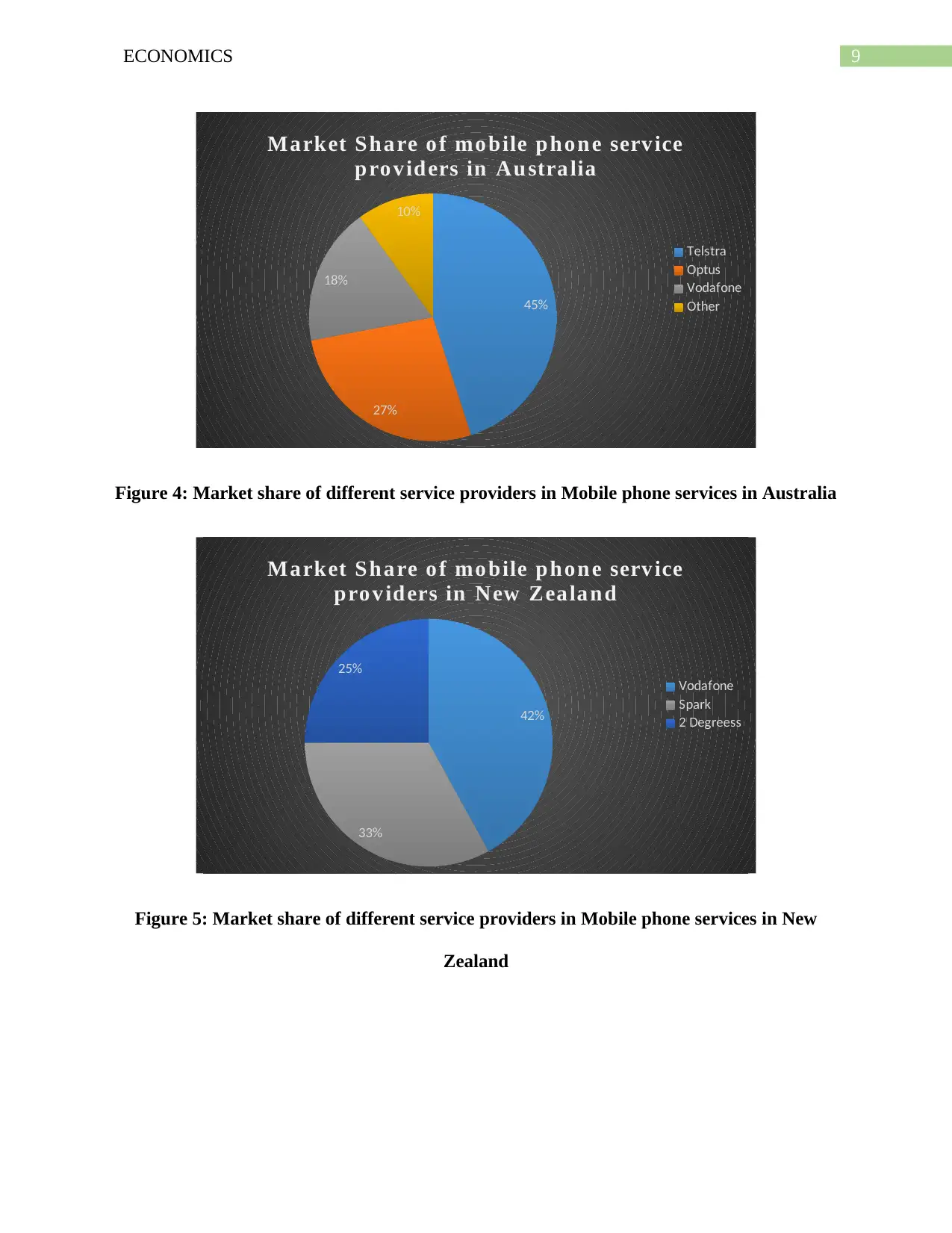

Figure 4: Market share of different service providers in Mobile phone services in Australia

42%

33%

25%

Ma rket Sh a re o f mo bile pho n e serv ice

pro v id ers in New Zea la n d

Vodafone

Spark

2 Degreess

Figure 5: Market share of different service providers in Mobile phone services in New

Zealand

45%

27%

18%

10%

Ma rket Sh a re o f mo bile pho n e serv ice

pro v id ers in Au stra lia

Telstra

Optus

Vodafone

Other

Figure 4: Market share of different service providers in Mobile phone services in Australia

42%

33%

25%

Ma rket Sh a re o f mo bile pho n e serv ice

pro v id ers in New Zea la n d

Vodafone

Spark

2 Degreess

Figure 5: Market share of different service providers in Mobile phone services in New

Zealand

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMICS

32%

24%

17%

8%

18%

Ma rket Sh a re o f mo bile pho n e serv ice

pro v id ers in UK

EE

o2

Vodafone

Virgin

Other

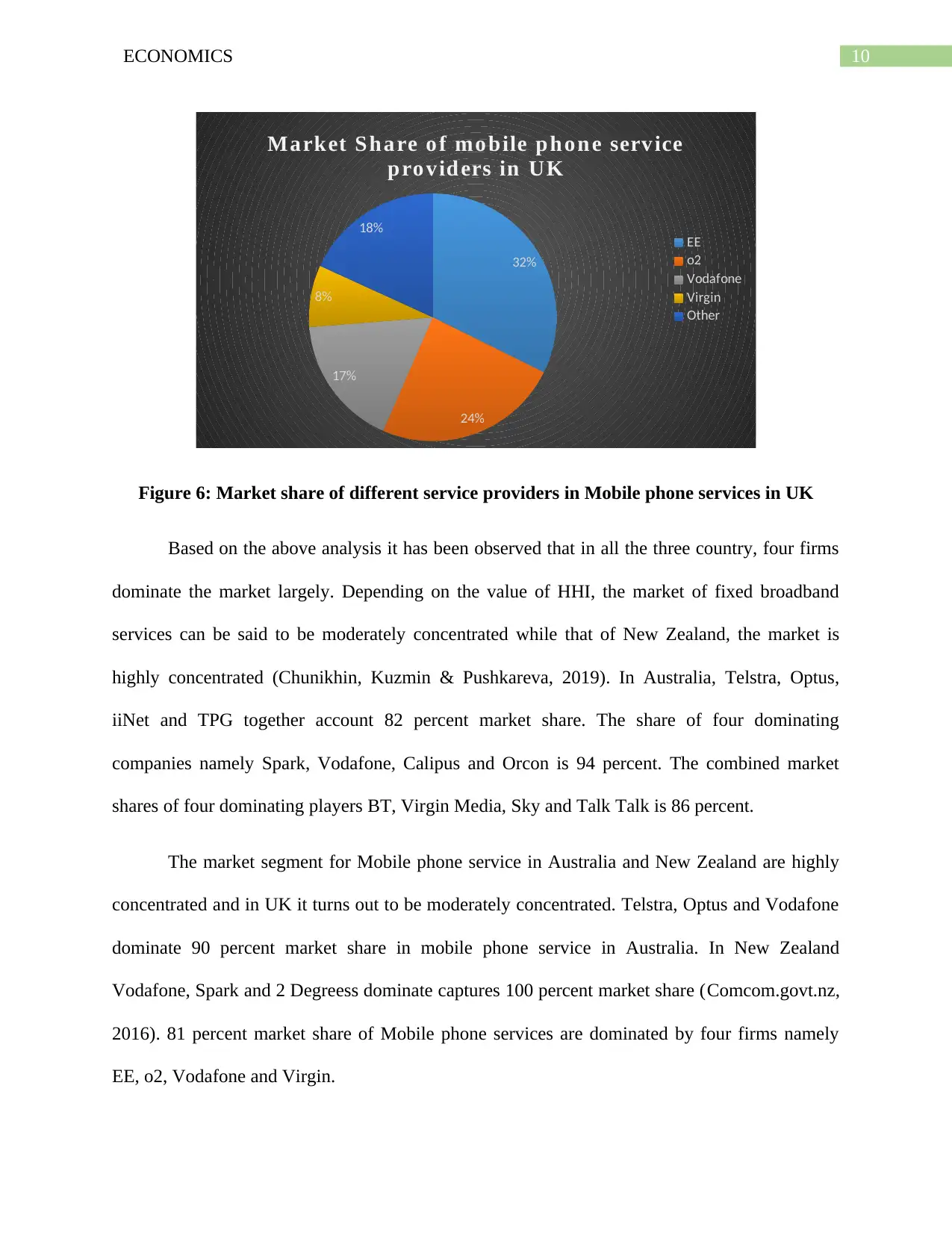

Figure 6: Market share of different service providers in Mobile phone services in UK

Based on the above analysis it has been observed that in all the three country, four firms

dominate the market largely. Depending on the value of HHI, the market of fixed broadband

services can be said to be moderately concentrated while that of New Zealand, the market is

highly concentrated (Chunikhin, Kuzmin & Pushkareva, 2019). In Australia, Telstra, Optus,

iiNet and TPG together account 82 percent market share. The share of four dominating

companies namely Spark, Vodafone, Calipus and Orcon is 94 percent. The combined market

shares of four dominating players BT, Virgin Media, Sky and Talk Talk is 86 percent.

The market segment for Mobile phone service in Australia and New Zealand are highly

concentrated and in UK it turns out to be moderately concentrated. Telstra, Optus and Vodafone

dominate 90 percent market share in mobile phone service in Australia. In New Zealand

Vodafone, Spark and 2 Degreess dominate captures 100 percent market share (Comcom.govt.nz,

2016). 81 percent market share of Mobile phone services are dominated by four firms namely

EE, o2, Vodafone and Virgin.

32%

24%

17%

8%

18%

Ma rket Sh a re o f mo bile pho n e serv ice

pro v id ers in UK

EE

o2

Vodafone

Virgin

Other

Figure 6: Market share of different service providers in Mobile phone services in UK

Based on the above analysis it has been observed that in all the three country, four firms

dominate the market largely. Depending on the value of HHI, the market of fixed broadband

services can be said to be moderately concentrated while that of New Zealand, the market is

highly concentrated (Chunikhin, Kuzmin & Pushkareva, 2019). In Australia, Telstra, Optus,

iiNet and TPG together account 82 percent market share. The share of four dominating

companies namely Spark, Vodafone, Calipus and Orcon is 94 percent. The combined market

shares of four dominating players BT, Virgin Media, Sky and Talk Talk is 86 percent.

The market segment for Mobile phone service in Australia and New Zealand are highly

concentrated and in UK it turns out to be moderately concentrated. Telstra, Optus and Vodafone

dominate 90 percent market share in mobile phone service in Australia. In New Zealand

Vodafone, Spark and 2 Degreess dominate captures 100 percent market share (Comcom.govt.nz,

2016). 81 percent market share of Mobile phone services are dominated by four firms namely

EE, o2, Vodafone and Virgin.

11ECONOMICS

The discussion on market concentration in Fixed Broadband and Mobile phone services

suggest that both the segments are highly concentrated among few large players. The market

structure of telecommunication industry therefore can be classified as having an oligopoly

market structure (Kreps, 2019).

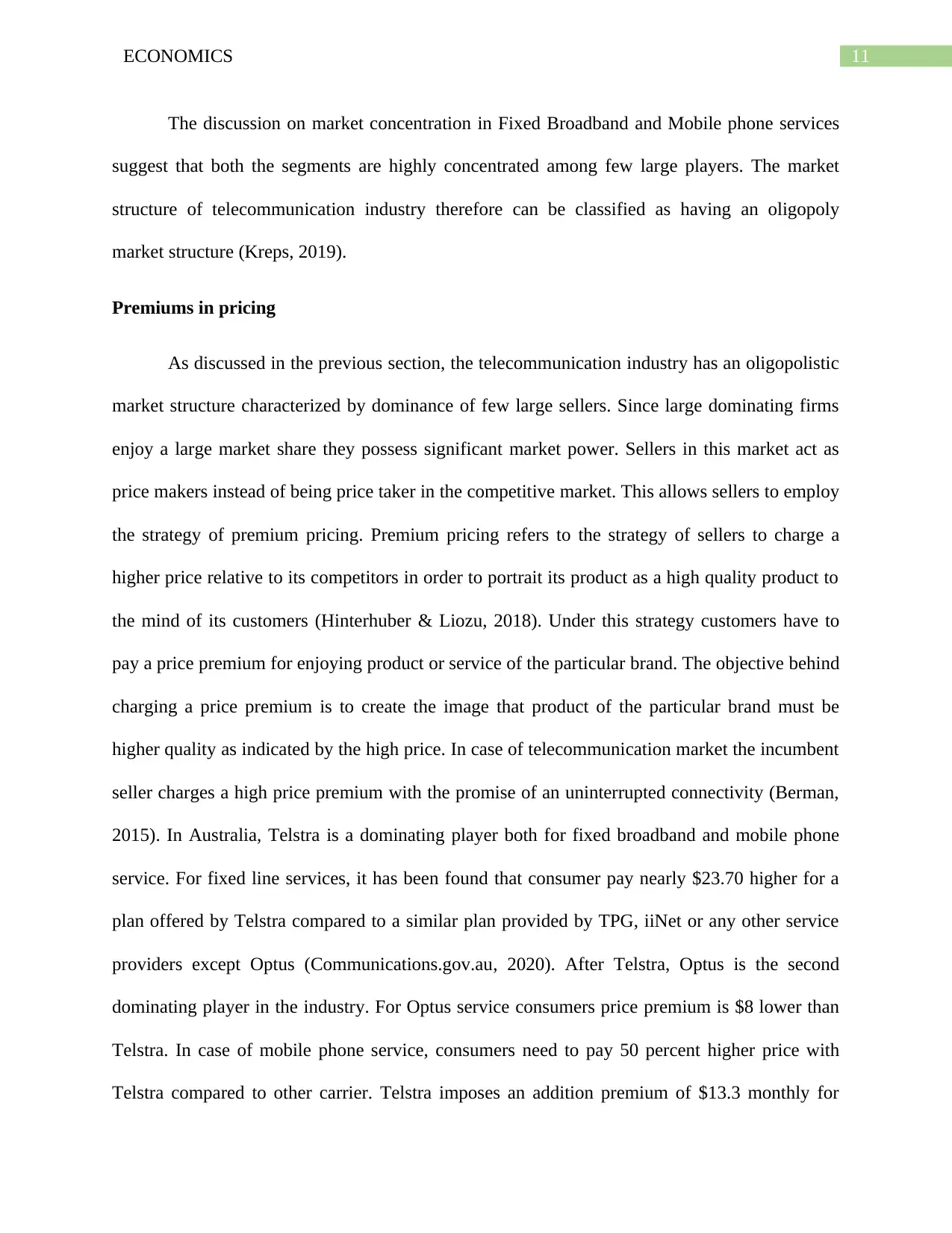

Premiums in pricing

As discussed in the previous section, the telecommunication industry has an oligopolistic

market structure characterized by dominance of few large sellers. Since large dominating firms

enjoy a large market share they possess significant market power. Sellers in this market act as

price makers instead of being price taker in the competitive market. This allows sellers to employ

the strategy of premium pricing. Premium pricing refers to the strategy of sellers to charge a

higher price relative to its competitors in order to portrait its product as a high quality product to

the mind of its customers (Hinterhuber & Liozu, 2018). Under this strategy customers have to

pay a price premium for enjoying product or service of the particular brand. The objective behind

charging a price premium is to create the image that product of the particular brand must be

higher quality as indicated by the high price. In case of telecommunication market the incumbent

seller charges a high price premium with the promise of an uninterrupted connectivity (Berman,

2015). In Australia, Telstra is a dominating player both for fixed broadband and mobile phone

service. For fixed line services, it has been found that consumer pay nearly $23.70 higher for a

plan offered by Telstra compared to a similar plan provided by TPG, iiNet or any other service

providers except Optus (Communications.gov.au, 2020). After Telstra, Optus is the second

dominating player in the industry. For Optus service consumers price premium is $8 lower than

Telstra. In case of mobile phone service, consumers need to pay 50 percent higher price with

Telstra compared to other carrier. Telstra imposes an addition premium of $13.3 monthly for

The discussion on market concentration in Fixed Broadband and Mobile phone services

suggest that both the segments are highly concentrated among few large players. The market

structure of telecommunication industry therefore can be classified as having an oligopoly

market structure (Kreps, 2019).

Premiums in pricing

As discussed in the previous section, the telecommunication industry has an oligopolistic

market structure characterized by dominance of few large sellers. Since large dominating firms

enjoy a large market share they possess significant market power. Sellers in this market act as

price makers instead of being price taker in the competitive market. This allows sellers to employ

the strategy of premium pricing. Premium pricing refers to the strategy of sellers to charge a

higher price relative to its competitors in order to portrait its product as a high quality product to

the mind of its customers (Hinterhuber & Liozu, 2018). Under this strategy customers have to

pay a price premium for enjoying product or service of the particular brand. The objective behind

charging a price premium is to create the image that product of the particular brand must be

higher quality as indicated by the high price. In case of telecommunication market the incumbent

seller charges a high price premium with the promise of an uninterrupted connectivity (Berman,

2015). In Australia, Telstra is a dominating player both for fixed broadband and mobile phone

service. For fixed line services, it has been found that consumer pay nearly $23.70 higher for a

plan offered by Telstra compared to a similar plan provided by TPG, iiNet or any other service

providers except Optus (Communications.gov.au, 2020). After Telstra, Optus is the second

dominating player in the industry. For Optus service consumers price premium is $8 lower than

Telstra. In case of mobile phone service, consumers need to pay 50 percent higher price with

Telstra compared to other carrier. Telstra imposes an addition premium of $13.3 monthly for

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.