Challenges and Opportunities: UK Automotive Industry Case Study

VerifiedAdded on 2023/03/22

|1

|1815

|57

Case Study

AI Summary

This case study examines the UK automotive industry, focusing on its key players such as Aston Martin, Rolls Royce, and Ferrari. It analyzes the industry's strategic positioning, marketing strategies, and the impact of globalization. The study employs Porter's Five Forces model to assess the competitive landscape, including barriers to entry, product differentiation, buyer and supplier power, and competitive rivalry. It also addresses the challenges faced, such as weak vehicle sales and supply chain risks, and explores opportunities for investment, international expansion, and job creation. The analysis highlights the importance of supply chain finance and the need for automotive firms to adapt to changing market dynamics and consumer preferences, particularly the growing demand for eco-friendly premium luxury cars. The study also touches upon the shift in the UK's trade balance and the increasing trade deficit in the manufacturing sector, including the automotive industry.

A CASE STUDY ON AUTOMOBILE INDUSTRY OF UK

INTRODUCTION

In UK, automotive industry is known as the major factor of economic growth and success. The

country’s global leadership in advanced technologies used in high performance cars. First and

foremost, a key distinctive factor of the luxury car market is that its performance is less affected by

changes in the macro environment. The recent financial crisis severely hit the car manufacturing

industry, however, the demand fluctuation in emerging markets was offset by a growing desire for

luxury cars in emerging markets. The luxury car market is dominated by three brands, ASTON

MARTIN, ROLLS ROYCE, FERRARI which are altogether controlling the majority of the sales in this

sector. The industry is expected to grow in the future, however, manufacturers and resellers must

ensure that they closely follow developments in their external environment.

As globalization has increased, many companies realised that strategic decisions with respect to

globalization must be made are issue companies must face is that, what works in one country or region

will not necessarily work in another, and strategies must be carefully crafted to take these variabilities’

into account. Another issue is the threat of political or social upheaval. Still another issue is the

difficulty of coordinating and managing far-flung operations. Indeed, in today global markets people

don't have to go abroad to experience international competition

PORTER’S 5 FORCES MODEL

Barriers to entry: The new launch of automobile companies, i.e. ASTON MARTIN, ROLLS ROYCE,

FERRARI requires high capital investment for the manufacturing of our new car which is

environmental friendly and targeting a specific segment of the market. So the risk of new entrant is

high as other big players might try to imitate the same concept. Apart from this, the ideas and

knowledge that provides competitive advantage over others is its unique hydrogen-based technology

which creates barrier to entry.

Product Differentiation: As the new product has to be different and accepted by the customers. So,

we are providing our customers with the expected attributes of premium luxury cars. In addition, a

well-developed distribution is must for its success when a new product is launched in the market

Buyers: As it is first of its kind, so they have no options to switch over. The bargaining power of

buyer is low as there we have mentioned in our switching cost that there are barriers to new entrants.

There is no forward integration of buyers.

Suppliers: The willingness of the customers to buy this product will be because of the higher

efficiency and good quality of an eco-friendly premium luxury car.

Competitive rivalry: the amount of competition in the car industry which appears to be in the luxury

cars such as ASTON MARTIN, ROLLS ROYCE , FERRARI in Europe. If the new product fails in

the market, then it is not easy for the company to exit because of the involvement of huge capital

investments. To maintain its new generation premium luxury car industry has to make manufacturing

improvements continuously to further keep uplift its quality.

"The company has a multifaceted strategy to position itself as a leading manufacturer of premium

vehicles offering high-quality products tailored to specific markets. The success of the industry is tied

to its investment in product development, and is reflected in the strategic focus on capital expenditure,

R&D and product design." The strategic position of Automobile industry as can be seen through the

previous analyses is strong within their target market. It can be seen that aims of automotive industries,

like - ASTON MARTIN, ROLLS ROYCE , FERRARI is to maintain this position through research

and development are indeed, how they are maintaining this position in reality.

The British car market is classified as a mass market which keeps growing. The smaller car market

finds itself at the peak of this growing market. Due to the variety of different models of cars, they can

be classified into two different car segments. Most models are located in the city/mini/supermini

segment and some in the lower medium/small family The trend towards higher sales of supermini

models is clearly visible, with 44% growth in that category stimulated by the continual addition of new

and more sophisticated features by manufacturers.

Challenges faced by automotive industry in UK

Challenges faced by automotive industry in UK

While the UK market has performed strongly in recent years and is set to exceed previous levels of

production, weak vehicle sales on the Continent are encouraging consolidation across the European sector as

makers look to cut costs and drive efficiencies. UK and European automotive suppliers are heavily integrated

and such significant changes in the industry will inevitably create some risk in the supply chain. There are a

number of financial solutions that can help businesses mitigate the risks of trading, one such is supply chain

finance (SCF) which can provide financial security to individual firms, while also adding stability and

sustainability to the wider sector. With SCF, a business can obtain early payment of their invoices with the

buyer’s bank, giving them greater access to working capital, but at no extra cost or debt to the buyer.

With complex network suppliers in the UK and globally, it could be highly advantageous to have a

programme like this in place to enable suppliers ‘down the chain’ to benefit from the financial strength of the

industry’s biggest names. The consideration of supply chain security will be vital to the future health of the

automotive sector as a whole and help large manufacturers to avoid any interruptions in production as change

permeates the industry.

Marketing strategy of Automobile industry

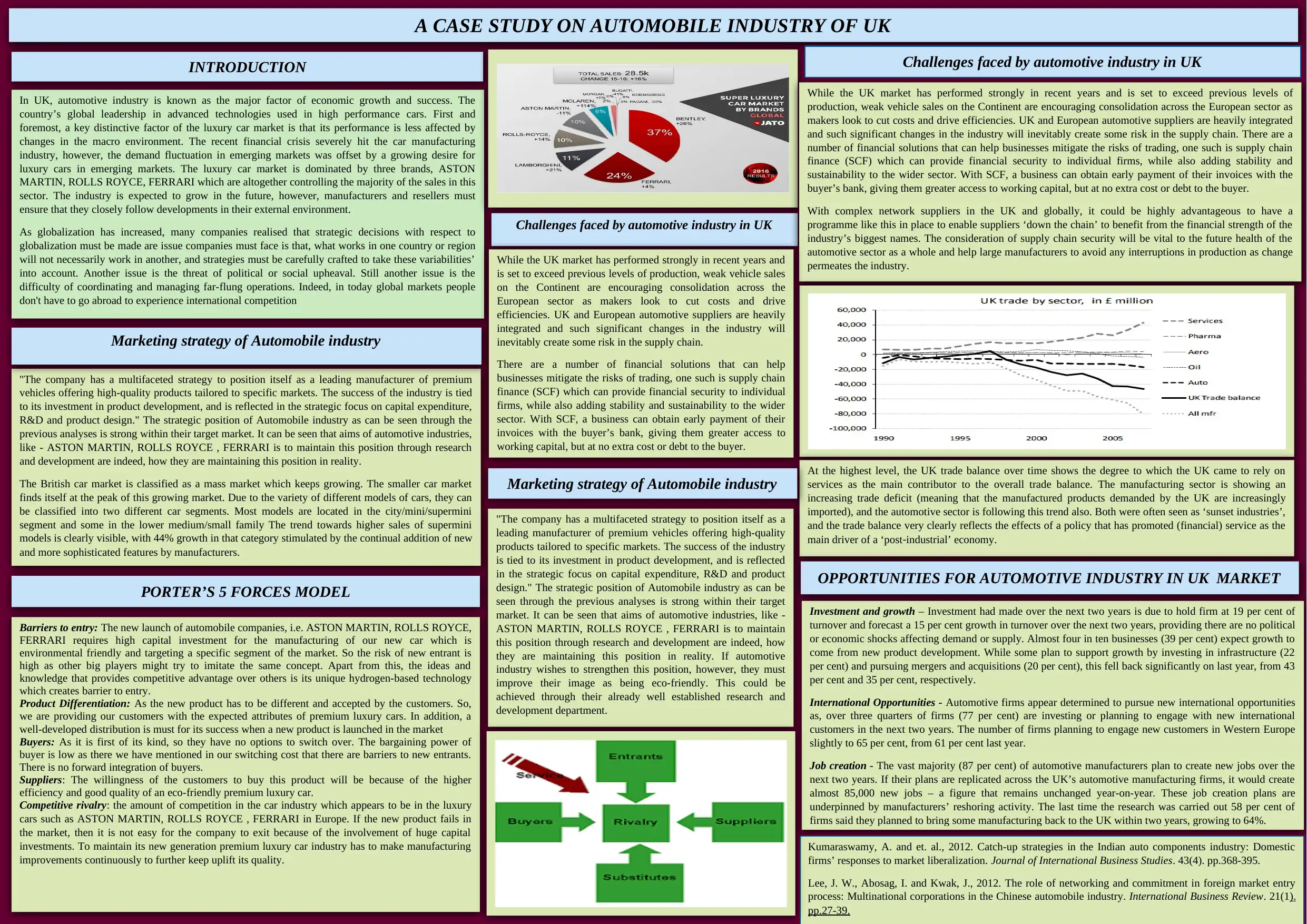

At the highest level, the UK trade balance over time shows the degree to which the UK came to rely on

services as the main contributor to the overall trade balance. The manufacturing sector is showing an

increasing trade deficit (meaning that the manufactured products demanded by the UK are increasingly

imported), and the automotive sector is following this trend also. Both were often seen as ‘sunset industries’,

and the trade balance very clearly reflects the effects of a policy that has promoted (financial) service as the

main driver of a ‘post‐industrial’ economy.

OPPORTUNITIES FOR AUTOMOTIVE INDUSTRY IN UK MARKET

Investment and growth – Investment had made over the next two years is due to hold firm at 19 per cent of

turnover and forecast a 15 per cent growth in turnover over the next two years, providing there are no political

or economic shocks affecting demand or supply. Almost four in ten businesses (39 per cent) expect growth to

come from new product development. While some plan to support growth by investing in infrastructure (22

per cent) and pursuing mergers and acquisitions (20 per cent), this fell back significantly on last year, from 43

per cent and 35 per cent, respectively.

International Opportunities - Automotive firms appear determined to pursue new international opportunities

as, over three quarters of firms (77 per cent) are investing or planning to engage with new international

customers in the next two years. The number of firms planning to engage new customers in Western Europe

slightly to 65 per cent, from 61 per cent last year.

Job creation - The vast majority (87 per cent) of automotive manufacturers plan to create new jobs over the

next two years. If their plans are replicated across the UK’s automotive manufacturing firms, it would create

almost 85,000 new jobs – a figure that remains unchanged year-on-year. These job creation plans are

underpinned by manufacturers’ reshoring activity. The last time the research was carried out 58 per cent of

firms said they planned to bring some manufacturing back to the UK within two years, growing to 64%.

Marketing strategy of Automobile industry

"The company has a multifaceted strategy to position itself as a

leading manufacturer of premium vehicles offering high-quality

products tailored to specific markets. The success of the industry

is tied to its investment in product development, and is reflected

in the strategic focus on capital expenditure, R&D and product

design." The strategic position of Automobile industry as can be

seen through the previous analyses is strong within their target

market. It can be seen that aims of automotive industries, like -

ASTON MARTIN, ROLLS ROYCE , FERRARI is to maintain

this position through research and development are indeed, how

they are maintaining this position in reality. If automotive

industry wishes to strengthen this position, however, they must

improve their image as being eco-friendly. This could be

achieved through their already well established research and

development department.

While the UK market has performed strongly in recent years and

is set to exceed previous levels of production, weak vehicle sales

on the Continent are encouraging consolidation across the

European sector as makers look to cut costs and drive

efficiencies. UK and European automotive suppliers are heavily

integrated and such significant changes in the industry will

inevitably create some risk in the supply chain.

There are a number of financial solutions that can help

businesses mitigate the risks of trading, one such is supply chain

finance (SCF) which can provide financial security to individual

firms, while also adding stability and sustainability to the wider

sector. With SCF, a business can obtain early payment of their

invoices with the buyer’s bank, giving them greater access to

working capital, but at no extra cost or debt to the buyer.

Kumaraswamy, A. and et. al., 2012. Catch-up strategies in the Indian auto components industry: Domestic

firms’ responses to market liberalization. Journal of International Business Studies. 43(4). pp.368-395.

Lee, J. W., Abosag, I. and Kwak, J., 2012. The role of networking and commitment in foreign market entry

process: Multinational corporations in the Chinese automobile industry. International Business Review. 21(1).

pp.27-39.

INTRODUCTION

In UK, automotive industry is known as the major factor of economic growth and success. The

country’s global leadership in advanced technologies used in high performance cars. First and

foremost, a key distinctive factor of the luxury car market is that its performance is less affected by

changes in the macro environment. The recent financial crisis severely hit the car manufacturing

industry, however, the demand fluctuation in emerging markets was offset by a growing desire for

luxury cars in emerging markets. The luxury car market is dominated by three brands, ASTON

MARTIN, ROLLS ROYCE, FERRARI which are altogether controlling the majority of the sales in this

sector. The industry is expected to grow in the future, however, manufacturers and resellers must

ensure that they closely follow developments in their external environment.

As globalization has increased, many companies realised that strategic decisions with respect to

globalization must be made are issue companies must face is that, what works in one country or region

will not necessarily work in another, and strategies must be carefully crafted to take these variabilities’

into account. Another issue is the threat of political or social upheaval. Still another issue is the

difficulty of coordinating and managing far-flung operations. Indeed, in today global markets people

don't have to go abroad to experience international competition

PORTER’S 5 FORCES MODEL

Barriers to entry: The new launch of automobile companies, i.e. ASTON MARTIN, ROLLS ROYCE,

FERRARI requires high capital investment for the manufacturing of our new car which is

environmental friendly and targeting a specific segment of the market. So the risk of new entrant is

high as other big players might try to imitate the same concept. Apart from this, the ideas and

knowledge that provides competitive advantage over others is its unique hydrogen-based technology

which creates barrier to entry.

Product Differentiation: As the new product has to be different and accepted by the customers. So,

we are providing our customers with the expected attributes of premium luxury cars. In addition, a

well-developed distribution is must for its success when a new product is launched in the market

Buyers: As it is first of its kind, so they have no options to switch over. The bargaining power of

buyer is low as there we have mentioned in our switching cost that there are barriers to new entrants.

There is no forward integration of buyers.

Suppliers: The willingness of the customers to buy this product will be because of the higher

efficiency and good quality of an eco-friendly premium luxury car.

Competitive rivalry: the amount of competition in the car industry which appears to be in the luxury

cars such as ASTON MARTIN, ROLLS ROYCE , FERRARI in Europe. If the new product fails in

the market, then it is not easy for the company to exit because of the involvement of huge capital

investments. To maintain its new generation premium luxury car industry has to make manufacturing

improvements continuously to further keep uplift its quality.

"The company has a multifaceted strategy to position itself as a leading manufacturer of premium

vehicles offering high-quality products tailored to specific markets. The success of the industry is tied

to its investment in product development, and is reflected in the strategic focus on capital expenditure,

R&D and product design." The strategic position of Automobile industry as can be seen through the

previous analyses is strong within their target market. It can be seen that aims of automotive industries,

like - ASTON MARTIN, ROLLS ROYCE , FERRARI is to maintain this position through research

and development are indeed, how they are maintaining this position in reality.

The British car market is classified as a mass market which keeps growing. The smaller car market

finds itself at the peak of this growing market. Due to the variety of different models of cars, they can

be classified into two different car segments. Most models are located in the city/mini/supermini

segment and some in the lower medium/small family The trend towards higher sales of supermini

models is clearly visible, with 44% growth in that category stimulated by the continual addition of new

and more sophisticated features by manufacturers.

Challenges faced by automotive industry in UK

Challenges faced by automotive industry in UK

While the UK market has performed strongly in recent years and is set to exceed previous levels of

production, weak vehicle sales on the Continent are encouraging consolidation across the European sector as

makers look to cut costs and drive efficiencies. UK and European automotive suppliers are heavily integrated

and such significant changes in the industry will inevitably create some risk in the supply chain. There are a

number of financial solutions that can help businesses mitigate the risks of trading, one such is supply chain

finance (SCF) which can provide financial security to individual firms, while also adding stability and

sustainability to the wider sector. With SCF, a business can obtain early payment of their invoices with the

buyer’s bank, giving them greater access to working capital, but at no extra cost or debt to the buyer.

With complex network suppliers in the UK and globally, it could be highly advantageous to have a

programme like this in place to enable suppliers ‘down the chain’ to benefit from the financial strength of the

industry’s biggest names. The consideration of supply chain security will be vital to the future health of the

automotive sector as a whole and help large manufacturers to avoid any interruptions in production as change

permeates the industry.

Marketing strategy of Automobile industry

At the highest level, the UK trade balance over time shows the degree to which the UK came to rely on

services as the main contributor to the overall trade balance. The manufacturing sector is showing an

increasing trade deficit (meaning that the manufactured products demanded by the UK are increasingly

imported), and the automotive sector is following this trend also. Both were often seen as ‘sunset industries’,

and the trade balance very clearly reflects the effects of a policy that has promoted (financial) service as the

main driver of a ‘post‐industrial’ economy.

OPPORTUNITIES FOR AUTOMOTIVE INDUSTRY IN UK MARKET

Investment and growth – Investment had made over the next two years is due to hold firm at 19 per cent of

turnover and forecast a 15 per cent growth in turnover over the next two years, providing there are no political

or economic shocks affecting demand or supply. Almost four in ten businesses (39 per cent) expect growth to

come from new product development. While some plan to support growth by investing in infrastructure (22

per cent) and pursuing mergers and acquisitions (20 per cent), this fell back significantly on last year, from 43

per cent and 35 per cent, respectively.

International Opportunities - Automotive firms appear determined to pursue new international opportunities

as, over three quarters of firms (77 per cent) are investing or planning to engage with new international

customers in the next two years. The number of firms planning to engage new customers in Western Europe

slightly to 65 per cent, from 61 per cent last year.

Job creation - The vast majority (87 per cent) of automotive manufacturers plan to create new jobs over the

next two years. If their plans are replicated across the UK’s automotive manufacturing firms, it would create

almost 85,000 new jobs – a figure that remains unchanged year-on-year. These job creation plans are

underpinned by manufacturers’ reshoring activity. The last time the research was carried out 58 per cent of

firms said they planned to bring some manufacturing back to the UK within two years, growing to 64%.

Marketing strategy of Automobile industry

"The company has a multifaceted strategy to position itself as a

leading manufacturer of premium vehicles offering high-quality

products tailored to specific markets. The success of the industry

is tied to its investment in product development, and is reflected

in the strategic focus on capital expenditure, R&D and product

design." The strategic position of Automobile industry as can be

seen through the previous analyses is strong within their target

market. It can be seen that aims of automotive industries, like -

ASTON MARTIN, ROLLS ROYCE , FERRARI is to maintain

this position through research and development are indeed, how

they are maintaining this position in reality. If automotive

industry wishes to strengthen this position, however, they must

improve their image as being eco-friendly. This could be

achieved through their already well established research and

development department.

While the UK market has performed strongly in recent years and

is set to exceed previous levels of production, weak vehicle sales

on the Continent are encouraging consolidation across the

European sector as makers look to cut costs and drive

efficiencies. UK and European automotive suppliers are heavily

integrated and such significant changes in the industry will

inevitably create some risk in the supply chain.

There are a number of financial solutions that can help

businesses mitigate the risks of trading, one such is supply chain

finance (SCF) which can provide financial security to individual

firms, while also adding stability and sustainability to the wider

sector. With SCF, a business can obtain early payment of their

invoices with the buyer’s bank, giving them greater access to

working capital, but at no extra cost or debt to the buyer.

Kumaraswamy, A. and et. al., 2012. Catch-up strategies in the Indian auto components industry: Domestic

firms’ responses to market liberalization. Journal of International Business Studies. 43(4). pp.368-395.

Lee, J. W., Abosag, I. and Kwak, J., 2012. The role of networking and commitment in foreign market entry

process: Multinational corporations in the Chinese automobile industry. International Business Review. 21(1).

pp.27-39.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.