Financial Accounting Report: Telstra Corporation Analysis

VerifiedAdded on 2022/12/30

|6

|860

|96

Report

AI Summary

This report analyzes Telstra Corporation's 2018 annual report, addressing specific accounting aspects. It begins by calculating the percentage of total assets comprised of intangible assets, which was found to be 21.41% of total assets, with key components including goodwill, licenses, software assets, and other intangible assets. The report then details the impairment losses recognized during the year, totaling $568 million, allocated across various asset categories like goodwill, software assets, and tangible assets such as buildings and communication assets. These losses were recognized because the carrying value of assets exceeded their recoverable amounts, reflecting the dynamic nature of the industry and the judgments involved in assessing future cash flows. Finally, the report notes that Telstra did not revalue any tangible or intangible assets during the year ended June 30, 2018.

Running head: COMPANY ACCOUNTING

Company accounting

Name of the student

Name of the university

Student ID

Author note

Company accounting

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1COMPANY ACCOUNTING

Table of Contents

Answer (a)..................................................................................................................................2

Answer (b)..................................................................................................................................2

Answer (c)..................................................................................................................................4

Reference....................................................................................................................................5

Table of Contents

Answer (a)..................................................................................................................................2

Answer (b)..................................................................................................................................2

Answer (c)..................................................................................................................................4

Reference....................................................................................................................................5

2COMPANY ACCOUNTING

Answer (a)

Intangible asset is the asset that does not have any physical substance. Examples for

intangible assets are patent, goodwill, copyrights, intellectual property and software. An

intangible asset may be segregated into the one that has definite life value and the one that

gas indefinite life value. For instance, brand value is considered to have indefinite life value

as it remains with the entity for its lifetime. On the contrary, legal agreement on patent can be

considered as the intangible asset with definite life value as legal agreement on patent is

made for definite time periods say 10 years or 20 years (Crema & Nosella, 2014).

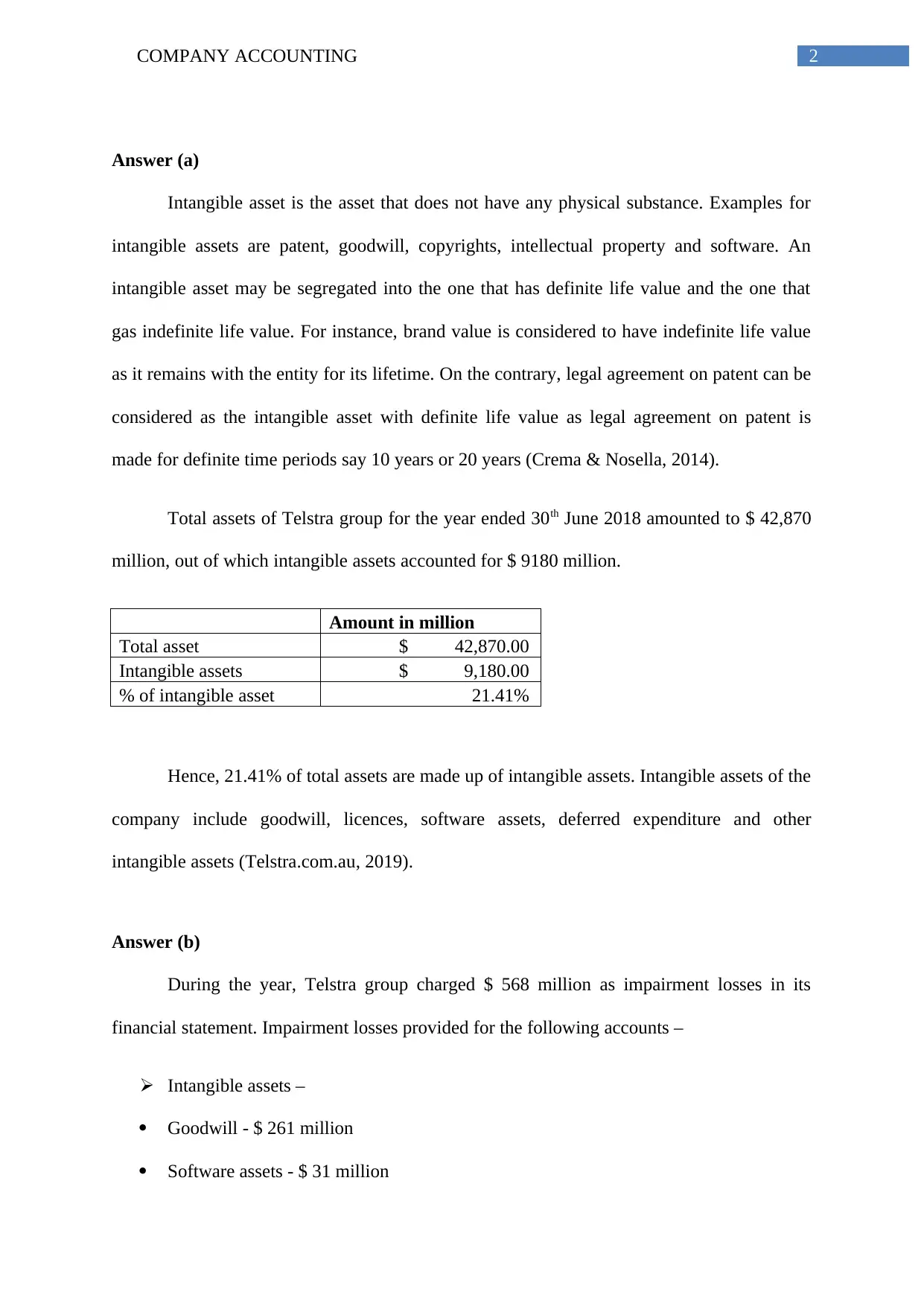

Total assets of Telstra group for the year ended 30th June 2018 amounted to $ 42,870

million, out of which intangible assets accounted for $ 9180 million.

Amount in million

Total asset $ 42,870.00

Intangible assets $ 9,180.00

% of intangible asset 21.41%

Hence, 21.41% of total assets are made up of intangible assets. Intangible assets of the

company include goodwill, licences, software assets, deferred expenditure and other

intangible assets (Telstra.com.au, 2019).

Answer (b)

During the year, Telstra group charged $ 568 million as impairment losses in its

financial statement. Impairment losses provided for the following accounts –

Intangible assets –

Goodwill - $ 261 million

Software assets - $ 31 million

Answer (a)

Intangible asset is the asset that does not have any physical substance. Examples for

intangible assets are patent, goodwill, copyrights, intellectual property and software. An

intangible asset may be segregated into the one that has definite life value and the one that

gas indefinite life value. For instance, brand value is considered to have indefinite life value

as it remains with the entity for its lifetime. On the contrary, legal agreement on patent can be

considered as the intangible asset with definite life value as legal agreement on patent is

made for definite time periods say 10 years or 20 years (Crema & Nosella, 2014).

Total assets of Telstra group for the year ended 30th June 2018 amounted to $ 42,870

million, out of which intangible assets accounted for $ 9180 million.

Amount in million

Total asset $ 42,870.00

Intangible assets $ 9,180.00

% of intangible asset 21.41%

Hence, 21.41% of total assets are made up of intangible assets. Intangible assets of the

company include goodwill, licences, software assets, deferred expenditure and other

intangible assets (Telstra.com.au, 2019).

Answer (b)

During the year, Telstra group charged $ 568 million as impairment losses in its

financial statement. Impairment losses provided for the following accounts –

Intangible assets –

Goodwill - $ 261 million

Software assets - $ 31 million

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3COMPANY ACCOUNTING

Other intangible assets - $ 5 million

Tangible assets –

Buildings - $ 4 million

Communication assets – $ 9 million

Other plant, equipment and motor vehicle - $ 7 million

Trade and other receivables - $ 219 million (Telstra.com.au, 2019).

Impairment loss is charged when the carrying value of the above mentioned assets

exceeded their recoverable amount. All the non-current tangible assets are reviewed for the

purpose of impairment if any event or any change in the circumstances signals that carrying

amount of the assets may not be recoverable. Recoverable value of the asses is the higher

among its value in use and the fair value after deducting the disposal costs thereon

(Aasb.gov.au, 2019). Further, as the goodwill and other intangible assets with the indefinite

useful life are not subject to the amortisation they are assessed for the purpose of impairment

at least once in a year or whenever any indication arises for impairment. The impairment loss

amount is reported under reporting period of income statement when carrying amount of the

assets exceeds its recoverable value (Telstra.com.au, 2019).

Considering the dynamic nature of industry under which Telstra Group operates its

business, risk is there that material impairment to the goodwill and other intangible and

tangible assets may take place. While determining whether there is an indication of

impairment associated with cash generating unit or other assets, it involves significant

judgement regarding future plans and cash flows for these CGUs and assets (Linnenluecke et

al., 2015). The entity evaluates the impairment computation of the assets including testing of

recoverable amount for each of the CGU where indication is there for impairment or

significant account balances are there for goodwill or for intangible assets with indefinite life.

Further, for computing impairment loss the group assessed reasonableness of cash flows

Other intangible assets - $ 5 million

Tangible assets –

Buildings - $ 4 million

Communication assets – $ 9 million

Other plant, equipment and motor vehicle - $ 7 million

Trade and other receivables - $ 219 million (Telstra.com.au, 2019).

Impairment loss is charged when the carrying value of the above mentioned assets

exceeded their recoverable amount. All the non-current tangible assets are reviewed for the

purpose of impairment if any event or any change in the circumstances signals that carrying

amount of the assets may not be recoverable. Recoverable value of the asses is the higher

among its value in use and the fair value after deducting the disposal costs thereon

(Aasb.gov.au, 2019). Further, as the goodwill and other intangible assets with the indefinite

useful life are not subject to the amortisation they are assessed for the purpose of impairment

at least once in a year or whenever any indication arises for impairment. The impairment loss

amount is reported under reporting period of income statement when carrying amount of the

assets exceeds its recoverable value (Telstra.com.au, 2019).

Considering the dynamic nature of industry under which Telstra Group operates its

business, risk is there that material impairment to the goodwill and other intangible and

tangible assets may take place. While determining whether there is an indication of

impairment associated with cash generating unit or other assets, it involves significant

judgement regarding future plans and cash flows for these CGUs and assets (Linnenluecke et

al., 2015). The entity evaluates the impairment computation of the assets including testing of

recoverable amount for each of the CGU where indication is there for impairment or

significant account balances are there for goodwill or for intangible assets with indefinite life.

Further, for computing impairment loss the group assessed reasonableness of cash flows

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4COMPANY ACCOUNTING

projections approved by the board and used the same for impairment as well as for measuring

reliability of forecasting for historical cash flows (Bond, Govendir & Wells, 2016).

Answer (c)

For the year ended 30th June 2018, Telstra group did not re-valued any of its tangible

as well as intangible assets (Telstra.com.au, 2019).

projections approved by the board and used the same for impairment as well as for measuring

reliability of forecasting for historical cash flows (Bond, Govendir & Wells, 2016).

Answer (c)

For the year ended 30th June 2018, Telstra group did not re-valued any of its tangible

as well as intangible assets (Telstra.com.au, 2019).

5COMPANY ACCOUNTING

Reference

Aasb.gov.au. (2019). Retrieved 4 May 2019, from

https://www.aasb.gov.au/admin/file/content102/c3/AASB136_07-

04_ERDRjun10_07-09.pdf

Bond, D., Govendir, B., & Wells, P. (2016). An evaluation of asset impairments by

Australian firms and whether they were impacted by AASB 136. Accounting &

Finance, 56(1), 259-288.

Crema, M., & Nosella, A. (2014). Intangible assets management and evaluation: Evidence

from SMEs. Engineering Management Journal, 26(1), 8-20.

Linnenluecke, M. K., Birt, J., Lyon, J., & Sidhu, B. K. (2015). Planetary boundaries:

implications for asset impairment. Accounting & Finance, 55(4), 911-929.

Telstra.com.au. (2019). Retrieved 4 May 2019, from

https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf%20F/2018-

Annual-Report.pdf

Reference

Aasb.gov.au. (2019). Retrieved 4 May 2019, from

https://www.aasb.gov.au/admin/file/content102/c3/AASB136_07-

04_ERDRjun10_07-09.pdf

Bond, D., Govendir, B., & Wells, P. (2016). An evaluation of asset impairments by

Australian firms and whether they were impacted by AASB 136. Accounting &

Finance, 56(1), 259-288.

Crema, M., & Nosella, A. (2014). Intangible assets management and evaluation: Evidence

from SMEs. Engineering Management Journal, 26(1), 8-20.

Linnenluecke, M. K., Birt, J., Lyon, J., & Sidhu, B. K. (2015). Planetary boundaries:

implications for asset impairment. Accounting & Finance, 55(4), 911-929.

Telstra.com.au. (2019). Retrieved 4 May 2019, from

https://www.telstra.com.au/content/dam/tcom/about-us/investors/pdf%20F/2018-

Annual-Report.pdf

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.