Corporate Finance Valuation of Telstra Company - TFIN501 Report

VerifiedAdded on 2022/12/15

|20

|4157

|153

Report

AI Summary

This report undertakes a valuation of Telstra Company, employing the discounted cash flow (DCF) method, with operating cash flows (OCF) as the primary input. The OCF for 2018 is calculated at $6,267 million, based on assumptions regarding cash revenues and expenses. A growth rate of 5.95% is used to forecast OCF for the next five years, and the Gordon growth model determines the terminal value at $6,19,427 million at period 5, utilizing a weighted average cost of capital (WACC) of 4% and a constant growth rate of 2.61%. This leads to a present value of Telstra of $5,42,267 million and an estimated share price of $44.17 as of July 30, 2018. The report compares this estimated price with the market price of $2.81, acknowledging potential discrepancies due to market conditions and model assumptions. The analysis includes detailed steps of the valuation process, from reconstructing the profit and loss statement to calculating the cost of equity, debt, and WACC, and finally determining the equity value and share price. The report also explores the sensitivity of the valuation to changes in growth rates and WACC.

Corporate Finance

Valuation of Telstra company

Student Name

Student Number

Course Code and Title

Due Date

Valuation of Telstra company

Student Name

Student Number

Course Code and Title

Due Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

This report performs the valuation of Telstra Company. Discounted cash flows method is

used for the valuation of the company and the cash flows used for this purpose are the

company’s operating cash flows (OCF). The operating cash flows for 2018 are calculated at

6,267 ($m) after assuming that 81 per cent and 75 per cent of the operating revenues and

expenses respectively are in cash. The growth rate of 5.95 % is assumed to forecast the OCF

for next five years. The Gordon growth method assuming the constant perpetual growth rate

is used for calculating the terminal value of the company. Terminal value at period 5 is found

to be 6,19,427 ($m) using the weighted average cost of capital of 4 per cent and constant

growth rate of 2.61 per cent. This resulted in the present value of Telstra of 5,42,267 ($m)

and the estimated share price of 44.17 ($) on 30 July 2018. It is found that this estimated

price is different than the market price of 2.81 ($). This difference can be due to the prevalent

market conditions and sensitivity of the valuation model to various assumptions.

This report performs the valuation of Telstra Company. Discounted cash flows method is

used for the valuation of the company and the cash flows used for this purpose are the

company’s operating cash flows (OCF). The operating cash flows for 2018 are calculated at

6,267 ($m) after assuming that 81 per cent and 75 per cent of the operating revenues and

expenses respectively are in cash. The growth rate of 5.95 % is assumed to forecast the OCF

for next five years. The Gordon growth method assuming the constant perpetual growth rate

is used for calculating the terminal value of the company. Terminal value at period 5 is found

to be 6,19,427 ($m) using the weighted average cost of capital of 4 per cent and constant

growth rate of 2.61 per cent. This resulted in the present value of Telstra of 5,42,267 ($m)

and the estimated share price of 44.17 ($) on 30 July 2018. It is found that this estimated

price is different than the market price of 2.81 ($). This difference can be due to the prevalent

market conditions and sensitivity of the valuation model to various assumptions.

Contents

Introduction...........................................................................................................................................1

Telstra Valuation...................................................................................................................................1

Step 1: Reconstruction of the profit and loss statement in the format of Operating Cash flow..........1

Step 2: Forecasting the reconstructed P&L for the next 5 years........................................................3

Step 3: Calculating the after tax OCF for the next 5 years.................................................................4

Step 4: Calculating the terminal value (TV) at time 5........................................................................4

Step 5: Calculating the cost of equity (Re)........................................................................................5

Step 6: Calculating cost of debt (Rd).................................................................................................5

Step 7: Calculating Debt/Value and Equity/Value ratio from the Debt/Equity ratio..........................6

Step 8: Calculating the Weighted Cost of Capital (WACC or k).......................................................6

Step 9: Calculating the present value of the asset of your company at time zero...............................6

Step 10: Calculating the Equity Value..............................................................................................6

Step 11: Calculating the share price..................................................................................................7

Step 12: Comparing the estimated share price of Telstra with its market price.................................7

Conclusion.............................................................................................................................................8

Recommendations.................................................................................................................................9

References...........................................................................................................................................10

Appendices..........................................................................................................................................11

Appendix 1: Balance sheets and Profit & Loss statements..............................................................11

Appendix 2: Telstra’s operating revenues and expenses.................................................................15

Appendix 3: Assumptions used for forecasting next 5 years reconstructed profit and loss

statement........................................................................................................................................16

Appendix 4: Average GDP growth rate for estimating the perpetual growth rate of Telstra..........17

Introduction...........................................................................................................................................1

Telstra Valuation...................................................................................................................................1

Step 1: Reconstruction of the profit and loss statement in the format of Operating Cash flow..........1

Step 2: Forecasting the reconstructed P&L for the next 5 years........................................................3

Step 3: Calculating the after tax OCF for the next 5 years.................................................................4

Step 4: Calculating the terminal value (TV) at time 5........................................................................4

Step 5: Calculating the cost of equity (Re)........................................................................................5

Step 6: Calculating cost of debt (Rd).................................................................................................5

Step 7: Calculating Debt/Value and Equity/Value ratio from the Debt/Equity ratio..........................6

Step 8: Calculating the Weighted Cost of Capital (WACC or k).......................................................6

Step 9: Calculating the present value of the asset of your company at time zero...............................6

Step 10: Calculating the Equity Value..............................................................................................6

Step 11: Calculating the share price..................................................................................................7

Step 12: Comparing the estimated share price of Telstra with its market price.................................7

Conclusion.............................................................................................................................................8

Recommendations.................................................................................................................................9

References...........................................................................................................................................10

Appendices..........................................................................................................................................11

Appendix 1: Balance sheets and Profit & Loss statements..............................................................11

Appendix 2: Telstra’s operating revenues and expenses.................................................................15

Appendix 3: Assumptions used for forecasting next 5 years reconstructed profit and loss

statement........................................................................................................................................16

Appendix 4: Average GDP growth rate for estimating the perpetual growth rate of Telstra..........17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate Finance [Surname, Student ID #]

Introduction

This report is on the valuation of Telstra Company. Telstra is the largest telecommunications

firm in Australia, founded in 1975. The company provides mobile phones, home phones and

broadband internet. This report uses the past five years balance sheets and profit and loss

statements for the valuation purpose. It reconstructs profit and loss statement in the format of

operating cash flows (OCF) by assuming certain percentage of revenues and expenses that

are cash. Then, it forecasts the OCF for next five year using certain growth rate assumption.

The report uses above cash flows and Gordon growth model to find the terminal value of

Telstra at period 5. Then, it uses discounted cash flows method to find the present value of

the company by assuming certain perpetual growth rate and the company’s weighted average

cost of capital (WACC). The report also estimates the share price of Telstra on 30 July 2018

and compares it with the actual market share price on that date. It uses the backward

induction method to find the growth rate and WACC that will cause the estimated share price

to equal the actual market price. The report further evaluates these rates to check if they are

acceptable. The document also provides an explanation of the difference between the

estimated share price and the market share price.

Telstra Valuation

Appendix 1 shows the historical balance sheets and income statements of Telstra: Data taken

from Telstra Annual Reports (2014), Telstra Annual Reports (2015), Telstra Annual Reports

(2016), Telstra Annual Reports (2017) and Telstra Annual Reports (2018).

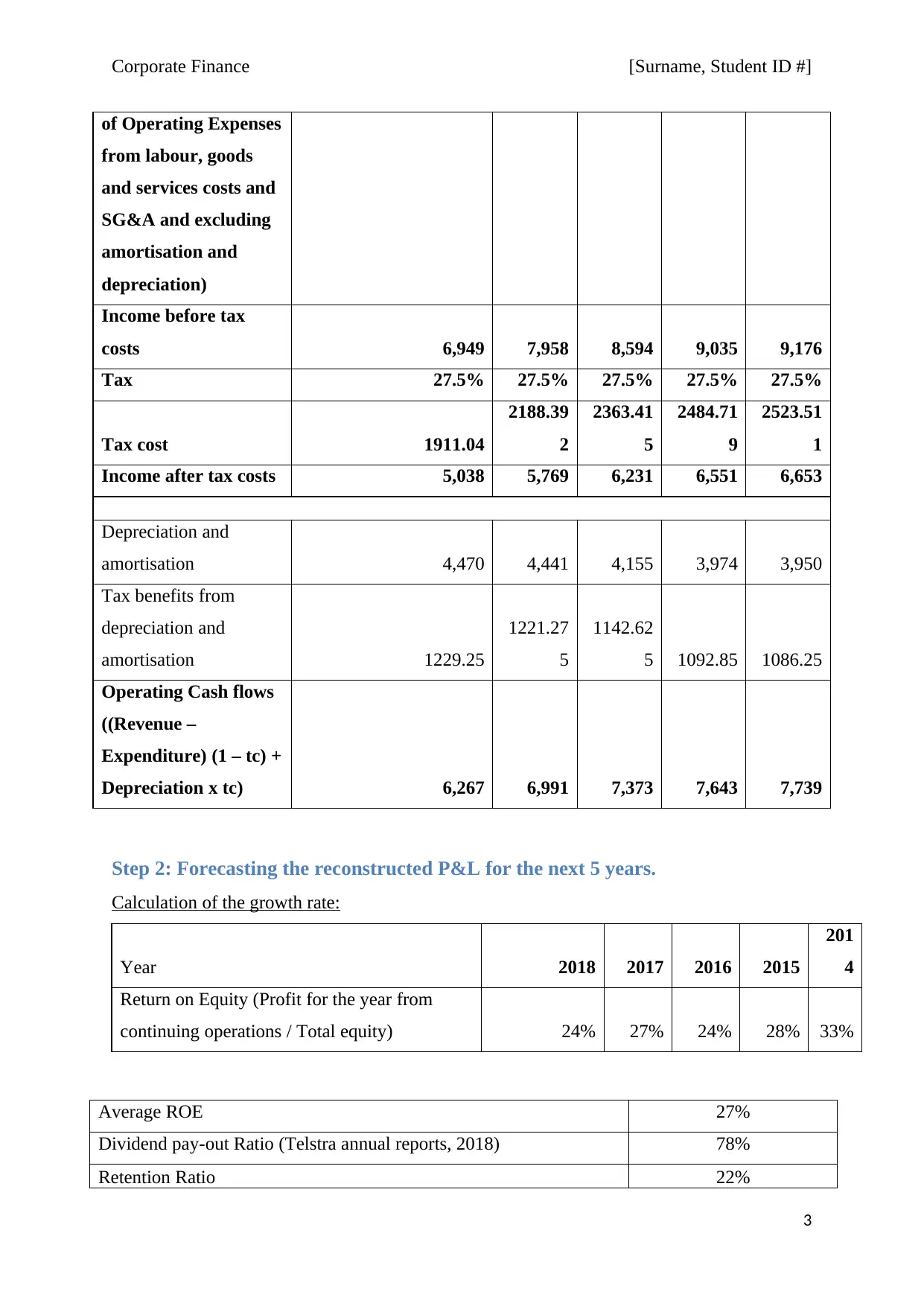

Step 1: Reconstruction of the profit and loss statement in the format of

Operating Cash flow.

The profit and loss statements can be reconstructed in the format of Operating Cash flow as:

OCF = (Revenue – Expenditure) (1 – tc) + Depreciation x tc

Considering only the income from operations but excluding other gains and incomes for

calculating revenue for the OCF and considering only labour costs, goods & services costs

and SG&A costs but excluding amortisation & depreciation costs for calculating expense for

the OCF as shown in appendix 2.

1

Introduction

This report is on the valuation of Telstra Company. Telstra is the largest telecommunications

firm in Australia, founded in 1975. The company provides mobile phones, home phones and

broadband internet. This report uses the past five years balance sheets and profit and loss

statements for the valuation purpose. It reconstructs profit and loss statement in the format of

operating cash flows (OCF) by assuming certain percentage of revenues and expenses that

are cash. Then, it forecasts the OCF for next five year using certain growth rate assumption.

The report uses above cash flows and Gordon growth model to find the terminal value of

Telstra at period 5. Then, it uses discounted cash flows method to find the present value of

the company by assuming certain perpetual growth rate and the company’s weighted average

cost of capital (WACC). The report also estimates the share price of Telstra on 30 July 2018

and compares it with the actual market share price on that date. It uses the backward

induction method to find the growth rate and WACC that will cause the estimated share price

to equal the actual market price. The report further evaluates these rates to check if they are

acceptable. The document also provides an explanation of the difference between the

estimated share price and the market share price.

Telstra Valuation

Appendix 1 shows the historical balance sheets and income statements of Telstra: Data taken

from Telstra Annual Reports (2014), Telstra Annual Reports (2015), Telstra Annual Reports

(2016), Telstra Annual Reports (2017) and Telstra Annual Reports (2018).

Step 1: Reconstruction of the profit and loss statement in the format of

Operating Cash flow.

The profit and loss statements can be reconstructed in the format of Operating Cash flow as:

OCF = (Revenue – Expenditure) (1 – tc) + Depreciation x tc

Considering only the income from operations but excluding other gains and incomes for

calculating revenue for the OCF and considering only labour costs, goods & services costs

and SG&A costs but excluding amortisation & depreciation costs for calculating expense for

the OCF as shown in appendix 2.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate Finance [Surname, Student ID #]

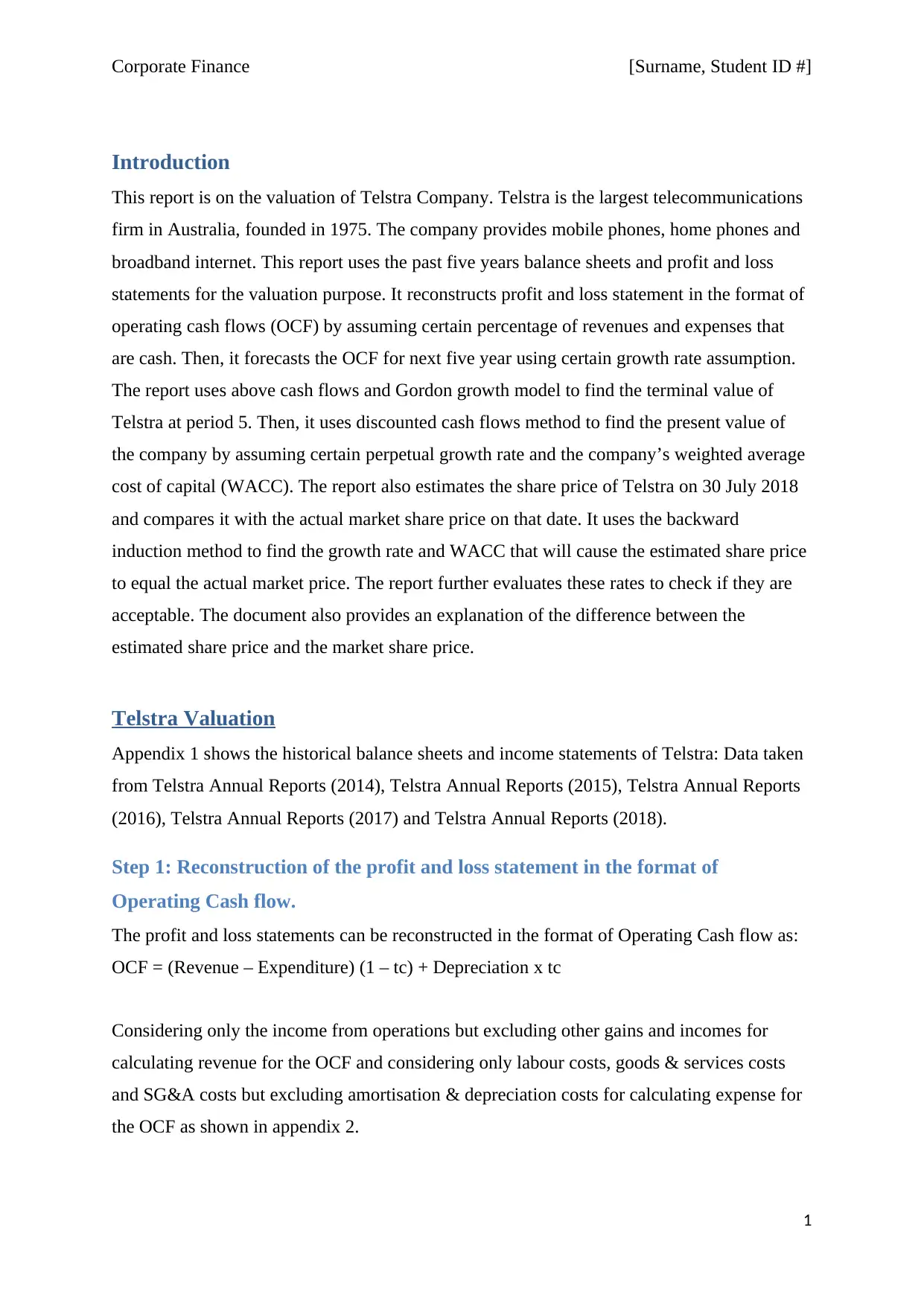

For assuming certain revenues/expenses percentage that is cash we need to consider average

accounts receivables and accounts payables in proportion to the total operating revenues and

expenses respectively.

Average Revenues (considering only the income

from operations and excluding other gains and

incomes) for last 5 years ($m) 25756.6

Average Operating Expenses (considering labour,

goods and services costs and SG&A and excluding

amortisation and depreciation) for last 5 years ($m) 16768

Average current account receivables for last 5 years

as a percentage of average revenues 19%

Average current account payables for last 5 years as

a percentage of average operating expenses 25%

Assumption for percentage of revenues that is cash

(revenue- average account receivable)/revenue 81%

Assumption for percentage of expenses that is cash

(revenue- average account payables)/revenue 75%

As the average account receivables for Telstra over last 5 years is 19% of the average

operating revenues so we can assume that cash revenues make 81% of the total operating

revenues. As the average account payables for Telstra over last 5 years is 25% of the average

operating expenses so we can assume that cash expenses make 75% of the total operating

expenses.

Reconstructed P&L

statement ($m) 2018 2017 2016 2015 2014

Cash Revenues (81%

of total revenues from

operations and

excluding other gains

and incomes) 21,140 21,142 21,059 20,748 20,579

Cash Expenses (75% 14,191 13,184 12,465 11,712 11,402

2

For assuming certain revenues/expenses percentage that is cash we need to consider average

accounts receivables and accounts payables in proportion to the total operating revenues and

expenses respectively.

Average Revenues (considering only the income

from operations and excluding other gains and

incomes) for last 5 years ($m) 25756.6

Average Operating Expenses (considering labour,

goods and services costs and SG&A and excluding

amortisation and depreciation) for last 5 years ($m) 16768

Average current account receivables for last 5 years

as a percentage of average revenues 19%

Average current account payables for last 5 years as

a percentage of average operating expenses 25%

Assumption for percentage of revenues that is cash

(revenue- average account receivable)/revenue 81%

Assumption for percentage of expenses that is cash

(revenue- average account payables)/revenue 75%

As the average account receivables for Telstra over last 5 years is 19% of the average

operating revenues so we can assume that cash revenues make 81% of the total operating

revenues. As the average account payables for Telstra over last 5 years is 25% of the average

operating expenses so we can assume that cash expenses make 75% of the total operating

expenses.

Reconstructed P&L

statement ($m) 2018 2017 2016 2015 2014

Cash Revenues (81%

of total revenues from

operations and

excluding other gains

and incomes) 21,140 21,142 21,059 20,748 20,579

Cash Expenses (75% 14,191 13,184 12,465 11,712 11,402

2

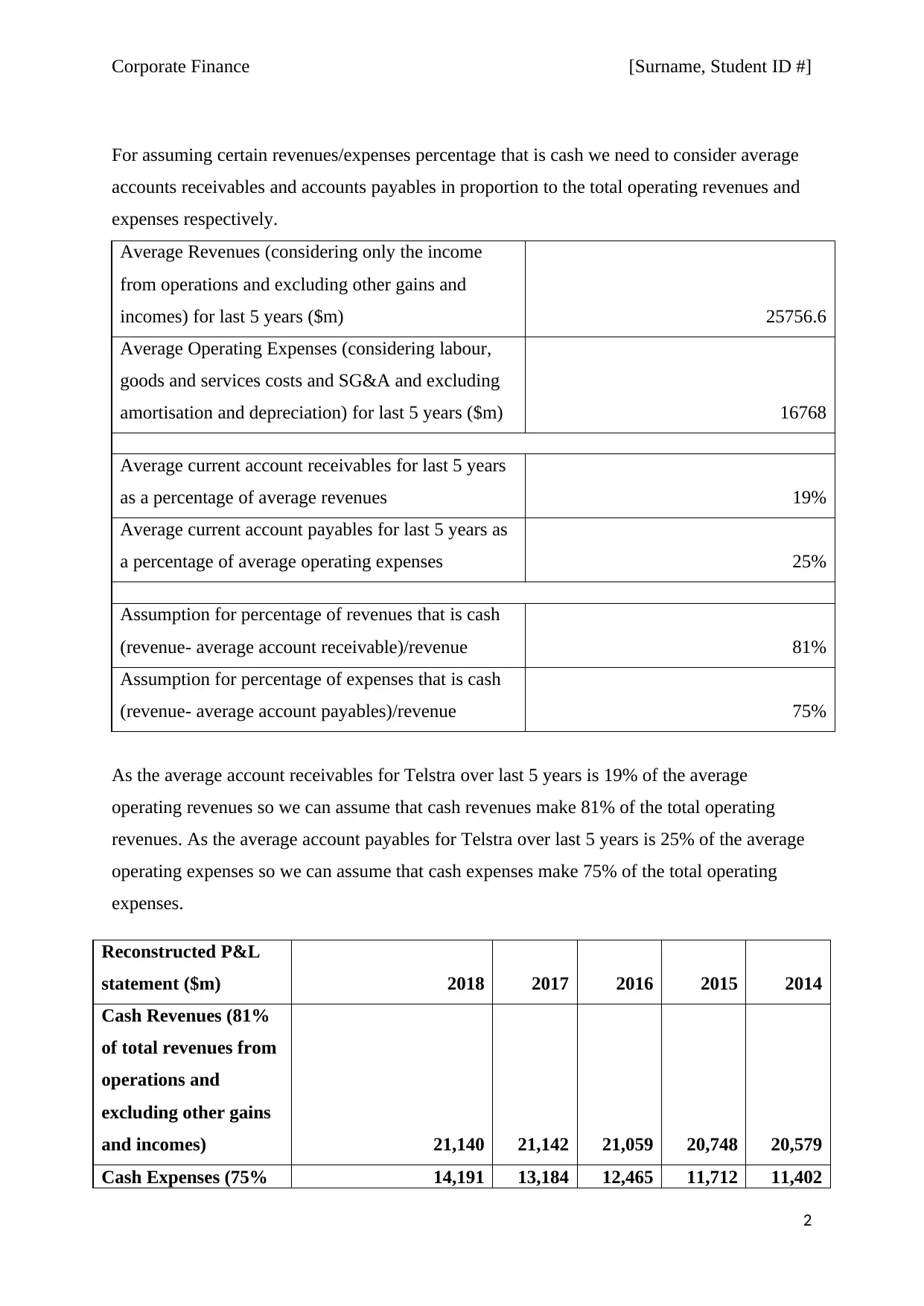

Corporate Finance [Surname, Student ID #]

of Operating Expenses

from labour, goods

and services costs and

SG&A and excluding

amortisation and

depreciation)

Income before tax

costs 6,949 7,958 8,594 9,035 9,176

Tax 27.5% 27.5% 27.5% 27.5% 27.5%

Tax cost 1911.04

2188.39

2

2363.41

5

2484.71

9

2523.51

1

Income after tax costs 5,038 5,769 6,231 6,551 6,653

Depreciation and

amortisation 4,470 4,441 4,155 3,974 3,950

Tax benefits from

depreciation and

amortisation 1229.25

1221.27

5

1142.62

5 1092.85 1086.25

Operating Cash flows

((Revenue –

Expenditure) (1 – tc) +

Depreciation x tc) 6,267 6,991 7,373 7,643 7,739

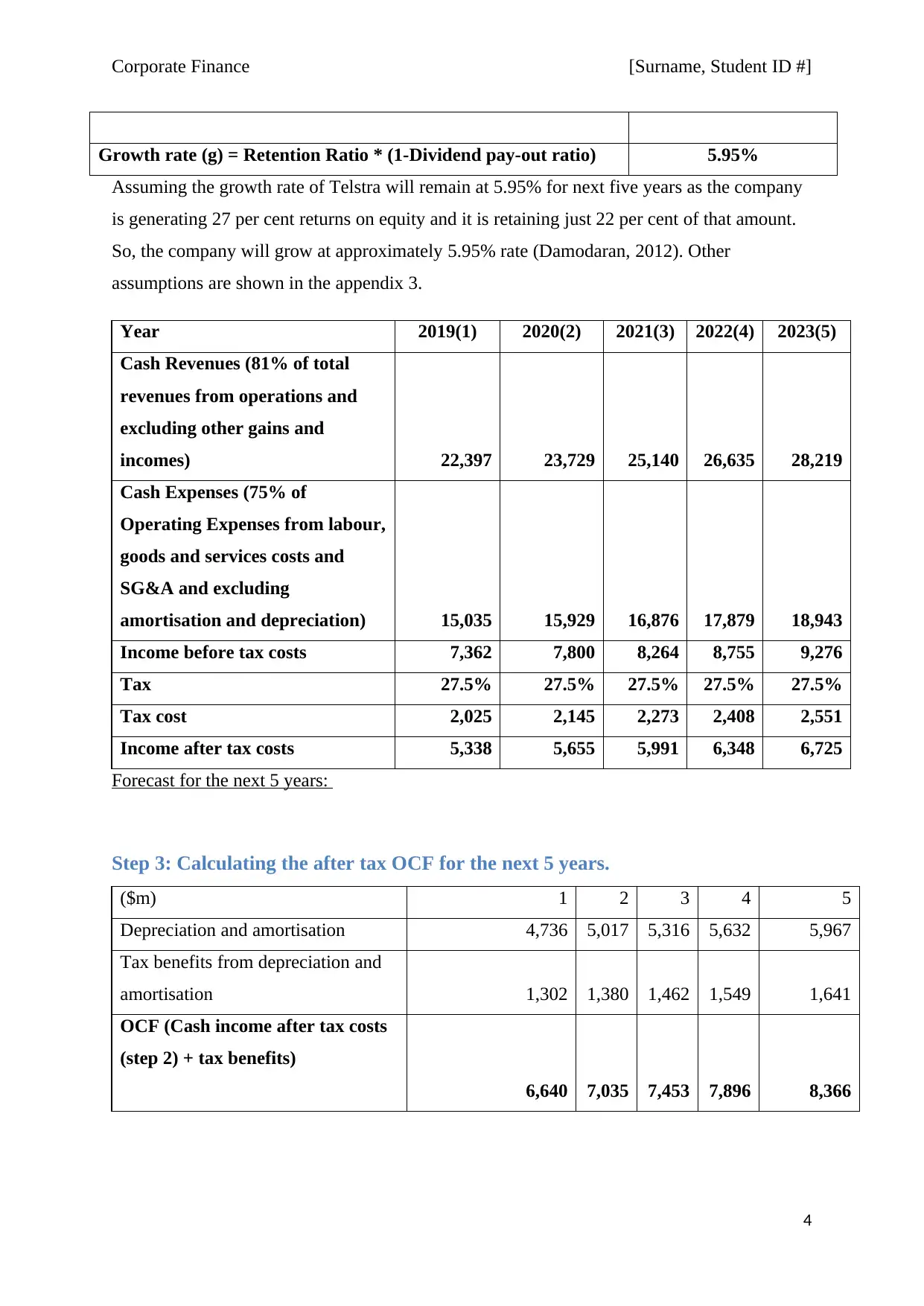

Step 2: Forecasting the reconstructed P&L for the next 5 years.

Calculation of the growth rate:

Year 2018 2017 2016 2015

201

4

Return on Equity (Profit for the year from

continuing operations / Total equity) 24% 27% 24% 28% 33%

Average ROE 27%

Dividend pay-out Ratio (Telstra annual reports, 2018) 78%

Retention Ratio 22%

3

of Operating Expenses

from labour, goods

and services costs and

SG&A and excluding

amortisation and

depreciation)

Income before tax

costs 6,949 7,958 8,594 9,035 9,176

Tax 27.5% 27.5% 27.5% 27.5% 27.5%

Tax cost 1911.04

2188.39

2

2363.41

5

2484.71

9

2523.51

1

Income after tax costs 5,038 5,769 6,231 6,551 6,653

Depreciation and

amortisation 4,470 4,441 4,155 3,974 3,950

Tax benefits from

depreciation and

amortisation 1229.25

1221.27

5

1142.62

5 1092.85 1086.25

Operating Cash flows

((Revenue –

Expenditure) (1 – tc) +

Depreciation x tc) 6,267 6,991 7,373 7,643 7,739

Step 2: Forecasting the reconstructed P&L for the next 5 years.

Calculation of the growth rate:

Year 2018 2017 2016 2015

201

4

Return on Equity (Profit for the year from

continuing operations / Total equity) 24% 27% 24% 28% 33%

Average ROE 27%

Dividend pay-out Ratio (Telstra annual reports, 2018) 78%

Retention Ratio 22%

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate Finance [Surname, Student ID #]

Growth rate (g) = Retention Ratio * (1-Dividend pay-out ratio) 5.95%

Assuming the growth rate of Telstra will remain at 5.95% for next five years as the company

is generating 27 per cent returns on equity and it is retaining just 22 per cent of that amount.

So, the company will grow at approximately 5.95% rate (Damodaran, 2012). Other

assumptions are shown in the appendix 3.

Year 2019(1) 2020(2) 2021(3) 2022(4) 2023(5)

Cash Revenues (81% of total

revenues from operations and

excluding other gains and

incomes) 22,397 23,729 25,140 26,635 28,219

Cash Expenses (75% of

Operating Expenses from labour,

goods and services costs and

SG&A and excluding

amortisation and depreciation) 15,035 15,929 16,876 17,879 18,943

Income before tax costs 7,362 7,800 8,264 8,755 9,276

Tax 27.5% 27.5% 27.5% 27.5% 27.5%

Tax cost 2,025 2,145 2,273 2,408 2,551

Income after tax costs 5,338 5,655 5,991 6,348 6,725

Forecast for the next 5 years:

Step 3: Calculating the after tax OCF for the next 5 years.

($m) 1 2 3 4 5

Depreciation and amortisation 4,736 5,017 5,316 5,632 5,967

Tax benefits from depreciation and

amortisation 1,302 1,380 1,462 1,549 1,641

OCF (Cash income after tax costs

(step 2) + tax benefits)

6,640 7,035 7,453 7,896 8,366

4

Growth rate (g) = Retention Ratio * (1-Dividend pay-out ratio) 5.95%

Assuming the growth rate of Telstra will remain at 5.95% for next five years as the company

is generating 27 per cent returns on equity and it is retaining just 22 per cent of that amount.

So, the company will grow at approximately 5.95% rate (Damodaran, 2012). Other

assumptions are shown in the appendix 3.

Year 2019(1) 2020(2) 2021(3) 2022(4) 2023(5)

Cash Revenues (81% of total

revenues from operations and

excluding other gains and

incomes) 22,397 23,729 25,140 26,635 28,219

Cash Expenses (75% of

Operating Expenses from labour,

goods and services costs and

SG&A and excluding

amortisation and depreciation) 15,035 15,929 16,876 17,879 18,943

Income before tax costs 7,362 7,800 8,264 8,755 9,276

Tax 27.5% 27.5% 27.5% 27.5% 27.5%

Tax cost 2,025 2,145 2,273 2,408 2,551

Income after tax costs 5,338 5,655 5,991 6,348 6,725

Forecast for the next 5 years:

Step 3: Calculating the after tax OCF for the next 5 years.

($m) 1 2 3 4 5

Depreciation and amortisation 4,736 5,017 5,316 5,632 5,967

Tax benefits from depreciation and

amortisation 1,302 1,380 1,462 1,549 1,641

OCF (Cash income after tax costs

(step 2) + tax benefits)

6,640 7,035 7,453 7,896 8,366

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate Finance [Surname, Student ID #]

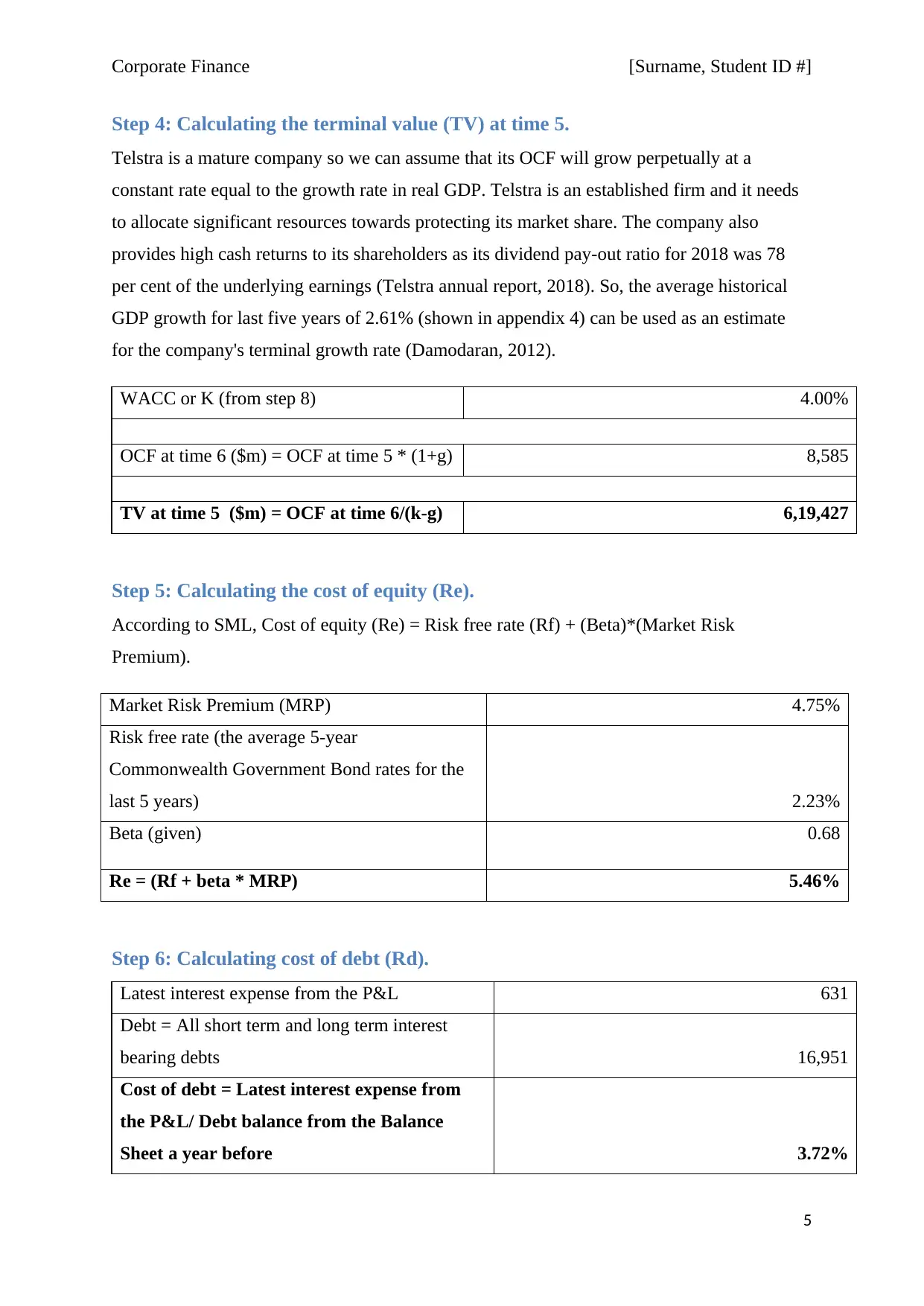

Step 4: Calculating the terminal value (TV) at time 5.

Telstra is a mature company so we can assume that its OCF will grow perpetually at a

constant rate equal to the growth rate in real GDP. Telstra is an established firm and it needs

to allocate significant resources towards protecting its market share. The company also

provides high cash returns to its shareholders as its dividend pay-out ratio for 2018 was 78

per cent of the underlying earnings (Telstra annual report, 2018). So, the average historical

GDP growth for last five years of 2.61% (shown in appendix 4) can be used as an estimate

for the company's terminal growth rate (Damodaran, 2012).

WACC or K (from step 8) 4.00%

OCF at time 6 ($m) = OCF at time 5 * (1+g) 8,585

TV at time 5 ($m) = OCF at time 6/(k-g) 6,19,427

Step 5: Calculating the cost of equity (Re).

According to SML, Cost of equity (Re) = Risk free rate (Rf) + (Beta)*(Market Risk

Premium).

Market Risk Premium (MRP) 4.75%

Risk free rate (the average 5-year

Commonwealth Government Bond rates for the

last 5 years) 2.23%

Beta (given) 0.68

Re = (Rf + beta * MRP) 5.46%

Step 6: Calculating cost of debt (Rd).

Latest interest expense from the P&L 631

Debt = All short term and long term interest

bearing debts 16,951

Cost of debt = Latest interest expense from

the P&L/ Debt balance from the Balance

Sheet a year before 3.72%

5

Step 4: Calculating the terminal value (TV) at time 5.

Telstra is a mature company so we can assume that its OCF will grow perpetually at a

constant rate equal to the growth rate in real GDP. Telstra is an established firm and it needs

to allocate significant resources towards protecting its market share. The company also

provides high cash returns to its shareholders as its dividend pay-out ratio for 2018 was 78

per cent of the underlying earnings (Telstra annual report, 2018). So, the average historical

GDP growth for last five years of 2.61% (shown in appendix 4) can be used as an estimate

for the company's terminal growth rate (Damodaran, 2012).

WACC or K (from step 8) 4.00%

OCF at time 6 ($m) = OCF at time 5 * (1+g) 8,585

TV at time 5 ($m) = OCF at time 6/(k-g) 6,19,427

Step 5: Calculating the cost of equity (Re).

According to SML, Cost of equity (Re) = Risk free rate (Rf) + (Beta)*(Market Risk

Premium).

Market Risk Premium (MRP) 4.75%

Risk free rate (the average 5-year

Commonwealth Government Bond rates for the

last 5 years) 2.23%

Beta (given) 0.68

Re = (Rf + beta * MRP) 5.46%

Step 6: Calculating cost of debt (Rd).

Latest interest expense from the P&L 631

Debt = All short term and long term interest

bearing debts 16,951

Cost of debt = Latest interest expense from

the P&L/ Debt balance from the Balance

Sheet a year before 3.72%

5

Corporate Finance [Surname, Student ID #]

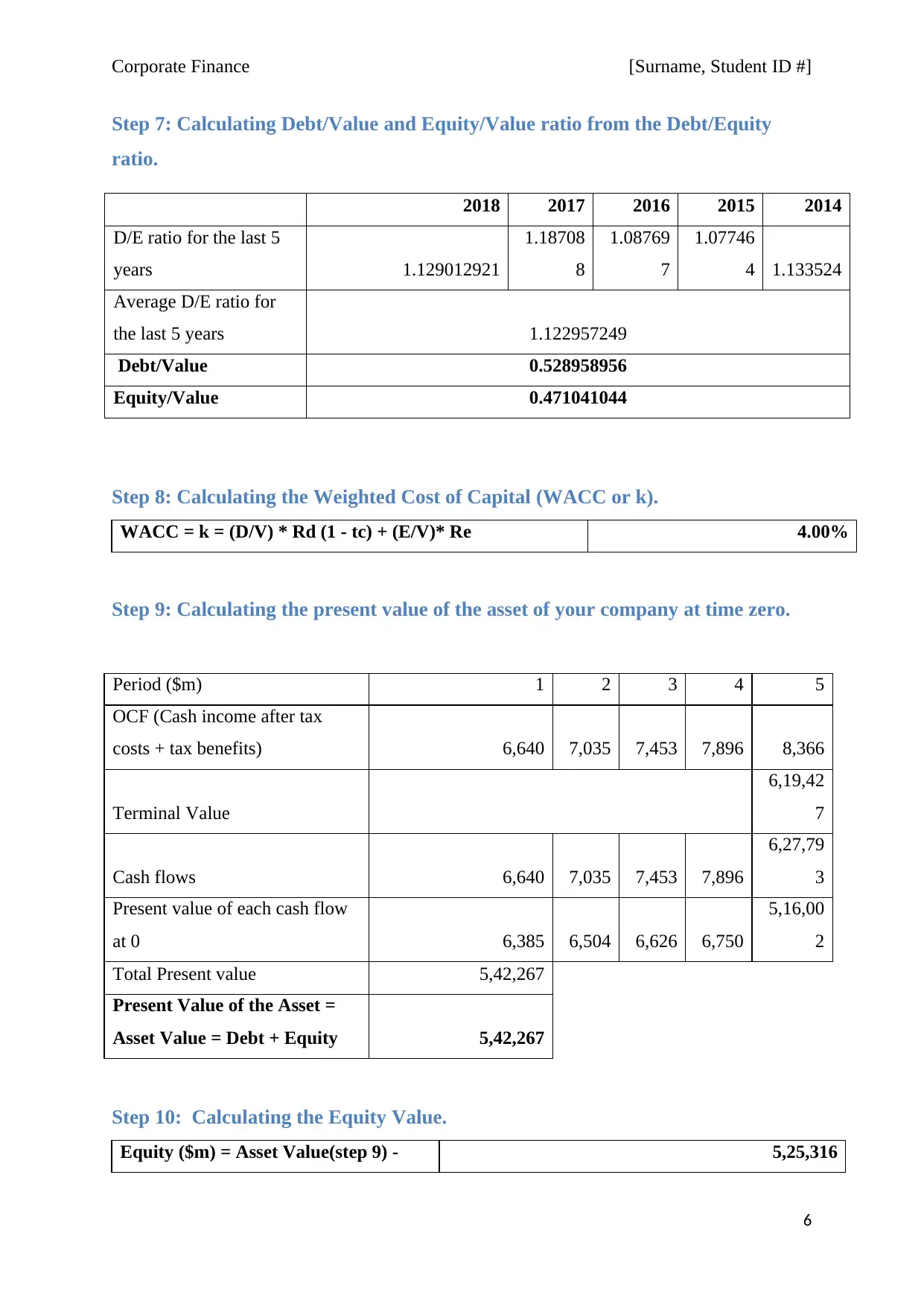

Step 7: Calculating Debt/Value and Equity/Value ratio from the Debt/Equity

ratio.

Step 8: Calculating the Weighted Cost of Capital (WACC or k).

WACC = k = (D/V) * Rd (1 - tc) + (E/V)* Re 4.00%

Step 9: Calculating the present value of the asset of your company at time zero.

Step 10: Calculating the Equity Value.

Equity ($m) = Asset Value(step 9) - 5,25,316

6

2018 2017 2016 2015 2014

D/E ratio for the last 5

years 1.129012921

1.18708

8

1.08769

7

1.07746

4 1.133524

Average D/E ratio for

the last 5 years 1.122957249

Debt/Value 0.528958956

Equity/Value 0.471041044

Period ($m) 1 2 3 4 5

OCF (Cash income after tax

costs + tax benefits) 6,640 7,035 7,453 7,896 8,366

Terminal Value

6,19,42

7

Cash flows 6,640 7,035 7,453 7,896

6,27,79

3

Present value of each cash flow

at 0 6,385 6,504 6,626 6,750

5,16,00

2

Total Present value 5,42,267

Present Value of the Asset =

Asset Value = Debt + Equity 5,42,267

Step 7: Calculating Debt/Value and Equity/Value ratio from the Debt/Equity

ratio.

Step 8: Calculating the Weighted Cost of Capital (WACC or k).

WACC = k = (D/V) * Rd (1 - tc) + (E/V)* Re 4.00%

Step 9: Calculating the present value of the asset of your company at time zero.

Step 10: Calculating the Equity Value.

Equity ($m) = Asset Value(step 9) - 5,25,316

6

2018 2017 2016 2015 2014

D/E ratio for the last 5

years 1.129012921

1.18708

8

1.08769

7

1.07746

4 1.133524

Average D/E ratio for

the last 5 years 1.122957249

Debt/Value 0.528958956

Equity/Value 0.471041044

Period ($m) 1 2 3 4 5

OCF (Cash income after tax

costs + tax benefits) 6,640 7,035 7,453 7,896 8,366

Terminal Value

6,19,42

7

Cash flows 6,640 7,035 7,453 7,896

6,27,79

3

Present value of each cash flow

at 0 6,385 6,504 6,626 6,750

5,16,00

2

Total Present value 5,42,267

Present Value of the Asset =

Asset Value = Debt + Equity 5,42,267

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate Finance [Surname, Student ID #]

Debt (step 6)

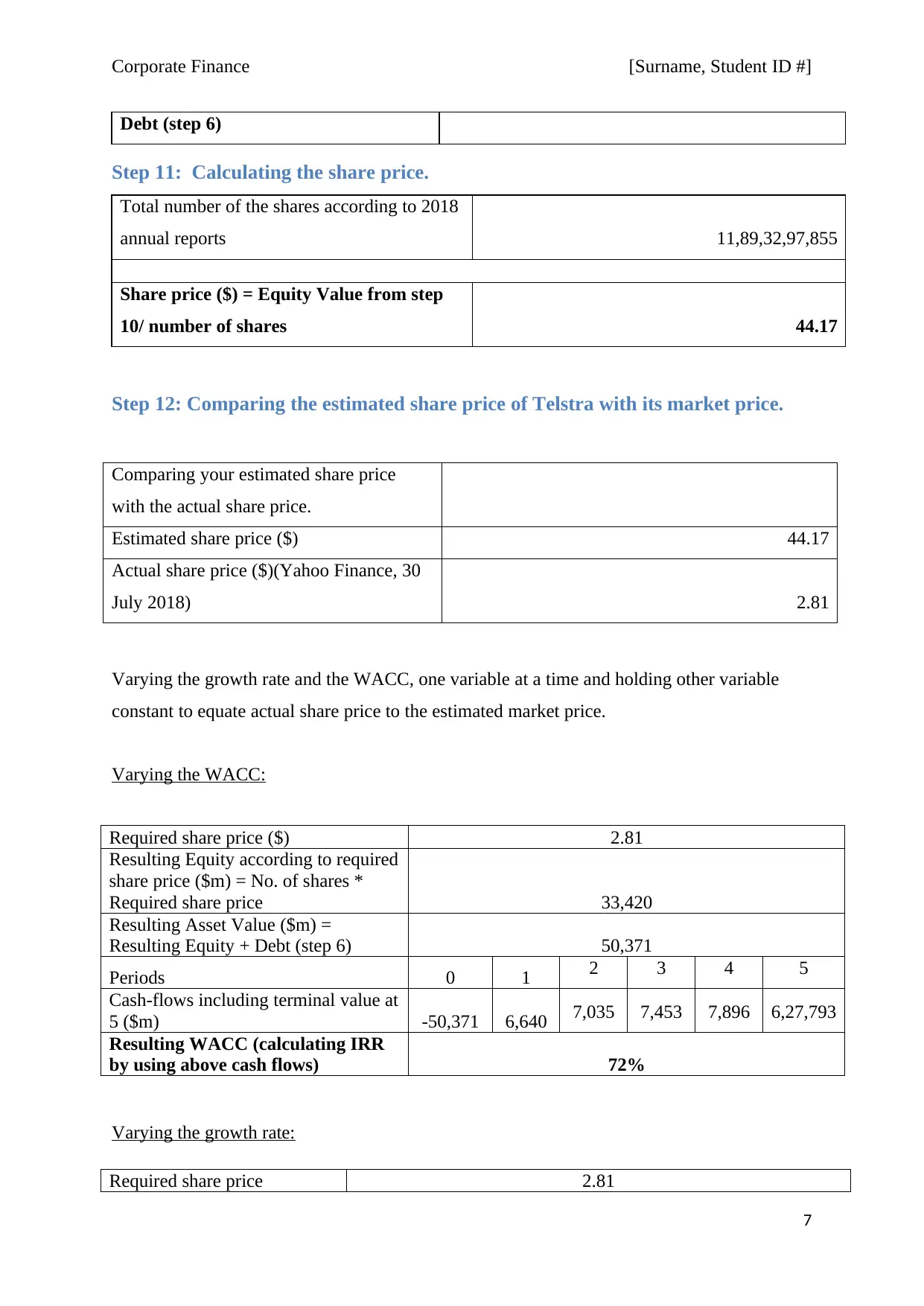

Step 11: Calculating the share price.

Total number of the shares according to 2018

annual reports 11,89,32,97,855

Share price ($) = Equity Value from step

10/ number of shares 44.17

Step 12: Comparing the estimated share price of Telstra with its market price.

Comparing your estimated share price

with the actual share price.

Estimated share price ($) 44.17

Actual share price ($)(Yahoo Finance, 30

July 2018) 2.81

Varying the growth rate and the WACC, one variable at a time and holding other variable

constant to equate actual share price to the estimated market price.

Varying the WACC:

Required share price ($) 2.81

Resulting Equity according to required

share price ($m) = No. of shares *

Required share price 33,420

Resulting Asset Value ($m) =

Resulting Equity + Debt (step 6) 50,371

Periods 0 1 2 3 4 5

Cash-flows including terminal value at

5 ($m) -50,371 6,640 7,035 7,453 7,896 6,27,793

Resulting WACC (calculating IRR

by using above cash flows) 72%

Varying the growth rate:

Required share price 2.81

7

Debt (step 6)

Step 11: Calculating the share price.

Total number of the shares according to 2018

annual reports 11,89,32,97,855

Share price ($) = Equity Value from step

10/ number of shares 44.17

Step 12: Comparing the estimated share price of Telstra with its market price.

Comparing your estimated share price

with the actual share price.

Estimated share price ($) 44.17

Actual share price ($)(Yahoo Finance, 30

July 2018) 2.81

Varying the growth rate and the WACC, one variable at a time and holding other variable

constant to equate actual share price to the estimated market price.

Varying the WACC:

Required share price ($) 2.81

Resulting Equity according to required

share price ($m) = No. of shares *

Required share price 33,420

Resulting Asset Value ($m) =

Resulting Equity + Debt (step 6) 50,371

Periods 0 1 2 3 4 5

Cash-flows including terminal value at

5 ($m) -50,371 6,640 7,035 7,453 7,896 6,27,793

Resulting WACC (calculating IRR

by using above cash flows) 72%

Varying the growth rate:

Required share price 2.81

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate Finance [Surname, Student ID #]

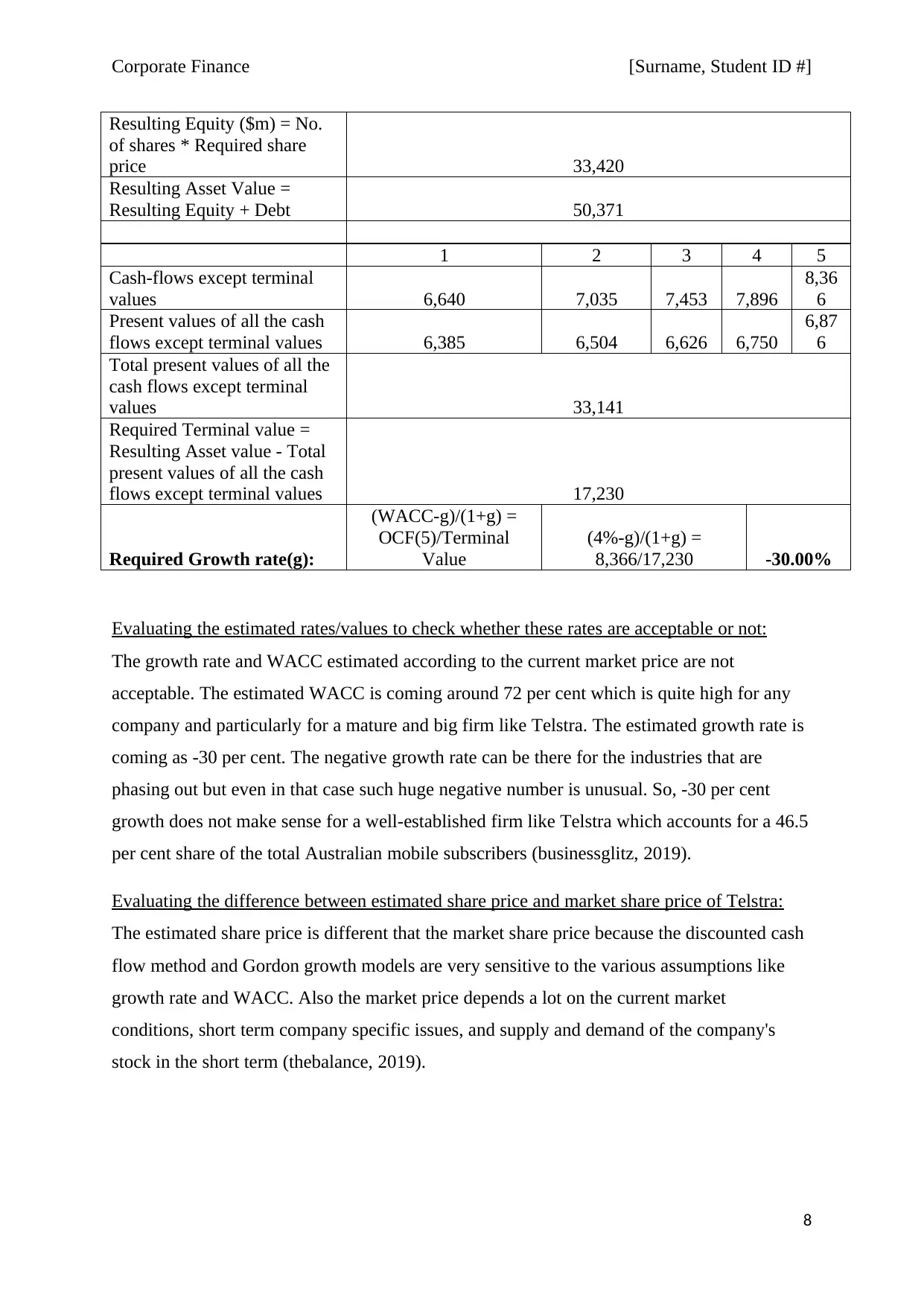

Resulting Equity ($m) = No.

of shares * Required share

price 33,420

Resulting Asset Value =

Resulting Equity + Debt 50,371

1 2 3 4 5

Cash-flows except terminal

values 6,640 7,035 7,453 7,896

8,36

6

Present values of all the cash

flows except terminal values 6,385 6,504 6,626 6,750

6,87

6

Total present values of all the

cash flows except terminal

values 33,141

Required Terminal value =

Resulting Asset value - Total

present values of all the cash

flows except terminal values 17,230

Required Growth rate(g):

(WACC-g)/(1+g) =

OCF(5)/Terminal

Value

(4%-g)/(1+g) =

8,366/17,230 -30.00%

Evaluating the estimated rates/values to check whether these rates are acceptable or not:

The growth rate and WACC estimated according to the current market price are not

acceptable. The estimated WACC is coming around 72 per cent which is quite high for any

company and particularly for a mature and big firm like Telstra. The estimated growth rate is

coming as -30 per cent. The negative growth rate can be there for the industries that are

phasing out but even in that case such huge negative number is unusual. So, -30 per cent

growth does not make sense for a well-established firm like Telstra which accounts for a 46.5

per cent share of the total Australian mobile subscribers (businessglitz, 2019).

Evaluating the difference between estimated share price and market share price of Telstra:

The estimated share price is different that the market share price because the discounted cash

flow method and Gordon growth models are very sensitive to the various assumptions like

growth rate and WACC. Also the market price depends a lot on the current market

conditions, short term company specific issues, and supply and demand of the company's

stock in the short term (thebalance, 2019).

8

Resulting Equity ($m) = No.

of shares * Required share

price 33,420

Resulting Asset Value =

Resulting Equity + Debt 50,371

1 2 3 4 5

Cash-flows except terminal

values 6,640 7,035 7,453 7,896

8,36

6

Present values of all the cash

flows except terminal values 6,385 6,504 6,626 6,750

6,87

6

Total present values of all the

cash flows except terminal

values 33,141

Required Terminal value =

Resulting Asset value - Total

present values of all the cash

flows except terminal values 17,230

Required Growth rate(g):

(WACC-g)/(1+g) =

OCF(5)/Terminal

Value

(4%-g)/(1+g) =

8,366/17,230 -30.00%

Evaluating the estimated rates/values to check whether these rates are acceptable or not:

The growth rate and WACC estimated according to the current market price are not

acceptable. The estimated WACC is coming around 72 per cent which is quite high for any

company and particularly for a mature and big firm like Telstra. The estimated growth rate is

coming as -30 per cent. The negative growth rate can be there for the industries that are

phasing out but even in that case such huge negative number is unusual. So, -30 per cent

growth does not make sense for a well-established firm like Telstra which accounts for a 46.5

per cent share of the total Australian mobile subscribers (businessglitz, 2019).

Evaluating the difference between estimated share price and market share price of Telstra:

The estimated share price is different that the market share price because the discounted cash

flow method and Gordon growth models are very sensitive to the various assumptions like

growth rate and WACC. Also the market price depends a lot on the current market

conditions, short term company specific issues, and supply and demand of the company's

stock in the short term (thebalance, 2019).

8

Corporate Finance [Surname, Student ID #]

Conclusion

This report performed the valuation of Telstra Company using discounted operating cash

flows method. The calculated operating cash flows for 2018 is 6,267 ($m). The OCF for next

five years is forecasted using growth rate of 5.95 %. The average GDP growth rate of 2.61

per-cent is used in the Gordon growth model to calculate terminal value of 6,19,427 ($m) at

period 5. This resulted in the present value of Telstra of 5,42,267 ($m) and the estimated

share price of 44.17 ($) on 30 July 2018. The significant difference is found in this estimated

price and market share price of 2.81 ($) due to the prevalent market conditions and the

sensitivity of the valuation model to various assumptions.

Recommendations

The discounted cash flows method can be used for the valuation of the company. It makes

sense to use the operating cash flows in this method as these cash flows are directly related to

the core business of the firm. This valuation model can be very sensitive to the various

assumptions like growth rate and WACC so it is recommended to perform sensitivity analysis

based on different rates/values before coming to the final conclusion of the fair value of the

asset.

9

Conclusion

This report performed the valuation of Telstra Company using discounted operating cash

flows method. The calculated operating cash flows for 2018 is 6,267 ($m). The OCF for next

five years is forecasted using growth rate of 5.95 %. The average GDP growth rate of 2.61

per-cent is used in the Gordon growth model to calculate terminal value of 6,19,427 ($m) at

period 5. This resulted in the present value of Telstra of 5,42,267 ($m) and the estimated

share price of 44.17 ($) on 30 July 2018. The significant difference is found in this estimated

price and market share price of 2.81 ($) due to the prevalent market conditions and the

sensitivity of the valuation model to various assumptions.

Recommendations

The discounted cash flows method can be used for the valuation of the company. It makes

sense to use the operating cash flows in this method as these cash flows are directly related to

the core business of the firm. This valuation model can be very sensitive to the various

assumptions like growth rate and WACC so it is recommended to perform sensitivity analysis

based on different rates/values before coming to the final conclusion of the fair value of the

asset.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.