Trading Income: Badges of Trade, Allowable Expenditure Analysis

VerifiedAdded on 2021/04/27

|20

|2145

|63

Homework Assignment

AI Summary

This document offers a detailed exploration of trading income, primarily focusing on the taxation of self-employed individuals or sole traders. It defines what constitutes a trade, referencing judicial decisions and the 'badges of trade' criteria established by the Royal Commission on the Taxation of Profits and Income, including the subject matter of the transaction, the length of ownership, frequency of transactions, supplementary work, circumstances of sale, motive, method of finance, and the existence of similar trading activities. The document also covers tax-adjusted trading profit, allowable and non-allowable expenditure, including items like subscriptions, charitable donations, appropriations, and capital assets. It delves into specific examples such as excessive salaries, interest, repairs versus improvements, and restrictions on car leasing costs based on CO2 emissions. The document provides practical examples and calculations to illustrate the application of these tax principles.

Trading income

• Self-employed/sole traders: individuals whose profits arise from a

trade, profession or vocation

• What constitutes a trade? This has been reviewed several times by

the Courts.

• In June 1955, the Royal Commission on the Taxation of Profits and

Income used these judicial decisions to establish what they

regarded to be the following main criteria in identifying the 'badges

of trade':

-1.The subject matter of the transaction; there are 3 reasons for

purchasing an asset:

1. For personal use – not subject to tax

2. As an investment – capital in nature and not subject to income tax

3. For resale at a profit (that constitutes a trade): therefore subject to income

tax

-

• Self-employed/sole traders: individuals whose profits arise from a

trade, profession or vocation

• What constitutes a trade? This has been reviewed several times by

the Courts.

• In June 1955, the Royal Commission on the Taxation of Profits and

Income used these judicial decisions to establish what they

regarded to be the following main criteria in identifying the 'badges

of trade':

-1.The subject matter of the transaction; there are 3 reasons for

purchasing an asset:

1. For personal use – not subject to tax

2. As an investment – capital in nature and not subject to income tax

3. For resale at a profit (that constitutes a trade): therefore subject to income

tax

-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Badges of trade

2.The length of the period of ownership: the longer the period

between date of acquisition and date of disposal, the more likely the

transaction will not be treated as trade.

3.The frequency or number of similar transactions by the same person;

usually the more transactions there are, the more likely that they will

be regarded as trading activities.

E.g. An individual acquired 1,000,000 toilet rolls and resold them at a

profit. In this case, he was judged to have made a trading profit and

single transaction was enough.

One could argue this was an investment but usually to be

considered as an investment, goods must be either income

producing (such as land or shares) or liable to be held for aesthetic

reasons (such as works of art)

2.The length of the period of ownership: the longer the period

between date of acquisition and date of disposal, the more likely the

transaction will not be treated as trade.

3.The frequency or number of similar transactions by the same person;

usually the more transactions there are, the more likely that they will

be regarded as trading activities.

E.g. An individual acquired 1,000,000 toilet rolls and resold them at a

profit. In this case, he was judged to have made a trading profit and

single transaction was enough.

One could argue this was an investment but usually to be

considered as an investment, goods must be either income

producing (such as land or shares) or liable to be held for aesthetic

reasons (such as works of art)

Badges of trade

• 4.Supplementary work and marketing; For example, in CIR v

Livingston and Others [1926] 11TC538 a sea vessel was purchased

as a joint venture by three individuals. The Lord President stated, at

pages 542 and 543:

• “The Respondents began by getting together a capital stock

sufficient (1) to buy a second-hand vessel, and (2) to convert her

into a marketable drifter. They bought the vessel and caused it to be

converted at their expense with that object in view, and they

successfully put her on the market. From beginning to end, these

operations seem to me to be the same as those which characterise

the trade of converting and refitting second-hand articles for sale…

The profit made by the venture arose, not from the mere

appreciation of the capital value of an isolated purchase for resale,

but from the expenditure on the subject purchased of money laid out

upon it for the purpose of making it marketable at a profit. That

seems to me of the very essence of trade”.'

• 4.Supplementary work and marketing; For example, in CIR v

Livingston and Others [1926] 11TC538 a sea vessel was purchased

as a joint venture by three individuals. The Lord President stated, at

pages 542 and 543:

• “The Respondents began by getting together a capital stock

sufficient (1) to buy a second-hand vessel, and (2) to convert her

into a marketable drifter. They bought the vessel and caused it to be

converted at their expense with that object in view, and they

successfully put her on the market. From beginning to end, these

operations seem to me to be the same as those which characterise

the trade of converting and refitting second-hand articles for sale…

The profit made by the venture arose, not from the mere

appreciation of the capital value of an isolated purchase for resale,

but from the expenditure on the subject purchased of money laid out

upon it for the purpose of making it marketable at a profit. That

seems to me of the very essence of trade”.'

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Badges of trade

• 5.The circumstances that were responsible for the sale;

a forced sale to raise cash for an emergency is an

indication that the transaction was not of a trading

nature.

• 6.Motive; intention to profit indicates trading. For e.g, an

individual hedging against devaluation of sterling by

purchasing silver bullion. On resale, a profit arises and is

regarded as trading profit since the motive for the

transaction was to make a profit in sterling terms.

• 7. Method of finance: If the purchaser has to borrow

money to buy an asset such that he has to sell that asset

quickly to repay the loan, it may be inferred that trading

was taking place.

• 5.The circumstances that were responsible for the sale;

a forced sale to raise cash for an emergency is an

indication that the transaction was not of a trading

nature.

• 6.Motive; intention to profit indicates trading. For e.g, an

individual hedging against devaluation of sterling by

purchasing silver bullion. On resale, a profit arises and is

regarded as trading profit since the motive for the

transaction was to make a profit in sterling terms.

• 7. Method of finance: If the purchaser has to borrow

money to buy an asset such that he has to sell that asset

quickly to repay the loan, it may be inferred that trading

was taking place.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Badges of trade

• 8. Existence of similar trading transactions or interests

If there is an existing trade, then a similarity to the

transaction which is being considered may point to that

transaction having a trading character. For e.g, a builder

who builds and sells a number of houses may be held to

be trading even if he retains one or more houses for

longer than usual and claims that they were held as an

investment

• Tax adjusted trading profit: the net profit per the financial

accounts often different from taxable trading profit figure.

Adjustments need to be made.

• 8. Existence of similar trading transactions or interests

If there is an existing trade, then a similarity to the

transaction which is being considered may point to that

transaction having a trading character. For e.g, a builder

who builds and sells a number of houses may be held to

be trading even if he retains one or more houses for

longer than usual and claims that they were held as an

investment

• Tax adjusted trading profit: the net profit per the financial

accounts often different from taxable trading profit figure.

Adjustments need to be made.

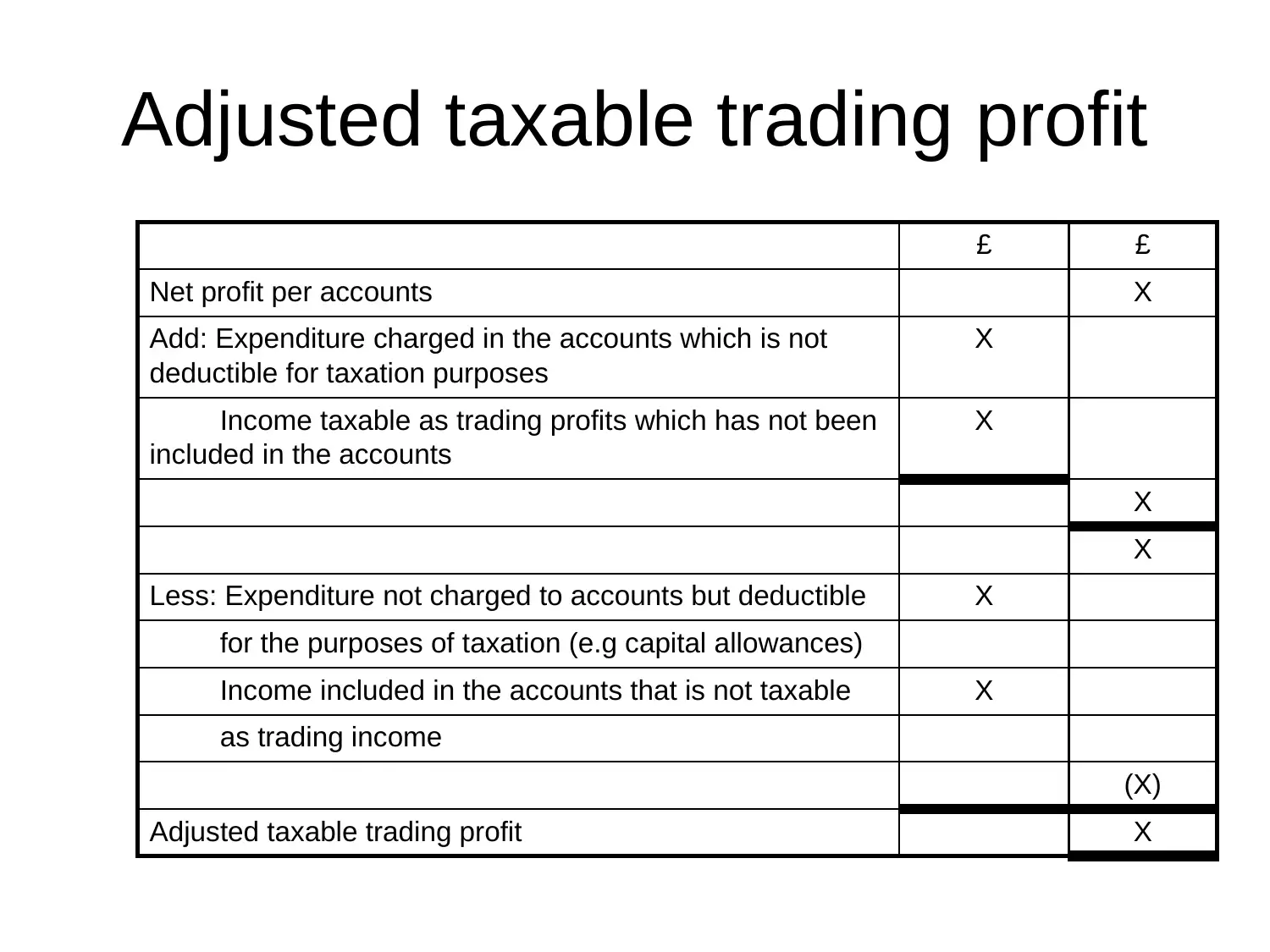

Adjusted taxable trading profit

£ £

Net profit per accounts X

Add: Expenditure charged in the accounts which is not

deductible for taxation purposes

X

Income taxable as trading profits which has not been

included in the accounts

X

X

X

Less: Expenditure not charged to accounts but deductible X

for the purposes of taxation (e.g capital allowances)

Income included in the accounts that is not taxable X

as trading income

(X)

Adjusted taxable trading profit X

£ £

Net profit per accounts X

Add: Expenditure charged in the accounts which is not

deductible for taxation purposes

X

Income taxable as trading profits which has not been

included in the accounts

X

X

X

Less: Expenditure not charged to accounts but deductible X

for the purposes of taxation (e.g capital allowances)

Income included in the accounts that is not taxable X

as trading income

(X)

Adjusted taxable trading profit X

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Allowable expenditure

• Tax rule: Expenditure incurred wholly and exclusively for

the purposes of trade is allowable

• Expenditure may not be allowable: remoteness test and

duality principle

• Remoteness test: expenditure regarded too remote from

the trade.

• Duality principle: expenditure has more than one

purpose and one of them is not trading. Illustration: a

self-employed trader was unable to eat lunch at home

and claimed the extra cost of eating out as a tax

deduction. This was not allowed. The duality of the case

lay in the fact that the taxpayer needed to eat to live as

well, not just to work.

• Tax rule: Expenditure incurred wholly and exclusively for

the purposes of trade is allowable

• Expenditure may not be allowable: remoteness test and

duality principle

• Remoteness test: expenditure regarded too remote from

the trade.

• Duality principle: expenditure has more than one

purpose and one of them is not trading. Illustration: a

self-employed trader was unable to eat lunch at home

and claimed the extra cost of eating out as a tax

deduction. This was not allowed. The duality of the case

lay in the fact that the taxpayer needed to eat to live as

well, not just to work.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Allowable expenditure

• Excessive salary paid to sole trader’s family: business

owners often employ their spouses or family members in

their business. Any salary paid to the latter must not be

excessive, i.e., it must be at the commercial rate for the

work performed. Excessive salary payments are

disallowed.

• Interest payable: interest on borrowings such as

business account overdrafts, credit cards or hire

purchase contracts is allowable trading expense

calculated on accruals basis

• Interest payable: interest paid on overdue tax is never

allowable. Interest received on overpaid tax not taxable.

• Excessive salary paid to sole trader’s family: business

owners often employ their spouses or family members in

their business. Any salary paid to the latter must not be

excessive, i.e., it must be at the commercial rate for the

work performed. Excessive salary payments are

disallowed.

• Interest payable: interest on borrowings such as

business account overdrafts, credit cards or hire

purchase contracts is allowable trading expense

calculated on accruals basis

• Interest payable: interest paid on overdue tax is never

allowable. Interest received on overpaid tax not taxable.

Allowable expenditure

• Subscriptions:

– Trade or professional association subscriptions normally

deductible since they will be made wholly and exclusively for the

purposes of the trade

• Charitable donations: to be allowable, expenses must

be: • Wholly and exclusively for trading purposes

• Local and reasonable in size in relation to the business making the

donation

• Made to an educational, religious, cultural, recreational or

benevolent organisation

• If donation is disallowed but payment was made to a charity, the

taxpayer can claim relief under Gift Aid Scheme

• Subscriptions and donations to political parties are not

deductible

• Subscriptions:

– Trade or professional association subscriptions normally

deductible since they will be made wholly and exclusively for the

purposes of the trade

• Charitable donations: to be allowable, expenses must

be: • Wholly and exclusively for trading purposes

• Local and reasonable in size in relation to the business making the

donation

• Made to an educational, religious, cultural, recreational or

benevolent organisation

• If donation is disallowed but payment was made to a charity, the

taxpayer can claim relief under Gift Aid Scheme

• Subscriptions and donations to political parties are not

deductible

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Non-Allowable expenditure

• Appropriations: withdrawal of funds from a

business and most common e.g’s are:

– Business owner’s salary

– Interest paid to owner on capital invested in

business

– Drawings by sole trader or partner

– Any private element of expenditure relating to

owner’s motor car, telephone

Such appropriations are disallowed expenses.

• Appropriations: withdrawal of funds from a

business and most common e.g’s are:

– Business owner’s salary

– Interest paid to owner on capital invested in

business

– Drawings by sole trader or partner

– Any private element of expenditure relating to

owner’s motor car, telephone

Such appropriations are disallowed expenses.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Non-Allowable expenditure

• Expenditure on capital assets not allowable.

• Expenditure on P&M attracts capital allowances (to be

covered later)

• Legal cases have shown the following in respect of

repair (revenue) versus improvement (capital)

expenditure:

1. Cost of initial repairs in order to make an asset

usable is not deductible

2. Cost of initial repairs is deductible if asset can be put

into use before any repairs are carried out

3. To be allowable, it needs to be proven that the

restoration renews a subsidiary part of an asset. For

e.g the replacement of an old stand with a new one at

a football club was held to be expenditure on a new

asset and thus capital expenditure.

• Expenditure on capital assets not allowable.

• Expenditure on P&M attracts capital allowances (to be

covered later)

• Legal cases have shown the following in respect of

repair (revenue) versus improvement (capital)

expenditure:

1. Cost of initial repairs in order to make an asset

usable is not deductible

2. Cost of initial repairs is deductible if asset can be put

into use before any repairs are carried out

3. To be allowable, it needs to be proven that the

restoration renews a subsidiary part of an asset. For

e.g the replacement of an old stand with a new one at

a football club was held to be expenditure on a new

asset and thus capital expenditure.

Non-charitable gifts

• Entertaining and gifts:

– Entertainment expenditure not allowed.

– Only exception: Expenditure relating to employees, provided it is

not incidental to the entertainment of others

• Gifts to employees:

– Allowable trading expenditure

– If gift falls within the benefit rules, to be assessed as employment

income for employee

• Gifts to customers:

– Allowable if they cost less than £50 per year, are not of food,

drink, tobacco or vouchers exchangeable for goods and carry a

conspicuous advertisement of the business making the gift

– If total of gifts in tax year exceed £50, the full cost of the item is

disallowable, not just the excess

• Entertaining and gifts:

– Entertainment expenditure not allowed.

– Only exception: Expenditure relating to employees, provided it is

not incidental to the entertainment of others

• Gifts to employees:

– Allowable trading expenditure

– If gift falls within the benefit rules, to be assessed as employment

income for employee

• Gifts to customers:

– Allowable if they cost less than £50 per year, are not of food,

drink, tobacco or vouchers exchangeable for goods and carry a

conspicuous advertisement of the business making the gift

– If total of gifts in tax year exceed £50, the full cost of the item is

disallowable, not just the excess

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.