Financial Accounting Analysis: Telstra's Strategies and Policies

VerifiedAdded on 2020/03/28

|17

|4247

|224

Report

AI Summary

This report offers a comprehensive analysis of Telstra's accounting practices, policies, and strategies. It begins with an executive summary, followed by an introduction to the IASB standards and conceptual framework. The report identifies key accounting policies, assesses accounting flexibility, and evaluates Telstra's accounting strategy, comparing it to competitors like TPG. A detailed analysis of the quality of disclosures under financial reporting is provided, along with potential red flags identified in the annual report. The report also examines the company's compliance with the conceptual framework and concludes with a summary of findings. The analysis covers Telstra's adoption of Australian Accounting Standards (AAS), US GAAP, and its move towards Australian equivalent IFRS (A-IFRS), highlighting the implications for its global expansion and competitive advantage. The report utilizes Telstra's 2017 Annual Report as a primary source, examining revenue recognition, risk management, and incentive plans for key management personnel.

Accounting Theory

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

The report has provided an evaluation of the accounting quality of Telstra through

evaluating its accounting policies and strategies. The Telstra being a multinational company

is complying with US accounting principles in addition to the Australia accounting policies.

The company in the coming future is also tending to adopt Australian equivalent IFRS for

meeting the needs of its international stakeholders. The change in the accounting policies is

specifically directed to achieve the company goals of expansion its business in the global

market. The company besides developing accounting strategies for improving its global

performance is also placing focus on attains a competitive advantage over its domestic rivals

such as TPG through incorporating the requirements of AASB. Also, the report has identified

some red flags in its annual report such as the company is still not able to achieve its expected

sales revenue from implementing the changed accounting strategies of A-IFRS adoption.

2

The report has provided an evaluation of the accounting quality of Telstra through

evaluating its accounting policies and strategies. The Telstra being a multinational company

is complying with US accounting principles in addition to the Australia accounting policies.

The company in the coming future is also tending to adopt Australian equivalent IFRS for

meeting the needs of its international stakeholders. The change in the accounting policies is

specifically directed to achieve the company goals of expansion its business in the global

market. The company besides developing accounting strategies for improving its global

performance is also placing focus on attains a competitive advantage over its domestic rivals

such as TPG through incorporating the requirements of AASB. Also, the report has identified

some red flags in its annual report such as the company is still not able to achieve its expected

sales revenue from implementing the changed accounting strategies of A-IFRS adoption.

2

Contents

Executive Summary...................................................................................................................2

Introduction................................................................................................................................4

Section 1: Identify Key Accounting Policies.............................................................................4

Section 2: Assess Accounting Flexibility..................................................................................5

Section 3: Evaluate Accounting Strategy...................................................................................6

Section 4: Detailed analysis of the quality of disclosures under financial reporting.................8

Section 5: Potential Flags in the Annual Report......................................................................12

Section 6: Compliant With Conceptual Framework................................................................13

Conclusion................................................................................................................................14

References................................................................................................................................15

3

Executive Summary...................................................................................................................2

Introduction................................................................................................................................4

Section 1: Identify Key Accounting Policies.............................................................................4

Section 2: Assess Accounting Flexibility..................................................................................5

Section 3: Evaluate Accounting Strategy...................................................................................6

Section 4: Detailed analysis of the quality of disclosures under financial reporting.................8

Section 5: Potential Flags in the Annual Report......................................................................12

Section 6: Compliant With Conceptual Framework................................................................13

Conclusion................................................................................................................................14

References................................................................................................................................15

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Introduction

The IASB has developed standard accounting policies and estimates that needs to be

adopted by all the business entities during preparation of their financial reports. The

accounting policies are based on the IFRS standards that business entities need to follow

while identifying and assessing the values of their various financial instruments. The

adoption of IFRS standards during corporate reporting implies that a business entity has

followed all the principles of conceptual accounting framework. The principle of conceptual

accounting framework is based on various accounting theories such as normative accounting

theory. In this context, the present report provides an analysis of the accounting strategies and

choices of an ASX listed firm, that is, Telstra, an Australian telecommunication company

involved in developing and providing telecom services. The accounting strategy of the

company is examined through evaluating its flexibility, analyzing the quality of disclosure,

identifying the major issues of concern as red flags and the compliant with conceptual

framework principles. In addition to this, the accounting policies of the firm are compared

with its rival company that is TPG in order to identify the norms of accounting policies with

industry peers (Mirza and Ankarath, 2012). The evaluation of the accounting quality of the

company helps in supporting the decision-making process of the company.

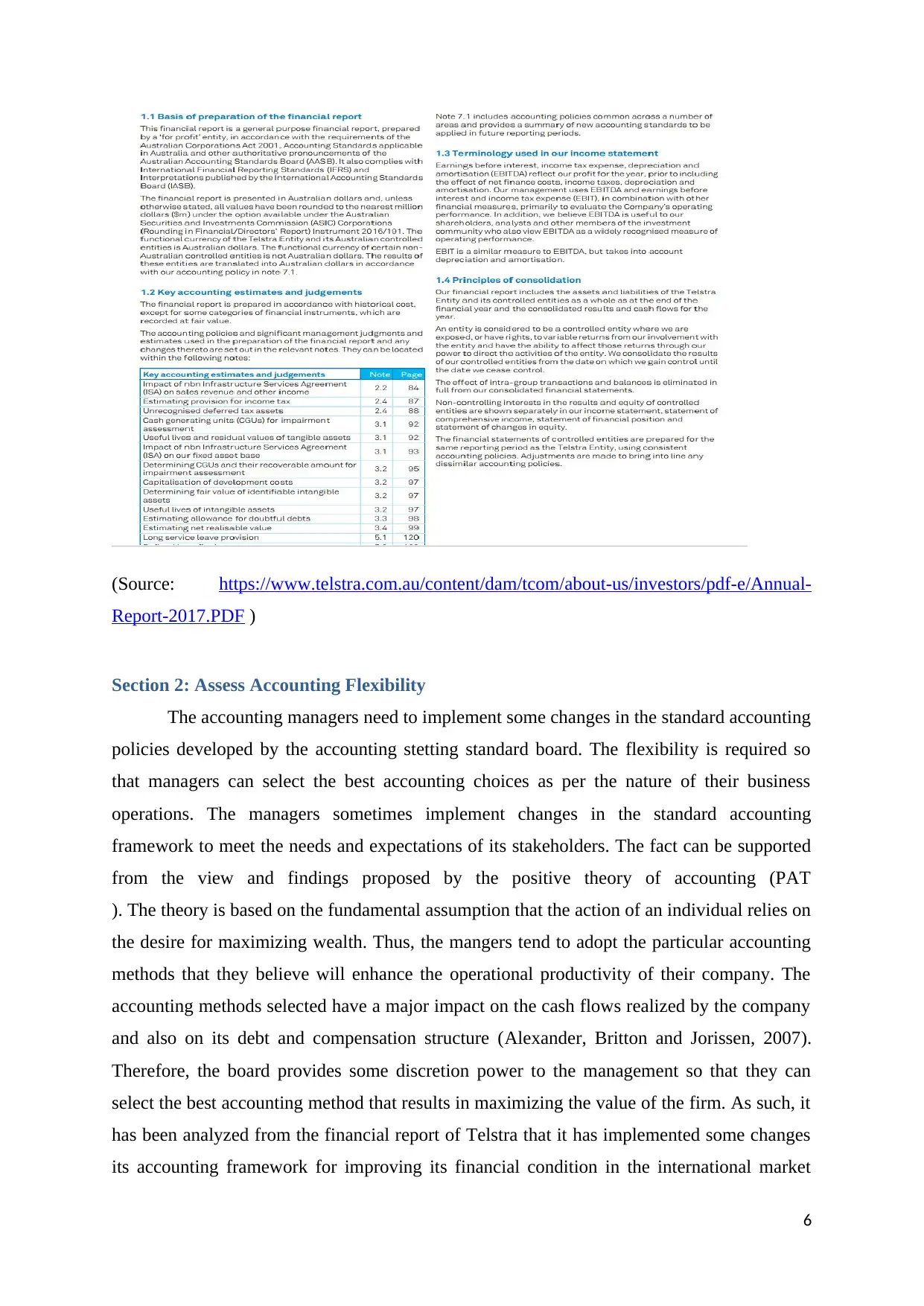

Section 1: Identify Key Accounting Policies

The company has adopted the accounting policies and principles as per the Australian

Accounting Standards. The company have discloses the compliance of its financial reports as

per the Australian generally accepted accounting principles. The financial report has been

prepared in accordance with the principle of consolidation by integrating the financial

statements of Telstra and all its controlled entities (Langendijk, Swagerman and Verhoog,

2003). The historical cost accounting approach is used for valuation of its financial

instruments except for some of the equity accounted investments. The financial reports are

presented in Australian dollar and for the end-users outside the Australia, the financial reports

are presented in US$M. The company has adopted the accounting policies that help it to meet

the accounting requirements under AGAAP and USGAAP. The company has also adopted

the Emerging Issues Task Force (ETIF00-21) in relation to the recognition of revenue arising

from multiple deliverable as per the USGAAP. The policy is adopted at the time of selling

tow or more revenue generating units under a single arrangement. Also, each deliverable is

4

The IASB has developed standard accounting policies and estimates that needs to be

adopted by all the business entities during preparation of their financial reports. The

accounting policies are based on the IFRS standards that business entities need to follow

while identifying and assessing the values of their various financial instruments. The

adoption of IFRS standards during corporate reporting implies that a business entity has

followed all the principles of conceptual accounting framework. The principle of conceptual

accounting framework is based on various accounting theories such as normative accounting

theory. In this context, the present report provides an analysis of the accounting strategies and

choices of an ASX listed firm, that is, Telstra, an Australian telecommunication company

involved in developing and providing telecom services. The accounting strategy of the

company is examined through evaluating its flexibility, analyzing the quality of disclosure,

identifying the major issues of concern as red flags and the compliant with conceptual

framework principles. In addition to this, the accounting policies of the firm are compared

with its rival company that is TPG in order to identify the norms of accounting policies with

industry peers (Mirza and Ankarath, 2012). The evaluation of the accounting quality of the

company helps in supporting the decision-making process of the company.

Section 1: Identify Key Accounting Policies

The company has adopted the accounting policies and principles as per the Australian

Accounting Standards. The company have discloses the compliance of its financial reports as

per the Australian generally accepted accounting principles. The financial report has been

prepared in accordance with the principle of consolidation by integrating the financial

statements of Telstra and all its controlled entities (Langendijk, Swagerman and Verhoog,

2003). The historical cost accounting approach is used for valuation of its financial

instruments except for some of the equity accounted investments. The financial reports are

presented in Australian dollar and for the end-users outside the Australia, the financial reports

are presented in US$M. The company has adopted the accounting policies that help it to meet

the accounting requirements under AGAAP and USGAAP. The company has also adopted

the Emerging Issues Task Force (ETIF00-21) in relation to the recognition of revenue arising

from multiple deliverable as per the USGAAP. The policy is adopted at the time of selling

tow or more revenue generating units under a single arrangement. Also, each deliverable is

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

regarded as a distinct unit of accounting as per the ETIF00-21. However, if the deliverable is

not regarded to be distinct unit of accounting the arrangement is accounted for a single unit.

The revenue realized from the revenue arrangements is allocated to the separate units on the

basis of relative fair value of each unit (Telstra Annual Report, 2017). However, if the fair

value of each unit cannot be recognized, then the revenue should be allocated on the basis of

difference between the total amount considered for the arrangement and the fair value of the

undelivered item` (Jensen, 2001).

The Australian entities that are reported under the Corporations Act 2001 are also

required to prepare their financial reports as per the Australian equivalents of IFRS. The

Telstra complies effectively with the Corporations Act 2001 and as such need to prepare its

financial reports as per the IFRS accounting standards and policies. The accounting rules and

policies of IFRS have been adopted in reporting the comparative financial information of two

years in the current reporting period (Higson, 2003). This is done in accordance with the US

Securities and Exchange Commission (SEC) that requires the foreign registered companies

operating under the home country to prepare their financial statements as per the IFRS. The

company is a recognized multinational company and provides its telecom services to various

parts of the world and therefore is emphasizing on converging its accounting standards with

IFRS for improving its competitive position in the international market (Hussey, and Ong,

2005). The company ahs also adopted accounting policies for effective management of risk

through implementing a proper governance framework that helps in monitoring the

operational risks faced by the company. The company hedges its exposure to foreign

currency risk that is developed by the transformation of its assets and liabilities from the

functional currency to the Australian dollars. The Board of directors of the company provides

the standard guidelines to the management for the use of hedging instruments in order to

mitigate the operational risks arising from the foreign currency exposure (Mumba, 2013).

5

not regarded to be distinct unit of accounting the arrangement is accounted for a single unit.

The revenue realized from the revenue arrangements is allocated to the separate units on the

basis of relative fair value of each unit (Telstra Annual Report, 2017). However, if the fair

value of each unit cannot be recognized, then the revenue should be allocated on the basis of

difference between the total amount considered for the arrangement and the fair value of the

undelivered item` (Jensen, 2001).

The Australian entities that are reported under the Corporations Act 2001 are also

required to prepare their financial reports as per the Australian equivalents of IFRS. The

Telstra complies effectively with the Corporations Act 2001 and as such need to prepare its

financial reports as per the IFRS accounting standards and policies. The accounting rules and

policies of IFRS have been adopted in reporting the comparative financial information of two

years in the current reporting period (Higson, 2003). This is done in accordance with the US

Securities and Exchange Commission (SEC) that requires the foreign registered companies

operating under the home country to prepare their financial statements as per the IFRS. The

company is a recognized multinational company and provides its telecom services to various

parts of the world and therefore is emphasizing on converging its accounting standards with

IFRS for improving its competitive position in the international market (Hussey, and Ong,

2005). The company ahs also adopted accounting policies for effective management of risk

through implementing a proper governance framework that helps in monitoring the

operational risks faced by the company. The company hedges its exposure to foreign

currency risk that is developed by the transformation of its assets and liabilities from the

functional currency to the Australian dollars. The Board of directors of the company provides

the standard guidelines to the management for the use of hedging instruments in order to

mitigate the operational risks arising from the foreign currency exposure (Mumba, 2013).

5

(Source: https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf-e/Annual-

Report-2017.PDF )

Section 2: Assess Accounting Flexibility

The accounting managers need to implement some changes in the standard accounting

policies developed by the accounting stetting standard board. The flexibility is required so

that managers can select the best accounting choices as per the nature of their business

operations. The managers sometimes implement changes in the standard accounting

framework to meet the needs and expectations of its stakeholders. The fact can be supported

from the view and findings proposed by the positive theory of accounting (PAT

). The theory is based on the fundamental assumption that the action of an individual relies on

the desire for maximizing wealth. Thus, the mangers tend to adopt the particular accounting

methods that they believe will enhance the operational productivity of their company. The

accounting methods selected have a major impact on the cash flows realized by the company

and also on its debt and compensation structure (Alexander, Britton and Jorissen, 2007).

Therefore, the board provides some discretion power to the management so that they can

select the best accounting method that results in maximizing the value of the firm. As such, it

has been analyzed from the financial report of Telstra that it has implemented some changes

its accounting framework for improving its financial condition in the international market

6

Report-2017.PDF )

Section 2: Assess Accounting Flexibility

The accounting managers need to implement some changes in the standard accounting

policies developed by the accounting stetting standard board. The flexibility is required so

that managers can select the best accounting choices as per the nature of their business

operations. The managers sometimes implement changes in the standard accounting

framework to meet the needs and expectations of its stakeholders. The fact can be supported

from the view and findings proposed by the positive theory of accounting (PAT

). The theory is based on the fundamental assumption that the action of an individual relies on

the desire for maximizing wealth. Thus, the mangers tend to adopt the particular accounting

methods that they believe will enhance the operational productivity of their company. The

accounting methods selected have a major impact on the cash flows realized by the company

and also on its debt and compensation structure (Alexander, Britton and Jorissen, 2007).

Therefore, the board provides some discretion power to the management so that they can

select the best accounting method that results in maximizing the value of the firm. As such, it

has been analyzed from the financial report of Telstra that it has implemented some changes

its accounting framework for improving its financial condition in the international market

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(Kenny, 2009). The company operates globally and therefore need to comply with the

accounting policies of different countries and therefore mangers adopt some changes in the

accounting framework to impact the needs and expectations of stakeholders of different

countries (Telstra Annual Report, 2017).

The Australian corporations need to adopt AGAAP for developing the financial

reports. However, the company has also adapted to the USGAAP in order to improve its

competitive position in the US financial market. For example, it has provided comparative

information of two years under a single reporting period as per the USGAAP. In addition to

this, the company has also complies with the accounting principles of security commission of

the US. The complete information regarding the changes adopted in the accounting policies is

provided in the notes to financial statements section of the financial report of the company.

The company has adopted the changed accounting policies for satisfying the requirements of

USGAAP in regards to recognizing the revenue by adopting the ETIF 00-21 accounting

policies. However, the company has maintained in its annual report that there is no

materialistic impact of adopted the changes in its accounting framework on its financial

statements. The managers are also emphasizing on adopting the Australian equivalent of

IFRS (A-IFRS) for restating its comparative financial reports. The changes are however not

expected to be implemented on the disclosure of financial instruments that does not require

publishing the comparative information. The restatement of the financial information as per

the A-IFRS will require changes in the opening retained profits recorded at the beginning of

the comparative period. The company has also developed a project teams forecasting a

convergence between its AASB standards and A-IFRS standards. The team holds the

responsibility of monitoring and evaluating the progress made by the company in complying

with the A-IFRS standards (Mintz, 2013).

Section 3: Evaluate Accounting Strategy

The accounting strategies are developed for communicating the economic

performance of an entity to its stakeholders. The accounting strategy is developed by the

selected accounting policies and choices that an entity adopts for maintaining its

competitiveness and achieving long-term growth. The company operates in a highly

competitive telecom market and therefore need to implement the accounting strategies that

help it to compete effectively with its competitors. The major rival company of the Telstra in

Australian telecom market is TPG that is also involved in providing specialist telecom

7

accounting policies of different countries and therefore mangers adopt some changes in the

accounting framework to impact the needs and expectations of stakeholders of different

countries (Telstra Annual Report, 2017).

The Australian corporations need to adopt AGAAP for developing the financial

reports. However, the company has also adapted to the USGAAP in order to improve its

competitive position in the US financial market. For example, it has provided comparative

information of two years under a single reporting period as per the USGAAP. In addition to

this, the company has also complies with the accounting principles of security commission of

the US. The complete information regarding the changes adopted in the accounting policies is

provided in the notes to financial statements section of the financial report of the company.

The company has adopted the changed accounting policies for satisfying the requirements of

USGAAP in regards to recognizing the revenue by adopting the ETIF 00-21 accounting

policies. However, the company has maintained in its annual report that there is no

materialistic impact of adopted the changes in its accounting framework on its financial

statements. The managers are also emphasizing on adopting the Australian equivalent of

IFRS (A-IFRS) for restating its comparative financial reports. The changes are however not

expected to be implemented on the disclosure of financial instruments that does not require

publishing the comparative information. The restatement of the financial information as per

the A-IFRS will require changes in the opening retained profits recorded at the beginning of

the comparative period. The company has also developed a project teams forecasting a

convergence between its AASB standards and A-IFRS standards. The team holds the

responsibility of monitoring and evaluating the progress made by the company in complying

with the A-IFRS standards (Mintz, 2013).

Section 3: Evaluate Accounting Strategy

The accounting strategies are developed for communicating the economic

performance of an entity to its stakeholders. The accounting strategy is developed by the

selected accounting policies and choices that an entity adopts for maintaining its

competitiveness and achieving long-term growth. The company operates in a highly

competitive telecom market and therefore need to implement the accounting strategies that

help it to compete effectively with its competitors. The major rival company of the Telstra in

Australian telecom market is TPG that is also involved in providing specialist telecom

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

services to the country’s population group (Marley and Pedersen, 2015). TPG mainly

provides its services in the domestic market and therefore complies largely with the AASB

and Corporations Act 2001. The company has adopted the principle of consolidation and all

the other significant accounting policies to develop its financial reports as per the AASB

standards. On the other hand, Telstra provide its telecom services in the international market

and therefore develops its financial reports in accordance with the IFRS accounting policies.

However, the company have also adopted significant accounting norms for competing with

its rival companies in the domestic market such as TPG. The company prepares its

accounting statements on a going concern basis as per its rival company of TPG (TPG

Annual Report, 2017). The TPG has adopted the use of AASB standard 134 for interim

financial reporting. The Telstra also has adopted AASB 134 standard to maintain its

competitiveness in the domestic market also (Telstra Annual Report, 2017).

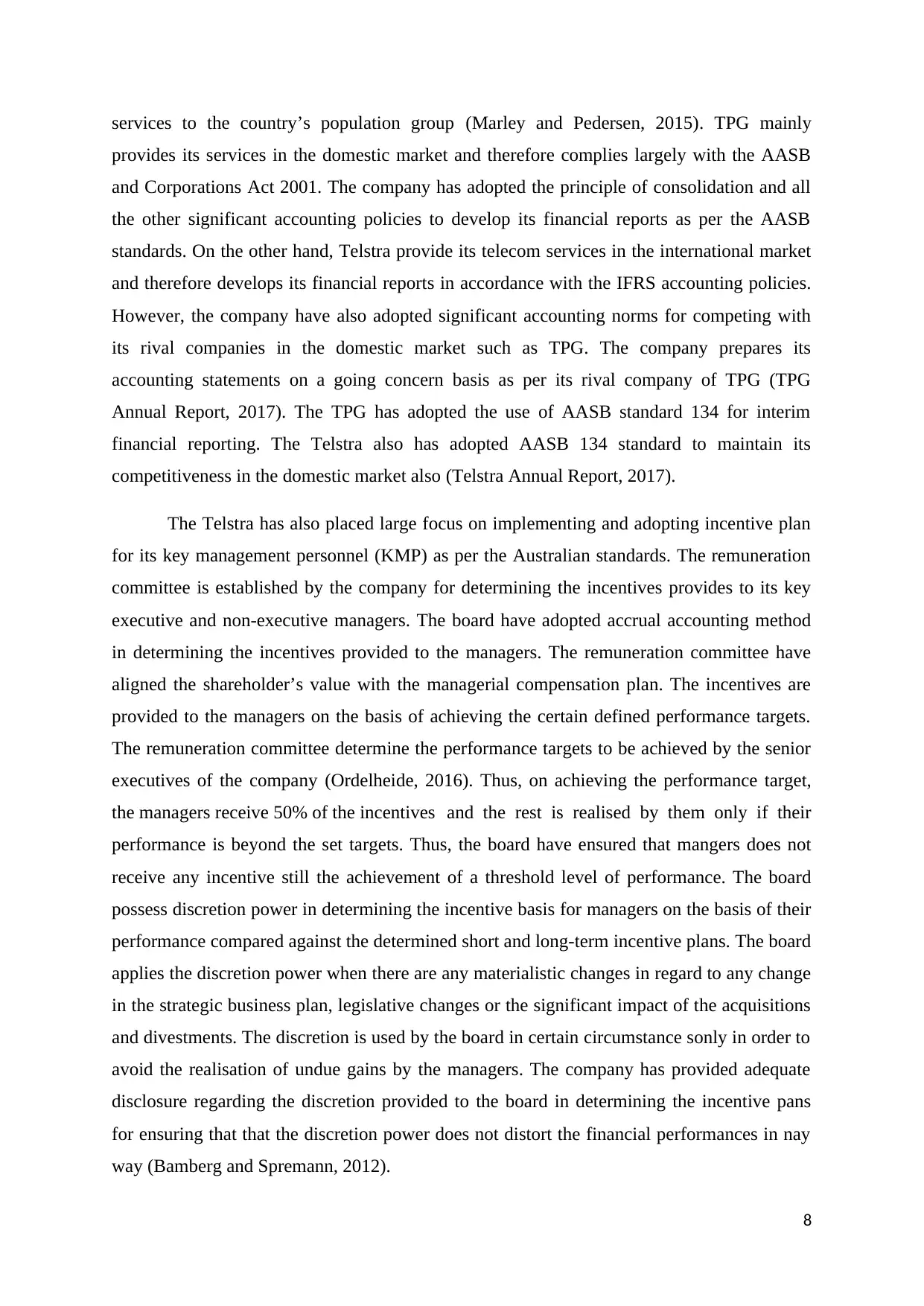

The Telstra has also placed large focus on implementing and adopting incentive plan

for its key management personnel (KMP) as per the Australian standards. The remuneration

committee is established by the company for determining the incentives provides to its key

executive and non-executive managers. The board have adopted accrual accounting method

in determining the incentives provided to the managers. The remuneration committee have

aligned the shareholder’s value with the managerial compensation plan. The incentives are

provided to the managers on the basis of achieving the certain defined performance targets.

The remuneration committee determine the performance targets to be achieved by the senior

executives of the company (Ordelheide, 2016). Thus, on achieving the performance target,

the managers receive 50% of the incentives and the rest is realised by them only if their

performance is beyond the set targets. Thus, the board have ensured that mangers does not

receive any incentive still the achievement of a threshold level of performance. The board

possess discretion power in determining the incentive basis for managers on the basis of their

performance compared against the determined short and long-term incentive plans. The board

applies the discretion power when there are any materialistic changes in regard to any change

in the strategic business plan, legislative changes or the significant impact of the acquisitions

and divestments. The discretion is used by the board in certain circumstance sonly in order to

avoid the realisation of undue gains by the managers. The company has provided adequate

disclosure regarding the discretion provided to the board in determining the incentive pans

for ensuring that that the discretion power does not distort the financial performances in nay

way (Bamberg and Spremann, 2012).

8

provides its services in the domestic market and therefore complies largely with the AASB

and Corporations Act 2001. The company has adopted the principle of consolidation and all

the other significant accounting policies to develop its financial reports as per the AASB

standards. On the other hand, Telstra provide its telecom services in the international market

and therefore develops its financial reports in accordance with the IFRS accounting policies.

However, the company have also adopted significant accounting norms for competing with

its rival companies in the domestic market such as TPG. The company prepares its

accounting statements on a going concern basis as per its rival company of TPG (TPG

Annual Report, 2017). The TPG has adopted the use of AASB standard 134 for interim

financial reporting. The Telstra also has adopted AASB 134 standard to maintain its

competitiveness in the domestic market also (Telstra Annual Report, 2017).

The Telstra has also placed large focus on implementing and adopting incentive plan

for its key management personnel (KMP) as per the Australian standards. The remuneration

committee is established by the company for determining the incentives provides to its key

executive and non-executive managers. The board have adopted accrual accounting method

in determining the incentives provided to the managers. The remuneration committee have

aligned the shareholder’s value with the managerial compensation plan. The incentives are

provided to the managers on the basis of achieving the certain defined performance targets.

The remuneration committee determine the performance targets to be achieved by the senior

executives of the company (Ordelheide, 2016). Thus, on achieving the performance target,

the managers receive 50% of the incentives and the rest is realised by them only if their

performance is beyond the set targets. Thus, the board have ensured that mangers does not

receive any incentive still the achievement of a threshold level of performance. The board

possess discretion power in determining the incentive basis for managers on the basis of their

performance compared against the determined short and long-term incentive plans. The board

applies the discretion power when there are any materialistic changes in regard to any change

in the strategic business plan, legislative changes or the significant impact of the acquisitions

and divestments. The discretion is used by the board in certain circumstance sonly in order to

avoid the realisation of undue gains by the managers. The company has provided adequate

disclosure regarding the discretion provided to the board in determining the incentive pans

for ensuring that that the discretion power does not distort the financial performances in nay

way (Bamberg and Spremann, 2012).

8

(Source: https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf-e/Annual-

Report-2017.PDF )

Section 4: Detailed analysis of the quality of disclosures under financial reporting

As per IAS 1: Presentation of financial statements every company has to prepare the

financial statements. These financial statements include income statements, statement of

financial position, statement of change in equity and statement of cash flow. In addition in to

making the financial statements there is requirement to submit the disclosures of accounting

policies, calculation of various items under the financial statements and other important

information. As per the accounting standards defined under the IFRS, every listed company is

obliged to produce the financial statements and provide the proper disclosures to it in the

form of notes to accounts. Disclosures requirements that have to be included in the notes to

accounts are given in accounting standards that company follows to prepare the financial

statements. In this section of section of report analysis of the disclosures made by the Telstra

in their annual report of year 2017 has been analyzed in detail (Telstra Annual Report, 2017).

Analysis of the disclosures made by the Telstra in their annual report seems to be

proper while comparing them with the requirement of each of the accounting standards.

Telstra produces their group financial statements that are in compliance with the US GAAP

9

Report-2017.PDF )

Section 4: Detailed analysis of the quality of disclosures under financial reporting

As per IAS 1: Presentation of financial statements every company has to prepare the

financial statements. These financial statements include income statements, statement of

financial position, statement of change in equity and statement of cash flow. In addition in to

making the financial statements there is requirement to submit the disclosures of accounting

policies, calculation of various items under the financial statements and other important

information. As per the accounting standards defined under the IFRS, every listed company is

obliged to produce the financial statements and provide the proper disclosures to it in the

form of notes to accounts. Disclosures requirements that have to be included in the notes to

accounts are given in accounting standards that company follows to prepare the financial

statements. In this section of section of report analysis of the disclosures made by the Telstra

in their annual report of year 2017 has been analyzed in detail (Telstra Annual Report, 2017).

Analysis of the disclosures made by the Telstra in their annual report seems to be

proper while comparing them with the requirement of each of the accounting standards.

Telstra produces their group financial statements that are in compliance with the US GAAP

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

and Australian GAAP because company is listed on both the stock exchange. Looking at the

annual report it has been found that complete information regarding the changes made in the

accounting has been included in the disclosures requirement (Telstra Annual Report, 2017).

Footnotes refers to information given under each of the financial statements that

provided information of what accounting standards have been used to prepare that particular

financial statements. For example, in preparing the financial statement of balance sheet, there

is requirement to include the footnotes regarding any contingent liabilities and other related

matter. So it can be said that company complies with the adequacy of the disclosures of the

footnotes to the financial statements (Telstra Annual Report, 2017).

On evaluating the notes to accounts of the Telstra in annual report of year 2017, it has

been found that there has been disclosure of each note that are required to be included as per

defined accounting standards. Disclosures made by the Telstra needs to be in compliance

with the performance of the company. It means notes to financial statements should reflect

the current performance of the company effectively and efficiently. It has been seen from the

financial statements that current financial position of the company was good and same can be

reflected under the notes to accounts also. For example, notes to accounts related to the

segment disclosures provide the profit position of each of segment that company have. This

information explains how company has performance during the year in each of its segment

(Telstra Annual Report, 2017).

Telstra Company has to comply with the US GAAP and Australian GAAP to produce

their financial statements. In the annual report it is clearly mentioned that company has used

the proper accounting guidelines to produce the financial reports that complies with

requirement of both US GAAP and Australian GAAP (Horngren, et al., 2012). Both US

GAAP and Australian GAAP are taken from the international accounting standards. Both

these GAAPs aim to provide the qualitative information to the people at large that use the

annual report to make the various decisions. So it can be said that GAAPs represents the

financial performance of the company and also tries make the financial information easy to

understand. In this regards it can be said that GAAPs helps to reflect the appropriate

measurement of key measures of success and also assures proper disclosures (Telstra Annual

Report, 2017).

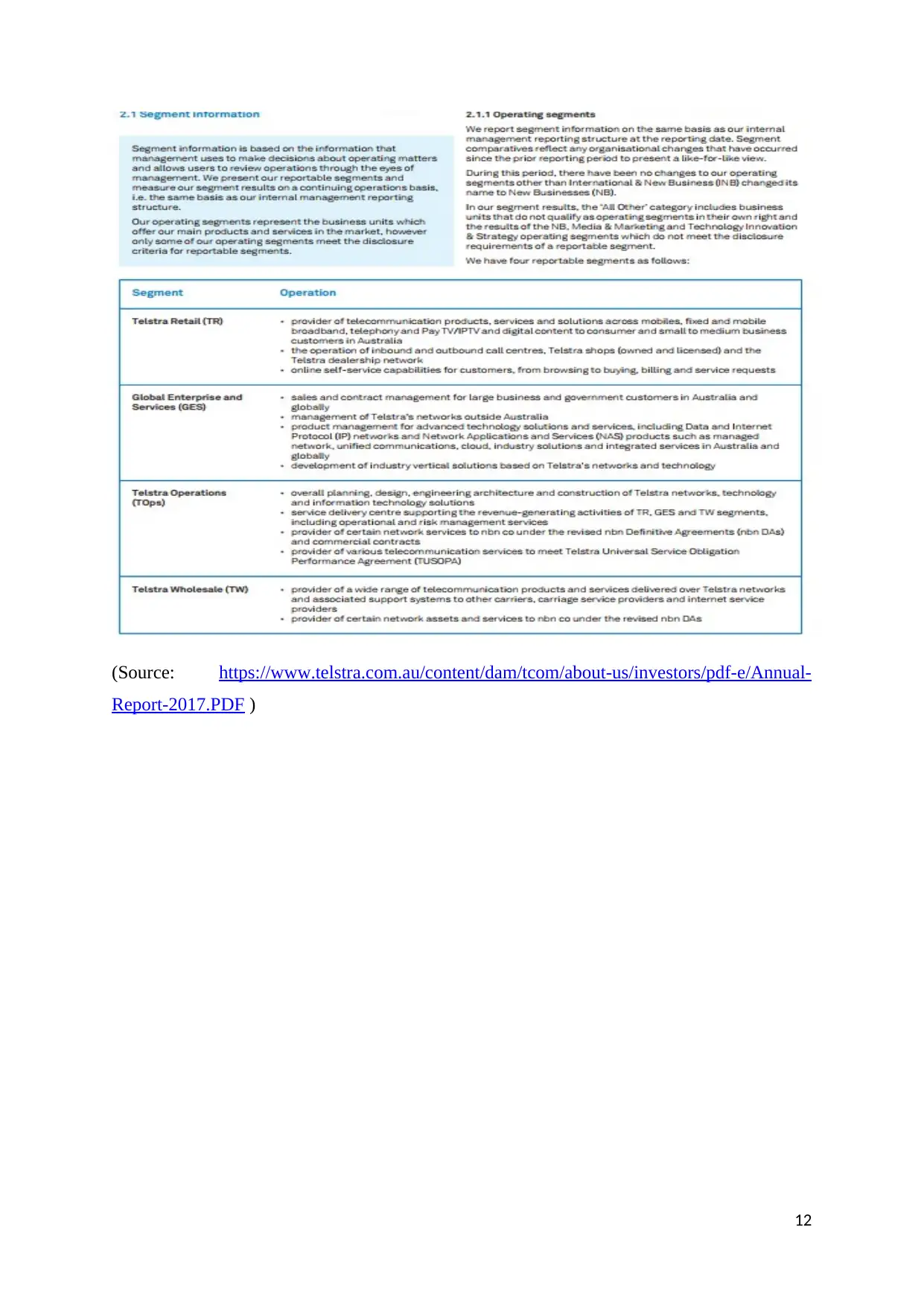

Segment disclosures means information provided for the various segments under the

notes to accounts. The business segment refers to part of the company which can be identified

10

annual report it has been found that complete information regarding the changes made in the

accounting has been included in the disclosures requirement (Telstra Annual Report, 2017).

Footnotes refers to information given under each of the financial statements that

provided information of what accounting standards have been used to prepare that particular

financial statements. For example, in preparing the financial statement of balance sheet, there

is requirement to include the footnotes regarding any contingent liabilities and other related

matter. So it can be said that company complies with the adequacy of the disclosures of the

footnotes to the financial statements (Telstra Annual Report, 2017).

On evaluating the notes to accounts of the Telstra in annual report of year 2017, it has

been found that there has been disclosure of each note that are required to be included as per

defined accounting standards. Disclosures made by the Telstra needs to be in compliance

with the performance of the company. It means notes to financial statements should reflect

the current performance of the company effectively and efficiently. It has been seen from the

financial statements that current financial position of the company was good and same can be

reflected under the notes to accounts also. For example, notes to accounts related to the

segment disclosures provide the profit position of each of segment that company have. This

information explains how company has performance during the year in each of its segment

(Telstra Annual Report, 2017).

Telstra Company has to comply with the US GAAP and Australian GAAP to produce

their financial statements. In the annual report it is clearly mentioned that company has used

the proper accounting guidelines to produce the financial reports that complies with

requirement of both US GAAP and Australian GAAP (Horngren, et al., 2012). Both US

GAAP and Australian GAAP are taken from the international accounting standards. Both

these GAAPs aim to provide the qualitative information to the people at large that use the

annual report to make the various decisions. So it can be said that GAAPs represents the

financial performance of the company and also tries make the financial information easy to

understand. In this regards it can be said that GAAPs helps to reflect the appropriate

measurement of key measures of success and also assures proper disclosures (Telstra Annual

Report, 2017).

Segment disclosures means information provided for the various segments under the

notes to accounts. The business segment refers to part of the company which can be identified

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

by its products and produces separate books of account. Segments are dividend on the basis

of the business location, products and services they deliver and profit deliver by them.

Segment disclosure has been included on page 77 of the annual report of year 2017. The

various operating segments of the Telstra are as under:

Telstra Retail: This segment provides telecommunication products and services and

other solutions of mobiles.

Global Enterprises and Services (GES): This business segment in made for managing

the sales and contract management for large business and government customers in

Australia and in other nations.

Telstra Operations (TOps): This business segment is designed for overall planning,

design, engineering architecture and construction of Telstra telephone networks,

technology, and similar work.

Telstra Wholesale: This unit delivers the telecommunication products and other

services over thousands of Telstra Network and other telecommunication network

carrier companies (Telstra Annual Report, 2017).

Company discloses detailed information regarding the segments in the following manner:

11

of the business location, products and services they deliver and profit deliver by them.

Segment disclosure has been included on page 77 of the annual report of year 2017. The

various operating segments of the Telstra are as under:

Telstra Retail: This segment provides telecommunication products and services and

other solutions of mobiles.

Global Enterprises and Services (GES): This business segment in made for managing

the sales and contract management for large business and government customers in

Australia and in other nations.

Telstra Operations (TOps): This business segment is designed for overall planning,

design, engineering architecture and construction of Telstra telephone networks,

technology, and similar work.

Telstra Wholesale: This unit delivers the telecommunication products and other

services over thousands of Telstra Network and other telecommunication network

carrier companies (Telstra Annual Report, 2017).

Company discloses detailed information regarding the segments in the following manner:

11

(Source: https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf-e/Annual-

Report-2017.PDF )

12

Report-2017.PDF )

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.