Accounting Diploma: UK Corporation Tax, Capital Gains and Liabilities

VerifiedAdded on 2023/06/10

|12

|1371

|313

Report

AI Summary

This report provides a detailed analysis of UK tax law and its implications for both unincorporated and incorporated businesses, focusing on corporation tax. It discusses the roles of HM Revenue and Customs (HMRC) and the various sources of tax revenue in the UK. The report highlights the differences in tax treatment between incorporated and unincorporated businesses, including corporation tax rates and self-assessment schemes. Furthermore, it delves into the determination of capital gains taxes payable, chargeable gains subject to corporation taxes, and the calculation of adjusted profit for corporation tax purposes. The document provides a comprehensive calculation of corporation tax liabilities, including trading taxable profit, capital gains, and non-trading loan relationships, offering a complete overview of corporate tax obligations in the UK. Desklib offers more solved assignments and resources for students.

5 EXTENDED DIPLOMA IN

ACCOUNTING

TASK 2: CORPORATION TAX

ACCOUNTING

TASK 2: CORPORATION TAX

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENT

• Discussion of UK Tax Law and its implications for unincorporated and incorporated businesses.

• Implication of UK Tax law for incorporated businesses

• Implication of Tax Law for UN-incorporated businesses.

• Determination of capital gain taxes payable and chargeable gains subject to corporation taxes.

• Determination of Capital Gain Tax :

• Determination of Chargeable gain subject to Corporation tax

• Calculation of Adjusted profit for corporation tax purposes.

• Calculation of corporation tax liabilities

• Discussion of UK Tax Law and its implications for unincorporated and incorporated businesses.

• Implication of UK Tax law for incorporated businesses

• Implication of Tax Law for UN-incorporated businesses.

• Determination of capital gain taxes payable and chargeable gains subject to corporation taxes.

• Determination of Capital Gain Tax :

• Determination of Chargeable gain subject to Corporation tax

• Calculation of Adjusted profit for corporation tax purposes.

• Calculation of corporation tax liabilities

Discussion of UK Tax Law and its implications

for unincorporated and incorporated

businesses

• In United Kingdom, HM Revenue and Custom (HMRC) is liable or responsible for administration and collection

of taxes from the various taxpayer's such as individual, corporate and not for profit organization.

• In the year 2020 – 2021, the total tax receipt is around £584.5 billion which is basically 7.7% decrease as

compared to previous year tax receipt.

• The main sources of taxes for the central government of UK is income tax, corporate tax, capital gain tax,

inheritance tax, insurance premium tax, environmental taxes, value added tax (VAT), custom duty, excises duty

and stamp, land, petroleum revenue taxes (Kasum, Sanni and Fagbemi, 2019).

• Individual in UK get a personal allowance of £12,570 (for 2022-23) as a tax-free income on which the individual

need not pay taxes.

for unincorporated and incorporated

businesses

• In United Kingdom, HM Revenue and Custom (HMRC) is liable or responsible for administration and collection

of taxes from the various taxpayer's such as individual, corporate and not for profit organization.

• In the year 2020 – 2021, the total tax receipt is around £584.5 billion which is basically 7.7% decrease as

compared to previous year tax receipt.

• The main sources of taxes for the central government of UK is income tax, corporate tax, capital gain tax,

inheritance tax, insurance premium tax, environmental taxes, value added tax (VAT), custom duty, excises duty

and stamp, land, petroleum revenue taxes (Kasum, Sanni and Fagbemi, 2019).

• Individual in UK get a personal allowance of £12,570 (for 2022-23) as a tax-free income on which the individual

need not pay taxes.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Implication of UK Tax law for incorporated

businesses

• Corporation tax in the UK is the tax which is levied on limited company and any foreign company with the UK

branch or office.

• The corporate tax is one of the largest source of tax revenue for the government of UK. The corporation tax rate

is one of the lowest in the word at 19%.

• At spring budget 2021, the government announced an increase in the Corporation Tax main rate from 19% to

25% for companies with profit over £250,000 together with the introduction of small profit rate of 19% with

effect from 1 April 2023.

• The small profit rate will apply to companies with profit of not more than £50,000. As per the current corporate

tax rule, all the incorporated companies need to pay the tax on its annual profit at the rate 19%.

• In order to compute the corporate tax, the federal tax law has signified that taxable income should be considered

different from business income (Überbacher and Scherer, 2019).

businesses

• Corporation tax in the UK is the tax which is levied on limited company and any foreign company with the UK

branch or office.

• The corporate tax is one of the largest source of tax revenue for the government of UK. The corporation tax rate

is one of the lowest in the word at 19%.

• At spring budget 2021, the government announced an increase in the Corporation Tax main rate from 19% to

25% for companies with profit over £250,000 together with the introduction of small profit rate of 19% with

effect from 1 April 2023.

• The small profit rate will apply to companies with profit of not more than £50,000. As per the current corporate

tax rule, all the incorporated companies need to pay the tax on its annual profit at the rate 19%.

• In order to compute the corporate tax, the federal tax law has signified that taxable income should be considered

different from business income (Überbacher and Scherer, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Implication of Tax Law for UN-incorporated

businesses

• Unincorporated businesses are the businesses which does not get themselves registered under the companies act,

2006 of UK.

• This includes sole proprietorship, partnership and trust which pay taxes as per different rules and with different

rates.

• The incorporated company pay taxes at flat rate while the unincorporated companies pay taxes at different rate

depending total taxable income.

• For example, as per UK tax law, sole traders pays the tax on their profit through annual self-assessment scheme

run by HMRC at 20%, 40% and 45%.

businesses

• Unincorporated businesses are the businesses which does not get themselves registered under the companies act,

2006 of UK.

• This includes sole proprietorship, partnership and trust which pay taxes as per different rules and with different

rates.

• The incorporated company pay taxes at flat rate while the unincorporated companies pay taxes at different rate

depending total taxable income.

• For example, as per UK tax law, sole traders pays the tax on their profit through annual self-assessment scheme

run by HMRC at 20%, 40% and 45%.

Determination of capital gain taxes payable and

chargeable gains subject to corporation

taxes

• You need to pay Capital Gains tax when you sell an asset, or an asset is deemed as sold if your total

taxable gains are above your annual capital gain tax allowances for individuals.

• However, if the asset is sold by a limited company (incorporated business), it is a chargeable gain

which is subject to a corporation tax.

• A limited company does not get capital gain tax allowances.

• The capita gain tax for individual is based on if they are higher taxpayer or basic taxpayer and type

of asset sold.

chargeable gains subject to corporation

taxes

• You need to pay Capital Gains tax when you sell an asset, or an asset is deemed as sold if your total

taxable gains are above your annual capital gain tax allowances for individuals.

• However, if the asset is sold by a limited company (incorporated business), it is a chargeable gain

which is subject to a corporation tax.

• A limited company does not get capital gain tax allowances.

• The capita gain tax for individual is based on if they are higher taxpayer or basic taxpayer and type

of asset sold.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

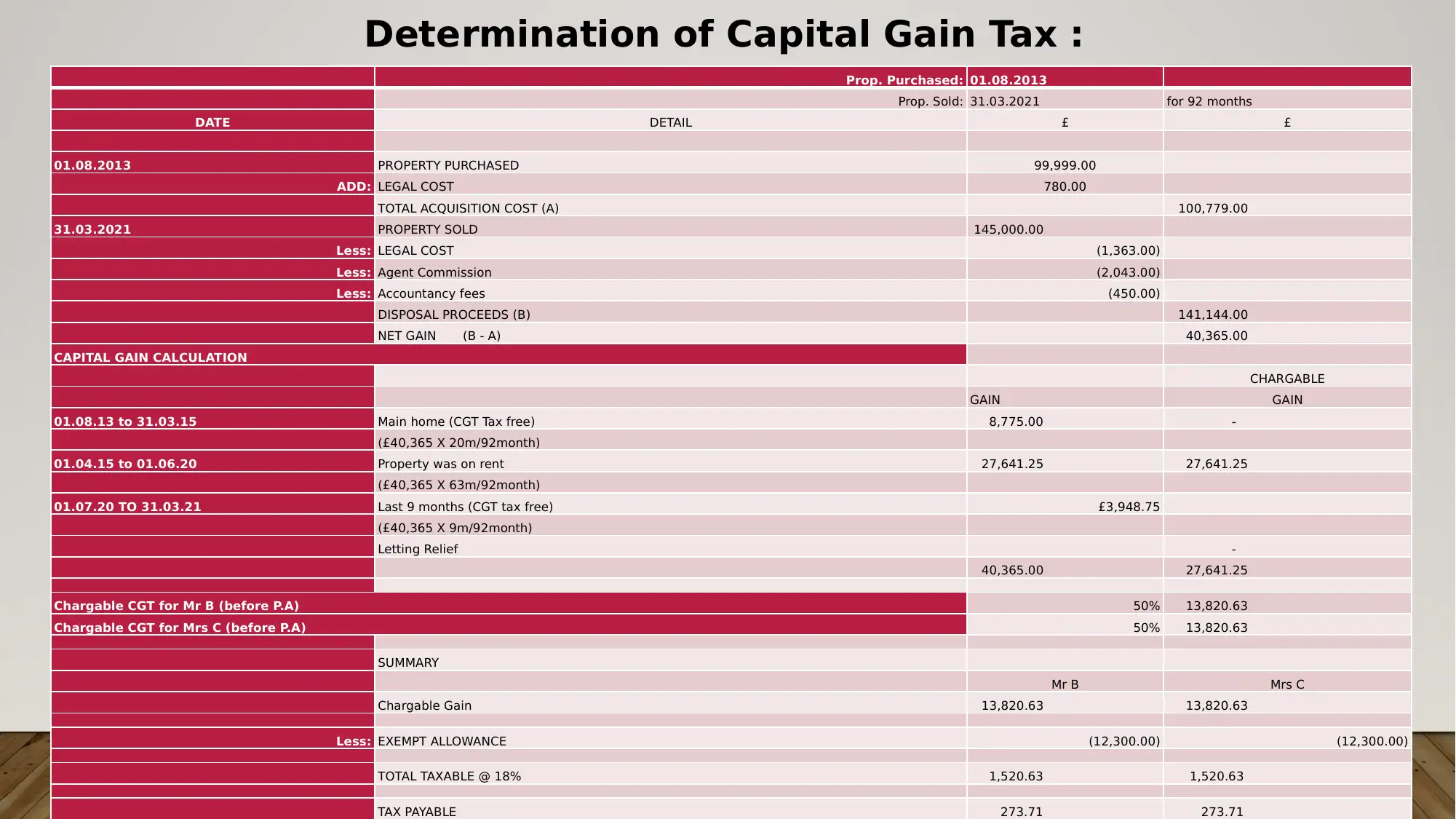

Determination of Capital Gain Tax :

Prop. Purchased: 01.08.2013

Prop. Sold: 31.03.2021 for 92 months

DATE DETAIL £ £

01.08.2013 PROPERTY PURCHASED 99,999.00

ADD: LEGAL COST 780.00

TOTAL ACQUISITION COST (A) 100,779.00

31.03.2021 PROPERTY SOLD 145,000.00

Less: LEGAL COST (1,363.00)

Less: Agent Commission (2,043.00)

Less: Accountancy fees (450.00)

DISPOSAL PROCEEDS (B) 141,144.00

NET GAIN (B - A) 40,365.00

CAPITAL GAIN CALCULATION

CHARGABLE

GAIN GAIN

01.08.13 to 31.03.15 Main home (CGT Tax free) 8,775.00 -

(£40,365 X 20m/92month)

01.04.15 to 01.06.20 Property was on rent 27,641.25 27,641.25

(£40,365 X 63m/92month)

01.07.20 TO 31.03.21 Last 9 months (CGT tax free) £3,948.75

(£40,365 X 9m/92month)

Letting Relief -

40,365.00 27,641.25

Chargable CGT for Mr B (before P.A) 50% 13,820.63

Chargable CGT for Mrs C (before P.A) 50% 13,820.63

SUMMARY

Mr B Mrs C

Chargable Gain 13,820.63 13,820.63

Less: EXEMPT ALLOWANCE (12,300.00) (12,300.00)

TOTAL TAXABLE @ 18% 1,520.63 1,520.63

TAX PAYABLE 273.71 273.71

Prop. Purchased: 01.08.2013

Prop. Sold: 31.03.2021 for 92 months

DATE DETAIL £ £

01.08.2013 PROPERTY PURCHASED 99,999.00

ADD: LEGAL COST 780.00

TOTAL ACQUISITION COST (A) 100,779.00

31.03.2021 PROPERTY SOLD 145,000.00

Less: LEGAL COST (1,363.00)

Less: Agent Commission (2,043.00)

Less: Accountancy fees (450.00)

DISPOSAL PROCEEDS (B) 141,144.00

NET GAIN (B - A) 40,365.00

CAPITAL GAIN CALCULATION

CHARGABLE

GAIN GAIN

01.08.13 to 31.03.15 Main home (CGT Tax free) 8,775.00 -

(£40,365 X 20m/92month)

01.04.15 to 01.06.20 Property was on rent 27,641.25 27,641.25

(£40,365 X 63m/92month)

01.07.20 TO 31.03.21 Last 9 months (CGT tax free) £3,948.75

(£40,365 X 9m/92month)

Letting Relief -

40,365.00 27,641.25

Chargable CGT for Mr B (before P.A) 50% 13,820.63

Chargable CGT for Mrs C (before P.A) 50% 13,820.63

SUMMARY

Mr B Mrs C

Chargable Gain 13,820.63 13,820.63

Less: EXEMPT ALLOWANCE (12,300.00) (12,300.00)

TOTAL TAXABLE @ 18% 1,520.63 1,520.63

TAX PAYABLE 273.71 273.71

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

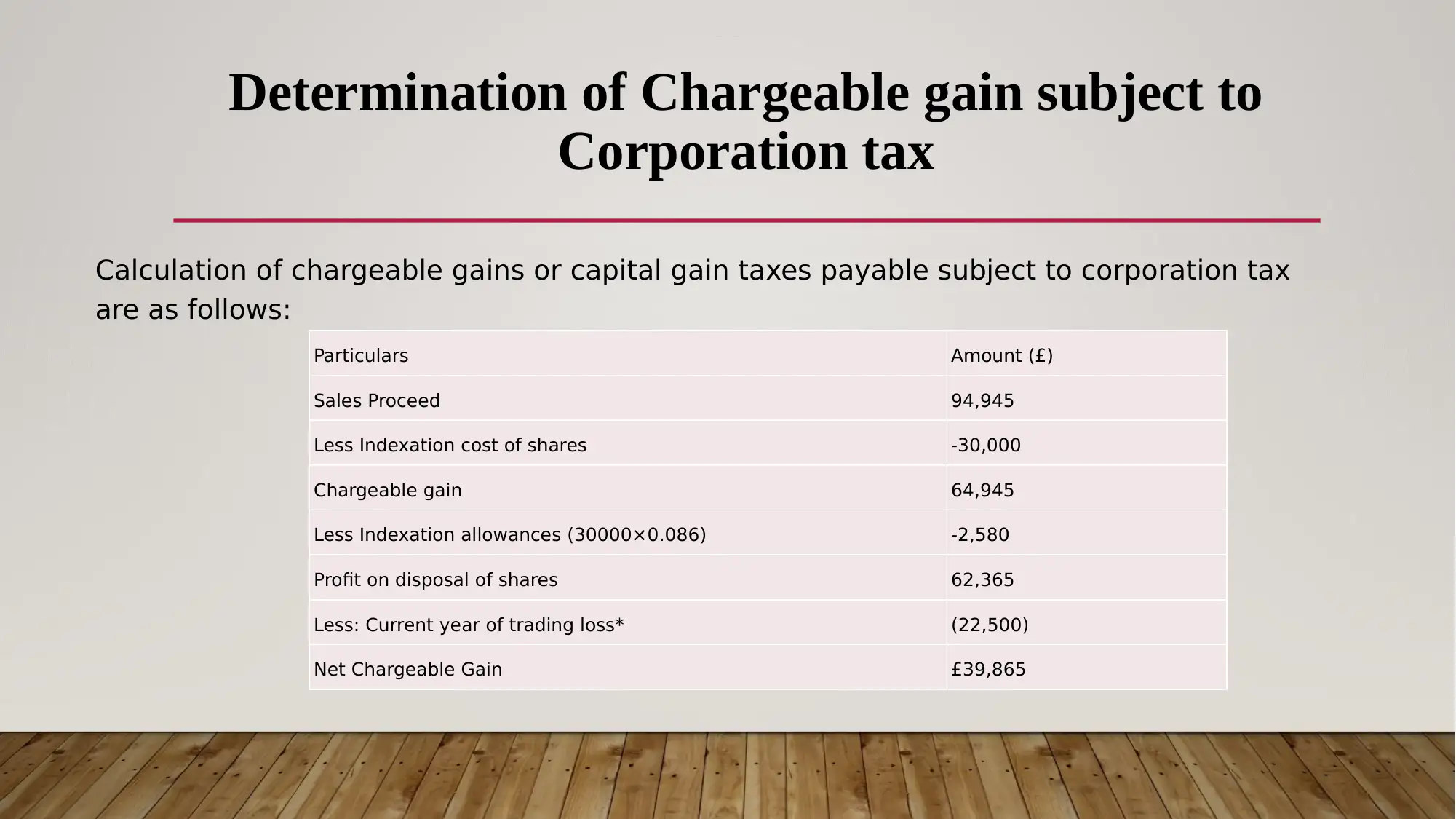

Determination of Chargeable gain subject to

Corporation tax

Calculation of chargeable gains or capital gain taxes payable subject to corporation tax

are as follows:

Particulars Amount (£)

Sales Proceed 94,945

Less Indexation cost of shares -30,000

Chargeable gain 64,945

Less Indexation allowances (30000×0.086) -2,580

Profit on disposal of shares 62,365

Less: Current year of trading loss* (22,500)

Net Chargeable Gain £39,865

Corporation tax

Calculation of chargeable gains or capital gain taxes payable subject to corporation tax

are as follows:

Particulars Amount (£)

Sales Proceed 94,945

Less Indexation cost of shares -30,000

Chargeable gain 64,945

Less Indexation allowances (30000×0.086) -2,580

Profit on disposal of shares 62,365

Less: Current year of trading loss* (22,500)

Net Chargeable Gain £39,865

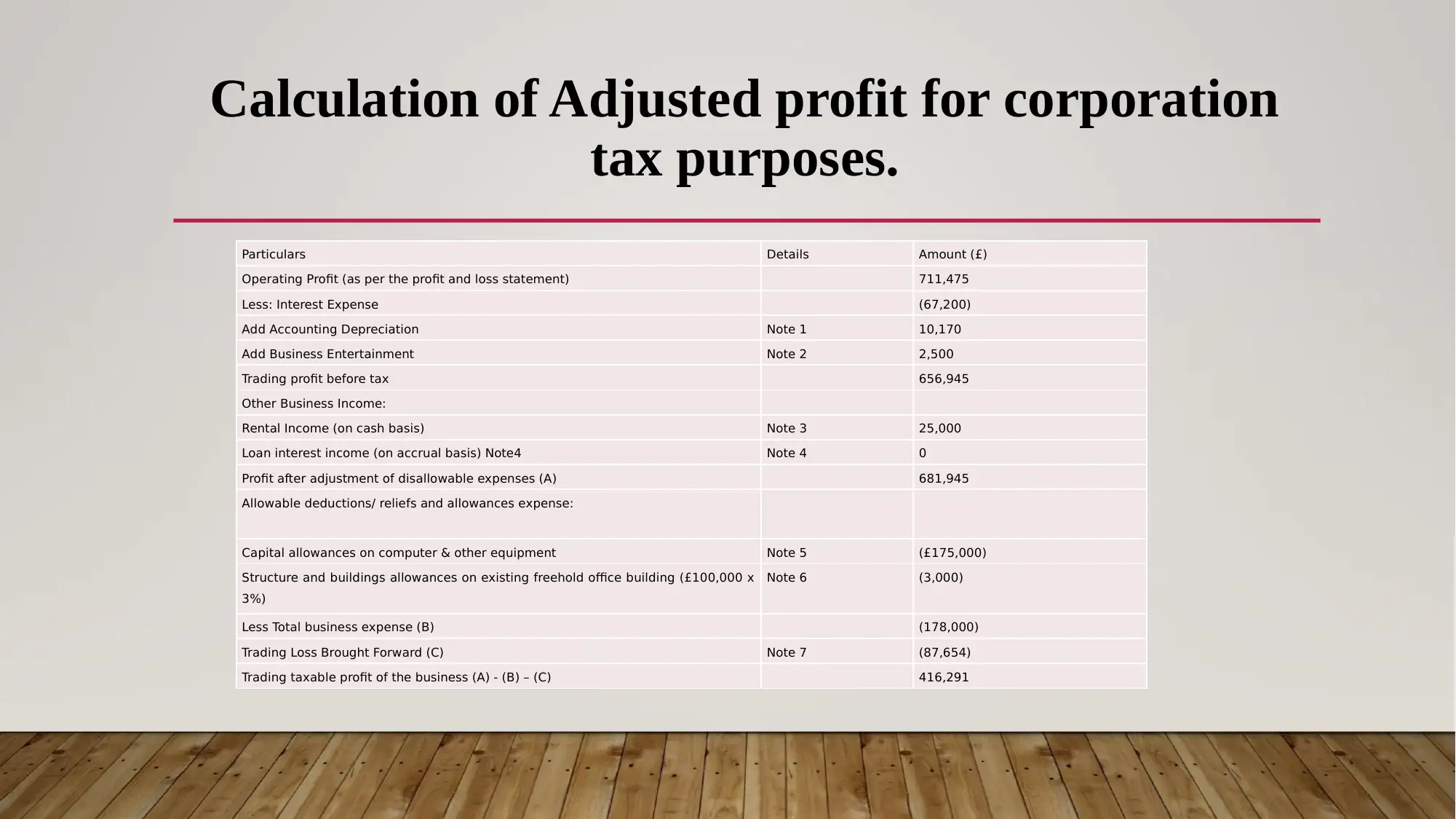

Calculation of Adjusted profit for corporation

tax purposes.

Particulars Details Amount (£)

Operating Profit (as per the profit and loss statement) 711,475

Less: Interest Expense (67,200)

Add Accounting Depreciation Note 1 10,170

Add Business Entertainment Note 2 2,500

Trading profit before tax 656,945

Other Business Income:

Rental Income (on cash basis) Note 3 25,000

Loan interest income (on accrual basis) Note4 Note 4 0

Profit after adjustment of disallowable expenses (A) 681,945

Allowable deductions/ reliefs and allowances expense:

Capital allowances on computer & other equipment Note 5 (£175,000)

Structure and buildings allowances on existing freehold office building (£100,000 x

3%)

Note 6 (3,000)

Less Total business expense (B) (178,000)

Trading Loss Brought Forward (C) Note 7 (87,654)

Trading taxable profit of the business (A) - (B) – (C) 416,291

tax purposes.

Particulars Details Amount (£)

Operating Profit (as per the profit and loss statement) 711,475

Less: Interest Expense (67,200)

Add Accounting Depreciation Note 1 10,170

Add Business Entertainment Note 2 2,500

Trading profit before tax 656,945

Other Business Income:

Rental Income (on cash basis) Note 3 25,000

Loan interest income (on accrual basis) Note4 Note 4 0

Profit after adjustment of disallowable expenses (A) 681,945

Allowable deductions/ reliefs and allowances expense:

Capital allowances on computer & other equipment Note 5 (£175,000)

Structure and buildings allowances on existing freehold office building (£100,000 x

3%)

Note 6 (3,000)

Less Total business expense (B) (178,000)

Trading Loss Brought Forward (C) Note 7 (87,654)

Trading taxable profit of the business (A) - (B) – (C) 416,291

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

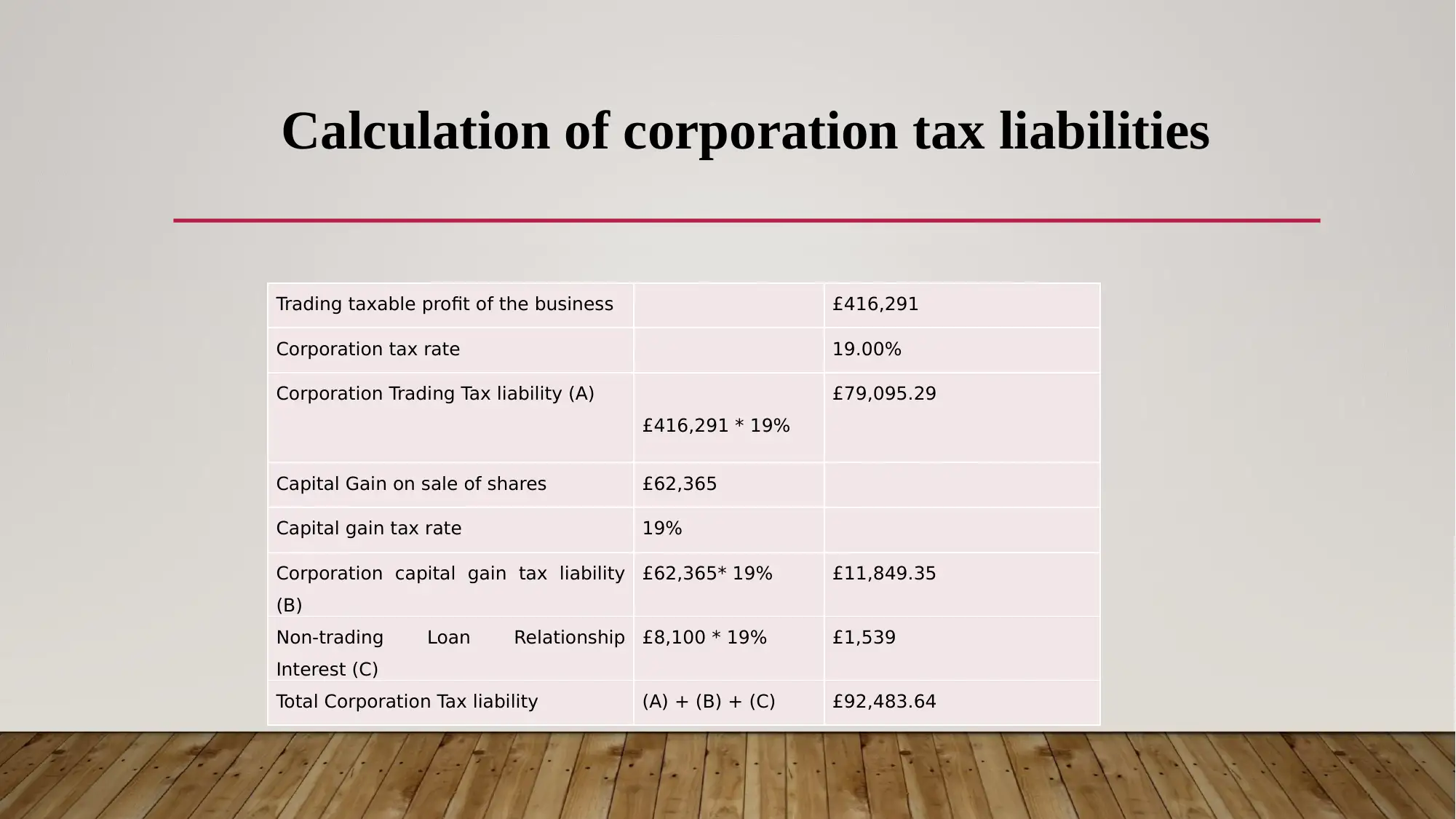

Calculation of corporation tax liabilities

Trading taxable profit of the business £416,291

Corporation tax rate 19.00%

Corporation Trading Tax liability (A)

£416,291 * 19%

£79,095.29

Capital Gain on sale of shares £62,365

Capital gain tax rate 19%

Corporation capital gain tax liability

(B)

£62,365* 19% £11,849.35

Non-trading Loan Relationship

Interest (C)

£8,100 * 19% £1,539

Total Corporation Tax liability (A) + (B) + (C) £92,483.64

Trading taxable profit of the business £416,291

Corporation tax rate 19.00%

Corporation Trading Tax liability (A)

£416,291 * 19%

£79,095.29

Capital Gain on sale of shares £62,365

Capital gain tax rate 19%

Corporation capital gain tax liability

(B)

£62,365* 19% £11,849.35

Non-trading Loan Relationship

Interest (C)

£8,100 * 19% £1,539

Total Corporation Tax liability (A) + (B) + (C) £92,483.64

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

• Wessels-Ridder, E., 2021. Evaluation of the case for the provision of investment incentives through the corporate

tax system. Available at SSRN 4032778.

• Schiavone, G., 2020. Tax aspects of UK debt financing. Novità fiscali, 2020(11), pp.721-725.

• Panikian, G. and et.al., 2021. Time series modelling methods to forecast the volume of self-assessment tax

returns in the UK. Journal of Applied Statistics, pp.1-18.

• Advani, A., 2022. Who does and doesn't pay taxes?. Fiscal Studies. 43(1). pp.5-22.

• Advani, A., Ooms, T. and Summers, A., 2021. Missing incomes in the UK: evidence and policy

implications. Journal of Social Policy, pp.1-21.

• Petit, G. and et.al., 2021. Policy Forum: Re-Envisaging the Canada Revenue Agency-From Tax Collector to

Benefit Delivery Agent. Canadian Tax Journal/Revue fiscale canadienne. 69(1). pp.99-114.

• Wessels-Ridder, E., 2021. Evaluation of the case for the provision of investment incentives through the corporate

tax system. Available at SSRN 4032778.

• Schiavone, G., 2020. Tax aspects of UK debt financing. Novità fiscali, 2020(11), pp.721-725.

• Panikian, G. and et.al., 2021. Time series modelling methods to forecast the volume of self-assessment tax

returns in the UK. Journal of Applied Statistics, pp.1-18.

• Advani, A., 2022. Who does and doesn't pay taxes?. Fiscal Studies. 43(1). pp.5-22.

• Advani, A., Ooms, T. and Summers, A., 2021. Missing incomes in the UK: evidence and policy

implications. Journal of Social Policy, pp.1-21.

• Petit, G. and et.al., 2021. Policy Forum: Re-Envisaging the Canada Revenue Agency-From Tax Collector to

Benefit Delivery Agent. Canadian Tax Journal/Revue fiscale canadienne. 69(1). pp.99-114.

THANK YOU

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.