Auriel's Trial Balance: Source, Structure, and Year-End Adjustments

VerifiedAdded on 2024/06/03

|6

|767

|196

Report

AI Summary

This report provides a detailed analysis of Auriel's trial balance, assessing its source and structure, which originates from ledger balances after journal entries, ensuring debits and credits are balanced as per double-entry accounting principles. It evaluates the impact of year-end adjustments, including accrual expenses (unpaid expenses like salaries), prepaid expenses (advance payments like insurance), depreciation (wear and tear on fixed assets), and provision for doubtful debts (estimated bad debts), on the business's income statement and balance sheet, explaining how these adjustments affect the presentation of financial information and the overall financial position of the company. The report references key accounting texts to support its analysis and conclusions.

Part B

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

A. Assess the source and structure of Auriel’s trial balance (3.1)......................................................3

B. Evaluate the effect of the following end of year adjustments and notes on the business’s income

statement and balance sheet (3.2)........................................................................................................5

References.............................................................................................................................................6

2

A. Assess the source and structure of Auriel’s trial balance (3.1)......................................................3

B. Evaluate the effect of the following end of year adjustments and notes on the business’s income

statement and balance sheet (3.2)........................................................................................................5

References.............................................................................................................................................6

2

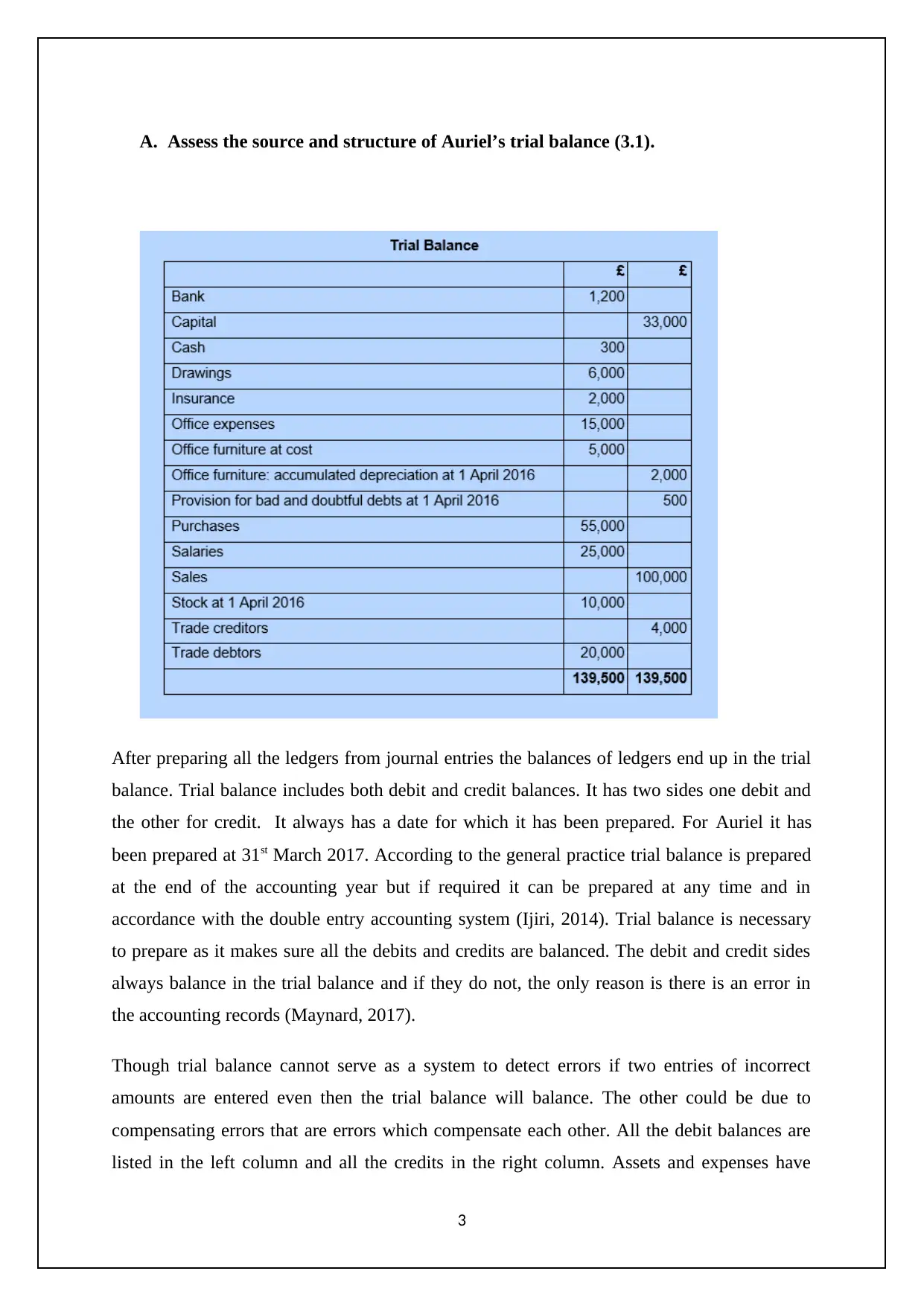

A. Assess the source and structure of Auriel’s trial balance (3.1).

After preparing all the ledgers from journal entries the balances of ledgers end up in the trial

balance. Trial balance includes both debit and credit balances. It has two sides one debit and

the other for credit. It always has a date for which it has been prepared. For Auriel it has

been prepared at 31st March 2017. According to the general practice trial balance is prepared

at the end of the accounting year but if required it can be prepared at any time and in

accordance with the double entry accounting system (Ijiri, 2014). Trial balance is necessary

to prepare as it makes sure all the debits and credits are balanced. The debit and credit sides

always balance in the trial balance and if they do not, the only reason is there is an error in

the accounting records (Maynard, 2017).

Though trial balance cannot serve as a system to detect errors if two entries of incorrect

amounts are entered even then the trial balance will balance. The other could be due to

compensating errors that are errors which compensate each other. All the debit balances are

listed in the left column and all the credits in the right column. Assets and expenses have

3

After preparing all the ledgers from journal entries the balances of ledgers end up in the trial

balance. Trial balance includes both debit and credit balances. It has two sides one debit and

the other for credit. It always has a date for which it has been prepared. For Auriel it has

been prepared at 31st March 2017. According to the general practice trial balance is prepared

at the end of the accounting year but if required it can be prepared at any time and in

accordance with the double entry accounting system (Ijiri, 2014). Trial balance is necessary

to prepare as it makes sure all the debits and credits are balanced. The debit and credit sides

always balance in the trial balance and if they do not, the only reason is there is an error in

the accounting records (Maynard, 2017).

Though trial balance cannot serve as a system to detect errors if two entries of incorrect

amounts are entered even then the trial balance will balance. The other could be due to

compensating errors that are errors which compensate each other. All the debit balances are

listed in the left column and all the credits in the right column. Assets and expenses have

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

debit balance and liabilities, equity and revenue will have a credit balance. In case of errors,

rectification entry can also be part of the trial balance. After the preparation of trial balance,

the balances are transferred to profit and loss account or balance sheet for preparation of final

accounts. Trial balance serves as an important tool for the preparation of final accounts

(Maynard, 2017).

4

rectification entry can also be part of the trial balance. After the preparation of trial balance,

the balances are transferred to profit and loss account or balance sheet for preparation of final

accounts. Trial balance serves as an important tool for the preparation of final accounts

(Maynard, 2017).

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

B. Evaluate the effect of the following end of year adjustments and notes on the

business’s income statement and balance sheet (3.2).

Accrual expenses:

Accrual means a charge incurred but not yet paid. Therefore, all those expenses which are

incurred by the firm but not yet paid are called accrual expenses. These are shown under the

head current liabilities e.g. salaries owed by the firm of £1000 (Weygandt, et. al., 2015).

Prepaid expenses:

At times the business has to pay certain expenses in advance to receive the services. These

advance payments are called prepaid expenses. Fir the firm it has paid for insurance in

advance for about £500. These expenses instead of being debited to profit and loss account

are shown under the current assets in the assets side of the balance sheet.

Depreciation:

The wear and tear of fixed assets of the firm because of their use is called depreciation.

Depreciation may be charged from the asset that will reduce the value of the asset or it may

be shown as accumulated depreciation as a separate balance in the balance sheet. E.g.

depreciation of the office furniture at 10 percent of original cost.

Provision for doubtful debts:

The firm often sells its goods on credit. The individuals who buy goods on credit are called

debtors of the firm. At times the debtors may decline to pay their dues due to insolvency or

other reasons. This gives rise to bad debts. The provision made for future bad debts that are

these bad debts may or may not arise is called provision for doubtful debts. Provision for

doubtful debts is £950 that is reduced from the debtors.

5

business’s income statement and balance sheet (3.2).

Accrual expenses:

Accrual means a charge incurred but not yet paid. Therefore, all those expenses which are

incurred by the firm but not yet paid are called accrual expenses. These are shown under the

head current liabilities e.g. salaries owed by the firm of £1000 (Weygandt, et. al., 2015).

Prepaid expenses:

At times the business has to pay certain expenses in advance to receive the services. These

advance payments are called prepaid expenses. Fir the firm it has paid for insurance in

advance for about £500. These expenses instead of being debited to profit and loss account

are shown under the current assets in the assets side of the balance sheet.

Depreciation:

The wear and tear of fixed assets of the firm because of their use is called depreciation.

Depreciation may be charged from the asset that will reduce the value of the asset or it may

be shown as accumulated depreciation as a separate balance in the balance sheet. E.g.

depreciation of the office furniture at 10 percent of original cost.

Provision for doubtful debts:

The firm often sells its goods on credit. The individuals who buy goods on credit are called

debtors of the firm. At times the debtors may decline to pay their dues due to insolvency or

other reasons. This gives rise to bad debts. The provision made for future bad debts that are

these bad debts may or may not arise is called provision for doubtful debts. Provision for

doubtful debts is £950 that is reduced from the debtors.

5

References:

Ijiri, Y., 2014. The beauty of double-entry bookkeeping and its impact on the nature

of accounting information. Economie Notes by Monte dei Paschi di Siena, 22(2-

1993), pp.265-285.

Maynard, J., 2017. Financial Accounting, Reporting, and Analysis. Oxford University

Press.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial

accounting. John Wiley & Sons.

6

Ijiri, Y., 2014. The beauty of double-entry bookkeeping and its impact on the nature

of accounting information. Economie Notes by Monte dei Paschi di Siena, 22(2-

1993), pp.265-285.

Maynard, J., 2017. Financial Accounting, Reporting, and Analysis. Oxford University

Press.

Weygandt, J.J., Kimmel, P.D. and Kieso, D.E., 2015. Financial & managerial

accounting. John Wiley & Sons.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.