Financial Decision Making and Risk Management at Tesco: A Report

VerifiedAdded on 2020/06/04

|20

|4813

|43

Report

AI Summary

This report provides a detailed analysis of Tesco's financial decision-making processes, risk management strategies, and the challenges and opportunities facing the company. It begins with an introduction to Tesco, outlining its aims, and then identifies the opportunities and threats it faces in the market, including competition from rivals like Lidl and Aldi, economic factors, and political regulations. The report then delves into the various risks Tesco faces, including performance risk, reputation risk, and political and economic risks, providing a risk register and potential mitigation strategies. The analysis covers both internal and external factors affecting Tesco's performance. The report emphasizes the importance of risk management in the retail sector, offering insights into how Tesco can improve its financial performance and maintain its market position. The conclusion summarizes the key findings and recommendations.

FINANCIAL DECISION MAKING FOR

CREATIVE PROJECTS AND EVENTS

CREATIVE PROJECTS AND EVENTS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

Introduction to company..............................................................................................................3

Aims of organization....................................................................................................................4

Opportunities and threat for the company...................................................................................4

Risk in business............................................................................................................................5

RISK REGISTER........................................................................................................................9

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION...........................................................................................................................3

Introduction to company..............................................................................................................3

Aims of organization....................................................................................................................4

Opportunities and threat for the company...................................................................................4

Risk in business............................................................................................................................5

RISK REGISTER........................................................................................................................9

CONCLUSION..............................................................................................................................18

REFERENCES..............................................................................................................................19

INTRODUCTION

Risk management is one of the main domain on which currently firms are focusing in order to manage wide range of risks.

Risk is the factor that always affect business firms to great extent. There are number of factors that internally and externally affect the

company business performance. It is very important to identify rate at which above mentioned factors are affecting the venture in

terms of risk. In the present research study threats and opportunities that are associated with the enterprise will be identified. Apart

from this, control mechanism that is followed by the firm to control the situation will be identified. Calculation of risk will be done

and on that basis risk register will be prepared in the report. On the basis of obtained results mitigation strategy will be developed so

that situation can be controlled is risk is increasing at rapid pace in the business. Tesco is following specific structure through which

risk is managed in the business. Under this, there are few managers that are in the risk management team. These managers consistently

monitor business environment and whenever required, steps are taken to handle specific risk to which firm is exposed. It can be said

that there is strong risk management mechanism in the firm.

Introduction to company

Tesco is the one of the largest retail chain in the UK as it expands its business consistently on yearly basis. From the last few

years it is observed that firm business does not expand at fast rate as it is facing heavy loss in its business. Two small rival firms Lidl

and Aldi are giving tough challenges to the business firm (Almeida and Williams, 2016)

. These firms are offering products at very low price in the market relative to Tesco and due to this reason they are giving tough

competition to the Tesco. It can be said that firm currently facing huge problems in its business . It needs to make changes in its

business in terms of restructuring and using analytic tools to improve business performance. As part of risk management strategy firm

is focusing on shutting down stores that are not profitable for the firm. By doing so, company is reducing cost in its business. It can be

said that by constructing relevant strategy it is improving its business performance. Price reduction consistently in the business is

another factor that lead to decline in earned profit in the business. This is another risk to which firm is currently exposed. Top

management needs to manage relevant risk in business to earn profit.

3 | P a g e

Risk management is one of the main domain on which currently firms are focusing in order to manage wide range of risks.

Risk is the factor that always affect business firms to great extent. There are number of factors that internally and externally affect the

company business performance. It is very important to identify rate at which above mentioned factors are affecting the venture in

terms of risk. In the present research study threats and opportunities that are associated with the enterprise will be identified. Apart

from this, control mechanism that is followed by the firm to control the situation will be identified. Calculation of risk will be done

and on that basis risk register will be prepared in the report. On the basis of obtained results mitigation strategy will be developed so

that situation can be controlled is risk is increasing at rapid pace in the business. Tesco is following specific structure through which

risk is managed in the business. Under this, there are few managers that are in the risk management team. These managers consistently

monitor business environment and whenever required, steps are taken to handle specific risk to which firm is exposed. It can be said

that there is strong risk management mechanism in the firm.

Introduction to company

Tesco is the one of the largest retail chain in the UK as it expands its business consistently on yearly basis. From the last few

years it is observed that firm business does not expand at fast rate as it is facing heavy loss in its business. Two small rival firms Lidl

and Aldi are giving tough challenges to the business firm (Almeida and Williams, 2016)

. These firms are offering products at very low price in the market relative to Tesco and due to this reason they are giving tough

competition to the Tesco. It can be said that firm currently facing huge problems in its business . It needs to make changes in its

business in terms of restructuring and using analytic tools to improve business performance. As part of risk management strategy firm

is focusing on shutting down stores that are not profitable for the firm. By doing so, company is reducing cost in its business. It can be

said that by constructing relevant strategy it is improving its business performance. Price reduction consistently in the business is

another factor that lead to decline in earned profit in the business. This is another risk to which firm is currently exposed. Top

management needs to manage relevant risk in business to earn profit.

3 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Aims of organization

There are following aims of the business firms and some of them are given below.

To grow market share in the FY 2017 by 10%.

To cut cost growth rate by 5%.

To make innovation in business and streamlining business operations for cost optimization and giving better services to the

customers (Hopkin, 2017).

On analysis of aims of Tesco it can be observed that firm is fully committed towards controlling cost of its products and services. In

this regard it is prepared to take number of steps and aims at reducing cost in the business so that profit amount can be increased for

the upcoming year. Main aim of the business firm is to accelerate its growth rate by 10% on yearly basis. There are some areas where

firm is currently focusing for sustainability such as, training and development of employees. Tesco aimed at act as responsibly for

community. In this regard it is taking number of steps so that confidence of customers can be gained back. In past years number of

cases were charged on the firm in respect to performance of unethical acts in business. Horse meat case is one of the example that is

quite popular in respect to business firm. Such kind of cases heavily damage firm image. Due to this reason firm aimed to become

responsible entity towards community.

Opportunities and threat for the company

Opportunities for Tesco

In the different countries where the company might be under-performing, there they have opportunities for making ventures

with other companies where the local organization will help to do proper marketing research and intelligence to enhance

performance in such areas (Finch, 2014).

They have very big opportunity to increase online shopping where they can able to serve their good and service on the virtual

basis and able to increase their sales for the company and they can offer home delivery service to that area where home deliver

is difficult which help them to gain competitive advantage.

4 | P a g e

There are following aims of the business firms and some of them are given below.

To grow market share in the FY 2017 by 10%.

To cut cost growth rate by 5%.

To make innovation in business and streamlining business operations for cost optimization and giving better services to the

customers (Hopkin, 2017).

On analysis of aims of Tesco it can be observed that firm is fully committed towards controlling cost of its products and services. In

this regard it is prepared to take number of steps and aims at reducing cost in the business so that profit amount can be increased for

the upcoming year. Main aim of the business firm is to accelerate its growth rate by 10% on yearly basis. There are some areas where

firm is currently focusing for sustainability such as, training and development of employees. Tesco aimed at act as responsibly for

community. In this regard it is taking number of steps so that confidence of customers can be gained back. In past years number of

cases were charged on the firm in respect to performance of unethical acts in business. Horse meat case is one of the example that is

quite popular in respect to business firm. Such kind of cases heavily damage firm image. Due to this reason firm aimed to become

responsible entity towards community.

Opportunities and threat for the company

Opportunities for Tesco

In the different countries where the company might be under-performing, there they have opportunities for making ventures

with other companies where the local organization will help to do proper marketing research and intelligence to enhance

performance in such areas (Finch, 2014).

They have very big opportunity to increase online shopping where they can able to serve their good and service on the virtual

basis and able to increase their sales for the company and they can offer home delivery service to that area where home deliver

is difficult which help them to gain competitive advantage.

4 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

There have opportunities for market of private label.

Rising markets still have large number chance for some retail outlets that the organization already serve which can provide

better right to the western goods which fulfill their needs and wants (Woods, 2017).

The company have opportunities to make strategical alliances with other organization and loved companies to serve large

number of products which help them to attract large consumers in their target market.

Threat for Tesco

Different credit crunches and economic recessions and will proceed to reduce the market share, profitability and productivity

in all the places around the world, decrease the size and number of selling to the consumers.

There are large number of competitor such as Salisbury will provide threats from the global retail giants which may serve

different goods and services at lower prices and greater variety. The competitor may serve more constituted international

supply chain networks to transfer the goods more faster than Tesco because the competitor are more innovative and know how

to do effective use application.

Food prices are on the growth around the world, which will reduces what consumers buying and how much disposable income

they have available.

There is large labor threats for increased benefits and wages in all over the globe add to Tesco cost basis, which will puts

impact on its strategies for pricing (Beck, 2017).

The political landscape and the government regulations and is also putting impact on the company such as high tax rate and

high interest rate. Different laws that company need to follow which increase their expenses.

Risk in business

Tesco is facing lots of risk related to their performance, reputation, economic and political. As seen in the recent months,

Tesco is facing problems related to the flagging sales growth. The organization has three major risk, that are as follows:

Performance risk

5 | P a g e

Rising markets still have large number chance for some retail outlets that the organization already serve which can provide

better right to the western goods which fulfill their needs and wants (Woods, 2017).

The company have opportunities to make strategical alliances with other organization and loved companies to serve large

number of products which help them to attract large consumers in their target market.

Threat for Tesco

Different credit crunches and economic recessions and will proceed to reduce the market share, profitability and productivity

in all the places around the world, decrease the size and number of selling to the consumers.

There are large number of competitor such as Salisbury will provide threats from the global retail giants which may serve

different goods and services at lower prices and greater variety. The competitor may serve more constituted international

supply chain networks to transfer the goods more faster than Tesco because the competitor are more innovative and know how

to do effective use application.

Food prices are on the growth around the world, which will reduces what consumers buying and how much disposable income

they have available.

There is large labor threats for increased benefits and wages in all over the globe add to Tesco cost basis, which will puts

impact on its strategies for pricing (Beck, 2017).

The political landscape and the government regulations and is also putting impact on the company such as high tax rate and

high interest rate. Different laws that company need to follow which increase their expenses.

Risk in business

Tesco is facing lots of risk related to their performance, reputation, economic and political. As seen in the recent months,

Tesco is facing problems related to the flagging sales growth. The organization has three major risk, that are as follows:

Performance risk

5 | P a g e

They have three danger to their performance that is risk is at business units, under-performing against the plan and against the

competitor (Almeida and Williams, 2016). All over the Tesco is not able to achieve and implement their strategies. As compare to

their rivals, they are not able to achieve the customer loyalty and satisfaction. Hence, Tesco is at economy downfall so reducing that

risk Tesco need to plan their objective and strategies which should be clear and achievable. They should provide reward to the

employees who are working effectively so that they can able to work in motivate way and able to improve their performance.

Secondly the executive should monitor the performance of the employees on regular basis so that if the employee are not working

properly they can provide suitable training which enhance their skill and then they can able to work in an effective way.

Tesco can able to increase their performance by enhancing the skills and knowledge of the employees. Organization

performance is totally based on the workers and manager performance, if they are working in effective and efficient way then only the

performance of Tesco will enhance. The company need to provide special training and development program to their employee and

manager so that they can able to learn the working environment of organization. Tesco need to adopt different changes so that they

can able to gain competitive advantage. They need to provide change management training to their employee which help them to

adopt the different internal as well as external change and reduce the stress which occur due to change. These all techniques will help

the organization to enhance their performance and will reduce their risk.

Reputation risk

Tesco have reputation risk where their brand is facing low image in the minds of consumer. The company brand is huge which

covers furniture, groceries, financial services and catalog selling but on the other side they are facing large downfalls, they fail to

protect their brand and reputation which leads to loss of confidence and trust (Hopkin, 2017). These all circumstances reduce the

customer base and their ability to retain and recruit good people in the organization. This failure leads to decrease their productivity

and profitability of the company, as the effective people are not in the organization. Tesco need to recruit large qualified and

experience individual so that they can able to produce large good and will able to fulfill customers orders on time. The values of the

6 | P a g e

competitor (Almeida and Williams, 2016). All over the Tesco is not able to achieve and implement their strategies. As compare to

their rivals, they are not able to achieve the customer loyalty and satisfaction. Hence, Tesco is at economy downfall so reducing that

risk Tesco need to plan their objective and strategies which should be clear and achievable. They should provide reward to the

employees who are working effectively so that they can able to work in motivate way and able to improve their performance.

Secondly the executive should monitor the performance of the employees on regular basis so that if the employee are not working

properly they can provide suitable training which enhance their skill and then they can able to work in an effective way.

Tesco can able to increase their performance by enhancing the skills and knowledge of the employees. Organization

performance is totally based on the workers and manager performance, if they are working in effective and efficient way then only the

performance of Tesco will enhance. The company need to provide special training and development program to their employee and

manager so that they can able to learn the working environment of organization. Tesco need to adopt different changes so that they

can able to gain competitive advantage. They need to provide change management training to their employee which help them to

adopt the different internal as well as external change and reduce the stress which occur due to change. These all techniques will help

the organization to enhance their performance and will reduce their risk.

Reputation risk

Tesco have reputation risk where their brand is facing low image in the minds of consumer. The company brand is huge which

covers furniture, groceries, financial services and catalog selling but on the other side they are facing large downfalls, they fail to

protect their brand and reputation which leads to loss of confidence and trust (Hopkin, 2017). These all circumstances reduce the

customer base and their ability to retain and recruit good people in the organization. This failure leads to decrease their productivity

and profitability of the company, as the effective people are not in the organization. Tesco need to recruit large qualified and

experience individual so that they can able to produce large good and will able to fulfill customers orders on time. The values of the

6 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

organization are not clear in the minds of the employees, they are not aware about the core principle and ethics which leads bad

practices at every level specifically governance communities guiding and monitoring policies.

Tesco does not have proper communication with its stakeholder so they are not able to engage properly with them. Every

organization need to have knowledge about the stakeholder that what they need and want so that they can able fulfill their need in

order to retain them in the future. Tesco need to train their employee which help then to enhance their skills and knowledge in order to

work properly for the organization's goal (Finch, 2014). Secondly the company need to communicate all the objective to the

employees and that objective must be clear so that all the workers can able to understand them and work on them. Thirdly, Tesco need

to consider the interest of all the stakeholder to identify their need and wants and able to fulfill them. These all activities help them to

retain customer which will enhance the brand image of the company (Woods, 2017).

Political and economic risk

Economy has great impact on the purchasing power of the customer, if it is at boom then individual have more money so they

will spend more and the economy is at depression stage at that time people will lave less money hence they spend less money. Thus,

purchasing power of customer is totally dependent on the economy cycle. Political instability is also very big problem for all big

companies like Tesco. Thus, a new rule in Korea states that company's Korean Home-plus stores will not open around the clock and

need to shut their stores for two Sunday in a month. The organization which is operating in different countries need to follow all laws

and regulation. The tax changes, increasing scrutiny by the competition authorities, economic environment and political development

also effect the organization sales (Beck, 2017).

For such circumstance, organization need to have prior planning so that they can able to adopt these changes. In the economy

cycle, when boom stage is there, they should increasing their product price so that can able to earn large profits, in the depression

period, they should decrease the prices so that they can able to sustain in the environment. They must have proper planning for the tax

management, there they can plan how to reduce tax and gain more advantage as well as they follow all ethical rules and regulation.

Tesco have different internal as well as external risk, which are as follows:

7 | P a g e

practices at every level specifically governance communities guiding and monitoring policies.

Tesco does not have proper communication with its stakeholder so they are not able to engage properly with them. Every

organization need to have knowledge about the stakeholder that what they need and want so that they can able fulfill their need in

order to retain them in the future. Tesco need to train their employee which help then to enhance their skills and knowledge in order to

work properly for the organization's goal (Finch, 2014). Secondly the company need to communicate all the objective to the

employees and that objective must be clear so that all the workers can able to understand them and work on them. Thirdly, Tesco need

to consider the interest of all the stakeholder to identify their need and wants and able to fulfill them. These all activities help them to

retain customer which will enhance the brand image of the company (Woods, 2017).

Political and economic risk

Economy has great impact on the purchasing power of the customer, if it is at boom then individual have more money so they

will spend more and the economy is at depression stage at that time people will lave less money hence they spend less money. Thus,

purchasing power of customer is totally dependent on the economy cycle. Political instability is also very big problem for all big

companies like Tesco. Thus, a new rule in Korea states that company's Korean Home-plus stores will not open around the clock and

need to shut their stores for two Sunday in a month. The organization which is operating in different countries need to follow all laws

and regulation. The tax changes, increasing scrutiny by the competition authorities, economic environment and political development

also effect the organization sales (Beck, 2017).

For such circumstance, organization need to have prior planning so that they can able to adopt these changes. In the economy

cycle, when boom stage is there, they should increasing their product price so that can able to earn large profits, in the depression

period, they should decrease the prices so that they can able to sustain in the environment. They must have proper planning for the tax

management, there they can plan how to reduce tax and gain more advantage as well as they follow all ethical rules and regulation.

Tesco have different internal as well as external risk, which are as follows:

7 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Internal risk

Product security: Tesco' s goods value and security is of predominant significance to the organization and being absolutely

crucial for sustaining confidence and believe. The organization have implemented the double checking system once is while

production of goods and another is after production of products (Woods, 2017).

Fraud and compliance: As all the retailer are had their own geographical region so the risk of fraud have increased. All the

retailers are depended on their own area and if once outlet have been closed, the employee who are working their will be

unemployed where they will try to do fraud with the organization.

External risk

Competition risk: there are many companies which have huge competition with the Tesco such as Sanisbury, Lidl, Aldi etc.

The company need to make their product, price, place and promotion according to their rivals. If they will mopt do so they will

loose their market share and brand image because the customer will buy those products which offer large services with the low

cost. So this is huge risk for the organization.

Customer risk: All the organization work to satisfy customer need and wants, the company's main motive is to produce goods

according to the taste and preference of the clients. As the clients need change they have to change their production and need

to produce those which is demanded in the market (Finch, 2014). If the consumer switch to other preferences, it is huge risk to

the Tesco because they will not able to sell their goods which will reduce profitability and productivity of the company.

The organization can able to manage the risk by proper risk management process, the process start with identification of risk which

ends with monitor and review of risk, the process is as follows:

Identification of risk: The process start with finding the risk by which organization is going through, this stage will provide

the base to remove the risk and guide to manage the risk in proper way. Organization need to collect all the information which

8 | P a g e

Product security: Tesco' s goods value and security is of predominant significance to the organization and being absolutely

crucial for sustaining confidence and believe. The organization have implemented the double checking system once is while

production of goods and another is after production of products (Woods, 2017).

Fraud and compliance: As all the retailer are had their own geographical region so the risk of fraud have increased. All the

retailers are depended on their own area and if once outlet have been closed, the employee who are working their will be

unemployed where they will try to do fraud with the organization.

External risk

Competition risk: there are many companies which have huge competition with the Tesco such as Sanisbury, Lidl, Aldi etc.

The company need to make their product, price, place and promotion according to their rivals. If they will mopt do so they will

loose their market share and brand image because the customer will buy those products which offer large services with the low

cost. So this is huge risk for the organization.

Customer risk: All the organization work to satisfy customer need and wants, the company's main motive is to produce goods

according to the taste and preference of the clients. As the clients need change they have to change their production and need

to produce those which is demanded in the market (Finch, 2014). If the consumer switch to other preferences, it is huge risk to

the Tesco because they will not able to sell their goods which will reduce profitability and productivity of the company.

The organization can able to manage the risk by proper risk management process, the process start with identification of risk which

ends with monitor and review of risk, the process is as follows:

Identification of risk: The process start with finding the risk by which organization is going through, this stage will provide

the base to remove the risk and guide to manage the risk in proper way. Organization need to collect all the information which

8 | P a g e

is related to the risk from the internal as well as internal source. They need to analyze the information to find the risk which

they need to manage (Hopkin, 2017).

Analyze the risk: in the previous stage, the company have find out the risk, they need to have deep knowledge about the risk

that what are the causes of risk and what will be consequence if the risk arises.

Evaluate the risk: After identification of the risk, organization need to rank them according the causes of risk. After analyzing

the risk, company need to find that risk is acceptable and to which extent it is acceptable or the risk need preventive action.

Treatment of risk: In the previous stage, the risk is being rank, the risk which have the highest risk will be planned to treat and

modifying that risk to make them acceptable. In this stage organization can able to minimize the probability of the risk or

increase the opportunities (Almeida and Williams, 2016). The step also include preparing different strategies so that they can

able to reduce the risk.

Monitor or risk: As the strategies are defined in the previous stage, organization need to implement those strategies so that they

can able to remove the risk. After proper implementation, executive need to monitor all risk that they are properly treated or

not (Woods, 2017).

RISK REGISTER

It refers to the risk log which is used by the organization so that manger can organize all the risk in an effective manner. It

includes all the information such as types of risks, it impacts to the organization, risk mitigation etc. These kinds of information are

recorded in a proper documentation so that it provide clear picture of the risk in an organization (Wu and Olson, 2015). There are

various kinds of approaches which are adopted by the different organization in a different way. To analysis the risk and make effective

control Tesco uses scoring methods. It can be achieved through a simple ordinal scale which could be one to five scale. This

approaches considered the likelihood and its impact of the risk in an organization.

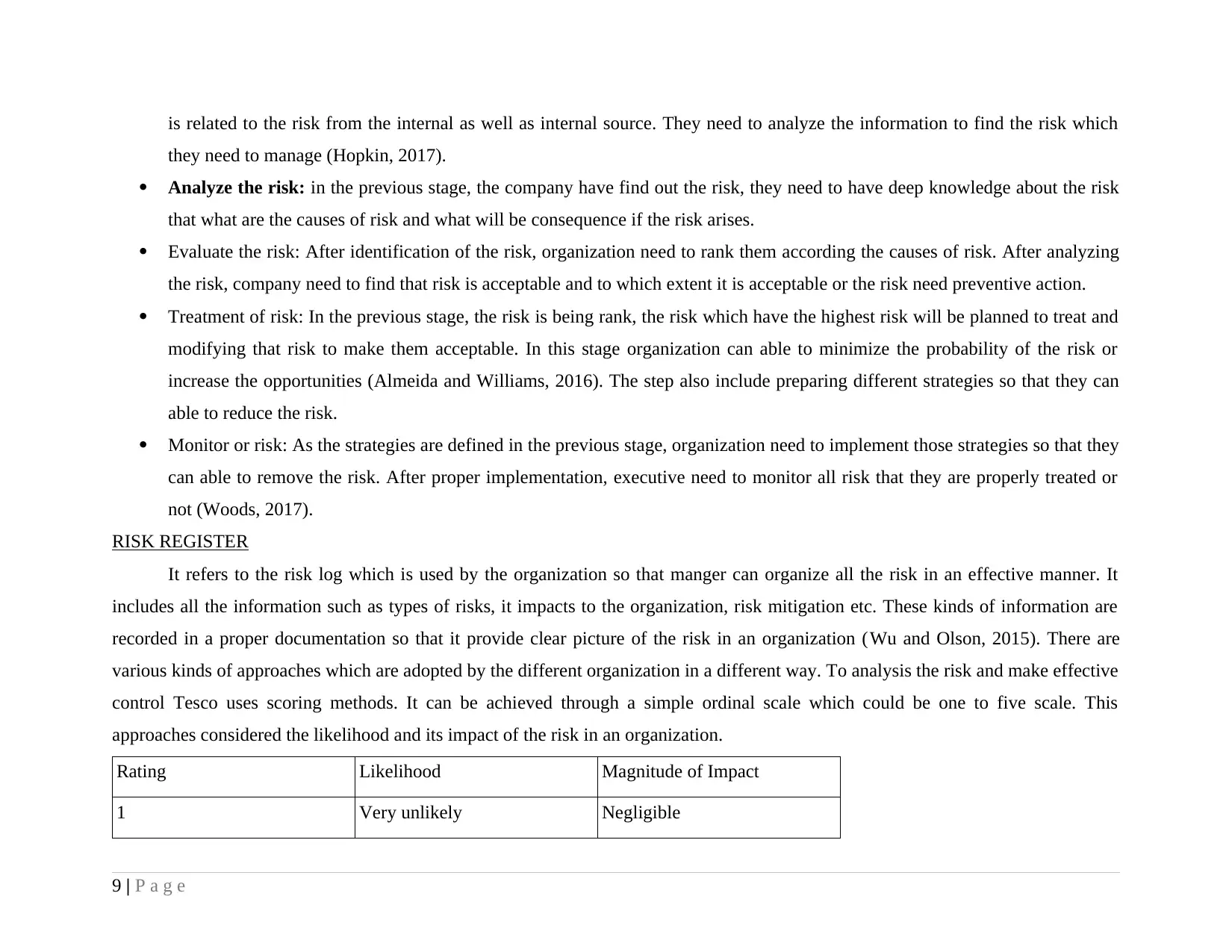

Rating Likelihood Magnitude of Impact

1 Very unlikely Negligible

9 | P a g e

they need to manage (Hopkin, 2017).

Analyze the risk: in the previous stage, the company have find out the risk, they need to have deep knowledge about the risk

that what are the causes of risk and what will be consequence if the risk arises.

Evaluate the risk: After identification of the risk, organization need to rank them according the causes of risk. After analyzing

the risk, company need to find that risk is acceptable and to which extent it is acceptable or the risk need preventive action.

Treatment of risk: In the previous stage, the risk is being rank, the risk which have the highest risk will be planned to treat and

modifying that risk to make them acceptable. In this stage organization can able to minimize the probability of the risk or

increase the opportunities (Almeida and Williams, 2016). The step also include preparing different strategies so that they can

able to reduce the risk.

Monitor or risk: As the strategies are defined in the previous stage, organization need to implement those strategies so that they

can able to remove the risk. After proper implementation, executive need to monitor all risk that they are properly treated or

not (Woods, 2017).

RISK REGISTER

It refers to the risk log which is used by the organization so that manger can organize all the risk in an effective manner. It

includes all the information such as types of risks, it impacts to the organization, risk mitigation etc. These kinds of information are

recorded in a proper documentation so that it provide clear picture of the risk in an organization (Wu and Olson, 2015). There are

various kinds of approaches which are adopted by the different organization in a different way. To analysis the risk and make effective

control Tesco uses scoring methods. It can be achieved through a simple ordinal scale which could be one to five scale. This

approaches considered the likelihood and its impact of the risk in an organization.

Rating Likelihood Magnitude of Impact

1 Very unlikely Negligible

9 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2 Unlikely Minor

3 Possible Moderate

4 Likely Severe

5 Very Likely Catastrophic

In order to this. Tesco company assess the risk by using this risk matrix. In this matrix, each risk is rated by classifying in

various kinds of magnitude and impact are recorded in a score (O and Musa, 2011).

Risk Register of Tesco

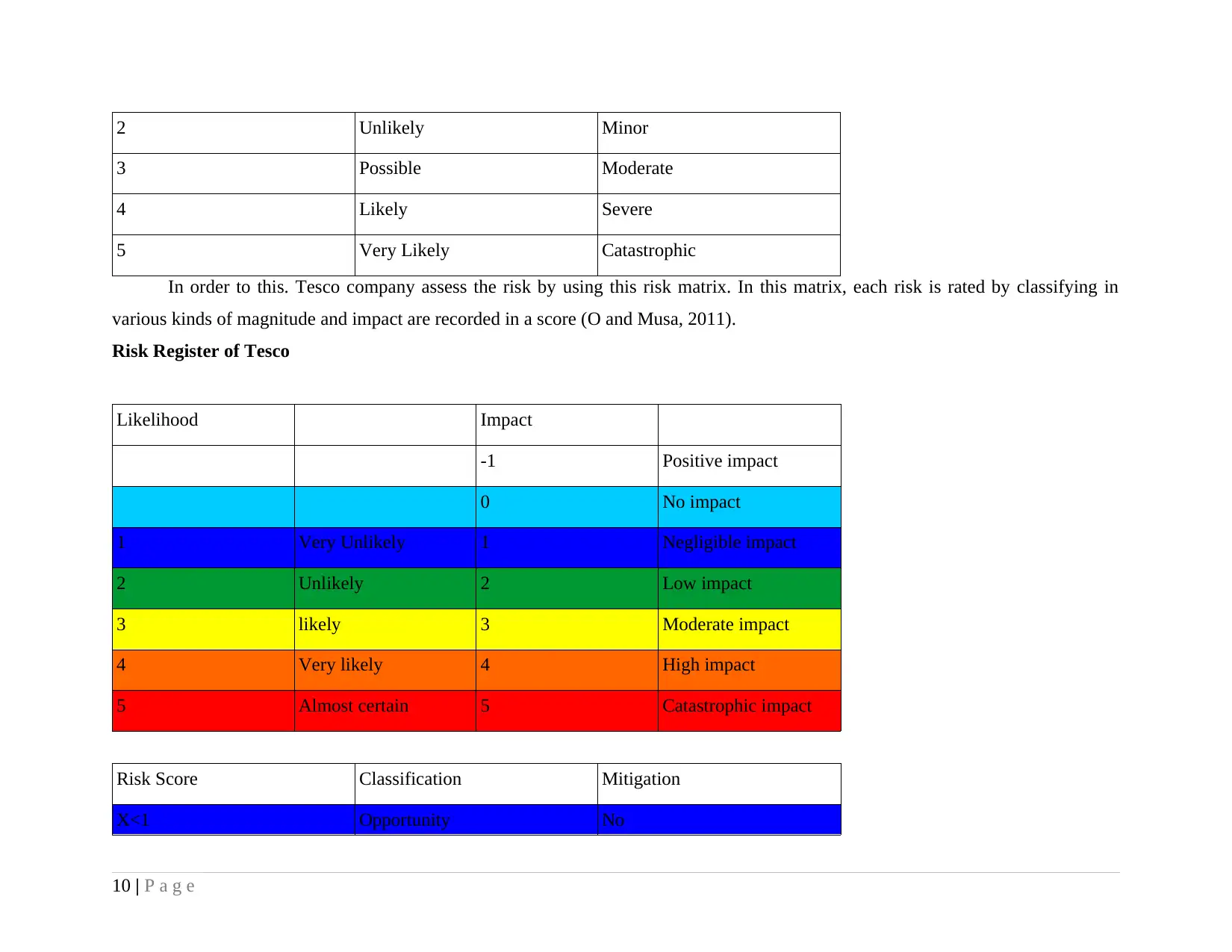

Likelihood Impact

-1 Positive impact

0 No impact

1 Very Unlikely 1 Negligible impact

2 Unlikely 2 Low impact

3 likely 3 Moderate impact

4 Very likely 4 High impact

5 Almost certain 5 Catastrophic impact

Risk Score Classification Mitigation

X<1 Opportunity No

10 | P a g e

3 Possible Moderate

4 Likely Severe

5 Very Likely Catastrophic

In order to this. Tesco company assess the risk by using this risk matrix. In this matrix, each risk is rated by classifying in

various kinds of magnitude and impact are recorded in a score (O and Musa, 2011).

Risk Register of Tesco

Likelihood Impact

-1 Positive impact

0 No impact

1 Very Unlikely 1 Negligible impact

2 Unlikely 2 Low impact

3 likely 3 Moderate impact

4 Very likely 4 High impact

5 Almost certain 5 Catastrophic impact

Risk Score Classification Mitigation

X<1 Opportunity No

10 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 to 5 Negligible risk No

5 to 10 Low risk No

10 to 15 Moderate risk No

15 to 25 High risk Yes

As per the above risk register it shows the scoring of risk and its impact. As per the rating scale between X<1 it shows the

opportunities buy no mitigation. On the other hand, if risk can be scored in 1 to 5 than it can be classified as negligible risk in which

mitigation can not be require. As same as, in 5 to 10 risk scale, their will be low risk and 10 to 15 classified as moderate risk. In 15 to

20 risk score shows the high risk which require mitigation by the organization to assess their risk (Rejda, 2011).

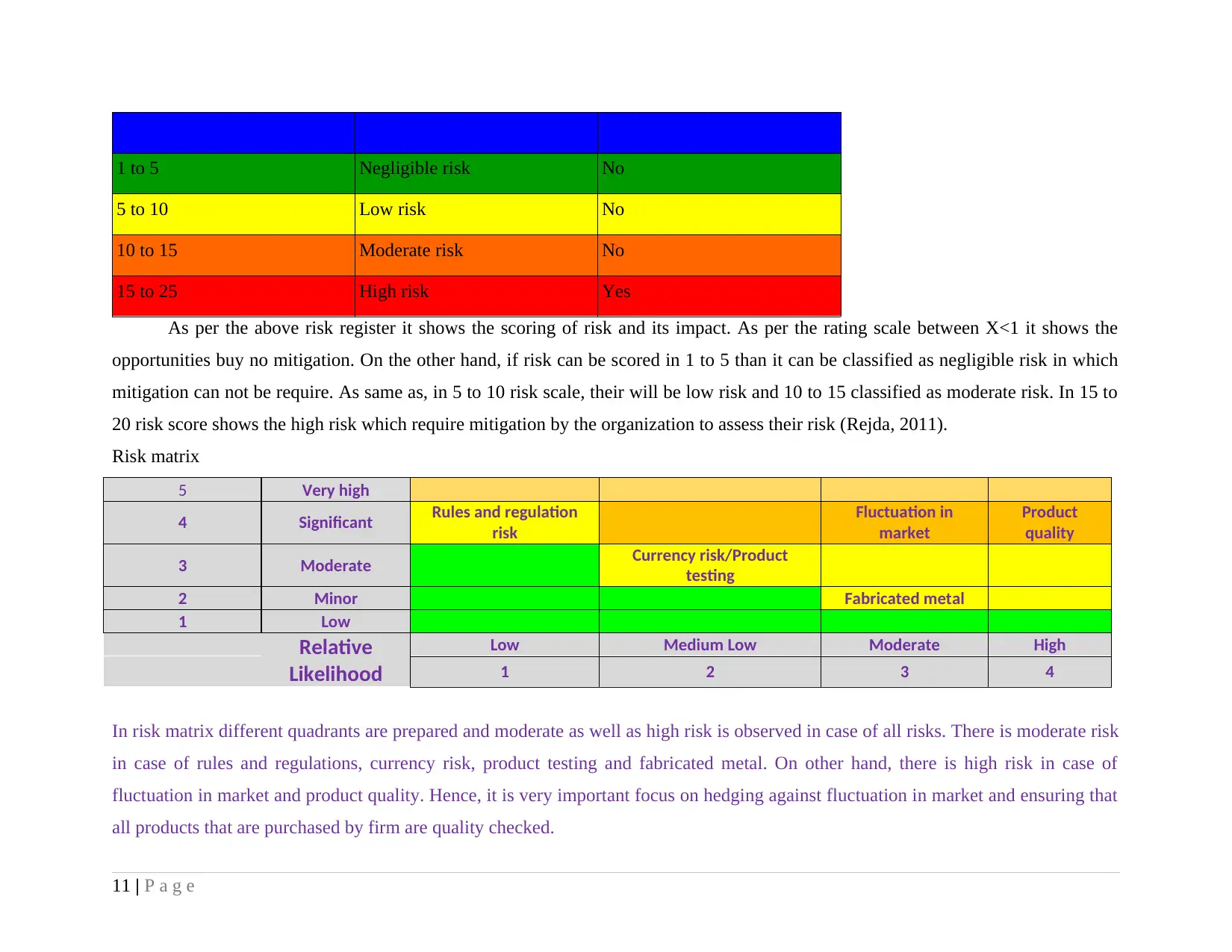

Risk matrix

5 Very high

4 Significant Rules and regulation

risk

Fluctuation in

market

Product

quality

3 Moderate Currency risk/Product

testing

2 Minor Fabricated metal

1 Low

Relative

Likelihood

Low Medium Low Moderate High

1 2 3 4

In risk matrix different quadrants are prepared and moderate as well as high risk is observed in case of all risks. There is moderate risk

in case of rules and regulations, currency risk, product testing and fabricated metal. On other hand, there is high risk in case of

fluctuation in market and product quality. Hence, it is very important focus on hedging against fluctuation in market and ensuring that

all products that are purchased by firm are quality checked.

11 | P a g e

5 to 10 Low risk No

10 to 15 Moderate risk No

15 to 25 High risk Yes

As per the above risk register it shows the scoring of risk and its impact. As per the rating scale between X<1 it shows the

opportunities buy no mitigation. On the other hand, if risk can be scored in 1 to 5 than it can be classified as negligible risk in which

mitigation can not be require. As same as, in 5 to 10 risk scale, their will be low risk and 10 to 15 classified as moderate risk. In 15 to

20 risk score shows the high risk which require mitigation by the organization to assess their risk (Rejda, 2011).

Risk matrix

5 Very high

4 Significant Rules and regulation

risk

Fluctuation in

market

Product

quality

3 Moderate Currency risk/Product

testing

2 Minor Fabricated metal

1 Low

Relative

Likelihood

Low Medium Low Moderate High

1 2 3 4

In risk matrix different quadrants are prepared and moderate as well as high risk is observed in case of all risks. There is moderate risk

in case of rules and regulations, currency risk, product testing and fabricated metal. On other hand, there is high risk in case of

fluctuation in market and product quality. Hence, it is very important focus on hedging against fluctuation in market and ensuring that

all products that are purchased by firm are quality checked.

11 | P a g e

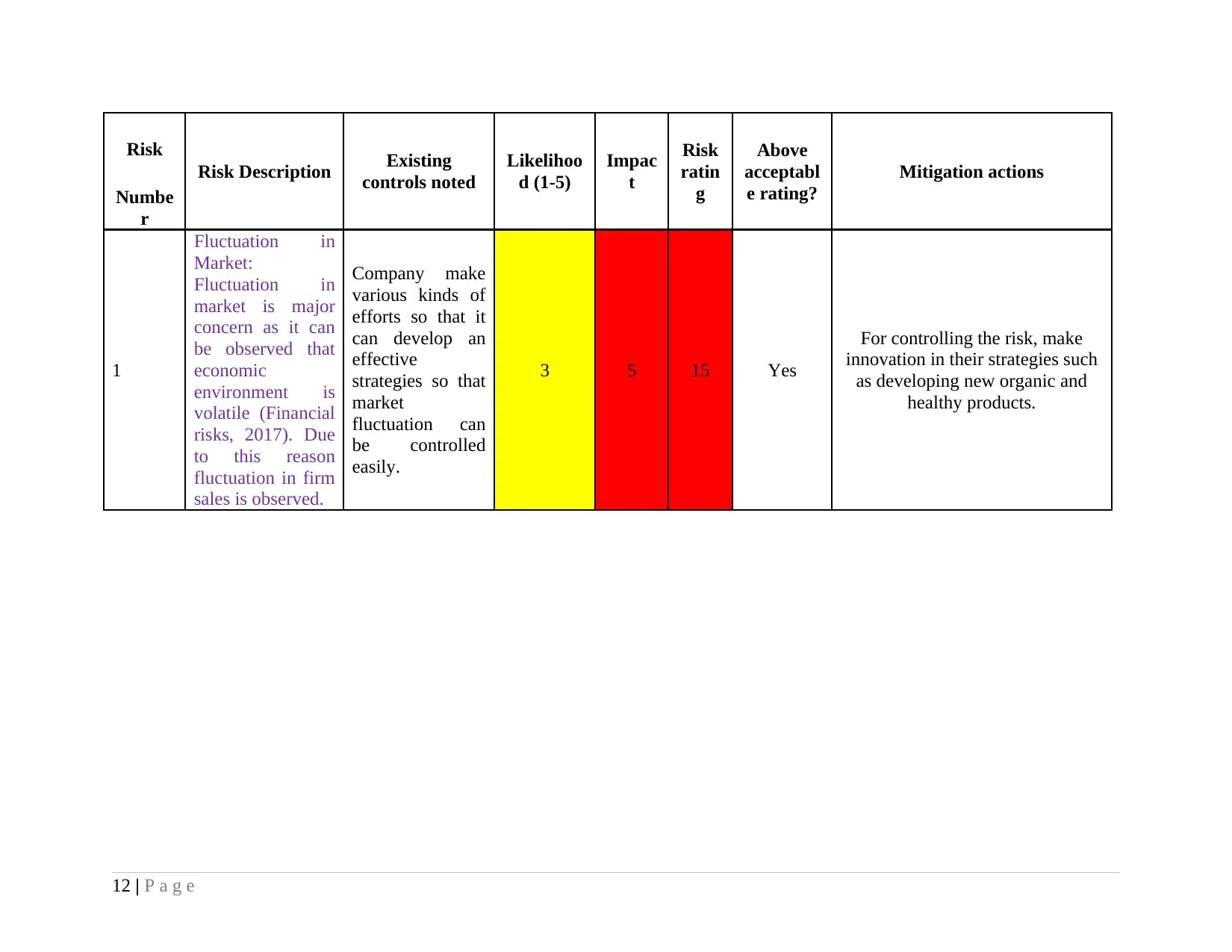

Risk

Risk Description Existing

controls noted

Likelihoo

d (1-5)

Impac

t

Risk

ratin

g

Above

acceptabl

e rating?

Mitigation actions

Numbe

r

1

Fluctuation in

Market:

Fluctuation in

market is major

concern as it can

be observed that

economic

environment is

volatile (Financial

risks, 2017). Due

to this reason

fluctuation in firm

sales is observed.

Company make

various kinds of

efforts so that it

can develop an

effective

strategies so that

market

fluctuation can

be controlled

easily.

3 5 15 Yes

For controlling the risk, make

innovation in their strategies such

as developing new organic and

healthy products.

12 | P a g e

Risk Description Existing

controls noted

Likelihoo

d (1-5)

Impac

t

Risk

ratin

g

Above

acceptabl

e rating?

Mitigation actions

Numbe

r

1

Fluctuation in

Market:

Fluctuation in

market is major

concern as it can

be observed that

economic

environment is

volatile (Financial

risks, 2017). Due

to this reason

fluctuation in firm

sales is observed.

Company make

various kinds of

efforts so that it

can develop an

effective

strategies so that

market

fluctuation can

be controlled

easily.

3 5 15 Yes

For controlling the risk, make

innovation in their strategies such

as developing new organic and

healthy products.

12 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.