Telstra's Market Structure: An Economic Report on Pricing and Profit

VerifiedAdded on 2023/06/10

|5

|685

|58

Report

AI Summary

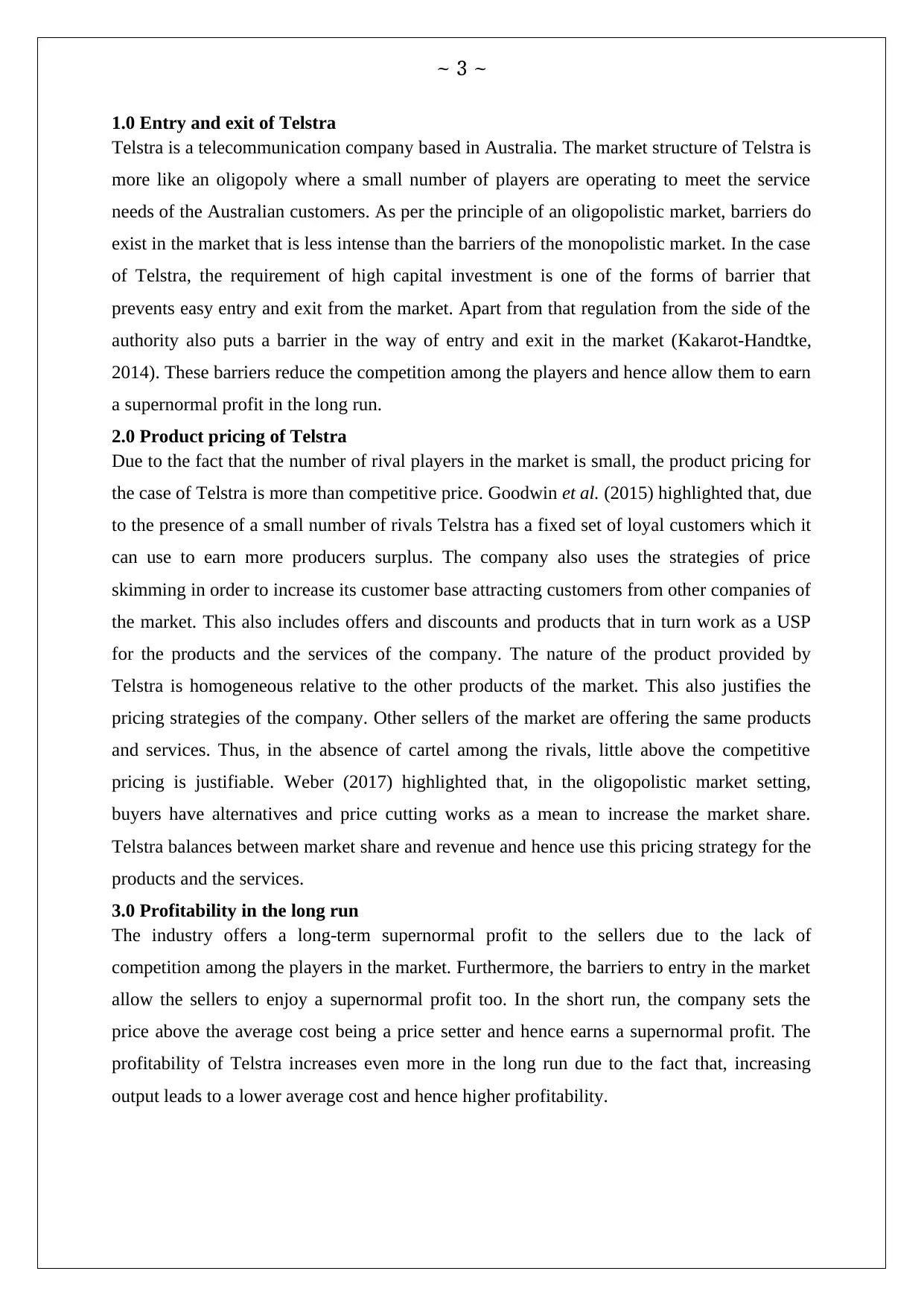

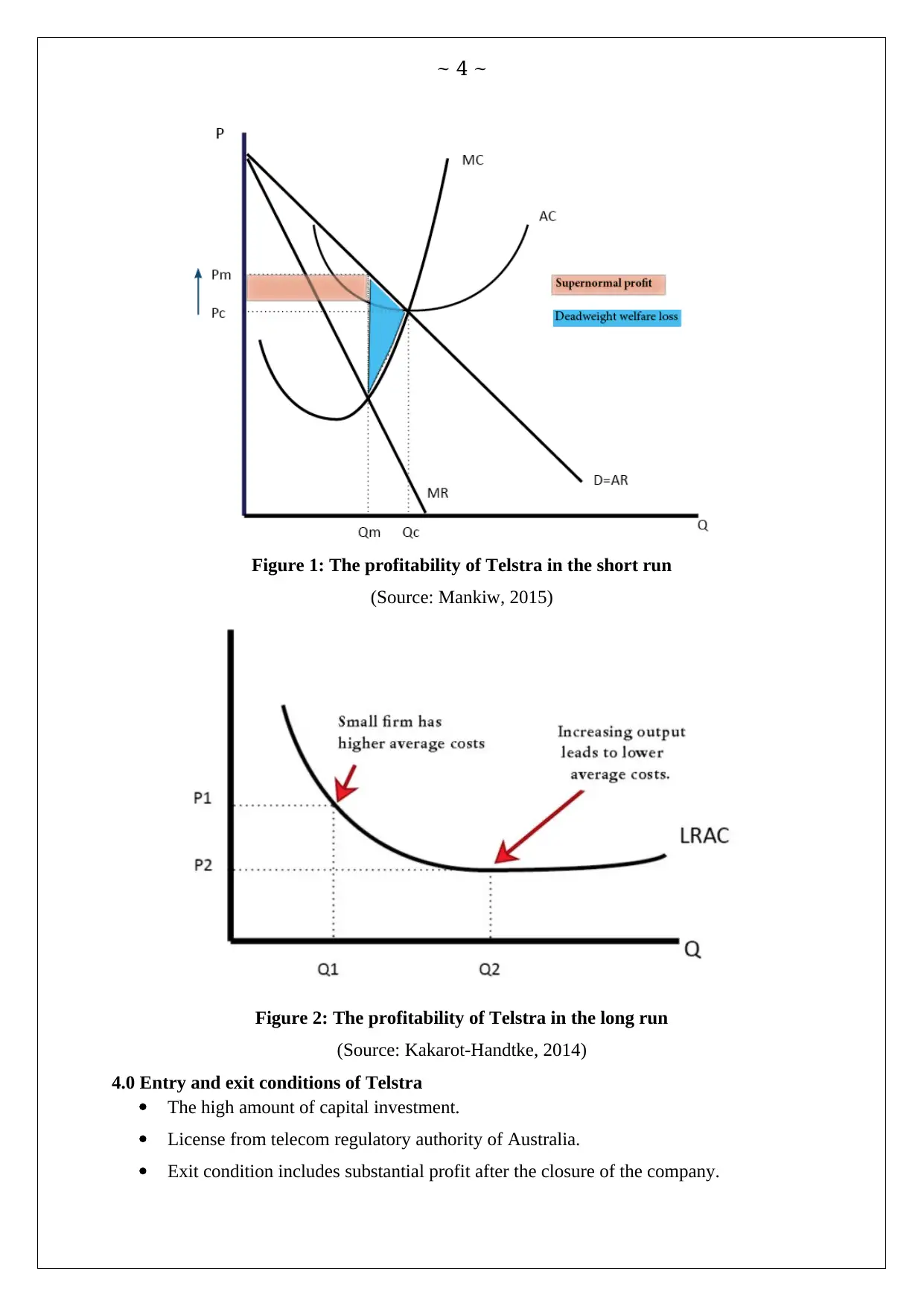

This report provides an economic analysis of Telstra, an Australian telecommunications company, operating in an oligopolistic market. It examines the conditions for entry and exit, noting the high capital investment and regulatory requirements that create barriers. The report discusses Telstra's product pricing strategies, including price skimming and competitive pricing relative to its rivals, considering the homogeneous nature of the services offered. It further analyzes Telstra's profitability, highlighting the potential for long-term supernormal profits due to limited competition and barriers to entry. Figures illustrating short-run and long-run profitability are referenced, with the report concluding by outlining the key entry and exit conditions for Telstra within the Australian telecommunications market. Desklib offers more solved assignments and past papers for students.

1 out of 5

![Economic Principles Assignment Solutions - [University Name]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fcu%2F2eeacc6c3d2f4a81a24641da89a141db.jpg&w=256&q=75)

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)